false

0001325670

0001325670

2025-01-28

2025-01-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 28, 2025

Primis Financial Corp.

(Exact Name of Registrant

as Specified in its Charter)

| Virginia |

001-33037 |

20-1417448 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

1676

International Drive, Suite 900, McLean, Virginia 22102

(Address of Principal Executive Offices) (Zip Code)

(703) 893-7400

(Registrant's telephone number, including area

code)

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| COMMON STOCK |

|

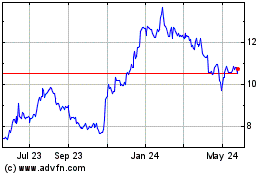

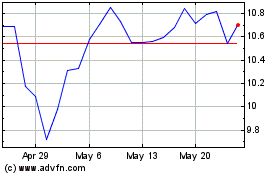

FRST |

|

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On January 28, 2025, Primis Financial Corp. (“Primis”

or the “Company”) issued a press release announcing its financial results for the period ended December 31, 2024.

A copy of the press release is furnished and attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and incorporated

herein by reference.

Item 7.01. Regulation FD Disclosure.

The Company has prepared presentation materials

(the “Investor Presentation”) that management intends to use from time to time hereafter in presentations about the Company’s

operations and performance. The Company may use the Investor Presentation, possibly with modifications, in presentations to current and

potential investors, analysts, lenders, business partners, acquisition candidates, customers, employees and others with an interest in

the Company and its business.

A

copy of the Investor Presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein

by reference. The Investor Presentation is also available on the Company's website at www.primisbank.com. Materials on the Company’s

website are not part of or incorporated by reference into this report.

In accordance with General Instruction B.2 of

Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 attached hereto, shall not be

deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any filing under the

Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On January 28, 2025, Primis issued a press

release announcing the declaration of a dividend payable on February 26, 2025 to shareholders of record as of February 12, 2025.

A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release dated January 28, 2025

99.2 Primis Financial Corp. Fourth Quarter 2024 Investor Presentation

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Primis Financial Corp. |

| |

|

|

| Date: January 28, 2025 |

By: |

/s/ Matthew A. Switzer |

| |

|

Matthew A. Switzer |

| |

|

Chief Financial Officer |

Exhibit 99.1

Primis Financial Corp. Reports Earnings per

Share for the Fourth Quarter of 2024

Declares Quarterly Cash Dividend of $0.10 Per

Share

For immediate release

Tuesday, January 28, 2025

McLean, Virginia, January 28, 2025 –

Primis Financial Corp. (NASDAQ: FRST) (“Primis” or the “Company”), and its wholly-owned subsidiary, Primis Bank

(the “Bank”), today reported a net loss available to common shareholders of $14.7 million or $0.59 loss per basic and diluted

share for the quarter ended December 31, 2024, compared to a net loss available to common shareholders of $8.2 million or $0.33 loss

per basic and diluted share for the quarter ended December 31, 2023. For the full year of 2024, the Company reported a net loss available

to common shareholders and loss per basic and diluted share of $7.5 million and $0.31, respectively, compared to a loss of $7.8 million

and $0.32, respectively, in 2023. Earnings for the three month and year-to-date periods of 2024 are highly affected by the Company’s

decision to move a third-party originated consumer loan portfolio to held for sale in the fourth quarter of 2024 as described further

below.

Strategic Options to Maximize Value

Dennis J. Zember, Jr., President and Chief

Executive Officer of Primis commented, “In the fourth quarter of 2024, we made several moves that were costly, but should better

position the Company to maximize its strategic value. These moves in the current quarter include neutralizing the credit impacts of the

consumer loan book by moving the majority of it to held for sale with substantial marks. Additionally, we sold our Life Premium Finance

business and launched a meaningful mortgage warehouse lending business that should add up to 15 basis points of additional return on assets

once it reaches scale in 2025.”

With the third-party consumer book marked, the

Company is exploring various avenues to maximize its shareholder value. These include decisions needed to drive higher earnings and operating

results that should no longer be overshadowed by the consumer portfolio's credit costs. Secondly, a more determined effort to highlight

the value and opportunity in the core community bank with its funding advantage and growth opportunities. Lastly, moving to deconsolidate

Panacea Financial Holdings and realize the economic gain which management believes has improved substantially since the unrealized $19.6

million market value at December 31, 2023. Other avenues are being explored alongside these operating strategies that would accelerate

the recognition of unrealized market value in the Company.

Strategic Repositioning

The Company spent substantial time and energy

in 2024 focusing the organization toward business lines it believes can drive the greatest long-term profitability and growth. Activities

included continued moves to enhance operating leverage in the core bank, lender recruitment and scaling in mortgage, relieving balance

sheet pressure through the sale of Life Premium Finance, leveraging existing infrastructure to expand the mortgage warehouse lending division

and neutralizing the credit cost impact of the third-party consumer loan program. The result of these moves is a significantly more focused

organization comprised of:

| · | A core community bank in strong markets with

$2.2 billion of low-cost customer deposits and low commercial real estate concentrations; |

| · | A retail mortgage company that has grown in the

face of industry pressures, reaching approximately $800 million of production in 2024 and poised to reach approximately $1.25 billion

of production in 2025; |

| · | A national strategy that combines lower risk

mortgage warehouse and construction-to-perm lending funded by a unique digital platform; and |

| · | The nation’s leading healthcare-focused

financial services brand in Panacea Financial whose already out-sized growth continues to accelerate and the market value of which is

not reflected in the Company’s capital. |

The following discussion highlights the near-term

opportunity for each of these strategies.

Core Community Bank

The core bank has 24 banking offices in Virginia

and Maryland and finished 2024 with $2.2 billion of customer deposits. The core bank’s cost of deposits of 1.87% at 2024 year-end

is lower than most of its larger regional bank competitors and up to 100 basis points lower than equal sized peers in the greater Washington,

D.C. region. The Bank’s proprietary V1BE service directly supports approximately $200 million of checking accounts and is driving

growth in new relationships focused on commercial and consumer checking accounts.

The Bank has reorganized its lending team and

added selective hires in key markets. Early signs of success from these efforts can be found in the loan pipeline which ended 2024 at

approximately $119 million with 88% of that amount representing new customers to the Bank versus $51 million and 21%, respectively, at

the end of 2023. The Bank’s loan portfolio is diversified across the footprint and is well below regulatory concentration limits

for commercial real estate.

Primis Mortgage

Primis Mortgage earned approximately $2.6 million

pre-tax in 2024, including its managed portfolio, versus immaterial earnings in 2023. Primis Mortgage had approximately $800 million of

production in 2024 versus approximately $600 million of production the prior year. Continued recruiting and operational improvements have

current applications, locks and closings 40% to 50% higher than the same month a year ago and the Company anticipates production of $1.25

billion in the current rate environment. Not included in this outlook is the impact of the Bank’s new construction-to-perm builder

partnerships focused on government lending that should generate additional volume with strong profitability metrics.

National Strategies

With the sale of Life Premium Finance, the Company

is focusing its national lending strategies on mortgage warehouse lending and a new partnership with a national builder leveraging the

Bank’s existing construction-to-perm loan product.

While the Bank had mortgage warehouse lending

capabilities, activity was insignificant until the team build-out in the fall of 2024. As of the end of January 2025, the team has

grown to 54 approved customers with over $400 million of committed lines. Average yield, including fees, was SOFR plus 340 basis points

in December. In addition to a growing customer pipeline, the mortgage warehouse team also plans to augment its growth with selective mortgage

servicing rights (“MSR”) relationships through 2025.

The Bank also recently gained preferred lender

status with a national builder by leveraging its one-time-close construction-to-permanent mortgage product. The partner builder had loan

volume of $15 billion in 2024 and has approved the Bank to work with 85 of its offices across the country. Pricing on the mortgages is

generally Prime or better with 50 to 100 basis points of fees and are based on government programs that make the mortgages eligible for

sale in the secondary market (via Primis Mortgage).

Funding for the national strategies is provided

by the Bank’s digital platform powering what we believe is one of only a handful of bank deposit offerings nationwide that is both

fully functional and inherently app-based. Since the launch in November 2022, the platform has grown to 18 thousand customers with

just under $1 billion of deposits priced around Fed Funds after the most recent rate adjustment. The Bank is leveraging the technology

underpinning its digital platform to launch a unique affinity brand in March 2025. This brand will leverage well-known ambassadors

and influencers to drive adoption of attractive deposit products in a unique niche. The Company believes this strategy is highly replicable

and has the potential to be a significant driver of growth in the next few years.

