QuantaSing Group Limited (NASDAQ: QSG) (“QuantaSing” or the

“Company”), a leading online learning service provider in China,

today opened its office in Hong Kong. Timed with the opening, the

company launched co-branded research on China’s Silver Economy,

entitled “White Paper on Unveiling Golden Opportunities in China's

Silver Economy, 2023” (“White Paper”).

The inaugural Hong Kong office is the company’s first office

outside Mainland China. Located strategically in the Exchange

Square, a prime area near investors and business leaders, this new

hub represents a significant milestone in QuantaSing’s market

expansion and global outreach. From this Hong Kong base, QuantaSing

is actively seeking new business opportunities with a global

perspective, broadening its reach beyond its original market.

“For QuantaSing, going international extends beyond simply

market expansion. It's about fostering cultural exchanges and

integration,” said Mr. Peng Li, Chairman and Chief Executive

Officer of QuantaSing. “As an international hub, Hong Kong offers

the ideal platform to gather resources, exchange ideas, grow our

business, and deliver quality services to global users. We will

also seek to apply global best practices to enhance our products

and services.”

Launched in partnership with China Insights Consultancy (CIC),

the release of the White Paper at the office opening event draws

upon QuantaSing’s comprehensive data and statistical analysis.

Leveraging the Company’s large user base, strong user engagement,

and rich experience in serving middle-aged and elderly users, the

report provides critical insights into the demographic trends,

consumption patterns, channels, and preferences of the elderly

population in China.

The White Paper delves into the current state and development

potential of China’s middle-aged and elderly market from three

dimensions: ‘people, products, and places.’ The research focuses on

key factors and pain points in middle-aged and elderly consumption,

the development trends of segmented product and service markets,

and the evolution of consumption channels. Based on extensive

research covering 5,710 middle-aged and elderly consumers, the

White Paper collects crucial data and information, providing

in-depth insights and important reference conclusions for

understanding and developing the middle-aged and elderly

market.

Mr. Li, adds, “The report underlines QuantaSing’s commitment to

improving the quality of life for the middle-aged and elderly

demographic. Guided by this White Paper, we hope to move forward

with like-minded partners, creating a supportive ecosystem for the

elderly population.”

As China transitions into an aging society, it is critical that

companies fill the gap to provide relevant products and services

that both meet market demand and provide for a more fulfilling life

in later years.

Access the full White Paper here:

https://qr61.cn/oVZJLW/q8otzaZ

White Paper Executive Summary

With the rapid socio-economic development, increase in life

expectancy, and the decline in fertility rates, China is gradually

transitioning into an “aging society“. China‘s population pyramid

is transitioning from a pyramid shape to a pillar shape. The silver

demographic (45+) is gradually becoming an important social

resource and consumer force. Currently, products and services

targeting the silver demographic are not yet fully mature,

presenting a substantial market potential for investment and

growth.

This White Paper, jointly released by QuantaSing Group and CIC,

provides an in-depth analysis of the current market conditions and

development potential of the silver economy in China in a

"People-Product-Place" Framework. The report focuses on key factors

and pain points of the silver economy, the current market

conditions and future trends of segmented products and services

markets, and the changes in purchase channels for the silver

demographic. Through extensive surveys of 5,710 respondents aged 45

and above, this paper has collected a large amount of data and

opinions, offering insights and conclusions for better

understanding and developing the silver economy.

“People” — The market size of the silver demographic

consumption continues to expand, with high quality and high value

becoming key factors.

Daily necessities: When purchasing daily

necessities, product quality is the most important factor for the

silver demographic, and poor product quality is also their biggest

pain point. For the silver demographic aged 45-64, they place

greater emphasis on brands. Manufacturers should prioritize brand

building alongside maintaining high standards of product quality,

competitive pricing, and functional appeal.

Healthcare service: Service quality is the most

important factor for the silver demographic when choosing

healthcare service. According to the survey, 81.9% of the silver

demographic report service quality as a key factor, far ahead of

other options. The silver demographic face issues like high prices,

low brand recognition, and poor service experience. Consumers under

65 primarily cite price issues and poor service experience.

Wellness products: Only 27.3% of the silver

demographic select price as the most important factor when

purchasing wellness products, while product quality, safety, and

efficacy are the top three considerations. Due to false advertising

by manufacturers and fraudulent practices by dishonest individuals,

the silver demographic has developed a profound sense of distrust

towards wellness products. Manufacturers of wellness products need

to improve product quality, enhance brand reputation, and

strengthen market education efforts.

Well-rounded life: Over half of the silver

demographic show preference for exercise, interest-based courses,

and travel. The silver demographic demonstrate a high willingness

to pay for a well-rounded life, indicating significant market

potential.

