UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14C

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of

the Securities Exchange Act of 1934

|

Check the appropriate box:

|

|

☐

|

|

Preliminary Information Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only

(as permitted by Rule 14c-5(d)(2))

|

|

☐

|

|

Definitive Information Statement

|

|

☒

|

|

Definitive Additional Materials

|

|

|

PIONEER

POWER SOLUTIONS, INC.

|

|

|

|

|

|

|

(Name

of Registrant As Specified In Its Charter)

|

|

|

|

|

|

|

Payment of Filing Fee (Check the

appropriate box):

|

|

☒

|

|

No fee required

|

|

☐

|

|

Fee computed on table below per

Exchange Act Rules 14c-5(g) and 0-11

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

(3)

|

Per unit

price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing.

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

(2)

|

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

|

Filing

Party:

|

|

|

(4)

|

|

Date

Filed:

|

PIONEER

POWER SOLUTIONS, Inc.

400 Kelby Street, 12th Floor

Fort

Lee, New Jersey 07024

SUPPLEMENT

TO

DEFINITIVE

INFORMATION STATEMENT

PURSUANT

TO SECTION 14(C)

OF

THE SECURITIES EXCHANGE ACT OF 1934 AND

REGULATION

14C PROMULGATED THEREUNDER

EXPLANATORY

NOTE

On

July 26, 2019, Pioneer Power Solutions, Inc., a Delaware corporation (“Pioneer Power” or the “Company”),

filed with the Securities and Exchange Commission (the “SEC”) a Definitive Information Statement (the “Information

Statement”) informing its stockholders of the approval by Company’s board of directors and the holders of 4,774,400

shares of the Company’s common stock, or approximately 54.7% of the Company’s outstanding common stock as of June

28, 2019, of the Stock Purchase Agreement, dated as of June 28, 2019 (the “Stock Purchase Agreement”), by and among

the Company, Electrogroup Canada, Inc., a wholly owned subsidiary of the Company (“Electrogroup”), Jefferson Electric,

Inc., a wholly owned subsidiary of the Company (“Jefferson”), JE Mexican Holdings, Inc., a wholly owned subsidiary

of the Company (“JE Mexico,” and together with Electrogroup and Jefferson, the “Disposed Companies”),

Nathan Mazurek, Pioneer Transformers L.P. (the “US Buyer”) and Pioneer Acquireco ULC (the “Canadian Buyer,”

and together with the US Buyer, the “Buyer”), and the other transaction documents and the consummation of the transactions

contemplated thereby.

Pursuant

to the terms of the Stock Purchase Agreement, the Company agreed to sell (i) all of the issued and outstanding equity interests

of Electrogroup to the Canadian Buyer and (ii) all of the issued and outstanding equity interests of Jefferson and JE Mexico to

the US Buyer (collectively, the “Equity Transaction”), for an aggregate base cash purchase price of $60.5 million,

as well as the issuance by the Buyer of a subordinated promissory note to the Company in the aggregate principal amount of $5.0

million (the “Seller Note”), in each case subject to adjustment as described in the Information Statement. The proceeds

from the Equity Transaction are payable solely to the Company. The Equity Transaction, however, constituted a sale of substantially

all of the assets of Pioneer Power pursuant to Section 271 of the Delaware General Corporation Law.

This

Supplement to the Information Statement (the “Supplement”) is being made publicly available to the

Company’s stockholders of record as of June 28, 2019 (the “Record Date”) only to provide updated

information regarding the status of the Equity Transaction, the Stock Purchase Agreement and all related transactions, which

are expected to be consummated in the near future. Copies of the Information Statement were first mailed to our stockholders

on July 26, 2019. All references to defined terms not defined in this Supplement shall have the meanings ascribed to them in

the Information Statement.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Copies

of this Supplement are to first being made available to our stockholders on August 13, 2019.

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO SUCH MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

THIS

SUPPLEMENT IS BEING PROVIDED ONLY TO INFORM YOU OF THE STATUS OF THE STOCK PURCHASE AGREEMENT, THE EQUITY TRANSACTION AND ALL

RELATED TRANSACTIONS. NO FURTHER ACTION IS REQUIRED BY ANY OF THE COMPANY’S STOCKHOLDERS.

PLEASE

NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE ALREADY ACTED BY WRITTEN CONSENT TO APPROVE THE STOCK PURCHASE AGREEMENT,

THE EQUITY TRANSACTION AND ALL RELATED TRANSACTIONS, AND THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE WRITTEN CONSENT

WAS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR THE EQUITY TRANSACTION UNDER APPLICABLE LAW AND THE COMPANY’S

ORGANIZATIONAL DOCUMENTS. ACCORDINGLY, NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THESE ACTIONS.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This

Supplement, and the documents to which you are referred in this Supplement, contain certain “forward-looking” statements

as that term is defined by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements

include information relating future events, future financial performance, financial projections, strategies, expectations, competitive

environment and regulation. Words such as “may,” “should,” “could,” “would,” “predicts,”

“potential,” “continue,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” and similar expressions, as well as statements in future

tense, identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance

or results and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements

are based on information available when those statements are made or management’s good faith belief as of that time with

respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ

materially from those expressed in or suggested by the forward-looking statements.

