UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: (Date of earliest event reported): May 10, 2024

Reneo Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40315 |

|

47-2309515 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 18575 Jamboree Road, Suite 275-S |

|

|

| Irvine, California |

|

92612 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (858) 283-0280

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of exchange

on which registered |

| Common Stock, par value $0.0001 per share |

|

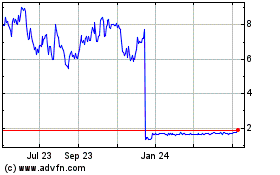

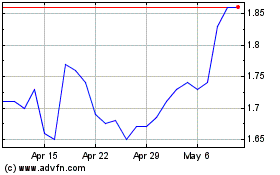

RPHM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

Merger Agreement

On May 10, 2024, Reneo

Pharmaceuticals, Inc., a Delaware corporation (“Reneo”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among Reneo, Radiate Merger Sub I, Inc., a Delaware corporation and

a direct, wholly owned subsidiary of Reneo (“Merger Sub I”), Radiate Merger Sub II, LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of Reneo (“Merger Sub II”), and

OnKure, Inc., a Delaware corporation (“OnKure”), pursuant to which, and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, (a) Merger Sub I will merge with and into OnKure (the

“First Merger”), with Merger Sub ceasing to exist and OnKure surviving the merger as a wholly owned subsidiary of Reneo, and (b) as promptly as practicable following the First Merger, OnKure, as the surviving corporation

of the First Merger, will merge with and into Merger Sub II, with OnKure ceasing to exist and Merger Sub II surviving the merger as a wholly owned subsidiary of Reneo (together with the First Merger, the “Mergers”). The

Mergers are intended to qualify for federal income tax purposes as a tax-free reorganization.

Subject to the terms and conditions of the Merger

Agreement, at the effective time of the First Merger (the “First Effective Time”), (a) each then-outstanding share of OnKure’s common stock, par value $0.0001 per share (“OnKure Common

Stock”) will be converted into the right to receive a number of shares of common stock of Reneo, which prior to closing will be reclassified as Class A common stock, par value $0.0001 per share, of Reneo (“Reneo

Class A Common Stock”), based on a ratio calculated in accordance with the Merger Agreement (the “Common Stock Exchange Ratio”) and (b) each then-outstanding

share of OnKure’s preferred stock, par value $0.0001 per share (“OnKure Preferred Stock”) will be converted into the right to receive a number of shares of Reneo Common Stock (as defined below), based on a ratio

calculated in accordance with the Merger Agreement (the “Preferred Stock Exchange Ratio” and, together with the Common Stock Exchange Ratio, the “Exchange Ratios”) (the shares of Reneo Class A

Common Stock issuable pursuant to the foregoing clauses (a) and (b) and any shares of Reneo Class B Common Stock issuable pursuant to the immediately following clause, the “Merger Consideration”); provided that a

holder of OnKure Preferred Stock will receive all or a portion of the Merger Consideration that they would otherwise receive in the form of Reneo Class A Common Stock in an equal number of shares of a new series of non-voting common stock designated Class B common stock, par value $0.0001 per share, of Reneo (“Reneo Class B Common Stock” and, together with Reneo

Class A Common Stock, “Reneo Common Stock”, and such shares of Reneo Class B Common Stock will also constitute Merger Consideration).

Subject to the terms and conditions of the Merger Agreement, at the First Effective Time, each restricted stock unit (“OnKure RSU”)

corresponding to shares of OnKure Preferred Stock issued pursuant to the OnKure 2023 RSU Equity Incentive Plan, the OnKure 2021 Stock Incentive Plan or the OnKure 2011 Stock Incentive Plan (the “OnKure Equity Plans”) that is

outstanding immediately prior to the First Effective Time will be assumed by Reneo and will be converted into a Reneo restricted stock unit award (“Converted Reneo RSU”) covering a number of shares of Reneo Class A

Common Stock equal to the Preferred Stock Exchange Ratio multiplied by the aggregate number of shares of OnKure Preferred Stock covered by such OnKure RSU immediately prior to the First Effective Time. Each Converted Reneo RSU will be subject to the

same terms and conditions (including vesting and repurchase provisions) that are applicable to such OnKure RSU as of immediately prior to the First Effective Time (with such changes as Reneo and OnKure mutually agree are appropriate to reflect the

assumption of the OnKure RSUs by Reneo).

Subject to the terms and conditions of the Merger Agreement, at the First Effective Time, each then-outstanding

option to purchase OnKure Common Stock (“OnKure Option”) will be assumed by Reneo and converted into an option to purchase Reneo Class A Common Stock (“Converted Reneo Option”),

subject to the adjustments set forth in the Merger Agreement.

Subject to the terms and conditions of the Merger Agreement, at the First Effective Time,

Reneo will assume the OnKure Equity Plans and any award agreements related to the Converted Reneo Options and Converted Reneo RSUs and, other than as set forth in the Merger Agreement, each Converted Reneo Option will be subject to the same terms

and conditions (including vesting schedule, repurchase provisions, forfeiture provisions, and any restrictions on exercisability) that are applicable to such OnKure Option as of immediately prior to the First Effective Time (with such changes as

Reneo and OnKure mutually agree are appropriate to reflect the assumption of the OnKure Options by Reneo).

Pursuant to the Common Stock Exchange Ratio and Preferred Stock Exchange Ratio formulas in the Merger

Agreement, upon the First Effective Time, on a pro forma basis and based upon the number of shares of Reneo Common Stock expected to be issued in the Mergers, pre-Mergers OnKure stockholders are expected to

own approximately 69.4% of the combined company, pre-Mergers Reneo stockholders are expected to own approximately 30.6% of the combined company on a fully-diluted basis (prior to giving effect to the

Concurrent PIPE Investment described below and excluding any shares reserved for future grants under the 2024 Equity Incentive Plan and the 2024 ESPP, each as defined in the Merger Agreement). The ownership percentage of pre-Mergers Reneo stockholders will be adjusted upward if Reneo’s net cash as of the close of business on the business day immediately preceding the closing date is greater than $61.0 million or downward

if Reneo’s net cash as of the close of business on the business day immediately preceding the closing date is less than $59.0 million.

The

Exchange Ratios assume (a) a valuation for Reneo of $75.0 million, which is subject to adjustment to the extent that Reneo’s net cash is greater than $61.0 million or less than $59.0 million, and (b) a valuation for

OnKure of $170.0 million. The Exchange Ratios are also based on the relative capitalization of each of Reneo and OnKure, using the treasury stock method, as set forth in the Merger Agreement.

In connection with the Mergers, Reneo will seek the approval of its stockholders to, among other things, (a) issue Reneo Common Stock in connection with

(i) the First Merger and (ii) the concurrent purchase, for cash or the cancellation of convertible debt incurred by OnKure, of a number of shares of Reneo Class A Common Stock by certain investors representing an aggregate commitment

of not less than $60.0 million, which amount may be increased by up to $20.0 million (such purchase, the “Concurrent PIPE Investment”) in accordance with the rules of The Nasdaq Stock Market LLC

(“Nasdaq”) (the “Nasdaq Issuance Proposal”), (b) amend Reneo’s amended and restated certificate of incorporation to effect a reverse stock split of Reneo’s common stock, at a reverse stock

split ratio determined by OnKure (subject to Reneo’s approval, such approval not to be unreasonably withheld, conditioned or delayed) (the “Reverse Stock Split Proposal”), (c) amend Reneo’s amended and restated

certificate of incorporation to (i) change Reneo’s name to “OnKure Therapeutics, Inc.” and (ii) reclassify the Reneo Class A Common Stock and create the new Reneo Class B Common Stock (together with the Reverse

Stock Split Proposal, the “Charter Amendment Proposals” and, the Nasdaq Issuance Proposal and the Charter Amendment Proposals, together, the “Required Stockholder Proposals”), (d) adopt the 2024 Equity

Incentive Plan, and (e) adopt the 2024 ESPP (collectively, the “Reneo Stockholder Proposals”).

