Roivant Sciences Ltd. (Nasdaq: ROIV) today reported its financial

results for the second quarter ended September 30, 2022 and

provided an update on the Company’s operations.

Roivant’s chief executive officer, Matt Gline, noted: “This has

been a great quarter for Roivant. In addition to VTAMA’s strong

performance and the enthusiastic feedback we’ve received from

patients and providers, we executed our first major PBM contract.

This provides immediate coverage for millions of lives associated

with that PBM, establishes a national template for unrestricted

access to VTAMA, and supports a paradigm shift to VTAMA as the

mainstay of psoriasis therapy. Our fully enrolled potentially

registrational SLE study for brepocitinib, which reads out next

year, and Immunovant’s broadened anti-FcRn portfolio, represent

notable progress in our immunology pipeline. Between cost reduction

and multiple recent infusions of capital, we’ve extended our runway

into the second half of calendar year 2025 – and we’re looking

forward to multiple key catalysts between now and then, including

many in the next year.”

Recent Developments

- Roivant: On November 8, priced $150 million

total gross primary and secondary offering, consisting of gross

primary proceeds to Roivant of $100 million. Roivant continued its

cost optimization and pipeline reprioritization initiatives

initially announced in June 2022 in order to focus capital on the

most valuable and meaningful opportunities in the pipeline, while

maintaining the financial flexibility to opportunistically

in-license assets. Roivant expects that its consolidated cash, cash

equivalents and restricted cash of $1.6 billion at September 30,

2022, or $1.9 billion after giving effect to subsequent Roivant and

Immunovant follow-on offerings and anticipated proceeds from the

sale of Myovant equity rights to Sumitomo Pharma, along with

continued cost savings initiatives, support cash runway into second

half of calendar year 2025.

- Dermavant: Through November 4, VTAMA has had

over 54,000 prescriptions written by approximately 6,400 unique

prescribers, based on IQVIA data. For the quarter ended September

30, 2022, Roivant reported VTAMA net product revenue of $5.0

million, representing a gross-to-net yield of approximately 12%.

Dermavant also entered into a reimbursement contract with one of

the three largest PBMs, effective October 1, 2022. Finally,

Dermavant announced results from its maximal use pharmacokinetic

study of VTAMA in atopic dermatitis, which showed minimal to no

systemic absorption and favorable tolerability when used in

pediatric patients down to age two.

- Priovant: Completed enrollment for its ongoing

potentially registrational global trial evaluating oral

brepocitinib for the treatment of SLE in August 2022. Oral

brepocitinib is a potential first-in-class dual, selective

inhibitor of TYK2 and JAK1 licensed from Pfizer that has been

evaluated in 14 completed Phase 1 and Phase 2 trials, including 5

placebo-controlled Phase 2 trials in psoriatic arthritis, plaque

psoriasis, ulcerative colitis, alopecia areata and hidradenitis

suppurativa that generated statistically significant and clinically

meaningful efficacy results. With over 1,000 patients exposed in

these studies, brepocitinib showed a safety and tolerability

profile in line with other class agents. Priovant is also

developing oral brepocitinib for the treatment of dermatomyositis,

for which it recently initiated a single potentially registrational

Phase 3 trial.

- Immunovant: At Roivant’s Investor Day on

September 28, Immunovant unveiled IMVT-1402, a next generation

anti-FcRn which showed deep IgG lowering similar to batoclimab with

no or minimal impact observed on albumin and LDL levels in a

head-to-head animal study with batoclimab and placebo.

Additionally, on September 7 Immunovant unveiled two new

development programs for batoclimab in Graves’ disease and chronic

inflammatory demyelinating polyneuropathy (CIDP). Immunovant also

completed a $75.0 million follow-on offering in October, with

leading life sciences investors including Logos Capital, Deep Track

Capital, Frazier Life Sciences, TCGX, BVF Partners, and Commodore

Capital participating.