Important

factors that could cause such differences include, but are not limited to:

|

|

●

|

the occurrence of

any event, change or other circumstances that could give rise to the termination of the Stock Purchase Agreement;

|

|

|

●

|

the failure to satisfy

any condition to consummation of the Stock Purchase Agreement, including the financing condition;

|

|

|

●

|

an increase in the

amount of costs, fees, expenses and other charges related to the Stock Purchase Agreement;

|

|

|

●

|

risks arising from

the diversion of management’s attention from its ongoing business operations;

|

|

|

●

|

the ability of the

Company to retain and hire key personnel and maintain relationships with customers, suppliers or other business partners pending

the consummation of the Stock Purchase Agreement;

|

|

|

●

|

the outcome of any

legal proceedings that may be instituted against the Company and/or others relating to the Stock Purchase Agreement and the

transactions contemplated thereby;

|

|

|

●

|

the impact of legislative,

regulatory and competitive changes and other risk factors relating to the industries in which the Company operates, as detailed

from time to time in the Company’s reports filed with the SEC;

|

|

|

●

|

risks associated

with the Company’s ability to identify and realize business opportunities following the consummation of the Stock Purchase

Agreement;

|

|

|

●

|

the risk that the

Stock Purchase Agreement may not be completed in a timely manner or at all, which may adversely affect the Company’s

business or the price of its common stock;

|

|

|

●

|

changes in the business

or operating prospects of the Company, including the occurrence of an event, circumstance, occurrence, fact, condition, development,

effect or change that constitutes a Material Adverse Effect;

|

|

|

●

|

the ability of the

Company to maintain compliance with NASDAQ’s continued listing standards following the consummation of the Equity Transaction;

|

|

|

●

|

limitations placed

on the Company’s ability to operate its business by the Stock Purchase Agreement;

|

|

|

●

|

the impact of the

announcement of the Equity Transaction on the market price of the Company’s common stock; and

|

|

|

●

|

the amount of costs,

fees and expenses associated with the Equity Transaction.

|

The

forward-looking statements contained in this Supplement and the documents to which you are referred in this Supplement are based

on assumptions that Pioneer Power’s management have made in light of their industry experience and their perceptions of

historical trends, current conditions, expected future developments and other important factors Pioneer Power believes are appropriate

under the circumstances. As you read and consider this Supplement and the documents to which you are referred in this Supplement,

you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (many

of which are beyond Pioneer Power’s control) and assumptions. Although Pioneer Power’s management believes that these

forward-looking statements are based on reasonable assumptions, you should be aware that many important factors such as those

listed above that could affect the Company’s actual operating and financial performance and cause the Company’s performance

to differ materially from the performance anticipated in the forward-looking statements.

Should

one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect, Pioneer Power’s

actual operating and financial performance may vary in material respects from the performance projected in these forward-looking

statements.

Further,

any forward-looking statement speaks only as of the date on which it is made, and except as required by law, Pioneer Power undertakes

no obligation to update any forward-looking statement contained in this Supplement or the documents to which you are referred

in this Supplement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated

or unanticipated events or circumstances. New important factors that could cause Pioneer Power’s business not to develop

as expected, emerge from time to time, and it is not possible to predict all of them.

SUPPLEMENTAL

INFORMATION

In

mid-July 2019, Pioneer Power delivered preliminary second quarter financial results to Mill Point Capital LLC (“Mill Point”),

which reflected a decline in Pioneer Power’s financial performance, largely due to increases in working capital as a result

of increased accounts payable. On July 21, 2019, Mill Point discussed its findings with representatives of Lincoln International

LLC (“Lincoln”) and expressed its concern that Pioneer Power’s financial performance would impact Mill Point’s

ability to obtain debt financing sufficient to fund the Equity Transaction. On August 1, RSM US LLP (“RSM”) delivered

a preliminary quality of earnings report to Mill Point, which reflected a 13% decrease in Pioneer Power’s EBITDA from June

2018 to June 2019.

On

August 7, 2019, based on the loss of Mill Point’s lead lender in its debt financing and Pioneer Power’s recent financial

performance, Mill Point delivered a revised offer to acquire the Disposed Companies to Pioneer Power and representatives of Lincoln,

which proposed maintaining an aggregate base purchase price of $65.5 million but making certain upward adjustments to the target

working capital. Over the next few days, the parties continued to discuss the transaction and negotiate the working capital adjustments.

On

August 9, 2019, Haynes and Boone, LLP, the Company’s outside legal counsel, delivered a draft of an amendment to the Stock

Purchase Agreement to Mill Point and its legal counsel. Over the next few days, the parties continued to negotiate the amendment

to the Stock Purchase Agreement.

On

August 13, 2019, Pioneer Power, the Buyer and the Disposed Companies entered into Amendment No. 1 to the Stock

Purchase Agreement (the “Amendment”) (a copy of which is attached as

Annex A

to this Supplement). Pursuant

to the Amendment, (i) the base purchase price was increased from $65.5 million to $68.0 million, (ii) the target working

capital amount of the Disposed Companies was increased from $21,205,000 to $29,558,000, (iii) the parties agreed to an

estimated closing net working capital amount of $23,558,000, (iv) the increase in the base purchase price will be paid in the

form of an additional Seller Note in the aggregate principal amount of $2.5 million that will be issued to Pioneer Power at

the closing, (v) a $150,000 deductible was added with respect to the indemnification obligations of Pioneer Power and

the Disposed Companies concerning certain legal matters, (vi) Pioneer Power agreed to pay any difference between the final

net purchase price and the closing date net purchase price in immediately available funds rather than causing the Buyer to

set off the amount of such difference against any amounts due and payable to Pioneer Power under the Seller Note, subject

to certain exceptions, (vii) the definition of Applicable Adverse Event was amended to exclude certain events related to

Pioneer Power’s financial performance through the second quarter (subject to certain exceptions, such items were also

excluded from the post-closing indemnity under the Stock Purchase Agreement) and (viii) the parties agreed to the allocation

of the insurance proceeds from the June 2019 flood at Pioneer Power’s facility in Reynosa, Mexico. Pioneer Power

expects to receive approximately $2.0 million of insurance proceeds related to the June 2019 flood. The Buyer will only be

required to set-off any indemnifiable losses the Buyer suffers as a result of certain actions, omissions, or

misrepresentations by Pioneer Power or the Disposed Companies against the first Seller Note in the aggregate principal amount

of $5.0 million.

Set

forth on page 6 of this Supplement is unaudited pro forma consolidated financial information giving effect to the Equity Transaction

but updated to reflect the adjustment in the purchase price described herein.

None

of the supplemental information provided hereby alters or modifies in any way the information disclosed in the Information Statement.

