false

0001034842

0001034842

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): November 7,

2024

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

| 0-29889 |

|

94-3248524 |

| (Commission File No.) |

|

(IRS Employer Identification No.) |

| |

|

|

611

Gateway Boulevard

Suite 900 |

|

|

| South San Francisco, CA |

|

94080 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (650) 624-1100

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of

Each Exchange on Which

Registered |

| Common Stock, par value $0.001 per share |

|

RIGL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On November 7, 2024,

Rigel Pharmaceuticals, Inc. (“Rigel”) announced certain financial results for its third quarter ended September 30,

2024. A copy of Rigel’s press release, titled “Rigel Reports Third Quarter 2024 Financial Results and Provides Business Update,”

is furnished pursuant to Item 2.02 as Exhibit 99.1 hereto.

The information in this

report, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities

Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into

any filing with the U.S. Securities and Exchange Commission made by Rigel, whether made before or after the date hereof, regardless of

any general incorporation language in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

|

| (d) |

Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: November 7, 2024 |

RIGEL PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Raymond J. Furey |

| |

|

Raymond J. Furey |

| |

|

Executive Vice President, General Counsel, Chief

Compliance Officer, and Corporate Secretary |

Exhibit 99.1

Rigel Reports Third Quarter 2024 Financial Results

and Provides Business Update

| · | Third quarter total revenue of $55.3 million, which includes TAVALISSE®

net product sales of $26.3 million, REZLIDHIA® net product sales of $5.5 million and GAVRETO® net product

sales of $7.1 million |

| · | Entered into an agreement with Kissei to develop and commercialize REZLIDHIA

in all potential indications in Japan, the Republic of Korea and Taiwan, recording an upfront cash payment of $10.0 million during the

third quarter |

| · | Initial data from the ongoing Phase 1b study evaluating R289, a dual IRAK1/4

inhibitor, in LR-MDS to be presented at the 66th ASH Annual Meeting |

| · | Conference call and webcast scheduled today at 4:30 p.m. Eastern

Time |

SOUTH SAN FRANCISCO,

Calif., November 7, 2024 /PRNewswire/ -- Rigel Pharmaceuticals, Inc. (Nasdaq: RIGL), a commercial stage biotechnology

company focused on hematologic disorders and cancer, today reported financial results for the third quarter ended September 30, 2024,

including sales of TAVALISSE® (fostamatinib disodium

hexahydrate) for the treatment of chronic immune thrombocytopenia (ITP); REZLIDHIA® (olutasidenib)

for the treatment of relapsed or refractory (R/R) mutated isocitrate dehydrogenase-1 (mIDH1) acute myeloid leukemia (AML);

and GAVRETO® (pralsetinib)

for the treatment of metastatic rearranged during transfection (RET) fusion-positive non-small cell lung cancer (NSCLC) and advanced or

metastatic thyroid cancer, and recent business progress.

“2024 has

been a significant year for Rigel, marked by the acquisition of GAVRETO, our third commercial product, strong revenue growth across our

commercial portfolio, and the advancement of our development pipeline,” said Raul Rodriguez, Rigel’s president and

CEO. “This great progress is underpinned by our focus on financial discipline, resulting in

positive third-quarter and year-to-date net income. As we close out the year, we will continue driving momentum in our commercial portfolio

and hematology and oncology development pipeline.”

Third Quarter

2024 Business Update

Commercial

Update

| · | Commercial strength continues for all products with record bottles shipped

to patients and clinics and total bottles sold. |

| · | GAVRETO became commercially available from Rigel in June 2024. Third-quarter

results reflect the successful transition of existing patients on therapy to Rigel’s product. For the fourth quarter, the focus

will be on continuing to transition patients. |

| · | The following table summarizes total bottles shipped for the third quarter: |

| | |

TAVALISSE | | |

REZLIDHIA | | |

GAVRETO* | |

| Bottles shipped to patients and clinics | |

| 2,797 | | |

| 444 | | |

| 717 | |

| Change in bottles remaining in distribution channel | |

| (4 | ) | |

| (15 | ) | |

| 35 | |

| Total bottles shipped | |

| 2,793 | | |

| 429 | | |

| 752 | |

*GAVRETO

bottle count represents 60-count bottle equivalent

| · | In

September, Rigel entered into

an exclusive license and supply agreement with Kissei Pharmaceutical Co., Ltd. (“Kissei”)

to develop and commercialize REZLIDHIA in all potential

indications in Japan, the Republic of Korea and Taiwan.

