false

0001041024

0001041024

2024-07-12

2024-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): July 12, 2024

Rockwell

Medical, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

000-23661 |

38-3317208 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

30142

S. Wixom Road, Wixom, Michigan 48393

(Address of principal executive offices, including

zip code)

(248) 960-9009

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class | |

Trading

Symbol | |

Name of Each exchange on which

registered |

| Common Stock, par value $0.0001 | |

RMTI | |

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On July 12, 2024, Rockwell Medical, Inc.

(the “Company”) and Evoqua Water Technologies LLC, a Delaware limited liability company (“Evoqua”), executed Amendment

No. 1 to the Asset Purchase Agreement (the “Amendment”), dated as of July 10, 2023, by and between the Company and

Evoqua (the “Purchase Agreement”). The Amendment clarifies certain terms regarding physical assets covered by the Purchase

Agreement and provides for an extended payment schedule for the deferred payments due by the Company to Evoqua and a partial reduction

in such payments as follows:

| · | $2,500,000 (the “First Deferred Payment”), which shall be partially offset $322,260 to reimburse

the Company for certain expenses incurred following the closing of the Purchase Agreement, resulting in a reduction of the First Deferred

Payment to $2,177,740, and which shall be paid in four quarterly installments through April 2025; and |

| · | $2,500,000, which shall be payable to Evoqua in four quarterly installments from July 10, 2025 through

April 10, 2026. |

The foregoing description of the Amendment and

the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text

of the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Form 8-K”) and incorporated

herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

Gross Margin Guidance for 2024

On July 15, 2024, Mark Strobeck, the Company’s Chief Executive

Officer, was interviewed by HC Wainwright as part of the 2024 Annual Kidney Conference. During such interview, Dr. Strobeck reconfirmed

the Company’s previously provided guidance of gross margin for 2024 between 14% and 16% (noting that Dr. Strobeck inadvertently

referred to gross margin guidance in the range of 13% to 15%, which was actually a reference to the Company’s previously issued gross

profit guidance of $13 to $15 million).

As noted in the Company’s first quarter earnings release, the

Company has excluded deferred revenue from the first quarter calculation of gross margin. This gross margin measure is a non-GAAP (as

defined below) financial measure. The Company has provided reconciliations to the GAAP measures at the end of the press release issued

by the Company on May 14, 2024, announcing gross margin guidance for 2024. Adjusted gross margin is used by the Company to understand

growth within its hemodialysis concentrates business by excluding a one-time item that is not indicative of its core operating performance.

Adjusted gross margin should not be considered in isolation of, or

as an alternative to, measures prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”).

Other companies, including companies in the same industry, may calculate similarly titled non-GAAP financial measures differently or may

use other measures to evaluate their performance, all of which could reduce the usefulness of adjusted gross margin as a tool for comparison.

There are a number of limitations related to the use of this non-GAAP financial measure rather than the most directly comparable financial

measures calculated in accordance with GAAP. When evaluating the Company’s performance, you should consider adjusted gross margin

alongside other financial performance measures, including net loss and other GAAP results. Adjusted gross margin enables us to understand

growth within our hemodialysis concentrates business by excluding a one-time item that is not indicative of our core operating performance.

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking

statements” within the meaning of the federal securities laws. Words such as, “may,” “might,” “will,”

“should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,”

“could,” “can,” “would,” “develop,” “plan,” “potential,” “predict,”

“forecast,” “project,” “intend,” “look forward to,” “remain confident,” “feel

confident,” “guidance,” or the negative of these terms, and similar expressions, or statements regarding intent, belief,

or current expectations, are forward-looking statements. These statements include (without limitation) statements regarding gross margin

and financial guidance for 2024. While the Company believes these forward-looking statements are reasonable, undue reliance should not

be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking

statements are based upon current estimates and assumptions and are subject to various risks and uncertainties (including, without limitation,

those set forth in the Company’s SEC filings), many of which are beyond our control and subject to change. Actual results could

be materially different. Risks and uncertainties include but are not limited to those risks more fully discussed in the “Risk Factors”

section of our Annual Report on Form 10-K for the year ended December 31, 2023, as such description may be amended or updated

in any subsequent reports filed with the SEC. The Company expressly disclaims any obligation to update our forward-looking statements,

except as may be required by law.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ROCKWELL MEDICAL, INC. |

| |

|

|

| Date: July 15, 2024 |

By: |

/s/ Mark Strobeck |

| |

|

Mark Strobeck, Ph.D. |

| |

|

President and Chief Executive Officer |

Exhibit 10.1

Amendment

No. 1 to Asset Purchase Agreement

This

Amendment No. 1 to Asset Purchase Agreement (this “Amendment”) is made as of July 12, 2024, by

and between Evoqua Water Technologies LLC, a Delaware limited liability company (“Seller”), and Rockwell Medical, Inc.,

a Delaware corporation (“Purchaser” and together with Seller, the “Parties”). Capitalized terms

used and not otherwise defined herein shall have the meanings accorded to such terms under the Agreement (as defined below).

