Exhibit 99.1

DECEMBER 7, 2023 READING INTERNATINAL 2023 ANNUAL MEETING F STCKHLDERS

2023 annual meeting f stckhlders Agenda WELCME AND INTRDUCTINS MARGARET Ctter Chair, Serving as Presiding fficer ESTABLISHMENT F SATISFACTIN F MEETING PREREQUISITES (Satisfactin f Ntice and Qurum Requirements); MEETING CALLED T RDER S. Craig Tmpkins Executive Vice President and General Cunsel, Serving as Annual Meeting Secretary REVIEW F MEETING PRCEDURES S. Craig Tmpkins Annual Meeting Secretary

2023 annual meeting f stckhlders Agenda IV. PRESENTATIN F PRPSALS AND DISCUSSIN; PENING F PLLS Prpsal 1 – T elect Five (5) Directrs t serve until ur Cmpany’s 2024 Annual Meeting f Stckhlders r until their successrs are duly elected and qualified. Prpsal 2 – Independent Auditr Ratificatin – T ratify the appintment f Grant Thrntn, LLP as ur Cmpany’s Independent Registered Public Accunting firm fr the fiscal year ended December 31, 2023. Prpsal 3 – Advisry Vte n Executive fficer Cmpensatin – T apprve, n a nn-binding, advisry basis, the executive cmpensatin f ur Named Executive fficers. Prpsal 4 – T apprve, n a nn-binding, advisry basis, the frequency f vtes n executive cmpensatin. Prpsal 5 – 2020 Stck Incentive Plan – T apprve an amendment t the Reading Internatinal, Inc. 2020 Stck Incentive Plan t increase the number f Shares f Class A Stck reserved fr issuance thereunder by an additinal 971,807 Shares. Prpsal 6 – T transact such ther business as may prperly cme befre ur Annual Meeting and any adjurnment r pstpnement theref. S. Craig Tmpkins Annual Meeting Secretary

2023 annual meeting f stckhlders Agenda V. VTING VI. REVIEW AND ANNUNCEMENT F PRELIMINARY VTING RESULTS SYLVIA MRALES Cmputershare Inspectr f Electins VII. ADJURNMENT F ANNUAL STCKHLDERS MEETING MARGARET Ctter Presiding fficer Chair VIII. MANAGEMENT PRESENTATIN AND QUESTIN & ANSWER SESSIN Questins may be sent using the Meeting Text Functin at any time during the meeting. Ellen M. Ctter President & Chief Executive fficer Gilbert Avanes Executive Vice President, Chief Financial fficer and Treasurer Andrzej J. Matyczynski Executive Vice President – Glbal peratins

DISCLAIMERS ur cmments tday may cntain frward-lking statements and management may make additinal frward-lking statements in respnse t yur questins. Such written and ral disclsures are made pursuant t the Safe Harbr prvisin f the Private Securities Litigatin Refrm Act f 1995. Althugh we believe ur expectatins expressed in such frward-lking statements are reasnable, we cannt assure yu that they will be realized. Investrs are cautined that such frward-lking statements invlve risks and uncertainties that culd cause actual results t differ materially frm the anticipated results, and therefre we refer yu t a mre detailed discussin f the risks and uncertainties in ur Cmpany’s filings with the Securities & Exchange Cmmissin. This presentatin is intended t summarize the prjects n which we are wrking and ur plan fr mving ur Cmpany frward. Many f the prjects are in their early stages and will be subject t varius Gvernmental and Bard apprvals. Accrdingly, n assurances can be given that the plans discussed herein will be achieved. We are a diversified internatinal cmpany and, fr risk management and ther business reasns, perate and hld ur assets thrugh and in varius subsidiary entities. Accrdingly, when using terms such as “we,” “ur” r “us,” we are using such terms t include ur Cmpany n a cnslidated basis and nt t negate, undercut r adversely impact the legal separateness f such subsidiaries.

FINANCIAL RECNCILIATINS We use EBITDA in the evaluatin f ur Cmpany’s perfrmance since we believe that EBITDA prvides a useful measure f financial perfrmance and value. We believe this principally fr the fllwing reasns: We believe that EBITDA is an accepted industry-wide cmparative measure f financial perfrmance. It is, in ur experience, a measure cmmnly adpted by analysts and financial cmmentatrs wh reprt upn the cinema exhibitin and real estate industries, and it is als a measure used by financial institutins in underwriting the creditwrthiness f cmpanies in these industries. Accrdingly, ur management mnitrs this calculatin as a methd f judging ur perfrmance against ur peers, market expectatins and ur creditwrthiness. It is widely accepted that analysts, financial cmmentatrs and persns active in the cinema exhibitin and real estate industries typically value enterprises engaged in these businesses at varius multiples f EBITDA. Accrdingly, we find EBITDA valuable as an indicatr f the underlying value f ur businesses. We expect that investrs may use EBITDA t judge ur ability t generate cash, as a basis f cmparisn t ther cmpanies engaged in the cinema exhibitin and real estate businesses and as a basis t value ur cmpany against such ther cmpanies. EBITDA is nt a measurement f financial perfrmance under generally accepted accunting principles in the United States f America and it shuld nt be cnsidered in islatin r cnstrued as a substitute fr net incme (lss) r ther peratins data r cash flw data prepared in accrdance with generally accepted accunting principles in the United States f America fr purpses f analyzing ur prfitability. The exclusin f varius cmpnents, such as interest, taxes, depreciatin, and amrtizatin, limits the usefulness f these measures when assessing ur financial perfrmance, as nt all funds depicted by EBITDA are available fr management’s discretinary use. Fr example, a substantial prtin f such funds may be subject t cntractual restrictins and functinal requirements t service debt, t fund necessary capital expenditures and t meet ther cmmitments frm time t time. EBITDA als fails t take int accunt the cst f interest and taxes. Interest is clearly a real cst that fr us is paid peridically as accrued. Taxes may r may nt be a current cash item but are nevertheless real csts that, in mst situatins, must eventually be paid. A cmpany that realizes taxable earnings in high tax jurisdictins may, ultimately, be less valuable than a cmpany that realizes the same amunt f taxable earnings in a lw tax jurisdictin. EBITDA fails t take int accunt the cst f depreciatin and amrtizatin and the fact that assets will eventually wear ut and have t be replaced. Adjusted EBITDA. Using the principles we cnsistently apply t determine ur EBITDA, we further adjust EBITDA fr certain items we believe t be external t ur cre business and nt reflective f ur csts f ding business r results f peratin. Such items may include (i) legal expenses relating t extrardinary litigatin and (ii) any ther items that can be cnsidered nn-recurring in accrdance with the tw-year SEC requirement fr determining an item is nn-recurring, infrequent r unusual in nature.

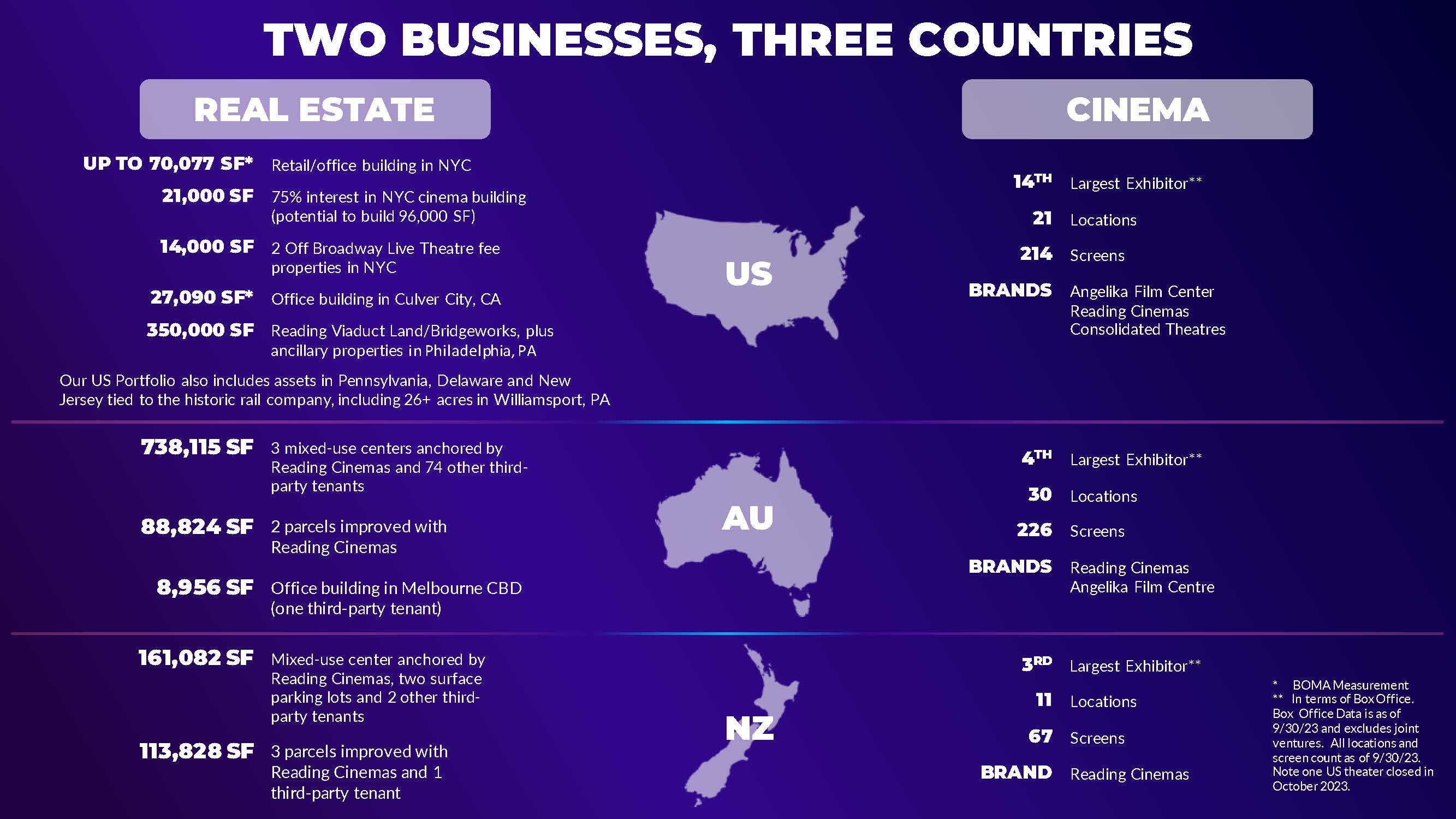

TW BUSINESSES, THREE CUNTRIES 738,115 SF 88,824 SF 8,956 SF UP T 70,077 SF* 21,000 SF 14,000 SF 27,090 SF* Retail/ffice building in NYC 75% interest in NYC cinema building (ptential t build 96,000 SF) 2 ff Bradway Live Theatre fee prperties in NYC ffice building in Culver City, CA 3 mixed-use centers anchred by Reading Cinemas and 74 ther third-party tenants 2 parcels imprved with Reading Cinemas ffice building in Melburne CBD (ne third-party tenant) 161,082 SF 113,828 SF Mixed-use center anchred by Reading Cinemas, tw surface parking lts and 2 ther third-party tenants 3 parcels imprved with Reading Cinemas and 1 third-party tenant * BMA Measurement ** In terms f Bx ffice. Bx ffice Data is as f 9/30/23 and excludes jint ventures.All lcatins and screen cunt as f 9/30/23. Nte ne US theater clsed in ctber 2023. 14TH 21 214 BRANDS Angelika Film Center Reading Cinemas Cnslidated Theatres Lcatins Screens Largest Exhibitr** REAL ESTATE CINEMA 4TH 30 226 BRANDS Reading Cinemas Angelika Film Centre Lcatins Screens Largest Exhibitr** 3RD 11 67 BRAND Reading Cinemas Lcatins Screens Largest Exhibitr** 350,000 SF Reading Viaduct Land/Bridgewrks, plus ancillary prperties in Philadelphia, PA ur US Prtfli als includes assets in Pennsylvania, Delaware and New Jersey tied t the histric rail cmpany, including 26+ acres in Williamsprt, PA

LNG-TERM MISSIN STRATEGICALLY DRIVE THE DEVELPMENT AND PERATIN F UR GLBAL REAL ESTATEANDCINEMA ASSETS T CREATE LNG-TERM STCKHLDER VALUE . 2024 PRIRITY DUE T 1) INTEREST RATES REACHING HIGHEST LEVELS IN 22 YEARS, 2) UR UPCMING DEBT MATURITIES IN ACHALLENGED LENDING MARKET, AND 3) N U.S. SHUTTERED VENUE FUNDING, WE’LL STRATEGICALLY MNETIZE CERTAIN REAL IMPRVE UR LIQUIDITY. ESTATE ASSETS T REDUCE UR DEBT AND

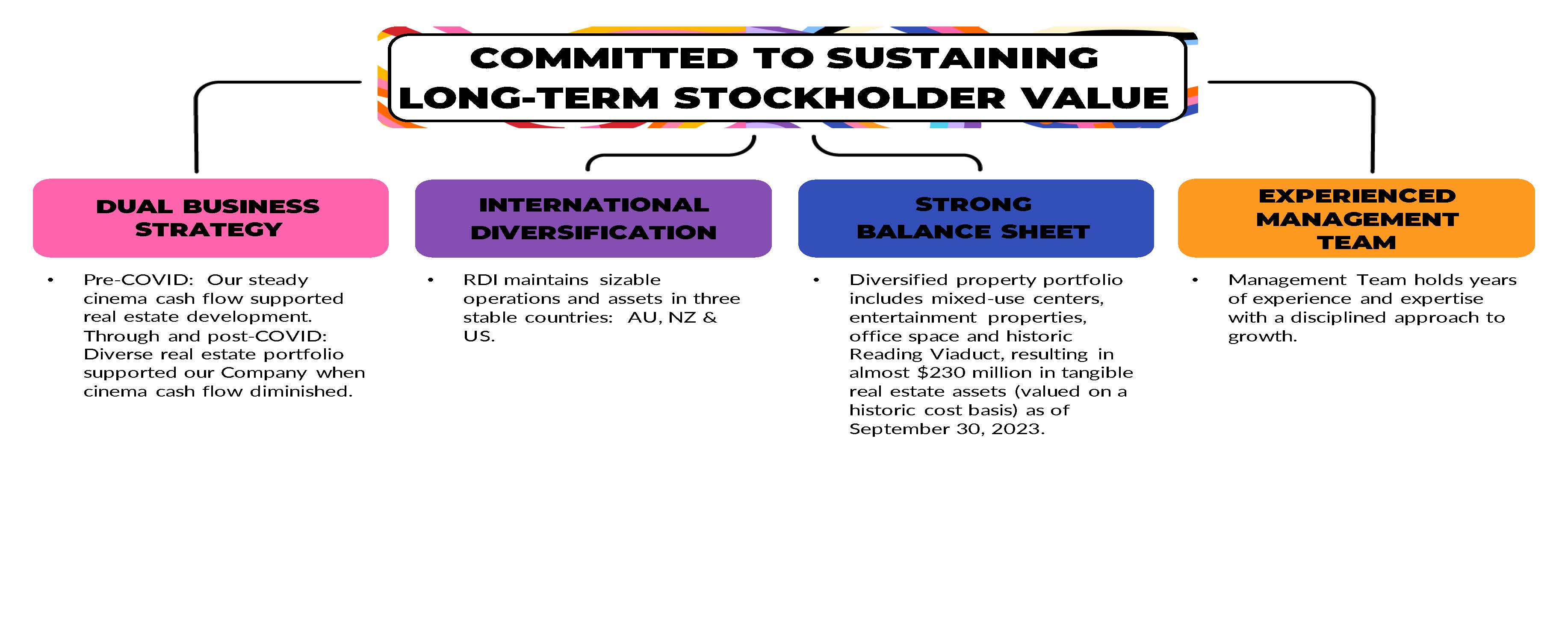

CMMITTED T SUSTAINING LNG-TERM STCKHLDER VALUE DUAL BUSINESS STRATEGY INTERNATINAL DIVERSIFICATIN STRNG BALANCE SHEET EXPERIENCED MANAGEMENT TEAM Pre-CVID: our steady cinema cash flow supported real estate development. Through and past-CVID: Diverse real estate portfolio supported our Company when cinema cash flow diminished. RDI maintains sizable operations and assets in three stable countries: AU, NZ& US. Diversified property profile includes mixed-use centers, entertainment properties, office space and historic Reading Viaduct, resulting in almost $230 million in tangible real estate assets (valued in a historic cast basis) as of September 30, 2023. Management Team holds years of experience and expertise with a disciplined approach to growth

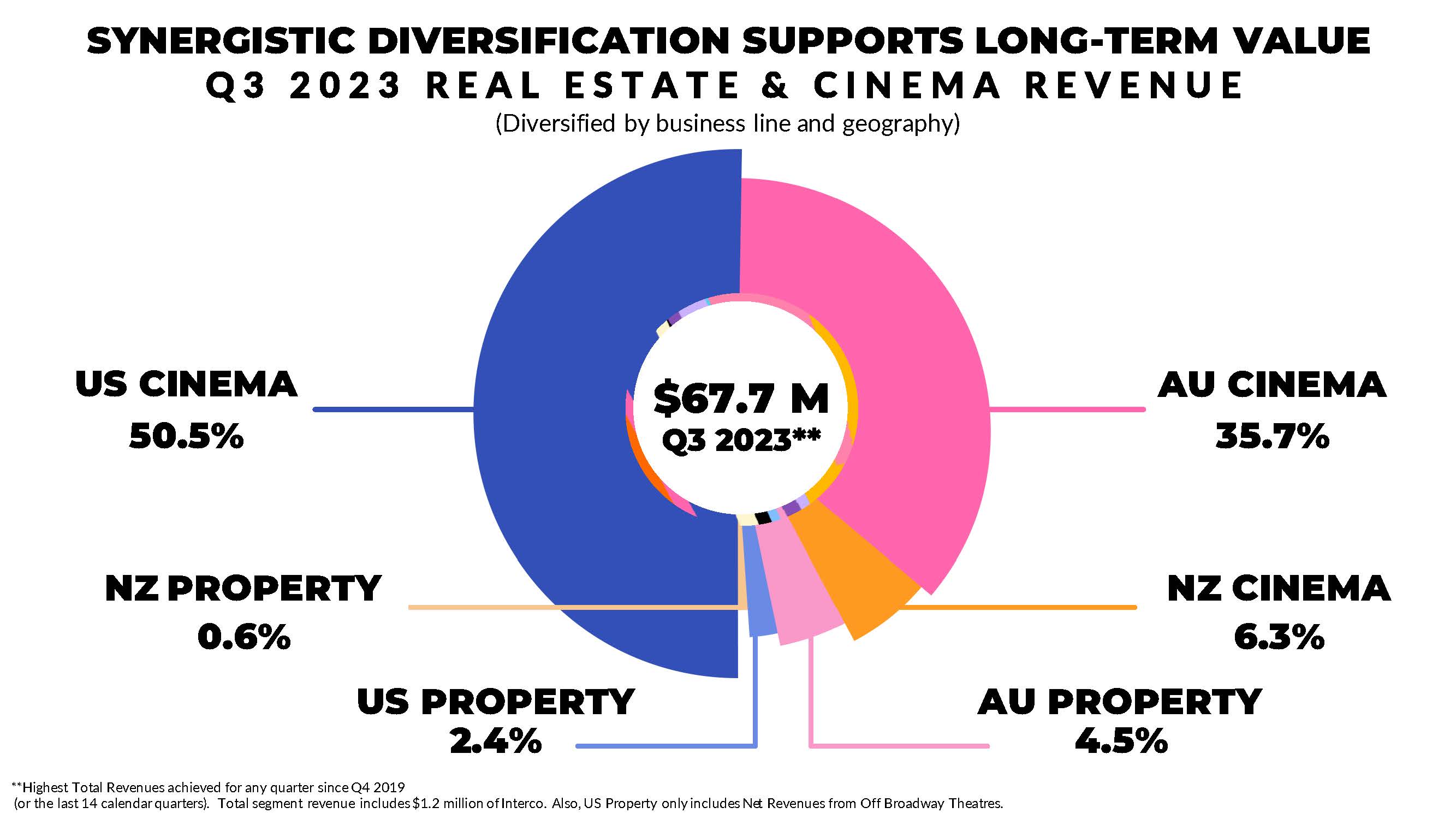

SYNERGISTIC DIVERSIFICATIN SUPPRTS LNG-TERM VALUE Q3 2023 REAL ESTATE & CINEMA REVENUE (Diversified by business line and geography) US CINEMA 50.5% NZ PRPERTY 0.6% US PRPERTY 2.4% $67.7 M Q3 2023** AU CINEMA 35.7% NZ CINEMA 6.3% AU PRPERTY 4.5% **Highest Total Revenues achieved for any quarter since Q4 2019 (r the last 14 calendar quarters). Total segment revenue includes $1.2 million of Interc. Als, US Property only includes Net Revenues from ff Bradway Theatres.

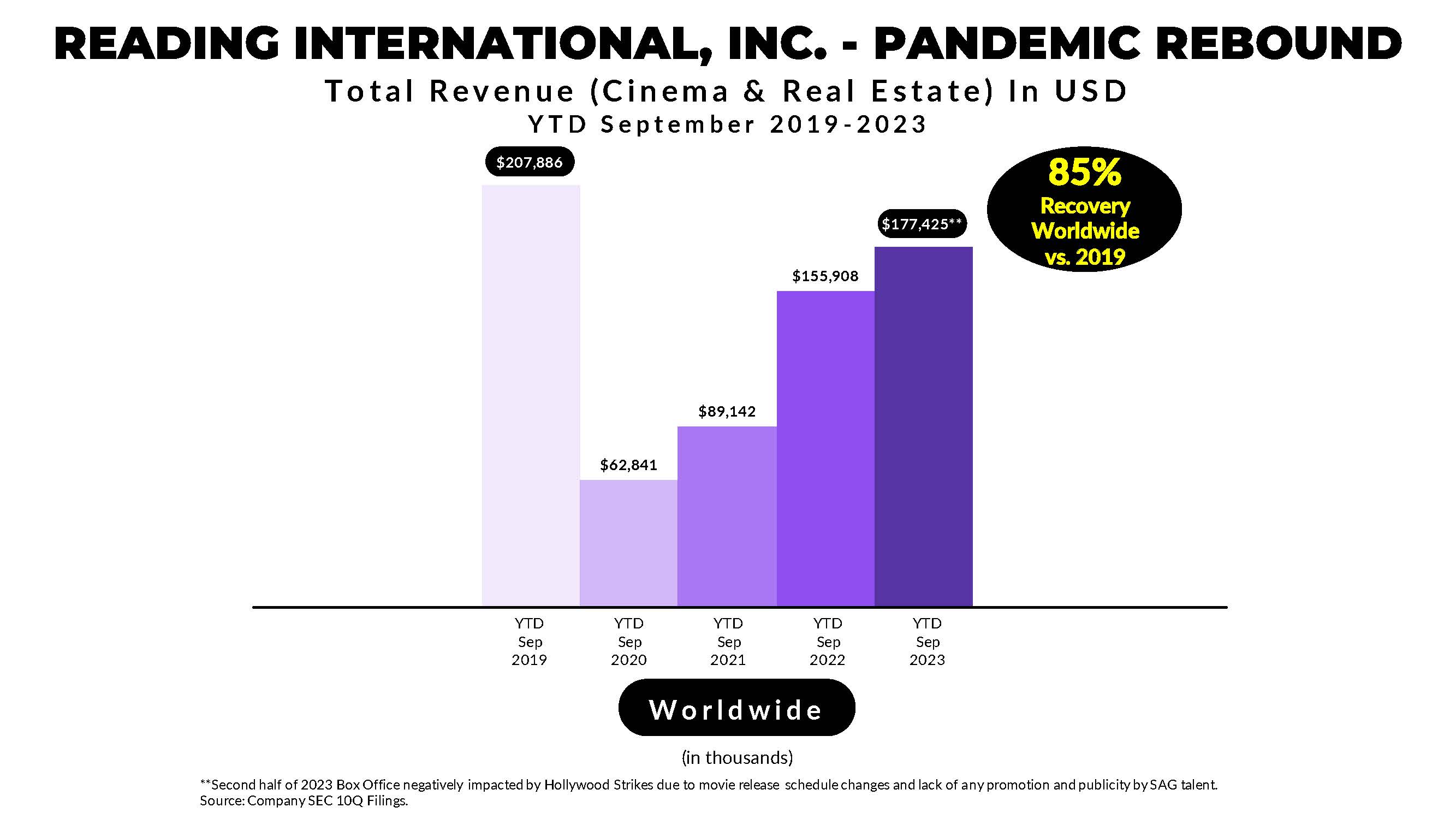

READING INTERNATINAL, INC. - PANDEMIC REBUND Total Revenue (Cinema & Real Estate) In USD YTD September 2019-2023 $207,886 $62,841 $89,142 $155,908 $177,425 YTD YTD YTD YTD YTD 85% Recovery Worldwide Vs. 2019 Sep Sep Sep Sep Sep 2019 2020 2021 2022 2023 Worldwide (in thousands) **Second half f 2023 Box office negatively impacted by Hollywood Strikes due to movie release schedule changes and lack of any promotion and publicity by SAG talent. Source: Company SEC 10Q Filings.