The information provided in this Supplement is intended only to inform stockholders of the status of the Equity Transaction, the

Stock Purchase Agreement and all transactions contemplated thereby since the date of the Information Statement.

AMENDED

AND RESTATED

UNAUDITED

PRO FORMA FINANCIAL INFORMATION

On

June 28, 2019, Pioneer Power entered into the Stock Purchase Agreement, by and among the Pioneer Power, Electrogroup, Jefferson,

JE Mexico, the Buyer and Nathan Mazurek. Pursuant to the terms of the Stock Purchase Agreement, as amended, the Company agreed

to sell (i) all of the issued and outstanding equity interests of Electrogroup to the Canadian Buyer and (ii) all of the issued

and outstanding equity interests of Jefferson and JE Mexico to the US Buyer, for a total purchase price of $68.0 million, subject

to customary working capital adjustments, of which $60.5 million is payable in cash and $7.5 million is payable in the form of

the Seller Note.

The

Equity Transaction will transfer the ownership of the dry type and liquid type transformer businesses (referred to in this section

as the “transformer business”) from Pioneer Power to Mill Point. As a result, the transformer business’ historical

results will be reported in Pioneer Power’s consolidated financial statements as discontinued operations and in subsequent

periods Pioneer Power’s consolidated financial statements will no longer reflect the assets, liabilities, results of operations

or cash flows attributable to the transformer business.

The

following unaudited pro forma condensed consolidated financial statements (“unaudited pro forma statements”) and explanatory

notes are based on Pioneer Power’s historical consolidated financial statements adjusted to give effect to the Equity Transaction.

The Unaudited Pro Forma Condensed Consolidated Statements of Operations for the three months ended March 31, 2019 and year ended

December 31, 2018 have been prepared with the assumption that the Equity Transaction occurred as of the beginning of the statement

period. The pro forma consolidated statement of operations as of December 31, 2017 has been included to present the impact of

the sale of the transformer business on continuing operations. The Unaudited Pro Forma Condensed Consolidated Balance Sheet as

of March 31, 2019 has been prepared with the assumption that the Equity Transaction was completed as of the balance sheet date.

The

unaudited pro forma statements do not necessarily reflect what Pioneer Power’s financial condition or results of operations

would have been had the Equity Transaction occurred on the date indicated, or which may result in the future. The actual financial

position and results of operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors.

The unaudited pro forma statements have been prepared by Pioneer Power based upon assumptions deemed appropriate by Pioneer Power’s

management. An explanation of certain assumptions is set forth under the Notes hereto.

The

unaudited pro forma statements should be read in conjunction with the audited financial statements and the notes for the year

ended December 31, 2018, as well as the Company’s unaudited condensed consolidated financial statements and notes thereto

for the three months ended March 31, 2019, each of which are included elsewhere herein.

PIONEER POWER SOLUTIONS, INC.

UNAUDITED PRO FORMA CONSOLIDATED BALANCE SHEETS

|

|

|

As

of March 31, 2019

|

|

|

|

|

|

|

|

Disposition

of

|

|

|

Other

|

|

|

|

|

|

|

|

|

|

Historical

|

|

|

Business

(2a)

|

|

|

Adjustments

|

|

|

|

|

Pro

forma

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

|

$

|

175

|

|

|

$

|

—

|

|

|

$

|

30,262

|

|

(2c)

|

|

|

$

|

30,437

|

|

|

Short

term investments

|

|

|

7,548

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

7,548

|

|

|

Accounts

receivable, net

|

|

|

17,383

|

|

|

|

15,299

|

|

|

|

|

|

|

|

|

|

2,084

|

|

|

Inventories,

net

|

|

|

27,694

|

|

|

|

23,465

|

|

|

|

|

|

|

|

|

|

4,229

|

|

|

Income

taxes receivable

|

|

|

578

|

|

|

|

578

|

|

|

|

|

|

|

|

|

|

—

|

|

|

Prepaid

expenses and other current assets

|

|

|

2,630

|

|

|

|

352

|

|

|

|

|

|

|

|

|

|

2,278

|

|

|

Total

current assets

|

|

|

56,008

|

|

|

|

39,694

|

|

|

|

30,262

|

|

|

|

|

|

46,576

|

|

|

Property,

plant and equipment, net

|

|

|

5,168

|

|

|

|

4,360

|

|

|

|

|

|

|

|

|

|

808

|

|

|

Deferred

income taxes

|

|

|

3,670

|

|

|

|

86

|

|

|

|

|

|

|

|

|

|

3,584

|

|

|

Other

assets

|

|

|

4,974

|

|

|

|

1,985

|

|

|

|

7,500

|

|

(2b)

|

|

|

|

10,489

|

|

|

Intangible

assets, net

|

|

|

3,531

|

|

|

|

3,418

|

|

|

|

|

|

|

|

|

|

113

|

|

|

Goodwill

|

|

|

8,527

|

|

|

|

5,557

|

|

|

|

|

|

|

|

|

|

2,970

|

|

|

Total

assets

|

|

$

|

81,878

|

|

|

$

|

55,100

|

|

|

$

|

37,762

|

|

|

|

|

$

|

64,540

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank

overdrafts

|

|

$

|

518

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

518

|

|

|

Revolving

credit facilities

|

|

|

19,915

|

|

|

|

|

|

|

|

(19,915

|

)

|

(2c)

|

|

|

|

—

|

|

|

Short

term borrowings

|

|

|

1,785

|

|

|

|

—

|

|

|

|

(1,785

|

)

|

(2c)

|

|

|

|

—

|

|

|

Accounts

payable and accrued liabilities

|

|

|

29,946

|

|

|

|

20,873

|

|

|

|

|

|

|

|

|

|

9,073

|

|

|

Current

maturities of long-term debt and capital lease obligations

|

|

|

1,175

|

|

|

|

|

|

|

|

(1,175

|

)