Each of Reneo and OnKure has

agreed to customary representations, warranties and covenants in the Merger Agreement, including, among others, covenants relating to (a) obtaining the requisite approval of their respective stockholders, (b) non-solicitation of alternative

acquisition proposals, (c) the conduct of their respective businesses during the period between the date of signing the Merger Agreement and the closing of the Mergers, (d) Reneo using commercially reasonable efforts to maintain the existing listing

of its common stock on Nasdaq and cause the shares of Reneo Common Stock to be issued in connection with the Mergers to be approved for listing on Nasdaq prior to the closing of the Mergers, (e) Reneo filing with the U.S. Securities and

Exchange Commission (the “SEC”) and causing to become effective a registration statement on Form S-4 to register the shares of Reneo Common Stock to be issued in connection

with the Mergers (the “Registration Statement”), (f) the Reneo board of directors adopting the 2024 Equity Incentive Plan and the 2024 ESPP, and (g) Reneo using commercially reasonable efforts to terminate the Reneo 2021

Employee Stock Purchase Plan.

Consummation of the Mergers is subject to certain closing conditions, including, among other things, (a) the

effectiveness of the Registration Statement, (b) no law, temporary restraining order, preliminary or permanent injunction or other judgement, order or decree preventing the consummation of the transactions contemplated by the Merger Agreement,

(c) approval by Reneo stockholders of the Required Stockholder Proposals, (d) approval by the requisite OnKure stockholders of the adoption and approval of the Merger Agreement and the transactions contemplated thereby,

(e) Nasdaq’s approval of the listing of the shares of Reneo Class A Common Stock to be issued in connection with the Mergers, (f) an amendment to OnKure’s amended and restated certificate of incorporation, (g) an

executed Subscription Agreement for the Concurrent PIPE Investment in full force and effect evidencing cash proceeds of not less than $60.0 million to be received by Reneo immediately prior to or immediately after the closing of the Mergers,

and (h) Reneo’s net cash at the closing of the Mergers being no less than $55.0 million. Each party’s obligation to consummate the Mergers is also subject to other specified customary conditions, including regarding the accuracy

of the representations and warranties of the other party, subject to the applicable materiality standard, the performance in all material respects by the other party of its obligations under the Merger Agreement required to be performed on or prior

to the date of the closing of the Mergers, and the absence of a material adverse effect on the other party’s business.

Pursuant to the Merger Agreement and contingent on the closing of the Mergers, Reneo has agreed that, as of

the closing of the Mergers, Reneo will grant no new awards under the Equity Plans (as defined herein) and will terminate the Equity Plans (to the extent not previously expired or terminated) for future use no later than immediately prior to the

closing of the Mergers.

The Merger Agreement contains certain termination rights of each of Reneo and OnKure. Upon termination of the Merger Agreement

under specified circumstances, Reneo may be required to pay OnKure a termination fee of $3.0 million, and in certain other circumstances, OnKure may be required to pay Reneo a termination fee of $3.0 million.

At the First Effective Time, the board of directors of Reneo is expected to consist of eight members, six of whom will be designated by OnKure and two of whom

will be designated by Reneo.

Support Agreements and Lock-Up Agreements

Concurrently and in connection with the execution of the Merger Agreement, (a) certain stockholders of OnKure (solely in their respective capacities as

OnKure stockholders) holding approximately 98.3% of the outstanding shares of OnKure preferred stock and approximately 77.3% of the outstanding shares of OnKure capital stock, have entered into support agreements with Reneo and OnKure to vote all of

their shares of OnKure capital stock in favor of the adoption of the Merger Agreement and the transactions contemplated thereby (the “OnKure Support Agreements”) and (b) certain stockholders of Reneo holding

approximately 28.2% of the outstanding shares of Reneo common stock have entered into support agreements with Reneo and OnKure to vote all of their shares of Reneo common stock in favor of the Reneo Stockholder Proposals (the “Reneo

Support Agreements,” and, together with the OnKure Support Agreements, the “Support Agreements”).

Concurrently and

in connection with the execution of the Merger Agreement, the executive officers and directors of OnKure, certain stockholders of OnKure and the directors of Reneo that are expected to remain on the board of directors of Reneo following the closing

of the Mergers, have entered into lock-up agreements (the “Lock-Up Agreements”) pursuant to which, and subject to specified exceptions, they have

agreed not to transfer their shares of Reneo Common Stock for the 180-day period following the closing of the Mergers.

The preceding summaries of the Merger Agreement, the Support Agreements and the Lock-Up Agreements do not purport to

be complete and are qualified in their entirety by reference to the Merger Agreement, the form of Reneo Support Agreement, the form of OnKure Support Agreement, and the form of Lock-Up Agreement, which are

filed as Exhibits 2.1, 10.1, 10.2, and 10.3, respectively, to this Current Report on Form 8-K and which are incorporated herein by reference. The Merger Agreement has been attached as an exhibit to this

Current Report on Form 8-K to provide investors and securityholders with information regarding its terms. It is not intended to provide any other factual information about Reneo or OnKure or to modify or

supplement any factual disclosures about Reneo in its public reports filed with the SEC. The Merger Agreement includes representations, warranties and covenants of OnKure, Reneo, Merger Sub I and Merger Sub II made solely for the purpose of the

Merger Agreement and solely for the benefit of the parties thereto in connection with the negotiated terms of the Merger Agreement. Investors should not rely on the representations, warranties and covenants in the Merger Agreement or any

descriptions thereof as characterizations of the actual state of facts or conditions of Reneo, OnKure or any of their respective affiliates. Moreover, certain of those representations and warranties may not be accurate or complete as of any

specified date, may be modified in important part by the underlying disclosure schedules which are not filed publicly, may be subject to a contractual standard of materiality different from those generally applicable to SEC filings or may have been

used for purposes of allocating risk among the parties to the Merger Agreement, rather than establishing matters of fact.

Private Placement and Subscription Agreement

On May 10, 2024, Reneo entered into a Subscription Agreement (the “Subscription Agreement”) with certain existing OnKure

stockholders and new investors (the “PIPE Investors”) relating to the Concurrent PIPE Investment.

Pursuant to the Subscription

Agreement, and subject to the terms and conditions of such agreements, Reneo agreed to sell, and the PIPE Investors agreed to purchase, shares of Reneo Class A Common Stock for an aggregate purchase price of $65.0 million.

The Concurrent PIPE Investment is exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the

“Securities Act”), as a transaction by an issuer not involving a public offering. The PIPE Investors represented that they are acquiring the securities for investment only and not with a view to or for sale in connection with

any distribution thereof, and appropriate legends will be affixed to the securities issued under the Subscription Agreement.

The foregoing summary of the

Subscription Agreement does not purport to be complete and is qualified in its entirety by reference to the Subscription Agreement, which is filed as Exhibit 10.4 to this Current Report on Form 8-K and

incorporated herein by reference.

Registration Rights Agreement

At the closing of the Concurrent PIPE Investment, in connection with the Subscription Agreement, Reneo has agreed to enter into a Registration Rights Agreement

(the “Registration Rights Agreement”) with the PIPE Investors. Pursuant to the Registration Rights Agreement, Reneo will prepare and file a resale registration statement with the SEC within 45 calendar days following the

closing of the Concurrent PIPE Investment. Reneo will use commercially reasonable efforts to cause this registration statement to be declared effective by the SEC within 90 calendar days of the closing of the Concurrent PIPE Investment (or within

120 calendar days if the SEC reviews the registration statement or by such deadline as otherwise provided in the Registration Rights Agreement based on certain conditions addressed therein).

