Roivant (Nasdaq: ROIV) today reported its financial results for the

second quarter ended September 30, 2023, and provided an update on

the business.

“In the last few weeks, we announced a historic

deal with Roche for the sale of Telavant for $7.25 billion. While

we intend to be very thoughtful about capital deployment, we expect

that the resulting cash will be sufficient to fund our programs

through profitability, in addition to enabling other opportunities

and investments,” said Matt Gline, CEO of Roivant. “This was also

another significant quarter for our clinical programs with a data

readout from IMVT-1402’s Phase 1 SAD study and 300 mg MAD cohort.

The data represent what we believe is the best-case scenario for

our FcRn franchise and truly broadens the horizon for what is

possible in the landscape of autoimmune therapies and for patients

suffering from autoimmune diseases. We are excited about the recent

progress and look forward to announcing additional clinical results

for 1402 and brepocitinib in the final quarter of the calendar

year. 2023 has continued to deliver on being an incredibly

catalyst-rich year, and certainly Roivant’s biggest year yet.”

Recent Developments

- Telavant: In October 2023, Roivant entered

into a definitive agreement with Roche for the sale of Telavant.

Roche will gain the rights to develop, manufacture and

commercialize RVT-3101 in the US and Japan for the treatment of

inflammatory bowel disease and potentially other diseases. Under

the terms of the agreement, Roche will pay a purchase price of $7.1

billion upfront and a milestone payment of $150 million payable

upon the initiation of a Phase 3 trial in ulcerative colitis.

Roivant owns 75% of the issued and outstanding shares of common

stock and preferred stock of Telavant and Pfizer owns the remaining

25%, in each case on an as-converted basis. Roivant’s net proceeds

from the transaction are expected to be approximately $5.2 billion

plus $110 million from the milestone payment. Regulatory filings in

connection with the transaction have been submitted and the closing

of the transaction remains on track for the fourth quarter of 2023

or the first quarter of 2024.

- Immunovant: In September 2023, Immunovant

announced initial data from the Phase 1 clinical trial evaluating

the safety, tolerability, and pharmacodynamic profiles of IMVT-1402

in healthy adults showed that subcutaneously administered doses of

IMVT-1402 produced dose-dependent reductions in Immunoglobulin G,

with no statistically significant dose-related decrease in serum

albumin or increase in LDL cholesterol, strengthening IMVT-1402 as

a potential best-in-class neonatal fragment crystallizable receptor

(FcRn) inhibitor. In October 2023, Immunovant announced the closing

of an underwritten public offering and concurrent private placement

offering of common stock yielding approximately $467 million in net

proceeds to Immunovant, after deducting underwriting commissions

and estimated offering expenses. Roivant owns approximately 55.2%

of Immunovant as of November 3, 2023.

-

Dermavant: For the second quarter

ended September 30, 2023, Roivant reported VTAMA net product

revenue of $18.4M, representing a 28% gross-to-net yield for the

quarter. As of November 2023, over 250,000 VTAMA prescriptions have

been written by approximately 12,800 unique prescribers for

psoriasis, based on IQVIA data. Coverage has been expanded to 137

million US commercial lives and includes coverage by all three of

the top pharmacy benefit managers.In October 2023, Dermavant

reported that in adult patients, VTAMA showed positive results from

a Phase 4 open-label trial for the treatment of intertriginous

plaque psoriasis - 82.8% achieved an intertriginous Physician

Global Assessment (iPGA) Score of 0 (clear) or 1 (almost clear) and

≥2-grade improvement from baseline at Week 12, demonstrating

compelling efficacy. Additionally, Dermavant reported in adults and

children down to two years of age with atopic dermatitis, VTAMA

showed rapid and significant onset of pruritus (itch) relief as

early as 24 hours after initial application.

- Roivant: In September 2023, Roivant raised

approximately $200 million in a follow-on offering. Roivant

reported cash, cash equivalents and restricted cash of

approximately $1.4 billion at September 30, 2023. Giving effect to

Immunovant’s October 2023 follow-on offering and expected cash

proceeds from the pending sale of Telavant (including one-time

milestone), Roivant’s cash, cash equivalents and restricted cash

would have been approximately $7.0 billion. The acquisition of

Telavant is subject to customary closing conditions and is expected

to close in the fourth quarter of 2023 or the first quarter of

2024.