|

(2c)*

|

|

|

|

—

|

|

|

Income

taxes payable

|

|

|

1,262

|

|

|

|

1,155

|

|

|

|

4,272

|

|

(2d)

|

|

|

|

4,379

|

|

|

Total

current liabilities

|

|

|

54,601

|

|

|

|

22,028

|

|

|

|

(18,603

|

)

|

|

|

|

|

13,970

|

|

|

Long-term

debt, net of current maturities

|

|

|

2,324

|

|

|

|

|

|

|

|

(2,324

|

)

|

(2c)*

|

|

|

|

—

|

|

|

Pension

deficit

|

|

|

32

|

|

|

|

32

|

|

|

|

|

|

|

|

|

|

—

|

|

|

Other

long-term liabilities

|

|

|

3,648

|

|

|

|

2,154

|

|

|

|

|

|

|

|

|

|

1,494

|

|

|

Noncurrent

deferred income taxes

|

|

|

3,892

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

3,892

|

|

|

Total

liabilities

|

|

|

64,497

|

|

|

|

24,214

|

|

|

|

(20,927

|

)

|

|

|

|

|

19,356

|

|

|

Stockholders’

equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred

stock, $0.001 par value, 5,000,000 shares authorized; none issued

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—

|

|

Common

stock, $0.001 par value, 30,000,000 shares authorized;

8,726,045 shares issued and outstanding on March 31, 2019 and

December 31, 2018

|

|

|

9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9

|

|

|

Additional

paid-in capital

|

|

|

23,971

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,971

|

|

|

Accumulated

other comprehensive loss

|

|

|

(6,119

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,119

|

)

|

|

Retained

earnings (accumulated deficit)

|

|

|

(480

|

)

|

|

|

|

|

|

|

27,803

|

|

2(e)*

|

|

|

|

27,323

|

|

|

Total

stockholders’ equity

|

|

|

17,381

|

|

|

|

—

|

|

|

|

27,803

|

|

|

|

|

|

45,184

|

|

|

Total

liabilities and stockholders’ equity

|

|

$

|

81,878

|

|

|

$

|

24,214

|

|

|

$

|

6,876

|

|

|

|

|

$

|

64,540

|

|

*The

balances as of March 31, 2019 are net of debt issuance cost of $39.

See the accompanying notes which are an integral part of these unaudited pro forma condensed consolidated

financial statements.

PIONEER POWER SOLUTIONS, INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

For

the Year ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposition

of

|

|

|

|

|

|

|

|

Historical

|

|

|

Business

(3

)

|

|

|

Pro

forma

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

114,391

|

|

|

$

|

86,396

|

|

|

$

|

27,995

|

|

|

Cost

of goods sold

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost

of goods sold

|

|

|

95,779

|

|

|

|

68,397

|

|

|

|

27,382

|

|

|

Restructuring

and integration

|

|

|

873

|

|

|

|

873

|

|

|

|

—

|

|

|

Total

cost of goods sold

|

|

|

96,652

|

|

|

|

69,270

|

|

|

|

27,382

|

|

|

Gross

profit

|

|

|

17,739

|

|

|

|

17,126

|

|

|

|

613

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling,

general and administrative

|

|

|

21,158

|

|

|

|

10,389

|

|

|

|

10,769

|

|

|

Restructuring

and integration

|

|

|

219

|

|

|

|

215

|

|

|

|

4

|

|

|

Foreign

exchange gain

|

|

|

(325

|

)

|

|

|

(325

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

operating expenses

|

|

|

21,052

|

|

|

|

10,279

|

|

|

|

10,773

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss)

Income from continuing operations

|

|

|

(3,313

|

)

|

|

|

6,847

|

|

|

|

(10,160

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

expense

|

|

|

2,462

|

|

|

|

—

|

|

|

|

2,462

|

|

|

Other

expense

|

|

|

411

|

|

|

|

80

|

|

|

|

331

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss)

income before taxes

|

|

|

(6,186

|

)

|

|

|

6,767

|

|

|

|

(12,953

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

tax expense

|

|

|

3,039

|

|

|

|

431

|

|

|

|

2,608

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

(loss) income

|

|

$

|

(9,225

|

)

|

|

$

|

6,336

|

|

|

$

|

(15,561

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(1.06

|

)

|

|

|

|

|

|

$

|

(1.79

|

)

|

|

Diluted

|

|

$

|

(1.06

|

)

|

|

|

|

|

|

$

|

(1.79

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

8,717

|

|

|

|

|

|

|

|

8,717

|

|

|

Diluted

|

|

|

8,717

|

|

|

|

|

|

|

|

8,717

|

|

See the accompanying notes which are an integral part of these

unaudited pro forma condensed consolidated financial statements.

PIONEER POWER SOLUTIONS, INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

For the Year

ended December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposition of

|

|

|

|

|

|

|

|

Historical

|

|

|

Business

(3

)

|

|

|

Pro

forma

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

106,390

|

|

|

$

|

86,296

|

|

|

$

|

20,094

|

|

|

Cost of goods sold

|

|

|

87,139

|

|

|

|

68,906

|

|

|

|

18,233

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

19,251

|

|

|

|

17,390

|

|

|

|

1,861

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

21,465

|

|

|

|

11,259

|

|

|

|

10,206

|

|

|

Foreign exchange gain

|

|

|

(341

|

)

|

|

|

(341

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

operating expenses

|

|

|

21,124

|

|

|

|

10,918

|

|

|

|

10,206

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) Income from continuing

operations

|

|

|

(1,873

|

)

|

|

|

6,472

|

|

|

|

(8,345

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

2,662

|

|

|

|

2,662

|

|

|

|

—

|

|

|

Other expense

|

|

|

826

|

|

|

|

762

|

|

|

|

64

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before taxes

|

|

|

(5,361

|

)

|

|

|

3,048

|

|

|

|

(8,409

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit)

|

|

|

303

|

|

|

|

655

|

|

|

|

(352

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$

|

(5,664

|

)

|

|

$

|

2,393

|

|

|

$

|

(8,057

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.65

|

)

|

|

|

|

|

|

$

|

(0.92

|

)

|

|

Diluted

|

|

$

|

(0.65

|

)

|

|

|

|

|

|

$

|

(0.92

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

8,726

|

|

|

|

|

|

|

|

8,726

|

|

|

Diluted

|

|

|

8,726

|

|

|

|

|

|

|

|

8,726

|

|

See the accompanying notes which are an integral part of these unaudited pro forma condensed consolidated

financial statements.

