Roivant (Nasdaq: ROIV) today reported its financial results for the

first quarter ended June 30, 2024, and provided a business update.

- Immunovant completed enrollment in

batoclimab pivotal myasthenia gravis (MG) trial; topline results

and initiation of a potentially registrational program in MG for

IMVT-1402 on track for fiscal year end (March 31, 2025)

- Brepocitinib development in

non-infectious uveitis (NIU) is progressing to Phase 3 following a

successful end of Phase 2 meeting with the FDA

- Brepocitinib Phase 3 VALOR study

enrollment in dermatomyositis (DM) is complete and on track to

report topline data in 2H 2025; VALOR is the largest interventional

DM trial ever conducted with 241 subjects enrolled across 90 sites

on four continents

- VTAMA net product revenue was $18.4M

for the first quarter ended June 30, 2024, with over 430,000

prescriptions written by approximately 16,000 unique prescribers

since launch

- Roivant reported its consolidated

cash, cash equivalents and restricted cash of $5.7B at June 30,

2024, following a $648M share repurchase announced in April 2024,

and not including a $110M milestone payment received in August 2024

related to the previously announced sale of Telavant, which closed

in December 2023

“This continues to be a year of investing, building, and

clinical execution for Roivant. We completed enrollment in a major

Phase 3 trial at each of Immunovant and Priovant with the

batoclimab trial in MG and the brepocitinib trial in DM,

respectively,” said Matt Gline, CEO of Roivant. “We are entering a

dense period of meaningful clinical data in the coming months,

particularly for our anti-FcRN franchise. We are also continuing to

evaluate a number of promising additions to our pipeline, and we

look forward to unveiling one such program next month.”

Recent Developments

- Immunovant: In August 2024, Immunovant

announced completion of enrollment in batoclimab pivotal MG

trial.

- Priovant: In June 2024, Priovant completed an

end of Phase 2 meeting with the FDA and will progress brepocitinib

to a Phase 3 program in NIU; detailed trial design will be shared

at a later date.

In July 2024, Priovant announced

completion of enrollment in VALOR, a global Phase 3 study of

brepocitinib in DM. The study enrolled 241 subjects across 90 sites

on four continents, making it the largest interventional DM trial

ever conducted.

- Dermavant: For the first quarter ended June

30, 2024, Roivant reported VTAMA net product revenue of $18.4M. As

of July 2024, over 430,000 VTAMA prescriptions have been written by

approximately 16,000 unique prescribers for psoriasis. VTAMA is

covered for over 141M US commercial lives, including coverage by

all three of the top pharmacy benefit managers.

- Genevant: In August 2024, the parties

requested an amended case schedule in Genevant’s and Arbutus’s

lawsuit against Moderna in order for Moderna to accommodate certain

outstanding discovery requests. If the Court approves the request,

the trial will begin in September 2025.

- Roivant: Roivant reported its consolidated

cash, cash equivalents and restricted cash of $5.7B at June 30,

2024, following a $648M share repurchase announced in April 2024,

and not including a $110M milestone payment received in August 2024

related to the previously announced sale of Telavant, which closed

in December 2023.

Major Upcoming Milestones

- Dermavant expects PDUFA action for VTAMA in

atopic dermatitis in the fourth quarter of calendar year 2024.

- Kinevant plans to report topline data from the

ongoing Phase 2 trial of namilumab for the treatment of sarcoidosis

in the fourth quarter of calendar year 2024.

- Priovant plans to

report topline data from the ongoing Phase 3 trial of brepocitinib

in DM in the second half of calendar year 2025 and to initiate a

Phase 3 program for brepocitinib in NIU in the second half of

calendar year 2024.

- Immunovant plans to

have initiated 4-5 potentially registrational programs by March 31,

2025, and plans to have initiated studies in a total of 10

indications by March 31, 2026, for IMVT-1402. In pursuit of this

goal, Immunovant expects to have at least 3 IND applications active

by the end of calendar year 2024. Detailed results from the

batoclimab study in Graves’ disease (GD) and an overview of the

development plan for IMVT-1402 in GD are expected in the fall of

2024. Batoclimab topline data in MG are expected to be reported by

March 31, 2025. Results from this trial are expected to inform a

decision regarding next steps for batoclimab in MG. Immunovant also

expects to initiate a potentially registrational program in MG for

IMVT-1402 by March 31, 2025. Initial data from period 1 of the

batoclimab chronic inflammatory demyelinating polyneuropathy (CIDP)

trial and the trial design for IMVT-1402 in CIDP are both expected

to be disclosed by March 31, 2025. Topline data from the current

pivotal program evaluating batoclimab in thyroid eye disease (TED)

continue to be expected in the first half of calendar year

2025.