- Genevant: On November 2, the federal district

court in Delaware issued an opinion and order in the patent

infringement suit brought by Genevant and Arbutus against Moderna.

The court denied Moderna’s partial motion to dismiss the suit based

on the government-contractor defense under 28 U.S.C. Section 1498,

which was an attempt by Moderna to shift liability for an

unspecified portion its alleged infringement to the US government

and taxpayers. The case is now expected to proceed to the pre-trial

discovery phase.

- Proteovant: Disclosed today data from its

preclinical estrogen receptor (ER) degrader demonstrating equal or

better tumor reduction in an in vivo model in a head-to-head

comparison with the most advanced degrader in its class.

- Affivant: Affivant and Affimed jointly

unveiled AFVT-2101 at the Society for Immunotherapy of Cancer

(SITC) Annual Meeting in Boston on November 8. AFVT-2101 is a

tetravalent, bispecific ICE® (innate cell engager) that selectively

targets folate receptor alpha (FRα) and CD16A (FcγR3A). AFVT-2101

directs innate immune cells to kill tumor cells selectively and

potently with a wide range of FRα expression. Due to the high

avidity for CD16A, AFVT-2101 is more efficacious and potent in both

antibody-dependent cellular cytotoxicity (ADCC) and

antibody-dependent cellular phagocytosis (ADCP) assays than

farletuzumab, a monoclonal antibody targeting FRα.

Major Upcoming Milestones

- Dermavant: Expects to provide updates on the

commercial launch of VTAMA for psoriasis on a periodic basis and to

report topline data from the Phase 3 trials of VTAMA for the

treatment of atopic dermatitis in the first half of calendar year

2023.

- Priovant: Plans to announce topline results

from the potentially registrational trial evaluating brepocitinib

for the treatment of patients with SLE in the second half of

calendar year 2023.

- Immunovant: Phase 3 trials of batoclimab in

myasthenia gravis (MG) and thyroid eye disease (TED) progressing

and expects to have top-line results from the MG trial in the

second half of calendar year 2024 and from the two TED trials in

the first half of calendar year 2025. A pivotal Phase 2b trial in

CIDP is planned to be initiated by the end of calendar year 2022,

with initial results from the open label period expected in the

first half of calendar year 2024. In Graves’ disease, a Phase 2

trial is planned to be initiated in early calendar year 2023 with

initial results expected in the second half of calendar year 2023.

Immunovant plans to finalize the lead asset and trial design in

WAIHA following an expected engagement with the hematology division

of the FDA before the end of calendar year 2022. Immunovant plans

to submit an IND and initiate a Phase 1 study for IMVT-1402 in

early 2023 with initial human data expected in mid-2023; Immunovant

believes these Phase 1 results together with strong IgG biomarker

data from batoclimab may accelerate the development program for

1402.

- Hemavant: Plans to announce data from the

ongoing open-label Phase 1/2 trial evaluating RVT-2001 for the

treatment of transfusion-dependent anemia in lower-risk MDS

patients in the second half of calendar year 2023.

- Kinevant: Plans to report topline data from

the ongoing Phase 2 trial of namilumab for the treatment of

sarcoidosis in the first half of calendar year 2024.

Second Quarter Ended September 30, 2022 Financial

Summary

Cash Position

As of September 30, 2022, we had cash, cash equivalents and

restricted cash of approximately $1.6 billion. Giving effect to

Immunovant’s October 2022 follow-on offering for $75 million in

gross proceeds, Roivant’s November follow-on offering for $100

million in gross primary proceeds, and $115 million in expected

proceeds from the planned sale of the Myovant top-up shares in

connection with the pending acquisition of Myovant by Sumitomo

Pharma, Roivant’s consolidated cash, cash equivalents and

restricted cash would have been approximately $1.9 billion. The

Myovant transaction is expected to close in the first calendar

quarter of 2023, subject to customary closing conditions.