Under the terms of the agreement, Rigel received an upfront cash payment of $10.0 million

from Kissei, with the potential for up to an additional $152.5 million in development, regulatory

and commercial milestone payments. |

| · | In

late October, Rigel issued a Dear Health Care Provider (DHCP) letter related to a new safety

signal for GAVRETO after consultation with the U.S. Food and Drug Administration (FDA). The

DHCP letter has been posted to the GAVRETO Healthcare Provider website at www.gavreto-hcp.com. |

Clinical

and Development Update

| · | Rigel continues to advance its

Phase 1b clinical study evaluating the safety, tolerability, pharmacokinetics, and preliminary efficacy of R2891, a novel and

selective dual IRAK1/4 inhibitor, in patients with R/R lower-risk myelodysplastic syndrome (LR-MDS). Enrollment in the fifth dose level

(500mg / 250mg split dose) is underway. |

| · | In

early November, Rigel announced

six poster presentations highlighting data from the company’s

commercial and clinical-stage hematology and oncology portfolio at the upcoming 66th American

Society of Hematology (ASH) Annual Meeting and Exposition. Initial data from the ongoing

Phase 1b study evaluating R289 in patients with R/R LR-MDS indicate that R289 was generally

well tolerated in a heavily pretreated LR-MDS patient population, the majority of whom were

high transfusion burden at study entry. As of the data cutoff, 14 of 19 patients were

evaluable for efficacy and per International Working Group (IWG) 2018, RBC-transfusion independence

(RBC-TI)/hematologic improvement (HI-E) occurred in 36% of patients receiving R289 doses

≥500 mg QD, with a median duration of RBC-TI of 29 weeks. RBC-TI >24 weeks was achieved

in 2 high transfusion burden patients following 3 and 5 prior therapies, including a hypomethylating

agent. The company will also present additional data for

olutasidenib in patients with R/R mIDH1 AML

and MDS. |

| · | In

September, Rigel announced the first patient was enrolled in a Phase 1b/2 triplet therapy

trial of decitabine and venetoclax in combination with REZLIDHIA in patients with mIDH1

AML, which is being sponsored and conducted by The University of Texas MD Anderson Cancer

Center (MD Anderson). This is the first trial in Rigel’s multi-year strategic

development alliance with MD Anderson. |

| · | A

paper detailing the differences in molecular structure, binding characteristics and clinical

outcomes between olutasidenib and ivosidenib, including response rates in patients previously

treated with ivosidenib or venetoclax, was published by Dr. Justin M. Watts, Associate

Professor of Medicine, Division of Hematology, Chief, Leukemia Section at the University

of Miami Health System, in Current

Treatment Options in Oncology in October 2024. |

Third Quarter 2024 and Year-To-Date Financial

Update

For the third quarter ended September 30,

2024, total revenues were $55.3 million, consisting of $26.3 million in TAVALISSE net product sales, $5.5 million in REZLIDHIA net product

sales, $7.1 million in GAVRETO net product sales, and $16.4 million in contract revenue from collaborations. TAVALISSE net product sales

grew 8% compared to $24.5 million in the same period of 2023. REZLIDHIA net product sales grew 107% compared to $2.7 million in the same

period of 2023. GAVRETO became commercially available from Rigel in June 2024. Contract revenue from collaborations consisted of

$13.0 million from Kissei Pharmaceutical Co., Ltd. (Kissei) related to an upfront fee from sublicensing olutasidenib and delivery

of drug supplies, as well as $3.3 million from Grifols S.A. (Grifols) and $0.1 million from Medison Pharma Trading AG (Medison) related

to delivery of drug supplies and earned royalties.

Total costs and expenses were $41.3 million

compared to $32.6 million for the same period of 2023. The increase in costs and expenses was mainly due to higher cost of product sales,

driven primarily by increased products sales, a sublicensing revenue fee to Forma, increased royalties and amortization of intangible

assets. In addition, there were increases in personnel-related costs and commercial-related expenses.

Rigel reported net income of $12.4 million,

or $0.71 basic and $0.70 diluted per share, compared to a net loss of $5.7 million, or $0.33 basic and diluted per share, for the same

period of 2023. The basic and diluted share and per share amounts for the prior period have been restated to reflect the 1-for-10 reverse

stock split effected on June 27, 2024 on a retroactive basis.

For the nine months ended September 30, 2024, total revenues were

$121.7 million, consisting of $73.8 million in TAVALISSE net product sales, $15.6 million in REZLIDHIA net product sales, $9.0 million

in GAVRETO net product sales, and $23.3 million in contract revenue from collaborations. TAVALISSE net product sales grew 8% compared

to $68.1 million in the same period of 2023. REZLIDHIA net product sales grew 133% compared to $6.7 million in the same period of 2023.