“Product” — Huge spending potential from the silver

demographic, highlights attractive market opportunities for

products and services catering to this demographic

Nutritional health products: Major concerns are

quality and safety (47%) and effectiveness (43%). There are

significant opportunities for growth in terms of brand recognition,

product quality, and customer service. Traditional Chinese medicine

health products have significant market potential given their

popularity among the silver demographic.

Baijiu: Baijiu is a highly social product in

China. In 2023, the scale of China’s baijiu industry exceeded

RMB750 billion, with the silver demographic accounting for more

than 30% of the market, highlighting a massive market

opportunity.

Online education: Learning is one of the

foremost ways for the silver demographic to stay engaged. Online

education for the silver demographic is not yet mature but has

clear advantages in convenience, course options and availability,

learning mobility, and lower costs, signaling huge market

potential. Health and wellness courses are the most popular

according to our survey, with 65% of respondents expressing a

desire for online education to include health and wellness

content.

Milk Powder: Higher sales growth rate of milk

powder for the silver demographic make this sector a key

competitive focus for dairy companies. Survey results show that

only 30.2% of respondents have purchased this product and 19.8% of

those who have never bought this product are either unaware of or

have never heard of it, highlighting the need for market education

and cultivating a consumer purchasing mindset.

Beauty and Skincare Products: Women in the

silver demographic are experiencing a lifestyle transition,

entering a phase where they have more time and money for leisure.

This leads to a resurgence in beauty awareness. Their demand for

beauty and skincare products is more complex and diverse. To

capitalize on growing market opportunities, brands must develop

tailored products and marketing strategies.

Tourism: The silver tourism industry in China

is still developing, with noticeable trends towards product

upgrades. Study tours that combine cultural elements with travel

are well suited to the preferences of the silver demographic.

China's silver tourism products lack diversity and are

discouragingly expensive. Despite this, the silver demographic

shows a strong desire to spend on travel.

“Place” — The potential of the silver demographic on

social media continues to be unleashed, with content e-commerce

platforms increasingly playing a crucial role.

The potential of the silver demographic on social

media: The silver demographic's presence on social media

is rapidly expanding. Platforms such as Douyin, other video-sharing

sites, as well as e-commerce platforms, are continuously attracting

this group through various means.

Channels for obtaining products and services for the

silver demographic: For the silver generation, accessing

products and services primarily revolves around traditional

e-commerce platforms and traditional offline stores in China. As an

emerging channel, content e-commerce platforms are currently a

preferred channel for 25.3% of the silver demographic.

Potential of content e-commerce platforms:

34.7% of the silver demographic aged 45-54 choose content

e-commerce platforms as one of their usual shopping channels, while

only 11.3% of those over 75 years old do so. As more seniors use

and become familiar with content e-commerce platforms, their

overall penetration rate will increase, providing momentum to the

development of these platforms.

Live-streaming e-commerce and silver demographic

influencers: Influencers are increasingly popular with the

silver demographic. Live broadcasts provide instant feedback and

interactivity, offering psychological comfort that satisfies basic

emotional needs. Also, Live e-commerce replaces traditional product

displays, meeting the silver demographic’s generally cautious and

skeptical approach toward product selection. Therefore, there is

significant potential for content e-commerce platforms among the

silver demographic.

About QuantaSing Group Limited

QuantaSing is a leading online service provider in China

dedicated to improving people’s quality of life and well-being by

providing lifelong personal learning and development opportunities.

The Company is the largest service provider in China’s online adult

learning market and China’s adult personal interest learning market

in terms of revenue, according to a report by Frost & Sullivan

based on data from 2022. By leveraging its proprietary tools and

technology, QuantaSing offers easy-to-understand, affordable, and

accessible online courses to adult learners, empowering users to

pursue personal development. Leveraging its extensive experience in

individual online learning services and its robust technology

infrastructure, the Company has expanded its services to corporate

clients, and diversified its operations into its e-commerce

business and its AI and technology business.

For more information, please visit:

https://ir.quantasing.com.

ContactLeah Guo, Investor RelationsQuantaSing Group

LimitedEmail: ir@quantasing.comTel: +86 (10) 6493-7857

Robin Yang, PartnerICR, LLCEmail: QuantaSing.IR@icrinc.com

Public RelationsBrad Burgess, Senior Vice PresidentICR,

LLCEmail: Brad.Burgess@icrinc.com

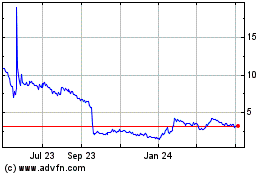

QuantaSing (NASDAQ:QSG)

Historical Stock Chart

From Feb 2025 to Mar 2025

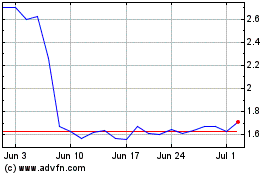

QuantaSing (NASDAQ:QSG)

Historical Stock Chart

From Mar 2024 to Mar 2025