Current Report Filing (8-k)

May 03 2023 - 4:03PM

Edgar (US Regulatory)

false 0001637715 0001637715 2023-05-03 2023-05-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 3, 2023

Reneo Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-40315 |

|

47-2309515 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 18575 Jamboree Road, Suite 275-S |

|

|

| Irvine, California |

|

92612 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 858 283-0280

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

RPHM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On May 3, 2023, Reneo Pharmaceuticals, Inc. (the “Company”) announced that, based upon preliminary and unaudited estimates and information available to the Company as of today, it expects to report that it had approximately $93.8 million of cash, cash equivalents and short-term investments as of March 31, 2023. The unaudited, estimated results as of the three months ended March 31, 2023 are preliminary and were prepared by the Company’s management based upon its estimates, a number of assumptions and currently available information. This preliminary financial information is the responsibility of management and has been prepared in good faith on a consistent basis with prior periods. However, the Company has not yet completed its quarter-end financial close process for the quarter ended March 31, 2023. This estimate of the Company’s cash, cash equivalents and short-term investments as of March 31, 2023 is preliminary, has not been audited and is subject to change upon completion of its financial statement closing procedures, and as a result should not be regarded as a representation by the Company and its management as to its actual cash, cash equivalents and short-term investments as of March 31, 2023. Additional information and disclosure would be required for a more complete understanding of the Company’s financial position and results of operations as of March 31, 2023. The Company’s independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to this preliminary result and, accordingly, does not express an opinion or any other form of assurance about it. This preliminary financial information should not be viewed as a substitute for full financial statements prepared in accordance with United States generally accepted accounting principles and reviewed by the Company’s auditors.

The information contained in this Current Report on Form 8-K under Item 2.02 is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and will not be incorporated by reference into any filing by the Company under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), unless specifically identified as being incorporated therein by reference.

| Item 7.01 |

Regulation D Disclosure. |

On May 3, 2023, the Company posted an updated corporate slide presentation in the “Investors” portion of its website at www.reneopharma.com. A copy of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The Company undertakes no obligation to update, supplement or amend the materials attached hereto as Exhibit 99.1.

The information in this Item 7.01 of this Current Report on 8-K (including Exhibit 99.1) is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act. The information shall not be deemed incorporated by reference into any other filing with the Securities Exchange Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

In April 2023, the Company entered into a non-binding term sheet (the “Term Sheet”), with an investor that holds more than 5% of its common stock and is affiliated with one of its directors, and its affiliated development company for a structured royalty financing of up to $100 million in conditional tranched funding, currently contemplated to include $30.0 million funded in connection with entering into the definitive agreement and the remaining amount in multiple tranches based on the achievement of development and regulatory milestones. If mavodelpar (REN001) is approved in the United States or the European Union, the Company would pay to the investor (1) fixed payments and (2) variable royalty payments based on net sales of mavodelpar, subject to specified caps. Pursuant to the Term Sheet, the Company will also enter into a collaboration agreement with the development company with respect to mavodelpar and establish a joint steering committee. The Term Sheet does not represent a definitive funding agreement and there is no guarantee that the Company will enter into a definitive funding agreement and close the proposed structured financing with the investor. If consummated, the closing is expected to occur in the second quarter of 2023.

Forward-Looking Statements

Statements contained in this Current Report on Form 8-K regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include statements regarding, among other things, the Company’s anticipated financial results for the fiscal quarter ended March 31, 2023, the ability of the Company to enter into a definitive agreement with investors and obtain funding on the terms set forth in the Term Sheet, the ability of the Company to satisfy conditions and entering into a collaboration agreement, and the expected timing of the closing. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “plans,” “will,” “believes,” “anticipates,” “expects,” “intends,” “goal,” “potential” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, that there is no assurance that the Company will enter into a definitive funding agreement with the investor and obtain funding on the terms set forth in the Term Sheet, or at all, and any definitive funding agreement executed pursuant to the Term Sheet would increase the Company’s operating complexity, risks and uncertainties associated with the Company’s business in general, and the other risks described in the Company’s filings with the Securities and Exchange Commission. All forward-looking statements contained in this Current Report on Form 8-K speak only as of the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Reneo Pharmaceuticals, Inc. |

|

|

|

|

| Date: May 3, 2023 |

|

|

|

By: |

|

/s/ Gregory J. Flesher |

|

|

|

|

|

|

Gregory J. Flesher President and Chief Executive Officer (Principal Executive Officer) |

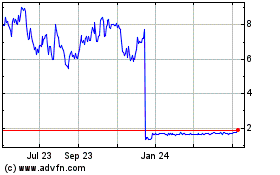

Reneo Pharmaceuticals (NASDAQ:RPHM)

Historical Stock Chart

From Jun 2024 to Jul 2024

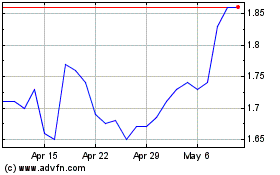

Reneo Pharmaceuticals (NASDAQ:RPHM)

Historical Stock Chart

From Jul 2023 to Jul 2024