Panacea Financial

Panacea’s growth accelerated to end 2024

with loans outstanding up 11% from the third quarter of 2024 to $434 million funded by $92 million of deposits attributable to the division.

Panacea is the number one ranked “Bank for doctors” on Google and banks approximately 6,000 professionals and practices nationwide

with a goal of reaching 10,000 customers by the end of 2025. Panacea is utilizing the proceeds of the Panacea Financial Holdings capital

raise from late 2023 to develop the initial phase of what is expected to be a sophisticated suite of technology products and services

targeting the medical, dental and veterinary space. As previously disclosed, the Company owns approximately 19% of Panacea Financial Holdings

and the value of our ownership was almost $20 million at the time of the capital raise.

Consumer Loan Program Winddown

As disclosed previously, the Company has originated

consumer loans through a third-party (the “Consumer Program”) since the second half of 2021. A subset of the Consumer Program

has promotional characteristics where interest is deferred during the promotional period and is waived if the customer pays off the loan

prior to the period end. In that event, the third-party reimburses the Bank for the waived interest. Until the end of the promotional

period, the Company is unable to accrue interest on the loan under GAAP but does record a derivative representing the fair value of expected

interest reimbursements from the third-party. Credit costs are also included in the Company’s results, including estimated life

of loan losses required by ASC 326 while potential credit enhancements from the Consumer Program are only reflected as received. Outstanding

balances in the Consumer Program before fair value marks were $173 million as of December 31, 2024 with $39 million of balances in

a promotional period versus $180 million and $60 million, respectively, at September 30, 2024.

In the fourth quarter of 2024, the Company made

the decision to cease originating new loans under the Consumer Program effective January 31, 2025 and moved a large portion of the

portfolio, with an amortized cost of $133 million, to loans held for sale and marked them to fair market value. The adjustment to fair

market value resulted in additional provision expense and charge-offs of $20.0 million in the fourth quarter of 2024. The remaining portion

of the portfolio still classified as held for investment of approximately $39 million at December 31, 2024 has an associated allowance

for credit losses of approximately $10 million and is expected to run off substantially in 2025. The table below highlights the drag on

2024 profitability from the program:

| Contribution ($000) | |

Q4 '24 | | |

2024 | |

| Net Interest Income | |

| 288 | | |

| 2,430 | |

| Provision Expense | |

| (20,842 | ) | |

| (34,025 | ) |

| Noninterest Income | |

| 928 | | |

| 4,320 | |

| Noninterest Expense | |

| (1,827 | ) | |

| (2,660 | ) |

| | |

| | | |

| | |

| Pre-Tax Contribution | |

$ | (21,452 | ) | |

$ | (29,935 | ) |

Outlook

Mr. Zember commented, “The Company’s

strategies are profitable and remarkably scalable given our size. We operate a successful and valuable community bank and lines of business

that can deliver outsized growth and profits relative to our size. As seen below, we have already made the moves necessary to deliver

attractive operating results and clearing the deck of the consumer loan noise was necessary for these results to be apparent. “

| Reported 2024 ROAA | |

| (0.19 | )% |

| Consumer Program Credit Costs | |

| 0.69 | |

| Lost Revenue on Promo Balances (@ 8)% | |

| 0.12 | |

| Gain on LPF sale | |

| (0.10 | ) |

| Nonrecurring Items (Restatements/Legal) | |

| 0.13 | |

| | |

| | |

| Adjusted 2024 ROAA | |

| 0.65 | % |

| | |

| | |

| Other Profitability Improvements Already Made and Potential Impact on 2025 Results: | |

| | |

| Trading out LPF for Mortgage Warehouse | |

| 0.15 | % |

| Mortgage Volume Run Rate Over 2024 | |

| 0.09 | |

| Incremental Funding Rate Savings Since Dec. 2024 | |

| 0.06 | |

Net Interest Income

Net interest income decreased approximately $1.9

million, or 7%, to $26.1 million during the fourth quarter of 2024 compared to the third quarter of 2024. Material items impacting the

fourth quarter level of net interest income were $2.5 million of interest reversals on charged off Consumer Program loans and approximately

$1.3 million of decline related to sale of the Life Premium Finance portfolio as of October 31, 2024. Higher spreads between loans

and deposits were achieved through the quarter as deposit rates fell by approximately 20 basis points in the core Bank which mostly neutralized

the impact of the sold Life Premium Finance portfolio. On a recurring basis excluding the impact of prior quarter reversals, net interest

income would have been $28.6 million compared to $28.0 million in the third quarter of 2024 and up 11.3% compared to $25.7 million in

the fourth quarter of 2023. Excluding the interest reversal described above, net interest margin for the fourth quarter of 2024 would

have been 3.18% compared to 2.86% in the fourth quarter of 2023.

Interest income, adjusted for the interest reversals

noted above, was $53.9 million for the fourth quarter of 2024, higher by 7.4% when compared to $50.2 million in the same quarter in 2023.

When adjusted for the interest reversals yield on earning assets was 5.99% in the fourth quarter of 2024 compared to 5.58% in the same

quarter in 2023. In 2025, the Company has approximately $350 million of loans with a weighted average yield of 5.90% subject to repricing

that indicate some level of opportunity for continued increases in interest income.

The pace of declines in interest expense alongside

steady levels of interest income accelerated in the fourth quarter and indicates stronger profitability moving into 2025. Cost of deposits

decreased 24 basis points to 2.80% in the fourth quarter of 2024 from 3.04% in the third quarter of 2024 and did not include lower costs

on almost $1 billion of digital deposits that repriced late in December 2024 and early in January 2025. Deposit costs on digital

deposits have declined by approximately 65 basis points compared to fourth quarter levels implying additional savings of approximately

$6.5 million annually.

Noninterest Income

Noninterest income was $13.2 million in the fourth

quarter of 2024 versus $9.3 million in the third quarter of 2024. Excluding the net gain from the Life Premium Finance sale, noninterest

income decreased to $8.4 million in the fourth quarter of 2024. Income from mortgage banking activity decreased $1.8 million during the

fourth quarter of 2024 due to seasonally lower activity. Partially offsetting the decrease in mortgage banking income was an increase

of $0.8 million in fee income related to the Consumer Program net of changes in the associated derivative fair market value. The fourth

quarter of 2024 also had a $13 thousand loss on disposal of bank property versus $0.4 million of gains in the third quarter of 2024.

Noninterest Expense

Noninterest expense was $37.2 million for

the fourth quarter of 2024, compared to $31.0 million for the third quarter of 2024. Noninterest expense also includes consolidated

expenses from Panacea Financial Holdings (“PFH”). Management considers the core expense burden of the Bank that adjusts

for certain items that are volume dependent such as mortgage banking-related expenses or expense related to changes in the

reserve for unfunded commitments. The following table illustrates the Company’s core operating expense burden during

2024:

| | |

4Q 2024 | | |

3Q 2024 | | |

2Q 2024 | | |

1Q 2024 | | |

4Q 2023 | |

| Reported Noninterest Expense | |

| 37,174 | | |

| 30,955 | | |

| 29,786 | | |

| 27,538 | | |

| 27,780 | |

| PFH Consolidated Expenses | |

| (3,641 | ) | |

| (2,576 | ) | |

| (2,347 | ) | |

| (2,119 | ) | |

| (2,813 | ) |

| Noninterest Expense Excl. PFH | |

| 33,533 | | |

| 28,379 | | |

| 27,439 | | |

| 25,419 | | |

| 24,967 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nonrecurring / Cons. Prog. Fraud Loss | |

| (3,032 | ) | |

| (1,352 | ) | |

| (1,453 | ) | |

| (438 | ) | |

| (165 | ) |

| Primis Mortgage Expenses | |

| (6,354 | ) | |

| (6,436 | ) | |

| (6,084 | ) | |

| (5,122 | ) | |

| (4,785 | ) |

| Consumer Program Servicing Fee | |

| (681 | ) | |

| (699 | ) | |

| (312 | ) | |

| (312 | ) | |

| (312 | ) |

| Reserve for Unfunded Commitment | |

| 6 | | |

| (96 | ) | |

| 546 | | |

| 2 | | |

| (554 | ) |

| Total Adjustments | |

| (10,061 | ) | |

| (8,583 | ) | |

| (7,303 | ) | |

| (5,870 | ) | |

| (5,816 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Core Operating Expense Burden | |

| 23,472 | | |

| 19,796 | | |

| 20,136 | | |

| 19,549 | | |

| 19,151 | |

As noted above, the core expense burden increased

$3.7 million in the fourth quarter of 2024 from the third quarter of 2024. Contributing to the increase was $1.0 million increase in compensation-related

accruals, including restricted stock expense and mortgage warehouse signing bonuses, $0.4 million of miscellaneous lending expense, $0.3

million increase in FDIC insurance expense and other consulting expenses and implementation fees related to various technology projects.

