Qifu Technology, Inc. (NASDAQ: QFIN; HKEx: 3660) (“Qifu Technology”

or the “Company”), a leading Credit-Tech platform in China, today

announced its unaudited financial results for the first quarter

ended March 31, 2024.

First Quarter 2024 Business

Highlights

- As of March 31, 2024, our platform

has connected 159 financial institutional partners and 241.4

million consumers*1 with potential credit needs, cumulatively, an

increase of 12.5% from 214.5 million a year ago.

- Cumulative users with approved

credit lines*2 were 52.3 million as of March 31, 2024, an increase

of 13.8% from 46.0 million as of March 31, 2023.

- Cumulative borrowers with

successful drawdown, including repeat borrowers were 31.2 million

as of March 31, 2024, an increase of 12.6% from 27.7 million as of

March 31, 2023.

- In the first quarter of 2024,

financial institutional partners originated 17,524,872 loans*3

through our platform. Total facilitation and origination loan

volume reached RMB99,237 million*4, a decrease of 9.3% from

RMB109,456 million in the same period of 2023.

- Out of those loans originated by

financial institutions, RMB60,506 million was under capital-light

model, Intelligence Credit Engine (“ICE”) and other technology

solutions*5, representing 61.0% of the total, a decrease of 1.4%

from RMB61,342 million in the same period of 2023.

- Total outstanding loan balance*6

was RMB169,920 million as of March 31, 2024, a decrease of 0.8%

from RMB171,302 million as of March 31, 2023.

- RMB107,597 million of such loan

balance was under capital-light model, “ICE” and other technology

solutions*7, an increase of 2.9% from RMB104,523 million as of

March 31, 2023.

- The weighted average contractual

tenor of loans originated by financial institutions across our

platform in the first quarter of 2024 was approximately 10.10

months, compared with 11.21 months in the same period of 2023.

- 90 day+ delinquency rate*8 of loans

originated by financial institutions across our platform was 3.35%

as of March 31, 2024.

- Repeat borrower contribution*9 of

loans originated by financial institutions across our platform for

the first quarter of 2024 was 91.5%.

1 Refers to cumulative registered users across

our platform.2 “Cumulative users with approved credit lines” refers

to the total number of users who had submitted their credit

applications and were approved with a credit line at the end of

each period.3 Including 3,449,001 loans across “V-pocket”, and

14,075,871 loans across other products.4 Refers to the total

principal amount of loans facilitated and originated during the

given period, including loan volume facilitated through

Intelligence Credit Engine (“ICE”) and other technology solutions.5

“ICE” is an open platform on our “360 Jietiao” APP, we match

borrowers and financial institutions through big data and cloud

computing technology on “ICE”, and provide pre-loan investigation

report of borrowers. For loans facilitated through “ICE”, the

Company does not bear principal risk. Loan facilitation volume

through “ICE” was RMB20,994 million in the first quarter of

2024.Under other technology solutions, we started to offer

financial institutions on-premise deployed, modular risk management

SaaS since 2021, which helps financial institution partners improve

credit assessment results. Since 2023, we started to offer

end-to-end technology solutions (“Total Solutions”) to financial

institutions based on on-premise deployment, SaaS or hybrid model.

Loan facilitation volume through other technology solutions was

RMB22,966 million in the first quarter of 2024, of which RMB513

million was through Total Solutions.6 “Total outstanding loan

balance” refers to the total amount of principal outstanding for

loans facilitated and originated at the end of each period,

including loan balance for “ICE” and other technology solutions,

excluding loans delinquent for more than 180 days.7 As of March 31,

2024, outstanding loan balance was RMB28,642 million for “ICE” and

RMB37,565 million for other technology solutions of which RMB610

million was for Total Solutions.8 “90 day+ delinquency rate” refers

to the outstanding principal balance of on- and off-balance sheet

loans that were 91 to 180 calendar days past due as a percentage of

the total outstanding principal balance of on- and off-balance

sheet loans across our platform as of a specific date. Loans that

are charged-off and loans under “ICE” and other technology

solutions are not included in the delinquency rate calculation.9

“Repeat borrower contribution” for a given period refers to (i) the

principal amount of loans borrowed during that period by borrowers

who had historically made at least one successful drawdown, divided

by (ii) the total loan facilitation and origination volume through

our platform during that period.

First Quarter 2024 Financial

Highlights

- Total net revenue was RMB4,153.2

million (US$575.2 million), compared to RMB3,599.2 million in the

same period of 2023.

- Income from operations was

RMB1,364.1 million (US$188.9 million), compared to RMB1,007.0

million in the same period of 2023.