PIONEER POWER SOLUTIONS, INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

For the Three

Months Ended March 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposition of

|

|

|

|

|

|

|

|

Historical

|

|

|

Business

(3)

|

|

|

Pro

forma

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

24,699

|

|

|

$

|

21,683

|

|

|

$

|

3,016

|

|

|

Cost of goods sold

|

|

|

20,600

|

|

|

|

17,839

|

|

|

|

2,761

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

4,099

|

|

|

|

3,844

|

|

|

|

255

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

4,139

|

|

|

|

2,644

|

|

|

|

1,495

|

|

|

Foreign exchange gain

|

|

|

(632

|

)

|

|

|

(632

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

operating expenses

|

|

|

3,507

|

|

|

|

2,012

|

|

|

|

1,495

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing

operations

|

|

|

592

|

|

|

|

1,832

|

|

|

|

(1,240

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

499

|

|

|

|

499

|

|

|

|

—

|

|

|

Other (income) expense

|

|

|

(3,295

|

)

|

|

|

47

|

|

|

|

(3,342

|

)

|

|

Gain on sale of subsidiary

|

|

|

(4,207

|

)

|

|

|

—

|

|

|

|

(4,207

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before taxes

|

|

|

7,595

|

|

|

|

1,286

|

|

|

|

6,309

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

1,948

|

|

|

|

383

|

|

|

|

1,565

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

5,647

|

|

|

$

|

903

|

|

|

$

|

4,744

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.65

|

|

|

|

|

|

|

$

|

0.54

|

|

|

Diluted

|

|

$

|

0.65

|

|

|

|

|

|

|

$

|

0.54

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

8,726

|

|

|

|

|

|

|

|

8,726

|

|

|

Diluted

|

|

|

8,730

|

|

|

|

|

|

|

|

8,730

|

|

See the accompanying notes which are an integral part of these unaudited pro forma condensed consolidated

financial statements.

Notes

to Unaudited Pro Forma Condensed Consolidated Financial Statements

1.

Sale Transaction

The

consideration payable by the Buyer in the Equity Transaction is a base cash purchase price of $60.5 million, as well as the issuance

by the Buyer of subordinated promissory notes to Pioneer Power in the aggregate principal amount of $7.5 million (the “Seller

Notes”), in each case subject to adjustment pursuant to the terms of the Stock Purchase Agreement. Pursuant to the terms

of the Stock Purchase Agreement, the Seller Notes will bear interest at an annualized rate of 4.0%, to be paid-in-kind annually,

and will have a maturity date of December 31, 2022. In addition, pursuant to the terms of the Stock Purchase Agreement, the Buyer

will have the right to set-off amounts owed to Pioneer Power under the Seller Note on a dollar-for-dollar basis by the amount

of any indemnifiable losses Buyer suffers as a result of certain actions or omissions by Pioneer Power or the Disposed Companies,

subject to a $5.0 million cap.

2.

Unaudited Pro Forma Adjustments

The

following notes describe the basis for and/or assumptions regarding the pro forma adjustments included in the Company’s

unaudited pro forma statements.

All

dollar amounts (except share and per share data) presented in the notes to our unaudited consolidated financial statements are

stated in thousands of dollars, unless otherwise noted. Amounts may not foot due to rounding.

(a)

Recording of the disposition of the Business. The amounts include the assets and liabilities attributable to the business being

sold.

(b)

Recording of the sale proceeds, net of estimated transaction related expenses.

|

Cash proceeds from sale

|

|

$

|

60,500

|

|

|

Note receivable

|

|

|

7,500

|

|

|

Less: estimated transaction costs

|

|

|

5,000

|

|

|

Net proceeds less transaction costs

|

|

$

|

63,000

|

|

(c)

Recording of repayment of the revolving credit facilities, short term borrowings and debt.

|

Cash proceeds from sale

|

|

$

|

60,500

|

|

|

Less: estimated transaction costs

|

|

|

5,000

|

|

|

Net Cash proceeds from sale

|

|

|

55,500

|

|

|

Repayment of short term borrowings

|

|

|

(1,785

|

)

|

|

Repayment of revolving credit facilities

|

|

|

(19,915

|

)

|

|

Repayment of term loan B

|

|

|

(3,538

|

)

|

|

Total Cash proceeds less repayment of debt

|

|

$

|

30,262

|

|

(d)

The table below represents the tax expense and related taxes payable associated with sale of PPSI’s transformer business.

|

Income Tax at statutory rate

|

|

$

|

8,093

|

|

|

Book tax differences

|

|

|

(3,097

|

)

|

|

Benefit from net operating loss utilization

|

|

|

(724

|

)

|

|

Total Income Tax Payable

|

|

$

|

4,272

|

|

We

have applied an effective tax rate of 25.2% which represents the consolidated group tax for US tax purposes.

The

Company estimates the taxable income of $17.0 million with respect to the gain on sale of common stocks of the Disposed Companies

to be partially offset by federal net operating losses on hand of approximately $2.9 million as of the transaction date. The Company

estimates that after utilizing federal, state and local net operating losses they will incur federal, state and local income taxes

of approximately $4.3 million.