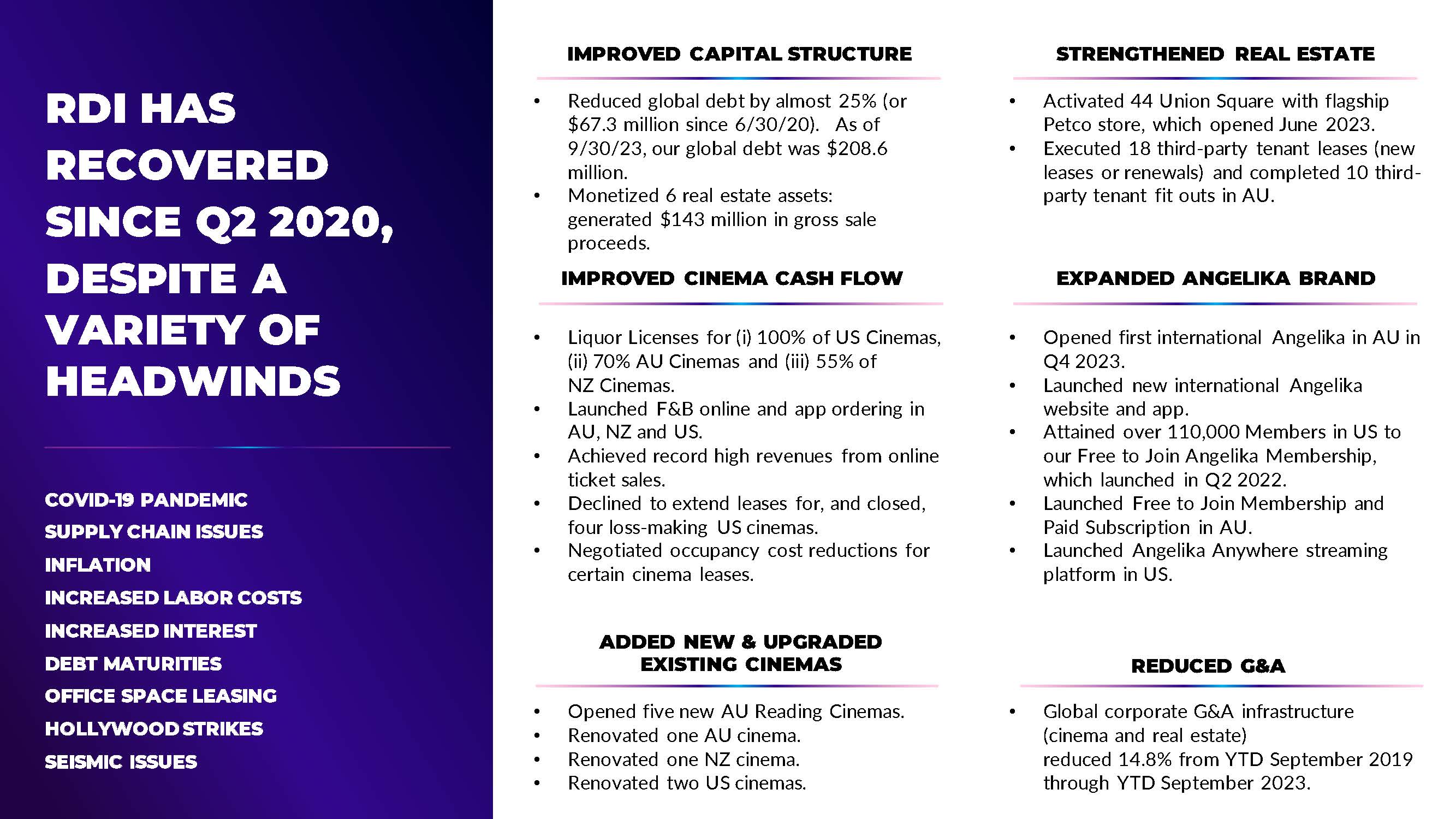

RDI HAS RECVERED SINCE Q2 2020, DESPITE A VARIETY Of HEADWINDS CVID-19 PANDEMIC SUPPLY CHAIN ISSUES INFLATIN INCREASED LABR CSTS INCREASED INTEREST DEBTMATURITIES FFICE SPACE LEASING HLLYWD STRIKES SEISMIC ISSUES IMPRVED CAPITAL STRUCTURE IMPRVED CINEMACASH FLW STRENGTHENED REAL ESTATE EXPANDED ANGELIKA BRAND ADDED NEW & UPGRADED EXISTING CINEMAS Reduced global debt by almst25% (r $67.3 million since 6/30/20). As f 9/30/23, our global debt was $208.6 million. Monetize 6 real estate assets: generated$143 million in gross sale proceeds. penned five new AU Reading Cinemas. Renovated ne AU cinema. Renovated ne NZ cinema. Renovated two US cinemas. Activated 44 Union Square with flagship Petco store, which opened June2023. Executed18 third-party tenant leases (new leases r renewals) and cmpleted10 third-party tenant fetus in AU. Liquor Licenses for (i) 100% f US Cinemas, (ii)70% AU Cinemas and (iii)55% f Cinemas. Launched F&B online and app ordering in AU,NZ and US. Achieved record high revenues from online ticket sales. Declined t extend leases for, and closed, fur less-making US cinemas. Negotiated occupancy cost reduction for certain cinema leases. opened first international Angelika in AU in Q4 2023. Launched new international Angelika website and app. Attained over 110,000 Members in US turn Free t Jin Angelika Membership, which launched in Q2 2022. Launched Free t Jin Membership and Paid Subscription in AU. Launched Angelika Anywhere streaming platform in Us. Global corporate G&A infrastructure (cinema and real estate) reduced14.8%frmYTD September 2019 through YTD September 2023. REDUCED G&A

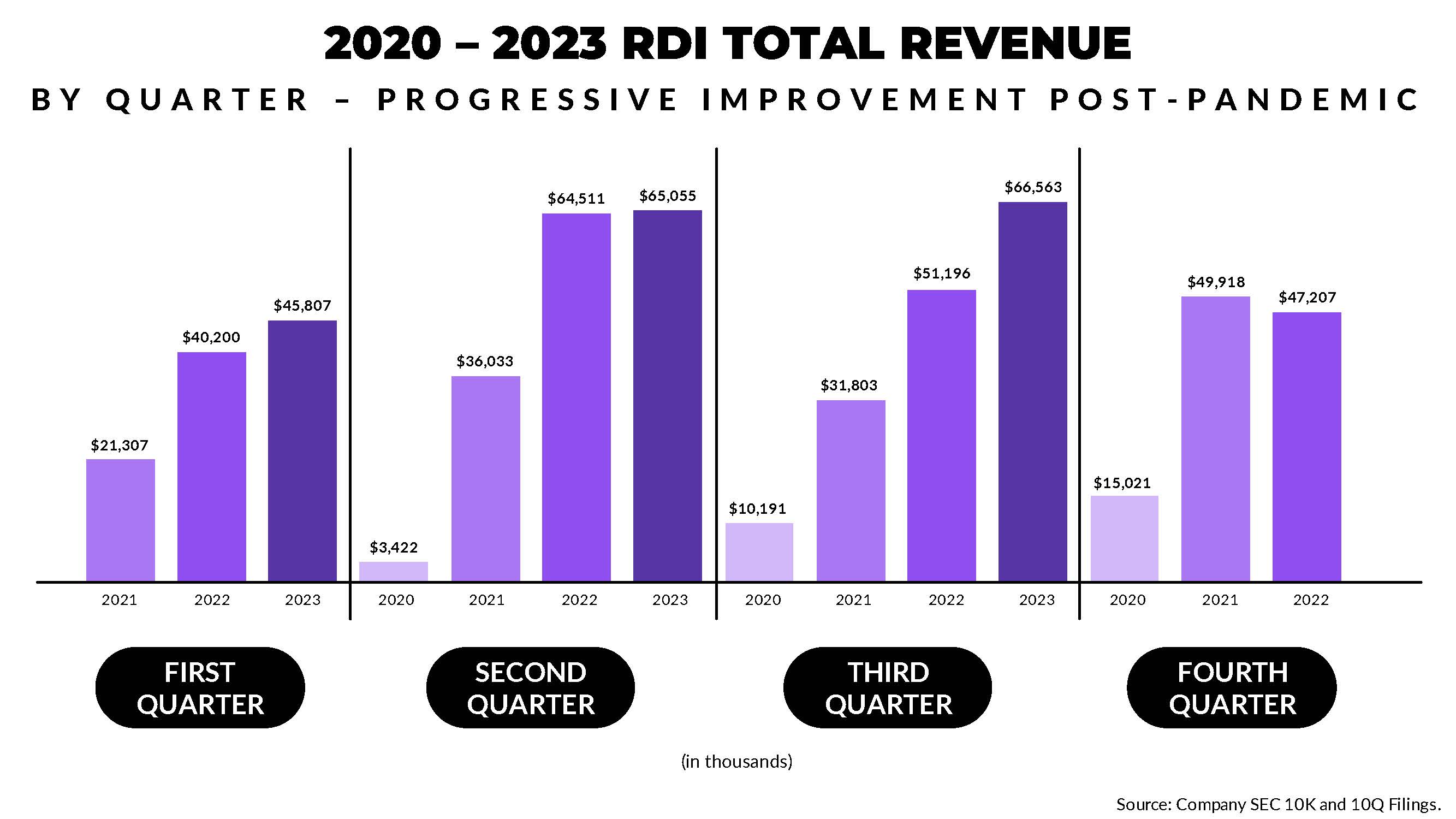

2020 – 2023 RDI TTAL REVENUE BY QUARTER – PRGRESSIVE IMPRVEMENT PST-PANDEMIC $21,307 $40,200 $45,807 $3,422 $36,033 $64,511 $65,055 $10,191 $31,803 $51,196 $66,563 $15,021 $49,918 $47,207 2021 2022 2023 2021 2022 2023 2020 2021 2022 2023 2020 2020 2021 2022 FIRST QUARTER SECND QUARTER THIRD QUARTER FURTH QUARTER (in thousands) Source: Company SEC 10K and 10Q Filings.

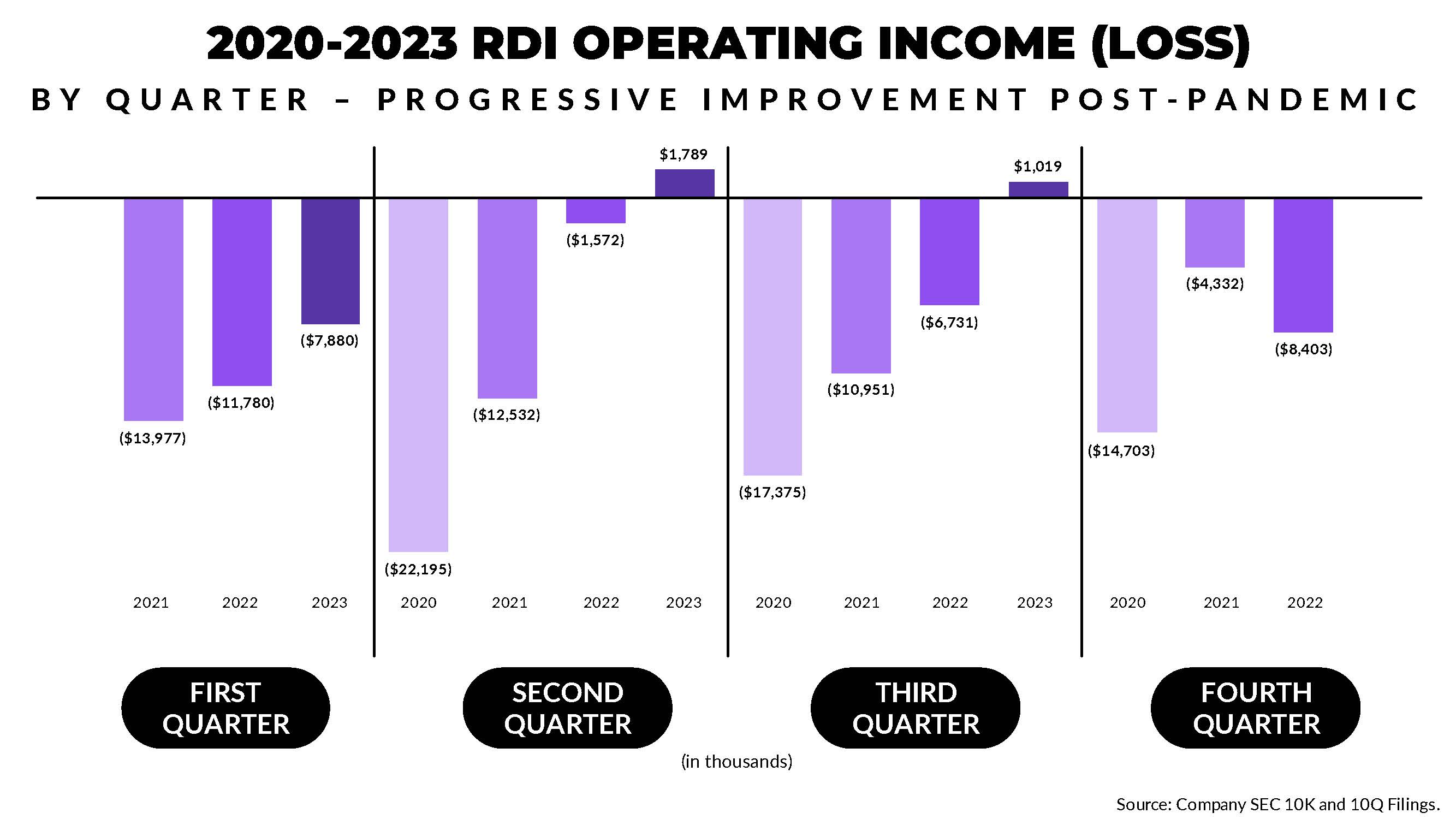

2020-2023 RDI PERATING INCME (LSS) BY QUARTER – PRGRESSIVE IMPRVEMENT PST-PANDEMIC ($13,977) ($11,780) ($7,880) ($22,195) ($12,532) ($1,572) $1,789 ($17,375) ($10,951) ($6,731) $1,019 ($14,703) ($4,332) ($8,403) 2021 2022 2023 2021 2022 2023 2020 2021 2022 2023 2020 2020 2021 2022 FIRST QUARTER SECND QUARTER THIRD QUARTER FURTH QUARTER (in thousands) Source: Company SEC 10K and 10Q Filings.

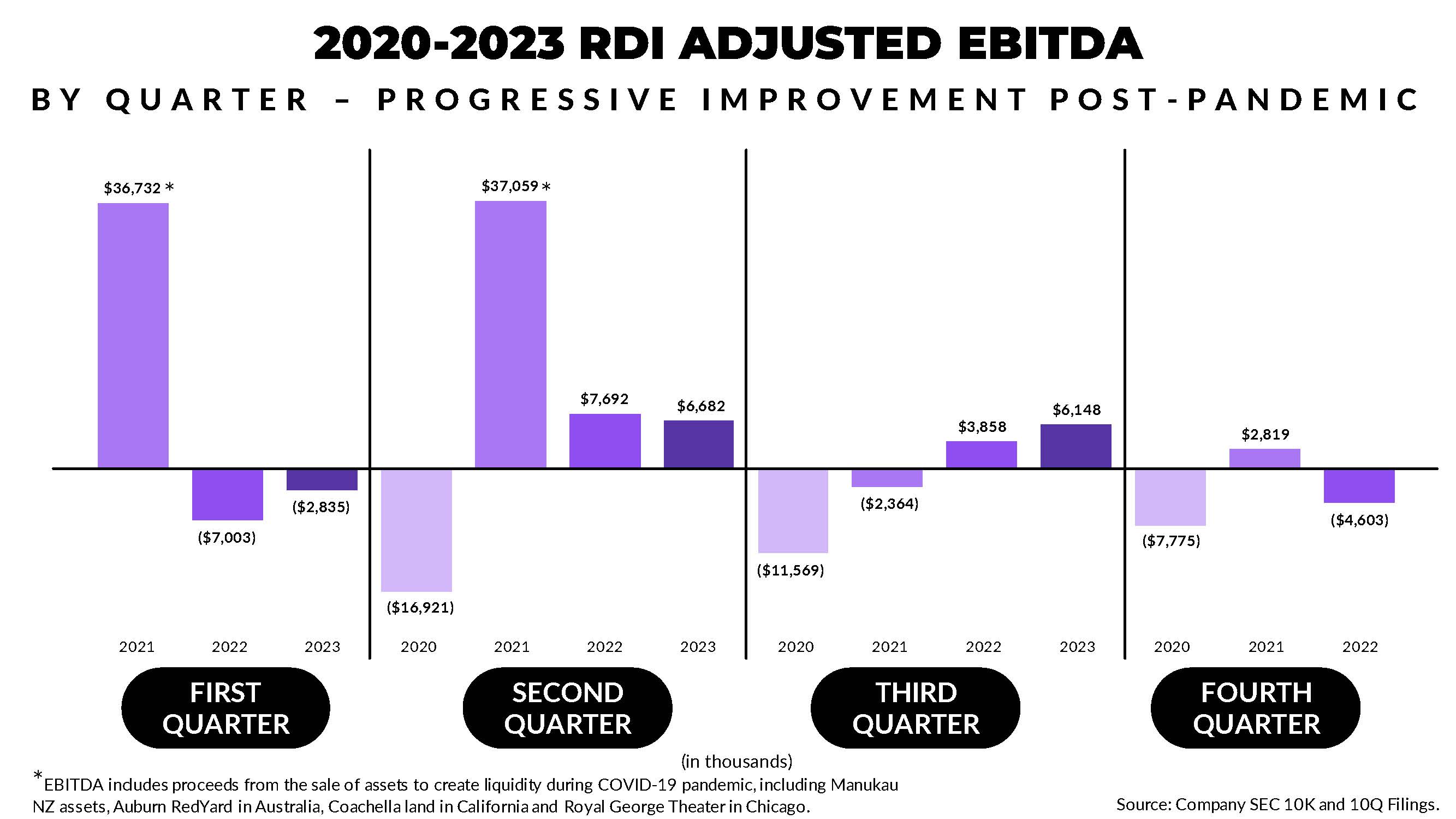

2020-2023 RDI ADJUSTED EBITDA BY QUARTER – PRGRESSIVE IMPRVEMENT PST-PANDEMIC $36,732 ($7,003) ($2,835) ($16,921) $37,059 $7,692 $6,682 ($11,569) ($2,364) $3,858 $6,148 ($7,775) $2,819 ($4,603) *EBITDA includes proceeds from the sale f assets t create liquidity during CVID-19 pandemic, including Manukau NZ assets, Auburn Red Yard in Australia, Coachella land in California and Ryal George Theater in Chicago. 2021 2022 2023 2021 2022 2023 2020 2021 2022 2023 2020 2020 2021 2022 FIRST QUARTER SECND QUARTER THIRD QUARTER FURTH QUARTER (in thousands) * * Source: Company SEC 10K and 10Q Filings.

THE PWER F THE MVIE GING EXPERIENCE IS Strong JESUS REVLUTIN Studies demonstrate dedication t the theatrical experience and commitment t theatrical window. Diversity f choices for moviegoers. Compelling and event driven marketing expanding audience. Content providers expanding Apple and MGM Amazon committed theatrical window Concert movies International films, including Suth Asian Faith based audiences However, Hollywood Strikes depressed Box office in latter part f2023, and while strikes have been settled the impact is expected to continue int2024.

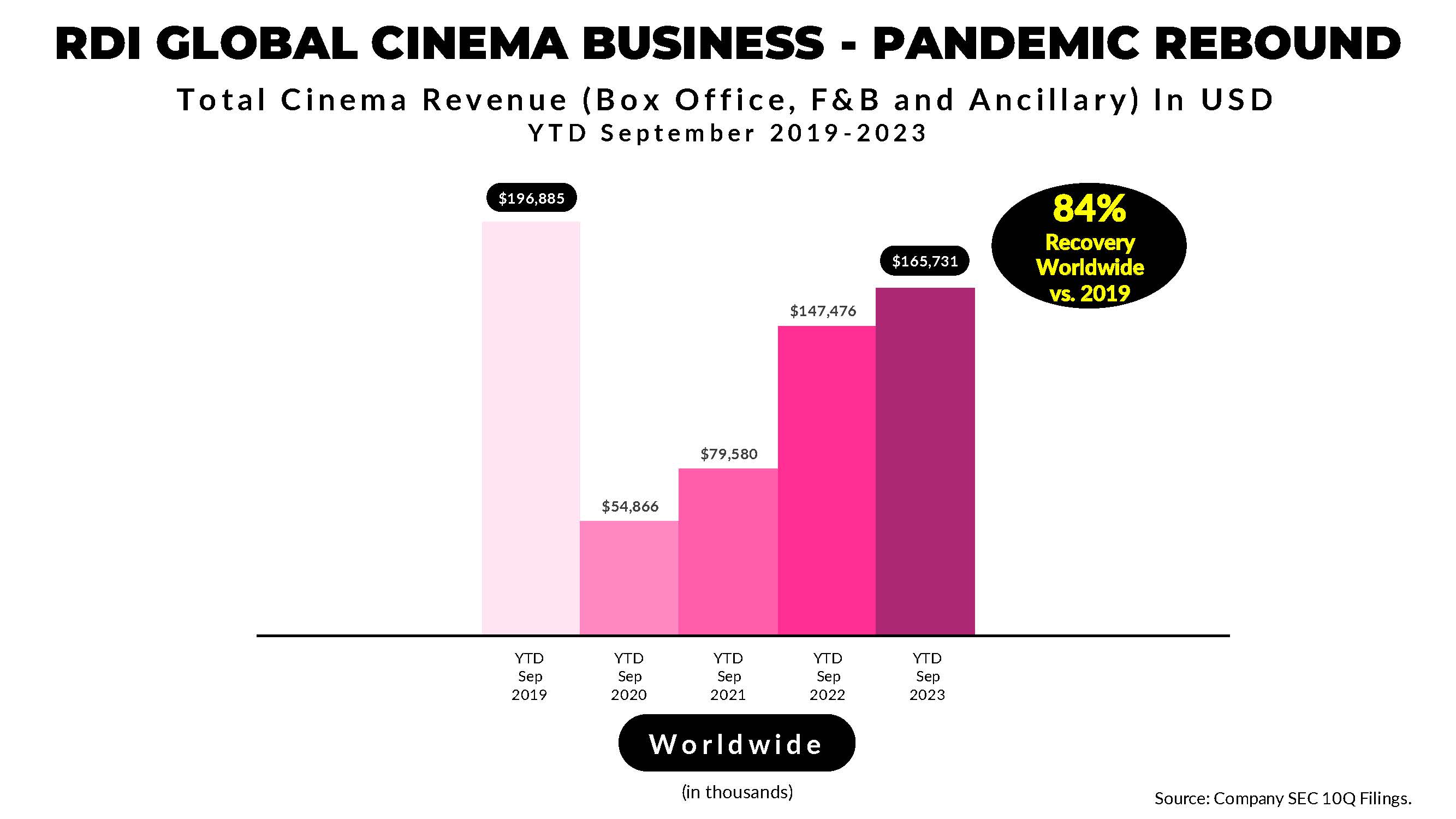

RDI GLBAL CINEMA BUSINESS - PANDEMIC REBUND Total Cinema Revenue (Box office, F&B and Ancillary) In USD YTD September 2019-2023 YTD Sep 2019 YTD Sep 2020 YTD Sep 2021 YTD Sep 2022 YTD Sep 2023 Worldwide 84% Recovery Worldwide vs. 2019 Source: Company SEC 10Q Filings.