- Non-GAAP*10 income from operations

was RMB1,408.7 million (US$195.1 million), compared to RMB1,053.5

million in the same period of 2023.

- Operating margin was 32.8%.

Non-GAAP operating margin was 33.9%.

- Net income was RMB1,160.1 million

(US$160.7 million), compared to RMB929.8 million in the same period

of 2023.

- Non-GAAP net income was RMB1,204.8

million (US$166.9 million), compared to RMB976.3 million in the

same period of 2023.

- Net income attributed to the

Company was RMB1,164.3 million (US$161.3 million), compared to

RMB934.1 million in the same period of 2023.

- Net income margin was 27.9%.

Non-GAAP net income margin was 29.0%.

- Net income per fully diluted

American depositary share (“ADS”) was RMB7.30 (US$1.02), compared

to RMB5.64 in the same period of 2023.

- Non-GAAP net income per fully

diluted ADS was RMB7.58 (US$1.05), compared to RMB5.92 in the same

period of 2023.

10 Non-GAAP income from operations, Non-GAAP net

income, Non-GAAP operating margin, Non-GAAP net income margin and

Non-GAAP net income per fully diluted ADS are Non-GAAP financial

measures. For more information on these Non-GAAP financial

measures, please see the section of “Use of Non-GAAP Financial

Measures Statement” and the table captioned “Unaudited

Reconciliations of GAAP and Non-GAAP Results” set forth at the end

of this press release.

Mr. Haisheng Wu, Chief Executive Officer and

Director of Qifu Technology, commented, “As macro-economic headwind

persisted in the first quarter, we continued to take a prudent

approach to manage our business and focus our effort on improving

the quality and profitability of our operations. With consistent

execution, we delivered another quarter of solid results.

During the quarter, we achieved better overall

return on our loan portfolio through improved cost efficiency and

optimized asset allocation. On balance sheet lending and ICE both

demonstrated strong growth momentum. The overall increased

contribution from non-credit risk bearing services helped us

mitigate some risks in a challenging environment. In the first

quarter, we reduced user acquisition costs through further

diversifying our user acquisition channels and deploying a prudent

user acquisition approach. Meanwhile, we continued to solidify our

relationship with financial institution partners. With the help of

strong ABS issuance, we significantly lowered overall funding costs

to another historic low.

Looking ahead, we intend to continue to take a

disciplined risk management approach in a still uncertain macro

environment, and further optimize our business mix to drive better

profitability and efficiency. We believe such effort will not only

help us better navigate through the current environment but also

position us well to capture long-term opportunities through new

platform models, enhanced products and collaborative

partnerships.”

“We are pleased to report another quarter of

strong financial results in an uncertain macro environment. Total

net revenue was RMB4.15 billion and Non-GAAP net income was RMB1.20

billion for the first quarter,” Mr. Alex Xu, Chief Financial

Officer, commented. “During the quarter, we generated approximately

RMB1.96 billion cash from operations, and total cash and cash

equivalent*11 was RMB8.32 billion at the quarter ending. Our strong

financial positions enable us to continue to generate healthy

returns to our shareholders through dividend and share repurchase.

We started to execute our 2024 share repurchase plan on April 1,

2024, at a pace faster than the time schedule thus far.”

Mr. Yan Zheng, Chief Risk Officer, added, “The

first quarter was still a challenging period for risk management as

economic uncertainties continued to impact some borrowers’ personal

finance conditions. However, as we took further actions to mitigate

the risks by reducing exposures to higher risk and longer duration

loans, driving more non-credit risk bearing services and optimizing

our collection operations, we started to see noticeable

improvements in the risk metrics of new loans facilitated in the

first quarter and modest improvements in key leading indicators of

overall loan portfolio. Day-1 delinquency rate*12 was 4.9% in the

first quarter, and 30-day collection rate*13 was 85.1%. Our prudent

actions are anticipated to lead to positive impacts on risk metrics

and we expect to see further gradual improvement throughout this

year.”

11 Including “Cash and cash equivalents”,

“Restricted cash”, and “Security deposit prepaid to third-party

guarantee companies”.12 “Day-1 delinquency rate” is defined as (i)

the total amount of principal that became overdue as of a specified

date, divided by (ii) the total amount of principal that was due

for repayment as of such specified date.13 “30-day collection rate”

is defined as (i) the amount of principal that was repaid in one

month among the total amount of principal that became overdue as of

a specified date, divided by (ii) the total amount of principal

that became overdue as of such specified date.

First Quarter 2024 Financial

Results

Total net revenue was

RMB4,153.2 million (US$575.2 million), compared to RMB3,599.2

million in the same period of 2023, and RMB4,495.5 million in the

prior quarter.

