Performance Shipping Inc. Secures Five-Year Time Charter Contracts With Clearlake for Three Newbuilding Vessels at US$31,000 Per Vessel Per Day

March 12 2024 - 9:28AM

Performance Shipping Inc. (NASDAQ: PSHG), ("we" or the "Company"),

a global shipping company specializing in the ownership of tanker

vessels, today announced that, through separate wholly-owned

subsidiaries, it has entered into time charter contracts with

Clearlake Shipping Pte Ltd (the "Charterer") for the previously

announced three newbuilding LNG-ready, scrubber-fitted, LR2 Aframax

tanker vessels. Each employment will be for a firm period of 5

years with the option to extend for a 6th and 7th year. The

optional periods are to be declared by the Charterer 12 months in

advance. The gross charter rate will be US$31,000 per vessel per

day for the firm period of five (5) years, and a base rate plus

profit share for the optional periods, if declared. Employment is

expected to commence upon delivery of the vessels to the Company in

the fourth quarter of 2025, the first quarter of 2026, and the

second quarter of 2026.

Andreas Michalopoulos, the Company's Chief

Executive Officer, stated:

"We are thrilled to announce these time charter

contracts for our newbuild vessels and the commencement of a

strategic relationship with Clearlake Shipping, a subsidiary of

Gunvor Group, one of the world’s largest independent commodities

trading houses. These contracts highlight our prudent approach in

securing long-term fixed revenue at profitable charter rates and

achieving significant cash flow visibility during the initial years

of operation of our three newbuilding sister ships. The gross

revenue for the firm period of the contracts is expected to reach

$169.8 million, representing approximately 88% of the aggregate

construction costs. This increases our remaining fleet-wide fixed

revenue backlog to approximately $211.4 million, based on the

minimum duration of each charter."

About the Company

Performance Shipping Inc. is a global provider

of shipping transportation services through its ownership of tanker

vessels. The Company employs its fleet on spot voyages, through

pool arrangements and on time charters.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include, but are not limited to,

statements concerning plans, objectives, goals, strategies, future

events or performance, and underlying assumptions and other

statements, which are other than statements of historical facts,

including with respect to the delivery of the vessels we have

agreed to acquire. The words "believe," "anticipate," "intends,"

"estimate," "forecast," "project," "plan," "potential," "will,"

"may," "should," "expect," "targets," "likely," "would," "could,"

"seeks," "continue," "possible," "might," "pending" and similar

expressions, terms or phrases may identify forward-looking

statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including, without

limitation, our management's examination of historical operating

trends, data contained in our records and other data available from

third parties. Although we believe that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, we

cannot assure you that we will achieve or accomplish these

expectations, beliefs, or projections.

In addition to these important factors, other

important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include, but are not limited to: the strength of world

economies, fluctuations in currencies and interest rates, general

market conditions, including fluctuations in charter rates and

vessel values, changes in demand in the tanker shipping industry,

changes in the supply of vessels, changes in worldwide oil

production and consumption and storage, changes in our operating

expenses, including bunker prices, crew costs, drydocking and

insurance costs, our future operating or financial results,

availability of financing and refinancing including with respect to

vessels we agree to acquire, changes in governmental rules and

regulations or actions taken by regulatory authorities, potential

liability from pending or future litigation, general domestic and

international political conditions, the length and severity of

epidemics and pandemics, including COVID-19, and their impact on

the demand for seaborne transportation of petroleum and other types

of products, changes in governmental rules and regulations or

actions taken by regulatory authorities, general domestic and

international political conditions or events, including "trade

wars", armed conflicts including the war in Ukraine and the war

between Israel and Hamas, the imposition of new international

sanctions, acts by terrorists or acts of piracy on ocean-going

vessels, potential disruption of shipping routes due to accidents,

labor disputes or political events, vessel breakdowns and instances

of off-hires and other important factors. Please see our filings

with the US Securities and Exchange Commission for a more complete

discussion of these and other risks and uncertainties.

Corporate Contact:

Andreas Michalopoulos

Chief Executive Officer, Director and Secretary

Telephone: +30-216-600-2400

Email: amichalopoulos@pshipping.com

Website: www.pshipping.com

Investor and Media Relations:

Edward Nebb

Comm-Counsellors, LLC

Telephone: + 1-203-972-8350

Email: enebb@optonline.net

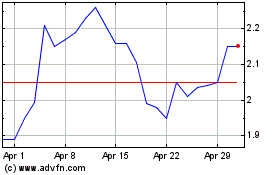

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From Oct 2024 to Nov 2024

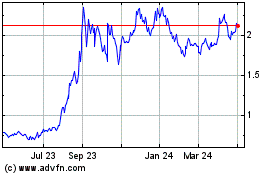

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From Nov 2023 to Nov 2024