2023 RECRD BREAKING RELEASES* DEMNSTRATE STRENGTH F THEATRICAL EXPERIENCE APR 2023 JUL 2023 CT 2023 At $1.36 billion, second highest grossing animated film f all time, behind Disney’s Frozen 2 Highest grossing film released by Illumination Biggest worldwide opening for an animated film At $1.4 billion, 2023’s highest grossing global movies and 14thhighest grossing movie f all time Highest earning movie in Warner Bros history Highest grossing opening for a non-franchise movie ever 13th movie in history t cross the $600 million mark domestically At $247 million global box office, ne f the most successful independent films f all time. Distributor: Angel Studios opened October 13, 2023, and has become the highest grossing concert film of all time and the second highest opening ever in October in North America $175 million in Domestic Grosses & $249 million worldwide. Super Mari Bros Movie Barbie Sund f Freedom Taylr Swift: The Eras Tur JUL 2023 JUL 2023 Oppenheimer At $950 million, second-highest grossing R rated film f all time, behind Joker(2019) Third-highest grossing film f 2023 worldwide and the highest-grossing World War II-related film f all time Its simultaneous release n Jul. 21 with Barbie led Bernheimer, which was the cultural phenomenon that urged audiences t see both films as audible feature DEMNSTRATE STRENGTH F THEATRICAL EXPERIENCE 2023 RECRD BREAKING RELEASES* JUN 2023 Spider-Man: Across the Spider-Verse $690 million gross The highest earning animated film based on a comic bk Spider-Man: Across the Spider-Verse tops box office f $120.5 million, 3rd biggest opening f 2023 domestically CT 2023 Five Nights at Freddy’s *All Bx office data through November 30, 2023 Despite having a joint release on a streaming platform, it achieved the highest Halloween opening weekend, breaking a record that held for the last 12 years Highest grossing movies of all time for Blumhouse Productions Best-Debut ever for PG-13 horror film in over 20 years 3rd Biggest Day at the Domestic Box office for a game-adapted movie

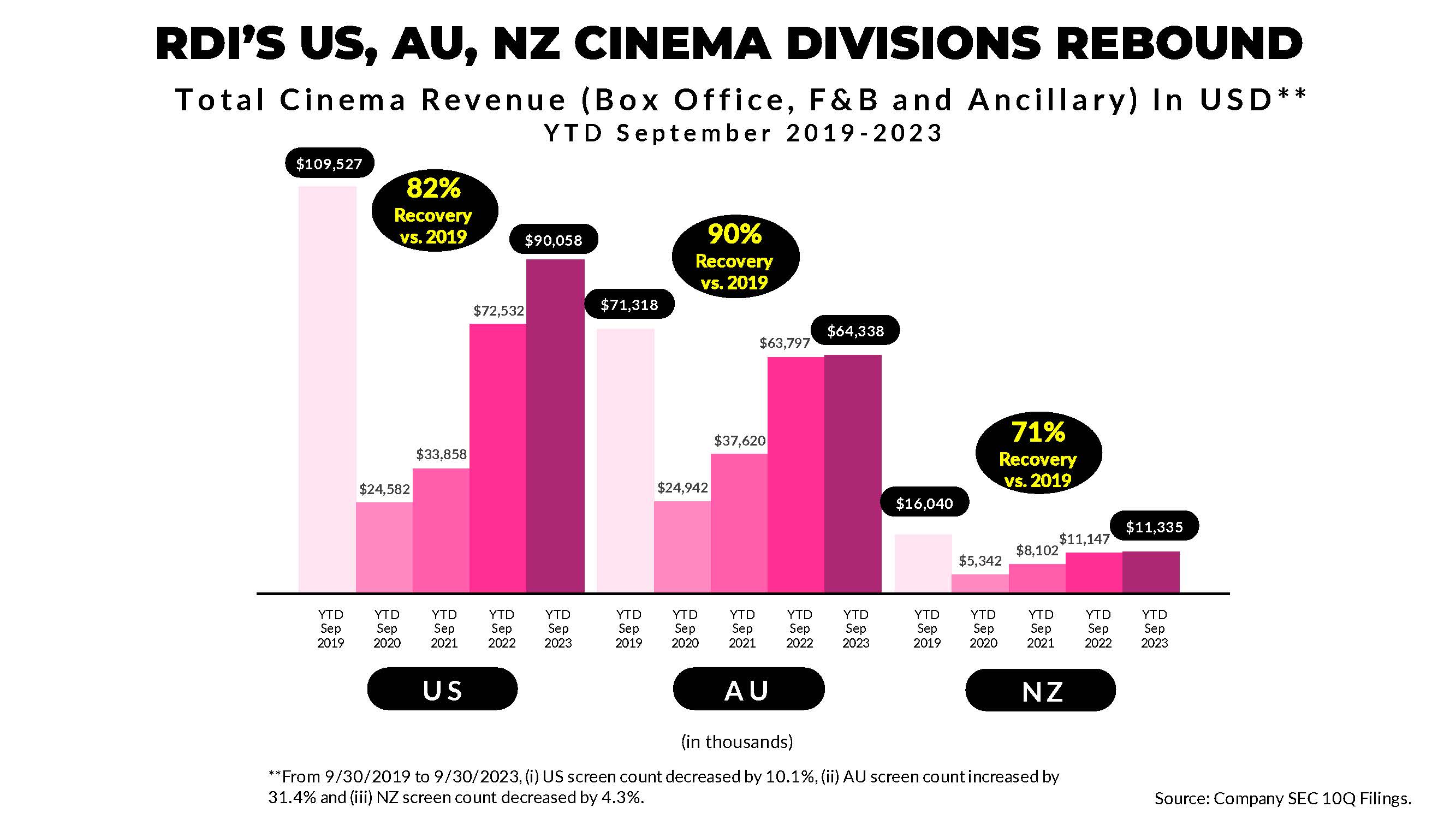

RDI’S US, AU, NZ CINEMA DIVISINS REBUND Total Cinema Revenue (Box office, F&B and Ancillary) In USD** YTD September 2019-2023 YTD Sep 2019 YTD Sep 2020 YTD Sep 2021 YTD Sep 2022 YTD Sep 2023 YTD Sep 2019 YTD Sep 2020 YTD Sep 2021 YTD Sep 2022 YTD Sep 2023 YTD Sep 2019 YTD Sep 2020 YTD Sep 2021 YTD Sep 2022 YTD Sep 2023 US AU NZ 90% Recovery vs. 2019 (in thousands) $24,582 $24,942 $5,342 $33,858 $37,620 $8,102 $72,532 $63,797 $11,147 $64,338 $16,040 $11,335 71% Recovery vs. 2019 **From 9/30/2019 t 9/30/2023, (i) US screen cunt decreased by 10.1%, (ii) AU screencast increased by 31.4% and (iii) NZ screencast decreased by 4.3%. Source: Company SEC 10Q Filings.

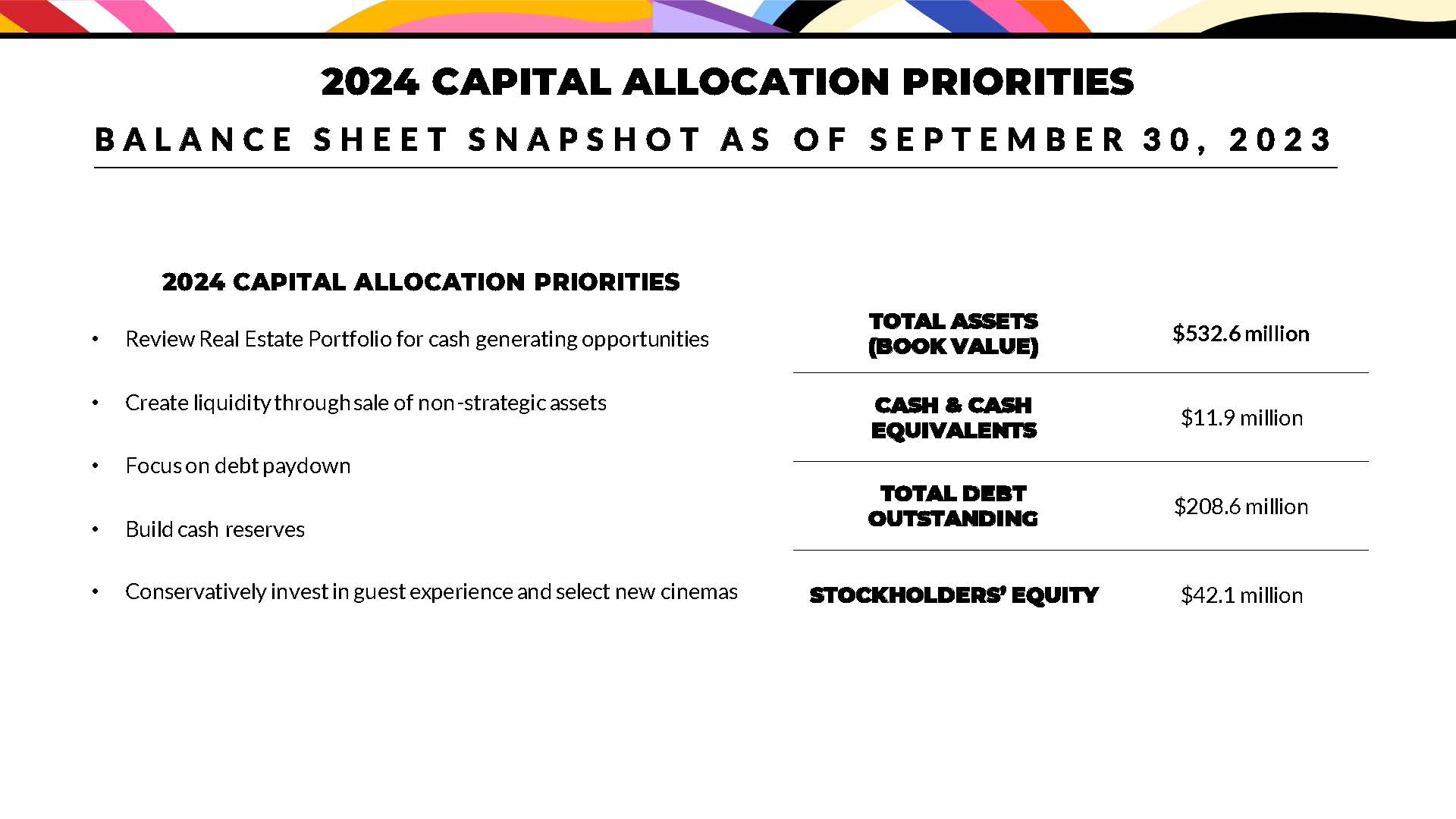

2024 CAPITAL ALLCATIN PRIRITIES BALANCE SHEET SNAPSHT AS F SEPTEMBER 30, 2023 2024 CAPITAL ALLCATIN PRIRITIES Review Real Estate Portfolio for cash generating opportunities Create liquidity through sale of non-strategic assets Focus on debt paydown Build cash reserves Conservatively invest in guest experience and select new cinemas (BK VALUE) $532.6 million CASH & CASH EQUIVALENTS $11.9 million TTAL DEBT UTSTANDING $208.6 million STCKHLDERS’ EQUITY $42.1 million

Strategically evaluate our profile to find assets to best liquidity and reduce interest expense. Continue to execute operational, marketing, leasing and capital investment strategies t engage with our communities and increase the value four real estate assets. Advance re-development plans for key assets in Wellington, NZ. Continuities leasing f 44 Union Square, our key New York City real development project.

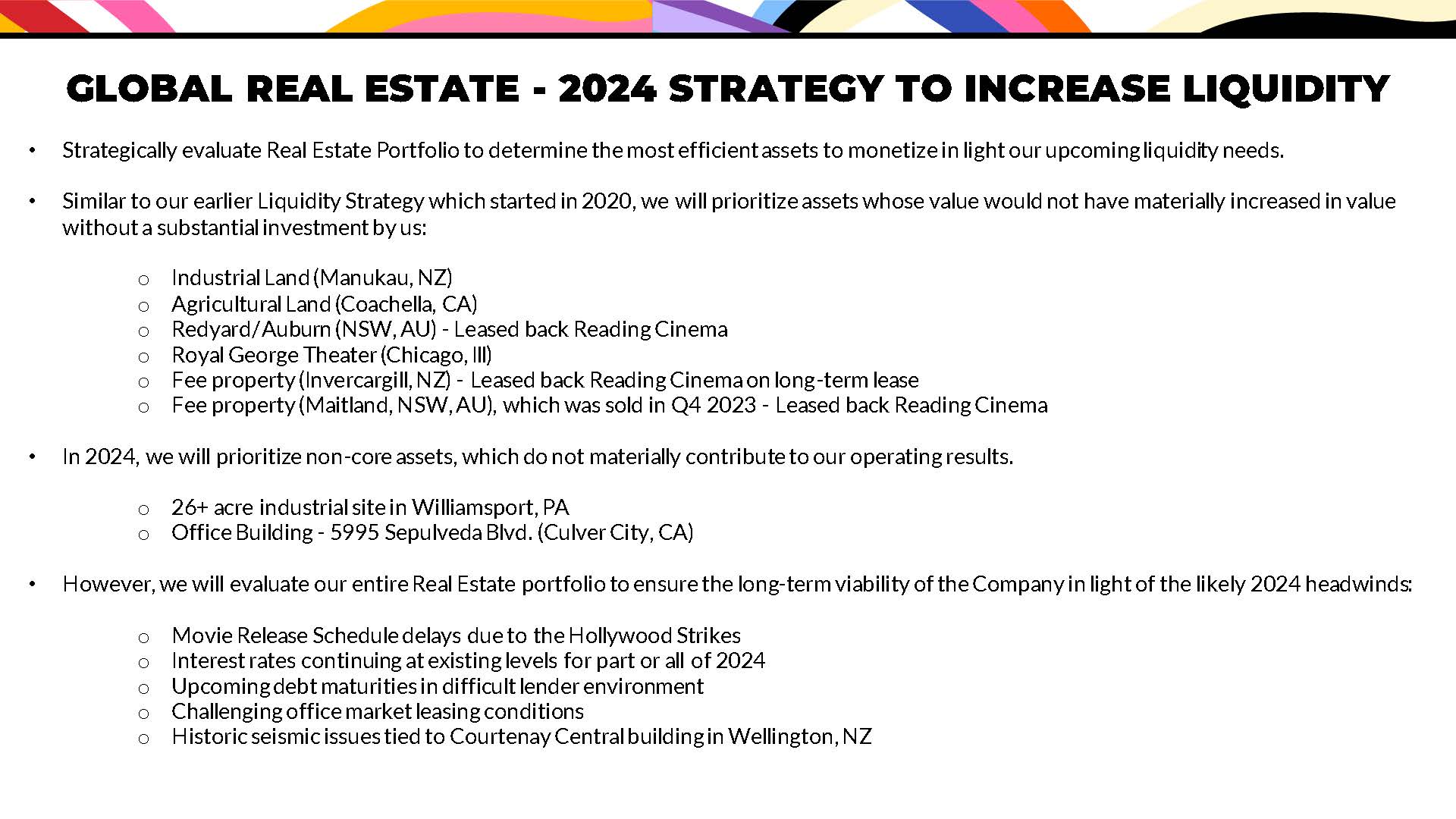

GLBAL REAL ESTATE - 2024 STRATEGY T INCREASE LIQUIDITY Strategically evaluate Real Estate Portfolio to determine the most efficient assets to monetize in light our upcoming liquidity needs. Similar to our earlier Liquidity Strategy which started in 2020, we will prioritize assets whose value would not have materially increased in value without substantial investment by us: Industrial Land (Manukau, NZ) Agricultural Land (Coachella, CA) Rudyard/Auburn (NSW, AU) - Leased back Reading Cinema Ryal George Theater (Chicago, Ill) Fee property (Invercargill, NZ) - Leased back Reading Cinema on long-term lease Fee property (Maitland, SW, AU), which was sold in Q4 2023 - Leased back Reading Cinema In 2024, we will prioritize non-core assets, which don’t materially contribute to our operating results. 26+acreindustrial site in Williamsport, PA office Building - 5995 Sepulveda Blvd. (Culver City, CA) However, we will evaluate our entire Real Estate portfolio to ensure the long-term viability f the Company in light f the likely 2024 headwinds: Movie Release Schedule delays due t the Hollywood Strikes Interest rates continuing existing levels for part r all f 2024 Upcoming debt maturities in difficult lender environment Challenging office market leasing conditions Historic seismic issues tied t Courtenay Central building in Wellington, NZ

AU/NZ REAL ESTATE PORTFOLI7 MULTI-TENANTED PROPERTIES 317,252 SF (29,474m2) 78 4 LAND PARCELS IMPROVED WITH READING CINEMAS 180,240 SF (16,744m2 ) THIRD-PARTY TENANTS 260,637 SF (24,214m2 ) 2 UNDEVELOPED LAND PARCELS 84,195 SF (7,822m2)

AU/NZ REAL ESTATE 2023 HIGHLIGHTS 97% IMPROVED FROM Q2 2023 (95%) & Q1 2023 (95%) THIRD-PARTY TENANT OCCUPANCY RATE

OTHER Q3 2023 AU REAL ESTATE PORTFOLIO HIGHLIGHTS ANNUAL NEWBARKET MARKETS Sold Maitland property (NSW) in October 2023 for A$2.8 million and leased back to Reading Cinema on a short-term basis. Book Value of property was A$1.1M. AU Property Level Cash Flow increased by 8.3% vs. Q2 2023 (in local currency), which continues to be supported by reliance on internal leasing, as opposed to paying brokerage fees with external brokers. $265K Percentage Rent Paid at November 30, 2023, with Third Party Tenant Sales increasing by 3.2% Q3 2023 vs. Q3 2022, despite inflationary headwinds. Vacancy rate reduced to 3% YTD Aged arrears reduced at end of Q3 2023 by 91% vs. Q3 2022 to de minimis amount THE NEWBARKET MARKETS ANNUAL NEWBARKET MARKETS

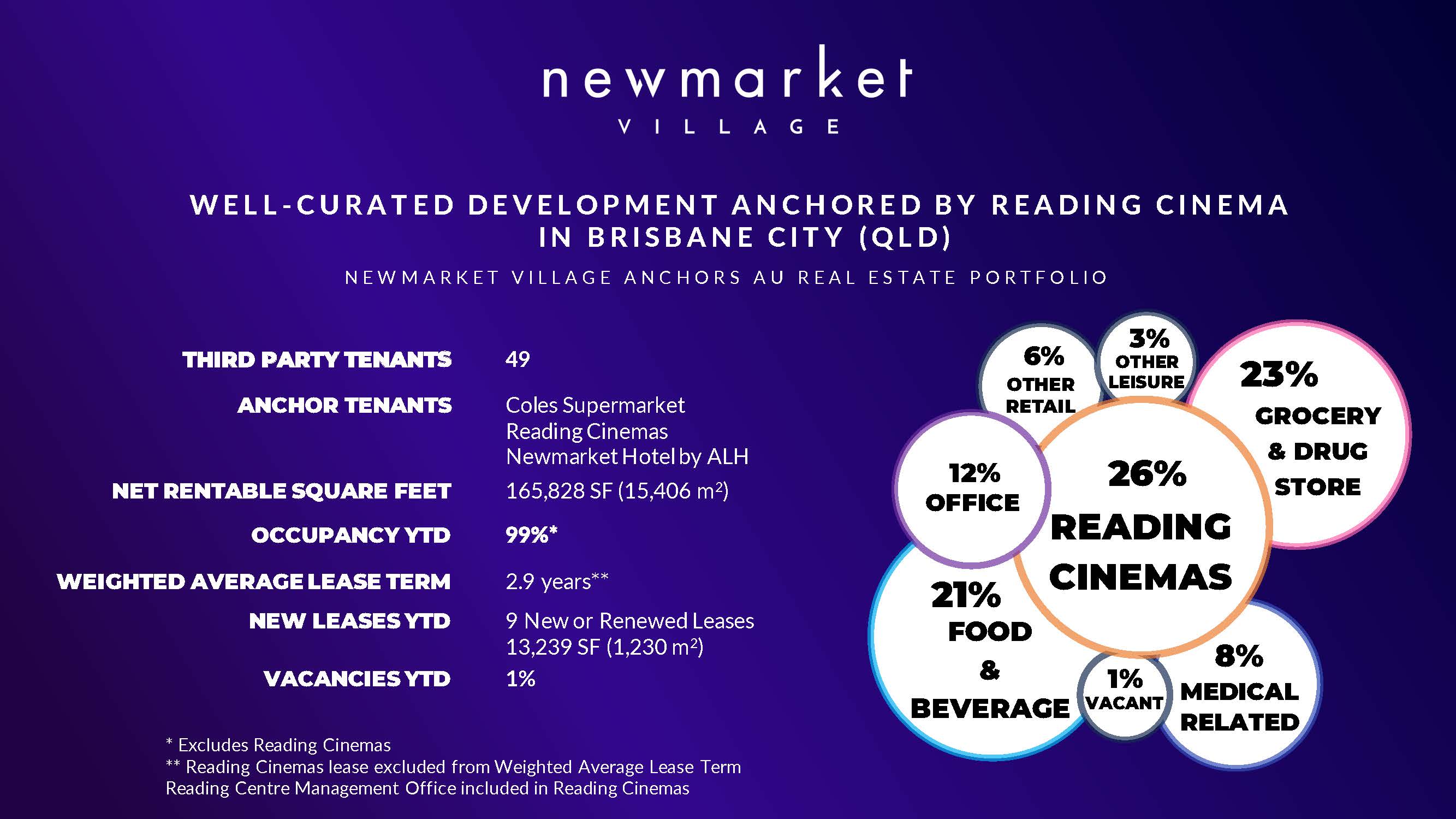

Newmarket VILLAGE WELL-CURATED DEVELOPMENT ANCHORED BY READING CINEMA IN BRISBANE CITY(QLD) NEWMARKET VILLAGE ANCHORS AU REAL ESTATE PORTFOLITHIRD PARTY TENANTS 49 ANCHOR TENANTS Coles Supermarket Reading Cinemas Newmarket Hotel by ALH NET RENTABLE SQUARE FEET 165,828 SF (15,406 m2) OCCUPANCY YTD 99%* WEIGHTED AVERAGE LEASE TERM 2.9 years** NEW LEASES YTD 9 New or Renewed Leases 13,239 SF (1,230 m2) VACANCIES YTD 1% READING CINEMAS GROCERY & DRUG STORE FOOD & BEVERAGE OFFICE MEDICAL RELATED 26% 23% 21% 12% OTHER RETAIL 8% 6% 3% OTHER LEISURE 1% VACANT * Excludes Reading Cinemas ** Reading Cinemas lease excluded from Weighted Average Lease Term Reading Centre Management Office included in Reading Cinemas