Net revenue from Credit Driven

Services was RMB3,016.3 million (US$417.8 million),

compared to RMB2,630.6 million in the same period of 2023, and

RMB3,248.3 million in the prior quarter.

Loan facilitation and servicing fees-capital

heavy were RMB243.8 million (US$33.8 million), compared to RMB311.2

million in the same period of 2023 and RMB481.2 million in the

prior quarter. The year-over-year and sequential decreases were

primarily due to the decreases in capital-heavy loan facilitation

volume.

Financing income*14 was RMB1,535.0 million

(US$212.6 million), compared to RMB1,065.9 million in the same

period of 2023 and RMB1,485.4 million in the prior quarter. The

year-over-year and sequential increases were primarily due to the

growth in average outstanding balance of the on-balance-sheet

loans.

Revenue from releasing of guarantee liabilities

was RMB1,166.0 million (US$161.5 million), compared to RMB1,209.8

million in the same period of 2023, and RMB1,211.8 million in the

prior quarter. The year-over-year and sequential decreases were

mainly due to the decreases in average outstanding balance of

off-balance-sheet capital-heavy loans during the period.

Other services fees were RMB71.5 million (US$9.9

million), compared to RMB43.8 million in the same period of 2023,

and RMB69.8 million in the prior quarter. The year-over-year and

sequential increases were mainly due to the increases in late

payment fees under the capital-heavy model.

Net revenue from Platform

Services was RMB1,136.9 million (US$157.5 million),

compared to RMB968.6 million in the same period of 2023 and

RMB1,247.2 million in the prior quarter.

Loan facilitation and servicing fees-capital

light were RMB502.7 million (US$69.6 million), compared to RMB765.3

million in the same period of 2023 and RMB697.0 million in the

prior quarter. The year-over-year and sequential decreases were

primarily due to the decreases in capital-light loan facilitation

volume.

Referral services fees were RMB548.8 million

(US$76.0 million), compared to RMB108.5 million in the same period

of 2023 and RMB446.5 million in the prior quarter. The

year-over-year and sequential increases were mainly due to the

increases in loan facilitation volume through ICE.

Other services fees were RMB85.4 million

(US$11.8 million), compared to RMB94.8 million in the same period

of 2023 and RMB103.8 million in the prior quarter.

Total operating costs and

expenses were RMB2,789.1 million (US$386.3 million),

compared to RMB2,592.1 million in the same period of 2023 and

RMB3,215.9 million in the prior quarter.

Facilitation, origination and servicing expenses

were RMB736.0 million (US$101.9 million), compared to RMB640.3

million in the same period of 2023 and RMB731.8 million in the

prior quarter. The year-over-year increase was primarily due to

higher collection fees.

Funding costs were RMB156.0 million (US$21.6

million), compared to RMB159.0 million in the same period of 2023

and RMB161.0 million in the prior quarter. The year-over-year and

sequential decreases were mainly due to the lower average cost of

ABSs, partially offset by the increased ABS issuance volume.

Sales and marketing expenses were RMB415.6

million (US$57.6 million), compared to RMB422.2 million in the same

period of 2023 and RMB551.6 million in the prior quarter. The

sequential decrease was primarily due to a more prudent customer

acquisition approach and lower unit customer acquisition cost.

General and administrative expenses were

RMB106.4 million (US$14.7 million), compared to RMB104.9 million in

the same period of 2023 and RMB108.0 million in the prior

quarter.

Provision for loans receivable was RMB847.9

million (US$117.4 million), compared to RMB518.9 million in the

same period of 2023 and RMB639.9 million in the prior quarter. The

year-over-year and sequential increases were mainly due to the

growth in loan origination volume of on-balance-sheet loans and

reflected the Company’s consistent approach in assessing provisions

commensurate with its underlying loan profile.

Provision for financial assets receivable was

RMB99.0 million (US$13.7 million), compared to RMB68.8 million in

the same period of 2023 and RMB148.2 million in the prior quarter.

The year-over-year and sequential changes reflected the Company’s

consistent approach in assessing provisions commensurate with its

underlying loan profile. In addition, the sequential decline was

partially due to a decrease in capital-heavy loan facilitation

volume.

Provision for accounts receivable and contract

assets was RMB111.5 million (US$15.4 million), compared to RMB-2.2

million in the same period of 2023 and RMB91.1 million in the prior

quarter. The year-over-year and sequential changes reflected the

Company’s consistent approach in assessing provisions commensurate

with its underlying loan profile.

Provision for contingent liability was RMB316.7

million (US$43.9 million), compared to RMB680.3 million in the same

period of 2023 and RMB784.3 million in the prior quarter. The

year-over-year and sequential decreases were primarily due to the

decreases in capital-heavy loan facilitation volume and reflected

the Company’s consistent approach in assessing provisions

commensurate with its underlying loan profile.

