false

0001325670

0001325670

2024-02-26

2024-02-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 26, 2024

PRIMIS FINANCIAL CORP.

(Exact name of registrant

as specified in its charter)

| Virginia |

001-33037 |

20-1417448 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1676 International Drive, Suite 900

McLean, Virginia 22102

(Address of Principal Executive Offices) (Zip Code)

(703) 893-7400

(Registrant's telephone number, including area

code)

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchanged on which registered |

| COMMON STOCK |

|

FRST |

|

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

Previously-Filed Quarterly Reports on Form

10-Q

On February 26, 2024, the Audit Committee of the

Board of Directors of Primis Financial Corp. (the “Company”) and the Company’s management team concluded, following

discussions with the Company’s independent registered public accounting firm, FORVIS, LLP, that the Company’s previously-issued

unaudited interim consolidated financial statements as of and for the three months ended March 31, 2023, the three and six months ended

June 30, 2023, and the three and nine months ended September 30, 2023 (the “Impacted Financial Statements”) should

no longer be relied upon.

The accounting matters underlying the Company’s

conclusion relate to transfers of loans by the Company’s subsidiary, Primis Bank, of approximately $33.7 million (the “Transferred

Loans”) to other financial institutions over the first, second, and third quarters of 2023. As part of the Company’s year-end

reporting process in the first quarter of 2024, the Company determined that the transfer of the Transferred Loans from Primis Bank to

other financial institutions did not qualify for sales treatment under U.S. GAAP and should have been accounted for as secured borrowings.

The Company’s management team then undertook extensive discussions with FORVIS, LLP regarding the effect of the mischaracterization

of the transfers on the Company’s reported financial results, and ultimately determined that the Impacted Financial Statements should

be restated.

The Company intends to file amended Quarterly

Reports on Form 10-Q as of and for the three months ended March 31, 2023, the three and six months ended June 30, 2023, and the three

and nine months ended September 30, 2023 as soon as practicable.

The Company expects the restated condensed

consolidated financial statements to disclose the following restated amounts for each period1,3:

As

of and for the Three Months Ended March 31, 2023

(In thousands,

except per share data) | |

As Reported,

As Revised2 | | |

As Restated | |

| Total loans | |

$ | 3,041,533 | | |

$ | 3,056,674 | |

| Total assets | |

| 4,203,426 | | |

| 4,218,099 | |

| Other borrowings | |

| 99,728 | | |

| 114,708 | |

| Total funding sources | |

| 3,767,725 | | |

| 3,782,705 | |

| Total liabilities | |

| 3,804,921 | | |

| 3,819,954 | |

| Stockholders' equity | |

| 398,505 | | |

| 398,145 | |

| | |

| | | |

| | |

| Interest income | |

$ | 47,114 | | |

$ | 47,395 | |

| Interest expense | |

| 18,749 | | |

| 18,857 | |

| Provision for credit losses | |

| 5,187 | | |

| 5,263 | |

| Noninterest income | |

| 11,532 | | |

| 11,105 | |

| Noninterest expense | |

| 27,404 | | |

| 27,411 | |

| Income tax expense | |

| 1,353 | | |

| 1,277 | |

| Net income | |

$ | 5,953 | | |

$ | 5,692 | |

| EPS – Basic | |

$ | 0.24 | | |

$ | 0.23 | |

| EPS – Diluted | |

$ | 0.24 | | |

$ | 0.23 | |

1

Total funding sources includes total deposits, which are the Company’s primary source of funding, along with the secured

borrowings, securities sold under agreements to repurchase – short term, FHLB advances, junior subordinated debt – long term,

and senior subordinated notes – long-term.

2

These balances were revised from the Company’s original Quarterly Report on Form 10-Q for the quarterly period ended

March 31, 2023 to reflect adjustments related to the fraud losses, as described and restated in the Company’s Current Report on

Form 8-K filed on July 27, 2023.