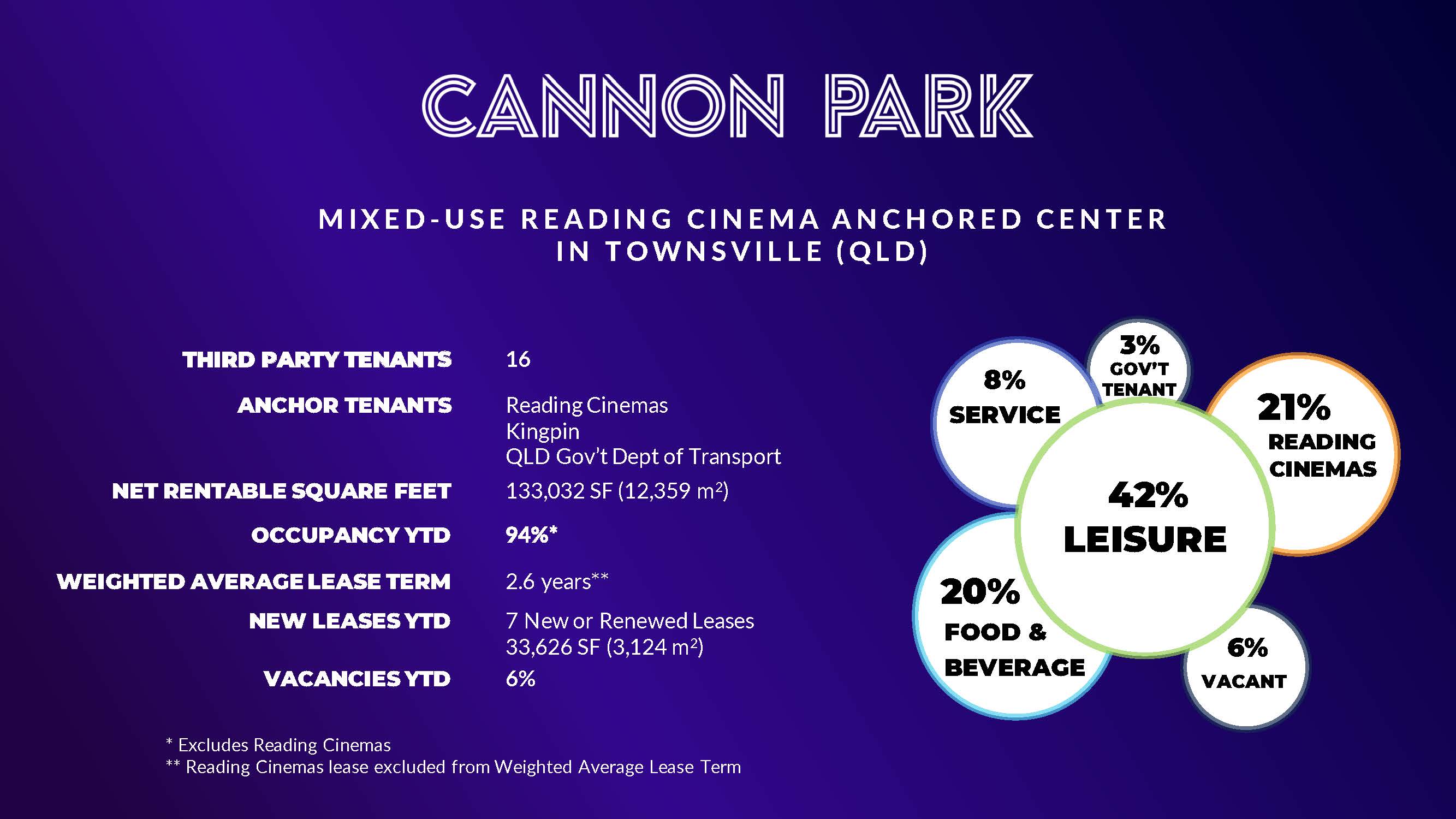

CANNON PARK GOV’T TENANT 3% VACANT 6% THIRD PARTY TENANTS 16 ANCHOR TENANTS Reading Cinemas Kingpin QLD Gov’t Dept of Transport NET RENTABLE SQUARE FEET 133,032 SF (12,359 m2) OCCUPANCY YTD 94%* WEIGHTED AVERAGE LEASE TERM 2.6 years** NEW LEASES YTD 7 New or Renewed Leases 33,626 SF (3,124 m2) VACANCIES YTD 6% LEISURE READING CINEMAS FOOD & BEVERAGE SERVICE 42% 21% 20% 8% ** Reading Cinemas lease excluded from Weighted Average Lease Term

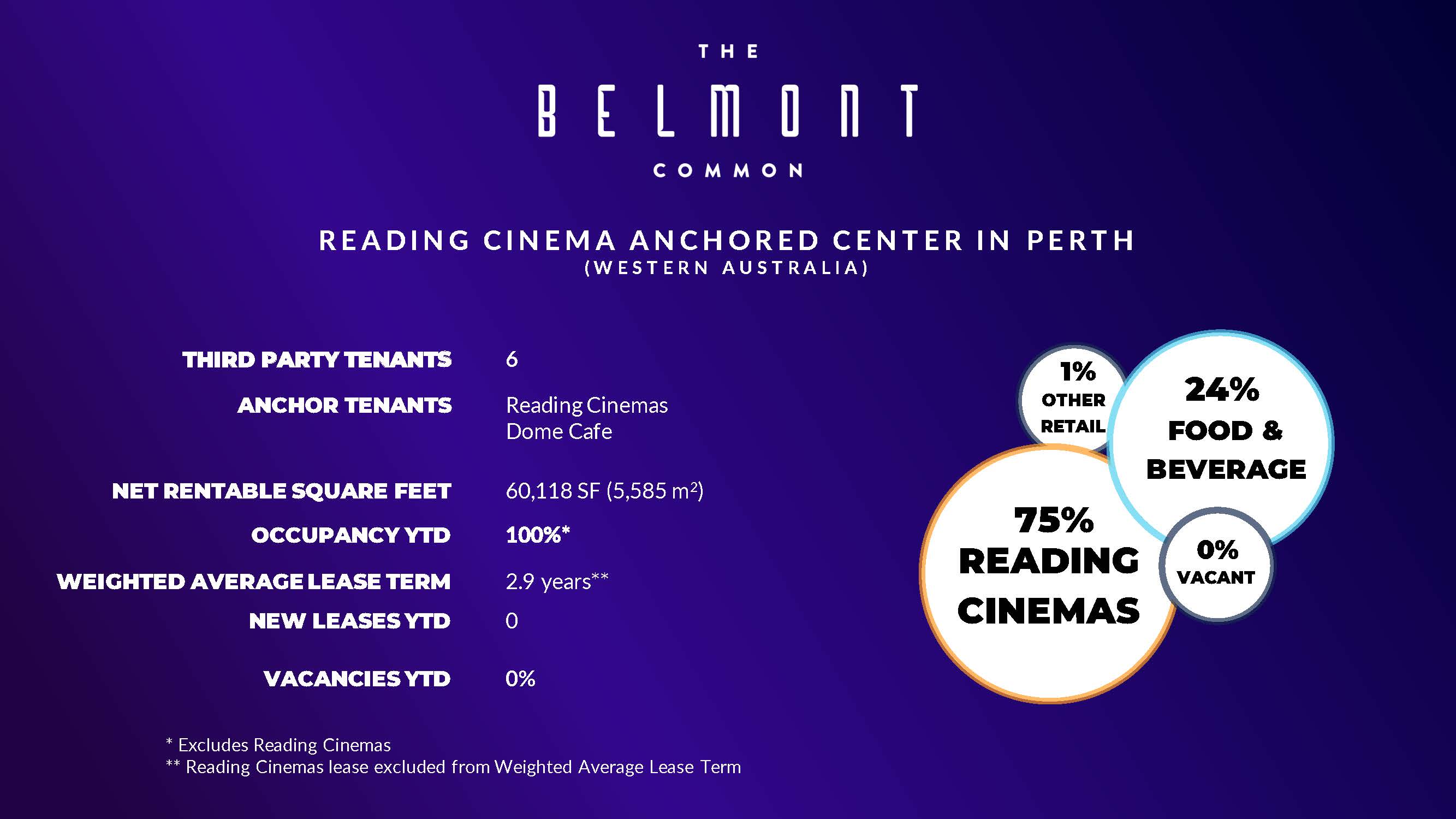

THE BELMONT COMMON READING CINEMA ANCHORED CENTER IN PERTH (WESTERN AUSTRALIA) THIRD PARTY TENANTS 6 ANCHOR TENANTS Reading Cinemas Dome Cafe NET RENTABLE SQUARE FEET 60,118 SF (5,585 m2) OCCUPANCY YTD 100%* WEIGHTED AVERAGE LEASE TERM 2.9 years** NEW LEASES YTD 0 VACANCIES YTD 0% READING CINEMAS 1% OTHER RETAIL 75% FOOD & BEVERAGE 24% READING CINEMA ANCHORED CENTER IN PERTH (WESTERN AUSTRALIA) * Excludes Reading Cinemas ** Reading Cinemas lease excluded from Weighted Average Lease Term VACANT 0%

YTD NOV 2023 AU REAL ESTATE PORTFOLI9 NEW LEASES (43,184 SF) / (4,012 m2 ) Signed with existing tenants with lease expiries NEW LEASES (7,190 SF) / (668 m2 ) Signed with new operators improving our well-curated tenancy mix 5 LEASE RENEWALS (2,432 SF) / (226 m2 ) Signed with existing tenants YTD NOV 2023 4 AU REAL ESTATE PORTFOLILASERQUEST Nando’s Moma Chicken A PLACE 2 MEAT QUALITY BUCHER FASTA FP PASTA FISHBOWL BURGER URGE

+3.2% AU PROPERTY PORTFOLIQ3 2023 Combined AU Third Party Tenant Sales Increase (vs.Q3 2022), despite inflationary headwinds

AU PORTFOLIO IMPROVING PERCENTAGE RENT Newmarket VILLAGE THE BELMONT COMMON CANNON PARK A$265K YTD 11/30/2023 Paid by Third Party Tenants

RETAIL GROUND LEASE REGIONAL MELBOURNE AREA Multi-year ground lease situated in Waurn Ponds, a residential suburb of Victoria. In addition to 8 screen Reading Cinema with TITAN LUXE, fully leased with two tenants and one telco tenant. SOUTH MELBOURNE, VIC Building is located on York Street in South Melbourne, the trendy suburb surrounding the famed South Melbourne Market and home to well-known cafes and restaurants. One floor currently serves as the headquarters of our Australian operations and the other floor is fully leased to medical/wellness user.

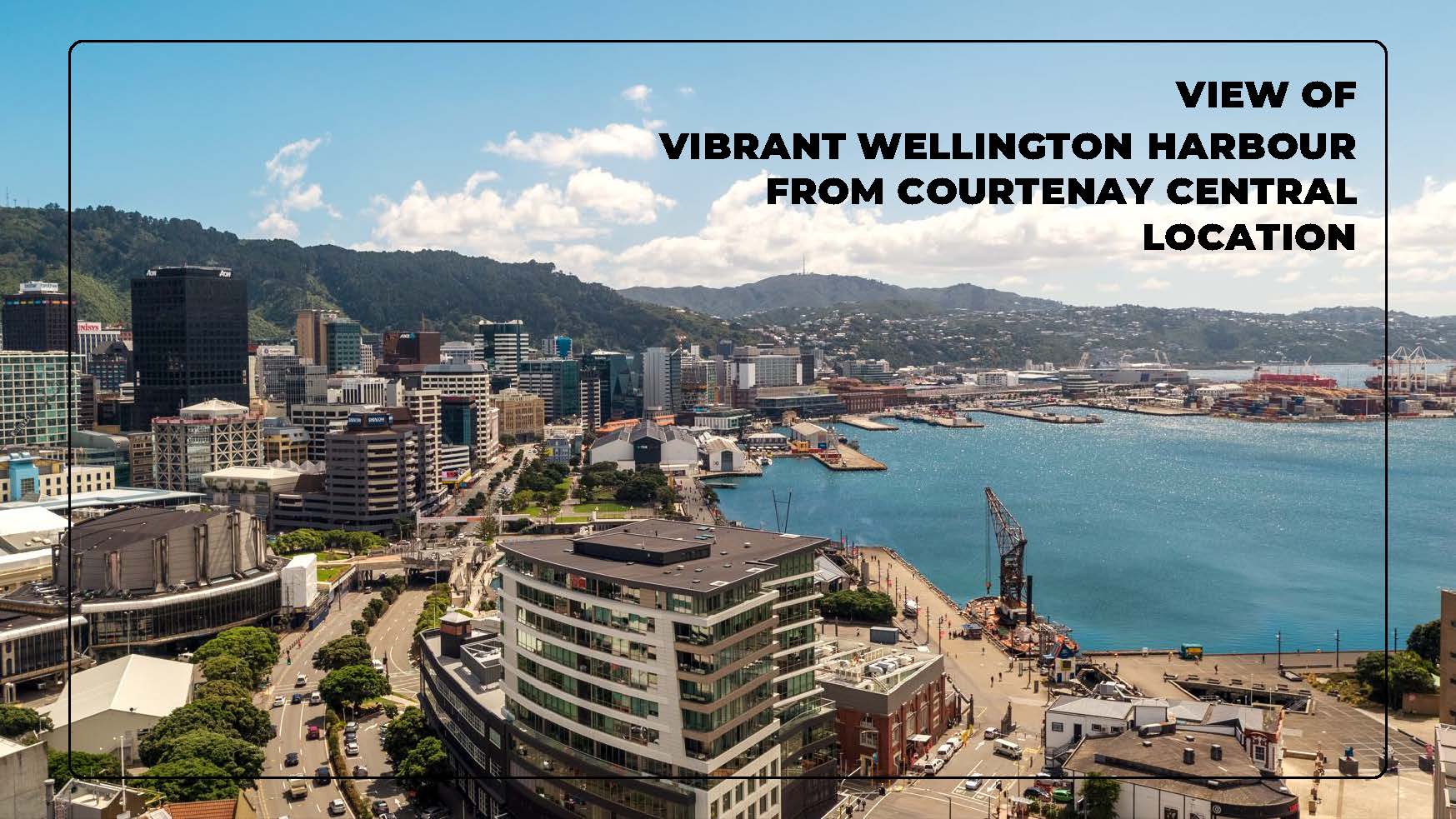

OUR ASSETS ARE LOCATED IN THE VIBRANT HEART OF WELLINGTON’S TE ARO DISTRICT “NEW ZEALAND’S MOST CREATIVE CITY” WELLINGTON

OUR KEY PROPERTY ASSETS WELLINGTON, NZ 161,071 SF OF LAND 85,000 SF improved with Courtenay Central building - Reading Cinemas, 53,755 SF retail space and 4,843 SF office To ensure community’s safety, we temporarily closed Courtenay Central in early 2019 for seismic reasons. One of a very few remaining undeveloped large-scale sites in the heart of Wellington City. These sites are currently utilized as two at-grade car parking sites, generating car parking income.

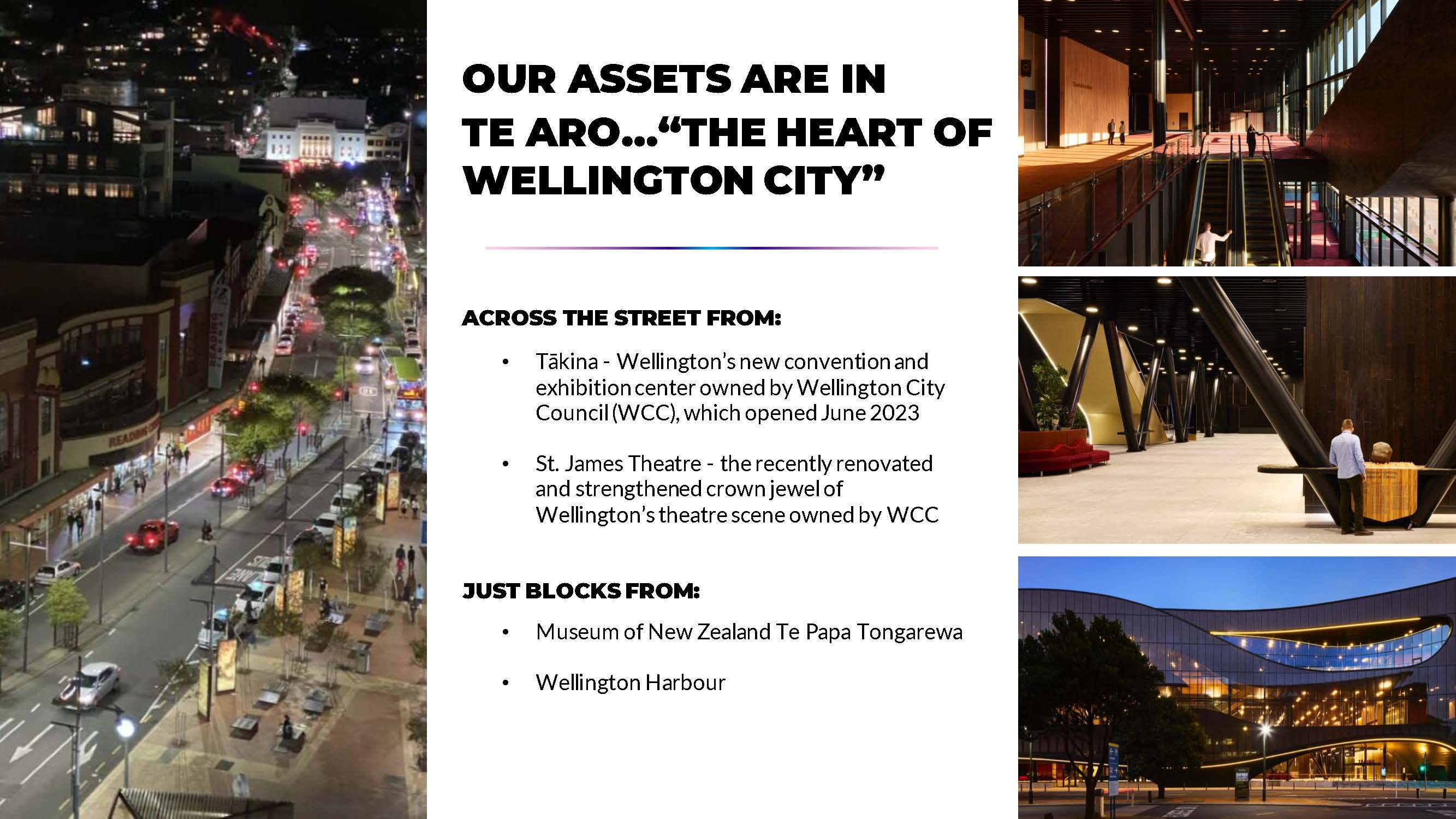

Tākina - Wellington’s new convention and exhibition center owned by Wellington City Council (WCC), which opened June 2023 St. James Theatre - the recently renovated and strengthened crown jewel of Wellington’s theatre scene owned by WCC Museum of New Zealand Te Papa Tongarewa Wellington Harbour ACROSS THE STREET FROM: JUST BLOCKS FROM:

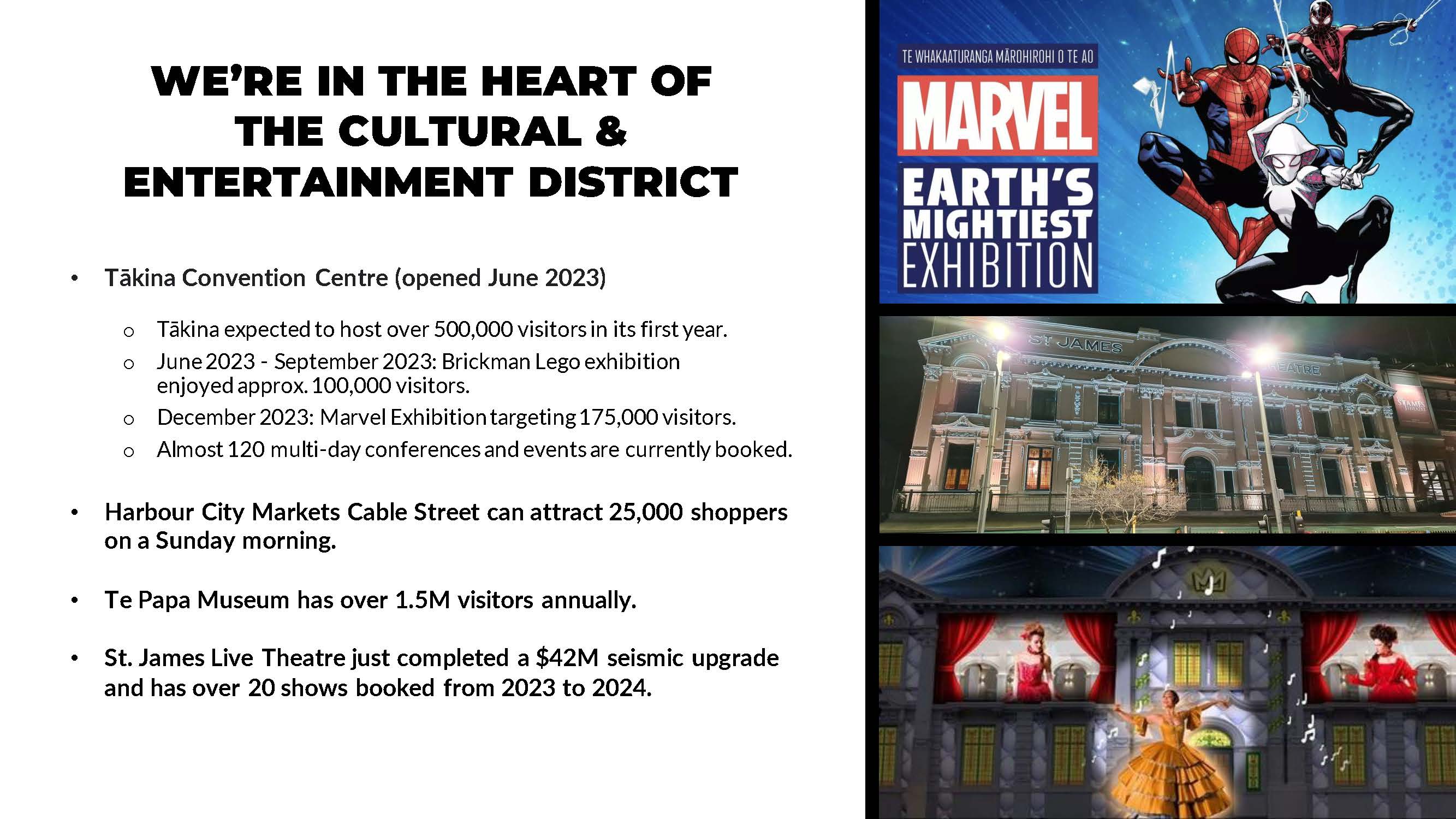

WE’RE IN THE HEART OF THE CULTURAL & ENTERTAINMENT DISTRICT Tākina Convention Centre (opened June2023) Tākina expected to host over 500,000 visitors in its first year. June 2023 - September 2023:Brickman Lego exhibition enjoyedapprox.100,000 visitors. December 2023:Marvel Exhibition targeting175,000 visitors. Almost 120multi-day conferences and events are currently booked. Harbour City Markets Cable Streetcar attract25,000 shoppers on a Sunday morning. The Papa Museum has over1.5M visitors annually. St. James Live Theater just completed a $42M seismic upgrade and has over 20 shows booked from 2023 to 2024.

