- Achieved solid Q2 results in line with expectations and

generated outstanding cash from operations of $70.4 million

- Delivered $56.7 million in product revenue, up 13%

sequentially

- Continued product portfolio expansion with DDR5 server PMICs,

Client Clock Driver, and PCIe 7 IP solutions

Rambus Inc. (NASDAQ:RMBS), a provider of industry-leading chips

and IP making data faster and safer, today reported financial

results for the second quarter ended June 30, 2024. GAAP revenue

for the second quarter was $132.1 million, licensing billings were

$61.5 million, product revenue was $56.7 million, and contract and

other revenue was $19.0 million. The Company also generated $70.4

million in cash provided by operating activities in the second

quarter.

“We delivered solid second quarter results with robust growth in

product revenue and excellent cash from operations,” said Luc

Seraphin, chief executive officer of Rambus. “Through continued

execution and ongoing investment in our industry-leading product

roadmap for data center and AI, we expect a strong third quarter

driven again by double-digit sequential chip growth.”

Quarterly Financial Review -

GAAP

Three Months Ended June

30,

(In millions, except for percentages

and per share amounts)

2024

2023

Revenue

Product revenue

$

56.7

$

55.0

Royalties

56.4

40.7

Contract and other revenue

19.0

24.1

Total revenue

132.1

119.8

Cost of product revenue

22.8

18.7

Cost of contract and other revenue

1.0

1.3

Amortization of acquired intangible assets

(included in total cost of revenue)

3.0

3.6

Total operating expenses (1)

65.0

84.5

Operating income

$

40.3

$

11.7

Operating margin

31

%

10

%

Net income

$

36.1

$

168.9

Diluted net income per share

$

0.33

$

1.51

Net cash provided by operating

activities

$

70.4

$

50.4

_________________________________ (1)

Includes amortization of acquired

intangible assets of approximately $0.2 million and $0.4 million

for the three months ended June 30, 2024 and 2023,

respectively.

Quarterly Financial Review - Supplemental

Information(1)

Three Months Ended June

30,

(In millions)

2024

2023

Licensing billings (operational metric)

(2)

$

61.5

$

60.2

Product revenue (GAAP)

$

56.7

$

55.0

Contract and other revenue (GAAP)

$

19.0

$

24.1

Non-GAAP cost of product revenue

$

22.7

$

18.6

Cost of contract and other revenue

(GAAP)

$

1.0

$

1.3

Non-GAAP total operating expenses

$

53.4

$

55.9

Non-GAAP interest and other income

(expense), net

$

3.9

$

1.2

Diluted share count (GAAP)

109

112

_________________________________________

(1)

See “Supplemental Reconciliation of GAAP

to Non-GAAP Results” table included below.

(2)

Licensing billings is an operational

metric that reflects amounts invoiced to our licensing customers

during the period, as adjusted for certain differences relating to

advanced payments for variable licensing agreements.

GAAP revenue for the quarter was $132.1 million. The Company

also had licensing billings of $61.5 million, product revenue of

$56.7 million, and contract and other revenue of $19.0 million. The

Company had total GAAP cost of revenue of $26.8 million and

operating expenses of $65.0 million. The Company also had total

non-GAAP operating expenses of $77.1 million (including non-GAAP

cost of revenue of $23.7 million). The Company had GAAP diluted net

income per share of $0.33. The Company’s basic share count was 108

million shares and its diluted share count was 109 million

shares.

Cash, cash equivalents, and marketable securities as of June 30,

2024 were $432.9 million, an increase of $41.8 million from March

31, 2024, mainly due to $70.4 million in cash provided by operating

activities, offset by $12.5 million paid in connection with a share

repurchase program and $11.3 million paid to acquire property,

plant and equipment.

2024 Third Quarter Outlook

The Company will discuss its full revenue guidance for the third

quarter of 2024 during its upcoming conference call. The following

table sets forth the third quarter outlook for other measures.