Many of these expense items are expected to decline beginning in the first quarter of 2025. Core operating expense burden is projected

to be between $21 million and $22 million per quarter for 2025.

Loan Portfolio and Asset Quality

Loans held for investment decreased to $2.91 billion

at December 31, 2024, compared to $2.97 billion at September 30, 2024. As noted above, the Bank reclassified $133 million of

gross loan balances associated with the Consumer Program to loans held for sale at December 31, 2024. Including these balances, loans

held for investment would have increased 2.2% unannualized in the fourth quarter of 2024. The Mortgage Warehouse and Panacea divisions

drove the growth in the period with loan growth of $49 million and $41 million, respectively, in the fourth quarter of 2024.

Nonperforming assets, excluding portions guaranteed

by the SBA, were only 0.29% of total assets, or $10.8 million at December 31, 2024, compared to 0.25% or $10.2 million at September 30,

2024. The Bank had no other real estate owned at the end of the fourth quarter of 2024.

The Company recorded a provision for loan losses

of $23.0 million for the fourth quarter of 2024 versus $7.5 million for the third quarter of 2024. Of this provision, $20.8 million was

due to Consumer Program activity including recording the fair market value adjustment for the portion of the portfolio that was moved

to loans held for sale through the allowance for credit losses. As a percentage of loans held for investment, the allowance for credit

losses was 1.49% and 1.72% at the end of the fourth and third quarter of 2024, respectively, with the decline due to the reclassification

of Consumer Program loans.

Net charge-offs were $31.0 million for the fourth

quarter of 2024, up from $8.0 million for the third quarter of 2024. Consumer Program net charge-offs were $30.5 million in the fourth

quarter versus $6.7 million in the third quarter of 2024. Core net charge-offs, excluding those losses from the Consumer Program, were

$0.5 million, or 0.05% of average loans, in the fourth quarter of 2024 compared to $0.9 million, or 0.11%, in the third quarter of 2024(1).

Deposits and Funding

Total deposits at December 31, 2024 decreased

to $3.17 billion from $3.31 billion at September 30, 2024 as the Bank paid off high cost brokered deposits and swept off excess liquidity

during the quarter. Deposits swept off balance sheet totaled $137 million at December 31, 2024 versus none at September 30,

2024. Importantly, noninterest bearing demand deposits were $439 million at December 31, 2024, up 4.2% from $421 million at September 30,

2024 as the Company emphasizes driving up low cost deposit balances.

Deposit growth in the Bank continues to benefit

from better technology and unique convenience factors. V1BE, the Bank’s proprietary invitation-only delivery tool, increased total

users by 20% in 2024, and now has over 3,000 users on the platform as of December 31, 2024. The service completed over 40 thousand

requests in 2024 and supports almost $200 million of deposits.

During the fourth quarter of 2024, the Bank opened

approximately $32.5 million new deposit accounts on the digital platform with very modest marketing expenses. At quarter end, the Bank

had approximately 18,000 digital accounts with $981 million in total deposits and average balances of approximately $55 thousand.

As of December 31, 2024, the Bank has no

wholesale funding.

Shareholders’ Equity

Book value per common share as of December 31,

2024 was $14.58, a decrease of $0.83 from September 30, 2024. Tangible book value per common share(1) at the end

of the fourth quarter of 2024 was $10.77, a decrease of $0.82 from September 30, 2024. Common shareholders’ equity was

$360 million, or 9.75% of total assets, at December 31, 2024. Tangible common equity(1) at December 31, 2024

was $266 million, or 7.39% of tangible assets(1). After-tax unrealized losses on the Company’s available-for-sale

securities portfolio increased by $4.0 million to $21 million due to increases in market interest rates during the fourth quarter of 2024.

The Company has the intent and ability to hold these securities until maturity or recovery of the value and does not anticipate realizing

any losses on the investments.

(1) Non-GAAP financial measure. Please see “Reconciliation

of Non-GAAP Items” in the financial tables for more information and for a reconciliation to GAAP.

The Board of Directors declared a dividend of

$0.10 per share payable on February 26, 2025 to shareholders of record on February 12, 2025. This is Primis’ fifty-third

consecutive quarterly dividend.

About Primis Financial Corp.

As of December 31, 2024, Primis had $3.7

billion in total assets, $2.9 billion in total loans held for investment and $3.2 billion in total deposits. Primis Bank provides a range

of financial services to individuals and small- and medium-sized businesses through twenty-four full-service branches in Virginia and

Maryland and provides services to customers through certain online and mobile applications.

| Contacts: |

Address: |

| Dennis J. Zember, Jr., President and CEO |

Primis Financial Corp. |

| Matthew A. Switzer, EVP and CFO |

1676 International Drive, Suite 900 |

| Phone: (703) 893-7400 |

McLean,

VA 22102 |

Primis Financial Corp., NASDAQ Symbol FRST

Website: www.primisbank.com

Conference Call

The Company’s management will host a conference

call to discuss its fourth quarter results on Wednesday, January 29, 2025 at 10:00 a.m. (ET). A live Webcast of the conference

call is available at the following website: https://events.q4inc.com/attendee/384098079. Participants may also call 1-800-715-9871 and

ask for the Primis Financial Corp. call. A replay of the teleconference will be available for 7 days by calling 1-800-770-2030 and providing

Replay Access Code 4554342.

Non-GAAP Measures

Statements included in this press release include

non-GAAP financial measures and should be read along with the accompanying tables. Primis uses non-GAAP financial measures to analyze

its performance. The measures entitled net income adjusted for nonrecurring income and expenses; pre-tax pre-provision operating earnings;

operating return on average assets; pre-tax pre-provision operating return on average assets; operating return on average equity; operating

return on average tangible equity; operating efficiency ratio; operating earnings per share – basic; operating earnings per share

– diluted; tangible book value per share; tangible common equity; tangible common equity to tangible assets; and core net interest

margin are not measures recognized under GAAP and therefore are considered non-GAAP financial measures. We use the term “operating”

to describe a financial measure that excludes income or expense considered to be non-recurring in nature. Items identified as non-operating

are those that, when excluded from a reported financial measure, provide management or the reader with a measure that may be more indicative

of forward-looking trends in our business. A reconciliation of these non-GAAP financial measures to the most comparable GAAP measures

is provided in the Reconciliation of Non-GAAP Items table.

Management believes that these non-GAAP financial

measures provide additional useful information about Primis that allows management and investors to evaluate the ongoing operating results,

financial strength and performance of Primis and provide meaningful comparison to its peers. Non-GAAP financial measures should not be

considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider

Primis’ performance and financial condition as reported under GAAP and all other relevant information when assessing the performance

or financial condition of Primis. Non-GAAP financial measures are not standardized and, therefore, it may not be possible to compare these

measures with other companies that present measures having the same or similar names.

Non-GAAP financial measures have limitations as

analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition

as reported under GAAP.

Forward-Looking Statements

This press release and certain of our other filings

with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning

of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. Such statements

can generally be identified by such words as "may," "plan," "contemplate," "anticipate," "believe,"

"intend," "continue," "expect," "project," "predict," "estimate," "could,"

"should," "would," "will," and other similar words or expressions of the future or otherwise regarding the

outlook for the Company’s future business and financial performance and/or the performance of the banking industry and economy in

general. These forward-looking statements include, but are not limited to, our expectations regarding our future operating and financial

performance, including the preliminary estimated financial and operating information presented herein, which is subject to adjustment;

our outlook and long-term goals for future growth and new offerings and services; our expectations regarding net interest margin; expectations

on our growth strategy, expense management, capital management and future profitability; expectations on credit quality and performance;

and the assumptions underlying our expectations.

