Quipt Home Medical Corp. (the “

Company”)

(NASDAQ:QIPT; TSXV:QIPT), a U.S. based home medical equipment

provider, focused on end-to-end respiratory care, today announced

its first quarter fiscal 2023 financial results and operational

highlights. These results pertain to the three months ended

December 31, 2022 and are reported in U.S. Dollars.

Quipt will host its Earnings Conference Call on

Tuesday, February 14, 2023 at 10:00 a.m. (ET). The dial-in number

is 1 (800) 319-4610 or 1 (604) 638-5340. The live audio webcast can

be found on the investor section of the Company’s website through

the following link: www.quipthomemedical.com.

Financial

Highlights:

- Revenue for fiscal Q1 2023 was

$40.8 million compared to $29.5 million for fiscal Q1 2022,

representing a 38% increase year-over-year.

- Organic growth increased by 2%

sequentially compared to fiscal Q4 2022. The Company anticipates

organic growth meeting and surpassing historical levels of 8-10% as

calendar 2023 progresses.

- Recurring Revenue (as defined

below) for fiscal Q1 2023 continues to be strong and exceeded 77%

of total revenue.

- Adjusted EBITDA

(defined below) for fiscal Q1 2023 was $9.0 million (22.0% margin),

compared to Adjusted EBITDA for fiscal Q1 2022 of $6.0 million

(20.3% margin), representing a 50% increase year-over-year. The

Company expects to continue seeing strong margin performance in

fiscal 2023.

- Net income for fiscal Q1 2023 was

$325,000 or $0.01 per fully diluted share, compared to a net loss

for fiscal Q1 2022 of $2.1 million or ($0.06) per fully diluted

share. The Company believes the recent consumer price index updates

by the United States Centers for Medicare & Medicaid Services

to the Durable Medical Equipment, Prosthetics, Orthotics and

Supplies (DMEPOS) fee schedule will have a positive impact on the

Company’s net income in calendar 2023.

- For fiscal Q1

2023, bad debt expense was at 5.6% of total revenues compared to

8.2% of total revenues in fiscal Q1 2022. This decrease is

primarily due to improved collections and is an example of how the

Company can scale and add more revenue through add-on acquisitions

without compromising billing and collection capabilities.

- Cash flow from

continuing operations was $4.8 million for fiscal Q1 2023, compared

to $5.1 million for fiscal Q1 2022. The decrease was largely due to

the increase in net working capital.

- The Company reported $3.7 million

of cash on hand and total credit availability of $101.9 million as

of December 31, 2022 with $16.9 million available towards a line of

credit and $85.0 million available on a delayed draw term loan

(DDTL). The Company paid down $3.9 million of its line of credit

during fiscal Q1 2023.

Operational

Highlights:

- The Company’s

customer base increased 32% year over year to 99,420 unique

patients served in fiscal Q1 2023 from 75,309 unique patients

served in fiscal Q1 2022.

- Compared to

118,100 unique set-ups/deliveries in fiscal Q1 2022, the Company

completed 146,350 unique set-ups/deliveries in fiscal Q1 2023, an

increase of 24%. There were 69,482 respiratory resupply

set-ups/deliveries during fiscal Q1 2023 compared to 51,137 during

fiscal Q1 2022, an increase of 36%, which the Company credits to

its continued use of technology and centralized intake

processes.

- The Company has

seen the supply chain for sleep devices rapidly improve in real

time with the expectation that supply levels will be back to

pre-pandemic levels in the first half of calendar 2023. The team is

actively driving set-ups across the organization to match the

robust demand which we feel will continue for the foreseeable

future.

- The Company

continues to experience robust demand for respiratory equipment,

such as oxygen concentrators, ventilators, as well as the CPAP

resupply and other supplies business.

- The Company has

expanded its sales reach, which now spans across 26 U.S. states

with the addition of experienced sales personnel.

