Form 8-K/A - Current report: [Amend]

August 22 2024 - 6:07AM

Edgar (US Regulatory)

true

0000868278

0000868278

2024-08-15

2024-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 15, 2024

PROPHASE

LABS, INC.

(Exact

name of Company as specified in its charter)

| Delaware |

|

000-21617 |

|

23-2577138

|

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

711

Stewart Avenue, Suite 200

Garden

City, New York |

|

11530 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (215) 345-0919

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any

of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered Pursuant to Section 12(b) of the Exchange Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.0005 |

|

PRPH |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

Note

ProPhase

Labs, Inc. (the “Company”) is filing this Amendment No. 1 on Form 8-K/A (the “Amendment”) solely to include

the disclosure of $16.1 million in working capital as of June 30, 2024 to the risk factor disclosed under Item 8.01 of its Current

Report on Form 8-K as filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 21, 2024 (the “Original

Report”). Item 8.01 of the Original Report is amended and restated in its entirety as set out below. No other items or disclosures

in the Original Report are being amended; however, this Amendment hereby restates and supersedes in its entirety the disclosures included

in the Original Report.

Item

1.01. Entry into a Material Definitive Agreement.

On

August 15, 2024, the Company issued an Amended and Restated Unsecured Promissory Note and Guaranty (the “Note”) for an aggregate

principal amount of $10.0 million to JXVII Trust (“JXVII”), that supersedes, terminates, restates, replaces, and amends the

Unsecured Promissory Note And Guaranty, dated as of January 26, 2023, for an aggregate principal amount of $7.6 million issued to JXVII

that was previously disclosed pursuant to a Form 8-K filed by the Company on January 30, 2023. The Note is due and payable on August

15, 2027, the third anniversary of August 15, 2024, the date on which the Note was funded (the “Closing Date”), and accrues

interest at a rate of 15% per year from the Closing Date, payable on a quarterly basis, until the Note is repaid in full. The Company

has the right to prepay the Note at any time after the Closing Date and prior to the maturity date without premium or penalty upon providing

seven days’ written notice to JXVII.

The

Note contains customary events of default. If a default occurs and is not cured within the applicable cure period or is not waived, any

outstanding obligations under the Note may be accelerated. The Note requires the Company to use proceeds from any divestment of assets

(other than in the ordinary course) for general working capital purposes and prohibits the Company from distributing or reinvesting such

proceeds without the prior approval of JXVII, subject to certain exceptions.

The

Company intends to use the proceeds from the Note for working capital and general corporate purposes, which may include capital expenditures,

product development and commercialization expenditures, and acquisitions of companies, businesses, technologies and products within and

outside the consumer products industry.

The

foregoing description of the Note does not purport to be complete and is subject to, and is qualified in its entirety by reference to,

the full text of the Note, which is attached as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

disclosure provided in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

Item

8.01. Other Events.

The

Company is supplementing the Company’s risk factors in its Annual Report on Form 10-K filed with the SEC on March 29, 2024, and

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, filed with the SEC on May 10, 2024 and August

14, 2024, respectively, with the risk factor set forth below.

Servicing

our debt will require a significant amount of cash, and we may not have sufficient cash flow from our business to pay our debt.

Our

ability to make scheduled payments of the principal of, to pay interest on or to refinance our indebtedness depends on our future performance,

which is subject to economic, financial, competitive and other factors beyond our control. We had, as of June 30, 2024, approximately

(i) $16.1 million in working capital, (ii) $2.4 million in cash and cash equivalents, and (iii) $13.6 million of outstanding indebtedness,

net of discounts. In addition, on August 15, 2024, we amended and restated the unsecured promissory note and guaranty previously

issued to JXVII Trust that increased the principal amount from $7.6 million to $10.0 million. Our business may not generate cash flow

from operations in the future sufficient to service our debt obligations and make necessary capital expenditures. If we are unable to

generate such cash flow, we may be required to adopt one or more alternatives, such as selling assets, restructuring debt or obtaining

additional equity capital on terms that may be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the

capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these

activities on desirable terms, which could result in a default on our debt obligations.

Item

9.01. Financial Statements and Exhibits.

| * |

Certain portions of this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(6) promulgated under the Exchange Act of

1934, as amended. The Company agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request. |

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

ProPhase

Labs, Inc. |

| |

|

|

| |

By: |

/s/

Ted Karkus |

| |

|

Ted

Karkus |

| |

|

Chief

Executive Officer |

| |

|

|

| Date:

August 22, 2024 |

|

|

v3.24.2.u1

Cover

|

Aug. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

ProPhase

Labs, Inc. (the “Company”) is filing this Amendment No. 1 on Form 8-K/A (the “Amendment”) solely to include

the disclosure of $16.1 million in working capital as of June 30, 2024 to the risk factor disclosed under Item 8.01 of its Current

Report on Form 8-K as filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 21, 2024 (the “Original

Report”). Item 8.01 of the Original Report is amended and restated in its entirety as set out below. No other items or disclosures

in the Original Report are being amended; however, this Amendment hereby restates and supersedes in its entirety the disclosures included

in the Original Report.

|

| Document Period End Date |

Aug. 15, 2024

|

| Entity File Number |

000-21617

|

| Entity Registrant Name |

PROPHASE

LABS, INC.

|

| Entity Central Index Key |

0000868278

|

| Entity Tax Identification Number |

23-2577138

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

711

Stewart Avenue

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Garden

City

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11530

|

| City Area Code |

(215)

|

| Local Phone Number |

345-0919

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0005

|

| Trading Symbol |

PRPH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

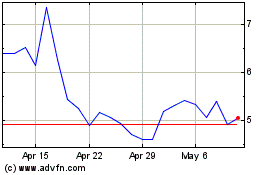

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Jul 2024 to Aug 2024

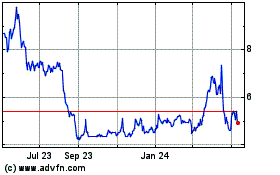

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Aug 2023 to Aug 2024