Research and Development Expenses

Research and development (R&D) expenses were $132.0 million

for the three months ended September 30, 2022 compared to $132.1

million for the three months ended September 30, 2021. The

quarter-over-quarter decrease was primarily due to a decrease in

share-based compensation expense due to the achievement of the

liquidity event vesting condition for certain equity instruments

upon the closing of the Business Combination with MAAC in September

2021, resulting in the recognition of a one-time catch-up expense.

This decrease was offset by increases in personnel-related expenses

and program-specific costs, reflecting the progression of our

programs and drug discovery. Non-GAAP R&D expenses were $123.3

million for the three months ended September 30, 2022 compared to

$103.2 million for the three months ended September 30, 2021.

Selling, General and Administrative

Expenses

Selling, general and administrative (SG&A) expenses were

$157.7 million for the three months ended September 30, 2022

compared to $437.8 million for the three months ended September 30,

2021. The quarter-over-quarter decrease was primarily due to a

decrease in share-based compensation expense, partially offset by

higher selling, general and administrative expenses at Dermavant as

a result of the commercial launch of VTAMA. The decrease in

share-based compensation resulted from the achievement of the

liquidity event vesting condition for certain equity instruments

upon the closing of the Business Combination with MAAC in September

2021, resulting in the recognition of a one-time catch-up expense.

This decrease was partially offset by continued vesting of the

equity instruments. Non-GAAP SG&A expenses were $101.5 million

for the three months ended September 30, 2022 compared to $68.0

million for the three months ended September 30, 2021.

Net Loss

Net loss was $315.9 million for the three months ended September

30, 2022 compared to $225.6 million for the three months ended

September 30, 2021. On a per common share basis, net loss was $0.42

for the three months ended September 30, 2022 and $0.32 for the

three months ended September 30, 2021. Non-GAAP net loss was $226.8

million for the three months ended September 30, 2022 compared to

$290.0 million for the three months ended September 30, 2021.

ROIVANT SCIENCES LTD.

Selected Balance Sheet Data (unaudited, in

thousands)

| |

September 30, 2022 |

|

March 31, 2022 |

| |

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

1,612,646 |

|

$ |

2,074,034 |

| Total assets |

|

2,215,534 |

|

|

2,585,129 |

| Total liabilities |

|

701,385 |

|

|

523,695 |

| Total shareholders’

equity |

|

1,514,149 |

|

|

2,038,943 |

| Total liabilities, redeemable

noncontrolling interest and shareholders’ equity |

|

2,215,534 |

|

|

2,585,129 |

ROIVANT SCIENCES LTD.

Condensed Consolidated Statements of Operations

(unaudited, in thousands, except share and per share amounts)