VIEW OF VIBRANT WELLINGTON HARBOUR From COURTENAY CENTRAL LOCATION

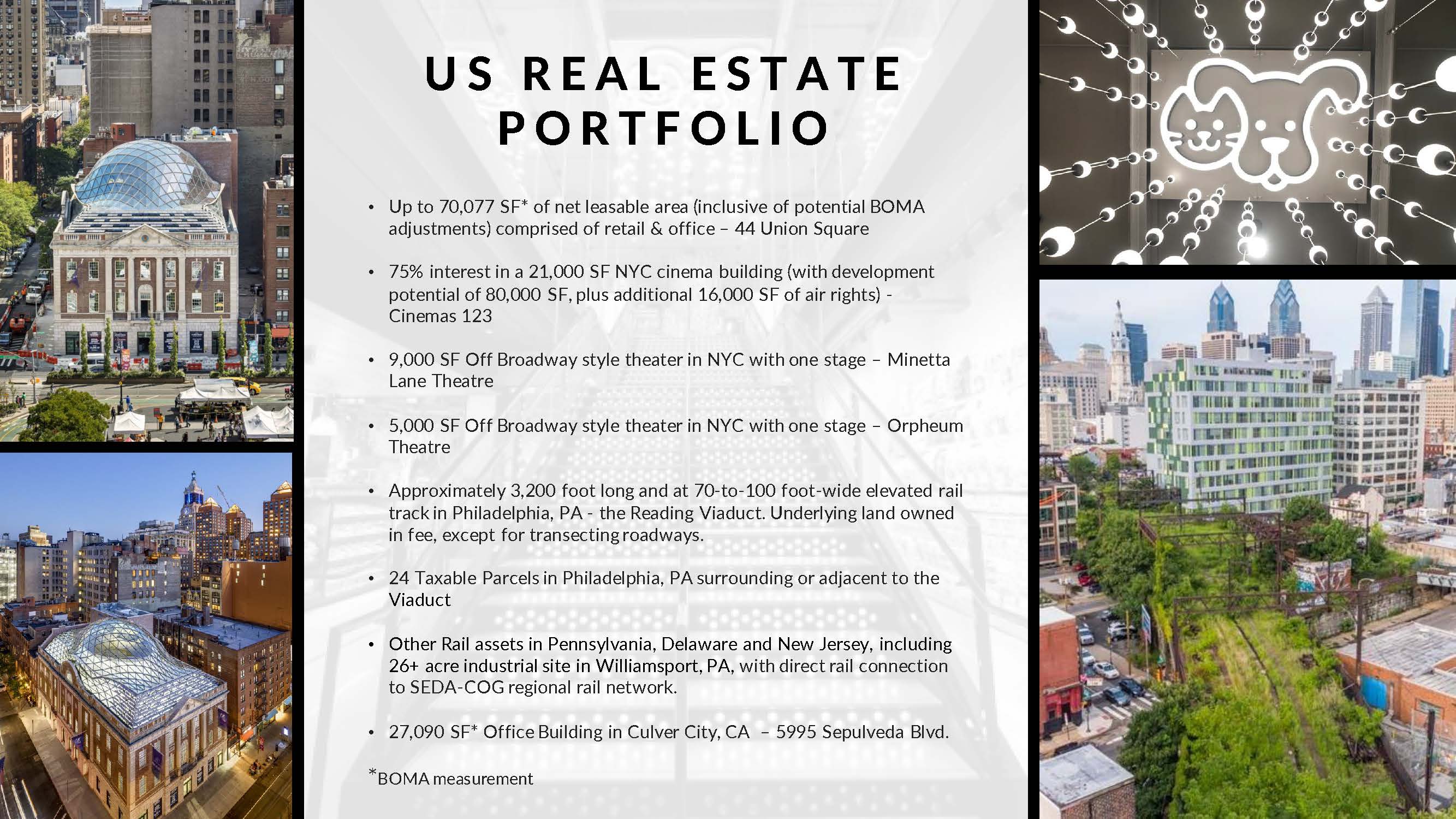

US REAL ESTATE PORTFOLIO Up to 70,077 SF* of net leasable area (inclusive of potential BOMA adjustments) comprised of retail & office – 44 Union Square 75% interest in a 21,000 SF NYC cinema building (with development potential of 80,000 SF, plus additional 16,000 SF of air rights) - Cinemas 123 9,000 SF Off Broadway style theater in NYC with one stage – Minetta Lane Theatre 5,000 SF Off Broadway style theater in NYC with one stage – Orpheum Theatre Approximately 3,200 foot long and at 70-to-100 foot-wide elevated rail track in Philadelphia, PA - the Reading Viaduct. Underlying land owned in fee, except for transecting roadways. 24 Taxable Parcels in Philadelphia, PA surrounding or adjacent to the Viaduct Other Rail assets in Pennsylvania, Delaware and New Jersey, including 26+ acre industrial site in Williamsport, PA, with direct rail connection to SEDA-COG regional rail network. 27,090 SF* Office Building in Culver City, CA – 5995 Sepulveda Blvd. *BOMA measurement

“We’re delighted to welcome pets and pet parents to this revolutionary flagship experience that embodies Petco’s fully integrated, omnichannel pet health and wellness ecosystem within a single pet care center,” -JUSTIN TICHY, PETCO’s COO 44 UNION SQUARE On June 1, 2023, Petco opened a new 25,000 SF flagship store. Petco “When Petco left its dreary, longtime store on the north side of Union Square for a new space across the street at the renovated Tammany Hall, the company decided to create a whimsical, New York City-themed location that would delight pets and their owners alike. We tried to make it an extension of Union Square Park…” COMMERCIAL OBSERVER, OCTOBER 17, 2023 Currently, reviewing LOIs from non-traditional users for remaining upper floors. Company is evaluating marketing and leasing options to re-position asset in light of challenging NYC office leasing environment.

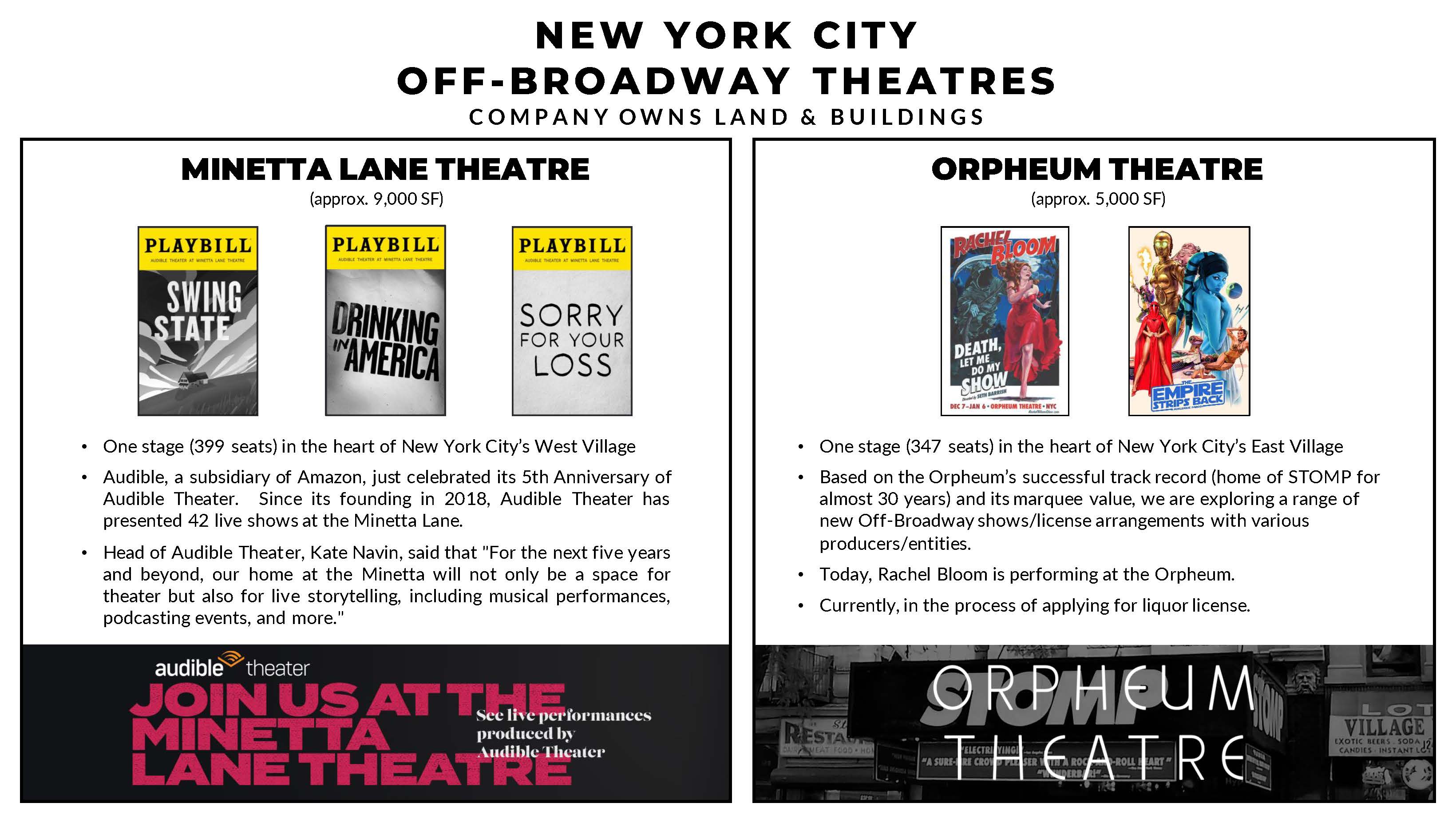

NEW YORK CITY OFF-BROADWAY THEATRES COMPANY OWNS LAND & BUILDINGS MINETTA LANE THEATRE (approx.. 9,000 SF) One stage (399 seats) in the heart of New York City’s West Village Audible, a subsidiary of Amazon, just celebrated its 5th Anniversary of Audible Theater. Since its founding in 2018, Audible Theater has presented 42 live shows at the Minetta Lane. Head of Audible Theater, Kate Navin, said that "For the next five years and beyond, our home at the Minetta will not only be a space for theater but also for live storytelling, including musical performances, podcasting events, and more." ORPHEUM THEATRE (approx. 5,000 SF) One stage (347 seats) in the heart of New York City’s East Village Based on the Orpheum’s successful track record (home of STOMP for almost 30 years) and its marquee value, we are exploring a range of new Off-Broadway shows/license arrangements with various producers/entities. Today, Rachel Bloom is performing at the Orpheum. Currently, in the process of applying for liquor license.

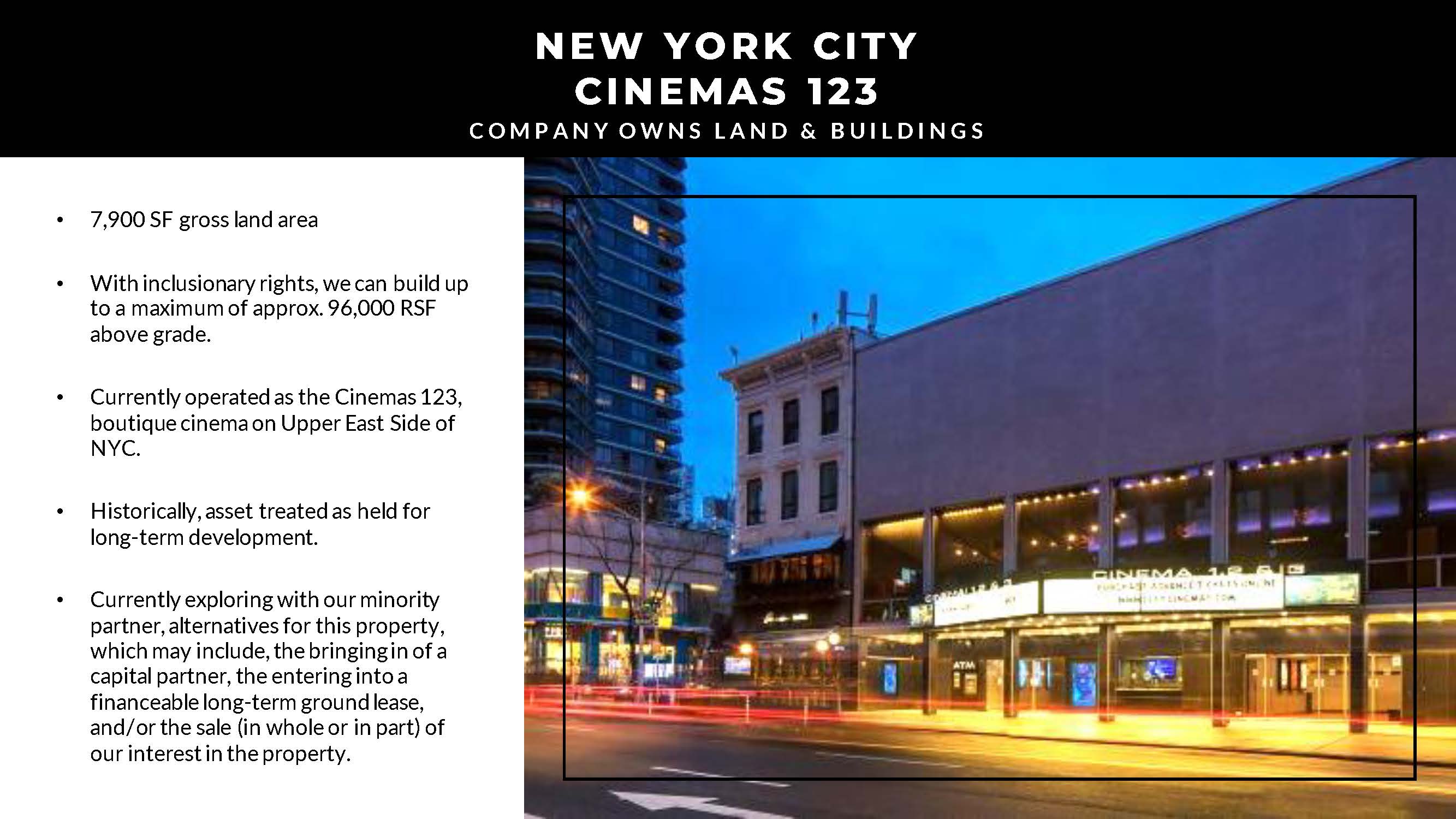

NEW YORK CITY CINEMAS 123 COMPANY OWNS Land & Buildings 7,900 SF gross land area With inclusionary rights, we can build up to a maximum of approx. 96,000 RSF above grade. Currently operated as the Cinemas 123, boutique cinema on Upper East Side of NYC. Historically, asset treated as held for long-term development. Currently exploring with our minority partner, alternatives for this property, which may include, the bringing in of a capital partner, the entering into a financeable long-term ground lease, and/or the sale (in whole or in part) of our interest in the property.

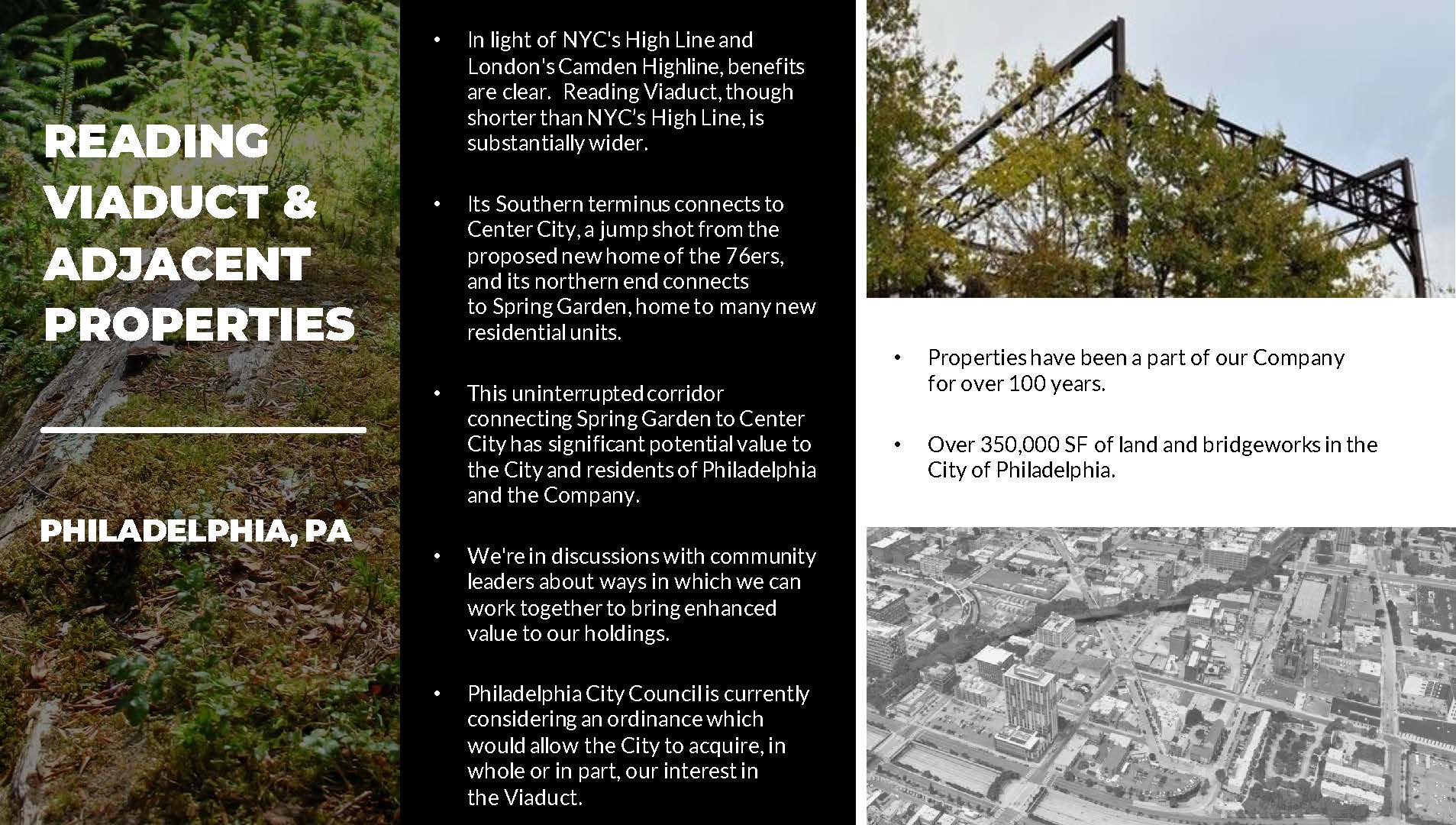

READING VIADUCT & ADJACENT PROPERTIES PHILADELPHIA, PA In light of NYC's High Line and London's Camden Highline, benefits are clear. Reading Viaduct, though shorter than NYC’s High Line, is substantially wider. Its Southern terminus connects to Center City, a jump shot from the proposed new home of the 76ers, and its northern end connects to Spring Garden, home to many new residential units. This uninterrupted corridor connecting Spring Garden to Center City has significant potential value to the City and residents of Philadelphia and the Company. We're in discussions with community leaders about ways in which we can work together to bring enhanced value to our holdings. Philadelphia City Council is currently considering an ordinance which would allow the City to acquire, in whole or in part, our interest in the Viaduct. Properties have been a part of our Company for over 100 years. Over 350,000 SF of land and bridgeworks in the City of Philadelphia.

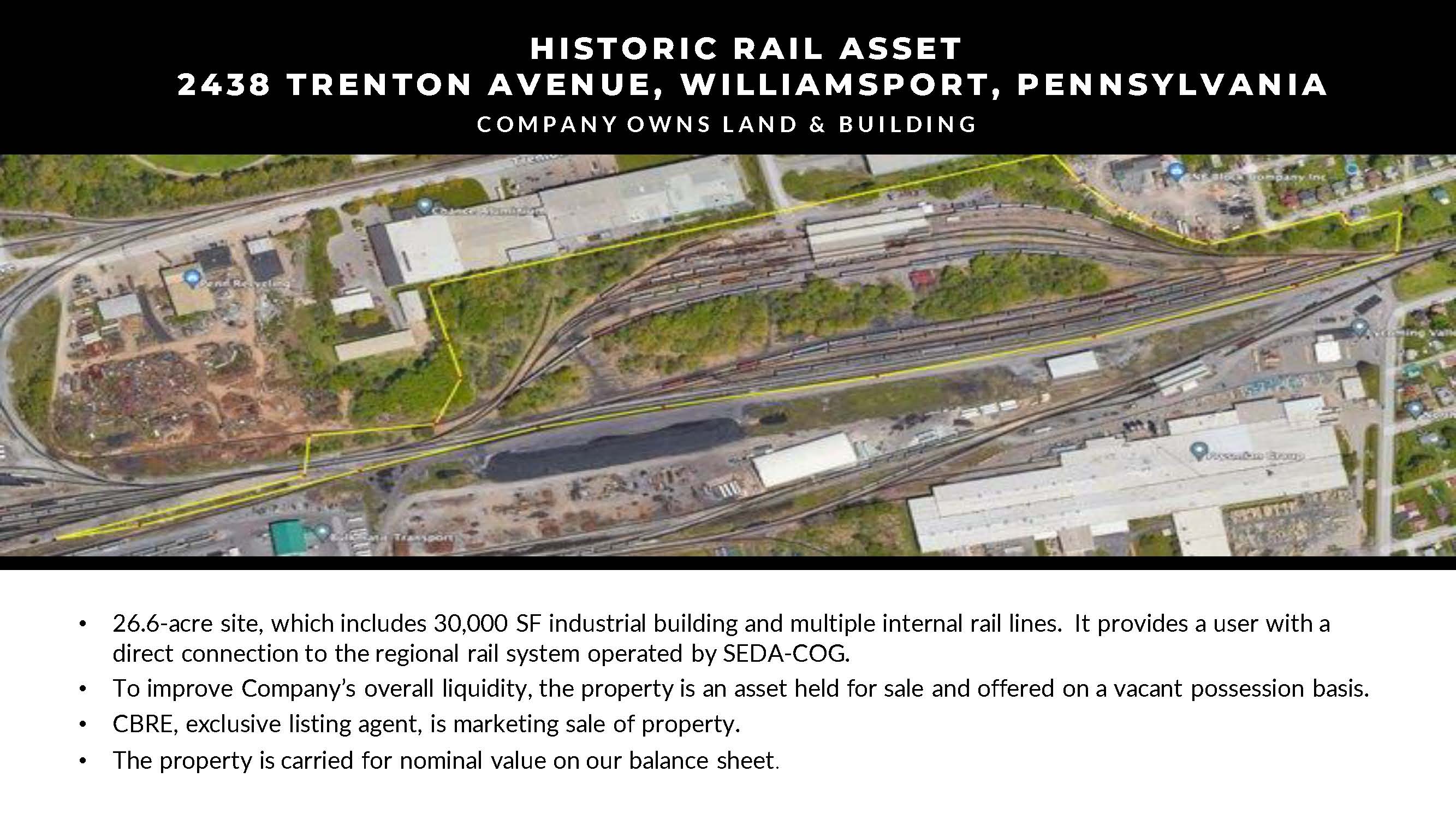

HISTORIC RAIL ASSET 2438 TRENTON AVENUE, WILLIAMSPORT, PENNSYLVANIA COMPANY OWNS LAND & BUILDING 26.6-acre site, which includes 30,000 SF industrial building and multiple internal rail lines. It provides a user with a direct connection to the regional rail system operated by SEDA-COG. To improve Company’s overall liquidity, the property is an asset held for sale and offered on a vacant possession basis. CBRE, exclusive listing agent, is marketing sale of property. The property is carried for nominal value on our balance sheet.

OFFICE BUILDING 5995 SEPULVEDA, CULVER CITY COMPANY OWNS LAND & BUILDING 27,090 RSF, three story office building ideally located in the heart of Culver City, one of the most dynamic creative nodes in West Los Angeles. To improve our Company’s overall liquidity, the property is an asset held for sale. On January 22-24, 2024, the property will be put up for auction online on Ten-X, the world’s largest online commercial real estate exchange. Newmark continues to be the listing agent.

