PetIQ, Inc. (“PetIQ” or the “Company”) (Nasdaq: PETQ), a leading

pet medication, health and wellness company, and Bansk Group

(“Bansk”), a consumer-focused private investment firm dedicated to

building distinctive consumer brands, today announced that PetIQ

entered into a definitive agreement (the “Agreement”) pursuant to

which Bansk Group will acquire all of the outstanding shares of

PetIQ’s common stock for $31.00 per share, in an all-cash

transaction valued at approximately $1.5 billion. PetIQ’s Board of

Directors (the “Board”) has approved the Agreement, which

represents a premium of approximately 41% to the 30-day

volume-weighted average stock price as of August 6, 2024, the last

trading day prior to announcement of the transaction, and a premium

of approximately 51% to the closing stock price on that date.

Cord Christensen, Founder, Chairman and CEO of PetIQ, commented,

“On behalf of PetIQ's Board of Directors, we are thrilled to

announce the execution of a definitive agreement with Bansk Group

at a substantial premium for PetIQ stockholders. After a

comprehensive assessment of the offer with the assistance of our

outside advisors, the Board has determined that this transaction

represents an attractive outcome for PetIQ and our

stockholders.”

Christensen concluded, “Our growth and success over the last 14

years is a testament to our emphasis on long-term,

strategic decision making, while operating our business in the

interest of all stakeholders. We are excited to partner with

Bansk Group and to utilize their extensive operational and

brand-building experience, including their direct expertise of

managing consumer health products for over four decades. This

transaction provides us with an incredible opportunity to

continue to execute on our strategy of providing pet parents

convenient access to affordable pet healthcare

while accelerating many longer-term

growth initiatives.”

“Cord and the entire PetIQ team have done a fantastic job

developing a comprehensive pet health and wellness platform that

offers effective and accessible solutions for pet owners,” said

Chris Kelly, Senior Partner of Bansk Group. “We are thrilled to

partner with the PetIQ team and look forward to leveraging our

expertise in building distinct, trusted consumer brands to support

the Company’s continued success.”

Bart Becht, Senior Partner and Chairman of Bansk Group added,

“As longtime investors in the consumer health and wellness space,

we believe PetIQ has developed a portfolio of uniquely

differentiated brands in the very attractive pet health and

wellness category. We look forward to working with the talented

PetIQ team to support their strong momentum, including through

investments in enhanced capabilities and offerings as well as

through strategic acquisitions.”

Transaction Details

The proposed transaction is expected to close in

the fourth quarter of 2024, subject to the approval of PetIQ

stockholders and the satisfaction of other customary closing

conditions, including expiration or termination of the applicable

waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976. The PetIQ Board recommends that PetIQ stockholders

vote in favor of the proposed transaction at the special meeting of

stockholders to be held in connection with the agreement. The

proposed transaction is not subject to any financing

conditions.

Upon completion of the proposed transaction,

PetIQ’s common stock will no longer be listed on the NASDAQ Stock

Market, and PetIQ will be privately held and continue to be

operated independently by the Company’s executive team.

Advisors

Jefferies LLC is serving as financial advisor

and Cooley LLP is serving as legal counsel to PetIQ. Davis Polk

& Wardwell LLP is serving as legal counsel to Bansk Group.

For further information regarding the

transaction, please see PetIQ's Current Report on Form 8-K, which

will be filed in connection with this announcement.

About PetIQ

PetIQ is a leading pet medication, health and wellness company

delivering a smarter way for pet parents to help their pets live

their best lives through convenient access to affordable products

and veterinary services. The Company's product business engages

with pet parents through retail and e-commerce sales channels with

its branded and distributed pet medications as well as health and

wellness items. PetIQ manufactures and distributes pet products

from its world-class facilities in Omaha, Nebraska, Springville,

Utah and Daytona Beach, Florida. The Company’s veterinarian

services offering operates in over 2,600 mobile community clinic

locations and wellness centers hosted at retail partners in 39

states. PetIQ believes that pets are an important part of the

family and deserve the best products and care we can provide

them.

About Bansk Group

Founded in 2019, Bansk Group is a New York-based private

investment firm focused on investing in and building distinctive

consumer brands. The firm partners with differentiated brands

across four primary consumer categories: beauty & personal

care, consumer health, food & beverage, and household

products.