Reneo will also agree to, among other things, indemnify the PIPE Investors, their officers, directors, members, employees and agents, successors and assigns

under the registration statement from certain liabilities and pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and selling commissions) incident to Reneo’s obligations under the

Registration Rights Agreement.

The foregoing summary of the Registration Rights Agreement does not purport to be complete and is qualified in its

entirety by reference to the form of Registration Rights Agreement, which is attached as Exhibit B to the Subscription Agreement, which is filed as Exhibit 10.4 to this Current Report on Form 8-K and

incorporated herein by reference.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

To the extent required by this Item, the information included in Item 1.01 of this Current Report on Form 8-K is

incorporated herein by reference.

The shares of Reneo Class A Common Stock to be issued in the Concurrent PIPE Investment will be issued in private

placements exempt from registration under Section 4(a)(2) of the Securities Act because the offer and sale of such securities do not involve a “public offering” as defined in Section 4(a)(2) of the Securities Act, and other

applicable requirements were met.

| Item 5.01. |

Changes in Control of Registrant. |

To the extent required by this Item, the information included in Item 1.01 of this Current Report on Form 8-K is

incorporated herein by reference.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

To the extent required by this Item, the information included in Item 1.01 of this

Current Report on Form 8-K is incorporated herein by reference.

On May 10, 2024, Reneo approved the

acceleration of vesting in connection with the Mergers of all equity awards (to the extent not already vested, and with any performance-based vesting deemed to have been achieved at 100% of the applicable target level) held by certain individuals

that will be outstanding as of immediately prior to the closing of the First Merger pursuant to (or that are otherwise subject to the terms of) Reneo’s 2014 Equity Incentive Plan (the “2014 Plan”) and 2021 Equity

Incentive Plan (the “2021 Plan”, and together with the 2014 Plan, the “Equity Plans”), including all awards held by Gregory J. Flesher, Alejandro Dorenbaum, Jennifer Lam and Ashley F. Hall.

On May 10, 2024, Reneo approved a modification in connection with the Mergers of all stock options granted pursuant to (or that are otherwise subject to

the terms of) the Equity Plans to certain members of management, including Gregory J. Flesher, Alejandro Dorenbaum, Jennifer Lam and Ashley F. Hall, that are outstanding as of the date of the Merger Agreement pursuant to which the exercise window

applicable to all such stock options held by such individual following the termination of service of such individual with Reneo (or an affiliate thereof) other than for Cause (as defined in the Equity Plans) will be the longer of: (a) a period

of three months following termination of service; or (b) a period commencing on the date of termination of service and ending on the six-month anniversary of the closing of the First Merger; provided,

however, that in the event that the Merger Agreement is terminated in accordance with its terms, such exercise window will be the longer of: (i) a period of three months following termination of service; or (ii) a period of three months

following termination of the Merger Agreement; provided, further, that in no event will the exercise window of any option be extended beyond the term applicable to such option.

On May 10, 2024, Reneo approved a retention agreement with Jennifer Lam (the “Lam Retention Agreement”), the form of which is

filed as Exhibit 10.5 to this Current Report on Form 8-K and incorporated herein by reference, that provides Ms. Lam with the opportunity to earn a one-time cash

bonus in the gross amount of $180,000, which bonus will be earned if either (a) Ms. Lam remains continuously employed in good standing by Reneo or an affiliate thereof through December 31, 2024, or (b) Ms. Lam is terminated

by Reneo or an affiliate thereof without cause, subject to timely execution of a general release of claims, in each case, in accordance with the terms of the Lam Retention Agreement.

On May 10, 2024, Reneo approved consulting agreements (“Consulting Agreements”), the form of which is filed as Exhibit 10.6 to this

Current Report on Form 8-K and incorporated herein by reference, pursuant to which certain individuals, including each of Gregory J. Flesher, Alejandro Dorenbaum, and Ashley F. Hall, agree to provide

consulting services to Reneo for up to five hours per month for a period of six months following the closing of the First Merger (unless earlier terminated in accordance with the terms of the applicable Consulting Agreement) in exchange for a one-time cash payment in the gross amount of $20,000 for Mr. Flesher and $15,000 for the other consultants, including each of Mr. Dorenbaum and Ms. Hall, payable within ten days following the six-month anniversary of the closing of the First Merger (unless the applicable Consulting Agreement is terminated for Cause (as defined in the applicable Consulting Agreement) prior to such time in accordance with

its terms). In addition, in connection with the closing of the First Merger and effective as of the closing of the First Merger, each of Mr. Flesher, Mr.Dorenbaum, and Ms. Hall are expected to resign as executive officers of Reneo.

| Item 7.01. |

Regulation FD Disclosure. |

On May 13, 2024, Reneo and OnKure issued a joint press release announcing the execution of the Merger Agreement and the Subscription Agreement. The press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference, except that the information contained on the websites referenced in the press release is not

incorporated herein by reference.

Furnished as Exhibit 99.2 hereto and incorporated herein by reference is the investor presentation that will be used by

Reneo and OnKure in connection with the Mergers.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by

reference in any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995, including but not limited to, express or implied statements regarding the structure, timing and completion of the proposed business combination involving Reneo and OnKure, the Concurrent PIPE Investment and any related proposed

transactions (collectively, the “Proposed Transactions”). Any statements contained in this Current Report that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements

generally are accompanied by words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “future,” “goal,” “intend,” “may,” “outlook,”

“plan,” “potential,” “predict,” “project,” “seem,” “seek,” “should,” “target,” “will,” “would,” and similar expressions that indicate future events

or trends or that are not statements of historical matters. These forward-looking statements may include, but are not limited to, statements regarding the Proposed Transactions; the combined company’s capitalization and the planned use of

proceeds following the Proposed Transactions; the expected executive officers and directors of the combined company; the potential of, and plans and expectations regarding, the combined company’s product candidates; the development of the

combined company’s current and future product candidates; the future operations of Reneo, OnKure and the combined company; and the commercial potential of the combined company’s product candidates, including any anticipated milestones.

These statements are based on various assumptions, whether or not identified in this Current Report, and on the current expectations of Reneo’s and

OnKure’s management and are not assurances as to actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances, many of which are outside of the control of Reneo and OnKure, are difficult or impossible to predict and will differ from assumptions

underlying forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties, including, among other

things: the risk that the conditions to the closing of the Proposed Transactions are not satisfied, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could

adversely affect Reneo, OnKure or the combined company or that the approval of the stockholders of Reneo or OnKure is not obtained on the timeline expected, if at all; uncertainties as to the timing of the closing of the Proposed Transactions and

the ability of each of Reneo and OnKure to consummate the Proposed Transactions; risks related to the ability of Reneo and OnKure to correctly estimate and manage their respective operating expenses and expenses associated with the Proposed