First Quarter Ended

June 30, 2024 Financial

Summary

Cash Position

As of June 30, 2024, the Company had consolidated cash,

cash equivalents and restricted cash of approximately $5.7

billion.

Research and Development Expenses

Research and development (R&D) expenses increased by $8.1

million to $133.2 million for the three months ended June 30,

2024, compared to $125.1 million for the three months ended

June 30, 2023. This increase was primarily driven by increases

in program-specific costs of $4.3 million, share-based compensation

of $3.1 million, and personnel-related expenses of $1.6

million.

Within program-specific costs, the increase of $4.3 million was

primarily driven by an increase in expense of $14.8 million related

to the anti-FcRn franchise, partially offset by a decrease in

expense of $10.9 million related to RVT-3101 for which the rights

to further develop and manufacture were sold to Roche in December

2023.

Non-GAAP R&D expenses were $121.5 million for the three

months ended June 30, 2024, compared to $115.7 million for the

three months ended June 30, 2023.

Selling, General and Administrative

Expenses

Selling, general and administrative (SG&A) expenses

decreased by $7.7 million to $148.5 million for the three months

ended June 30, 2024, compared to $156.2 million for the three

months ended June 30, 2023, primarily due to a decrease in

selling, general and administrative expenses of $16.1 million at

Dermavant, which largely resulted from reduced marketing spend.

This decrease was partially offset by an increase in

personnel-related expenses of $7.3 million, primarily as a result

of a special one-time cash retention bonus award granted to

employees, following approval in December

2023.

Non-GAAP SG&A expenses were $107.5 million for the three

months ended June 30, 2024, compared to $113.0 million for the

three months ended June 30, 2023.

Net Income (Loss)

Net income was $57.5 million for the three months ended

June 30, 2024, compared to a net loss of $327.8 million for

the three months ended June 30, 2023. On a basic and diluted

per common share basis, net income was $0.13 and $0.12,

respectively, for the three months ended June 30, 2024. Basic

and diluted net loss per common share was $0.38 for the three

months ended June 30, 2023. Non-GAAP net loss was $131.2

million for the three months ended June 30, 2024, compared to

$211.5 million for the three months ended June 30, 2023.

|

ROIVANT SCIENCES LTD.Selected Balance Sheet

Data(unaudited, in thousands) |

| |

|

|

|

| |

June 30, 2024 |

|

March 31, 2024 |

|

Cash, cash equivalents and restricted cash |

$ |

5,693,300 |

|

|

$ |

6,550,450 |

|

| Total assets |

|

6,496,448 |

|

|

|

7,222,482 |

|

| Total liabilities |

|

601,162 |

|

|

|

773,953 |

|

| Total shareholders’