(In millions)

GAAP

Non-GAAP (1)

Licensing billings (operational metric)

(2)

$60 - $66

$60 - $66

Product revenue (GAAP)

$62 - $68

$62 - $68

Contract and other revenue (GAAP)

$17 - $23

$17 - $23

Total operating costs and expenses

$97 - $93

$82 - $78

Interest and other income (expense),

net

$4

$4

Diluted share count

109

109

_________________________________________

(1)

See “Reconciliation of GAAP

Forward-Looking Estimates to Non-GAAP Forward-Looking Estimates”

table included below.

(2)

Licensing billings is an operational

metric that reflects amounts invoiced to our licensing customers

during the period, as adjusted for certain differences relating to

advanced payments for variable licensing agreements.

For the third quarter of 2024, the Company expects licensing

billings to be between $60 million and $66 million. The Company

also expects royalty revenue to be between $59 million and $65

million, product revenue to be between $62 million and $68 million,

and contract and other revenue to be between $17 million and $23

million. Revenue is not without risk and achieving revenue in this

range will require that the Company sign customer agreements for

various product sales and solutions licensing, among other

matters.

The Company also expects operating costs and expenses to be

between $97 million and $93 million. Additionally, the Company

expects non-GAAP operating costs and expenses to be between $82

million and $78 million. These expectations also assume a tax rate

of 22% and a diluted share count of 109 million, and exclude

stock-based compensation expense of $12 million and amortization of

acquired intangible assets of $3 million.

Conference Call

The Company’s management will discuss the results of the quarter

during a conference call scheduled for 2:00 p.m. PT today. The

call, audio and slides will be available online at

investor.rambus.com and a replay will be available for the next

week at the following numbers: (866) 813-9403 (domestic) or (+1)

929-458-6194 (international) with ID# 295037.

Non-GAAP Financial Information

In the commentary set forth above and in the financial

statements included in this earnings release, the Company presents

the following non-GAAP financial measures: cost of product revenue,

operating expenses and interest and other income (expense), net. In

computing each of these non-GAAP financial measures, the following

items were considered as discussed below: stock-based compensation

expense, acquisition-related costs and retention bonus expense,

amortization of acquired intangible assets, restructuring and other

charges, expense on abandoned operating leases, facility

restoration costs, change in fair value of earn-out liability,

impairment of assets, and certain other one-time adjustments. The

non-GAAP financial measures disclosed by the Company should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations from these

results should be carefully evaluated. Management believes the

non-GAAP financial measures are appropriate for both its own

assessment of, and to show investors, how the Company’s performance

compares to other periods. The non-GAAP financial measures used by

the Company may be calculated differently from, and therefore may

not be comparable to, similarly titled measures used by other

companies. A reconciliation from GAAP to non-GAAP results is

included in the financial statements contained in this release.

The Company’s non-GAAP financial measures reflect adjustments

based on the following items:

Stock-based compensation expense. These expenses primarily

relate to employee stock options, employee stock purchase plans,

and employee non-vested equity stock and non-vested stock units.

The Company excludes stock-based compensation expense from its

non-GAAP measures primarily because such expenses are non-cash

expenses that the Company does not believe are reflective of

ongoing operating results. Additionally, given the fact that other

companies may grant different amounts and types of equity awards

and may use different option valuation assumptions, excluding

stock-based compensation expense permits more accurate comparisons

of the Company’s results with peer companies.

Acquisition-related costs and retention bonus expense. These

expenses include all direct costs of certain acquisitions and the

current periods’ portion of any retention bonus expense associated

with the acquisitions. The Company excludes these expenses in order

to provide better comparability between periods as they are related

to acquisitions and have no direct correlation to the Company’s

operations.

Amortization of acquired intangible assets. The Company incurs

expenses for the amortization of intangible assets acquired in

acquisitions. The Company excludes these items because these

expenses are not reflective of ongoing operating results in the

period incurred. These amounts arise from the Company’s prior

acquisitions and have no direct correlation to the operation of the

Company’s core business.

Restructuring and other charges. These charges may consist of

severance, contractual retention payments, exit costs and other

charges and are excluded because such charges are not directly

related to ongoing business results and do not reflect expected

future operating expenses.

Expense on abandoned operating leases. Reflects the expense on

building leases that were abandoned. The Company excludes these

charges because such charges are not directly related to ongoing

business results and do not reflect expected future operating

expenses.