Transactions pending the closing of the Proposed Transactions; risks associated with the possible failure to realize certain anticipated benefits of the Proposed Transactions, including with respect to future financial and operating results; the

potential for the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Proposed Transactions and any agreements entered into in connection therewith; the possible effect of the

announcement, pendency or completion of the Proposed Transactions on Reneo’s or OnKure’s business relationships, operating results and business generally; the risk that as a result of adjustments to the exchange ratio, Reneo stockholders

and OnKure stockholders could own more or less of the combined company than is currently anticipated; risks related to the market price of Reneo’s common stock relative to the value suggested by the exchange ratio; unexpected costs, charges or

expenses resulting from the Proposed Transactions; the potential for, and uncertainty associated with the outcome of, any legal proceedings that may be instituted against Reneo or OnKure or any of their respective directors or officers related to

the Proposed Transactions; risks related to OnKure’s early stage of development; the uncertainties associated with OnKure’s product candidates, as well as risks associated with the clinical development and regulatory approval of product

candidates, including potential delays in the completion of clinical trials; the significant net losses each of Reneo and OnKure has incurred since inception; the combined company’s ability to initiate and complete ongoing and planned

preclinical studies and clinical trials and advance its product candidates through clinical development; the timing of the availability of data from the combined company’s clinical trials; the outcome of preclinical testing and clinical trials

of the combined company’s product candidates, including the ability of those trials to satisfy relevant governmental or regulatory requirements; the combined company’s plans to research, develop and commercialize its current and future

product candidates; the clinical utility, potential benefits and market acceptance of the combined company’s product candidates; the requirement for additional capital to continue to advance these product candidates, which may not be available

on favorable terms or at all; the combined company’s ability to attract, hire, and retain skilled executive officers and employees; the combined company’s ability to protect its intellectual property and proprietary technologies; the

combined company’s reliance on third parties, contract manufacturers, and contract research organizations; the possibility that Reneo, OnKure or the combined company may be adversely affected by other economic, business, or competitive factors;

risks associated with changes in applicable laws or regulations; those factors discussed in Reneo’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 under the heading

“Item 1A. Risk Factors” and in Reneo’s other filings with the SEC; and other risks.

This Current Report also concerns product candidates that are under clinical investigation and which have

not yet been approved for marketing by the U.S. Food and Drug Administration. Such product candidates are currently limited by federal law to investigational use, and no representation is made as to their safety or effectiveness for the purposes for

which they are being investigated.

Additional Information and Where to Find It

The information herein does not purport to be all-inclusive or contain all the information that may be required to make

a full analysis of Reneo, OnKure, the combined company or the Proposed Transactions. Readers should each make their own evaluation of Reneo and OnKure and of the relevance and adequacy of the information disclosed herein and made available elsewhere

by Reneo and OnKure, as described below, and should make such other investigations as they deem necessary.

This Current Report may be deemed to be

solicitation material in respect of the Proposed Transactions. In connection with the Proposed Transactions, Reneo will file relevant materials with the SEC, including a registration statement on Form S-4 (the

“Form S-4”) that will contain a proxy statement (the “Proxy Statement”) and prospectus. This Current Report is not a substitute for the Form S-4, the Proxy Statement or for any other document that Reneo may file with the SEC and/or send to Reneo’s stockholders in connection with the Proposed Transactions. BEFORE MAKING ANY VOTING DECISION, INVESTORS

AND SECURITY HOLDERS OF RENEO AND ONKURE ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN IMPORTANT INFORMATION ABOUT RENEO, ONKURE, THE COMBINED COMPANY, THE PROPOSED TRANSACTIONS AND RELATED MATTERS.

Investors and security holders

will be able to obtain free copies of the Form S-4, the Proxy Statement and other documents filed by Reneo with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed

by Reneo with the SEC will also be available free of charge on Reneo’s website at www.reneopharma.com/investors or by contacting Reneo’s Investor Relations at investors@reneopharma.com.

Participants in the Solicitation

Reneo, OnKure and their

respective directors and certain of their executive officers may be considered participants in the solicitation of proxies from Reneo’s stockholders with respect to the Proposed Transactions under the rules of the SEC. Information about the

directors and executive officers of Reneo and their ownership of common stock of Reneo is set forth in its Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on

March 28, 2024, as amended on April 26, 2024, including under the sections entitled “Item 10. Directors, Executive Officers and Corporate Governance”, “Item 11. Executive Compensation”, “Item 12. Security Ownership

of Certain Beneficial Owners and Management and Related Stockholder Matters”, and “Item 13. Certain Relationships and Related Transactions, and Director Independence”. To the extent the security holdings of directors and executive

officers of Reneo have changed since the amounts described in this filing, such changes are set forth on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC, which can be found at no

charge at the SEC’s website at www.sec.gov. In addition, certain of Reneo’s executive officers are expected to provide consulting services to the combined company following the closing of the Mergers. Additional information regarding the

persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in the Form S-4, the Proxy

Statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of this document as described above.

OnKure and its directors and executive officers, which consist of R. Michael Carruthers, Isaac Manke, Ph.D.,

Andrew Phillips, Ph.D., who are the non-employee members of the OnKure board of directors, Nicholas A. Saccomano, Ph.D., OnKure’s President and Chief Executive Officer and a member of the OnKure board of

directors, and Jason Leverone, OnKure’s Chief Financial Officer, may be deemed to be participants in the solicitation of proxies from Reneo stockholders in connection with the Proposed Transactions. In the Proposed Transactions, certain

outstanding, unvested equity awards held by Dr. Saccomano will become fully vested. Following the closing of the Proposed Transactions, Dr. Saccomano and Mr. Leverone will be named the President and Chief Executive Officer and Chief

Financial Officer, respectively, of Reneo. Additional information about the OnKure directors and executive officers, including their direct and indirect interests in Reneo, by security holdings or otherwise, will be included in the Form S-4, the Proxy Statement and other relevant materials to be filed with the SEC when they become available. That document can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report is for

informational purposes only and is neither an offer to sell, nor a solicitation of an offer to buy or subscribe for, any securities of Reneo or OnKure, nor is it a solicitation of any vote in any jurisdiction with respect to the Proposed

Transactions or otherwise.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

Exhibit

Number |

|

Description |

|

|

| 2.1* |

|

Agreement and Plan of Merger, dated May 10, 2024, by and among Reneo Pharmaceuticals, Inc., Radiate Merger Sub I, Inc., Radiate Merger Sub II, LLC and OnKure, Inc. |

|

|

| 10.1* |

|

Form of Reneo Support Agreement (included as Exhibit C in Exhibit 2.1) |

|

|

| 10.2* |

|

Form of OnKure Support Agreement (included as Exhibit D-1 in Exhibit 2.1) |

|

|

| 10.3 |

|

Form of Lock-Up Agreement (included as Exhibit E in Exhibit 2.1) |

|

|

| 10.4* |

|

Subscription Agreement dated May 10, 2024 |

|

|

| 10.5 |

|

Letter Agreement by and between Reneo Pharmaceuticals, Inc. and Jennifer Lam |

|

|

| 10.6 |

|

Form of Consulting Agreement |

|

|

| 99.1 |

|

Press Release, dated May 13, 2024, jointly issued by Reneo Pharmaceuticals, Inc. and OnKure, Inc. |

|

|

| 99.2 |

|

Investor Presentation, dated May 13, 2024 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * |

Certain exhibits and/or schedules (and similar attachments) have been omitted pursuant to the provisions of

Regulation S-K, Item 601(a)(5). The registrant hereby undertakes to furnish supplementally to the Securities and Exchange Commission (SEC) upon request by the SEC copies of any of the omitted exhibits and

schedules (or similar attachments). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Dated: May 13, 2024

|

|

|

| Reneo Pharmaceuticals, Inc. |

|

|

| By: |

|

/s/ Gregory J. Flesher |

| Name: |

|

Gregory J. Flesher |

| Title: |

|

President and Chief Executive Officer

(Principal Executive Officer) |

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and among

RENEO

PHARMACEUTICALS, INC.

RADIATE MERGER SUB I, INC.

RADIATE MERGER SUB II, LLC

and

ONKURE, INC.