| |

Three Months Ended September 30, |

|

Six Months Ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

| Revenue, net |

$ |

12,533 |

|

|

$ |

13,987 |

|

|

$ |

16,852 |

|

|

$ |

21,722 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of revenues |

|

3,641 |

|

|

|

6,381 |

|

|

|

5,367 |

|

|

|

7,123 |

|

|

Research and development (includes $7,417 and $28,157 of

share-based compensation expense for the three months ended

September 30, 2022 and 2021 and $19,660 and $29,772 for the six

months ended September 30, 2022 and 2021, respectively) |

|

131,995 |

|

|

|

132,098 |

|

|

|

267,825 |

|

|

|

210,613 |

|

|

Acquired in-process research and development |

|

— |

|

|

|

122,161 |

|

|

|

— |

|

|

|

122,272 |

|

|

Selling, general and administrative (includes $54,479 and $369,155

of share-based compensation expense for the three months ended

September 30, 2022 and 2021 and $115,030 and $386,809 for the six

months ended September 30, 2022 and 2021, respectively) |

|

157,663 |

|

|

|

437,776 |

|

|

|

306,735 |

|

|

|

520,530 |

|

|

Total operating expenses |

|

293,299 |

|

|

|

698,416 |

|

|

|

579,927 |

|

|

|

860,538 |

|

| |

|

|

|

|

|

|

|

| Loss from operations |

|

(280,766 |

) |

|

|

(684,429 |

) |

|

|

(563,075 |

) |

|

|

(838,816 |

) |

| |

|

|

|

|

|

|

|

| Change in fair value of

investments |

|

54,678 |

|

|

|

(32,273 |

) |

|

|

79,225 |

|

|

|

(23,654 |

) |

| Gain on sale of

investment |

|

— |

|

|

|

(443,754 |

) |

|

|

— |

|

|

|

(443,754 |

) |

| Change in fair value of debt

and liability instruments |

|

(13,541 |

) |

|

|

13,145 |

|

|

|

27,672 |

|

|

|

17,730 |

|

| Gain on termination of

Sumitomo Options |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(66,472 |

) |

| Gain on deconsolidation of

subsidiary |

|

(16,762 |

) |

|

|

— |

|

|

|

(16,762 |

) |

|

|

— |

|

| Other expense, net |

|

8,615 |

|

|

|

3,692 |

|

|

|

10,331 |

|

|

|

3,558 |

|

| Loss before income taxes |

|

(313,756 |

) |

|

|

(225,239 |

) |

|

|

(663,541 |

) |

|

|

(326,224 |

) |

| Income tax expense |

|

2,165 |

|

|

|

401 |

|

|

|

6,164 |

|

|

|

494 |

|

| Net loss |

|

(315,921 |

) |

|

|

(225,640 |

) |

|

|

(669,705 |

) |

|

|

(326,718 |

) |

| Net loss attributable to

noncontrolling interests |

|

(24,331 |

) |

|

|

(17,159 |

) |

|

|

(46,306 |

) |

|

|

(36,054 |

) |

| Net loss attributable to

Roivant Sciences Ltd. |

$ |

(291,590 |

) |

|

$ |

(208,481 |

) |

|

$ |

(623,399 |

) |

|

$ |

(290,664 |

) |

| Net loss per common

share—basic and diluted |

$ |

(0.42 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.89 |

) |

|

$ |

(0.45 |

) |

| Weighted average shares

outstanding—basic and diluted |

|

699,888,061 |

|

|

|

650,225,764 |

|

|

|

697,894,414 |

|

|

|

650,041,993 |

|

ROIVANT SCIENCES LTD.

Reconciliation of GAAP to Non-GAAP Financial

Measures (unaudited, in thousands)