3

Other borrowings includes secured borrowings, securities sold under agreements to repurchase – short term, FHLB advances,

junior subordinated debt – long term, and senior subordinated notes – long-term.

| As of and for the Three Months Ended June 30, 2023 |

| (In thousands, except per share data) | |

As Reported | | |

As Restated | |

| Total loans | |

$ | 3,173,638 | | |

$ | 3,194,352 | |

| Total assets | |

| 3,848,493 | | |

| 3,868,675 | |

| Other borrowings | |

| 99,374 | | |

| 119,877 | |

| Total funding sources | |

| 3,416,370 | | |

| 3,436,873 | |

| Total liabilities | |

| 3,455,277 | | |

| 3,475,844 | |

| Stockholders' equity | |

| 393,216 | | |

| 392,831 | |

| | |

| | | |

| | |

| Interest income | |

$ | 52,679 | | |

$ | 53,029 | |

| Interest expense | |

| 26,522 | | |

| 26,794 | |

| Provision for credit losses | |

| 4,301 | | |

| 4,355 | |

| Noninterest income | |

| 8,486 | | |

| 8,305 | |

| Noninterest expense | |

| 30,552 | | |

| 30,554 | |

| Income tax benefit | |

| (22 | ) | |

| (58 | ) |

| Net loss | |

$ | (188 | ) | |

$ | (311 | ) |

| EPS – Basic | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| EPS – Diluted | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Six Months Ended June 30, 2023 |

| (In thousands, except per share data) | |

As Reported | | |

As Restated | |

| Interest income | |

$ | 99,793 | | |

$ | 100,424 | |

| Interest expense | |

| 45,271 | | |

| 45,651 | |

| Provision for credit losses | |

| 9,488 | | |

| 9,618 | |

| Noninterest income | |

| 20,018 | | |

| 19,410 | |

| Noninterest expense | |

| 57,956 | | |

| 57,965 | |

| Income tax expense | |

| 1,331 | | |

| 1,220 | |

| Net income | |

$ | 5,765 | | |

$ | 5,380 | |

| EPS – Basic | |

$ | 0.23 | | |

$ | 0.22 | |

| EPS – Diluted | |

$ | 0.23 | | |

$ | 0.22 | |

| As of and for the Three Months Ended September 30, 2023 |

| (In thousands, except per share data) | |

As Reported | | |

As Restated | |

| Total loans | |

$ | 3,145,867 | | |

$ | 3,175,501 | |

| Total assets | |

| 3,813,775 | | |

| 3,842,695 | |

| Other borrowings | |

| 99,362 | | |

| 128,794 | |

| Total funding sources | |

| 3,392,766 | | |

| 3,422,198 | |

| Total liabilities | |

| 3,430,909 | | |

| 3,460,409 | |

| Stockholders' equity | |

| 382,866 | | |

| 382,286 | |

| | |

| | | |

| | |

| Interest income | |

$ | 50,486 | | |

$ | 50,808 | |

| Interest expense | |

| 23,361 | | |

| 23,672 | |

| Provision for credit losses | |

| 1,648 | | |

| 1,679 | |

| Noninterest income | |

| 9,942 | | |

| 9,707 | |

| Noninterest expense | |

| 37,074 | | |

| 37,066 | |

| Income tax expense | |

| 1,912 | | |

| 1,859 | |

| Net loss | |

$ | (3,567 | ) | |

$ | (3,761 | ) |

| EPS – Basic | |

$ | (0.14 | ) | |

$ | (0.15 | ) |

| EPS – Diluted | |

$ | (0.14 | ) | |

$ | (0.15 | ) |

| Nine Months Ended September 30, 2023 |

| (In thousands, except per share data) | |

As Reported | | |

As Restated | |

| Interest income | |

$ | 150,279 | | |

$ | 151,232 | |

| Interest expense | |

| 68,632 | | |

| 69,323 | |

| Provision for credit losses | |

| 11,136 | | |

| 11,297 | |

| Noninterest income | |

| 29,960 | | |

| 29,117 | |

| Noninterest expense | |

| 95,030 | | |

| 95,032 | |

| Income tax expense | |

| 3,243 | | |

| 3,079 | |

| Net income | |

$ | 2,198 | | |

$ | 1,618 | |

| EPS – Basic | |

$ | 0.09 | | |

$ | 0.07 | |

| EPS – Diluted | |

$ | 0.09 | | |

$ | 0.07 | |

As a result of the inaccuracies described above,

investors also should no longer rely upon the financial statements and related information in the Company’s earnings releases issued,

and investor presentations distributed, for the periods covered by the Impacted Financial Statements.