GLOBAL CINEMA STRATEGY 2024 – 2025 Proactively improve our dollar spend per guest through focus on programming, marketing, operational and pricing strategies. Grow cinema business through a disciplined approach to renovations and new opportunities. READING CINEMAS ANGELIKA FILM CENTER & CAFÉ CONSOLIDATED THEATERS

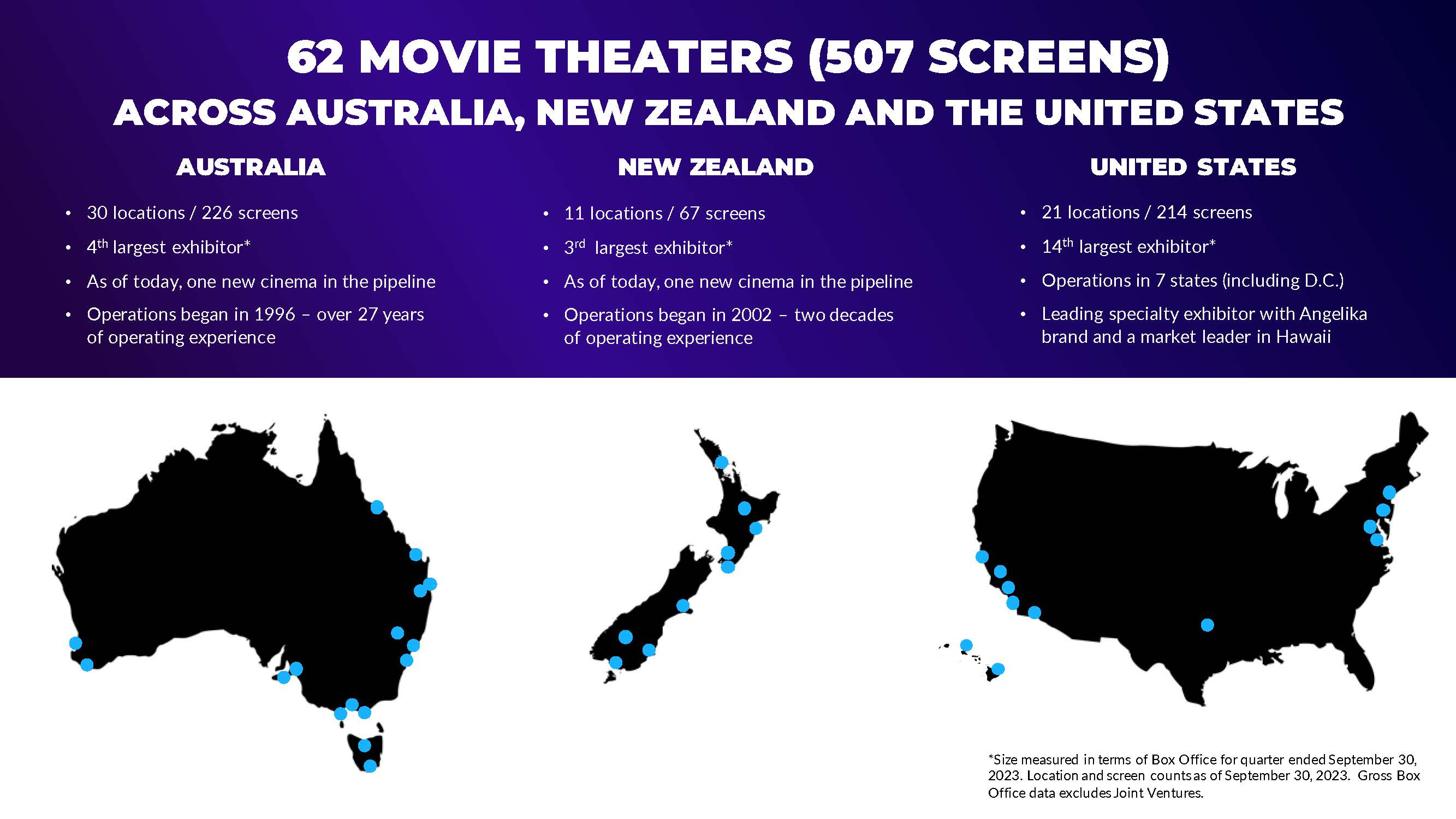

62 MOVIE THEATERS (507 screens) ACROSS AUSTRALIA, NEW ZEALAND AND THE UNITED STATES AUSTRALIA 30 locations / 226 screens 4th largest exhibitor* As of today, one new cinema in the pipeline Operations began in 1996 – over 27 years of operating experience NEW ZELAND 11 locations / 67 screens 3rd largest exhibitor* As of today, one new cinema in the pipeline Operations began in 2002 – two decades of operating experience UNITED STATES 21 locations / 214 screens 14th largest exhibitor* Operations in 7 states (including D.C.) Leading specialty exhibitor with Angelika brand and a market leader in Hawaii *Size measured in terms of Box Office for quarter ended September 30, 2023. Location and screen counts as of September 30, 2023. Gross Box Office data excludes Joint Ventures.

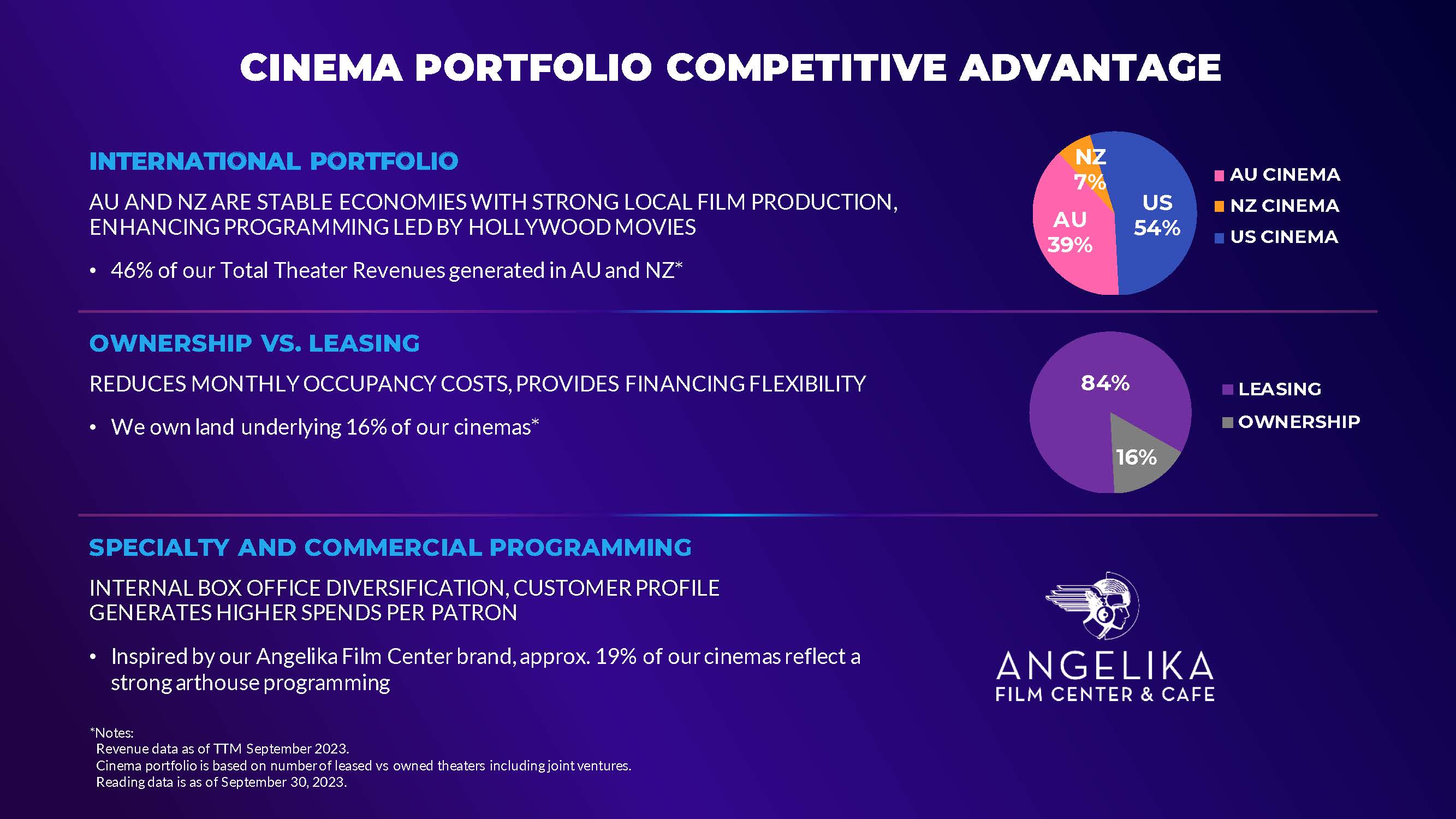

CINEMA PORTFOLIO COMPETITIVE ADVANTAGE INTERNATIONAL PORTFOLIO AU and NZ ARE stable economies with strong local FILM PRODUCTION, ENHANCING programming led BY HOLLYWOOD MOVIES 46% of our Total Theater Revenues generated in AU and NZ* OWNERSHIP VS. LEASING Reduces monthly occupancy costs, provides financing flexibility We own land underlying 16% of our cinemas* SPECIALTY AND COMMERCIAL PROGRAMMING Internal box office diversification, customer profile generates higher spends per patron Inspired by our Angelika Film Center brand, approx. 19% of our cinemas reflect a strong arthouse programming *Notes: Revenue data as of TTM September 2023. Cinema portfolio is based on number of leased vs owned theaters including joint ventures. Reading data is as of September 30, 2023.

2023 GLOBAL INDUSTRY BOX OFFICE IS BOUNCING BACK 2019 BOX OFFICE 2022 BOX OFFICE TTM NOV 2023 BOX OFFICE Global $42.5 Billion $26.0 Billion (down 39% vs. 2019) $30.7 Billion (down 28% vs. 2019) North America $11.4 Billion $7.5 Billion (down 34% vs. 2019) $8.7 Billion (down 19% vs. 2019) Australia AU$1.2 Billion AU $946.9 Million (down 23% vs. 2019) AU$978.0 Million (down 19% vs. 2019) New Zealand NZ$206.2 Million NZ$155.0 Million (down 25% vs. 2019) NZ$174.0 Million (down 14% vs. 2019)

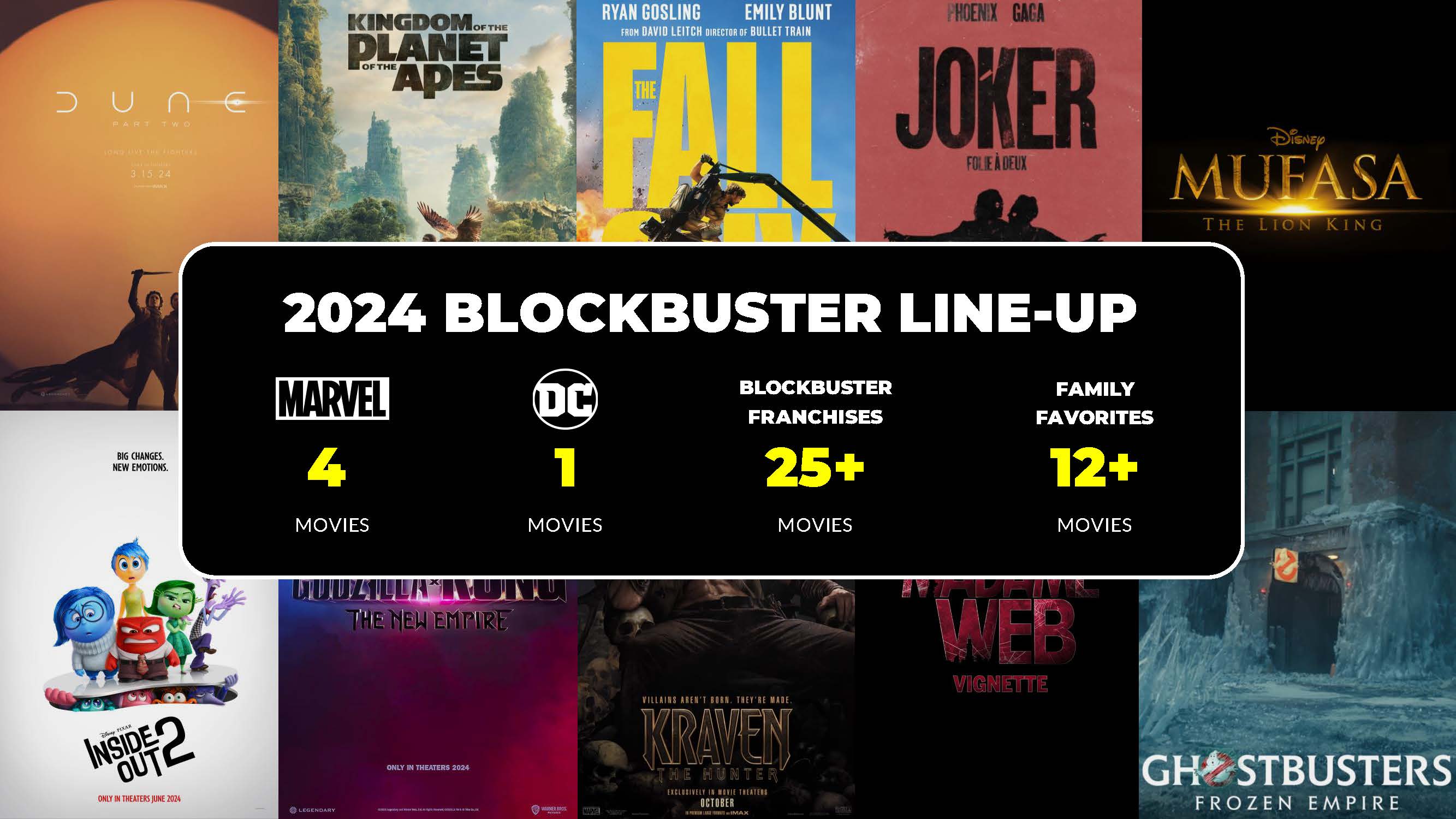

2024 BLOCKBUSTER LINE-UP MARVEL 4 MOVIES DC 1 MOVIES BLOCKBUSTER FRANCHISES 25+ MOVIES FAMILY FAVORITES 12+ MOVIES

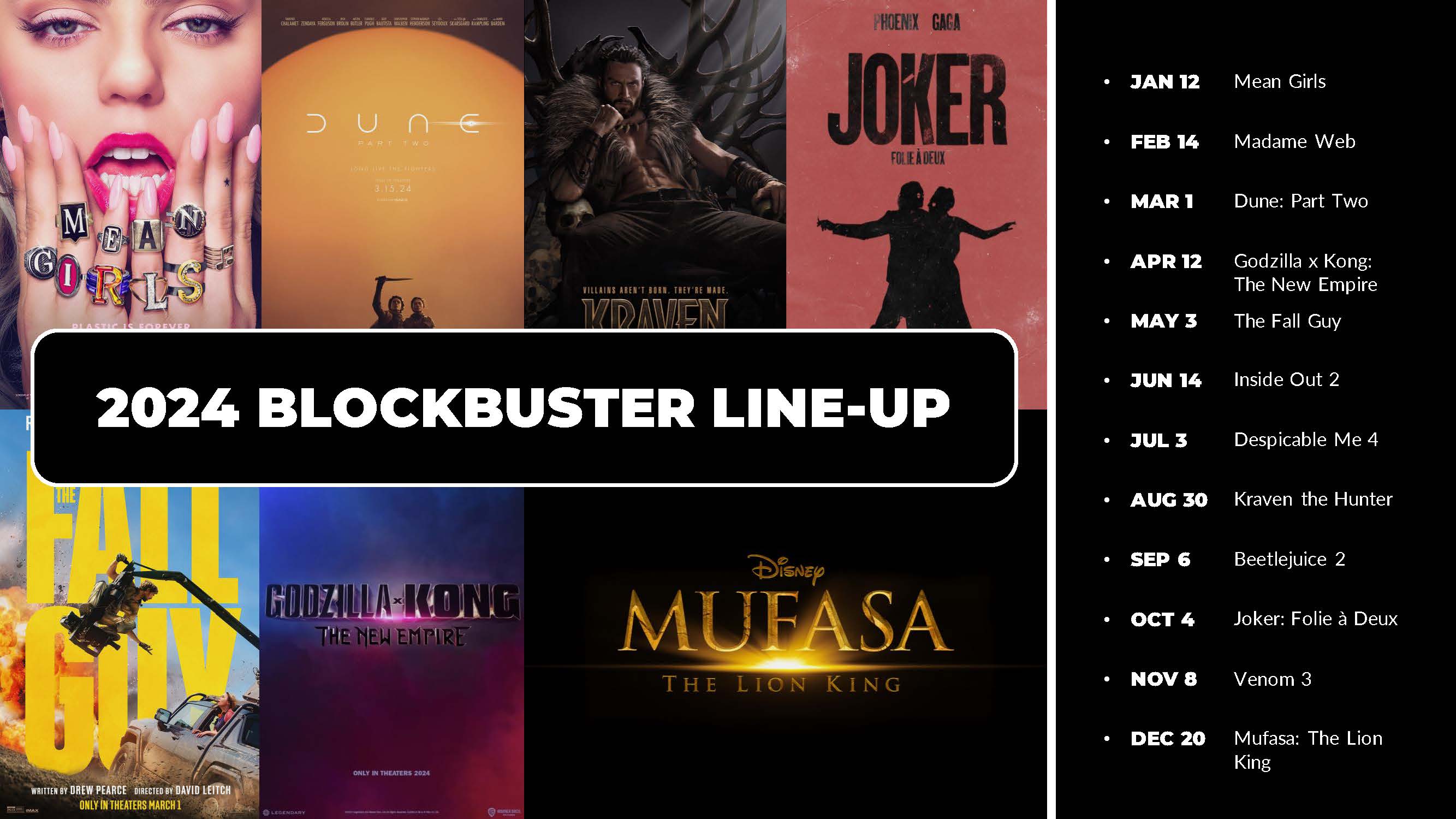

2024 BLOCKBUSTER LINE-UP JAN 12 Mean Girls FEB 14 Madame Web MAR 1 Dune: Part Two APR 12 Godzilla x Kong: The New Empire MAY 3 The Fall Guy JUN 14 Inside Out 2 JUL 3 Despicable Me 4 AUG 30 Kraven the Hunter SEP 6 Beetlejuice 2 OCT 4 Joker: Folie a Deux NOV 8 Venom 3 DEC 20 Mufasa: The Lion King

ANGELIKA IN NYC – 2023 SPECIALTY FILMS THAT DELIVERED PAST LIVES At over $605,000, Angelika’s Box Office engagement ranked highest in North America and over 6% of North American reported Box Office ASTEROID CITY At almost $475,000, Angelika’s Box Office engagement ranked highest in North America BOTTOMS ASTEROID CITY Box Office engagement over $231,000 since release Over 1300 North American engagements and Angelika’s engagement ranked top three THEATER CAMP Box Office engagement over $205,000 since release Highest grossing engagement in North America

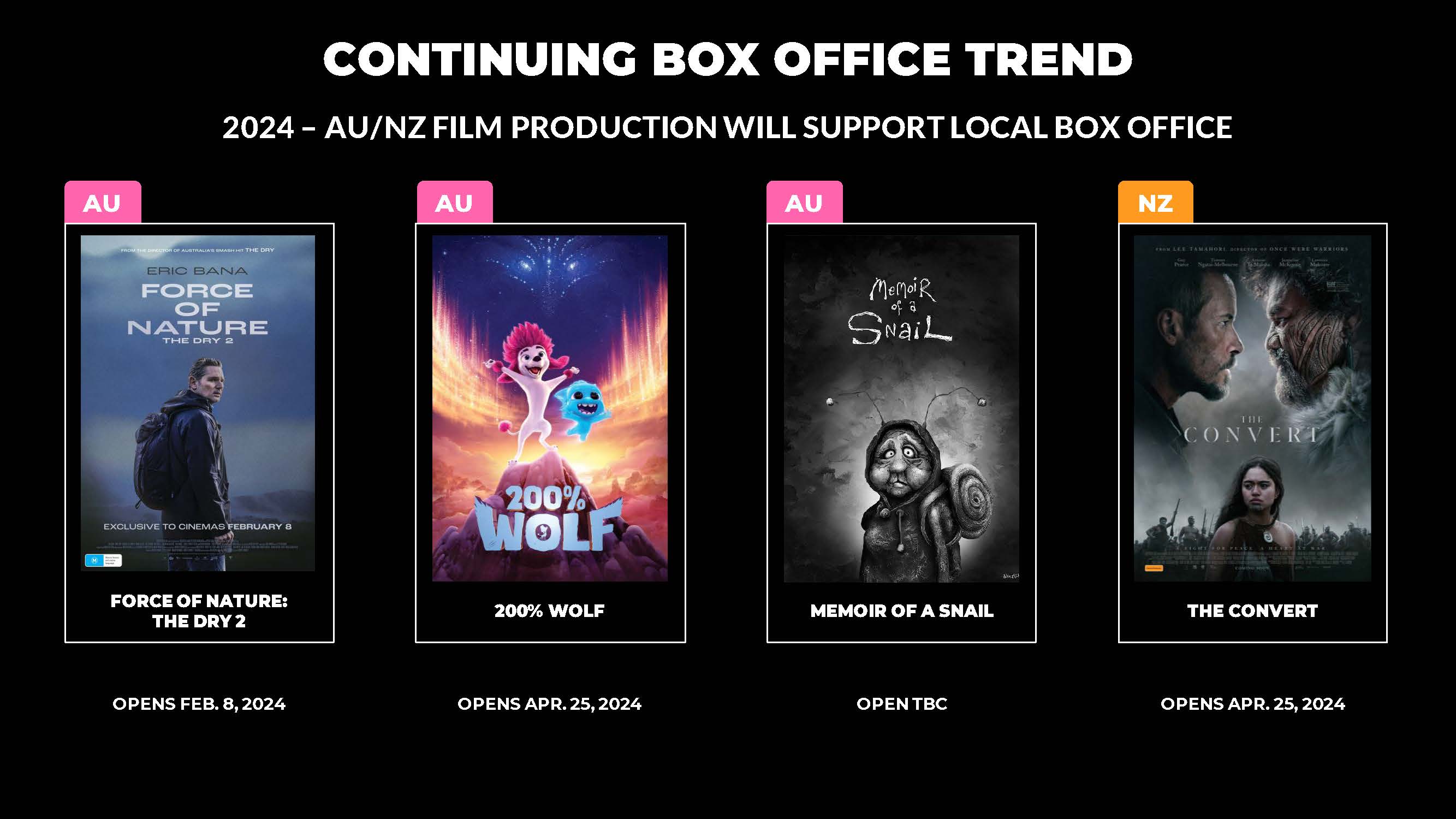

CONTINUING BOX OFFICE TREND 2024 – AU/NZ FILM PRODUCTION WILL SUPPORT LOCAL BOX OFFICE FORCE OF NATURE THE DRY 2 OPENS FEB. 8, 2024 200% WOLF OPENS APR. 25, 2024 MEMOIR OF A SNAIL OPEN TBC THE CONVERT OPENS APR. 25, 2024