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

$ |

(315,921 |

) |

|

$ |

(225,640 |

) |

|

$ |

(669,705 |

) |

|

$ |

(326,718 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

(1 |

) |

|

|

2,200 |

|

|

|

— |

|

|

|

2,942 |

|

|

|

— |

|

| Research and development: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

7,417 |

|

|

|

28,157 |

|

|

|

19,660 |

|

|

|

29,772 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,230 |

|

|

|

780 |

|

|

|

2,300 |

|

|

|

1,523 |

|

| General and

administrative: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

54,479 |

|

|

|

369,155 |

|

|

|

115,030 |

|

|

|

386,809 |

|

|

Depreciation and amortization |

(3 |

) |

|

|

1,646 |

|

|

|

589 |

|

|

|

2,512 |

|

|

|

1,333 |

|

| Other: |

|

|

|

|

|

|

|

|

|

|

Change in fair value of investments |

(4 |

) |

|

|

54,678 |

|

|

|

(32,273 |

) |

|

|

79,225 |

|

|

|

(23,654 |

) |

|

Gain on sale of investment |

(5 |

) |

|

|

— |

|

|

|

(443,754 |

) |

|

|

— |

|

|

|

(443,754 |

) |

|

Change in fair value of debt and liability instruments |

(6 |

) |

|

|

(13,541 |

) |

|

|

13,145 |

|

|

|

27,672 |

|

|

|

17,730 |

|

|

Gain on termination of Sumitomo Options |

(7 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(66,472 |

) |

|

Gain on deconsolidation of subsidiary |

(8 |

) |

|

|

(16,762 |

) |

|

|

— |

|

|

|

(16,762 |

) |

|

|

— |

|

|

Estimated income tax impact from adjustments |

(9 |

) |

|

|

(2,219 |

) |

|

|

(156 |

) |

|

|

(346 |

) |

|

|

60 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted net loss

(Non-GAAP) |

|

|

$ |

(226,793 |

) |

|

$ |

(289,997 |

) |

|

$ |

(437,472 |

) |

|

$ |

(423,371 |

) |

|

|

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

|

|

Note |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

$ |

131,995 |

|

$ |

132,098 |

|

$ |

267,825 |

|

$ |

210,613 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

7,417 |

|

|

28,157 |

|

|

19,660 |

|

|

29,772 |

|

Depreciation and amortization |

(3 |

) |

|

|

1,230 |

|

|

780 |

|

|

2,300 |

|

|

1,523 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted research and development expenses

(Non-GAAP) |

|

|

$ |

123,348 |

|

$ |

103,161 |

|

$ |

245,865 |

|

$ |

179,318 |

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

| |

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

|

$ |

157,663 |

|

$ |

437,776 |

|

$ |

306,735 |

|

$ |

520,530 |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(2 |

) |

|

|

54,479 |

|

|

369,155 |

|

|

115,030 |

|

|

386,809 |

|

Depreciation and amortization |

(3 |

) |

|

|

1,646 |

|

|

589 |

|

|

2,512 |

|

|

1,333 |

| |

|

|

|

|

|

|

|

|

|

| Adjusted selling,

general and administrative expenses (Non-GAAP) |

|

|

$ |

101,538 |

|

$ |

68,032 |

|

$ |

189,193 |

|

$ |

132,388 |

Notes to non-GAAP financial measures:

(1) Represents non-cash amortization of intangible assets

associated with milestone payments made in connection with

regulatory approvals.

(2) Represents non-cash share-based compensation expense.

(3) Represents non-cash depreciation and amortization expense,

other than amortization of intangible assets associated with

milestone payments made in connection with regulatory

approvals.

(4) Represents the unrealized loss (gain) on equity investments

in unconsolidated entities that are accounted for at fair value

with changes in value reported in earnings.

(5) Represents a one-time gain on sale of investment resulting

from the merger of Datavant and CIOX Health in July 2021.

(6) Represents the change in fair value of debt and liability

instruments, which is non-cash and primarily includes the

unrealized (gain) loss relating to the measurement and recognition

of fair value on a recurring basis of certain liabilities.

(7) Represents the one-time gain on termination of the options

held by Sumitomo Dainippon Pharma Co., Ltd. to purchase Roivant’s

ownership interest in certain Vants (the “Sumitomo Options”).

(8) Represents the one-time gain on deconsolidation of a

subsidiary.

(9) Represents the estimated tax effect of the adjustments.

Beginning in the fourth quarter of the fiscal year ended March

31, 2022, the Company no longer excludes from its non-GAAP

financial measures acquired IPR&D expenses, which include

consideration for the purchase of IPR&D through asset

acquisitions and license agreements as well as payments made in

connection with asset acquisitions and license agreements upon the

achievement of development milestones. Previously, these items were

excluded from the Company’s non-GAAP financial measures. In

conjunction with this change, acquired IPR&D expenses are now

reported as a separate line item in its consolidated statements of

operations. Prior period amounts have been revised to conform to

the current presentation.

There was no acquired IPR&D expense for the three and six

months ended September 30, 2022. For the three and six months ended

September 30, 2021, acquired IPR&D expense was $122.2 million

and $122.3 million, respectively.

