UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-41829

Primech Holdings Ltd.

23 Ubi Crescent

Singapore 408579

+65 6286 1868

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Nasdaq Letter

Primech Holdings Ltd. received a notice dated

May 14, 2024, from the Listings Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”)

notifying the Company that the minimum bid price per share of its ordinary shares was below $1.00 for a period of 30 consecutive business

days and that the Company did not meet the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum

Bid Price Rule”). The Nasdaq notification letter does not result in the immediate delisting of the Company’s ordinary shares,

and the shares will continue to trade uninterrupted under the symbol “PMEC.”

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A),

the Company has a compliance period of one hundred eighty (180) calendar days, or until November 11, 2024 (the “Compliance Period”),

to regain compliance with Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the closing bid price

per share of the Company’s ordinary shares is at least $1.00 for a minimum of ten (10) consecutive business days, Nasdaq will provide

the Company a written confirmation of compliance and the matter will be closed.

In the event the Company does not regain compliance

by November 11, 2024, the Company may be eligible for an additional 180 calendar day grace period. To qualify, the Company will be required

to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq

Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the

deficiency during the second compliance period, including by effecting a reverse stock split, if necessary. If the Company chooses to

implement a reverse stock split, it must complete the split no later than ten (10) business days prior to November 11, 2024, or the expiration

of the second compliance period if granted.

This information is being provided solely to comply

with NASDAQ Listing Rules requiring public announcement of the Company’s receipt of the letter from NASDAQ.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Primech Holdings Ltd. |

| |

|

|

| Date: May 17, 2024 |

By: |

/s/ Kin Wai Ho |

| |

Name: |

Kin Wai Ho |

| |

Title: |

Chief Executive Officer |

EXHIBIT INDEX

3

Exhibit 99.1

Primech

Holdings Limited Announces Receipt of Nasdaq Notification Letter Regarding Minimum Bid Price Deficiency

SINGAPORE, May 17, 2024 (GlobeNewswire) -- Primech

Holdings Limited (Nasdaq: PMEC) (“Primech” or the “Company”), an established technology-driven facilities services

provider in the public and private sectors operating mainly in Singapore, today announces that it received a delinquency notification

letter (the “Notice”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) on

May 14, 2024 indicating that the Company is not currently in compliance with the minimum bid price requirement set forth in Nasdaq’s

Listing Rules for continued listing on the Nasdaq Capital Market, as the closing bid price for the Company’s ordinary shares listed

on the Nasdaq Capital Market was below $1.00 per share for 30 consecutive business days. Nasdaq Listing Rule 5550(a)(2) requires listed

securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the

minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. The Notice provides that

the Company has a period of 180 calendar days from the date of the Notice, or until November 11, 2024, to regain compliance with the minimum

bid price requirement.

The receipt of the Notice has no immediate effect

on the Company’s business operations or the listing of the Company’s ordinary shares, which will continue to trade uninterrupted

on the Nasdaq under the ticker “PMEC.” Pursuant to the Notice, the Company has until November 11, 2024 to regain compliance

with the minimum bid price requirement, during which time the Company’s ordinary shares will continue to trade on the Nasdaq Capital

Market. If at any time before November 11, 2024, the bid price of the Company’s ordinary shares closes at or above $1.00 per share

for a minimum of 10 consecutive business days, Nasdaq will provide written confirmation of compliance to the Company. In the event that

the Company does not regain compliance by November 11, 2024, the Company may be eligible for additional time to regain compliance or may

face delisting.

About Primech Holdings Limited

Headquartered in Singapore, Primech Holdings Limited

is a leading provider of comprehensive technology-driven facilities services, predominantly serving both public and private sectors throughout

Singapore, with expanding operations in Malaysia. With a legacy of excellence and innovation in the facilities services industry, Primech

offers an extensive range of services tailored to meet the complex demands of its diverse clientele. The Company’s service portfolio

includes advanced general facilities maintenance, specialized cleaning solutions such as marble polishing and facade cleaning, meticulous

stewarding services, and targeted cleaning services for offices and homes. Additionally, Primech manufactures and supplies various high-quality

cleaning products under its brand, extending its reach and capabilities within the industry. Known for its commitment to sustainability

and cutting-edge technology, Primech integrates eco-friendly practices and smart technology solutions to enhance operational efficiency

and client satisfaction. This strategic approach positions Primech as a leader in the industry and a proactive contributor to advancing

industry standards and practices in Singapore and beyond. For more information, visit www.primechholdings.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking

statements, including, for example, statements about completing the acquisition, anticipated revenues, growth, and expansion. These forward-looking

statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections

about future events that the Company believes may affect its financial condition, results of operations, business strategy, and financial

needs. These forward-looking statements are also based on assumptions regarding the Company’s present and future business strategies

and the environment in which the Company will operate in the future. Investors can find many (but not all) of these statements by the

use of words such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,”

“intend,” “plan,” “believe,” “likely to” or other similar expressions. The Company undertakes

no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances or changes

in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking

statements are reasonable, it cannot assure that such expectations will be correct. The Company cautions investors that actual results

may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results

in the Company’s registration statement and other filings with the SEC.

Company Contact:

ir@primech.com.sg

Investor Relations Contact:

Matthew Abenante, IRC

President

Strategic Investor Relations, LLC

Tel: 347-947-2093

Email: matthew@strategic-ir.com

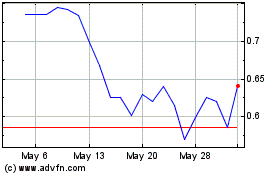

Primech (NASDAQ:PMEC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Primech (NASDAQ:PMEC)

Historical Stock Chart

From Nov 2023 to Nov 2024