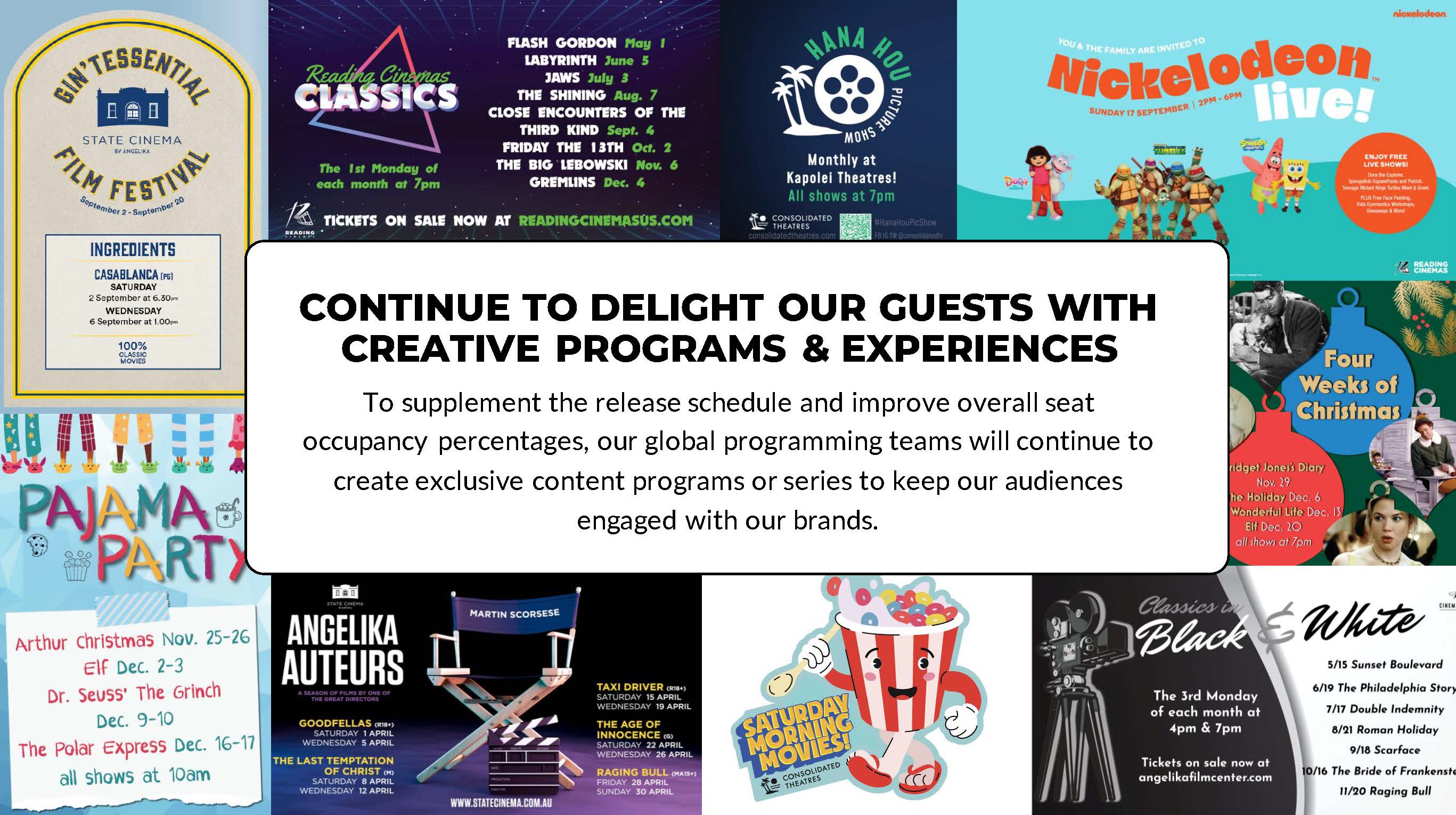

CONTINUE TO DELIGHT OUR GUESTS WITH CREATIVE PROGRAMS & EXPERIENCES To supplement the release schedule and improve overall seat occupancy percentages, our global programming teams will continue to create exclusive content programs or series to keep our audiences engaged with our brands.

FOCUS ON ELEVATING THE GUEST EXPERIENCE SIGNIFICANT INVESTMENT MADE IN THE LAST DECADE IN NEW AND EXISTING CINEMA ASSETS LUXURY RECLINER SEATING 51% of US screens feature Luxury Recliner Seating 30% of AU/NZ screens feature Luxury Recliner Seating PREMIUM LARGE FORMAT (PLF) SCREENS 38% of US theaters feature at least one PLF auditorium (IMAX, TITAN LUXE or TITAN XC) 49% of AU/NZ theaters feature a PLF Auditorium (TITAN XC or TITAN LUXE) ELEVATED FOOD & BEVERAGE 86% of US cinemas offer enhanced F&B menus (including liquor) 100% of US cinemas offer liquor (beer, wine and/or spirits) 56% of AU/NZ cinemas offer enhanced F&B menus 77% of our global cinemas serve liquor *Note: Above statistics are as of September 30, 2023

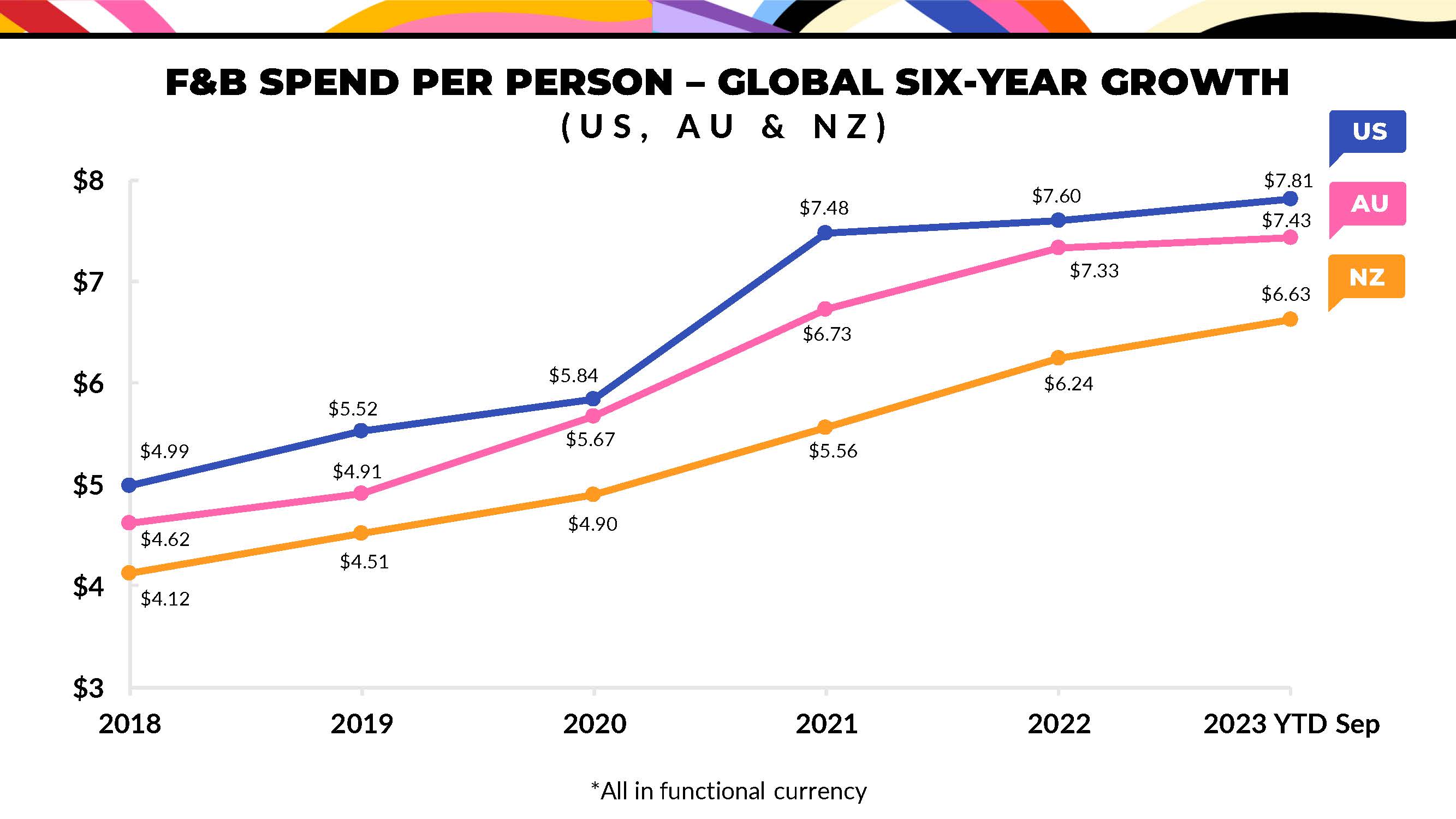

F&B SPEND PER PERSON – GLOBAL SIX-YEAR GROWTH (US, AU & NZ) $4.99 $5.52 $5.84 $7.48 $7.60 $7.81 $4.62 $4.91 $5.67 $6.73 $7.33 $7.43 $4.12 $4.51 $4.90 $5.56 $6.24 $6.63 $3 $4 $5 $6 $7 $8 2018 2019 2020 2021 2022 2023 YTD Sep AU NZ *All in functional currency

STRONG F&B METRICS SUPPORTED BY MOVIE-THEMED MENUS (US, AU & NZ)

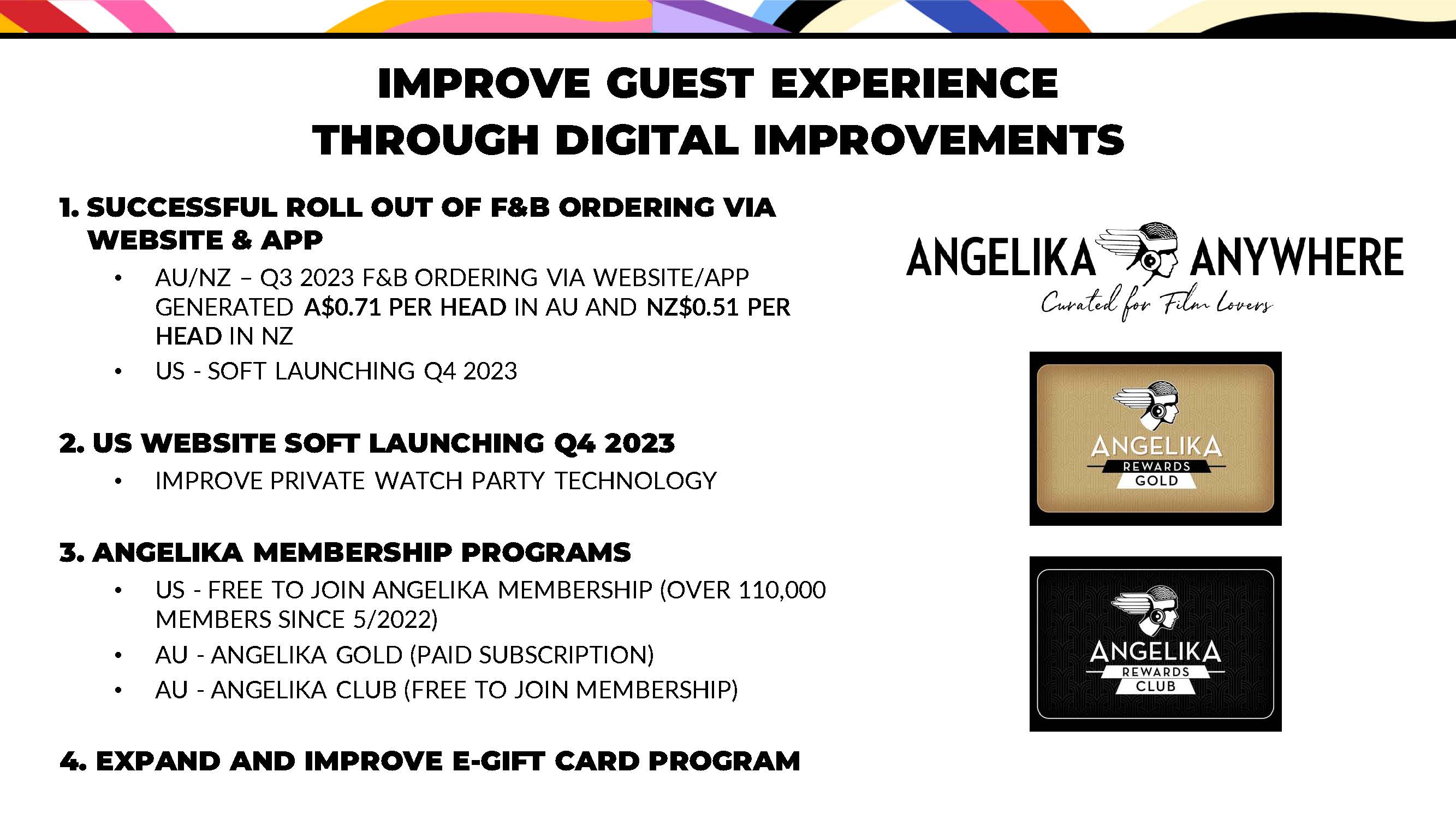

IMPROVE GUEST EXPERIENCE THROUGH DIGITAL IMPROVEMENTS 1. SUCCESSFUL ROLL OUT OF F&B ORDERING VIA WEBSITE & APP AU/NZ – Q3 2023 F&B ORDERING VIA WEBSITE/APP GENERATED A$0.71 PER HEAD IN AU AND NZ$0.51 PER HEAD IN NZ US - SOFT LAUNCHING Q4 2023 2. US WEBSITE SOFT LAUNCHING Q4 2023 IMPROVE PRIVATE WATCH PARTY TECHNOLOGY 3. ANGELIKA MEMBERSHIP PROGRAMS US - FREE TO JOIN ANGELIKA MEMBERSHIP (OVER 110,000 MEMBERS SINCE 5/2022) AU - ANGELIKA GOLD (PAID SUBSCRIPTION) AU - ANGELIKA CLUB (FREE TO JOIN MEMBERSHIP) 4. EXPAND AND IMPROVE E-GIFT CARD PROGRAM

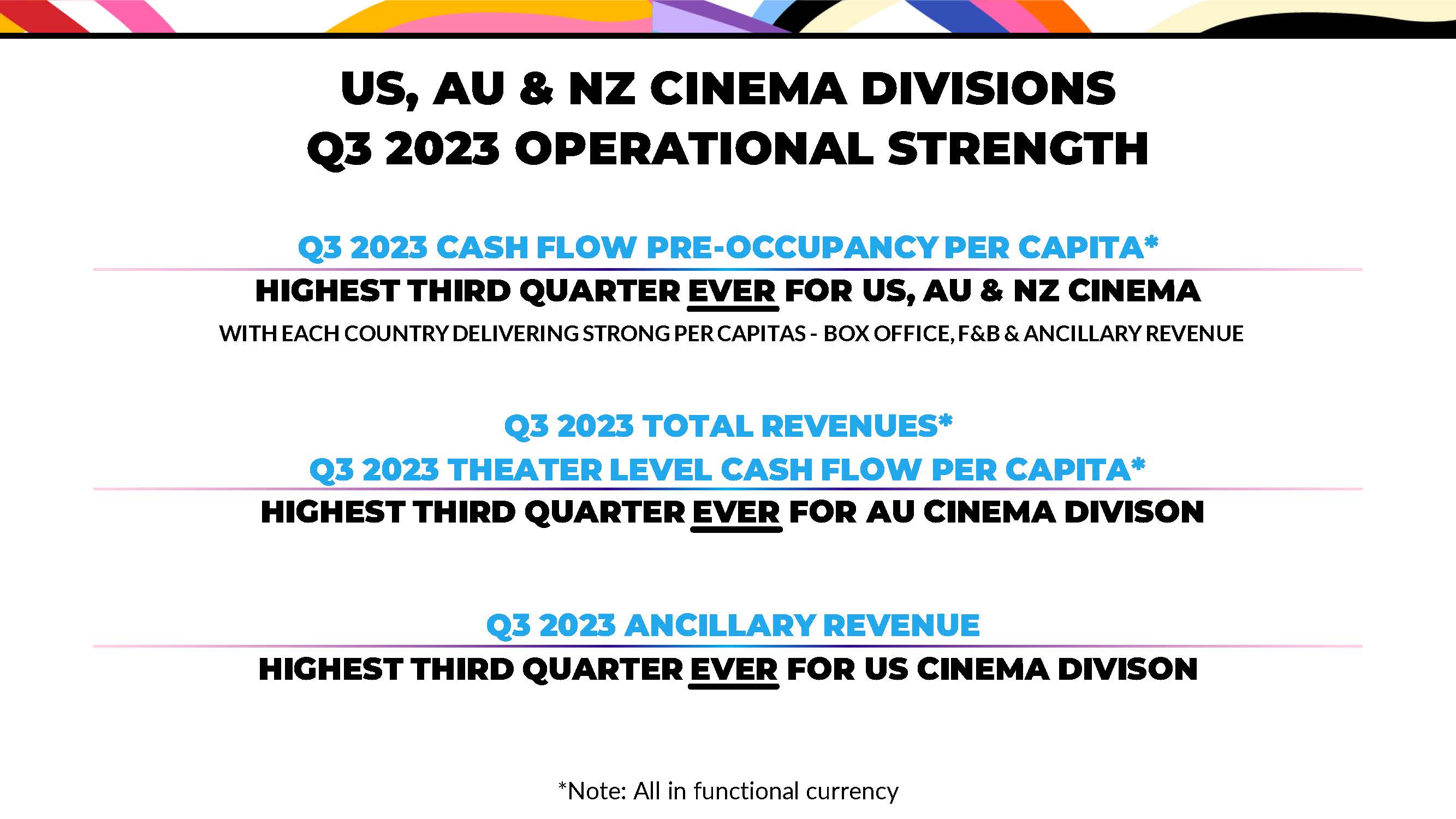

US, AU & NZ CINEMA DIVISIONS Q3 2023 OPERATIONAL STRENGTH Q3 2023 CASH FLOW PRE-OCCUPANCY PER CAPITA* HIGHEST THIRD QUARTER EVER FOR US, AU & NZ CINEMA WITH EACH COUNTRY DELIVERING STRONG PER CAPITAS - BOX OFFICE, F&B & ANCILLARY REVENUE Q3 2023 ANCILLARY REVENUE HIGHEST THIRD QUARTER EVER FOR US CINEMA DIVISON Q3 2023 TOTAL REVENUES* Q3 2023 THEATER LEVEL CASH FLOW PER CAPITA* HIGHEST THIRD QUARTER EVER FOR AU CINEMA DIVISON *Note: All in functional currency

FIRST INTERNATIONAL ANGELIKA OPENS IN BRISBANE (QLD) Angelika Film Centre opened in Brisbane (QLD) on August 24, 2023 in the sophisticated mixed-use development, South/City/SQ 8 screens featuring all luxury recliners 3 ultra luxury Soho Lounge cinemas with waiter service from curated F&B menu Elegant and chic lobby lounge Elevated F&B offer, with al fresco dining at the Highline Terrace balcony bar Curated specialty film programming in line with angelica mission ANGELIKA FILM CENTRE

EXPANSION OF AU/NZ CINEMA PORTFOLIO - 2023-2026 AUSTRALIA Three cinemas opened in AU in 2023 o Angelika Film Centre in Brisbane – October 2023 o Reading Cinemas with TITAN LUXE in Busselton – September 2023 o Reading Cinemas in Armadale – January 2023 One new Reading Cinemas planned in Noosa (QLD) (2026) NEW ZELAND One Reading Cinema scheduled to open in New Zealand (2026)

US CINEMA RENOVATION IN 2024 ANGELIKA FILM CENTER & CAFÉ IN DALLAS, TX Full Top-to-Bottom Renovation with recliner seating Elevated F&B menu Lobby redesign

READING INTERNATIONAL FINANCIAL REVIEW GILBERT AVANES EXECUTIVE VICE PRESIDENT CHIEF FINANCIAL OFFICER & TREASURER

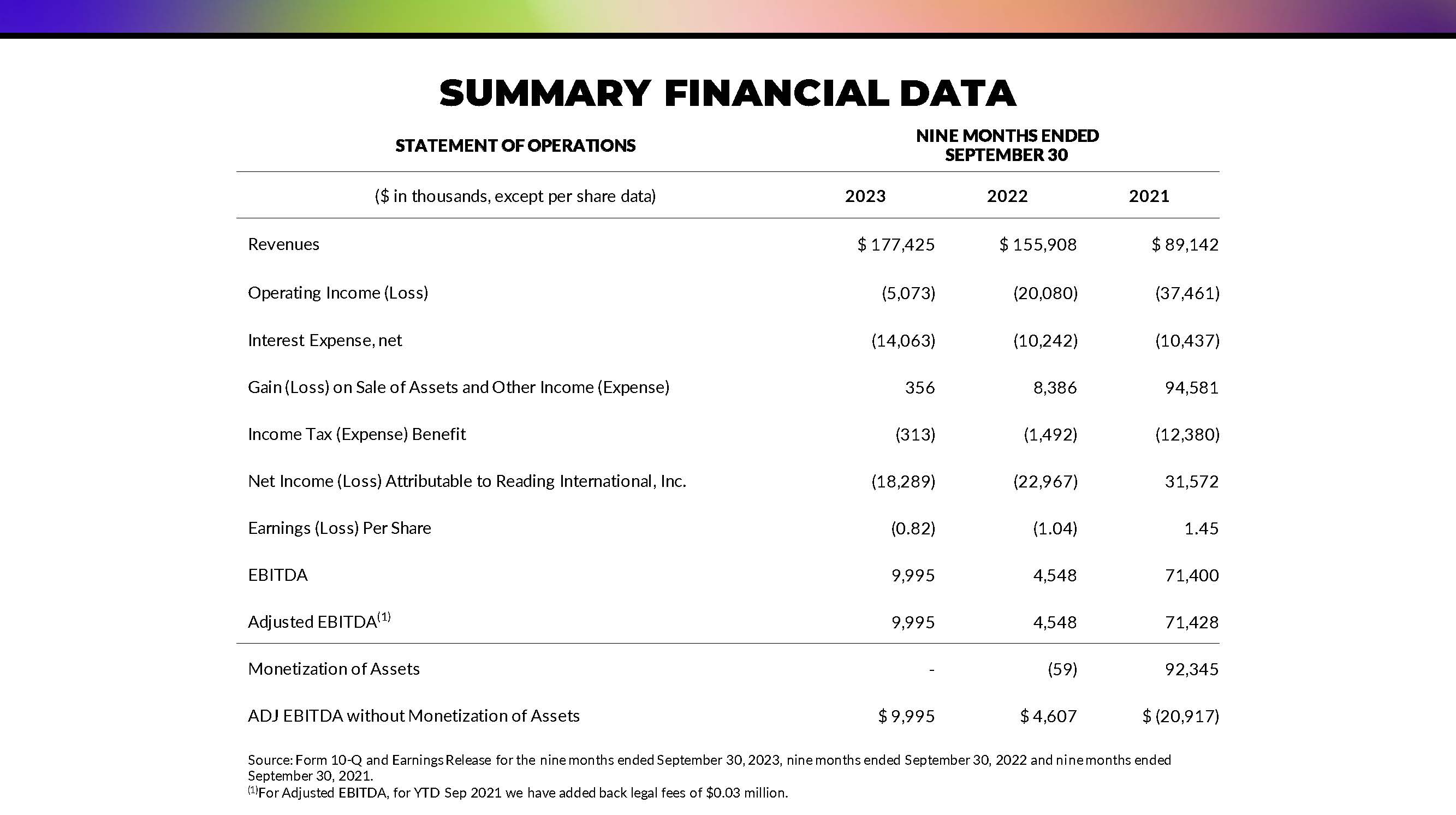

SUMMARY FINANCIAL DATA STATEMENT OF OPERATIONS NINE MONTHS ENDED SEPTEMBER 30 ($ in thousands, except per share data) 2023 2022 2021 Revenues $ 177,425 $ 155,908 $ 89,142 Operating Income (Loss) (5,073) (20,080) (37,461) Interest Expense, net (14,063) (10,242) (10,437) Gain (Loss) on Sale of Assets and Other Income (Expense) 356 8,386 94,581 Income Tax (Expense) Benefit (313) (1,492) (12,380) Net Income (Loss) Attributable to Reading International, Inc. (18,289) (22,967) 31,572 Earnings (Loss) Per Share (0.82) (1.04) 1.45 EBITDA 9,995 4,548 71,400 Adjusted EBITDA(1) 9,995 4,548 71,428 Monetization of Assets - (59) 92,345 ADJ EBITDA without Monetization of Assets $ 9,995 $ 4,607 $ (20,917) Source: Form 10-Q and Earnings Release for the nine months ended September 30, 2023, nine months ended September 30, 2022 and nine months ended September 30, 2021. (1)For Adjusted EBITDA, for YTD Sep 2021 we have added back legal fees of $0.03 million.