Roivant also announced today that it will participate in

three additional upcoming investor conferences:

- Cantor Medical & Aesthetic Dermatology, Ophthalmology &

MedTech Conference in Miami from December 7-8. CFO Richard Pulik

will participate in the panel “Commercial Successes, Current &

Upcoming Launches” at 9:00 a.m. EST on Thursday, December 8

- Jefferies Healthcare Summit in Denver from December 14-15

- 41st Annual J.P. Morgan Healthcare Conference in San Francisco

from January 9-12

Investor Conference Call Information

Roivant will host a live conference call and webcast at 8:00

a.m. EST on Monday, November 14, 2022 to report its financial

results for the fiscal quarter ended September 30, 2022 and provide

a corporate update.

To access the conference call by phone, please register online

using this registration link. A webcast of the call will also be

available under “Events & Presentations” in the Investors

section of the Roivant website at

https://investor.roivant.com/news-events/events. The archived

webcast will be available on Roivant’s website after the conference

call.

About Roivant Sciences

Roivant’s mission is to improve the delivery of healthcare to

patients by treating every inefficiency as an opportunity. Roivant

develops transformative medicines faster by building technologies

and developing talent in creative ways, leveraging the Roivant

platform to launch “Vants” – nimble and focused biopharmaceutical

and health technology companies. For more information, please visit

www.roivant.com.

Roivant Sciences Forward-Looking Statements

This press release contains forward-looking statements.

Statements in this press release may include statements that are

not historical facts and are considered forward-looking within the

meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

which are usually identified by the use of words such as

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “would” and variations of such

words or similar expressions. The words may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. We intend these

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in

Section 27A of the Securities Act and Section 21E of the

Exchange Act.

Our forward-looking statements include, but are not limited to,

statements regarding our or our management team's expectations,

hopes, beliefs, intentions or strategies regarding the future, and

statements that are not historical facts, including statements

about the clinical and therapeutic potential of VTAMA and our other

existing and future product candidates, the timing and expectations

of potential regulatory submissions, the availability and success

of topline results from our ongoing clinical trials, any commercial

potential of VTAMA and our other product candidates, including but

not limited to the anticipated timeline of commercial coverage of

VTAMA, the receipt of proceeds from the expected sale of the

Myovant top-up shares to Sumitomo Pharma, any pending or potential

litigation, including but not limited to our expectations regarding

the outcome of any such litigation and costs and expenses

associated with such litigation, and our business strategies,

financial condition, and trends, competitive position, potential

growth opportunities, and expectations or probabilities for

success. In addition, any statements that refer to projections,

forecasts or other characterizations of future events or

circumstances, including any underlying assumptions, are

forward-looking statements.

Although we believe that our plans, intentions, expectations and

strategies as reflected in or suggested by those forward-looking

statements are reasonable, we can give no assurance that the plans,

intentions, expectations or strategies will be attained or

achieved. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a number of risks, uncertainties and assumptions,

including, but not limited to, those risks set forth in the Risk

Factors section of our filings with the U.S. Securities and

Exchange Commission. Moreover, we operate in a very competitive and

rapidly changing environment in which new risks emerge from time to

time. These forward-looking statements are based upon the current

expectations and beliefs of our management as of the date of this

press release, and are subject to certain risks and uncertainties

that could cause actual results to differ materially from those

described in the forward-looking statements. Except as required by

applicable law, we assume no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts

Investors Roivant Investor Relations ir@roivant.com

Media Stephanie LeeRoivant Sciences

stephanie.lee@roivant.com

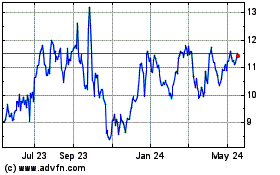

Roivant Sciences (NASDAQ:ROIV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Roivant Sciences (NASDAQ:ROIV)

Historical Stock Chart

From Jan 2024 to Jan 2025