Dated as of May 10, 2024

|

|

|

|

|

|

|

| ARTICLE I DEFINITIONS & INTERPRETATIONS |

|

|

4 |

|

|

|

|

| Section 1.1 |

|

Certain Definitions |

|

|

4 |

|

| Section 1.2 |

|

Interpretation |

|

|

14 |

|

| Section 1.3 |

|

Currency |

|

|

14 |

|

|

|

| ARTICLE II THE MERGER |

|

|

15 |

|

|

|

|

| Section 2.1 |

|

Formation of Merger Subs |

|

|

15 |

|

| Section 2.2 |

|

The Mergers |

|

|

15 |

|

| Section 2.3 |

|

Closing |

|

|

15 |

|

| Section 2.4 |

|

Effective Times |

|

|

15 |

|

| Section 2.5 |

|

Effects of the Mergers |

|

|

16 |

|

| Section 2.6 |

|

Parent Governance |

|

|

16 |

|

| Section 2.7 |

|

Surviving Company Governance |

|

|

17 |

|

| Section 2.8 |

|

Surviving Entity Governance |

|

|

17 |

|

|

|

| ARTICLE III EFFECT ON THE EQUITY INTERESTS OF THE CONSTITUENT COMPANIES; EXCHANGE OF CERTIFICATES |

|

|

18 |

|

|

|

|

| Section 3.1 |

|

Conversion of Capital Stock |

|

|

18 |

|

| Section 3.2 |

|

Treatment of Company RSUs |

|

|

22 |

|

| Section 3.3 |

|

Treatment of Company Options |

|

|

22 |

|

| Section 3.4 |

|

Exchange and Payment |

|

|

23 |

|

| Section 3.5 |

|

Withholding Rights |

|

|

25 |

|

| Section 3.6 |

|

Dissenters Rights |

|

|

25 |

|

| Section 3.7 |

|

Calculation of Net Cash and Exchange Ratios |

|

|

26 |

|

|

|

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

|

|

28 |

|

|

|

|

| Section 4.1 |

|

Organization, Standing and Power |

|

|

28 |

|

| Section 4.2 |

|

Capital Stock |

|

|

29 |

|

| Section 4.3 |

|

Subsidiaries |

|

|

30 |

|

| Section 4.4 |

|

Authority |

|

|

30 |

|

| Section 4.5 |

|

No Conflict; Consents and Approvals |

|

|

31 |

|

| Section 4.6 |

|

Financial Statements |

|

|

32 |

|

| Section 4.7 |

|

No Undisclosed Liabilities |

|

|

33 |

|

| Section 4.8 |

|

Absence of Certain Changes or Events |

|

|

33 |

|

| Section 4.9 |

|

Litigation |

|

|

34 |

|

| Section 4.10 |

|

Compliance with Laws |

|

|

34 |

|

| Section 4.11 |

|

Health Care Regulatory Matters |

|

|

35 |

|

| Section 4.12 |

|

Benefit Plans |

|

|

38 |

|

| Section 4.13 |

|

Labor and Employment Matters |

|

|

40 |

|

| Section 4.14 |

|

Environmental Matters |

|

|

43 |

|

| Section 4.15 |

|

Taxes |

|

|

44 |

|

| Section 4.16 |

|

Contracts |

|

|

46 |

|

-i-

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

|

| Section 4.17 |

|

Insurance |

|

|

48 |

|

| Section 4.18 |

|

Properties |

|

|

48 |

|

| Section 4.19 |

|

Intellectual Property; Privacy |

|

|

49 |

|

| Section 4.20 |

|

Related Party Transactions |

|

|

51 |

|

| Section 4.21 |

|

State Takeover Statutes |

|

|

51 |

|

| Section 4.22 |

|

No Rights Plan |

|

|

51 |

|

| Section 4.23 |

|

Certain Payments |

|

|

51 |

|

| Section 4.24 |

|

Subscription Agreement |

|

|

51 |

|

| Section 4.25 |

|

Brokers |

|

|

52 |

|

| Section 4.26 |

|

No Other Representations and Warranties |

|

|

52 |

|

|

|

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUBS |

|

|

52 |

|

|

|

|

| Section 5.1 |

|

Organization, Standing and Power |

|

|

53 |

|

| Section 5.2 |

|

Capital Stock |

|

|

54 |

|

| Section 5.3 |

|

Subsidiaries |

|

|

55 |

|

| Section 5.4 |

|

Authority |

|

|

56 |

|

| Section 5.5 |

|

No Conflict; Consents and Approvals |

|

|

57 |

|

| Section 5.6 |

|

SEC Reports; Financial Statements |

|

|

58 |

|

| Section 5.7 |

|

No Undisclosed Liabilities |

|

|

60 |

|

| Section 5.8 |

|

Absence of Certain Changes or Events |

|

|

60 |

|

| Section 5.9 |

|

Litigation |

|

|

61 |

|

| Section 5.10 |

|

Compliance with Laws |

|

|

61 |

|

| Section 5.11 |

|

Health Care Regulatory Matters |

|

|

62 |

|

| Section 5.12 |

|

Benefit Plans |

|

|

65 |

|

| Section 5.13 |

|

Labor and Employment Matters |

|

|

67 |

|

| Section 5.14 |

|

Environmental Matters |

|

|

70 |

|

| Section 5.15 |

|

Taxes |

|

|

70 |

|

| Section 5.16 |

|

Contracts |

|

|

72 |

|

| Section 5.17 |

|

Insurance |

|

|

75 |

|

| Section 5.18 |

|

Properties |

|

|

75 |

|

| Section 5.19 |

|

Intellectual Property; Privacy |

|

|

76 |

|

| Section 5.20 |

|

Related Party Transactions |

|

|

77 |

|

| Section 5.21 |

|

State Takeover Statutes |

|

|

77 |

|

| Section 5.22 |

|

Certain Payments |

|

|

78 |

|

| Section 5.23 |

|

Broker |

|

|

78 |

|

| Section 5.24 |

|

Opinion of Financial Advisor |

|

|

78 |

|

| Section 5.25 |

|

Subscription Agreement |

|

|

78 |

|

| Section 5.26 |

|

280G |

|

|

78 |

|

| Section 5.27 |

|

No Other Representations or Warranties |

|

|

79 |

|

-ii-

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

| ARTICLE VI COVENANTS |

|

|

79 |

|

|

|

|

| Section 6.1 |

|

Operation of Parent’s Business |

|

|

79 |

|

| Section 6.2 |

|

Operation of Company’s Business |

|

|

82 |

|

| Section 6.3 |

|

Access and Investigation |

|

|

85 |

|

| Section 6.4 |

|

No Solicitation |

|

|

86 |

|

| Section 6.5 |

|

Notification of Certain Matters |

|

|

87 |

|

| Section 6.6 |

|

Regulatory Matters |

|

|

88 |

|

|

|

| ARTICLE VII ADDITIONAL AGREEMENTS |

|

|

88 |

|

|

|

|

| Section 7.1 |

|

Registration Statement; Proxy Statement |

|

|

88 |

|

| Section 7.2 |

|

Company Stockholder Approval |

|

|

91 |

|

| Section 7.3 |

|

Parent Stockholders’ Meeting |

|

|

93 |

|

| Section 7.4 |

|

Efforts; Regulatory Approvals; Transaction Litigation |

|

|

95 |

|

| Section 7.5 |

|

Indemnification, Exculpation and Insurance |

|

|

96 |

|

| Section 7.6 |

|

Section 16 Matters |

|

|

97 |

|

| Section 7.7 |

|

Disclosure |

|

|

98 |

|

| Section 7.8 |

|

Listing |

|

|

98 |

|

| Section 7.9 |

|

Tax Matters |

|

|

99 |

|

| Section 7.10 |

|

Directors and Officers |

|

|

100 |

|

| Section 7.11 |

|

Termination of Certain Agreements and Rights |

|

|

100 |

|

| Section 7.12 |

|

Obligations of Merger Subs |

|

|

101 |

|

| Section 7.13 |

|

Allocation Certificate |