Income from operations was

RMB1,364.1 million (US$188.9 million), compared to RMB1,007.0

million in the same period of 2023 and RMB1,279.6 million in the

prior quarter.

Non-GAAP income from operations

was RMB1,408.7 million (US$195.1 million), compared to RMB1,053.5

million in the same period of 2023 and RMB1,322.1 million in the

prior quarter.

Operating margin was 32.8%.

Non-GAAP operating margin was 33.9%.

Income before income tax

expense was RMB1,526.2 million (US$211.4 million),

compared to RMB1,102.1 million in the same period of 2023 and

RMB1,330.9 million in the prior quarter.

Net income was RMB1,160.1

million (US$160.7 million), compared to RMB929.8 million in the

same period of 2023 and RMB1,107.7 million in the prior

quarter.

Non-GAAP net income was

RMB1,204.8 million (US$166.9 million), compared to RMB976.3 million

in the same period of 2023 and RMB1,150.3 million in the prior

quarter.

Net income margin was 27.9%.

Non-GAAP net income margin was 29.0%.

Net income attributed to the

Company was RMB1,164.3 million (US$161.3 million),

compared to RMB934.1 million in the same period of 2023 and

RMB1,111.7 million in the prior quarter.

Non-GAAP net income

attributed to the Company was RMB1,208.9 million

(US$167.4 million), compared to RMB980.6 million in the same period

of 2023 and RMB1,154.3 million in the prior quarter.

Net income per fully diluted

ADS was RMB7.30 (US$1.02), compared to RMB5.64 in the same

period of 2023 and RMB6.88 in the prior quarter.

Non-GAAP net income per fully diluted

ADS was RMB7.58 (US$1.05), compared to RMB5.92 in the same

period of 2023 and RMB7.14 in the prior quarter.

Weighted average basic ADS used in

calculating GAAP and Non-GAAP net income per ADS was

156.01 million.

Weighted average diluted ADS used in

calculating GAAP and Non-GAAP net income per ADS was

159.46 million.

14 “Financing income” is generated from loans

facilitated through the Company’s platform funded by the

consolidated trusts and Fuzhou Microcredit, which charge fees and

interests from borrowers.

30 Day+ Delinquency Rate by Vintage and

180 Day+ Delinquency Rate by Vintage

The following charts and tables display the

historical cumulative 30 day+ delinquency rates by loan

facilitation and origination vintage and 180 day+ delinquency rates

by loan facilitation and origination vintage for all loans

facilitated and originated through the Company’s platform. Loans

under “ICE” and other technology solutions are not included in the

30 day+ charts and the 180 day+ charts:

http://ml.globenewswire.com/Resource/Download/515bcc02-f6aa-4eb1-81d7-d85a47aface0

http://ml.globenewswire.com/Resource/Download/b557ea28-4411-477f-8e78-c330d00db361

Update on Share Repurchase

On June 20, 2023, the Company announced a share

repurchase plan (the “2023 Share Repurchase Plan”) whereby the

Company is authorized to repurchase its ADSs or Class A ordinary

shares with an aggregate value of up to US$150 million during the

12-month period from June 20, 2023. As of March 28, 2024, the

Company had utilized substantially all of the total authorized

value of the 2023 Share Repurchase Plan.

On March 12, 2024, the board of directors

approved a new share repurchase plan (the “2024 Share Repurchase

Plan”) whereby the Company is authorized to repurchase its ADSs or

Class A ordinary shares with an aggregate value of up to US$350

million during the 12-month period from April 1, 2024.

As of May 17, 2024, the Company had in aggregate

purchased approximately 3.4 million ADSs in the open market for a

total amount of approximately US$65 million (inclusive of

commissions) at an average price of US$19.3 per ADS pursuant to the

2024 Share Repurchase Plan.

Business Outlook

As macro-economic uncertainties continue to

create headwinds to its operations, the Company intends to maintain

a prudent approach in its business planning. The management will

continue to purposely trim exposure to under-performing assets and

focus on enhancing the profitability and efficiency of the

Company’s operations. As such, for the second quarter of 2024, the

Company expects to generate a net income between RMB1.17 billion

and RMB1.23 billion, representing a year-on-year growth between

7.0% and 12.5% and a non-GAAP net income*15 between RMB1.22 billion

and RMB1.28 billion, representing a year-on-year growth between

6.4% and 11.6%. This outlook reflects the Company’s current and

preliminary views, which is subject to material changes.

15 Non-GAAP net income represents net income

excluding share-based compensation expenses.