Subsequent

Highlights:

- On January 3,

2023, the Company announced the completed acquisition of Great Elm

Healthcare, LLC (“Great Elm”), a clinical

respiratory company with locations across eight states in the

Midwest, Southwest and Pacific Northwest, for a total purchase

price of $80 million (subject to customary adjustments of Great

Elm’s working capital, existing debt and expenses). Based on an

independent quality of earnings report, Great Elm had unaudited

revenues for the 12 months ended August 31, 2022 of $60 million

with an Adjusted EBITDA (defined below) of $13 million.

- Quipt has identified $2 million in

cost savings and synergies, which it expects to capture during the

first six months post-closing and would result in Great Elm’s

Anticipated Annualized Adjusted EBITDA (defined below) to be $15

million, representing a purchase price of 5.2x Adjusted EBITDA post

cost savings and synergies.

- Post-acquisition, the Company

anticipates Annualized Revenue (defined below) and Anticipated

Annualized Adjusted EBITDA of $220 million and $49 million,

inclusive of the $2 million of anticipated synergies and cost

savings.

- Post-acquisition, Quipt's Recurring

Revenue (defined below) is expected to increase from 77% for the

fiscal year ended September 30, 2022, to 82%, on a pro forma

basis.

- The Company has

now reached 270,000 active patients, 32,500 referring physicians

and 115 locations.

Management

Commentary:

“We are pleased to announce another record

quarter in the first quarter of our fiscal year 2023, and we are

seeing considerable momentum throughout the business as calendar

year 2023 gets underway. Organic growth has returned to historic

levels, our Adjusted EBITDA margin has accelerated, supply chain

concerns have subsided, and we just completed our largest

acquisition to date. The strong performance during the first

quarter of the fiscal year is evidence of the ongoing operational

excellence in which we take great pride. We are thrilled that our

Adjusted EBITDA margin has reached 22% as we get closer to critical

scale, and we expect that margins will continue to increase in the

future,” said CEO and Chairman Greg Crawford.

“Our nationwide expansion of our patient centric

ecosystem has been targeted on geographies with a high prevalence

of chronic obstructive pulmonary disease (COPD) COPD and we have

made tremendous progress reaching 26 states. As we can see from the

current environment, a lot is being done to make sure that a

patient is treated at home whenever it is practical. Therefore, we

will continue to develop our healthcare network through the

utilization of our clinical service model, which is based on

technological applications like remote patient monitoring, to

minimize the load that is being placed on the conventional

healthcare system. Given the favorable regulatory environment, the

ongoing strong demand for respiratory equipment, the positive

demographic trends, and Quipt's continuous operational success

across the board, the Company is in the best position it has ever

been in as we start 2023.”

Chief Financial Officer Hardik Mehta added, “Our

exceptional financial and operational success in the first quarter

of the fiscal year 2023 has given us a lot to be proud of. It is a

remarkable success for the team that we were able to improve our

Adjusted EBITDA margin to 22%, recover to 2% sequential organic

growth, and post positive net income. We expect our margins to

remain strong as we progress through 2023 given the continued

scaling of the business. In addition, at the beginning of the year,

we announced the closing of our most significant acquisition to

date, which was the purchase of Great Elm Healthcare. This

acquisition encompassed eight states, seven of which had not

previously been covered by Quipt. We have been successful in

maintaining a conservative net leverage ratio of 1.96x, allowing us

to have a significant amount of financial flexibility going ahead.

We believe that we will be able to increase the amount of our

senior credit facilities as soon as the right opportunity presents

itself to us. The combined Annualized Revenue and Anticipated

Annualized Adjusted EBITDA for Quipt in real time is $220 million

and $49 million, respectively. This figure considers the cost

reductions and synergies that resulted from the transaction, which

totaled $2 million, but does not include the recent increase in the

consumer price index updates to the DMEPOS fee schedule. Given our

solid financial position, improved supply chain, and favorable

operating climate, we continue to concentrate our efforts on our

strong organic growth initiatives, and strategic acquisition

candidates that would allow us to expand our company into existing

and new favorable geographic areas in the United States.”

ABOUT QUIPT HOME MEDICAL CORP.