Prospective

investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown

risks and uncertainties which may cause the actual results, performance or achievements of the Company to be materially different from

the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are

based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant

risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that

might cause such differences include, but are not limited to: the Company’s ability to implement its various strategic and

growth initiatives, including its recently established Panacea Financial Division, digital banking platform, V1BE fulfillment service,

mortgage warehouse division and Primis Mortgage Company; the risks associated with the Life Premium Finance sale, including failure to

achieve the expected impact to our operating results; competitive pressures among financial institutions

increasing significantly; changes in applicable laws, rules, or regulations, including changes to statutes, regulations or regulatory

policies or practices; changes in management’s plans for the future; credit risk associated with our lending activities; the impact

of current and future economic and market conditions generally (including seasonality) and in the financial services industry, nationally

and within our primary market areas; changes in interest rates, inflation, loan demand, real estate values, or competition, as well as

labor shortages and supply chain disruptions; the impacts of tariffs and trade policies; changes in accounting principles, policies, or

guidelines; adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions; potential

impacts of adverse developments in the banking industry highlighted by high-profile bank failures, including impacts on customer confidence,

deposit outflows, liquidity and the regulatory response thereto; potential increases in the provision for credit losses; our ability to

identify and address increased cybersecurity risks, including those impacting vendors and other third parties; fraud or misconduct by

internal or external actors, which we may not be able to prevent, detect or mitigate; acts of God or of war or other conflicts, including

the current Ukraine/Russia conflict and Israel/Hamas conflict, acts of terrorism, pandemics or other catastrophic events that may affect

general economic conditions; and other general competitive, economic, political, and market factors, including those affecting our business,

operations, pricing, products, or services.

Forward-looking statements speak only as of the

date on which such statements are made. These forward-looking statements are based upon information presently known to the Company’s

management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without

limitation, the risks and other factors set forth in the Company’s filings with the Securities and Exchange Commission, the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, under the captions “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors,” and in the Company’s Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the

date on which such statement is made, or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance

on these forward-looking statements.

Primis

Financial Corp.

| Financial

Highlights (unaudited) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| (Dollars

in thousands, except per share data) | |

For

Three Months Ended: | | |

For

Twelve Months Ended: | |

| Selected Performance Ratios: | |

4Q

2024 | | |

3Q

2024 | | |

2Q

2024 | | |

1Q

2024 | | |

4Q

2023 | | |

4Q

2024 | | |

4Q

2023 | |

| Return on average

assets | |

| (1.53 | )% | |

| 0.12 | % | |

| 0.35 | % | |

| 0.26 | % | |

| (0.85 | )% | |

| (0.19 | )% | |

| (0.20 | )% |

| Operating

return on average assets(1) | |

| (1.67 | )% | |

| 0.20 | % | |

| 0.46 | % | |

| 0.29 | % | |

| (0.80 | )% | |

| (0.17 | )% | |

| 0.13 | % |

| Pre-tax

pre-provision return on average assets(1) | |

| 0.52 | % | |

| 0.86 | % | |

| 0.75 | % | |

| 1.02 | % | |

| 0.96 | % | |

| 0.62 | % | |

| 0.60 | % |

| Pre-tax

pre-provision operating return on average assets(1) | |

| 0.34 | % | |

| 0.96 | % | |

| 0.85 | % | |

| 1.06 | % | |

| 1.03 | % | |

| 0.65 | % | |

| 0.94 | % |

| Return on average common equity | |

| (15.26 | )% | |

| 1.31 | % | |

| 3.69 | % | |

| 2.59 | % | |

| (8.54 | )% | |

| (2.02 | )% | |

| (1.99 | )% |

| Operating

return on average common equity(1) | |

| (16.64 | )% | |

| 2.15 | % | |

| 4.81 | % | |

| 2.95 | % | |

| (8.01 | )% | |

| (1.79 | )% | |

| 1.31 | % |

| Operating

return on average tangible common equity(1) | |

| (22.07 | )% | |

| 2.86 | % | |

| 6.42 | % | |

| 3.94 | % | |

| (10.71 | )% | |

| (2.40 | )% | |

| 1.78 | % |

| Cost of funds | |

| 2.97 | % | |

| 3.25 | % | |

| 3.16 | % | |

| 2.97 | % | |

| 2.85 | % | |

| 3.09 | % | |

| 2.67 | % |

| Net interest margin | |

| 2.91 | % | |

| 2.97 | % | |

| 2.72 | % | |

| 2.84 | % | |

| 2.86 | % | |

| 2.86 | % | |

| 2.68 | % |

| Gross loans to deposits | |

| 91.70 | % | |

| 89.94 | % | |

| 98.95 | % | |

| 97.37 | % | |

| 98.45 | % | |

| 91.70 | % | |

| 98.45 | % |

| Efficiency ratio | |

| 94.59 | % | |

| 82.98 | % | |

| 83.42 | % | |

| 77.41 | % | |

| 81.31 | % | |

| 84.83 | % | |

| 85.16 | % |

| Operating

efficiency ratio(1) | |

| 98.74 | % | |

| 80.11 | % | |

| 79.63 | % | |

| 76.17 | % | |

| 79.43 | % | |

| 83.52 | % | |

| 75.80 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Per Common Share Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings per common share - Basic | |

$ | (0.59 | ) | |

$ | 0.05 | | |

$ | 0.14 | | |

$ | 0.10 | | |

$ | (0.33 | ) | |

$ | (0.31 | ) | |

$ | (0.32 | ) |

| Operating

earnings per common share - Basic(1) | |

$ | (0.65 | ) | |

$ | 0.08 | | |

$ | 0.18 | | |

$ | 0.11 | | |

$ | (0.31 | ) | |

$ | (0.27 | ) | |

$ | 0.21 | |

| Earnings per common share - Diluted | |

$ | (0.59 | ) | |

$ | 0.05 | | |

$ | 0.14 | | |

$ | 0.10 | | |

$ | (0.33 | ) | |

$ | (0.31 | ) | |

$ | (0.32 | ) |

| Operating

earnings per common share - Diluted(1) | |

$ | (0.65 | ) | |

$ | 0.08 | | |

$ | 0.18 | | |

$ | 0.11 | | |

$ | (0.31 | ) | |

$ | (0.27 | ) | |

$ | 0.21 | |

| Book value per common share | |

$ | 14.58 | | |

$ | 15.41 | | |

$ | 15.22 | | |

$ | 15.16 | | |

$ | 15.23 | | |

$ | 14.58 | | |

$ | 15.23 | |

| Tangible

book value per common share(1) | |

$ | 10.77 | | |

$ | 11.59 | | |

$ | 11.38 | | |

$ | 11.31 | | |

$ | 11.37 | | |

$ | 10.77 | | |

$ | 11.37 | |

| Cash dividend per common share | |

$ | 0.10 | | |

$ | 0.10 | | |

$ | 0.10 | | |

$ | 0.10 | | |

$ | 0.10 | | |

$ | 0.40 | | |

$ | 0.40 | |

| Weighted average shares outstanding - Basic | |

| 24,701,260 | | |

| 24,695,685 | | |

| 24,683,734 | | |

| 24,673,857 | | |

| 24,647,728 | | |

| 24,688,006 | | |

| 24,647,728 | |

| Weighted average shares outstanding - Diluted | |

| 24,701,260 | | |

| 24,719,920 | | |

| 24,708,484 | | |

| 24,707,113 | | |

| 24,647,728 | | |

| 24,688,006 | | |

| 24,647,728 | |

| Shares outstanding at end of period | |

| 24,722,734 | | |

| 24,722,734 | | |

| 24,708,234 | | |

| 24,708,588 | | |

| 24,693,172 | | |

| 24,722,734 | | |

| 24,693,172 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset Quality Ratios: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-performing assets as a percent

of total assets, excluding SBA guarantees | |

| 0.29 | % | |

| 0.25 | % | |

| 0.25 | % | |

| 0.23 | % | |

| 0.20 | % | |

| 0.29 | % | |

| 0.20 | % |

| Net charge-offs (recoveries)