Conference Call

Preregistration

Qifu Technology’s management team will host an

earnings conference call at 7:30 AM U.S. Eastern Time on Monday,

May 20, 2024 (7:30 PM Beijing Time on Monday, May 20, 2024).

All participants wishing to join the conference

call must pre-register online using the link provided below.

Registration Link:

https://register.vevent.com/register/BI2bd17921325e423580dfcbdbe67c05d4

Upon registration, each participant will receive

details for the conference call, including dial-in numbers and a

unique access PIN. Please dial in 10 minutes before the call is

scheduled to begin.

Additionally, a live and archived webcast of the

conference call will be available on the Investor Relations section

of the Company’s website at https://ir.qifu.tech.

About Qifu Technology

Qifu Technology is a leading Credit-Tech

platform in China that provides a comprehensive suite of technology

services to assist financial institutions and consumers and SMEs in

the loan lifecycle, ranging from borrower acquisition, preliminary

credit assessment, fund matching and post-facilitation services.

The Company is dedicated to making credit services more accessible

and personalized to consumers and SMEs through Credit-Tech services

to financial institutions.

For more information, please visit:

https://ir.qifu.tech.

Use of Non-GAAP Financial Measures

Statement

To supplement our financial results presented in

accordance with U.S. GAAP, we use Non-GAAP financial measure, which

is adjusted from results based on U.S. GAAP to exclude share-based

compensation expenses. Reconciliations of our Non-GAAP financial

measures to our U.S. GAAP financial measures are set forth in

tables at the end of this earnings release, which provide more

details on the Non-GAAP financial measures.

We use Non-GAAP income from operation, Non-GAAP

operating margin, Non-GAAP net income, Non-GAAP net income margin,

Non-GAAP net income attributed to the Company and Non-GAAP net

income per fully diluted ADS in evaluating our operating results

and for financial and operational decision-making purposes.

Non-GAAP income from operation represents income from operation

excluding share-based compensation expenses. Non-GAAP operating

margin is equal to Non-GAAP income from operation divided by total

net revenue. Non-GAAP net income represents net income excluding

share-based compensation expenses. Non-GAAP net income margin is

equal to Non-GAAP net income divided by total net revenue. Non-GAAP

net income attributed to the Company represents net income

attributed to the Company excluding share-based compensation

expenses. Non-GAAP net income per fully diluted ADS represents net

income excluding share-based compensation expenses per fully

diluted ADS. Such adjustments have no impact on income tax. We

believe that Non-GAAP income from operation, Non-GAAP operating

margin, Non-GAAP net income, Non-GAAP net income margin, Non-GAAP

net income attributed to the Company and Non-GAAP net income per

fully diluted ADS help identify underlying trends in our business

that could otherwise be distorted by the effect of certain expenses

that we include in results based on U.S. GAAP. We believe that

Non-GAAP income from operation and Non-GAAP net income provide

useful information about our operating results, enhance the overall

understanding of our past performance and future prospects and

allow for greater visibility with respect to key metrics used by

our management in its financial and operational decision-making.

Our Non-GAAP financial information should be considered in addition

to results prepared in accordance with U.S. GAAP, but should not be

considered a substitute for or superior to U.S. GAAP results. In

addition, our calculation of Non-GAAP financial information may be

different from the calculation used by other companies, and

therefore comparability may be limited.

Exchange Rate Information

This announcement contains translations of

certain RMB amounts into U.S. dollars at specified rates solely for

the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars are made at a rate of

RMB7.2203 to US$1.00, the exchange rate set forth in the H.10

statistical release of the Board of Governors of the Federal

Reserve System as of March 29, 2024.

Safe Harbor Statement

Any forward-looking statements contained in this

announcement are made under the “safe harbor” provisions of the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar statements. Among other things,

the business outlook and quotations from management in this

announcement, as well as the Company’s strategic and operational

plans, contain forward-looking statements. Qifu Technology may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (“SEC”), in

announcements made on the website of The Stock Exchange of Hong

Kong Limited (the “Hong Kong Stock Exchange”), in its annual report

to shareholders, in press releases and other written materials and

in oral statements made by its officers, directors or employees to

third parties. Statements that are not historical facts, including

the Company’s business outlook, beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, which factors include but not limited to

the following: the Company’s growth strategies, the Company’s

cooperation with 360 Group, changes in laws, rules and regulatory

environments, the recognition of the Company’s brand, market

acceptance of the Company’s products and services, trends and

developments in the credit-tech industry, governmental policies

relating to the credit-tech industry, general economic conditions

in China and around the globe, and assumptions underlying or

related to any of the foregoing. Further information regarding

these and other risks and uncertainties is included in Qifu

Technology’s filings with the SEC and announcements on the website

of the Hong Kong Stock Exchange. All information provided in this

press release is as of the date of this press release, and Qifu

Technology does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

For more information, please

contact:

Qifu

Technology E-mail:

ir@360shuke.com

|

Unaudited Condensed Consolidated Balance

Sheets |

|

(Amounts in thousands of Renminbi ("RMB") and U.S. dollars

("USD")except for number of shares and per share data, or otherwise

noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

March 31, |

March 31, |

|

|

|

2023 |

2024 |

2024 |

|

|

|

RMB |

RMB |

USD |

|

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

4,177,890 |

5,301,288 |

734,220 |

|

|

Restricted cash |

3,381,107 |

2,855,305 |

395,455 |

|

|

Short term investments |

15,000 |

15,000 |

2,077 |

|

|

Security deposit prepaid to third-party guarantee companies |

207,071 |

166,622 |

23,077 |

|

|

Funds receivable from third party payment service providers |

1,603,419 |

1,218,797 |

168,801 |

|

|

Accounts receivable and contract assets, net |

2,909,245 |

2,777,867 |

384,730 |

|

|

Financial assets receivable, net |

2,522,543 |

1,890,151 |

261,783 |

|

|

Amounts due from related parties |

45,346 |

25,253 |

3,498 |

|

|

Loans receivable, net |

24,604,487 |

27,060,541 |

3,747,842 |

|

|

Prepaid expenses and other assets |

329,920 |

505,508 |

70,012 |

|

|

Total current assets |

39,796,028 |

41,816,332 |

5,791,495 |

|

|

Non-current assets: |

|

|

|

|

|

Accounts receivable and contract assets, net-noncurrent |

146,995 |

79,453 |

11,004 |

|

|

Financial assets receivable, net-noncurrent |

596,330 |

391,099 |

54,167 |

|

|

Amounts due from related parties |

4,240 |

1,677 |

232 |

|

|

Loans receivable, net-noncurrent |

2,898,005 |

2,692,041 |

372,843 |

|

|

Property and equipment, net |

231,221 |

256,724 |

35,556 |

|

|

Land use rights, net |

977,461 |

972,280 |

134,659 |

|

|

Intangible assets |

13,443 |

12,899 |

1,786 |

|

|

Goodwill |

41,210 |

41,210 |

5,708 |

|

|

Deferred tax assets |

1,067,738 |

1,106,355 |

153,228 |

|

|

Other non-current assets |

45,901 |

56,448 |

7,818 |

|

|

Total non-current assets |

6,022,544 |

5,610,186 |

777,001 |

|

|

TOTAL ASSETS |

45,818,572 |

47,426,518 |

6,568,496 |

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Payable to investors of the consolidated trusts-current |