Major Upcoming Milestones

- Immunovant expects

additional IMVT-1402 data from the 600 mg multiple-ascending dose

cohort in November 2023. Additionally, for batoclimab: Top-line

data from the Phase 3 clinical trial in MG are expected in the

second half of calendar year 2024. For the Phase 3 program in TED,

top-line data are expected in the first half of calendar year 2025.

Immunovant also expects to have initial results from period 1 of

the Phase 2B clinical trial in CIDP in the first half of calendar

year 2024, and initial Phase 2 proof-of-concept data in Graves’

disease by the end of calendar year 2023.

- Priovant plans to

announce topline results from the potentially registrational trial

evaluating brepocitinib for the treatment of patients with systemic

lupus erythematosus (SLE) in the fourth quarter of calendar year

2023. Priovant also expects to announce topline results from the

Phase 2 POC study in non-infectious uveitis (NIU) in the first

quarter of calendar year 2024 and topline results from the Phase 3

trial in dermatomyositis (DM) in calendar year 2025.

- Dermavant plans to submit its sNDA for VTAMA

in atopic dermatitis to the FDA in the first quarter of calendar

year 2024.

- Hemavant plans to

announce data from the ongoing open-label Phase 1/2 trial

evaluating RVT-2001 for the treatment of transfusion-dependent

anemia in lower-risk myelodysplastic syndromes (MDS) patients in

the first quarter of calendar year 2024.

- Kinevant plans to report topline data from the

ongoing Phase 2 trial of namilumab for the treatment of sarcoidosis

in the second half of calendar year 2024.

Second Quarter Ended

September 30, 2023 Financial

Summary

Cash Position

As of September 30, 2023, the Company had consolidated

cash, cash equivalents and restricted cash of $1.4 billion.

Research and Development Expenses

Research and development expenses were $132.0 million for each

of the three months ended September 30, 2023, and 2022.

Changes in the components of research and development expenses

included a decrease in personnel-related expenses of $5.4 million

and increases in share-based compensation expense of $1.5 million

and program-specific costs of $1.2 million.

Within program-specific costs, the primary drivers of change

during the three months ended September 30, 2023 as compared

to the three months ended September 30, 2022 were an

additional expense of $18.6 million related to RVT-3101, which was

acquired in November 2022, and a decrease in expenses related to

other development and discovery programs of $18.2 million, which in

part resulted from the deconsolidation of Proteovant in August 2023

along with the reprioritization of certain programs and drug

discovery efforts.

Non-GAAP R&D expenses were $121.9 million for the three

months ended September 30, 2023, compared to $123.3 million

for the three months ended September 30, 2022.

Selling, General and Administrative

Expenses

Selling, general and administrative expenses increased by $6.7

million to $164.4 million for the three months ended

September 30, 2023, compared to $157.7 million for the three

months ended September 30, 2022, primarily due to an increase

in selling, general and administrative expenses of $21.8 million at

Dermavant as a result of the progression of the commercial launch

of VTAMA, partially offset by a decrease of $14.2 million of

share-based compensation expense.

Non-GAAP SG&A expenses were $122.1 million for the three

months ended September 30, 2023, compared to $101.5 million

for the three months ended September 30, 2022. The majority of

non-GAAP SG&A expenses were related to Dermavant’s SG&A and

ongoing VTAMA commercial launch activities.

Net Loss

Net loss was $331.1 million for the three months ended

September 30, 2023, compared to $315.9 million for the three

months ended September 30, 2022. On a per common share basis,

net loss was $0.40 for the three months ended September 30,

2023, and $0.42 for the three months ended September 30, 2022.

Non-GAAP net loss was $225.4 million for the three months ended

September 30, 2023, compared to $226.8 million for the three

months ended September 30, 2022.

