R1 RCM Inc. (NASDAQ: RCM) (“R1” or the “Company”), a leading

provider of technology-driven solutions that transform the patient

experience and financial performance of healthcare providers, today

announced that it has entered into a definitive agreement to be

acquired by investment funds affiliated with TowerBrook Capital

Partners and Clayton, Dubilier & Rice (“CD&R”), in an

all-cash transaction with an enterprise value of approximately $8.9

billion. An investment vehicle controlled by TowerBrook is

currently the beneficial owner of approximately 36% of the

Company’s outstanding shares of common stock, including the warrant

held by TowerBrook. Under the terms of the agreement, TowerBrook

and CD&R will acquire all the outstanding common stock that

TowerBrook does not currently own for $14.30 per share.

The consideration of $14.30 per share in common stock to R1

stockholders represents a premium of approximately 29% to the

Company’s unaffected closing price on February 23, 2024, the last

full trading day before New Mountain Capital publicly disclosed its

initial non-binding acquisition proposal on its Schedule 13D.

The transaction has been unanimously approved by a special

committee of the R1 Board of Directors comprised solely of

independent directors (the “Special Committee”), which, as

previously announced on March 11, 2024, was formed to evaluate

strategic alternatives. Transaction negotiations were led by the

Special Committee, advised by independent legal and financial

advisors, and following the recommendation of the Special

Committee, R1’s Board approved the transaction.

“TowerBrook has been an outstanding long-term investor and

partner to R1 and shares our vision of being the automation

platform of choice for the provider industry,” said Lee Rivas, R1’s

CEO. “Our agreement reflects TowerBrook’s and CD&R’s confidence

in our team and the unmatched scale, technology and value we

provide. We believe the transaction represents the best path

forward for R1 at an attractive valuation to our stockholders that

reflects the Company’s position as a leading provider of

technology-driven solutions for its customers.”

Ian Sacks, Managing Director at TowerBrook, stated, “As a

long-term, responsible investor in R1, TowerBrook has supported the

development of R1 as a leader in healthcare provider revenue

management since 2016. Together with CD&R, we look forward to

continuing to invest in the Company’s core operations to drive

customer performance and value while also continuing to build R1 as

a leader in intelligent automation and in the use of GAI in revenue

management.”

“R1 is a trusted partner in healthcare technology and

automation,” said Ravi Sachdev, Partner at CD&R. “We see

tremendous opportunity to build on R1’s differentiated platform to

continue delivering solutions to help healthcare providers operate

more efficiently and reduce costs in the system. We are excited to

work alongside TowerBrook and the talented team at R1 to continue

setting the standard for healthcare performance.”

Upon completion of the transaction, R1 will become a private

company and its shares will no longer trade on Nasdaq. The

transaction is expected to close by the end of the year, subject to

customary closing conditions, including receipt of stockholder

approval and regulatory approvals. The transaction is expected to

be financed with a combination of committed debt financing and

equity from investment funds affiliated with TowerBrook and

CD&R.

R1 Second Quarter 2024 Financial Results

R1 expects to release its financial results for the second

quarter ended June 30, 2024 on Wednesday, August 7, 2024. Given the

transaction announced today, R1 will not host a live conference

call in conjunction with its second quarter earnings release. A

pre-recorded call will be available at the Investor Relations

section of the Company’s website at ir.r1rcm.com on August 7,

2024.

AdvisorsQatalyst Partners and Barclays are

serving as financial advisors to the Special Committee and Skadden,

Arps, Slate, Meagher & Flom LLP is acting as legal counsel to

the Special Committee. Kirkland & Ellis LLP is acting as legal

counsel to the Company.

Centerview Partners LLC is serving as lead financial advisor to

TowerBrook and CD&R. In addition, Deutsche Bank and Royal Bank

of Canada have committed to provide financing for the transaction,

and Deutsche Bank Securities, Inc. and RBC Capital Markets, LLC are

serving as financial advisors to TowerBrook and CD&R. Wachtell,

Lipton, Rosen & Katz is acting as legal counsel to

TowerBrook, and Debevoise & Plimpton LLP is acting as legal

counsel to CD&R.