Facility restoration costs. These charges consist of exit costs

associated with our leased office space and are excluded because

such charges are not directly related to ongoing business results

and do not reflect expected future operating expenses.

Change in fair value of earn-out liability. This change is due

to adjustments to acquisition purchase consideration. The Company

excludes these adjustments because such adjustments are not

directly related to ongoing business results and do not reflect

expected future operating expenses.

Impairment of assets. These charges primarily consist of

non-cash charges to property, plant and equipment assets, which are

excluded because such charges are non-recurring and do not reduce

the Company’s liquidity.

Income tax adjustments. For purposes of internal forecasting,

planning and analyzing future periods that assume net income from

operations, the Company estimates a fixed, long-term projected tax

rate of approximately 22 percent and 24 percent for 2024 and 2023,

respectively, which consists of estimated U.S. federal and state

tax rates, and excludes tax rates associated with certain items

such as withholding tax, tax credits, deferred tax asset valuation

allowance and the release of any deferred tax asset valuation

allowance. Accordingly, the Company has applied these tax rates to

its non-GAAP financial results for all periods in the relevant

years to assist the Company’s planning.

On occasion in the future, there may be other items, such as

significant gains or losses from contingencies, that the Company

may exclude in deriving its non-GAAP financial measures if it

believes that doing so is consistent with the goal of providing

useful information to investors and management.

About Rambus Inc.

Rambus is a provider of industry-leading chips and silicon IP

making data faster and safer. With over 30 years of advanced

semiconductor experience, we are a pioneer in high-performance

memory solutions that solve the bottleneck between memory and

processing for data-intensive systems. Whether in the cloud, at the

edge or in your hand, real-time and immersive applications depend

on data throughput and integrity. Rambus products and innovations

deliver the increased bandwidth, capacity and security required to

meet the world’s data needs and drive ever-greater end-user

experiences. For more information, visit rambus.com.

Forward-Looking Statements

This release contains forward-looking statements under the

Private Securities Litigation Reform Act of 1995, including those

relating to Rambus’ expectations regarding business opportunities,

the Company’s ability to deliver long-term, profitable growth,

product and investment strategies, and the Company’s outlook and

financial guidance for the third quarter of 2024 and related

drivers, and the Company’s ability to effectively manage market

challenges. Such forward-looking statements are based on current

expectations, estimates and projections, management’s beliefs and

certain assumptions made by the Company’s management. Actual

results may differ materially. The Company’s business generally is

subject to a number of risks which are described more fully in

Rambus’ periodic reports filed with the Securities and Exchange

Commission. The Company undertakes no obligation to update

forward-looking statements to reflect events or circumstances after

the date hereof.

Rambus Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

June 30, 2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

124,578

$

94,767

Marketable securities

308,306

331,077

Accounts receivable

83,210

82,925

Unbilled receivables

29,493

50,872

Inventories

52,596

36,154

Prepaids and other current assets

11,975

34,850

Total current assets

610,158

630,645

Intangible assets, net

22,279

28,769

Goodwill

286,812

286,812

Property, plant and equipment, net

74,916

67,808

Operating lease right-of-use assets

21,760

21,497

Unbilled receivables

4,391

4,423

Deferred tax assets

130,163

127,892

Income taxes receivable

98,683

88,768

Other assets

1,461

1,613

Total assets

$

1,250,623

$

1,258,227

LIABILITIES &

STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$

26,970

$

18,074

Accrued salaries and benefits

15,880

17,504

Deferred revenue

15,385

17,393

Income taxes payable

1,005

5,099

Operating lease liabilities

5,033

4,453

Other current liabilities

20,761

26,598

Total current liabilities

85,034

89,121

Long-term liabilities:

Long-term operating lease liabilities

25,780

26,255

Long-term income taxes payable

92,728

78,947

Deferred tax liabilities

3,949

4,462

Other long-term liabilities

14,240

21,341

Total long-term liabilities

136,697

131,005

Total stockholders’ equity

1,028,892

1,038,101

Total liabilities and stockholders’

equity

$

1,250,623

$

1,258,227

Rambus Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(In thousands, except per share

amounts)

2024

2023

2024

2023

Revenue:

Product revenue

$

56,692

$

54,978

$

107,052

$

118,753

Royalties

56,380

40,672

103,856

68,841

Contract and other revenue

19,066

24,182

39,101

46,000

Total revenue

132,138

119,832

250,009

233,594

Cost of revenue:

Cost of product revenue

22,779

18,743

42,827

45,166

Cost of contract and other revenue

1,000

1,294

1,555

2,985

Amortization of acquired intangible

assets

3,052

3,561

6,108

7,123

Total cost of revenue

26,831

23,598

50,490

55,274

Gross profit

105,307

96,234

199,519

178,320

Operating expenses:

Research and development

40,525

41,576

77,884

83,474

Sales, general and administrative

24,402

26,187

50,229

57,151

Amortization of acquired intangible

assets

187

382

382

764

Restructuring and other charges

—

9,494

—

9,494

Impairment of assets

1,071

—

1,071

—

Change in fair value of earn-out

liability

(1,200

)

6,900

(500

)

13,800

Total operating expenses

64,985

84,539

129,066

164,683

Operating income

40,322

11,695

70,453

13,637

Interest income and other income

(expense), net

4,400

2,236

8,987

4,397

Loss on fair value adjustment of

derivatives, net

—

—

—

(240

)

Interest expense

(371

)

(376

)

(737

)

(757

)

Interest and other income (expense),

net

4,029

1,860

8,250

3,400

Income before income taxes

44,351

13,555

78,703

17,037

Provision for (benefit from) income

taxes

8,295

(155,325

)

9,749

(155,124

)

Net income

$

36,056

$

168,880

$

68,954

$

172,161

Net income per share:

Basic

$

0.33

$

1.55

$

0.64

$

1.59

Diluted

$

0.33

$

1.51

$

0.63

$

1.55

Weighted average shares used in per share

calculation

Basic

107,721

109,039

107,906

108,561

Diluted

109,047

111,601

109,628

111,373

Rambus Inc.

Supplemental Reconciliation of

GAAP to Non-GAAP Results

(Unaudited)

Three Months Ended June

30,

(In thousands)

2024

2023

Cost of product revenue

$

22,779

$

18,743

Adjustment:

Stock-based compensation expense

(122

)

(151

)

Non-GAAP cost of product

revenue

$

22,657

$

18,592

Total operating expenses

$

64,985

$

84,539

Adjustments:

Stock-based compensation expense

(11,528

)

(11,224

)

Acquisition-related costs and retention

bonus expense

(12

)

(478

)

Amortization of acquired intangible

assets

(187

)

(382

)

Restructuring and other charges

—

(9,494

)

Expense on abandoned operating leases

—

(195

)

Facility restoration costs

—

(10

)

Impairment of assets

(1,071

)

—

Change in fair value of earn-out

liability

1,200

(6,900

)

Non-GAAP total operating

expenses

$

53,387

$

55,856

Interest and other income (expense),

net

$

4,029

$

1,860

Adjustments:

Interest income related to significant

financing component from fixed-fee patent and technology licensing

arrangements

(118

)

(627

)

Non-GAAP interest and other income

(expense), net

$

3,911

$

1,233

Rambus Inc.

Reconciliation of GAAP

Forward-Looking Estimates to Non-GAAP Forward-Looking

Estimates

(Unaudited)

2024 Third Quarter Outlook

Three Months Ended

September 30, 2024

(In millions)

Low

High

Forward-looking operating costs and

expenses

$

97.0

$

93.0

Adjustments:

Stock-based compensation expense

(12.0

)

(12.0

)

Amortization of acquired intangible

assets

(3.0

)

(3.0

)

Forward-looking Non-GAAP operating

costs and expenses

$

82.0

$

78.0

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240729986257/en/

Desmond Lynch Senior Vice President, Finance and Chief Financial

Officer (408) 462-8000 dlynch@rambus.com

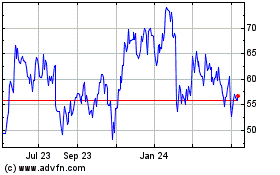

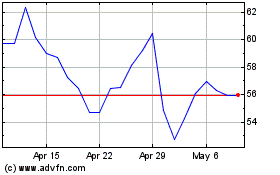

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Dec 2023 to Dec 2024