ROIVANT SCIENCES

LTD.Selected Balance Sheet

Data(unaudited, in thousands)

| |

September 30, 2023 |

|

March 31, 2023 |

| |

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

1,423,188 |

|

$ |

1,692,115 |

| Total assets |

|

2,065,543 |

|

|

2,389,604 |

| Total liabilities |

|

739,910 |

|

|

782,017 |

| Total shareholders’

equity |

|

1,325,633 |

|

|

1,607,587 |

| Total liabilities and

shareholders’ equity |

|

2,065,543 |

|

|

2,389,604 |

ROIVANT SCIENCES

LTD.Condensed Consolidated Statements of

Operations(unaudited, in thousands, except share and per

share amounts)

| |

Three Months Ended September 30, |

|

Six Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

18,424 |

|

|

$ |

4,969 |

|

|

$ |

35,083 |

|

|

$ |

5,110 |

|

|

License, milestone and other revenue |

|

18,677 |

|

|

|

7,564 |

|

|

|

23,642 |

|

|

|

11,742 |

|

|

Revenue, net |

|

37,101 |

|

|

|

12,533 |

|

|

|

58,725 |

|

|

|

16,852 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of revenues |

|

3,266 |

|

|

|

3,641 |

|

|

|

7,480 |

|

|

|

5,367 |

|

|

Research and development (includes $8,877 and $7,417 of share-based

compensation expense for the three months ended September 30, 2023

and 2022 and $16,830 and $19,660 for the six months ended September

30, 2023 and 2022, respectively) |

|

131,984 |

|

|

|

131,995 |

|

|

|

257,117 |

|

|

|

267,825 |

|

|

Acquired in-process research and development |

|

13,950 |

|

|

|

— |

|

|

|

26,450 |

|

|

|

— |

|

|

Selling, general and administrative (includes $40,309 and $54,479

of share-based compensation expense for the three months ended

September 30, 2023 and 2022 and $81,501 and $115,030 for the six

months ended September 30, 2023 and 2022, respectively) |

|

164,355 |

|

|

|

157,663 |

|

|

|

320,545 |

|

|

|

306,735 |

|

|

Total operating expenses |

|

313,555 |

|

|

|

293,299 |

|

|

|

611,592 |

|

|

|

579,927 |

|

| |

|

|

|

|

|

|

|

| Loss from operations |

|

(276,454 |

) |

|

|

(280,766 |

) |

|

|

(552,867 |

) |

|

|

(563,075 |

) |

| |

|

|

|

|

|

|

|

| Change in fair value of

investments |

|

45,849 |

|

|

|

54,678 |

|

|

|

53,413 |

|

|

|

79,225 |

|

| Change in fair value of debt

and liability instruments |

|

21,533 |

|

|

|

(13,541 |

) |

|

|

76,045 |

|

|

|

27,672 |

|

| Gain on deconsolidation of

subsidiaries |

|

(17,354 |

) |

|

|

(16,762 |

) |

|

|

(17,354 |

) |

|

|

(16,762 |

) |

| Interest income |

|

(14,299 |

) |

|

|

(5,670 |

) |

|

|

(31,014 |

) |

|

|

(7,651 |

) |

| Interest expense |

|

9,247 |

|

|

|

8,335 |

|

|

|

18,159 |

|

|

|

10,947 |

|

| Other expense, net |

|

5,931 |

|

|

|

5,950 |

|

|

|

1,338 |

|

|

|

7,035 |

|

| Loss before income taxes |

|

(327,361 |

) |

|

|

(313,756 |

) |

|

|

(653,454 |

) |

|

|

(663,541 |

) |

| Income tax expense |

|

3,757 |

|

|

|

2,165 |

|

|

|

5,509 |

|

|

|

6,164 |

|

| Net loss |

|

(331,118 |

) |

|

|

(315,921 |

) |

|

|

(658,963 |

) |

|

|

(669,705 |

) |

| Net loss attributable to

noncontrolling interests |

|

(26,791 |

) |

|

|

(24,331 |

) |

|

|

(62,820 |

) |

|

|

(46,306 |

) |

| Net loss attributable to

Roivant Sciences Ltd. |

$ |

(304,327 |

) |

|

$ |

(291,590 |

) |

|

$ |

(596,143 |

) |

|

$ |

(623,399 |

) |

| Net loss per common

share—basic and diluted |

$ |

(0.40 |

) |

|

$ |

(0.42 |

) |

|

$ |

(0.78 |

) |

|

$ |

(0.89 |

) |

| Weighted average shares

outstanding—basic and diluted |

|

770,227,849 |

|

|

|

699,888,061 |

|

|

|

764,780,630 |

|

|

|

697,894,414 |

|

ROIVANT SCIENCES

LTD.Reconciliation of GAAP to Non-GAAP Financial

Measures(unaudited, in thousands)