About TowerBrookTowerBrook Capital Partners is

a purpose-driven, transatlantic investment management firm that has

raised in excess of $23 billion to date. As a disciplined investor

with a commitment to fundamental value, TowerBrook seeks to deliver

superior, risk-adjusted returns to investors on a consistent basis,

guided by TowerBrook Responsible Ownership™ principles which

are central to the firm’s value creation strategy. TowerBrook

partners with talented, experienced managers and senior advisors

who share the firm’s values and support its investment objectives,

providing capital and resources to transform the capabilities and

prospects of the businesses in which it invests, driving better

outcomes for all stakeholders. TowerBrook takes an entrepreneurial,

multinational, single-team approach and since inception in 2001 has

invested in more than 90 companies on both sides of the Atlantic.

TowerBrook is the first mainstream private equity firm to be

certified as a B Corporation, demonstrating leadership in its

commitment to environmental, social and governance (ESG) standards

and responsible business practices. For more information, please

visit www.towerbrook.com.

About CD&RFounded in 1978, CD&R is a

leading private investment firm with a strategy of generating

strong investment returns by building more robust and sustainable

businesses through the combination of skilled investment experience

and deep operating capabilities. In partnership with the management

teams of its portfolio companies, CD&R takes a long-term view

of value creation and emphasizes positive stewardship and impact.

The firm invests in businesses that span a broad range of

industries, including industrial, healthcare, consumer, technology

and financial services end markets. CD&R is privately owned by

its partners and has offices in New York and London. For more

information, please visit www.cdr-inc.com and follow the

firm's activities

through LinkedIn and @CDRBuilds on

X/Twitter.

About R1 RCMR1 is a leading provider of

technology-driven solutions that transform the financial

performance and patient experience for health systems, hospitals,

and physician groups. R1’s proven and scalable operating models

seamlessly complement a healthcare organization’s infrastructure,

quickly driving sustainable improvements to net patient revenue and

cash flows while driving revenue yield, reducing operating costs,

and enhancing the patient experience. To learn more, visit:

r1rcm.com.

Forward-Looking Statements

Disclaimer

This communication includes certain

“forward-looking statements” within the meaning of, and subject to

the safe harbor created by, the federal securities laws, including

statements related to the proposed merger of Project Raven Merger

Sub, Inc. with and into the Company (the “Transaction”), including

financial estimates and statements as to the expected timing,

completion and effects of the Transaction. These forward-looking

statements are based on the Company’s current expectations,

estimates and projections regarding, among other things, the

expected date of closing of the Transaction and the potential

benefits thereof, its business and industry, management’s beliefs

and certain assumptions made by the Company, all of which are

subject to change. Forward-looking statements often contain words

such as “expect,” “anticipate,” “intend,” “aims,” “plan,”

“believe,” “could,” “seek,” “see,” “will,” “may,” “would,” “might,”

“considered,” “potential,” “estimate,” “continue,” “likely,”

“expect,” “target” or similar expressions or the negatives of these

words or other comparable terminology that convey uncertainty of

future events or outcomes. By their nature, forward-looking

statements address matters that involve risks and uncertainties

because they relate to events and depend upon future circumstances

that may or may not occur, such as the consummation of the

Transaction and the anticipated benefits thereof. These and other

forward-looking statements are not guarantees of future results and

are subject to risks, uncertainties and assumptions that could

cause actual results to differ materially from those expressed in

any forward-looking statements. Important risk factors that may

cause such a difference include, but are not limited to: (i) the

completion of the Transaction on anticipated terms and timing or at

all, including obtaining required stockholder and regulatory

approvals, and the satisfaction of other conditions to the

completion of the Transaction; (ii) the ability of affiliates of

Raven Acquisition Holdings, LLC to obtain the necessary financing

arrangements set forth in the commitment letters received in

connection with the Transaction; (iii) potential litigation

relating to the Transaction that could be instituted against Raven

Acquisition Holdings, LLC, the Company or their respective

affiliates, directors, managers or officers, including the effects

of any outcomes related thereto; (iv) the risk that disruptions

from the Transaction, including the diversion management’s

attention from the Company’s ongoing business operations will harm

the Company’s business, including current plans and operations; (v)