As mentioned above, GAVRETO became commercially available from Rigel in June 2024. Contract revenue from collaborations consisted

of $17.5 million from Kissei related to an upfront fee from sublicensing olutasidenib and delivery of drug supplies, as well as $5.5 million

from Grifols and $0.2 million from Medison related to delivery of drug supplies and earned royalties.

Total costs and expenses were $114.1 million

compared to $103.5 million for the same period of 2023. The increase in costs and expenses was mainly due to higher cost of product sales

driven primarily by increased products sales, a sublicensing revenue fee to Forma, increased royalties and amortization of intangible

assets. In addition, there were increases in personnel-related costs, stock-based compensation expense and commercial-related expenses.

These increases were partially offset by decreased research and development costs due to the timing of clinical trial activities related

to R289, the company’s dual IRAK 1/4 inhibitor program, as well as reduced trial activities related to the completed Phase 3 clinical

trials of fostamatinib in patients with COVID-19 and in patients with warm antibody hemolytic anemia (wAIHA).

Rigel reported net income of $3.1 million,

or $0.18 basic and diluted per share, compared to a net loss of $25.8 million, or $1.49 basic and diluted per share, for the same period

of 2023. As discussed above, the share and per share amounts for the prior period have been restated to reflect the 1-for-10 reverse stock

split on a retroactive basis for the periods presented.

Cash, cash equivalents and short-term investments

as of September 30, 2024 was $61.1 million, compared to $49.1 million as of June 30, 2024, and $56.9 million as of December 31,

2023.

Conference Call and Webcast with Slides

Today at 4:30pm Eastern Time

Rigel will hold a live conference call and webcast

today at 4:30pm Eastern Time (1:30pm Pacific Time).

Participants

can access the live conference call by dialing (877) 407-3088 (domestic) or (201) 389-0927 (international). The conference call will

also be webcast live and can be accessed from the Investor Relations section of the company’s website at www.rigel.com.

The webcast will be archived and available for replay after the call via the Rigel website.

About ITP

In patients

with ITP (immune thrombocytopenia), the immune system attacks and destroys the body’s own blood platelets, which play an active

role in blood clotting and healing. Common symptoms of ITP are excessive bruising and bleeding. People suffering with chronic ITP may

live with an increased risk of severe bleeding events that can result in serious medical complications or even death. Current therapies

for ITP include steroids, blood platelet production boosters (TPO-RAs), and splenectomy. However, not all patients respond to existing

therapies. As a result, there remains a significant medical need for additional treatment options for patients with ITP.

About AML

Acute myeloid leukemia (AML) is a rapidly progressing cancer of the blood and bone marrow that affects myeloid cells, which normally

develop into various types of mature blood cells. AML occurs primarily in adults and accounts for about 1 percent of all adult cancers.

The American Cancer Society estimates that there will be about 20,800 new cases in the United States, most in adults, in 2024.2

Relapsed AML

affects about half of all patients who, following treatment and remission, experience a return of leukemia cells in the bone marrow.3 Refractory

AML, which affects between 10 and 40 percent of newly diagnosed patients, occurs when a patient fails to achieve remission even after

intensive treatment.4 Quality of life declines for patients with each successive line of treatment for AML, and well-tolerated

treatments in relapsed or refractory disease remain an unmet need.

About NSCLC

It is estimated that over 230,000 adults in the U.S. will be diagnosed with lung cancer in 2024. Lung cancer is the leading

cause of cancer death in the U.S, with NSCLC being the most common type accounting for 80-85% of all lung cancer diagnoses.5 RET

fusions are implicated in approximately 1-2% of patients with NSCLC.6

About

TAVALISSE®

TAVALISSE (fostamatinib disodium hexahydrate) tablets is indicated for the treatment of thrombocytopenia

in adult patients with chronic immune thrombocytopenia (ITP) who have had an insufficient response to a previous treatment.

Please click

here for Important Safety Information and Full Prescribing Information for TAVALISSE.

About REZLIDHIA®

REZLIDHIA

is indicated for the treatment of adult patients with relapsed or refractory acute myeloid leukemia (AML) with a susceptible isocitrate

dehydrogenase-1 (IDH1) mutation as detected by an FDA-approved test.

Please click here for

Important Safety Information and Full Prescribing Information, including Boxed WARNING, for REZLIDHIA.