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

$ |

(331,118 |

) |

|

$ |

(315,921 |

) |

|

$ |

(658,963 |

) |

|

$ |

(669,705 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

(1 |

) |

|

|

2,399 |

|

|

|

2,200 |

|

|

|

4,769 |

|

|

|

2,942 |

|

|

Share-based compensation |

(2 |

) |

|

|

60 |

|

|

|

— |

|

|

|

98 |

|

|

|

— |

|

| Research and development: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

8,877 |

|

|

|

7,417 |

|

|

|

16,830 |

|

|

|

19,660 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,205 |

|

|

|

1,230 |

|

|

|

2,694 |

|

|

|

2,300 |

|

| Selling, general and

administrative: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

40,309 |

|

|

|

54,479 |

|

|

|

81,501 |

|

|

|

115,030 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,966 |

|

|

|

1,646 |

|

|

|

3,946 |

|

|

|

2,512 |

|

| Other: |

|

|

|

|

|

|

|

|

|

|

Change in fair value of investments |

(4 |

) |

|

|

45,849 |

|

|

|

54,678 |

|

|

|

53,413 |

|

|

|

79,225 |

|

|

Change in fair value of debt and liability instruments |

(5 |

) |

|

|

21,533 |

|

|

|

(13,541 |

) |

|

|

76,045 |

|

|

|

27,672 |

|

|

Gain on deconsolidation of subsidiaries |

(6 |

) |

|

|

(17,354 |

) |

|

|

(16,762 |

) |

|

|

(17,354 |

) |

|

|

(16,762 |

) |

| Estimated income tax impact

from adjustments |

(7 |

) |

|

|

884 |

|

|

|

(2,219 |

) |

|

|

152 |

|

|

|

(346 |

) |

| |

|

|

|

|

|

|

|

|

|

| Adjusted net loss

(Non-GAAP) |

|

|

$ |

(225,390 |

) |

|

$ |

(226,793 |

) |

|

$ |

(436,869 |

) |

|

$ |

(437,472 |

) |

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

|

| Research and

development expenses |

|

|

$ |

131,984 |

|

|

$ |

131,995 |

|

|

$ |

257,117 |

|

|

$ |

267,825 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

8,877 |

|

|

|

7,417 |

|

|

|

16,830 |

|

|

|

19,660 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,205 |

|

|

|

1,230 |

|

|

|

2,694 |

|

|

|

2,300 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted research and

development expenses (Non-GAAP) |

|

|

$ |

121,902 |

|

|

$ |

123,348 |

|

|

$ |

237,593 |

|

|

$ |

245,865 |

|

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

|

$ |

164,355 |

|

|

$ |

157,663 |

|

|

$ |

320,545 |

|

|

$ |

306,735 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

40,309 |

|

|

|

54,479 |

|

|

|

81,501 |

|

|

|

115,030 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,966 |

|

|

|

1,646 |

|

|

|

3,946 |

|

|

|

2,512 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted selling,

general and administrative expenses (Non-GAAP) |

|

|

$ |

122,080 |

|

|

$ |

101,538 |

|

|

$ |

235,098 |

|

|

$ |

189,193 |

|

Notes to non-GAAP financial measures:

(1) Represents non-cash amortization of intangible assets

associated with milestone payments made in connection with

regulatory approvals.

(2) Represents non-cash share-based compensation expense.

(3) Represents non-cash depreciation and amortization expense,

other than amortization of intangible assets associated with

milestone payments made in connection with regulatory

approvals.

(4) Represents the unrealized loss on equity investments in

unconsolidated entities that are accounted for at fair value with

changes in value reported in earnings.