The Company provides in-home monitoring and

disease management services including end-to-end respiratory

solutions for patients in the United States healthcare market. It

seeks to continue to expand its offerings to include the management

of several chronic disease states focusing on patients with heart

or pulmonary disease, sleep disorders, reduced mobility, and other

chronic health conditions. The primary business objective of the

Company is to create shareholder value by offering a broader range

of services to patients in need of in-home monitoring and chronic

disease management. The Company’s organic growth strategy is to

increase annual revenue per patient by offering multiple services

to the same patient, consolidating the patient’s services, and

making life easier for the patient.

Reader Advisories

Readers are cautioned that the financial

information regarding Great Elm disclosed herein is unaudited and

derived as a result of an independent quality of earnings report

as well as the Company’s due diligence, including a review of Great

Elm’s bank statements and tax returns.

There can be no assurance that any of the

potential acquisitions in the Company’s pipeline or in negotiations

will be completed as proposed or at all and no definitive

agreements have been executed. Completion of any transaction will

be subject to applicable director, shareholder, and regulatory

approvals.

Unless otherwise specified, all dollar amounts

in this press release are expressed in U.S.

dollars. Neither

the TSX Venture Exchange nor its Regulation Services Provider (as

that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Statements

Certain statements contained in this press

release constitute "forward-looking information" as such term is

defined in applicable Canadian securities legislation. The words

"may", "would", "could", "should", "potential", "will", "seek",

"intend", "plan", "anticipate", "believe", "estimate", "expect",

"outlook", and similar expressions as they relate to the

Company, including: post integration financial results (Anticipated

Annualized Revenue and Anticipated Annualized Adjusted EBITDA);

anticipated pro forma cost savings and synergies and the timing of

capturing them; the Company anticipating organic growth meeting and

surpassing historical levels of 8-10% as calendar 2023 progresses;

the Company expecting to continue seeing strong margin performance

in fiscal 2023; the Company believing the recent consumer price

index updates to the DMEPOS fee schedule will have a positive

impact on the Company’s net income in calendar 2023; the Company

believing there will be robust demand for set-ups/deliveries for

the foreseeable future; the Company expecting that margins will

continue to increase in the future; the Company expecting margins

to remain strong through 2023; and the Company being able to expand

its senior credit facilities when opportunities arise; are intended

to identify forward-looking information. All statements other

than statements of historical fact may be forward-looking

information. Such statements reflect the Company's current views

and intentions with respect to future events, and current

information available to the Company, and are subject to certain

risks, uncertainties and assumptions, including: the Acquisition

achieving results at least as good as historical performances;

the financial information regarding the Acquisition being

verified when included in the Company’s consolidated financial

statements prepared in accordance with generally accepted

accounting principles in Canada as set out in the CPA Canada

Handbook – Accounting under Part I, which incorporates

International Financial Reporting Standards as issued by the

International Accounting Standards Board; $2 million of cost

savings and synergies, with all other projected elements remaining

the same based on historical performance; and the Company

successfully identified, negotiating and completing additional

acquisitions, including accretive acquisitions. Many factors

could cause the actual results, performance or achievements that

may be expressed or implied by such forward-looking information to

vary from those described herein should one or more of these

risks or uncertainties materialize. Examples of such risk factors

include, without limitation: credit; market (including equity,

commodity, foreign exchange and interest rate); liquidity;

operational (including technology and infrastructure);

reputational; insurance; strategic; regulatory; legal;

environmental; capital adequacy; the general business and

economic conditions in the regions in which the Company operates;

the ability of the Company to execute on key priorities, including

the successful completion of acquisitions, business retention,

and strategic plans and to attract, develop and retain key

executives; difficulty integrating newly acquired businesses;

the ability to implement business strategies and pursue business

opportunities; low profit market segments; disruptions in or

attacks (including cyber-attacks) on the Company's information

technology, internet, network access or other voice or data

communications systems or services; the evolution of various types

of fraud or other criminal behavior to which the Company is

exposed; the failure of third parties to comply with their

obligations to the Company or its affiliates; the impact of new

and changes to, or application of, current laws and regulations;

decline of reimbursement rates; dependence on few payors;