About GAVRETO®

GAVRETO is

indicated for the treatment of adult patients with metastatic rearranged during transfection (RET) fusion-positive non-small cell lung

cancer (NSCLC) as detected by an FDA-approved test and adult and pediatric patients 12 years of age and older with advanced or metastatic

RET fusion-positive thyroid cancer who require systemic therapy and who are radioactive iodine-refractory (if radioactive iodine is appropriate).*

*Thyroid indication is approved

under accelerated approval based on overall response rate and duration of response. Continued approval for this indication may be contingent

upon verification and description of clinical benefit in confirmatory trial(s).

Please click here for

Important Safety Information and Full Prescribing Information for GAVRETO.

To report side

effects of prescription drugs to the FDA, visit www.fda.gov/medwatch or

call 1-800-FDA-1088 (800-332-1088).

TAVALISSE, REZLIDHIA and GAVRETO

are registered trademarks of Rigel Pharmaceuticals, Inc.

About

Rigel

Rigel Pharmaceuticals, Inc. (Nasdaq: RIGL) is a biotechnology company dedicated to discovering, developing and providing

novel therapies that significantly improve the lives of patients with hematologic disorders and cancer. Founded in 1996, Rigel is based

in South San Francisco, California. For more information on Rigel, the Company's marketed products and pipeline of potential products,

visit www.rigel.com.

| 1. | R289 is an investigational compound not approved by the FDA. |

| 2. | The

American Cancer Society. Key Statistics for Acute Myeloid Leukemia (AML). Revised June 5,

2024. Accessed June 30, 2024: https://www.cancer.org/cancer/acute-myeloid-leukemia/about/key-statistics.html |

| 3. | Leukaemia

Care. Relapse in Acute Myeloid Leukaemia (AML). Version 3. Reviewed October 2021. Accessed

June 30, 2024: https://media.leukaemiacare.org.uk/wp-content/uploads/Relapse-in-Acute-Myeloid-Leukaemia-AML-Web-Version.pdf |

| 4. | Thol

F, Schlenk RF, Heuser M, Ganser A. How I treat refractory and early relapsed acute

myeloid leukemia. Blood (2015) 126 (3): 319-27. Accessed June 30, 2024. doi: https://doi.org/10.1182/blood-2014-10-551911 |

| 5. | The

American Cancer Society. Key Statistics for Lung Cancer. Revised January 29, 2024. Accessed

June 30, 2024: https://www.cancer.org/cancer/types/lung-cancer/about/key-statistics.html |

| 6. | Kato, S. et al. RET Aberrations in Diverse Cancers: Next-Generation Sequencing of 4,871 Patients. Clin Cancer Res. 2017;23(8):1988-1997

doi: 10.1158/1078-0432.CCR-16-1679 |

Forward Looking Statements

This press release contains

forward-looking statements relating to, among other things, expected commercial and financial results, expectations for developing and

commercializing REZLIDHIA in certain international markets, study results relating to safety and tolerability of R289 for the treatment

of lower-risk myeloid dysplastic syndrome, expectations for development of Rigel’s commercial portfolio and hematology and oncology

pipeline, and expectations for Rigel’s partnering and collaboration efforts. Any statements contained in this press release that

are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements can be identified by

words such as “plan”, “potential”, “may”, “look to”, “expects”, “will”,

“initial”, and similar expressions in reference to future periods. Forward-looking statements are neither historical facts

nor assurances of future performance. Instead, they are based on Rigel’s current beliefs, expectations, and assumptions and hence

they inherently involve significant risks, uncertainties and changes in circumstances that are difficult to predict and many of

which are outside of our control. Therefore, you should not rely on any of these forward-looking statements. Actual results and

the timing of events could differ materially from those anticipated in such forward looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with the commercialization and marketing of fostamatinib,

olutasidenib and pralsetinib; risks that the FDA, European Medicines Agency, PMDA or other regulatory authorities may make adverse decisions

regarding fostamatinib, pralsetinib or olutasidenib; risks that clinical trials may not be predictive of real-world results or of

results in subsequent clinical trials; risks that fostamatinib, pralsetinib or olutasidenib may have unintended side effects, adverse

reactions or incidents of misuses; the availability of resources to develop Rigel’s product candidates; market competition; as

well as other risks detailed from time to time in Rigel’s reports filed with the Securities and Exchange Commission, including

its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 and subsequent filings. Any forward-looking statement

made by us in this press release is based only on information currently available to us and speaks only as of the date on which

it is made. Rigel does not undertake any obligation to update forward-looking statements, whether written or oral, that may be made from

time to time, whether as a result of new information, future developments or otherwise, and expressly disclaims any obligation or undertaking

to release publicly any updates or revisions to any forward-looking statements contained herein, except as required by law.