(e)

The estimated gain on the sale of the business if we had completed the sale as of March 31, 2019 is as follows:

|

Net proceeds (Note (b))

|

|

$

|

63,000

|

|

|

Net assets sold

|

|

|

(30,886

|

)

|

|

Pre-tax gain on sale

|

|

|

32,114

|

|

|

Tax expense

|

|

|

4,272

|

|

|

After-tax gain on sale

|

|

$

|

27,842

|

|

This

estimated gain has not been reflected in the pro forma condensed consolidated statement of operations as it is considered to be

nonrecurring in nature and is reflected within equity on the Balance Sheet for the period ended March 31, 2019. No adjustment

has been made to the sale proceeds to give effect to any potential post-closing adjustments under the terms of the Sale Transaction.

3.

Discontinued Operations

The

Financial results of the transformer business, net of income taxes, have been removed to reflect the effects of the disposition

and the retrospective presentation as discontinued operations in future filings. The following table presents the financial results

for the transformer business for the periods ended March 31, 2019 and December 31, 2018 and 2017:

|

|

|

For the Year ended

December 31, 2017

|

|

|

For the Year ended

December 31, 2018

|

|

|

For the three months

ended March 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

86,396

|

|

|

$

|

86,296

|

|

|

$

|

21,683

|

|

|

Cost of goods sold

|

|

|

68,397

|

|

|

|

68,906

|

|

|

|

17,839

|

|

|

Restructuring and integration

|

|

|

873

|

|

|

|

—

|

|

|

|

—

|

|

|

Gross profit

|

|

|

17,126

|

|

|

|

17,390

|

|

|

|

3,844

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

10,389

|

|

|

|

11,259

|

|

|

|

2,644

|

|

|

Restructuring and integration

|

|

|

215

|

|

|

|

—

|

|

|

|

—

|

|

|

Foreign exchange gain

|

|

|

(325

|

)

|

|

|

(341

|

)

|

|

|

(632

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

10,279

|

|

|

|

10,918

|

|

|

|

2,012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

6,847

|

|

|

|

6,472

|

|

|

|

1,832

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

1,065

|

|

|

|

840

|

|

|

|

14

|

|

|

Other expense

|

|

|

80

|

|

|

|

762

|

|

|

|

47

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before taxes

|

|

|

5,702

|

|

|

|

4,870

|

|

|

|

1,771

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

431

|

|

|

|

655

|

|

|

|

383

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

5,271

|

|

|

$

|

4,215

|

|

|

$

|

1,388

|

|

Annex

A

Amendment

No. 1 to Stock Purchase Agreement

Execution

Version

FIRST

AMENDMENT TO

STOCK

PURCHASE AGREEMENT

This

First Amendment to Stock Purchase Agreement (this “

Amendment

”), dated as of August 13, 2019 (the “

Amendment

Date

”), is entered into by and among Pioneer Power Solutions, Inc., a Delaware corporation (the “

Seller

”),

Pioneer Electrogroup Canada Inc., a Canadian corporation (“

Electrogroup

”), Jefferson Electric, Inc.,

a Delaware corporation (“

Jefferson

”), JE Mexican Holdings, Inc., a Delaware corporation (“

JE

Mexico

” and, together with Electrogroup and Jefferson, each the “

Acquired Companies

”),

and (a) Pioneer Transformers L.P., a Delaware limited partnership (“

US Buyer

”) and (b) Pioneer Acquireco

ULC, a British Columbia Unlimited Liability Company (“

Canadian Buyer

”) (US Buyer and Canadian Buyer

are hereinafter collectively referred to as “

Buyer

”). The Acquired Companies, Seller and Buyer are collectively

referred to herein as the “

Parties

” and individually as a “

Party

.”

RECITALS:

A. The Parties entered into that certain Stock Purchase Agreement, dated June 28, 2019 (the “

Purchase Agreement

”),

pursuant to which the Seller agreed to sell, and Buyer agreed to purchase, all of the Interests (as defined therein), all as more

specifically provided therein.

B. The

Parties desire to amend the Purchase Agreement as set forth in this Amendment.

NOW,

THEREFORE, in consideration of the foregoing and other good and valuable consideration, the receipt and sufficiency of which are

hereby confirmed, and subject to the terms and conditions set forth herein, the Parties intending to be legally bound hereby agree

as follows:

1.

Capitalized Terms

. Capitalized terms used but not otherwise defined herein shall have their respective meanings as set

forth in the Purchase Agreement.

2.

Base Purchase Price Increase

. The Base Purchase Price of $65,500,000 in Section 2.2 of the Purchase Agreement shall be

increased to $68,000,000.

3.

Second Seller Note

. Section 2.4(a) of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“Buyer

shall issue (i) a promissory note to Seller (the “

First Seller Note

”), in the amount of $5,000,000 (the

“

First Seller Note Amount

”), in the form attached hereto as

Exhibit B

, and (ii) a promissory

note to Seller (the “

Second Seller Note

”), in the amount of $2,500,000 (the “

Second Seller

Note Amount

”), in the form attached hereto as

Exhibit E

; and”

4.

Net Purchase Price Reduction

. Section 2.5(e)(ii) of the Purchase Agreement is hereby amended and restated in its entirety

as follows:

“if

the Final Net Purchase Price is less than the Closing Date Net Purchase Price (the amount of such difference, the “

Net

Purchase Price Reduction

”), then Seller shall pay (or cause to be paid) to Buyer an amount in cash or other immediately

available funds (to the account(s) designated in writing to the Seller by Buyer) equal to the Net Purchase Price Reduction;

provided

,

however

, in the event that Seller fails to make such payment of the Net Purchase Price Reduction (if any) as required pursuant

to the terms hereof, Buyer, at its sole election shall be entitled to set-off such Net Purchase Price Reduction on a dollar-for-dollar

basis against any amounts due and payable to Seller by Buyer under the First Seller Note in accordance with

Section 2.6

;

and”

5.

Seller Note Defined Term Updates

. (a) The reference to “Seller Note Amount” in Section 2.2 is hereby replaced

with “Aggregate Seller Note Amount”, (b) the references to “Seller Note” in Sections 2.6, and 10.5 of

the Purchase Agreement are hereby replaced with “First Seller Note” and (c) the reference to “Seller Note Amount”

in Section 2.6 is hereby replaced with “First Seller Note Amount”.

