UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

| Filed

by the Registrant |

☒ |

| Filed

by a Party other than the Registrant |

☐ |

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☒ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

PONO

CAPITAL TWO, INC.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

EXPLANATORY

NOTE

On

April 24, 2023, Pono Capital Two, Inc. (the “Registrant”) filed with the Securities and Exchange Commission a definitive

proxy statement for the Special Meeting of Shareholders to be held on May 5, 2023 at 10:00 a.m. EST (the “Definitive Proxy Statement”).

The Registrant is filing these definitive additional proxy materials (the “Proxy Supplement”) on May 4, 2023, to amend and

supplement certain information in the Definitive Proxy Statement. Other than the definitive additional materials filed by the Registrant

on May 4, 2023, no other information in the Definitive Proxy Statement has been revised,

supplemented, updated or amended.

PONO

CAPITAL TWO, INC.

643

Ilalo St. #102

Honolulu,

Hawaii 96813

SUPPLEMENT

TO DEFINITIVE PROXY STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 5, 2023

The

following disclosure updates certain information in the Definitive Proxy Statement as set forth below.

Except

as amended and supplemented below, all other information in the Definitive Proxy Statement, as supplemented by the definitive additional materials filed by the

Registrant on May 4, 2023, remains unchanged. The updated disclosures

should be read in conjunction with the disclosures contained in the Definitive Proxy Statement, which should be read in its entirety.

To the extent the information set forth herein differs from or updates information contained in the Definitive Proxy Statement, the information

set forth herein shall supersede or supplement the information in the Definitive Proxy Statement. All page and paragraph references used

herein refer to the Definitive Proxy Statement before any additions or deletions resulting from the revised disclosures, and terms used

herein, unless otherwise defined, have the meanings set forth in the Definitive Proxy Statement.

Proposal

1 on (i) page 2 of the Definitive Proxy Statement under Item (i), (ii) page 6 of the Definitive Proxy Statement under Item 1, and (iii)

page 10 of the Definitive Proxy Statement under Item 1, is hereby amended and restated in its entirety to read:

Proposal

1 — A proposal to amend (the “Extension Amendment”) the Company’s Third Amended and Restated Certificate of Incorporation

(as amended, the “Charter”), to (i) extend the date by which PTWO has to consummate a business combination from May 9, 2023

to February 9, 2024 (the “Extended Date”) and (ii) provide for the right of a holder of Class B common stock of the Company,

par value $0.0001 per share (“Class B Common Stock”) to convert such shares into shares of Class A common stock of the Company,

par value $0.0001 per share (“Class A Common Stock”) on a one-for-one basis prior to the closing of a business combination

at the election of the holder;

The

first sentence of the first full paragraph on page 20 of the Definitive Proxy Statement is hereby amended and restated in its entirety

to read:

This

is a proposal to amend (the “Extension Amendment”) PTWO’s Third Amended and Restated Certificate of Incorporation (as

amended, the “Charter”), to (i) extend

the date by which PTWO has to consummate a business combination from May 9, 2023 to February 9, 2024 (the “Extended Date”)

and (ii) provide for the right of a holder of Class B common stock of the Company, par value $0.0001 per share (“Class B

Common Stock”) to convert such shares into shares of Class A common stock of the Company, par value $0.0001 per share (“Class

A Common Stock”) on a one-for-one basis prior to the closing of a business combination at the election of the holder.

Annex

A to the Definitive Proxy Statement is hereby amended and restated in its entirety to read as set forth in Annex A to this Supplement.

This

Extension Amendment Proposal, as supplemented pursuant to this Proxy Supplement, will give the Company further flexibility to retain

public stockholders and meet continued listing requirements of the Nasdaq Stock Market in the event the Extension Proposal is approved.

In

the event the Extension Amendment is implemented, upon conversion of any shares of Class B Common Stock to Class A Common Stock, such

Class A Common Stock converted from the Class B Common Stock shall not be entitled to receive funds from the Trust Account through redemptions

or otherwise. Additionally, the as-converted Class A Stock Common Stock will be subject to all of the restrictions applicable to the

pre-conversion Class B Common Stock, including the prohibition on transferring, assigning or selling such shares until the earlier to

occur of: (A) six months after the date of the Company’s initial business combination or (B) subsequent to the Company’s

initial business combination, (x) if the reported last sale price of the Company’s Class A Common Stock equals or exceeds $12.00

per share for any 20 trading days within any 30-trading day period commencing at least 150 days after the Company’s initial business

combination, or (y) the date on which the Company completes a liquidation, merger, capital stock exchange, reorganization or other similar

transaction that results in all of our stockholders having the right to exchange their shares of common stock for cash, securities or

other property.

The

chairman intends to adjourn the special meeting to May 8, 2023 at 10:00 a.m. ET in order to provide stockholders with additional time

to consider Proposal 1 as supplemented by this Proxy Supplement. The date by which public stockholders may submit redemption requests for their public shares is not being extended in connection with

the adjournment.