Contact for Investors &

Media:

Investors:

Rigel Pharmaceuticals, Inc.

650.624.1232

ir@rigel.com

Media:

David Rosen

Argot Partners

646.461.6387

david.rosen@argotpartners.com

RIGEL PHARMACEUTICALS, INC.

STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(unaudited) | |

| Revenues: | |

| | |

| | |

| | |

| |

| Product sales, net | |

$ | 38,927 | | |

$ | 27,129 | | |

$ | 98,380 | | |

$ | 74,755 | |

| Contract revenues from collaborations | |

| 16,380 | | |

| 1,005 | | |

| 23,302 | | |

| 5,335 | |

| Government contract | |

| — | | |

| — | | |

| — | | |

| 1,000 | |

| Total revenues | |

| 55,307 | | |

| 28,134 | | |

| 121,682 | | |

| 81,090 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of product sales | |

| 8,026 | | |

| 1,268 | | |

| 12,858 | | |

| 3,320 | |

| Research and development (see Note A) | |

| 6,182 | | |

| 6,475 | | |

| 17,748 | | |

| 21,336 | |

| Selling, general and administrative (see Note A) | |

| 27,043 | | |

| 24,856 | | |

| 83,539 | | |

| 78,891 | |

| Total costs and expenses | |

| 41,251 | | |

| 32,599 | | |

| 114,145 | | |

| 103,547 | |

| Income (loss) from operations | |

| 14,056 | | |

| (4,465 | ) | |

| 7,537 | | |

| (22,457 | ) |

| Interest income | |

| 425 | | |

| 672 | | |

| 1,570 | | |

| 1,594 | |

| Interest expense | |

| (2,060 | ) | |

| (1,899 | ) | |

| (5,963 | ) | |

| (4,965 | ) |

| Net income (loss) | |

$ | 12,421 | | |

$ | (5,692 | ) | |

$ | 3,144 | | |

$ | (25,828 | ) |

| Net income (loss) per share (1) | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.71 | | |

$ | (0.33 | ) | |

$ | 0.18 | | |

$ | (1.49 | ) |

| Diluted | |

$ | 0.70 | | |

$ | (0.33 | ) | |

$ | 0.18 | | |

$ | (1.49 | ) |

| Weighted average shares used in computing net income (loss) per share(1) | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 17,600 | | |

| 17,436 | | |

| 17,556 | | |

| 17,389 | |

| Diluted | |

| 17,648 | | |

| 17,436 | | |

| 17,599 | | |

| 17,389 | |

| Note A | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation expense included in: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

$ | 2,360 | | |

$ | 1,596 | | |

$ | 9,067 | | |

$ | 5,127 | |

| Research and development | |

| 284 | | |

| 347 | | |

| 1,239 | | |

| 1,746 | |

| | |

$ | 2,644 | | |

$ | 1,943 | | |

$ | 10,306 | | |

$ | 6,873 | |

| (1) |

Share and per share amounts have been restated to reflect the 1-for-10 reverse stock split effected on June 27, 2024 on a retroactive basis for all periods presented. |

SUMMARY BALANCE SHEET DATA

(in thousands)

| | |

As of September, | | |

As of December 31, | |

| | |

| 2024 | | |

| 2023(1) | |

| | |

| (unaudited) | | |

| | |

| Cash, cash equivalents and short-term investments | |

$ | 61,114 | | |

$ | 56,933 | |

| Total assets | |

| 139,419 | | |

| 117,225 | |

| Stockholders' deficit | |

| (14,636 | ) | |

| (28,644 | ) |

| (1) |

Derived from audited financial statements |

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity File Number |

0-29889

|

| Entity Registrant Name |

RIGEL PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001034842

|

| Entity Tax Identification Number |

94-3248524

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

611

Gateway Boulevard

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

624-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

RIGL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

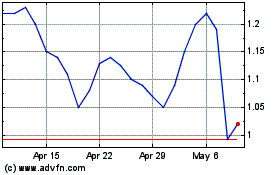

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Oct 2024 to Nov 2024

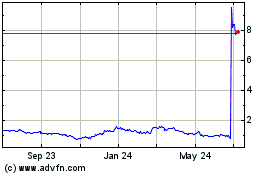

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Nov 2023 to Nov 2024