6.

Delivery of Closing Settlement Amounts

. Section 3.3 of the Purchase Agreement is hereby amended by adding the following

new Section 3.3(g):

“(g) to

the Persons entitled thereto, by wire transfer of immediately available funds to the account designated in writing by such Person

or Seller, or by check to such address designated in writing by such Person or Seller, such recipient’s portion of the Transaction

Expenses and/or Acquired Company Debt set forth on the certificate delivered to Buyer by Seller pursuant to

Section 2.3

,

as applicable.”

7.

Reynosa Flood Matters

. Section 7.17 of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“

Reynosa

Flood Matters

. Prior to the Closing Date, the Seller shall cause Reynosa Facility #2 to be restored to the conditions

and operation substantially similar in all material respects to the conditions and operation that existed at Reynosa Facility

#2 immediately prior to the flood that occurred at Reynosa Facility #2 in Reynosa, Mexico in June 2019 (the “

Reynosa

Flood

”). Seller shall keep Buyer reasonably informed, and promptly respond to the Buyer’s reasonable requests,

regarding the status of developments with respect to the restoration of operations at the facility. Seller shall use reasonably

best efforts to recover any available insurance proceeds with respect to damaged or destroyed plant, property or equipment as

a result of the Reynosa Flood, and the Parties shall reasonably cooperate with respect to any insurance claims regarding the Reynosa

Flood as follows: (i) all insurance proceeds relating to business interruption insurance in connection with the Reynosa Flood

whether for the period prior to or after the Closing and whether paid before or following Closing shall be the property of the

Seller, (ii) all insurance proceeds in connection with the Reynosa Flood (whether received prior to or after the Closing) relating

to the reimbursement for lost or damaged inventory, work in progress or finished goods shall be the property of the Seller, (iii)

all insurance proceeds in connection with the Reynosa Flood (whether received prior to or after the Closing) relating to the reimbursement

for damaged or destroyed plant, property or equipment shall be the property of the Buyer;

provided

, that if the insurance

proceeds with respect to any such claim for damaged or destroyed plant, property or equipment that would be the property of Buyer

pursuant to this

Section 7.17

are reduced as a result of the aggregate claims exceeding the applicable insurance

policy limits, Seller agrees to promptly pay to Buyer the amount of any such reduction. As of the Closing Date, neither the Seller

nor any Acquired Company has received any insurance proceeds with respect to the Reynosa Flood. Notwithstanding anything contained

herein to the contrary, Net Working Capital shall not include any Current Assets or Current Liabilities associated with the Reynosa

Flood, including any insurance proceeds received or receivable, vendor and contractor payments relating to the repair or replacement

of damaged property.”

8.

Grievance Deductible

. The last sentence of Section 10.4(a) of the Purchase Agreement is hereby amended and restated in

its entirety as follows:

“In

addition, Seller shall not have any liability for Losses under

Section 10.2(a)(viii)

hereof solely with respect

to the grievances listed in item #9 of

Schedule 4.13

unless and until the aggregate amount of all such Losses that

are imposed on or incurred by the Buyer Indemnified Parties with respect to the grievances listed in item #9 of

Schedule

4.13

exceeds $150,000 (the “

Grievance Deductible

”) in which case the applicable Buyer Indemnified

Parties shall be entitled to indemnification (subject to the other limitations set forth in this

Section 10.4

) for

all such Losses in excess of the Grievance Deductible.”

9.

Indemnification for August Update Matters

. The last sentence of Section 10.4(a) of the Purchase Agreement is hereby amended

and restated in its entirety as follows:

“Other

than with respect to a breach of the representations and covenants set forth in Section 7.17, Seller shall not be liable for,

and Buyer shall not be permitted to claim, any Losses under this

Article X

resulting from the items specifically

set forth on

Schedule 10

.”

10.

Deletion of the Canadian Certificate of Authority Indemnity

.

(a)

Section 10.2(a)(vii) of the Purchase Agreement is hereby amended and restated in its entirety as follows:

“[intentionally

omitted]”

(b)

Sections 10.4(b)(iii) and 10.6 of the Purchase Agreement are hereby deleted in their entirety.

11.

Definition Updates

.

(a)

Exhibit A

to the Purchase Agreement is hereby amended by replacing or adding, as applicable, the following defined terms

in the appropriate alphabetic position:

“

Aggregate

Seller Note Amount

” means an amount equal to the sum of the First Seller Note Amount plus the Second Seller Note

Amount.

“

Ancillary

Agreements

” means, collectively, the Stockholder Consent, the First Seller Note, the Second Seller Note, the R&W

Policy, the Voting Agreement and the Limited Guaranty.

“

Applicable

Adverse Event

” means any state of fact, event, change, result, circumstance, occurrence, or development that, either

alone or in combination with any other fact, event, change, result, circumstance, occurrence, or development, has or would reasonably

be expected to have an adverse change or effect in excess of $3,500,000 on (a) the business, results of operations or financial

condition of the Acquired Companies and the Subsidiaries taken as a whole, but excluding facts, events, changes, results, circumstances,

occurrences, or developments, either alone or taken together, relating to or arising from (i) changes or developments in the United

States or worldwide economy or credit, currency, oil, financial, banking, securities or capital markets, (ii) changes or developments

in any national or international political, or regulatory conditions, including acts of terrorism, sabotage, cyber-attack, military

action, national emergency or war (whether or not declared), or any escalation or worsening thereof, (iii) changes or developments

in the business conditions or regulatory conditions affecting the industries or markets in which the Acquired Companies and the