8,942,291 |

9,633,321 |

1,334,200 |

|

|

Accrued expenses and other current liabilities |

2,016,039 |

2,537,055 |

351,378 |

|

|

Amounts due to related parties |

80,376 |

41,974 |

5,813 |

|

|

Short term loans |

798,586 |

683,804 |

94,706 |

|

|

Guarantee liabilities-stand ready |

3,949,601 |

3,198,783 |

443,026 |

|

|

Guarantee liabilities-contingent |

3,207,264 |

2,676,826 |

370,736 |

|

|

Income tax payable |

742,210 |

848,222 |

117,477 |

|

|

Other tax payable |

163,252 |

145,701 |

20,179 |

|

|

Total current liabilities |

19,899,619 |

19,765,686 |

2,737,515 |

|

|

Non-current liabilities: |

|

|

|

|

|

Deferred tax liabilities |

224,823 |

193,892 |

26,854 |

|

|

Payable to investors of the consolidated trusts-noncurrent |

3,581,800 |

5,154,600 |

713,904 |

|

|

Other long-term liabilities |

102,473 |

171,128 |

23,701 |

|

|

Total non-current liabilities |

3,909,096 |

5,519,620 |

764,459 |

|

|

TOTAL LIABILITIES |

23,808,715 |

25,285,306 |

3,501,974 |

|

|

TOTAL QIFU TECHNOLOGY INC EQUITY |

21,937,483 |

22,072,981 |

3,057,072 |

|

|

Noncontrolling interests |

72,374 |

68,231 |

9,450 |

|

|

TOTAL EQUITY |

22,009,857 |

22,141,212 |

3,066,522 |

|

|

TOTAL LIABILITIES AND EQUITY |

45,818,572 |

47,426,518 |

6,568,496 |

|

| |

|

|

|

|

| Unaudited

Condensed Consolidated Statements of Operations |

| (Amounts in

thousands of Renminbi ("RMB") and U.S. dollars ("USD")except for

number of shares and per share data, or otherwise noted) |

| |

|

|

|

|

| |

Three months ended March 31, |

|

|

|

2023 |

2024 |

2024 |

|

|

|

RMB |

RMB |

USD |

|

|

Credit driven services |

2,630,621 |

|

3,016,282 |

|

417,750 |

|

|

|

Loan facilitation and servicing

fees-capital heavy |

311,164 |

|

243,766 |

|

33,761 |

|

|

|

Financing income |

1,065,882 |

|

1,534,986 |

|

212,593 |

|

|

|

Revenue from releasing of guarantee

liabilities |

1,209,820 |

|

1,166,018 |

|

161,492 |

|

|

|

Other services fees |

43,755 |

|

71,512 |

|

9,904 |

|

|

|

Platform services |

968,553 |

|

1,136,901 |

|

157,459 |

|

|

|

Loan facilitation and servicing

fees-capital light |

765,280 |

|

502,715 |

|

69,625 |

|

|

|

Referral services fees |

108,476 |

|

548,824 |

|

76,011 |

|

|

|

Other services fees |

94,797 |

|

85,362 |

|

11,823 |

|

|

|

Total net revenue |

3,599,174 |

|

4,153,183 |

|

575,209 |

|

|

|

Facilitation, origination and

servicing |

640,341 |

|

736,026 |

|

101,938 |

|

|

|

Funding costs |

159,023 |

|

155,963 |

|

21,601 |

|

|

|

Sales and marketing |

422,177 |

|

415,617 |

|

57,562 |

|

|

|

General and administrative |

104,889 |

|

106,415 |

|

14,738 |

|

|

|

Provision for loans receivable |

518,864 |

|

847,921 |

|

117,436 |

|

|

|

Provision for financial assets

receivable |

68,752 |

|

99,003 |

|

13,712 |

|

|

|

Provision for accounts receivable and

contract assets |

(2,236 |

) |

111,473 |

|

15,439 |

|

|

|

Provision for contingent liabilities |

680,334 |

|

316,664 |

|

43,857 |

|

|

|

Total operating costs and expenses |

2,592,144 |

|

2,789,082 |

|

386,283 |

|

|

|

Income from operations |

1,007,030 |

|

1,364,101 |

|

188,926 |

|

|

|

Interest income, net |

64,770 |

|

50,058 |

|

6,933 |

|

|

|

Foreign exchange gain |

6,149 |

|

82 |

|

11 |

|

|

|

Other income, net |

24,164 |

|

111,968 |

|

15,507 |

|

|

|

Investment loss |

- |

|

- |

|

- |

|

|

|

Income before income tax expense |

1,102,113 |

|

1,526,209 |

|

211,377 |

|

|

|

Income taxes expense |

(172,291 |

) |

(366,065 |

) |

(50,699 |

) |

|

| Net

income |

929,822 |

|

1,160,144 |

|

160,678 |

|

|

|

Net loss attributable to noncontrolling

interests |

4,287 |

|

4,143 |

|

574 |

|

|

| Net

income attributable to ordinary shareholders of the

Company |

934,109 |

|

1,164,287 |

|

161,252 |

|

|

|

Net income per ordinary share attributable to ordinary shareholders

of Qifu Technology, Inc. |

| Basic |

2.89 |

|

3.73 |

|

0.52 |

|

|

| Diluted |

2.82 |

|

3.65 |

|

0.51 |

|

|

| |

|

|

|

|

|

Net income per ADS attributable to ordinary shareholders of Qifu

Technology, Inc. |

| Basic |

5.78 |

|

7.46 |

|

1.04 |

|

|

| Diluted |

5.64 |

|

7.30 |

|

1.02 |

|

|

| |

|

|

|

|

|

Weighted average shares used in calculating net income per ordinary

share |

|

| Basic |

322,859,462 |

|

312,027,192 |

|

312,027,192 |

|

|

| Diluted |

331,219,266 |

|

318,915,157 |

|

318,915,157 |

|

|

| |

|

|

|

|

|

Unaudited Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in thousands of Renminbi ("RMB") and U.S. dollars