possible new drug discoveries; a novel business model; dependence

on key suppliers; granting of permits and licenses in a highly

regulated business; the overall difficult litigation environment,

including in the U.S.; increased competition; changes in foreign

currency rates; increased funding costs and market volatility due

to market illiquidity and competition for funding; the

availability of funds and resources to pursue operations;

critical accounting estimates and changes to accounting

standards, policies, and methods used by the Company; the

occurrence of natural and unnatural catastrophic events and claims

resulting from such events; and risks related to COVID-19

including various recommendations, orders and measures of

governmental authorities to try to limit the pandemic, including

travel restrictions, border closures, non-essential business

closures, quarantines, self-isolations, shelters-in-place and

social distancing, disruptions to markets, economic activity,

financing, supply chains and sales channels, and a deterioration

of general economic conditions including a possible national or

global recession; as well as those risk factors discussed or

referred to in the Company’s disclosure documents filed with

United States Securities and Exchange Commission and available at

www.sec.gov, and with the securities regulatory authorities in

certain provinces of Canada and available at www.sedar.com.

Should any factor affect the Company in an unexpected manner, or

should assumptions underlying the forward-looking information

prove incorrect, the actual results or events may differ

materially from the results or events predicted. Any such

forward-looking information is expressly qualified in its

entirety by this cautionary statement. Moreover, the Company

does not assume responsibility for the accuracy or completeness

of such forward-looking information. The forward-looking

information included in this press release is made as of the date

of this press release and the Company undertakes no obligation to

publicly update or revise any forward-looking information, other

than as required by applicable law.

Non-GAAP Measures

This press release refers to “Annualized

Revenue”, “Recurring Revenue”, “Adjusted EBITDA”, “Annualized

Adjusted EBITDA” and “Anticipated Annualized Adjusted EBITDA”,

which are non-GAAP and non-IFRS financial measures that do not

have standardized meanings prescribed by GAAP or IFRS. The

Company’s presentation of these financial measures may not be

comparable to similarly titled measures used by other companies.

These financial measures are intended to provide additional

information to investors concerning the Company’s

performance.

Annualized Revenue as used in this press release

is calculated as Quipt’s total revenues for the three months ended

September 30, 2022 of $40 million multiplied by four, or $160

million, plus Great Elm revenue for the twelve months ended August

31, 2022 of $60 million, for a total of $220 million.

Recurring Revenue for Quipt for the three months

ended December 31, 2022, as used in this press release is

calculated as rentals of medical equipment of $18.4 million plus

sales of respiratory resupplies of $13.0 million for a total of

$31.4 million, divided by total revenues of $40.8 million, or

77%.

Recurring Revenue for Quipt post-acquisition, as

used in this press release is calculated as pro forma rentals of

medical equipment of $91 million ($69 million from Quipt and $22

million from Great Elm) plus sales of respiratory resupplies of $72

million ($41 million from Quipt and $31 million from Great Elm)

for a total of $163 million, divided by total pro forma revenues

of $200 million (Quipt reported $140 million for the year ended

September 30, 2022, plus Great Elm of $60 million for the twelve

months ended August 31, 2022), or 82%.

EBITDA is defined as net income (loss),

excluding interest, income taxes, depreciation, amortization..

Adjusted EBITDA is defined as net income (loss), excluding

interest, income taxes, depreciation, amortization, change in fair

value of derivative financial liabilities, stock-based

compensation, other income from government grant, loss on

extinguishment of debt, loss on settlement of shares to be issued,

acquisition-related and other transaction costs, and change in fair

value of derivatives. EBITDA and Adjusted EBITDA are a non-IFRS

measure the Company uses as an indicator of financial health and

excludes several items which may be useful in the consideration of

the financial condition of the Company. The following table shows

our Non-IFRS measure (Adjusted EBITDA) reconciled to our net income

for the following indicated periods (in $millions):