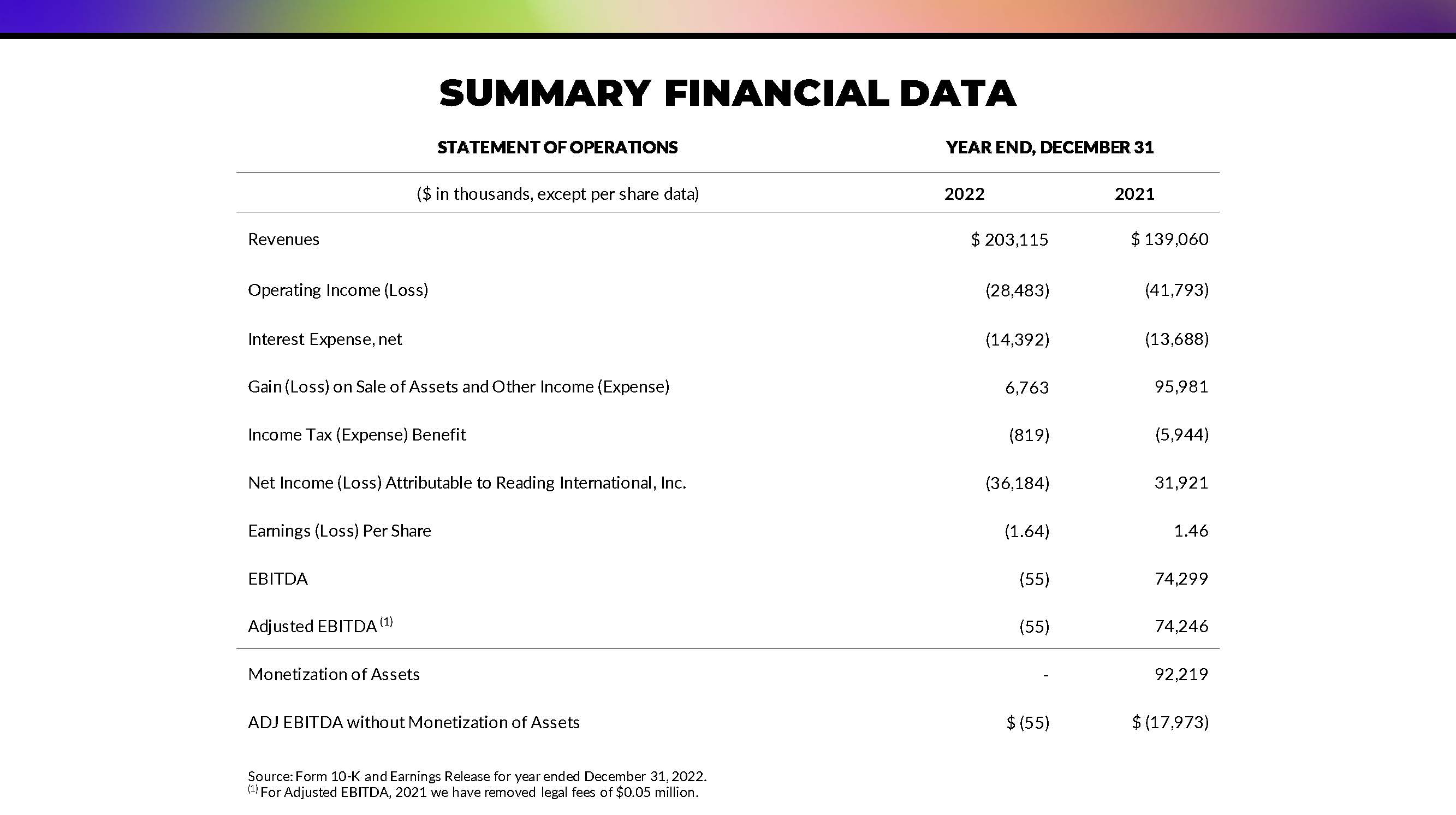

SUMMARY FINANCIAL DATA STATEMENT OF OPERATIONS YEAR END, DECEMBER 31 ($ in thousands, except per share data) 2022 2021 Revenues $ 203,115 $ 139,060 Operating Income (Loss) (28,483) (41,793) Interest Expense, net (14,392) (13,688) Gain (Loss) on Sale of Assets and Other Income (Expense) 6,763 95,981 Income Tax (Expense) Benefit (819) (5,944) Net Income (Loss) Attributable to Reading International, Inc. (36,184) 31,921 Earnings (Loss) Per Share (1.64) 1.46 EBITDA (55) 74,299 Adjusted EBITDA (1) (55) 74,246 Monetization of Assets - 92,219 ADJ EBITDA without Monetization of Assets $ (55) $ (17,973) Source: Form 10-K and Earnings Release for year ended December 31, 2022. (1) For Adjusted EBITDA, 2021 we have removed legal fees of $0.05 million.

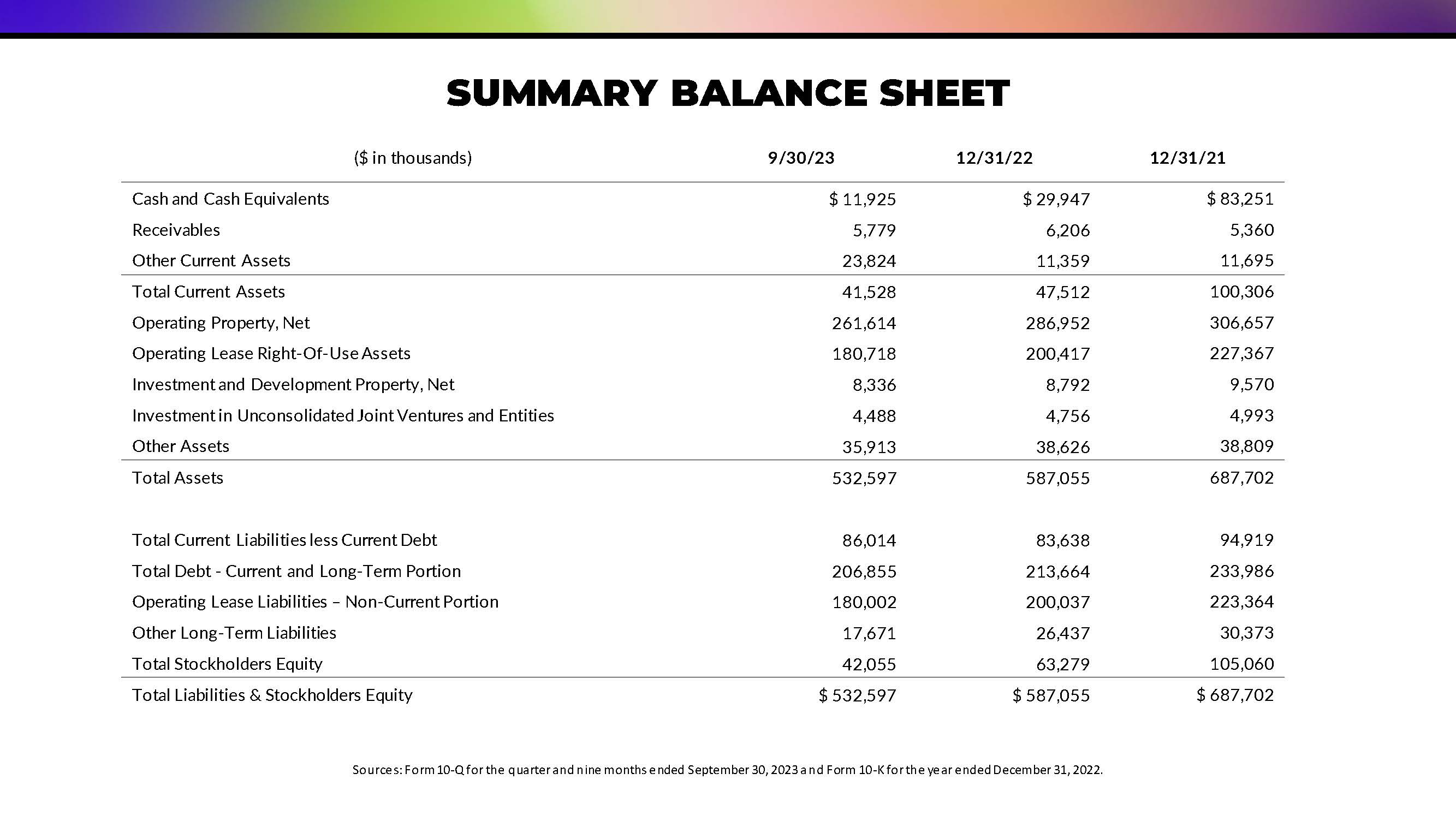

SUMMARY BALANCE SHEET ($ in thousands) 9/30/23 12/31/22 12/31/21 Cash and Cash Equivalents $ 11,925 $ 29,947 $ 83,251 Receivables 5,779 6,206 5,360 Other Current Assets 23,824 11,359 11,695 Total Current Assets 41,528 47,512 100,306 Operating Property, Net 261,614 286,952 306,657 Operating Lease Right-Of-Use Assets 180,718 200,417 227,367 Investment and Development Property, Net 8,336 8,792 9,570 Investment in Unconsolidated Joint Ventures and Entities 4,488 4,756 4,993 Other Assets 35,913 38,626 38,809 Total Assets 532,597 587,055 687,702 Total Current Liabilities less Current Debt 86,014 83,638 94,919 Total Debt - Current and Long-Term Portion 206,855 213,664 233,986 Operating Lease Liabilities – Non-Current Portion 180,002 200,037 223,364 Other Long-Term Liabilities 17,671 26,437 30,373 Total Stockholders Equity 42,055 63,279 105,060 Total Liabilities & Stockholders Equity $ 532,597 $ 587,055 $ 687,702 Sources: Form 10-Q for the quarter and nine months ended September 30, 2023 and Form 10-K for the year ended December 31, 2022.

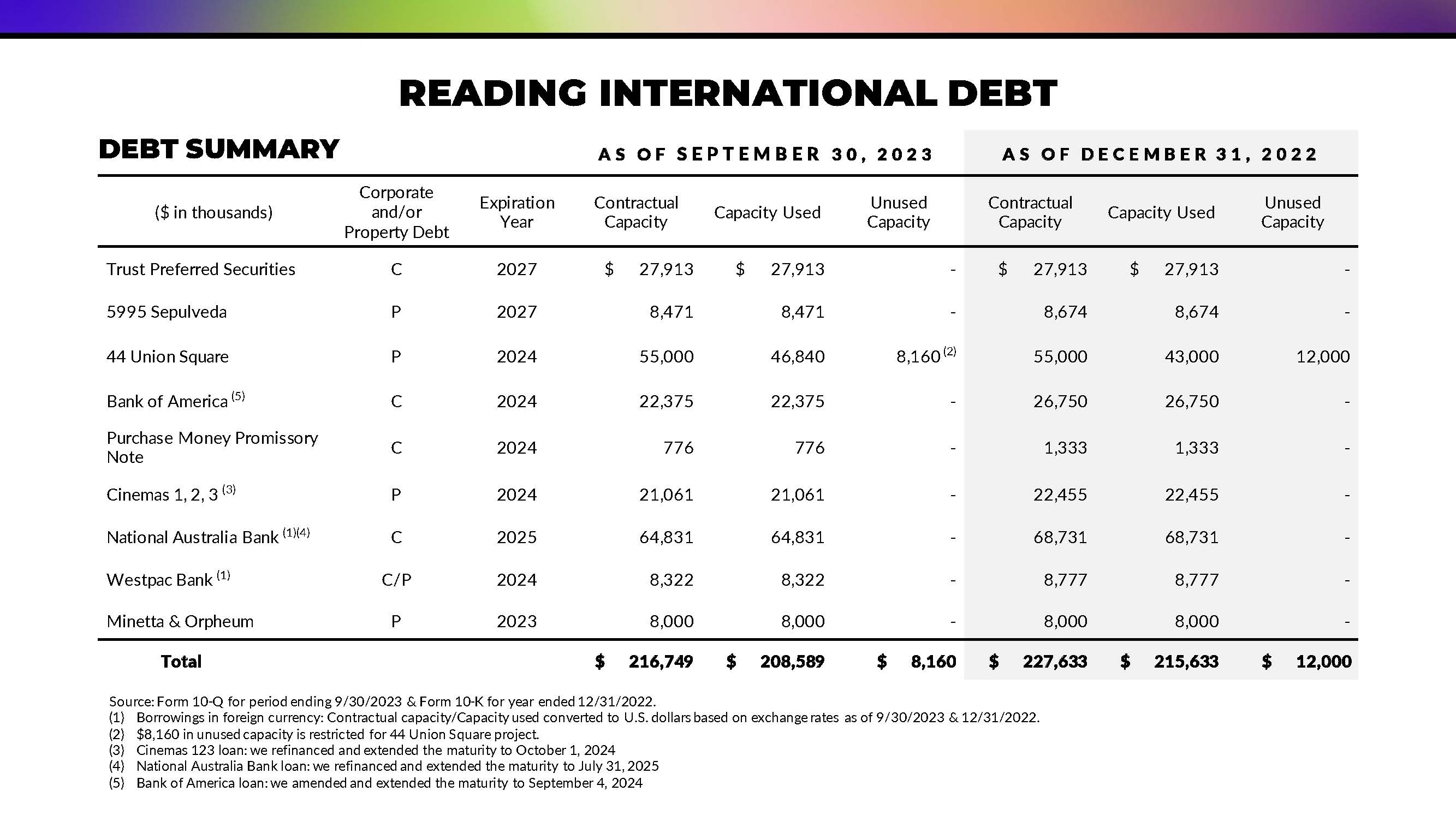

READING INTERNATIONAL DEBT DEBT SUMMARY AS OF SEPTEMBER 30, 2023 AS OF DECEMBER 31, 2022 ($ in thousands) Corporate and/or Property Debt Expiration Year Contractual Capacity Capacity Used Unused Capacity Contractual Capacity Capacity Used Unused Capacity Trust Preferred Securities C 2027 $ 27,913 $ 27,913 - $ 27,913 $ 27,913 - 5995 Sepulveda P 2027 8,471 8,471 - 8,674 8,674 - 44 Union Square P 2024 55,000 46,840 8,160 (2) 55,000 43,000 12,000 Bank of America (5) C 2024 22,375 22,375 - 26,750 26,750 - Purchase Money Promissory Note C 2024 776 776 - 1,333 1,333 - Cinemas 1, 2, 3 (3) P 2024 21,061 21,061 - 22,455 22,455 - National Australia Bank (1)(4) C 2025 64,831 64,831 - 68,731 68,731 - Westpac Bank (1) C/P 2024 8,322 8,322 - 8,777 8,777 - Minetta & Orpheum P 2023 8,000 8,000 - 8,000 8,000 - Total $ 216,749 $ 208,589 $ 8,160 $ 227,633 $ 215,633 $ 12,000 Source: Form 10-Q for period ending 9/30/2023 & Form 10-K for year ended 12/31/2022. Borrowings in foreign currency: Contractual capacity/Capacity used converted to U.S. dollars based on exchange rates as of 9/30/2023 & 12/31/2022. $8,160 in unused capacity is restricted for 44 Union Square project. Cinemas 123 loan: we refinanced and extended the maturity to October 1, 2024 National Australia Bank loan: we refinanced and extended the maturity to July 31, 2025 Bank of America loan: we amended and extended the maturity to September 4, 2024

FINANCING MATTER SUBSEQUENT TO FILING Q3 2023 FORM 10Q WESTPAC/NZ LOAN On November 29, 2023, Westpac extended the terms and conditions of our loan to January 1, 2025. Currently our balance is NZ$13.8 million.

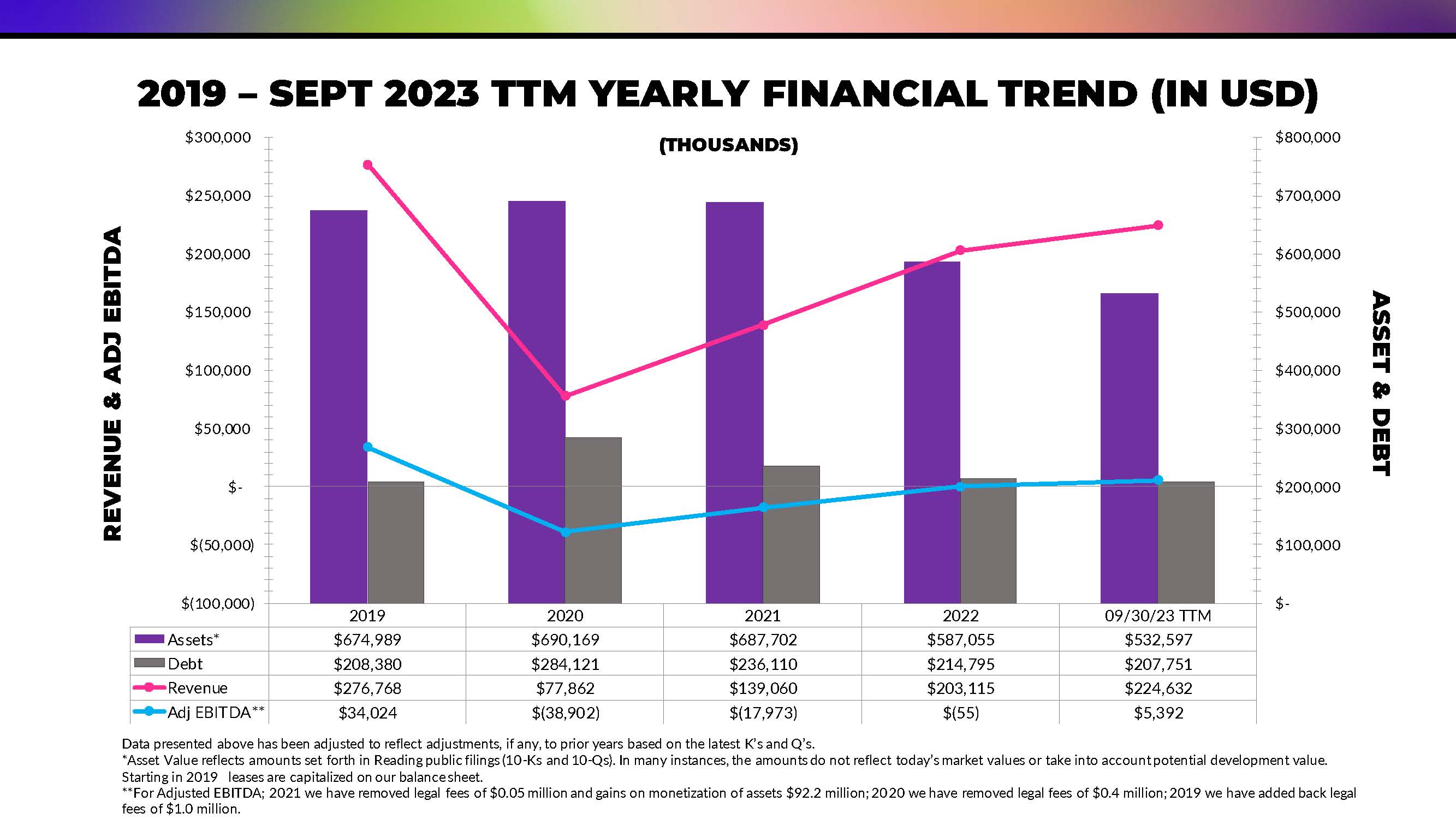

2019 – SEPT 2023 TTM YEARLY FINANCIAL TREND (IN USD) 2019 2020 2021 2022 09/30/23 TTM Assets* $674,989 $690,169 $687,702 $587,055 $532,597 Debt $208,380 $284,121 $236,110 $214,795 $207,751 Revenue $276,768 $77,862 $139,060 $203,115 $224,632 Adj EBITDA** $34,024 $(38,902) $(17,973) $(55) $5,392 $- $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $(100,000) $(50,000) $- $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 (THOUSANDS) ASSET & DEBT REVENUE & ADJ EBITDA Data presented above has been adjusted to reflect adjustments, if any, to prior years based on the latest K’s and Q’s. *Asset Value reflects amounts set forth in Reading public filings (10-Ks and 10-Qs). In many instances, the amounts do not reflect today’s market values or take into account potential development value. Starting in 2019 leases are capitalized on our balance sheet. **For Adjusted EBITDA; 2021 we have removed legal fees of $0.05 million and gains on monetization of assets $92.2 million; 2020 we have removed legal fees of $0.4 million; 2019 we have added back legal fees of $1.0 million.

EMPATHETIC approach to our stakeholders approach to our business analysis underpins our strategies our guests is paramount to our success Is a focus of our multi-year strategy means pursuing a long-term value strategy THE CORE VALUES & GUIDING PRINCIPLES INSPIRED BY OUR FOUNDER CONTINUE TO GUIDE US THROUGH NEWEST HEADWINDS, SUCH AS HOLLYWOOD STRIKES AND RECORD INTEREST RATES JAMES J. COTTER SR. OUR CONTROLLING STOCKHOLDER REMAINS COMMITED TO THE PRESERVATION OF LONG-TERM STOCKHOLDER VALUE ENTREPRENEURIAL EDUCATED ENGAGING EXECUTION EXTENDED VIEW

THANK YOU TO THE ENTIRE READING TEAM AND, CONGRATULATIONS ON WELL-DESERVED HONORS IN 2023! SHOPPING CENTRE COUNCIL OF AUSTRALIA 2023 MARKETING AWARDS KYLER KOKUBUN Marketing & Events Manager 40 UNDER 40 BY PACIFIC BUSINESS NEWS HONOREE ROBERT SMERLING President, US Cinemas Reading International, Inc. MOTION PICTURE CLUB – MPC SUMMER IN THE CITY EVENT BEST MOVIE THEATER BY EDITORS AT HONOLULU MAGAZINE BEST MOVIE THEATER BY DALLAS MORNING NEWS WINNER CINDERELLA VIDEO ANIMATION ONTO EXTERIOR OF ST. JAMES THEATRE AUSTRALIAN GOOD DESIGN AWARDS Reading Property Team – Lena Kretzschmann-Hill, Amy Boston, Alana White AUSTRALIAN INDEPENDENT DISTRIBUTORS ASSOCIATION’S BEST METRO MULTIPLEX CINEMA THE NEW BARK’ET MARKETS – NEWMARKET VILLAGE RUNNER-UP Reading Property Team, together with Wellington City Council and St. James Theatre STATE CINEMA BY ANGELIKA Hobart, Tasmania, Australia October 2023 Consolidated Theatres July 2023 WINNER CONSOLIDATED THEATRES - WARD VILLAGE BEST MOVIE THEATER BY EDITORS AT HONOLULU MAGAZINE FINALIST CONSOLIDATED THEATRES – KAHALA SHOPPING CENTER WINNER – BEST MOVIE THEATER IN DFW ANGELIKA FILM CENTER & CAFÉ – MOCKINGBIRD STATION July 2023

READING INTERNATINAL Q&A SESSION

THANK YOU WE ARE STILL HERE OUR REAL ESTATE IS STRONG OUR CINEMAS CONTINUE THEIR REBOUND