as a percent of average loans (annualized) | |

| 3.84 | % | |

| 0.93 | % | |

| 0.60 | % | |

| 0.64 | % | |

| 0.94 | % | |

| 1.48 | % | |

| 0.45 | % |

| Core

net charge-offs (recoveries) as a percent of average loans (annualized)(1) | |

| 0.05 | % | |

| 0.11 | % | |

| (0.07 | )% | |

| 0.10 | % | |

| 0.57 | % | |

| 0.05 | % | |

| 0.20 | % |

| Allowance for credit losses to

total loans | |

| 1.49 | % | |

| 1.72 | % | |

| 1.56 | % | |

| 1.66 | % | |

| 1.62 | % | |

| 1.49 | % | |

| 1.62 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Capital Ratios: | |

| | |

| | |

| | |

| | |

| |

|

|

|

|

|

|

|

|

| Common equity to

assets | |

| 9.75 | % | |

| 9.47 | % | |

| 9.48 | % | |

| 9.63 | % | |

| 9.75 | % |

|

|

|

|

|

|

|

|

| Tangible

common equity to tangible assets(1) | |

| 7.39 | % | |

| 7.29 | % | |

| 7.27 | % | |

| 7.36 | % | |

| 7.46 | % |

|

|

|

|

|

|

|

|

| Leverage

ratio(2) | |

| 8.00 | % | |

| 8.20 | % | |

| 8.25 | % | |

| 8.38 | % | |

| 8.37 | % |

|

|

|

|

|

|

|

|

| Common

equity tier 1 capital ratio(2) | |

| 8.64 | % | |

| 8.23 | % | |

| 8.85 | % | |

| 8.98 | % | |

| 8.96 | % |

|

|

|

|

|

|

|

|

| Tier

1 risk-based capital ratio(2) | |

| 8.94 | % | |

| 8.51 | % | |

| 9.14 | % | |

| 9.27 | % | |

| 9.25 | % |

|

|

|

|

|

|

|

|

| Total

risk-based capital ratio(2) | |

| 12.35 | % | |

| 11.68 | % | |

| 12.45 | % | |

| 12.62 | % | |

| 13.44 | % |

|

|

|

|

|

|

|

|

(1) See Reconciliation of Non-GAAP financial measures.

(2) Ratios are estimated and may be subject to change pending the final filing of the FR Y-9C.

Primis

Financial Corp.

| (Dollars in thousands) | |

For

Three Months Ended: | |

| Condensed

Consolidated Balance Sheets (unaudited) | |

4Q

2024 | | |

3Q

2024 | | |

2Q

2024 | | |

1Q

2024 | | |

4Q

2023 | |

| Assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 64,505 | | |

$ | 77,274 | | |

$ | 66,580 | | |

$ | 88,717 | | |

$ | 77,553 | |

| Investment securities-available

for sale | |

| 235,903 | | |

| 242,543 | | |

| 232,867 | | |

| 230,617 | | |

| 228,420 | |

| Investment securities-held to

maturity | |

| 9,448 | | |

| 9,766 | | |

| 10,649 | | |

| 10,992 | | |

| 11,650 | |

| Loans held for sale | |

| 227,235 | | |

| 458,722 | | |

| 94,644 | | |

| 72,217 | | |

| 57,691 | |

| Loans receivable, net of deferred

fees | |

| 2,907,914 | | |

| 2,973,723 | | |

| 3,300,562 | | |

| 3,227,665 | | |

| 3,219,414 | |

| Allowance

for credit losses | |

| (43,227 | ) | |

| (51,132 | ) | |

| (51,574 | ) | |

| (53,456 | ) | |

| (52,209 | ) |

| Net loans | |

| 2,864,687 | | |

| 2,922,591 | | |

| 3,248,988 | | |

| 3,174,209 | | |

| 3,167,205 | |

| Stock in Federal Reserve Bank

and Federal Home Loan Bank | |

| 13,037 | | |

| 20,875 | | |

| 16,837 | | |

| 14,225 | | |

| 14,246 | |

| Bank premises and equipment,

net | |

| 19,432 | | |

| 19,668 | | |

| 19,946 | | |

| 20,412 | | |

| 20,611 | |

| Operating lease right-of-use

assets | |

| 10,279 | | |

| 10,465 | | |

| 10,293 | | |

| 10,206 | | |

| 10,646 | |

| Goodwill and other intangible

assets | |

| 94,124 | | |

| 94,444 | | |

| 94,768 | | |

| 95,092 | | |

| 95,417 | |

| Assets held for sale, net | |

| 5,185 | | |

| 9,864 | | |

| 5,136 | | |

| 6,359 | | |

| 6,735 | |

| Bank-owned life insurance | |

| 67,184 | | |

| 66,750 | | |

| 66,319 | | |

| 67,685 | | |

| 67,588 | |

| Deferred tax assets, net | |

| 24,019 | | |

| 25,582 | | |

| 25,232 | | |

| 24,513 | | |

| 22,395 | |

| Consumer Program derivative

asset | |

| 4,511 | | |

| 7,146 | | |

| 9,929 | | |

| 10,685 | | |

| 10,806 | |

| Other assets | |

| 59,272 | | |

| 58,657 | | |

| 63,830 | | |

| 64,050 | | |

| 65,583 | |

| Total

assets | |

$ | 3,698,821 | | |

$ | 4,024,347 | | |

$ | 3,966,018 | | |

$ | 3,889,979 | | |

$ | 3,856,546 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities and stockholders'

equity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Demand deposits | |

$ | 438,917 | | |

$ | 421,231 | | |

$ | 420,241 | | |

$ | 463,190 | | |

$ | 472,941 | |

| NOW accounts | |

| 817,715 | | |

| 748,833 | | |

| 793,608 | | |

| 771,116 | | |

| 773,028 | |

| Money market accounts | |

| 798,506 | | |

| 835,099 | | |

| 831,834 | | |

| 834,514 | | |

| 794,530 | |

| Savings accounts | |

| 775,719 | | |

| 873,810 | | |

| 866,279 | | |

| 823,325 | | |

| 783,758 | |

| Time deposits | |

| 340,178 | | |

| 427,458 | | |

| 423,501 | | |

| 422,778 | | |

| 445,898 | |

| Total

deposits | |

| 3,171,035 | | |

| 3,306,431 | | |

| 3,335,463 | | |

| 3,314,923 | | |

| 3,270,155 | |

| Securities sold under agreements

to repurchase - short term | |

| 3,918 | | |

| 3,677 | | |

| 3,273 | | |

| 3,038 | | |

| 3,044 | |

| Federal Home Loan Bank advances | |

| - | | |

| 165,000 | | |

| 80,000 | | |

| 25,000 | | |

| 30,000 | |

| Secured borrowings | |

| 17,195 | | |

| 17,495 | | |

| 21,069 | | |

| 21,298 | | |

| 20,393 | |

| Subordinated debt and notes | |

| 95,878 | | |

| 95,808 | | |

| 95,737 | | |

| 95,666 | | |

| 95,595 | |

| Operating lease liabilities | |

| 11,566 | | |

| 11,704 | | |

| 11,488 | | |

| 11,353 | | |

| 11,686 | |

| Other liabilities | |

| 25,541 | | |

| 27,169 | | |

| 24,777 | | |

| 24,102 | | |

| 28,080 | |

| Total liabilities | |

| 3,325,133 | | |

| 3,627,284 | | |

| 3,571,807 | | |

| 3,495,380 | | |

| 3,458,953 | |

| Total Primis common stockholders'

equity | |

| 360,462 | | |

| 381,022 | | |

| 376,047 | | |

| 374,577 | | |

| 376,161 | |

| Noncontrolling

interest | |

| 13,226 | | |

| 16,041 | | |

| 18,164 | | |

| 20,022 | | |

| 21,432 | |

| Total

stockholders' equity | |

| 373,688 | | |

| 397,063 | | |

| 394,211 | | |

| 394,599 | | |

| 397,593 | |

| Total

liabilities and stockholders' equity | |

$ | 3,698,821 | | |

$ | 4,024,347 | | |

$ | 3,966,018 | | |

$ | 3,889,979 | | |

$ | 3,856,546 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tangible

common equity(1) | |

$ | 266,338 | | |

$ | 286,578 | | |

$ | 281,279 | | |

$ | 279,485 | | |

$ | 280,744 | |

| Primis Financial Corp. | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| (Dollars in thousands) | |