BACKGROUND

WHEREAS,

the Parties are each party to that certain Asset Purchase Agreement, dated as of July 10, 2023 (the “Agreement”);

WHEREAS,

Section 10.2 of the Agreement provides that the Agreement may be amended by an agreement in writing executed by the Parties; and

Whereas,

the Parties wish to make certain changes to the provisions related to the Purchase Price, including to account for payments made by Rockwell

to dispose of expired Inventory.

AGREEMENT

NOW

THEREFORE, in consideration of the foregoing premises and certain other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the Parties hereby agree as follows:

| 1. | Amendment to Section 1.1(d). Section 1.1(d) of the Agreement is hereby amended and

restated to read in its entirety as follows: |

(d) all manufacturing equipment,

supplies and other tangible personal property used primarily in the Concentrates Business, including the manufacturing equipment, supplies

and other tangible personal property listed on Disclosure Schedule 1.1(d) (the “Equipment”); provided, however, that

Equipment listed on Disclosure Schedule 1.1(d) that cannot be physically separated from its existing site and physically relocated

to Purchaser’s site using commercially reasonable efforts (the “Undeliverable Equipment”) shall not be considered an

Acquired Asset and Seller shall have no obligation to reimburse Purchaser for such Undeliverable Equipment;

| 2. | Amendment to Section 2.1. Section 2.1 of the Agreement is hereby amended and restated

to read in its entirety as follows: |

“2.1 Purchase

Price. In consideration of the sale and transfer of the Acquired Assets and assumption of the Assumed Liabilities, Purchaser shall

pay and deliver to Seller an aggregate purchase price amount equal to sixteen million dollars ($16,000,000) plus the Final Inventory Amount

(collectively, the “Purchase Price”). The Purchase Price shall be paid by Purchaser to Seller as follows:

(a) at

Closing, an amount equal to eleven million dollars ($11,000,000) (the “Closing Purchase Price”) plus the Estimated

Inventory Amount, by wire transfer of immediately available funds to an account designated by Seller;

(b) two

million five hundred thousand dollars ($2,500,000), (the “First Deferred Payment”), payable by wire transfer of immediately

available funds to an account designated by Seller; provided, however, that pursuant to Section 8.4(d) the First Deferred Payment

shall be partially offset by an amount equal to three hundred twenty-two thousand, two hundred sixty dollars ($322,260) to reimburse Purchaser

for expenses incurred by Purchaser following the Closing related to the disposal of expired Inventory (the “Expired Inventory”),

resulting in a reduction of the First Deferred Payment to two million one hundred seventy-seven thousand seven hundred forty dollars ($2,177,740)

(the “Adjusted First Deferred Payment”). Such Adjusted First Deferred Payment shall be made in in four (4) installments

payable as follows: $653,322 on July 12, 2024; $653,322 on October 10, 2024; $435,548 on January 10, 2025; and $435,548

on April 10, 2025; and

(c) two

million five hundred thousand dollars ($2,500,000) (the “Second Deferred Payment” and collectively with the Adjusted

First Deferred Payment, the “Deferred Payments”), payable by wire transfer of immediately available funds to an account

designated by Seller in four (4) installments payable as follows: $750,000 on July 10, 2025; $750,000 on October 10, 2025;

$500,000 on January 12, 2026; and $500,000 on April 10, 2026.”

3. Release.

In consideration of the foregoing amendments, Purchaser, on behalf of itself and its affiliates, their respective successors and assigns,

and their respective employees, representatives, officers, directors, and shareholders, hereby fully releases and forever discharges Seller

and its affiliates, their respective successors and assigns, and their respective employees, representatives, officers, directors, and

shareholders from any and all claims, demands, and causes of action, in law, equity, or otherwise, whether asserted or unasserted, known

or unknown, suspected or unsuspected, based in contract, tort, statute, or regulation (whether state, local, foreign, federal, statutory,

regulatory, common, or other law or rule), or otherwise, contingent or non-contingent, based on, arising out of, relating to, or concerning,

in whole or in part, any failure to deliver the Undeliverable Equipment or Purchaser’s disposal of Expired Inventory.

4. Effect

of this Amendment; Counterparts. Except as specifically modified herein, the Agreement remains in full force and effect. This Amendment

may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one

and the same instrument, with the same effect as if the signatures thereto were in the same instrument. Article X of the Agreement

is hereby incorporated by reference mutatis mutandis.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Parties have executed this

Amendment as of the date first written above.

| |

PURCHASER: |

| |

|

| |

Rockwell Medical, Inc. |

| |

|

| |

|

| |

By: |

/s/ MARK STROBECK |

| |

Name: Mark Strobeck, Ph.D |

| |

Title: President and CEO |

| |

|

| |

|

| |

SELLER: |

| |

|

| |

EVOQUA WATER TECHNOLOGIES LLC |

| |

|

| |

|

| |

By: |

/s/ RODNEY MCNELLY |

| |

Name: Rodney McNelly |

| |

Title: VP WSS North America |

[Signature Page to Amendment No. 1

to Asset Purchase Agreement]

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

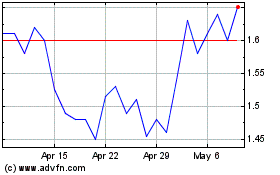

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Jul 2023 to Jul 2024