|

|

101 |

|

| Section 7.14 |

|

New Parent Equity Plans; Termination of Parent ESPP |

|

|

101 |

|

| Section 7.15 |

|

Legends |

|

|

102 |

|

| Section 7.16 |

|

280G |

|

|

102 |

|

| Section 7.17 |

|

Subscription Agreement |

|

|

102 |

|

| Section 7.18 |

|

Company 2023 Financial Statements |

|

|

103 |

|

|

|

| ARTICLE VIII CLOSING CONDITIONS |

|

|

103 |

|

|

|

|

| Section 8.1 |

|

Conditions Precedent of Each Party |

|

|

103 |

|

| Section 8.2 |

|

Conditions Precedent to Obligation of the Company |

|

|

104 |

|

| Section 8.3 |

|

Conditions Precedent of Parent and Merger Subs |

|

|

105 |

|

|

|

| ARTICLE IX TERMINATION |

|

|

106 |

|

|

|

|

| Section 9.1 |

|

Termination |

|

|

106 |

|

| Section 9.2 |

|

Effect of Termination |

|

|

108 |

|

| Section 9.3 |

|

Expenses; Termination Fees |

|

|

108 |

|

-iii-

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

| ARTICLE X GENERAL PROVISIONS |

|

|

110 |

|

|

|

|

| Section 10.1 |

|

Non-survival of Representations and Warranties |

|

|

110 |

|

| Section 10.2 |

|

Amendment or Supplement |

|

|

111 |

|

| Section 10.3 |

|

Waiver |

|

|

111 |

|

| Section 10.4 |

|

Notices |

|

|

111 |

|

| Section 10.5 |

|

Entire Agreement |

|

|

112 |

|

| Section 10.6 |

|

No Third-Party Beneficiaries |

|

|

112 |

|

| Section 10.7 |

|

Governing Law |

|

|

113 |

|

| Section 10.8 |

|

Submission to Jurisdiction |

|

|

113 |

|

| Section 10.9 |

|

Assignment; Successors |

|

|

113 |

|

| Section 10.10 |

|

Specific Performance |

|

|

114 |

|

| Section 10.11 |

|

Further Assurances |

|

|

114 |

|

| Section 10.12 |

|

Severability |

|

|

114 |

|

| Section 10.13 |

|

Waiver of Jury Trial |

|

|

114 |

|

| Section 10.14 |

|

Counterparts |

|

|

114 |

|

| Section 10.15 |

|

Electronic Signature |

|

|

114 |

|

| Section 10.16 |

|

No Presumption Against Drafting Party |

|

|

115 |

|

|

|

|

| Exhibit A |

|

Form of Parent Amended Charter |

| Exhibit B |

|

Form of Parent Amended Bylaws |

| Exhibit C |

|

Form of Parent Support Agreement |

| Exhibit D |

|

Form of Company Support Agreement |

| Exhibit E |

|

Form of Lock-Up Agreement |

| Exhibit F |

|

Form of Subscription Agreement |

| Exhibit G |

|

Form of Restated Certificate of Formation |

| Exhibit H |

|

Form of Restated Limited Liability Company Agreement |

| Exhibit I |

|

Form of Company Charter Amendment |

-iv-

INDEX OF DEFINED TERMS

|

|

|

| Definition |

|

Location |

| 280G Analysis |

|

5.26 |

| 2023 Company Balance Sheet |

|

4.6(a) |

| 2024 Company Balance Sheet |

|

4.6(a) |

| 2024 Equity Incentive Plan |

|

1.1(a) |

| 2024 Equity Incentive Plan Proposal |

|

Recitals |

| 2024 ESPP |

|

1.1(b) |

| 2024 ESPP Proposal |

|

Recitals |

| Acceptable Confidentiality Agreement |

|

1.1(c) |

| Accounting Firm |

|

3.7(e) |

| Acquisition Inquiry |

|

1.1(d) |

| Acquisition Proposal |

|

1.1(e) |

| Action |

|

4.9 |

| Additional Subscription Agreements |

|

7.17(a) |

| Affiliate |

|

1.1(f) |

| Agreement |

|

Preamble |

| Allocation Certificate |

|

7.13 |

| Anticipated Closing Date |

|

3.7(a) |

| Book-Entry Shares |

|

3.4(b) |

| Business Day |

|

1.1(g) |

| Carve-Out Percentage |

|

3.1(a)(i)(A) |

| Cash Determination Time |

|

3.7(a) |

| Certificates |

|

3.4(b) |

| Charter Amendment Proposals |

|

Recitals |

| Clinical Trials |

|

4.11(d) |

| Closing |

|

2.3 |

| Closing Date |

|

2.3 |

| Code |

|

Recitals |

| Common Stock Exchange Ratio |

|

3.1(a)(i) |

| Company |

|

Preamble |

| Company 2023 Financial Statements |

|

7.18 |

| Company Benefit Plans |

|

1.1(h) |

| Company Board |

|

Recitals |

| Company Board Adverse Recommendation Change |

|

7.2(d) |

| Company Board Recommendation |

|

7.2(d) |

| Company Budget |

|

6.2(b)(vi) |

| Company Bylaws |

|

4.1(b) |

| Company Capital Stock |

|

1.1(i) |

| Company Capitalization Representation |

|

1.1(j) |

| Company Charter |

|

4.1(b) |

| Company Charter Amendment |

|

8.1(e) |

| Company Class A Common Stock |

|

4.2(a) |

| Company Class B Common Stock |

|

4.2(a) |

| Company Common Stock |

|

1.1(k) |

-v-

|

|

|

| Definition |

|

Location |

| Company Common Value Per Share |

|

3.1(a)(i)(B) |

| Company Disclosure Letter |

|

Article IV |

| Company Equity Plans |

|

1.1(l) |

| Company Facilities |

|

4.18(b) |

| Company Financial Statements |

|

4.6(a) |

| Company Fundamental Representations |

|

1.1(m) |

| Company Interim Financial Statements |

|

4.6(a) |

| Company Intervening Event |

|

1.1(n) |

| Company Leases |

|

4.18(b) |

| Company Material Adverse Effect |

|

4.1(a) |

| Company Material Contracts |

|

4.16(a) |

| Company Measurement Date |

|

4.2(a) |

| Company Notice Period |

|

7.2(c) |

| Company Options |

|

1.1(o) |

| Company Outstanding Common Stock Shares |

|

3.1(a)(i)(C) |

| Company Outstanding Preferred Stock Shares |

|

3.1(a)(i)(D) |

| Company Owned IP |

|

1.1(p) |

| Company Preferred Stock |

|

1.1(q) |

| Company Privacy Laws |

|

4.19(g) |

| Company Products |

|

4.11(c) |

| Company Registered IP |

|

4.19(a) |

| Company RSUs |

|

1.1(r) |

| Company Series C Preferred Stock |

|

4.2(a) |

| Company Stock Awards |

|

4.2(c) |

| Company Stockholder Approval |

|

Recitals |

| Company Stockholder Written Consent |

|

Recitals |

| Company Support Agreements |

|

Recitals |

| Company Termination Fee |

|

9.3(d) |

| Company Triggering Event |

|

1.1(s) |

| Company Valuation |

|

3.1(a)(i)(E) |

| Company Worker |

|

4.13(a) |

| Concurrent PIPE Investment |

|

Recitals |

| Confidentiality Agreement |

|

1.1(t) |

| Contract |

|

4.5(a) |

| control |

|

1.1(u) |

| Controlled Group |

|

1.1(v) |

| Converted Parent Option |

|

3.3(a) |

| Converted Parent RSU |

|

3.2 |

| CRO |

|

1.1(w) |

| D&O Indemnified Parties |

|

7.5(a) |

| Delaware Secretary of State |

|

2.4(a) |

| Delivery Date |

|

3.7(a) |

| DGCL |

|

Recitals |

| Dispute Notice |

|

3.7(b) |