equity |

|

5,895,286 |

|

|

|

6,448,529 |

|

| Total liabilities and

shareholders’ equity |

|

6,496,448 |

|

|

|

7,222,482 |

|

| |

|

|

|

|

|

|

|

|

ROIVANT SCIENCES LTD.Condensed Consolidated

Statements of Operations(unaudited, in thousands, except share and

per share amounts) |

| |

|

| |

Three Months Ended June 30, |

|

|

2024 |

|

2023 |

| Revenues: |

|

|

|

|

Product revenue, net |

$ |

18,367 |

|

|

$ |

16,659 |

|

|

License, milestone and other revenue |

|

36,765 |

|

|

|

4,965 |

|

|

Revenue, net |

|

55,132 |

|

|

|

21,624 |

|

| Operating expenses: |

|

|

|

|

Cost of revenues |

|

3,978 |

|

|

|

4,214 |

|

|

Research and development (includes $11,009 and $7,953 of

share-based compensation expense for the three months ended June

30, 2024 and 2023, respectively) |

|

133,208 |

|

|

|

125,133 |

|

|

Acquired in-process research and development |

|

— |

|

|

|

12,500 |

|

|

Selling, general and administrative (includes $39,144 and $41,192

of share-based compensation expense for the three months ended June

30, 2024 and 2023, respectively) |

|

148,519 |

|

|

|

156,190 |

|

|

Total operating expenses |

|

285,705 |

|

|

|

298,037 |

|

| Gain on sale of Telavant net

assets |

|

110,387 |

|

|

|

— |

|

| Loss from operations |

|

(120,186 |

) |

|

|

(276,413 |

) |

| Change in fair value of

investments |

|

(15,226 |

) |

|

|

7,564 |

|

| Change in fair value of debt

and liability instruments |

|

(118,202 |

) |

|

|

54,512 |

|

| Interest income |

|

(72,127 |

) |

|

|

(16,715 |

) |

| Interest expense |

|

13,399 |

|

|

|

8,912 |

|

| Other expense (income),

net |

|

1,825 |

|

|

|

(4,593 |

) |

| Income (loss) before income

taxes |

|

70,145 |

|

|

|

(326,093 |

) |

| Income tax expense |

|

12,655 |

|

|

|

1,752 |

|

| Net income (loss) |

|

57,490 |

|

|

|

(327,845 |

) |

| Net loss attributable to

noncontrolling interests |

|

(37,807 |

) |

|

|

(36,029 |

) |

| Net income (loss) attributable

to Roivant Sciences Ltd. |

$ |

95,297 |

|

|

$ |

(291,816 |

) |

| |

|

|

|

| Net income (loss) per common

share: |

|

|

|

|

Basic |

$ |

0.13 |

|

|

$ |

(0.38 |

) |

|

Diluted |

$ |

0.12 |

|

|

$ |

(0.38 |

) |

| |

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

Basic |

|

735,816,536 |

|

|

|

759,273,550 |

|

|

Diluted |

|

781,627,601 |

|

|

|

759,273,550 |

|

|

|

|

|

|

|

|

|

|

|

ROIVANT SCIENCES LTD.Reconciliation of GAAP to

Non-GAAP Financial Measures(unaudited, in thousands) |

| |

|

|

|

| |

|

|

Three Months Ended June 30, |

| |

Note |

|

2024 |

|

2023 |

| Net income

(loss) |

|

|

$ |

57,490 |

|

|

$ |

(327,845 |

) |

| Adjustments: |

|

|

|

|

|

| Cost of revenues: |

|

|

|

|

|

|

Amortization of intangible assets |

(1 |

) |

|

|

2,350 |

|

|

|

2,370 |

|

|

Share-based compensation |

(2 |

) |

|

|

38 |

|

|

|

38 |

|

| Research and development: |

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

11,009 |

|

|

|

7,953 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

694 |

|

|

|

1,489 |

|

| Selling, general and

administrative: |

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

39,144 |

|

|

|

41,192 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,839 |

|

|

|

1,980 |

|

| Gain on sale of Telavant net

assets |

(4 |

) |

|

|

(110,387 |

) |

|

|

— |

|

| Other: |

|

|

|

|

|

|

Change in fair value of investments |

(5 |

) |

|

|

(15,226 |

) |

|

|

7,564 |

|

|

Change in fair value of debt and liability instruments |

(6 |

) |

|

|

(118,202 |

) |

|

|

54,512 |

|

| Estimated income tax impact

from adjustments |

(7 |

) |

|

|

12 |

|

|

|

(732 |

) |

| Adjusted net loss

(Non-GAAP) |

|

|

$ |

(131,239 |

) |

|

$ |

(211,479 |

) |

| |

|

|

Three Months Ended June 30, |

| |

Note |

|

2024 |

|

2023 |

| Research and

development expenses |

|

|

$ |

133,208 |

|

|

$ |

125,133 |

|

| Adjustments: |

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

11,009 |

|

|

|

7,953 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

694 |

|

|

|

1,489 |

|

| Adjusted research and

development expenses (Non-GAAP) |

|

|

$ |

121,505 |

|

|

$ |

115,691 |

|

| |

|

|

Three Months Ended June 30, |

| |

Note |

|

2024 |

|

2023 |

| Selling, general and

administrative expenses |

|

|

$ |

148,519 |

|

|

$ |

156,190 |

|

| Adjustments: |

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

39,144 |

|

|

|

41,192 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,839 |

|

|

|

1,980 |

|

| Adjusted selling,

general and administrative expenses (Non-GAAP) |

|

|

$ |

107,536 |

|

|

$ |

113,018 |

|

Notes to non-GAAP financial measures:

(1) Represents non-cash amortization of intangible assets

associated with milestone payments made in connection with

regulatory approvals.