Subsidiaries operate or conduct their business generally, (iv) any earthquake, hurricane, tsunami, tornado, flood, mudslide or

other natural disaster, pandemic, weather condition, explosion or fire or other force majeure event or act of God, whether or

not caused by any Person, or any national or international calamity or crisis, (v) the announcement of this Agreement or the transactions

contemplated hereby, (vi) any action taken at the specific written request of Buyer, (vii) any changes or prospective changes

in Law or GAAP or enforcement or interpretation thereof, (viii) any failure, in and of itself, to meet any budgets, projections,

forecasts, estimates, plans, predictions, or milestones (whether or not shared with Buyer or its Affiliates or representatives)

(but, for the avoidance of doubt, in each case, not the underlying causes of any such failure to the extent such underlying cause

is not otherwise excluded from the definition of Applicable Adverse Event), or (ix) the items specifically set forth on

Schedule

10

;

provided

, that, with respect to the foregoing clauses (i), (ii), (iii) (iv) and (vii), any such effect shall

be taken into account if and to the extent it, individually or in the aggregate with any other effect, disproportionately affects

the Acquired Companies, taken as a whole, compared to other companies operating in the industries in which the Acquired Companies

operate or (b) the ability of the Seller to consummate the Equity Transaction or perform its obligations under this Agreement

or the Ancillary Agreements.

“

Estimated

Closing Net Working Capital

” means $23,558,000.

“

First

Seller Note

” has the meaning set forth in

Section 2.4(a)

.

“

First

Seller Note Amount

” has the meaning set forth in

Section 2.4(a)

.

“

Grievance

Deductible

” has the meaning set forth in

Section 10.4(a)

.

“

Net

Purchase Price

” means an amount equal to (i) the Base Purchase Price,

plus

(ii) the amount, if any, by which

the Closing Net Working Capital exceeds the Target Net Working Capital,

minus

(iii) the amount, if any, by which the Target

Net Working Capital exceeds the Closing Net Working Capital,

minus

(iv) Acquired Company Debt,

minus

(v) the Transaction

Expenses,

minus

(vi) the Aggregate Seller Note Amount,

plus

(vii) the Closing Cash.

“

Second

Seller Note

” has the meaning set forth in

Section 2.4(a)

.

“

Second

Seller Note Amount

” has the meaning set forth in

Section 2.4(a)

.

“

Target

Net Working Capital

” means $29,558,000.

(b)

Exhibit A

to the Purchase Agreement is hereby amended by deleting the following defined terms:

“

Seller

Note

” has the meaning set forth in

Section 2.4(a)

.

“

Seller

Note Amount

” has the meaning set forth in

Section 2.4(a)

.

12.

Schedule 2.2

. Schedule 2.2 to the Purchase Agreement is hereby deleted in its entirety and replaced with the revised Schedule

2.2 attached hereto as

Exhibit A

. The parties acknowledge and agree that all accounts payable in excess of 30 days past

due shall be treated for all purposes under this Agreement as Acquired Company Debt.

13.

Schedule 8

. Schedule 8 to the Purchase Agreement is hereby deleted in its entirety and replaced with the revised Schedule

8 attached hereto as

Exhibit B

.

14.

August Update Schedule

.

Exhibit C

attached hereto is hereby incorporated into to the Purchase Agreement as Schedule

10 thereto.

15.

Second Seller Note Exhibit

.

Exhibit D

attached hereto is hereby incorporated into to the Purchase Agreement as Exhibit

E thereto.

16.

Continuing Effectiveness

. Except as expressly modified by this Amendment, the Purchase Agreement shall continue in full

force and effect, and as modified by this Amendment, the Purchase Agreement is hereby ratified and confirmed by the Parties.

[Signature

pages follow.]

IN

WITNESS WHEREOF, Buyer, the Acquired Companies, and Seller have executed this Agreement to be effective as of the Signing Date.

|

|

ACQUIRED COMPANIES:

|

|

|

|

|

|

|

PIONEER ELECTROGROUP CANADA INC.

|

|

|

|

|

|

|

By:

|

/s/ Nathan J. Mazurek

|

|

|

Name:

|

Nathan J. Mazurek

|

|

|

Title:

|

President

|

|

|

|

|

|

|

JEFFERSON ELECTRIC, INC.

|

|

|

|

|

|

|

By:

|

/s/ Nathan J. Mazurek

|

|

|

Name:

|

Nathan J. Mazurek

|

|

|

Title:

|

President

|

|

|

|

|

|

|

JE MEXICAN HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Nathan J. Mazurek

|

|

|

Name:

|

Nathan J. Mazurek

|

|

|

Title:

|

President

|

[Signatures

continue on next page.]

Signature

Page to First Amendment to Stock Purchase Agreement

|

|

SELLER:

|

|

|

|

|

|

|

PIONEER

POWER SOLUTIONS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Nathan J. Mazurek

|

|

|

Name:

|

Nathan

J. Mazurek

|

|

|

Title:

|

President

& CEO

|

[Signatures

continue on next page.]

Signature

Page to First Amendment to Stock Purchase Agreement

|

|

US BUYER:

|

|

|

|

|

|

|

PIONEER TRANSFORMERS L.P.

|

|

|

|

|

|

|

By:

|

/s/ Dustin Smith

|

|

|

Name:

|

Dustin Smith

|

|

|

Title:

|

Manager

|

|

|

|

|

|

|

CANADIAN BUYER:

|

|

|

|

|

|

|

PIONEER ACQUIRECO ULC

|

|

|

|

|

|

|

By:

|

/s/ Dustin Smith

|

|

|

Name:

|

Dustin Smith

|

|

|

Title:

|

Manager

|

Signature

Page to First Amendment to Stock Purchase Agreement

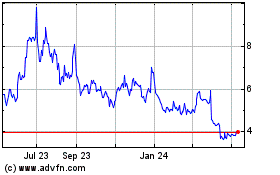

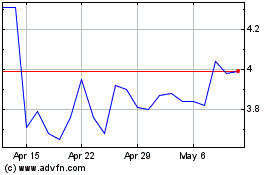

Pioneer Power Solutions (NASDAQ:PPSI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pioneer Power Solutions (NASDAQ:PPSI)

Historical Stock Chart

From Jul 2023 to Jul 2024