| Dissenting Shares |

|

3.6 |

-vi-

|

|

|

| Definition |

|

Location |

| Employment Practices |

|

4.13(b) |

| End Date |

|

9.1(b) |

| Environmental Law |

|

1.1(x) |

| Equity Plan Proposals |

|

Recitals |

| ERISA |

|

1.1(y) |

| Exchange Act |

|

4.5(b) |

| Exchange Agent |

|

3.4(a) |

| Exchange Fund |

|

3.4(a) |

| Exchange Ratios |

|

1.1(z) |

| Excluded Shares |

|

3.1(a)(iii) |

| FDA |

|

4.11(c) |

| FDA Ethics Policy |

|

4.11(j) |

| FDCA |

|

1.1(cc) |

| Final Parent Net Cash |

|

3.7(c) |

| First Certificate of Merger |

|

2.4(a) |

| First Effective Time |

|

2.4(a) |

| First Merger |

|

Recitals |

| Form S-4 |

|

7.1(a) |

| GAAP |

|

4.6(a) |

| Governmental Entity |

|

4.5(b) |

| Hazardous Substance |

|

1.1(aa) |

| HCP |

|

1.1(bb) |

| Health Care Laws |

|

1.1(cc) |

| Information Statement |

|

7.2(a) |

| Intellectual Property Rights |

|

1.1(dd) |

| Intended Tax Treatment |

|

Recitals |

| In-The-Money Company Option |

|

1.1(ee) |

| Investor Agreements |

|

7.11 |

| IRCA |

|

4.13(m) |

| IRS |

|

1.1(ff) |

| knowledge |

|

1.1(gg) |

| Law |

|

1.1(hh) |

| Leerink Partners |

|

5.23 |

| Liens |

|

4.5(a) |

| Lock-Up Agreement |

|

Recitals |

| Material Parent Registered IP |

|

5.19(a) |

| Merger Consideration |

|

3.1(a)(i) |

| Merger Sub I |

|

Preamble |

| Merger Sub II |

|

Preamble |

| Nasdaq |

|

1.1(ii) |

| Nasdaq Issuance Proposal |

|

Recitals |

| Nasdaq Listing Application |

|

7.8 |

| Nasdaq Reverse Stock Split |

|

1.1(jj) |

| Net Cash |

|

1.1(kk) |

-vii-

|

|

|

| Definition |

|

Location |

| Ordinary Course Agreement |

|

4.15(g) |

| Parent |

|

Preamble |

| Parent Allocation Percentage |

|

3.1(a)(i)(F) |

| Parent Amended Bylaws |

|

Recitals |

| Parent Amended Charter |

|

Recitals |

| Parent Balance Sheet |

|

5.7 |

| Parent Benefit Plans |

|

1.1(ll) |

| Parent Board |

|

Recitals |

| Parent Board Adverse Recommendation Change |

|

7.3(c) |

| Parent Board Recommendation |

|

7.3(c) |

| Parent Capitalization Representation |

|

1.1(mm) |

| Parent Class A Common Stock |

|

1.1(nn) |

| Parent Class B Common Stock |

|

1.1(oo) |

| Parent Common Stock |

|

1.1(nn) |

| Parent Common Stock Issuance |

|

5.4(a) |

| Parent Disclosure Letter |

|

Article V |

| Parent Equity Plans |

|

1.1(qq) |

| Parent ESPP |

|

7.14(c) |

| Parent Facilities |

|

5.18(b) |

| Parent Fundamental Representations |

|

1.1(rr) |

| Parent Intervening Event |

|

1.1(ss) |

| Parent Leases |

|

5.18(b) |

| Parent Legacy Assets |

|

1.1(tt) |

| Parent Legacy Business |

|

1.1(tt) |

| Parent Material Adverse Effect |

|

5.1(a) |

| Parent Material Contracts |

|

5.16(a) |

| Parent Measurement Date |

|

5.2(a) |

| Parent Net Cash Calculation |

|

3.7(a) |

| Parent Net Cash Schedule |

|

3.7(a) |

| Parent Notice Period |

|

7.3(d) |

| Parent Options |

|

1.1(uu) |

| Parent Outstanding Shares |

|

3.1(a)(i)(G) |

| Parent Owned IP |

|

1.1(vv) |

| Parent Preferred Stock |

|

5.2(a) |

| Parent Privacy Laws |

|

5.19(g) |

| Parent Products |

|

5.11(c) |

| Parent RSUs |

|

1.1(ww) |

| Parent SEC Documents |

|

5.6(a) |

| Parent Stockholder Approval |

|

5.4(a) |

| Parent Stockholder Meeting |

|

7.3(a) |

| Parent Stockholder Proposals |

|

7.3(a) |

| Parent Termination Fee |

|

9.3(b) |

| Parent Triggering Event |

|

1.1(xx) |

| Parent Valuation |

|

3.1(a)(i)(H) |

| Parent Value Per Share |

|

3.1(a)(i)(I) |

-viii-

|

|

|

| Definition |

|

Location |

| Parent Worker |

|

5.13(a) |

| Party |

|

Preamble |

| PBGC |

|

4.12(d) |

| Permits |

|

4.10 |

| Permitted Liens |

|

4.18(a) |

| Person |

|

1.1(yy) |

| Personal Information |

|

4.19(g) |

| Post-Closing Company Common Stock Shares |

|

3.1(a)(i)(K) |

| Post-Closing Company Shares |

|

3.1(a)(i)(J) |

| Post-Closing Parent Shares |

|

3.1(a)(i)(M) |

| Post-Closing Company Preferred Stock Shares |

|

3.1(a)(i)(L) |

| Pre-Closing Period |

|

6.1(a) |

| Pre-Closing Tax Period |

|

1.1(zz) |

| Preferred Stock Exchange Ratio |

|

3.1(a)(i) |

| Proxy Statement |

|

7.1(a) |

| Registration Statement |

|

7.1(a) |

| Representative |

|

1.1(aaa) |

| Required Parent Stockholder Approvals |

|

5.4(a) |

| Response Date |

|

3.7(b) |

| Restated Certificate of Formation |

|

2.8(a) |

| Restated Limited Liability Company Agreement |

|

2.8(b) |

| Reverse Stock Split Proposal |

|

Recitals |

| Safety Notices |

|

4.11(h) |

| Sarbanes-Oxley Act |

|

5.6(a) |

| SEC |

|

1.1(bbb) |

| Second Certificate of Merger |

|

2.4(b) |

| Second Effective Time |

|

2.4(b) |

| Second Merger |

|

Recitals |

| Securities Act |

|

4.5(b) |

| Stockholder Notice |

|

7.2(b) |

| Straddle Period |

|

7.9(d) |

| Subscription Agreement |

|

Recitals |

| Subsequent Transaction |

|

1.1(ccc) |

| Subsidiary |

|

1.1(ddd) |

| Superior Offer |

|

1.1(eee) |

| Surviving Company |

|

2.2(a) |

| Surviving Entity |

|

2.2(b) |

| Takeover Laws |

|

4.21 |

| Tax Action |

|

4.15(d) |

| Tax Counsel |

|

7.9(b) |

| Tax Return |

|

1.1(fff) |

| Taxes |

|

1.1(ggg) |

| Trade Secret |

|

1.1(dd) |

| Transaction Litigation |

|

7.4(c) |

| Transactions |

|

1.1(hhh) |

-ix-

|

|

|

| Definition |

|

Location |

| Transfer Taxes |

|

7.9(c) |

| Treasury Regulations |

|

1.1(iii) |

| Treasury Stock Method |

|

3.1(a)(i)(N) |

| WARN Act |

|

4.13(f) |

| Withholding Agent |

|

3.5 |

-x-

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of May 10, 2024, by and among Reneo Pharmaceuticals,

Inc., a Delaware corporation (“Parent”), Radiate Merger Sub I, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of Parent (“Merger Sub I”), Radiate Merger Sub II, LLC, a Delaware limited liability

company and a direct, wholly-owned subsidiary of Parent (“Merger Sub II”, and together with Merger Sub I, “Merger Subs”) and OnKure, Inc., a Delaware corporation (the “Company”). Parent, the Merger

Subs and the Company are referred to herein collectively as the “Parties” and individually as a “Party.”