(2) Represents non-cash share-based compensation expense.

(3) Represents non-cash depreciation and amortization expense,

other than amortization of intangible assets associated with

milestone payments made in connection with regulatory

approvals.

(4) Represents a gain on the sale of Telavant net assets to

Roche due to achievement of a one-time milestone in June 2024.

(5) Represents the unrealized (gain) loss on equity investments

in unconsolidated entities that are accounted for at fair value

with changes in value reported in earnings.

(6) Represents the change in fair value of debt and liability

instruments, which is non-cash and primarily includes the

unrealized (gain) loss relating to the measurement and recognition

of fair value on a recurring basis of certain liabilities.

(7) Represents the estimated tax effect of the adjustments.

Investor Conference Call Information

Roivant will host a live conference call and webcast at 8:00

a.m. ET on Thursday, August 8, 2024, to report its financial

results for the first quarter ended June 30, 2024, and provide a

corporate update.

To access the conference call by phone, please register online

using this registration link. The presentation and webcast details

will also be available under “Events & Presentations” in the

Investors section of the Roivant website at

https://investor.roivant.com/news-events/events. The archived

webcast will be available on Roivant’s website after the conference

call.

About Roivant

Roivant is a commercial-stage biopharmaceutical company that

aims to improve the lives of patients by accelerating the

development and commercialization of medicines that matter. Today,

Roivant’s pipeline includes VTAMA, a novel topical approved for the

treatment of psoriasis and in development for the treatment of

atopic dermatitis; IMVT-1402 and batoclimab, fully human monoclonal

antibodies targeting the neonatal Fc receptor (“FcRn”) in

development across several IgG-mediated autoimmune indications; and

brepocitinib, a potent small molecule inhibitor of TYK2 and JAK1

for the treatment of dermatomyositis and non-infectious uveitis, in

addition to other clinical stage molecules. We advance our pipeline

by creating nimble subsidiaries or “Vants” to develop and

commercialize our medicines and technologies. Beyond therapeutics,

Roivant also incubates discovery-stage companies and health

technology startups complementary to its biopharmaceutical

business. For more information, www.roivant.com.

Roivant Forward-Looking Statements

This press release contains forward-looking statements.

Statements in this press release may include statements that are

not historical facts and are considered forward-looking within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), which are usually

identified by the use of words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and variations of such words or similar

expressions. The words may identify forward-looking statements, but

the absence of these words does not mean that a statement is not

forward-looking. We intend these forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act.

Our forward-looking statements include, but are not limited to,

statements regarding our or our management team’s expectations,

hopes, beliefs, intentions or strategies regarding the future, and

statements that are not historical facts, including statements

about potential share repurchases, the clinical and therapeutic

potential of our products and product candidates, the availability

and success of topline results from our ongoing clinical trials and

any commercial potential of our products and product candidates. In

addition, any statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking

statements.

Although we believe that our plans, intentions, expectations and

strategies as reflected in or suggested by those forward-looking

statements are reasonable, we can give no assurance that the plans,

intentions, expectations or strategies will be attained or

achieved. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a number of risks, uncertainties and assumptions,

including, but not limited to, those risks set forth in the Risk

Factors section of our filings with the U.S. Securities and

Exchange Commission. Moreover, we operate in a very competitive and

rapidly changing environment in which new risks emerge from time to

time. These forward-looking statements are based upon the current

expectations and beliefs of our management as of the date of this

press release and are subject to certain risks and uncertainties

that could cause actual results to differ materially from those

described in the forward-looking statements. Except as required by

applicable law, we assume no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts:InvestorsRoivant Investor

Relationsir@roivant.com

MediaStephanie LeeRoivant Sciencesstephanie.lee@roivant.com

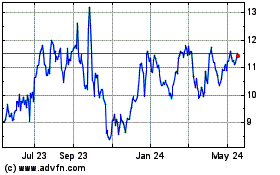

Roivant Sciences (NASDAQ:ROIV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Roivant Sciences (NASDAQ:ROIV)

Historical Stock Chart

From Dec 2023 to Dec 2024