Over their careers with Bansk and elsewhere, Bansk's tenured

group of investors and operators have been involved in more than

$30 billion of equity capital investments across more than 40

transactions with some of the most innovative and well-known

consumer companies in the world. With extensive investment

experience in the consumer products industry, a global network of

relationships, and a tested value creation playbook, Bansk seeks to

partner with exceptional founders and management teams to drive

outsized organic and acquisitive growth and position brands for

enduring long-term success in the evolving consumer landscape. For

more information, please visit www.banskgroup.com.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of the proposed acquisition of PetIQ, Inc. (the "Company")

by Gula Buyer Inc. ("Parent") pursuant to the Agreement and Plan of

Merger, dated as of August 7, 2024, by and among the Company,

Parent and Gula Merger Sub Inc. The Company intends to file with

the SEC and furnish to its stockholders a proxy statement on

Schedule 14A, as well as other relevant documents concerning the

proposed transaction. The proxy statement will contain important

information about the proposed transaction and related

matters. Investors and security holders of the Company

are urged to carefully read the entire proxy statement (including

any amendments or supplements thereto) when it becomes available

because it will contain important information about the proposed

transaction. A definitive proxy statement will be sent to

the stockholders of the Company seeking any required stockholder

approvals. Investors and security holders of the Company will be

able to obtain a free copy of the proxy statement, as well as other

relevant filings containing information about the Company and the

proposed transaction, including materials that will be incorporated

by reference into the proxy statement, without charge, at the SEC’s

website (http://www.sec.gov) or from the Company by contacting the

Company’s Investor Relations at 208-513-1513, by email at

investor.relations@petiq.com, or by going to the Company’s Investor

Relations page on its website at https://ir.petiq.com/ and clicking

on the link under “Financial Information” titled “SEC Filings.”

Participants in the Solicitation

The Company and certain of its directors, executive officers and

employees may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information

regarding the interests of the Company’s directors and executive

officers and their ownership of the Company’s common stock is set

forth in the Company’s annual report on Form 10-K filed with the

SEC on February 29, 2024 and the Company’s proxy statement on

Schedule 14A filed with the SEC on April 19, 2024. Other

information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests in the

proposed transaction, by security holdings or otherwise, will be

contained in the proxy statement and other relevant materials to be

filed with the SEC in connection with the proposed transaction.

Copies of these documents may be obtained, free of charge, from the

SEC or the Company as described in the preceding paragraph.

Notice Regarding Forward-Looking Statements

This communication includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“anticipate,” “estimate,” “plan,” “project,” “continuing,”

“ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,”

“could” or other similar expressions that predict or indicate

future events or trends or that are not statements of historical

matters. These forward-looking statements include, but are not

limited to, statements regarding the benefits of and timeline for

closing the proposed transaction with the Bansk Group. These

statements are based on various assumptions, whether or not

identified in this communication, and on the current expectations

of Company management and are not predictions of actual

performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and

must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and may differ from assumptions. Many actual

events and circumstances are beyond the control of the Company.

These forward-looking statements are subject to a number of risks

and uncertainties, including the timing, receipt and terms and

conditions of any required governmental and regulatory approvals of

the proposed transaction that could delay the consummation of the

proposed transaction or cause the parties to abandon the proposed

transaction; the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement entered into in connection with the proposed transaction;

the possibility that the Company’s stockholders may not approve the

proposed transaction; the risk that the parties to the merger

agreement may not be able to satisfy the conditions to the proposed

transaction in a timely manner or at all; risks related to

disruption of management time from ongoing business operations due

to the proposed transaction; the risk that any announcements

relating to the proposed transaction could have adverse effects on

the market price of the common stock of the Company; the risk of

any unexpected costs or expenses resulting from the proposed

transaction; the risk of any litigation relating to the proposed

transaction; and the risk that the proposed transaction and its

announcement could have an adverse effect on the ability of the

Company to retain and hire key personnel and to maintain

relationships with customers, vendors, partners, employees,

stockholders and other business relationships and on its operating

results and business generally. Further information on factors that

could cause actual results to differ materially from the results

anticipated by the forward-looking statements is included in the

Company’s Annual Report on Form 10‑K for the fiscal year ended

December 31, 2023, Quarterly Reports on Form 10‑Q, Current Reports

on Form 8‑K and other filings made by the Company from time to time

with the Securities and Exchange Commission. These filings, when

available, are available on the investor relations section of the

Company’s website at https://ir.petiq.com/ or on the SEC’s website

at https://www.sec.gov. If any of these risks materialize or any of

these assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking

statements. There may be additional risks that the Company

presently does not know of or that the Company currently believes

are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. The

forward-looking statements included in this communication are made

only as of the date hereof. The Company assumes no obligation and

does not intend to update these forward-looking statements, except

as required by law.

Contacts: PetIQInvestors:

katie.turner@petiq.com or 208.513.1513Media: kara.schafer@petiq.com

or 407.929.6727

Bansk GroupMedia: Woomi Yun / Erik CarlsonJoele

Frank, Wilkinson Brimmer Katcher+1 (212) 355-4449

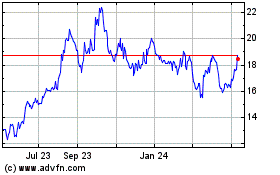

PetIQ (NASDAQ:PETQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

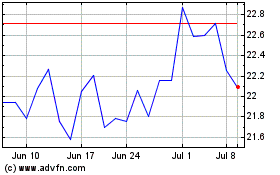

PetIQ (NASDAQ:PETQ)

Historical Stock Chart

From Nov 2023 to Nov 2024