Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

June 30 2023 - 5:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2023

Commission File Number: 001-38851

POWERBRIDGE TECHNOLOGIES

CO., LTD.

(Translation of Registrant’s

name into English)

Advanced Business Park,

9th Fl, Bldg C2

29 Lanwan Lane, Hightech

District

Zhuhai, Guangdong 519080,

China

(Address of Principal Executive

Office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

CONTENTS

Powerbridge Technologies Co., Ltd.

Regains Compliance with Nasdaq Listing Requirements

Powerbridge Technologies Co., Ltd.

(the “Company”) has regained compliance with the continued listing requirements of the Nasdaq Stock Market LLC (“Nasdaq”),

as required by the Hearing Panel’s (“Panel”) decision dated May 23, 2023.

As previously announced on April 28,

2023, the Company has timely submitted a request for a hearing before the Panel to appeal Nasdaq’s delisting determination and the

plan for a 1-for-30 reverse stock split of the Company’s securities. Such plan was approved by the shareholders of the Company at

an extraordinary general meeting held on May 30, 2023. On June 9, 2023, the Company effected a reverse stock split and traded above $1.00

for the past 11 consecutive trading days, from June 9, 2023 to June 26, 2023.

On June 27, 2023, the Company received

a written notification from Nasdaq’s Listing Qualifications Department stating that the closing bid price of the Company’s

common shares has been $1.00 per share or greater for 10 consecutive trading days. Hence, the Company has regained compliance with Nasdaq

Listing Rule 5550(a)(2) to remain listed in the Nasdaq, subject to a Mandatory Panel Monitor, for a period of one year from June 27, 2023,

of the Company’s ongoing compliance with such requirements as set force in Listing Rule 5815(d)(4)(B). If, within that one-year

monitoring period, Listing Qualifications staff (“Staff”) finds the Company again out of compliance with the requirement that

was the subject of the exception, notwithstanding Rule 5810(c)(2), the Company will not be permitted to provide the Staff with a plan

of compliance with respect to that deficiency and Staff will not be permitted to grant additional time for the Company to regain compliance

with respect to that deficiency, nor will the company be afforded an applicable cure or compliance period pursuant to Rule 5810(c)(3).

Instead, Staff will issue a Delist Determination Letter and the Company will have an opportunity to request a new hearing with the initial

Panel or a newly convened Hearings Panel if the initial Panel is unavailable. The Company will have the opportunity to respond/present

to the Hearings Panel as provided by Listing Rule 5815(d)(4)(C). The Company’s securities may be at that time delisted from Nasdaq.

SIGNATURE

Pursuant to the requirements of the Securities and Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 30, 2023 |

|

| |

|

| |

POWERBRIDGE TECHNOLOGIES CO., LTD. |

| |

|

|

| |

By: |

/s/ Stewart Lor |

| |

|

Stewart Lor |

| |

|

Chief Executive Officer |

2

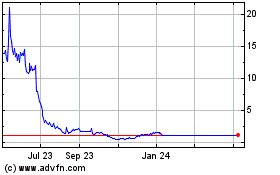

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Dec 2023 to Dec 2024