RECITALS

WHEREAS, Parent

and the Company intend to effect a merger of Merger Sub I with and into the Company (the “First Merger”) in accordance with this Agreement and the General Corporation Law of the State of Delaware (the “DGCL”). Upon

consummation of the First Merger, Merger Sub I will cease to exist and the Company will become a direct, wholly-owned subsidiary of Parent. As promptly as practicable following the First Merger, and as part of the same overall transaction, the

surviving corporation of the First Merger will merge with and into Merger Sub II (the “Second Merger” and, together with the First Merger, the “Mergers”) in accordance with this Agreement and the DGCL. Upon

consummation of the Second Merger, the surviving corporation of the First Merger will cease to exist and Merger Sub II will continue as a direct, wholly-owned subsidiary of Parent;

WHEREAS, the Parties intend that (i) the Mergers together constitute an integrated plan described in Rev. Rul. 2001-46, 2001-2 C.B. 321, that shall qualify as a single “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended

(the “Code”) (the “Intended Tax Treatment”) and (ii) this Agreement shall constitute, and is hereby adopted as, a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a);

WHEREAS, the Board of Directors of

the Company (the “Company Board”) has unanimously (i) determined that the Transactions are fair to, advisable and in the best interests of the Company and its stockholders, (ii) approved and declared advisable this

Agreement and the Transactions and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Company vote to adopt this Agreement and thereby approve the Transactions;

WHEREAS, the Company Board has approved this Agreement and the Mergers, with the Company continuing as the Surviving Company (as defined

below) after the First Effective Time (as defined below), pursuant to which each share of Company Capital Stock shall be converted into the right to receive a number of shares of Parent Class A Common Stock (as defined below) or Parent

Class B Common Stock (as defined below), and Merger Sub II continuing as the Surviving Entity (as defined below) after the Second Effective Time (as defined below) as provided in Section 3.1(a)(i), upon the terms and

subject to the conditions set forth in this Agreement;

1

WHEREAS, Merger Sub I is a newly incorporated Delaware corporation and Merger Sub II is a

newly formed Delaware limited liability company, in each case, that is wholly-owned by Parent, and has been incorporated or formed for the sole purpose of effecting the Merger;

WHEREAS, effective as of the First Effective Time, the certificate of incorporation and bylaws of Parent shall be amended and restated in the

form attached hereto as Exhibit A and Exhibit B, respectively (respectively, with such changes as may be mutually agreed between Parent and the Company, the “Parent Amended Charter” and the “Parent Amended

Bylaws”) to contemplate a name change;

WHEREAS, the Board of Directors of Parent (the “Parent Board”) has

unanimously (i) determined that the Transactions are fair to, advisable and in the best interests of Parent and its stockholders, (ii) approved and declared advisable this Agreement and the Transactions, including the issuance of shares of

Parent Common Stock to the stockholders of the Company pursuant to this Agreement, (iii) determined and declared that the Charter Amendment Proposals (as defined below) are advisable and in the best interests of Parent and its stockholders,

(iv) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of Parent vote to authorize the issuance of the Parent Common Stock in connection with the First Merger and the

Concurrent PIPE Investment (as defined below) in accordance with Nasdaq Listing Rule 5635 (the “Nasdaq Issuance Proposal”) and (v) determined to recommend, upon the terms and subject to the conditions set forth in this

Agreement, as promptly as practicable after the forms thereof are mutually agreed to by Parent and the Company, that the stockholders of Parent vote to approve (a) one or more amendments to Parent’s certificate of incorporation to effect

the Nasdaq Reverse Stock Split (the “Reverse Stock Split Proposal”), (b) the Parent Amended Charter (together with the Reverse Stock Split Proposal, the “Charter Amendment Proposals”) and to take formal action to

approve, adopt and declare advisable such final form of the Parent Amended Charter, (c) the adoption of the 2024 Equity Incentive Plan (the “2024 Equity Incentive Plan Proposal”) and (d) the adoption of the 2024 ESPP (the

“2024 ESPP Proposal”, and together with the 2024 Equity Incentive Plan Proposal, the “Equity Plan Proposals”);

WHEREAS, the boards of directors or members, as applicable, of each Merger Sub has (i) determined that the Transactions are fair to,

advisable and in the best interests of such Merger Sub and its sole stockholder or sole member, (ii) approved and declared advisable this Agreement and the Transactions and (iii) determined to recommend, upon the terms and subject to the

conditions set forth in this Agreement, that the stockholder or member, as applicable, of such Merger Sub votes to adopt this Agreement and thereby approve the Transactions;

WHEREAS, Parent, the Merger Subs and the Company each desire to make certain representations, warranties, covenants and agreements in

connection with the Mergers and also to prescribe certain conditions to the Mergers as specified herein;

WHEREAS, concurrently with the

execution and delivery of this Agreement and as a condition and inducement to the Company’s willingness to enter into this Agreement, the officers, directors and stockholders of Parent listed on Section A of the Parent Disclosure Letter have

(following Parent Board approval thereof) entered into Parent Support Agreements, dated as of the date of this Agreement, in substantially the form attached hereto as Exhibit C (the “Parent Support Agreements”), pursuant to

which such officers, directors and stockholders have, subject to the terms and conditions set forth therein, agreed to vote all of their shares of Parent Common Stock in favor of the approval of the Parent Stockholder Proposals;

2

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition

and inducement of Parent’s willingness to enter into this Agreement, the officers, directors and stockholders of the Company listed on Section A of the Company Disclosure Letter have (following Company Board approval thereof) entered into

Company Support Agreements, dated as of the date of this Agreement, in substantially the form attached hereto as Exhibit D (the “Company Support Agreements”), pursuant to which such officers, directors and stockholders have,

subject to the terms and conditions set forth therein, agreed to vote all of their shares of Company Capital Stock in favor of the adoption of this Agreement and thereby approve the Transactions;

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to Parent’s willingness to

enter into this Agreement, certain stockholders of the Company listed on Section B of the Company Disclosure Letter are executing lock-up agreements in substantially the form attached hereto as Exhibit

E (the “Lock-Up Agreement”);

WHEREAS, concurrently with the execution and

delivery of this Agreement and as a condition and inducement to Company’s willingness to enter into this Agreement, the continuing executive officers of Parent (if any) and the continuing members of the Parent Board listed on Section B of the

Parent Disclosure Letter are executing the Lock-Up Agreement;

WHEREAS, it is expected that no

later than the fifth Business Day after the Registration Statement is declared effective under the Securities Act, holders of shares of Company Capital Stock sufficient to adopt and approve this Agreement and the Transactions as required under the

DGCL and the Company Charter and Company Bylaws will execute an action by written consent in form and substance reasonably acceptable to Parent (the “Company Stockholder Written Consent”) adopting this Agreement and approving the

Company Charter Amendment, including by the holders of (i) at least a majority of the voting power of outstanding shares of Company Class A Common Stock and Company Series C Preferred Stock, voting together as a single class, and

(ii) at least a majority of the outstanding shares of Company Series C Preferred Stock, voting as a separate class, approving and adopting this Agreement (together, subclauses (i) and (ii), the “Company Stockholder