the ability of the Company to retain and hire key personnel in

light of the Transaction; (vi) potential adverse reactions or

changes to business relationships resulting from the announcement

or completion of the Transaction; (vii) continued availability of

capital and financing and rating agency actions; (viii)

legislative, regulatory and economic developments affecting the

Company’s business; (ix) general economic and market developments

and conditions; (x) potential business uncertainty, including

changes to existing business relationships, during the pendency of

the Transaction that could affect the Company’s financial

performance; (xi) certain restrictions during the pendency of the

Transaction that may impact the Company’s ability to pursue certain

business opportunities or strategic transactions; (xii)

unpredictability and severity of catastrophic events, including but

not limited to acts of terrorism, pandemics, outbreaks of war or

hostilities, as well as the Company’s response to any of the

aforementioned factors; (xiii) significant transaction costs

associated with the Transaction, including the possibility that the

Transaction may be more expensive to complete than anticipated,

including as a result of unexpected factors or events; (xiv) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the Transaction, including in

circumstances requiring the Company to pay a termination fee or

other expenses; (xv) competitive responses to the Transaction,

including the possibility that competing offers or acquisition

proposals for the Company will be made; (xvi) the risk that the

Company’s stock price may decline significantly if the Merger is

not consummated; (xvii) the risks and uncertainties pertaining to

the Company’s business, including those set forth in Part I, Item

1A of the Company’s most recent Annual Report on Form 10-K and Part

II, Item 1A of the Company’s subsequent Quarterly Reports on Form

10-Q, as such risk factors may be amended, supplemented or

superseded from time to time by other reports filed by the Company

with the SEC; and (xviii) the risks and uncertainties that will be

described in the proxy statement available from the sources

indicated below. These risks, as well as other risks associated

with the Transaction, will be more fully discussed in the proxy

statement. While the list of factors presented here is, and the

list of factors to be presented in the proxy statement will be,

considered representative, no such list should be considered a

complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward-looking statements. Consequences of

material differences in results as compared with those anticipated

in the forward-looking statements could include, among other

things, business disruption, operational problems, financial loss,

legal liability to third parties and similar risks, any of which

could have a material impact on the Company’s financial condition,

results of operations, credit rating or liquidity. In light of the

significant uncertainties in these forward-looking statements, the

Company cannot assure you that the forward-looking statements in

this communication will prove to be accurate, and you should not

regard these statements as a representation or warranty by the

Company, its directors, officers or employees or any other person

that the Company will achieve its objectives and plans in any

specified time frame, or at all. These forward-looking statements

speak only as of the date they are made, and the Company does not

undertake to and specifically disclaims any obligation to publicly

release the results of any updates or revisions to these

forward-looking statements that may be made to reflect future

events or circumstances after the date of such statements or to

reflect the occurrence of anticipated or unanticipated events,

except as required by applicable law.

Important Additional Information and

Where to Find It

In connection with the Transaction, the Company

will file with the SEC a proxy statement on Schedule 14A, the

definitive version of which will be sent or provided to Company

stockholders. The Company, affiliates of the Company and affiliates

of each of Clayton, Dubilier & Rice, LLC and TowerBrook Capital

Partners L.P. intend to jointly file a transaction statement on

Schedule 13E-3 (the “Schedule 13E-3”) with the SEC. The Company may

also file other documents with the SEC regarding the Transaction.