For Three

Months Ended: | | |

For Twelve

Months Ended: | |

| Condensed

Consolidated Statement of Operations (unaudited) | |

4Q

2024 | | |

3Q

2024 | | |

2Q

2024 | | |

1Q

2024 | | |

4Q

2023 | | |

4Q

2024 | | |

4Q

2023 | |

| Interest and dividend

income | |

$ | 51,400 | | |

$ | 57,104 | | |

$ | 52,191 | | |

$ | 50,336 | | |

$ | 50,163 | | |

$ | 211,031 | | |

$ | 192,618 | |

| Interest

expense | |

| 25,260 | | |

| 29,081 | | |

| 27,338 | | |

| 25,067 | | |

| 24,437 | | |

| 106,746 | | |

| 93,907 | |

| Net interest income | |

| 26,140 | | |

| 28,023 | | |

| 24,853 | | |

| 25,269 | | |

| 25,726 | | |

| 104,285 | | |

| 98,711 | |

| Provision

for credit losses | |

| 23,046 | | |

| 7,511 | | |

| 3,119 | | |

| 6,508 | | |

| 21,310 | | |

| 40,184 | | |

| 32,540 | |

| Net interest

income after provision for credit losses | |

| 3,094 | | |

| 20,512 | | |

| 21,734 | | |

| 18,761 | | |

| 4,416 | | |

| 64,101 | | |

| 66,171 | |

| Account maintenance and deposit

service fees | |

| 1,276 | | |

| 1,398 | | |

| 1,780 | | |

| 1,330 | | |

| 1,518 | | |

| 5,784 | | |

| 5,733 | |

| Income from bank-owned life insurance | |

| 434 | | |

| 431 | | |

| 981 | | |

| 564 | | |

| 420 | | |

| 2,410 | | |

| 2,021 | |

| Mortgage banking income | |

| 5,140 | | |

| 6,803 | | |

| 6,402 | | |

| 5,574 | | |

| 3,210 | | |

| 23,919 | | |

| 17,645 | |

| Gain (loss) on sale of loans | |

| (4 | ) | |

| - | | |

| (29 | ) | |

| 336 | | |

| 526 | | |

| 303 | | |

| 794 | |

| Gain on sale of Life Premium

Finance portfolio, net of broker fees | |

| 4,723 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,723 | | |

| - | |

| Consumer Program derivative | |

| 928 | | |

| 79 | | |

| 1,272 | | |

| 2,041 | | |

| 2,886 | | |

| 4,320 | | |

| 18,120 | |

| Gain on other investments | |

| 15 | | |

| 51 | | |

| 136 | | |

| 206 | | |

| 190 | | |

| 408 | | |

| 184 | |

| Gain (loss) on bank premises

and equipment | |

| (13 | ) | |

| 352 | | |

| 124 | | |

| - | | |

| (478 | ) | |

| 463 | | |

| - | |

| Other | |

| 663 | | |

| 168 | | |

| 186 | | |

| 256 | | |

| 169 | | |

| 1,273 | | |

| 753 | |

| Noninterest

income | |

| 13,162 | | |

| 9,282 | | |

| 10,852 | | |

| 10,307 | | |

| 8,441 | | |

| 43,603 | | |

| 45,250 | |

| Employee compensation and benefits | |

| 15,717 | | |

| 16,764 | | |

| 16,088 | | |

| 15,735 | | |

| 14,645 | | |

| 64,304 | | |

| 58,765 | |

| Occupancy and equipment expenses | |

| 3,466 | | |

| 3,071 | | |

| 3,099 | | |

| 3,106 | | |

| 2,982 | | |

| 12,742 | | |

| 12,620 | |

| Amortization of intangible assets | |

| 313 | | |

| 318 | | |

| 317 | | |

| 317 | | |

| 317 | | |

| 1,265 | | |

| 1,269 | |

| Goodwill impairment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 11,150 | |

| Virginia franchise tax expense | |

| 631 | | |

| 631 | | |

| 632 | | |

| 631 | | |

| 849 | | |

| 2,525 | | |

| 3,395 | |

| Data processing expense | |

| 3,434 | | |

| 2,552 | | |

| 2,347 | | |

| 2,231 | | |

| 2,216 | | |

| 10,564 | | |

| 9,545 | |

| Marketing expense | |

| 499 | | |

| 449 | | |

| 499 | | |

| 459 | | |

| 352 | | |

| 1,906 | | |

| 1,819 | |

| Telecommunication and communication

expense | |

| 295 | | |

| 330 | | |

| 341 | | |

| 346 | | |

| 358 | | |

| 1,312 | | |

| 1,507 | |

| Professional fees | |

| 3,129 | | |

| 2,914 | | |

| 2,976 | | |

| 1,365 | | |

| 1,586 | | |

| 10,384 | | |

| 4,641 | |

| Miscellaneous lending expenses | |

| 1,446 | | |

| 1,098 | | |

| 285 | | |

| 451 | | |

| 1,128 | | |

| 3,280 | | |

| 3,006 | |

| Other expenses | |

| 8,244 | | |

| 2,828 | | |

| 3,202 | | |

| 2,897 | | |

| 3,347 | | |

| 17,171 | | |

| 14,883 | |

| Noninterest

expense | |

| 37,174 | | |

| 30,955 | | |

| 29,786 | | |

| 27,538 | | |

| 27,780 | | |

| 125,453 | | |

| 122,600 | |

| Income (loss) before income taxes | |

| (20,918 | ) | |

| (1,161 | ) | |

| 2,800 | | |

| 1,530 | | |

| (14,923 | ) | |

| (17,749 | ) | |

| (11,179 | ) |

| Income tax

expense (benefit) | |

| (3,428 | ) | |

| (304 | ) | |

| 1,265 | | |

| 718 | | |

| (4,472 | ) | |

| (1,749 | ) | |

| (1,067 | ) |

| Net Income (loss) | |

| (17,490 | ) | |

| (857 | ) | |

| 1,535 | | |

| 812 | | |

| (10,451 | ) | |

| (16,000 | ) | |

| (10,112 | ) |

| Noncontrolling

interest | |

| 2,820 | | |

| 2,085 | | |

| 1,901 | | |

| 1,654 | | |

| 2,280 | | |

| 8,460 | | |

| 2,280 | |

| Net income

(loss) attributable to Primis' common shareholders | |

$ | (14,670 | ) | |

$ | 1,228 | | |

$ | 3,436 | | |

$ | 2,466 | | |

$ | (8,171 | ) | |

$ | (7,540 | ) | |

$ | (7,832 | ) |

(1) See

Reconciliation of Non-GAAP financial measures.

| Primis Financial Corp. | |

| | |

| | |

| | |

| | |

| |

| (Dollars in thousands) | |

For Three Months Ended: | |

| Loan Portfolio Composition | |

4Q 2024 | | |

3Q 2024 | | |

2Q 2024 | | |

1Q 2024 | | |

4Q 2023 | |

| Loans held for sale | |

$ | 227,235 | | |

$ | 458,722 | | |

$ | 94,644 | | |

$ | 72,217 | | |

$ | 57,691 | |

| Loans secured by real estate: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commercial real estate - owner occupied | |

| 475,892 | | |

| 463,848 | | |

| 463,328 | | |

| 458,026 | | |

| 455,397 | |

| Commercial real estate - non-owner occupied | |

| 610,473 | | |

| 609,743 | | |

| 612,428 | | |

| 577,752 | | |

| 578,600 | |

| Secured by farmland | |

| 3,706 | | |

| 4,356 | | |

| 4,758 | | |

| 4,341 | | |

| 5,044 | |

| Construction and land development | |

| 101,243 | | |

| 105,541 | | |

| 104,886 | | |

| 146,908 | | |

| 164,742 | |

| Residential 1-4 family | |

| 588,855 | | |

| 607,313 | | |

| 608,035 | | |

| 602,124 | | |

| 606,226 | |

| Multi-family residential | |

| 158,426 | | |

| 169,368 | | |

| 171,512 | | |

| 128,599 | | |

| 127,857 | |

| Home equity lines of credit | |

| 62,955 | | |

| 62,421 | | |

| 62,152 | | |

| 57,765 | | |

| 59,670 | |

| Total real estate loans | |

| 2,001,550 | | |

| 2,022,590 | | |

| 2,027,099 | | |

| 1,975,515 | | |

| 1,997,536 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commercial loans | |