(5) Represents the change in fair value of debt and liability

instruments, which is non-cash and primarily includes the

unrealized loss relating to the measurement and recognition of fair

value on a recurring basis of certain liabilities.

(6) Represents the one-time gain on deconsolidation of

subsidiaries.

(7) Represents the estimated tax effect of the adjustments.

Investor Conference Call Information

Roivant will host a live conference call and webcast at 8:00

a.m. ET on Monday, November 13, 2023, to report its financial

results for the second quarter ended September 30, 2023, and

provide a corporate update.

To access the conference call by phone, please

register online using this registration link. The presentation and

webcast details will also be available under “Events &

Presentations” in the Investors section of the Roivant website at

https://investor.roivant.com/news-events/events. The archived

webcast will be available on Roivant’s website after the conference

call.

About Roivant

Roivant is a commercial-stage biopharmaceutical company that

aims to improve the lives of patients by accelerating the

development and commercialization of medicines that matter. Today,

Roivant’s pipeline includes VTAMA®, a novel topical approved for

the treatment of psoriasis and in development for the treatment of

atopic dermatitis; batoclimab and IMVT-1402, fully human monoclonal

antibodies targeting the neonatal Fc receptor (“FcRn”) in

development across several IgG-mediated autoimmune indications;

brepocitinib, a novel TYK2/JAK1 inhibitor in late stage development

for dermatomyositis, systemic lupus erythematosus, and other

autoimmune conditions; and, additional clinical stage molecules. We

advance our pipeline by creating nimble subsidiaries or “Vants” to

develop and commercialize our medicines and technologies. Beyond

therapeutics, Roivant also incubates discovery-stage companies and

health technology startups complementary to its biopharmaceutical

business. For more information, www.roivant.com.

Roivant Forward-Looking Statements

This press release contains forward-looking statements.

Statements in this press release may include statements that are

not historical facts and are considered forward-looking within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), which are usually

identified by the use of words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and variations of such words or similar

expressions. The words may identify forward-looking statements, but

the absence of these words does not mean that a statement is not

forward-looking. We intend these forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act.

Our forward-looking statements include, but are not limited to,

statements regarding our or our management team’s expectations,

hopes, beliefs, intentions or strategies regarding the future, and

statements that are not historical facts, including statements

about the pending sale of our subsidiary Telavant to Roche (the

“Telavant Transaction”), the clinical and therapeutic potential of

our products and product candidates, the availability and success

of topline results from our ongoing clinical trials and any

commercial potential of our products and product candidates. In

addition, any statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking

statements.

The Telavant Transaction is subject to the expiration or

termination of the waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976 and other customary closing

conditions. There can be no assurance that the Telavant Transaction

will close on the timelines specified in this presentation or at

all.

Although we believe that our plans, intentions, expectations and

strategies as reflected in or suggested by those forward-looking

statements are reasonable, we can give no assurance that the plans,

intentions, expectations or strategies will be attained or

achieved. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a number of risks, uncertainties and assumptions,

including, but not limited to, those risks set forth in the Risk

Factors section of our filings with the U.S. Securities and

Exchange Commission. Moreover, we operate in a very competitive and

rapidly changing environment in which new risks emerge from time to

time. These forward-looking statements are based upon the current

expectations and beliefs of our management as of the date of this

press release, and are subject to certain risks and uncertainties

that could cause actual results to differ materially from those

described in the forward-looking statements. Except as required by

applicable law, we assume no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts:

InvestorsRoivant Investor Relationsir@roivant.com

MediaStephanie LeeRoivant Sciencesstephanie.lee@roivant.com

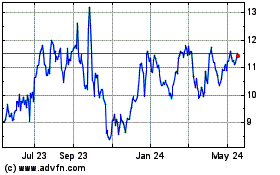

Roivant Sciences (NASDAQ:ROIV)

Historical Stock Chart

From Nov 2024 to Dec 2024

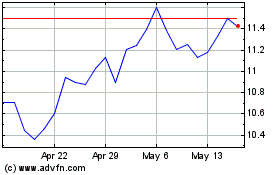

Roivant Sciences (NASDAQ:ROIV)

Historical Stock Chart

From Dec 2023 to Dec 2024