This document is not a substitute for the Proxy Statement, the

Schedule 13E-3 or any other document which the Company may file

with the SEC. Promptly after filing its definitive proxy statement

with the SEC, the Company will mail or provide the definitive proxy

statement, the Schedule 13E-3 and a proxy card to each Company

stockholder entitled to vote at the meeting relating to the

Transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

PROXY STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER RELEVANT

DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH

RESPECT TO THE TRANSACTION BECAUSE THEY CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS.

Investors and security holders may obtain free copies of the proxy

statement, Schedule 13E-3 and other documents that are filed or

will be filed with the SEC by the Company through the website

maintained by the SEC at www.sec.gov, the Company’s website at

ir.r1rcm.com or by contacting the Company’s Investor Relations Team

at investorrelations@r1rcm.com.

The Transaction will be implemented solely

pursuant to the Merger Agreement dated as of July 31, 2024, among

the Company, Raven Acquisition Holdings, LLC and Project Raven

Merger Sub, Inc., which contains the full terms and conditions of

the Transaction.

Participants in the

Solicitation

The Company and certain of its directors,

executive officers and other employees, may be deemed to be

participants in the solicitation of proxies from the stockholders

of the Company in connection with the Transaction. Information

regarding the Company’s directors and executive officers is

contained in the “Director Compensation,” “Executive Compensation”

and “Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters” sections of the definitive proxy

statement for the 2024 annual meeting of stockholders of R1 RCM

Inc., which was filed with the SEC on April 12, 2024 (the “Annual

Meeting Proxy Statement”) and will be contained in the proxy

statement to be filed by the Company in connection with the

Transaction. Any change of the holdings of the Company’s securities

by its directors or executive officers from the amounts set forth

in the Annual Meeting Proxy Statement have been reflected in the

following Statements of Changes in Beneficial Ownership on Form 4

filed with the SEC: by Michael C. Feiner, filed on May 23, 2024; by

Agnes Bundy Scanlan, filed on May 23, 2024; by John B. Henneman,

III, filed on May 23, 2024; by Anthony R. Tersigni, filed on May

23, 2024; by Jill Smith, filed on May 23, 2024; by Joseph Flanagan,

filed on May 23, 2024; by Jeremy Delinsky, filed on May 23, 2024;

by David M. Dill, filed on May 23, 2024; by Bradford Kyle

Armbrester, filed on May 23, 2024; by Anthony J. Speranzo, filed on

May 23, 2024; by Jennifer Williams, filed on June 3, 2024; by John

Sparby, filed on June 3, 2024; by Pamela L. Spikner, filed on June

3, 2024; by Lee Rivas, filed on June 3, 2024; and by Kyle Hicok,

filed on June 3, 2024. Additional information regarding the

identity of potential participants, and their direct or indirect

interests, by security holdings or otherwise, will be included in

the definitive proxy statement relating to the Transaction when it

is filed with the SEC. These documents (when available) may be

obtained free of charge from the SEC’s website at www.sec.gov, the

Company’s website at ir.r1rcm.com or by contacting the Company’s

Investor Relations Team at investorrelations@r1rcm.com.

Contacts

Investor Relations:Evan Smith, CFA(516)

743-5184investorrelations@r1rcm.com

Media Contact for R1: Josh Blumenthal(323)

449-4380media@r1rcm.com

Andrew Brimmer / Andrea RoseJoele Frank, Wilkinson Brimmer

Katcher(212) 355-4449

Media Contact for TowerBrook:Brunswick GroupAlex Yankus(917)

818-5204towerbrookcapital@brunswickgroup.com

Media Contact for CD&R:Jon Selib212 407

5200JSelib@cdr-inc.com

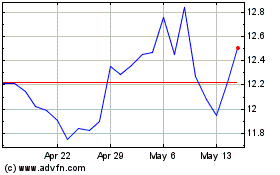

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Oct 2024 to Nov 2024

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Nov 2023 to Nov 2024