Current Report on Form 8-K filed on January 26, 2024

On February 26, 2024, the Audit Committee of the

Board of Directors of the Company and the Company’s management team also concluded, following discussions with the Company’s

independent registered public accounting firm, FORVIS, LLP, that the earnings release and investor presentation furnished with the Current

Report on Form 8-K that the Company filed on January 26, 2024 (the “Q4 Earnings Materials”) should no longer be relied

upon. The accounting matters underlying the Company’s conclusion in respect of the Q4 Earnings Materials primarily relate to:

(1) A subsequent event confirming

losses on a receivable Primis Bank previously reported on the Company’s balance sheet as of December 31, 2023 that met the accounting

requirements to be recognized during the year ended December 31, 2023. The receivable loss is related to a third party managed portfolio

of loans and will be offset by increases to noninterest income related to credit enhancements provided by the third party, resulting in

no impact to net income.

(2) Management’s determination

following the release of the Q4 Earnings Materials that a transfer of loans from Primis Bank to another financial institution during the

third quarter of 2023 failed to qualify as a sale for accounting purposes until the fourth quarter of 2023.

(3) Management’s determination

as part of its customary procedures to finalize its financial statements for inclusion in its Annual Report on Form 10-K for the year

ended December 31, 2023 that the Company’s allowance for credit losses related to a third party managed portfolio was insufficient

as of the end of the fourth quarter of 2023. As a result of the insufficiency of the Company’s allowance for credit losses, provision

expense and expense for unfunded commitment reserves will increase for the fourth quarter of 2023 with offsetting increases to noninterest

income related to credit enhancements provided by the third party portfolio manager resulting in no impact to net income.

The Company intends to file an amended Current

Report on Form 8-K restating and replacing the Q4 Earnings Materials as soon as practicable to reflect the revisions noted above. While

the Company finalizes its allowance for credit loss adjustments, it is providing preliminary restated amounts as of and for the three

months and year ended December 31, 2023 to reflect the impact of the subsequent event and failed loan sale:

| As of and for the Three Months Ended December 31, 2023 |

| (In thousands, except per share data) | |

As Reported | | |

As Restated | |

| Total loans | |

$ | 3,213,805 | | |

$ | 3,213,805 | |

| Total assets | |

| 3,876,074 | | |

| 3,876,064 | |

| Other borrowings | |

| 148,971 | | |

| 148,854 | |

| Total funding sources | |

| 3,419,126 | | |

| 3,419,009 | |

| Total liabilities | |

| 3,457,312 | | |

| 3,457,266 | |

| Stockholders' equity | |

| 418,762 | | |

| 418,798 | |

| | |

| | | |

| | |

| Interest income | |

$ | 54,661 | | |

$ | 54,661 | |

| Interest expense | |

| 24,405 | | |

| 24,405 | |

| Provision for credit losses* | |

| 3,141 | | |

| 3,074 | |

| Noninterest income* | |

| 8,980 | | |

| 9,647 | |

| Noninterest expense* | |

| 29,836 | | |

| 30,268 | |

| Income tax expense | |

| 418 | | |

| 483 | |

| Net income | |

| 5,841 | | |

| 6,078 | |

| Noncontrolling interest | |

| 2,280 | | |

| 2,280 | |

| Net income attributable to Primis common shareholders | |

$ | 8,121 | | |

$ | 8,358 | |

| EPS – Basic | |

$ | 0.33 | | |

$ | 0.34 | |

| EPS – Diluted | |

$ | 0.33 | | |

$ | 0.34 | |

*Subject to finalization of allowance for credit

loss adjustments

| Year Ended December 31, 2023 |

| (In thousands, except per share data) | |

As Reported | | |

As Restated | |

| Interest income | |

$ | 205,893 | | |

$ | 205,893 | |

| Interest expense | |

| 93,774 | | |

| 93,728 | |

| Provision for credit losses* | |

| 14,371 | | |

| 14,371 | |

| Noninterest income* | |

| 38,332 | | |

| 38,764 | |

| Noninterest expense* | |

| 124,868 | | |

| 125,299 | |

| Income tax expense | |

| 3,552 | | |

| 3,561 | |

| Net income | |

| 7,660 | | |

| 7,698 | |

| Noncontrolling interest | |

| 2,280 | | |

| 2,280 | |

| Net income attributable to Primis common shareholders | |

$ | 9,940 | | |

$ | 9,978 | |

| EPS – Basic | |

$ | 0.40 | | |

$ | 0.40 | |

| EPS – Diluted | |

$ | 0.40 | | |

$ | 0.40 | |

*Subject to finalization of allowance for credit

loss adjustments

Internal Control Over Financial Reporting

In light of the matters disclosed in this Current

Report, management is reassessing the effectiveness of the Company’s internal control over financial reporting and disclosure controls

and procedures, and the Company expects to report a material weakness in its internal controls with respect to the inaccuracies described

above. Management intends to implement and enhance controls to remediate any control deficiencies that exist with respect to these transactions.

The Company’s remediation plan with respect to such material weaknesses is expected to be described in the 2023 Form 10-K.

The Company’s management team and Audit

Committee discussed the matters disclosed pursuant to this Item 4.02 with FORVIS, LLP, which serves as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2023.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about

the Company’s expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are

not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words and phrases

such as “may,” “could,” “should,” “looking forward,” “will,” “would,”

“believes,” “expects,” “hope,” “anticipates,” “estimate,” “intends,”

“plans,” “assume,” “goal,” “seek,” “can”, “predicts,” “potential,”

“projects,” “continuing,” “ongoing,” and similar expressions. Although the Company believes that

the expectations reflected in these forward-looking statements are reasonable as of the date on which the statements are made, these

statements are not guarantees of future performance and involve risks and uncertainties which are subject to change based on various

important factors and assumptions, some of which are beyond the Company’s control. Among the factors that could cause the Company’s

financial performance to differ materially from that suggested by forward-looking statements include, without limitation, the risks and

uncertainties described in the Company’s filings with the Securities and Exchange Commission. If one or more of the factors affecting

the Company’s forward-looking information and statements renders forward-looking information or statements incorrect, the Company’s

actual results, performance or achievements could differ materially from those expressed in, or implied by, the forward-looking information

and statements. Therefore, the Company cautions the reader not to place undue reliance on any forward-looking information or statements

herein. The effect of these factors is difficult to predict. Factors other than these also could adversely affect the Company’s

results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties as new factors

emerge from time to time. Management cannot assess the impact of any such factor on the Company’s business or the extent to which

any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement.

Any forward-looking statements reflect the current beliefs and expectations of the Company’s management and only speak as of the

date of this document, and the Company.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

PRIMIS FINANCIAL CORP. |

| |

|

| |

|

| |

By: |

/s/ Matthew A. Switzer |

| March 1, 2024 |

|

Matthew Switzer |

| |

|

Chief Financial Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

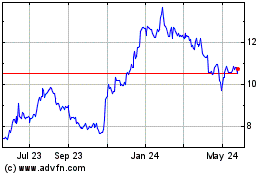

Primis Financial (NASDAQ:FRST)

Historical Stock Chart

From Jun 2024 to Jul 2024

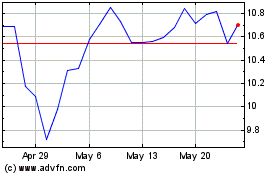

Primis Financial (NASDAQ:FRST)

Historical Stock Chart

From Jul 2023 to Jul 2024