You

may change your vote or revoke your proxy at any time prior to the vote at the special meeting. If you are the stockholder of record,

you may change your vote by granting a new proxy bearing a later date, which automatically revokes the earlier proxy, by providing a

written notice of revocation to our Secretary prior to your shares being voted, or by attending the special meeting and voting in person

via teleconference. Attendance at the special meeting will not cause your previously granted proxy to be revoked unless you specifically

so request.

If

you are a beneficial owner, you may change your vote by submitting a new voting instruction card to your broker, trustee or nominee,

or, if you have obtained a legal proxy from your broker, trustee or nominee giving you the right to vote your shares, by attending the

special meeting and voting in person via teleconference.

Annex

A

Charter

Amendment

AMENDMENT

TO THE

THIRD

AMENDED AND RESTATED

CERTIFICATE

OF INCORPORATION OF

PONO

CAPITAL TWO, INC.

[●],

2023

Pono

Capital Two, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”),

DOES HEREBY CERTIFY AS FOLLOWS:

1.

The name of the Corporation is Pono Capital Two, Inc. The original certificate of incorporation of the Corporation was filed with the

Secretary of State of the State of Delaware on March 11, 2022. The amended and restated certificate of incorporation of the Corporation

was filed with the Secretary of State of the State of Delaware on May 17, 2022. The second amended and restated certificate of incorporation

of the Corporation was filed with the Secretary of State of the State of Delaware on August 2, 2022. The Third Amended and Restated Certificate

of Incorporation (the “Amended and Restated Certificate”) was filed with the Secretary of State of Delaware on August

4, 2022.

2.

This Amendment to the Amended and Restated Certificate amends the Amended and Restated Certificate.

3.

This Amendment to the Amended and Restated Certificate was duly adopted by the Board of Directors of the Corporation and the stockholders

of the Corporation in accordance with Section 242 of the General Corporation Law of the State of Delaware.

4. The text of Section 4.3(b)(i) of Article IV

of the Amended and Restated Certificate is hereby amended and restated to read in full as follows:

“(i) Shares of Class B Common Stock shall be convertible into shares of Class A Common

Stock on a one-for-one basis (the “Initial Conversion Ratio”) (a) at any time and from time to time at the option of the

holder thereof and (b) automatically on the closing of the Business Combination.”

5.

The text of Section 9.1(b) of Article IX of the

Amended and Restated Certificate is hereby amended and restated to read in full as follows:

“(b)

Immediately after the Offering, a certain amount of the net offering proceeds received by the Corporation in the Offering (including

the proceeds of any exercise of the underwriters’ over-allotment option, if any) and certain other amounts specified in the Corporation’s

registration statement on Form S-1, initially filed with the U.S. Securities and Exchange Commission (the “SEC”) on June

14, 2022, as amended (the “Registration Statement”), shall be deposited in a trust account (the “Trust Account”),

established for the benefit of the Public Stockholders (as defined below) pursuant to a trust agreement described in the Registration

Statement (the “Trust Agreement”). Except for the withdrawal of interest to pay taxes, none of the funds held in the Trust

Account (including the interest earned on the funds held in the Trust Account) will be released from the Trust Account until the earliest

to occur of (i) the completion of the initial Business Combination, (ii) the redemption of 100% of the Offering Shares (as defined below)

if the Corporation is unable to complete its initial Business Combination within 18 months from the closing of the Offering (or, if the

Office of the Delaware Division of Corporations shall not be open for business (including filing of corporate documents) on such date

the next date upon which the Office of the Delaware Division of Corporations shall be open) (the “Deadline Date”) and (iii)

the redemption of shares in connection with a stockholder vote to amend any provisions of this Amended and Restated Certificate (a) to

modify the substance or timing of the Corporation’s obligation to provide for the redemption of the Offering Shares in connection

with an initial Business Combination or to redeem 100% of such shares if the Corporation has not consummated an initial Business Combination

by the Deadline Date or (b) with respect to any other provision relating to stockholders’ rights or pre-initial Business Combination

activity (as described in Section 9.7). Holders of shares of Common Stock included as part of the units sold in the Offering (the “Offering

Shares”) (whether such Offering Shares were purchased in the Offering or in the secondary market following the Offering and whether

or not such holders are the Sponsor or officers or directors of the Corporation, or affiliates of any of the foregoing) are referred

to herein as “Public Stockholders.”“

IN

WITNESS WHEREOF, Pono Capital Two, Inc. has caused this Amendment to the Amended and Restated Certificate to be duly executed in its

name and on its behalf by an authorized officer as of the date first set above.

Pono

Capital Two, Inc.

| By: |

|

|

| Name: |

Darryl

Nakamoto |

|

| Title: |

Chief

Executive Officer |

|

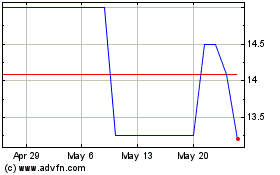

Pono Capital Two (NASDAQ:PTWOU)

Historical Stock Chart

From May 2024 to Jun 2024

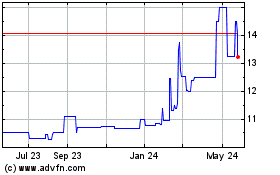

Pono Capital Two (NASDAQ:PTWOU)

Historical Stock Chart

From Jun 2023 to Jun 2024