| 614,162 | | |

| 533,998 | | |

| 619,365 | | |

| 623,804 | | |

| 602,623 | |

| Paycheck Protection Program loans | |

| 1,927 | | |

| 1,941 | | |

| 1,969 | | |

| 2,003 | | |

| 2,023 | |

| Consumer loans | |

| 284,955 | | |

| 409,754 | | |

| 646,590 | | |

| 620,745 | | |

| 611,583 | |

| Total Non-PCD loans | |

| 2,902,594 | | |

| 2,968,283 | | |

| 3,295,023 | | |

| 3,222,067 | | |

| 3,213,765 | |

| PCD loans | |

| 5,320 | | |

| 5,440 | | |

| 5,539 | | |

| 5,598 | | |

| 5,649 | |

| Total loans receivable, net of deferred fees | |

$ | 2,907,914 | | |

$ | 2,973,723 | | |

$ | 3,300,562 | | |

$ | 3,227,665 | | |

$ | 3,219,414 | |

| Loans by Risk Grade: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pass Grade 1 - Highest Quality | |

| 872 | | |

| 820 | | |

| 692 | | |

| 633 | | |

| 875 | |

| Pass Grade 2 - Good Quality | |

| 195,669 | | |

| 177,763 | | |

| 488,728 | | |

| 412,593 | | |

| 405,019 | |

| Pass Grade 3 - Satisfactory Quality | |

| 1,567,228 | | |

| 1,509,405 | | |

| 1,503,918 | | |

| 1,603,053 | | |

| 1,626,380 | |

| Pass Grade 4 - Pass | |

| 1,042,404 | | |

| 1,184,671 | | |

| 1,204,268 | | |

| 1,177,065 | | |

| 1,154,971 | |

| Pass Grade 5 - Special Mention | |

| 30,111 | | |

| 53,473 | | |

| 87,471 | | |

| 19,454 | | |

| 14,930 | |

| Grade 6 - Substandard | |

| 71,630 | | |

| 47,591 | | |

| 15,485 | | |

| 14,867 | | |

| 17,239 | |

| Grade 7 - Doubtful | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Grade 8 - Loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total loans | |

$ | 2,907,914 | | |

$ | 2,973,723 | | |

$ | 3,300,562 | | |

$ | 3,227,665 | | |

$ | 3,219,414 | |

| (Dollars in thousands) | |

For Three Months Ended: | |

| Asset Quality Information | |

4Q 2024 | | |

3Q 2024 | | |

2Q 2024 | | |

1Q 2024 | | |

4Q 2023 | |

| Allowance for Credit Losses: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at beginning of period | |

$ | (51,132 | ) | |

$ | (51,574 | ) | |

$ | (53,456 | ) | |

$ | (52,209 | ) | |

$ | (38,541 | ) |

| Provision for for credit losses | |

| (23,046 | ) | |

| (7,511 | ) | |

| (3,119 | ) | |

| (6,508 | ) | |

| (21,310 | ) |

| Net charge-offs | |

| 30,951 | | |

| 7,953 | | |

| 5,001 | | |

| 5,261 | | |

| 7,642 | |

| Ending balance | |

$ | (43,227 | ) | |

$ | (51,132 | ) | |

$ | (51,574 | ) | |

$ | (53,456 | ) | |

$ | (52,209 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reserve for Unfunded Commitments: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at beginning of period | |

$ | (1,127 | ) | |

$ | (1,031 | ) | |

$ | (1,577 | ) | |

$ | (1,579 | ) | |

$ | (1,025 | ) |

| (Expense for) / recovery of unfunded loan commitment reserve | |

| 6 | | |

| (96 | ) | |

| 546 | | |

| 2 | | |

| (554 | ) |

| Total Reserve for Unfunded Commitments | |

$ | (1,121 | ) | |

$ | (1,127 | ) | |

$ | (1,031 | ) | |

$ | (1,577 | ) | |

$ | (1,579 | ) |

| Non-Performing Assets: | |

| | |

| | |

| | |

| | |

| |

| Nonaccrual loans | |

$ | 15,027 | | |

$ | 14,424 | | |

$ | 11,289 | | |

$ | 10,139 | | |

$ | 9,095 | |

| Accruing loans delinquent 90 days or more | |

| 1,713 | | |

| 1,714 | | |

| 1,897 | | |

| 1,714 | | |

| 1,714 | |

| Total non-performing assets | |

$ | 16,740 | | |

$ | 16,138 | | |

$ | 13,186 | | |

$ | 11,853 | | |

$ | 10,809 | |

| SBA guaranteed portion of non-performing loans | |

$ | 5,921 | | |

$ | 5,954 | | |

$ | 3,268 | | |

$ | 3,095 | | |

$ | 3,115 | |

| Primis Financial Corp. | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| (Dollars in thousands) | |

For

Three Months Ended: | | |

For

Twelve Months Ended: | |

| Average Balance Sheet | |

4Q 2024 | | |

3Q 2024 | | |

2Q 2024 | | |

1Q 2024 | | |

4Q 2023 | | |

4Q 2024 | | |

4Q 2023 | |

| Assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans held for sale | |

$ | 100,027 | | |

$ | 98,110 | | |

$ | 84,389 | | |

$ | 58,896 | | |

$ | 48,380 | | |

$ | 85,430 | | |

$ | 44,643 | |

| Loans, net of deferred fees | |

| 3,127,472 | | |

| 3,324,157 | | |

| 3,266,651 | | |

| 3,206,888 | | |

| 3,208,295 | | |

| 3,231,262 | | |

| 3,126,717 | |

| Investment securities | |

| 253,120 | | |

| 242,631 | | |

| 244,308 | | |

| 241,179 | | |

| 228,335 | | |

| 245,323 | | |

| 237,452 | |

| Other earning

assets | |

| 96,697 | | |

| 83,405 | | |

| 73,697 | | |

| 77,067 | | |

| 79,925 | | |

| 82,757 | | |

| 281,052 | |

| Total earning assets | |

| 3,577,316 | | |

| 3,748,303 | | |

| 3,669,045 | | |

| 3,584,030 | | |

| 3,564,935 | | |

| 3,644,772 | | |

| 3,689,864 | |

| Other assets | |

| 237,793 | | |

| 243,715 | | |

| 243,196 | | |

| 248,082 | | |

| 262,977 | | |

| 242,566 | | |

| 261,265 | |

| Total

assets | |

$ | 3,815,109 | | |

$ | 3,992,018 | | |

$ | 3,912,241 | | |

$ | 3,832,112 | | |

$ | 3,827,912 | | |

$ | 3,887,338 | | |

$ | 3,951,129 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities and equity | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Demand deposits | |

$ | 437,388 | | |

$ | 421,908 | | |

$ | 433,315 | | |

$ | 458,306 | | |

$ | 473,750 | | |

$ | 441,520 | | |

$ | 495,107 | |

| Interest-bearing liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NOW and other demand accounts | |

| 787,884 | | |

| 748,202 | | |

| 778,458 | | |

| 773,943 | | |

| 782,305 | | |

| 772,099 | | |

| 784,680 | |

| Money market accounts | |

| 819,803 | | |

| 859,988 | | |

| 823,156 | | |

| 814,147 | | |

| 790,971 | | |

| 829,331 | | |

| 831,196 | |

| Savings accounts | |

| 767,342 | | |

| 866,375 | | |

| 866,652 | | |

| 800,328 | | |

| 783,432 | | |

| 825,129 | | |

| 777,143 | |

| Time deposits | |

| 404,682 | | |

| 425,238 | | |

| 423,107 | | |

| 431,340 | | |

| 451,521 | | |

| 421,058 | | |

| 474,178 | |

| Total

Deposits | |

| 3,217,099 | | |

| 3,321,711 | | |

| 3,324,688 | | |

| 3,278,064 | | |

| 3,281,979 | | |

| 3,289,137 | | |

| 3,362,304 | |

| Borrowings | |

| 160,886 | | |

| 238,994 | | |

| 158,919 | | |

| 120,188 | | |

| 120,213 | | |

| 169,912 | | |

| 159,442 | |

| Total Funding | |

| 3,377,985 | | |

| 3,560,705 | | |

| 3,483,607 | | |

| 3,398,252 | | |

| 3,402,192 | | |

| 3,459,049 | | |

| 3,521,746 | |

| Other Liabilities | |

| 39,566 | | |

| 36,527 | | |

| 34,494 | | |

| 34,900 | | |

| 39,056 | | |

| 36,421 | | |

| 35,494 | |

| Total liabilites | |

| 3,417,551 | | |

| 3,597,232 | | |

| 3,518,101 | | |

| 3,433,152 | | |

| 3,441,248 | | |

| 3,495,470 | | |

| 3,557,240 | |

| Primis common stockholders' equity | |

| 382,466 | | |

| 377,314 | | |

| 374,731 | | |

| 378,008 | | |

| 379,442 | | |

| 373,637 | | |

| 393,302 | |

| Noncontrolling

interest | |

| 15,092 | | |

| 17,472 | | |

| 19,409 | | |

| 20,952 | | |

| 7,222 | | |

| 18,231 | | |

| 587 | |

| Total

stockholders' equity | |

| 397,558 | | |

| 394,786 | | |

| 394,140 | | |

| 398,960 | | |

| 386,664 | | |

| 391,868 | | |

| 393,889 | |

| Total

liabilities and stockholders' equity | |

$ | 3,815,109 | | |

$ | 3,992,018 | | |

$ | 3,912,241 | | |

$ | 3,832,112 | | |

$ | 3,827,912 | | |

$ | 3,887,338 | | |

$ | 3,951,129 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Interest Income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans held for sale | |