The following table shows the Company’s IFRS

measures reconciled to EBITDA and Adjusted EBITDA (non-IFRS

measures) for the indicated periods (in $millions)

| |

|

|

|

|

|

|

|

| |

|

Three |

|

Three |

|

| |

|

months |

|

months |

|

| |

|

ended December |

|

ended December |

|

| |

|

31, 2022 |

|

31, 2021 |

|

|

| Net income (loss) |

|

$ |

0.3 |

|

$ |

(2.1 |

) |

|

| Add back: |

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

6.8 |

|

|

5.0 |

|

|

| Interest expense, net |

|

|

0.7 |

|

|

0.5 |

|

|

| Provision (benefit) for income

taxes |

|

|

0.3 |

|

|

0.1 |

|

|

| EBITDA |

|

|

8.1 |

|

|

3.5 |

|

|

| Stock-based compensation |

|

|

0.6 |

|

|

2.1 |

|

|

| Acquisition-related costs |

|

|

0.3 |

|

|

0.1 |

|

|

| Gain (loss) on foreign

currency transactions |

|

|

0.0 |

|

|

0.0 |

|

|

| Change in fair value of

debentures and warrants |

|

|

— |

|

|

0.3 |

|

|

| Adjusted EBITDA |

|

$ |

9.0 |

|

$ |

6.0 |

|

|

Annualized Adjusted EBITDA as used in this press

release is calculated as Quipt’s Adjusted EBITDA for the three

months ended September 30, 2022 of $8.4 million multiplied by four,

or $33.2 million, plus Great Elm’s Adjusted EBITDA of $13.4

million, for a total of $47 million.

|

|

|

QuiptThree months endedSeptember 30, 2022(audited) |

|

Great ElmTwelve months endedAugust 31, 2022(unaudited) |

| Net income (loss) from continuing

operations |

|

$ |

1.8 |

|

|

$ |

(2.0 |

) |

| Add back: |

|

|

- |

|

|

|

- |

|

| Depreciation and

amortization |

|

|

7.2 |

|

|

|

8.3 |

|

| Interest expense, net |

|

|

0.6 |

|

|

|

6.1 |

|

| (Recovery of) provision for

income taxes |

|

|

(2.4 |

) |

|

|

- |

|

| EBITDA |

|

|

7.2 |

|

|

|

12.4 |

|

| Stock-based compensation |

|

|

0.9 |

|

|

|

- |

|

| Acquisition-related and other

transaction costs |

|

|

0.1 |

|

|

|

0.6 |

|

| Other income from government

grant |

|

|

(0.6 |

) |

|

|

(2.3 |

) |

| Gain (loss) on foreign currency

transactions |

|

|

0.1 |

|

|

|

- |

|

| Loss on extinguishment of

debt |

|

|

0.3 |

|

|

|

- |

|

| Loss on settlement of shares to

be issued |

|

|

0.4 |

|

|

|

- |

|

| Change in fair value of

derivatives |

|

|

0.1 |

|

|

|

2.1 |

|

| Parent company management

fee |

|

|

- |

|

|

|

0.4 |

|

| Other |

|

|

(0.1 |

) |

|

|

0.2 |

|

| Adjusted EBITDA |

|

$ |

8.4 |

|

|

$ |

13.4 |

|

Anticipated Annualized Adjusted EBITDA as used

in this press release is calculated as Annualized Adjusted EBITDA,

as defined above, of $13 million for Great Elm and $47 million for

the combination of Quipt and Great Elm, plus $2 million of

identified cost savings and synergies, for a total of $15 million

for Great Elm and $49 million for the combination of Quipt and

Great Elm.

For further information please visit our website

at www.Quipthomemedical.com, or contact:

Cole StevensVP of Corporate DevelopmentQuipt

Home Medical Corp.859-300-6455cole.stevens@myquipt.com

Gregory CrawfordChief Executive OfficerQuipt

Home Medical Corp.859-300-6455investorinfo@myquipt.com

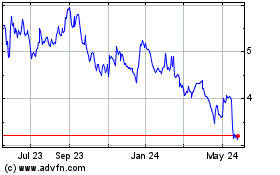

Quipt Home Medical (NASDAQ:QIPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

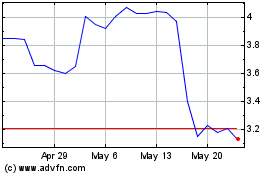

Quipt Home Medical (NASDAQ:QIPT)

Historical Stock Chart

From Dec 2023 to Dec 2024