("USD")except for number of shares and per share data, or otherwise

noted) |

| |

|

|

|

|

|

|

Three months ended March 31, |

|

|

|

2023 |

2024 |

2024 |

|

|

|

RMB |

RMB |

USD |

|

|

Net cash provided by operating activities |

1,761,091 |

|

1,958,267 |

|

271,217 |

|

|

|

Net cash used in investing activities |

(3,564,207 |

) |

(3,138,175 |

) |

(434,632 |

) |

|

|

Net cash provided by financing activities |

38,940 |

|

1,775,409 |

|

245,891 |

|

|

|

Effect of foreign exchange rate changes |

(2,843 |

) |

2,095 |

|

290 |

|

|

|

Net (decrease) increase in cash and cash equivalents |

(1,767,019 |

) |

597,596 |

|

82,766 |

|

|

|

Cash, cash equivalents, and restricted cash, beginning of

period |

10,512,363 |

|

7,558,997 |

|

1,046,909 |

|

|

|

Cash, cash equivalents, and restricted cash, end of period |

8,745,344 |

|

8,156,593 |

|

1,129,675 |

|

|

|

|

|

|

|

|

|

Unaudited Condensed Consolidated Statements of

Comprehensive (Loss)/Income |

|

|

(Amounts in thousands of Renminbi ("RMB") and U.S. dollars

("USD")except for number of shares and per share data, or otherwise

noted) |

|

|

|

|

|

|

|

|

|

Three months ended March 31, |

|

|

|

2023 |

2024 |

2024 |

|

|

|

RMB |

RMB |

USD |

|

|

Net income |

929,822 |

|

1,160,144 |

160,678 |

|

|

Other comprehensive income, net of tax of nil: |

|

|

|

|

|

Foreign currency translation adjustment |

(2,808 |

) |

2,010 |

278 |

|

|

Other comprehensive (loss) income |

(2,808 |

) |

2,010 |

278 |

|

|

Total comprehensive income |

927,014 |

|

1,162,154 |

160,956 |

|

|

Comprehensive loss attributable to noncontrolling interests |

4,287 |

|

4,143 |

574 |

|

|

Comprehensive income attributable to ordinary

shareholders |

931,301 |

|

1,166,297 |

161,530 |

|

|

|

|

|

|

|

|

Unaudited Reconciliations of GAAP and Non-GAAP

Results |

|

(Amounts in thousands of Renminbi ("RMB") and U.S. dollars

("USD")except for number of shares and per share data, or otherwise

noted) |

|

|

|

|

|

|

|

|

Three months ended March 31, |

|

|

2023 |

2024 |

2024 |

| |

RMB |

RMB |

USD |

|

Reconciliation of Non-GAAP Net Income to Net

Income |

|

|

|

|

|

Net income |

929,822 |

|

1,160,144 |

|

160,678 |

|

|

Add: Share-based compensation expenses |

46,496 |

|

44,645 |

|

6,183 |

|

|

Non-GAAP net income |

976,318 |

|

1,204,789 |

|

166,861 |

|

|

GAAP net income margin |

25.8 |

% |

27.9 |

% |

|

|

|

Non-GAAP net income margin |

27.1 |

% |

29.0 |

% |

|

|

|

|

|

|

|

|

|

Net income attributable to shareholders of Qifu Technology,

Inc. |

934,109 |

|

1,164,287 |

|

161,252 |

|

|

Add: Share-based compensation expenses |

46,496 |

|

44,645 |

|

6,183 |

|

|

Non-GAAP net income attributable to shareholders of Qifu

Technology, Inc. |

980,605 |

|

1,208,932 |

|

167,435 |

|

|

Weighted average ADS used in calculating net income per ordinary

share for both GAAP and non-GAAP EPS -diluted |

165,609,633 |

|

159,457,579 |

|

159,457,579 |

|

|

Net income per ADS attributable to ordinary shareholders of Qifu

Technology, Inc. -diluted |

5.64 |

|

7.30 |

|

1.02 |

|

|

Non-GAAP net income per ADS attributable to ordinary shareholders

of Qifu Technology, Inc. -diluted |

5.92 |

|

7.58 |

|

1.05 |

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Income from operations to Income

from operations |

|

|

|

|

|

Income from operations |

1,007,030 |

|

1,364,101 |

|

188,926 |

|

|

Add: Share-based compensation expenses |

46,496 |

|

44,645 |

|

6,183 |

|

|

Non-GAAP Income from operations |

1,053,526 |

|

1,408,746 |

|

195,109 |

|

|

GAAP operating margin |

28.0 |

% |

32.8 |

% |

|

|

|

Non-GAAP operating margin |

29.3 |

% |

33.9 |

% |

|

|

|

|

|

|

|

|

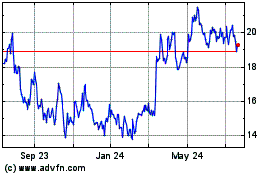

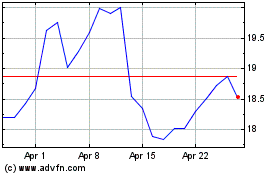

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Dec 2023 to Dec 2024