$ | 1,553 | | |

$ | 1,589 | | |

$ | 1,521 | | |

$ | 907 | | |

$ | 842 | | |

$ | 5,570 | | |

$ | 2,806 | |

| Loans | |

| 46,893 | | |

| 52,699 | | |

| 48,024 | | |

| 46,816 | | |

| 46,723 | | |

| 194,432 | | |

| 169,982 | |

| Investment securities | |

| 1,894 | | |

| 1,799 | | |

| 1,805 | | |

| 1,715 | | |

| 1,645 | | |

| 7,213 | | |

| 6,373 | |

| Other earning

assets | |

| 1,060 | | |

| 1,017 | | |

| 841 | | |

| 898 | | |

| 953 | | |

| 3,816 | | |

| 13,457 | |

| Total

Earning Assets Income | |

| 51,400 | | |

| 57,104 | | |

| 52,191 | | |

| 50,336 | | |

| 50,163 | | |

| 211,031 | | |

| 192,618 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-interest bearing DDA | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| NOW and other interest-bearing

demand accounts | |

| 4,771 | | |

| 4,630 | | |

| 4,827 | | |

| 4,467 | | |

| 4,334 | | |

| 18,695 | | |

| 15,404 | |

| Money market accounts | |

| 6,190 | | |

| 7,432 | | |

| 6,788 | | |

| 6,512 | | |

| 6,129 | | |

| 26,923 | | |

| 23,717 | |

| Savings accounts | |

| 7,587 | | |

| 8,918 | | |

| 8,912 | | |

| 8,045 | | |

| 7,860 | | |

| 33,462 | | |

| 29,774 | |

| Time deposits | |

| 4,127 | | |

| 4,371 | | |

| 4,095 | | |

| 3,990 | | |

| 3,964 | | |

| 16,582 | | |

| 14,795 | |

| Total

Deposit Costs | |

| 22,675 | | |

| 25,351 | | |

| 24,622 | | |

| 23,014 | | |

| 22,287 | | |

| 95,662 | | |

| 83,690 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Borrowings | |

| 2,585 | | |

| 3,730 | | |

| 2,716 | | |

| 2,053 | | |

| 2,150 | | |

| 11,084 | | |

| 10,217 | |

| Total

Funding Costs | |

| 25,260 | | |

| 29,081 | | |

| 27,338 | | |

| 25,067 | | |

| 24,437 | | |

| 106,746 | | |

| 93,907 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Interest Income | |

$ | 26,140 | | |

$ | 28,023 | | |

$ | 24,853 | | |

$ | 25,269 | | |

$ | 25,726 | | |

$ | 104,285 | | |

$ | 98,711 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Interest Margin | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans held for sale | |

| 6.18 | % | |

| 6.44 | % | |

| 7.25 | % | |

| 6.19 | % | |

| 6.90 | % | |

| 6.52 | % | |

| 6.29 | % |

| Loans | |

| 5.96 | % | |

| 6.31 | % | |

| 5.91 | % | |

| 5.87 | % | |

| 5.78 | % | |

| 6.02 | % | |

| 5.44 | % |

| Investments | |

| 2.98 | % | |

| 2.95 | % | |

| 2.97 | % | |

| 2.86 | % | |

| 2.86 | % | |

| 2.94 | % | |

| 2.68 | % |

| Other Earning

Assets | |

| 4.36 | % | |

| 4.85 | % | |

| 4.59 | % | |

| 4.69 | % | |

| 4.73 | % | |

| 4.61 | % | |

| 4.79 | % |

| Total

Earning Assets | |

| 5.72 | % | |

| 6.06 | % | |

| 5.72 | % | |

| 5.65 | % | |

| 5.58 | % | |

| 5.79 | % | |

| 5.22 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NOW | |

| 2.41 | % | |

| 2.46 | % | |

| 2.49 | % | |

| 2.32 | % | |

| 2.20 | % | |

| 2.42 | % | |

| 1.96 | % |

| MMDA | |

| 3.00 | % | |

| 3.44 | % | |

| 3.32 | % | |

| 3.22 | % | |

| 3.07 | % | |

| 3.25 | % | |

| 2.85 | % |

| Savings | |

| 3.93 | % | |

| 4.10 | % | |

| 4.14 | % | |

| 4.04 | % | |

| 3.98 | % | |

| 4.06 | % | |

| 3.83 | % |

| CDs | |

| 4.06 | % | |

| 4.09 | % | |

| 3.89 | % | |

| 3.72 | % | |

| 3.48 | % | |

| 3.94 | % | |

| 3.12 | % |

| Cost

of Interest Bearing Deposits | |

| 3.25 | % | |

| 3.48 | % | |

| 3.42 | % | |

| 3.28 | % | |

| 3.15 | % | |

| 3.36 | % | |

| 2.92 | % |

| Cost of Deposits | |

| 2.80 | % | |

| 3.04 | % | |

| 2.98 | % | |

| 2.82 | % | |

| 2.69 | % | |

| 2.91 | % | |

| 2.49 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Funding | |

| 6.39 | % | |

| 6.22 | % | |

| 6.89 | % | |

| 6.90 | % | |

| 7.10 | % | |

| 6.52 | % | |

| 6.41 | % |

| Total

Cost of Funds | |

| 2.97 | % | |

| 3.25 | % | |

| 3.16 | % | |

| 2.97 | % | |

| 2.85 | % | |

| 3.09 | % | |

| 2.67 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Interest Margin | |

| 2.91 | % | |

| 2.97 | % | |

| 2.72 | % | |

| 2.84 | % | |

| 2.86 | % | |

| 2.86 | % | |

| 2.68 | % |

| Net Interest Spread | |

| 2.30 | % | |

| 2.37 | % | |

| 2.11 | % | |

| 2.22 | % | |

| 2.27 | % | |

| 2.25 | % | |

| 2.12 | % |

| Primis Financial Corp. | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| (Dollars

in thousands, except per share data) | |

For Three

Months Ended: | | |

For Twelve

Months Ended: | |

| Reconciliation of Non-GAAP

items: | |

4Q 2024 | | |

3Q 2024 | | |

2Q 2024 | | |

1Q 2024 | | |

4Q 2023 | | |

4Q 2024 | | |

4Q 2023 | |

| Net income (loss)

attributable to Primis' common shareholders | |

$ | (14,670 | ) | |

$ | 1,228 | | |

$ | 3,436 | | |

$ | 2,466 | | |

$ | (8,171 | ) | |

$ | (7,540 | ) | |

$ | (7,832 | ) |

| Non-GAAP adjustments to Net Income: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Branch Consolidation / Other

restructuring | |

| - | | |

| - | | |

| - | | |

| - | | |

| 449 | | |

| - | | |

| 1,937 | |

| Loan officer fraud, operational

losses | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 200 | |

| Professional fee expense related

to accounting matters and LPF sale | |

| 1,782 | | |

| 1,352 | | |

| 1,453 | | |

| 438 | | |

| - | | |

| 5,025 | | |

| - | |

| Professional fee expenses related

to Panacea investment | |

| - | | |

| - | | |

| - | | |

| - | | |

| 194 | | |

| - | | |

| 194 | |

| Goodwill impairment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 11,150 | |

| Gains on sale of closed bank

branch buildings | |

| - | | |

| (352 | ) | |

| (124 | ) | |

| - | | |

| - | | |

| (476 | ) | |

| - | |