Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National” or

the “Company”) today announced that it has commenced an

underwritten public offering of $250 million of shares of common

stock of the Company (the “Common Stock Offering”) and an

underwritten public offering of $250 million aggregate principal

amount of Convertible Senior Notes due 2026 (the “Convertible

Notes” and such offering, the “Convertible Notes Offering”).

The Company intends to grant the underwriters a 30-day option to

purchase up to $37.5 million of additional shares of its common

stock in the Common Stock Offering and a 30-day option to purchase

up to $37.5 million aggregate principal amount of additional

Convertible Notes in the Convertible Notes Offering. The Company

expects to use the net proceeds from the Common Stock Offering and

the Convertible Notes Offering for general corporate purposes.

Neither of the closings of the Common Stock Offering or the

Convertible Notes Offering is conditioned upon the closing of the

other offering.

Goldman Sachs & Co. LLC and BofA Securities are acting as

joint book-running managers for the Common Stock Offering and the

Convertible Notes Offering. A shelf registration statement relating

to these securities has been filed with the U.S. Securities and

Exchange Commission (“SEC”) and has become effective. Each of the

Common Stock Offering and the Convertible Notes Offering may be

made only by means of a prospectus supplement and an accompanying

base prospectus. The preliminary prospectus supplements and

accompanying base prospectus relating to each of the Common Stock

Offering and the Convertible Notes Offering will be filed with the

SEC and will be available on the SEC's website at www.sec.gov.

Copies of the preliminary prospectus supplements and accompanying

base prospectus relating to the Common Stock Offering and the

Convertible Notes Offering may be obtained from Goldman Sachs &

Co. LLC, 200 West Street, New York, New York 10282, Attention:

Prospectus Department, by telephone at (866) 471-2526, or by email

at prospectus-ny@ny.email.gs.com or BofA Securities, NC1-004-03-43,

200 North College Street, 3rd floor, Charlotte NC 28255-0001,

Attention: Prospectus Department, or via email:

dg.prospectus_requests@bofa.com.

This press release does not constitute an offer to sell, or the

solicitation of an offer to buy, any share of common stock, any

Convertible Notes or any other security and shall not constitute

any offer, solicitation or sale in any jurisdiction in which such

offer, solicitation, purchase or sale is unlawful. Before

investing, please read the applicable prospectus supplement and

accompanying base prospectus and other documents Penn National has

filed with the SEC for more complete information about Penn

National.

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests

in 41 gaming and racing properties in 19 jurisdictions and video

gaming terminal operations with a focus on slot machine

entertainment. We also offer live sports betting at our properties

in Indiana, Iowa, Michigan, Mississippi, Pennsylvania and West

Virginia. In total, Penn National’s properties feature

approximately 50,000 gaming machines, 1,300 table games and 8,800

hotel rooms. In addition, the Company operates an interactive

gaming division through its subsidiary, Penn Interactive Ventures,

LLC, which launched iCasino in Pennsylvania and, through strategic

partnerships, operates online sports betting in Indiana,

Pennsylvania and West Virginia. The Company also has a leading

customer loyalty program, mychoice, with over five million active

customers.

Forward-looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements can be identified by the use of

forward-looking terminology such as “expects,” “believes,”

“estimates,” “projects,” “intends,” “plans,” “goal,” “seeks,”

“may,” “will,” “should,” or “anticipates” or the negative or other

variations of these or similar words, or by discussions of future

events, strategies or risks and uncertainties. Such statements are

all subject to risks, uncertainties and changes in circumstances

that could significantly affect the Company’s future financial

results and business.

Accordingly, the Company cautions that the forward-looking

statements contained herein are qualified by important factors that

could cause actual results to differ materially from those

reflected by such statements. Such factors include, but are not

limited to, risks related to the following: (a) market conditions

for the Company’s common stock and corporate debt generally, for

the securities of gaming, hospitality and entertainment companies;

(b) the anticipated terms of the proposed Common Stock Offering and

Convertible Notes Offering; (c) the timing and ability of the

Company to consummate the Common Stock Offering and Convertible

Notes Offering; (d) the anticipated use of proceeds and

difficulties, delays or unexpected costs in offering the Common

Stock Offering and Convertible Notes Offering; (e) the magnitude

and duration of the impact of the COVID-19 pandemic on capital

markets, general economic conditions, unemployment, consumer

spending and the Company’s liquidity, financial condition, supply

chain, operations and personnel; (f) industry, market, economic,

political, regulatory and health conditions; (g) disruptions in

operations from data protection breaches, cyberattacks, extreme

weather conditions, medical epidemics or pandemics such as

COVID-19, and other natural or manmade disasters or catastrophic

events; (h) the reopening of the Company’s gaming properties are

subject to various conditions, including numerous regulatory

approvals and potential delays and operational restrictions; (i)

our ability to access additional capital on favorable terms or at

all; (j) our ability to remain in compliance with the financial

covenants of our debt obligations; (k) the consummation of the

proposed Morgantown and Perryville transactions with GLPI are

subject to various conditions, including third-party agreements and

approvals, and accordingly may be delayed or may not occur at all;

(l) actions to reduce costs and improve efficiencies to mitigate

losses as a result of the COVID-19 pandemic could negatively impact

guest loyalty and our ability to attract and retain employees; (m)

the outcome of any legal proceedings that may be instituted against

the Company or its directors, officers or employees; (n) the impact

of new or changes in current laws, regulations, rules or other

industry standards; (o) the ability of our operating teams to drive

revenue and margins; (p) the impact of significant competition from

other gaming and entertainment operations; (q) our ability to

obtain timely regulatory approvals required to own, develop and/or

operate our properties, or other delays, approvals or impediments

to completing our planned acquisitions or projects, construction

factors, including delays, and increased costs; (r) the passage of

state, federal or local legislation (including referenda) that

would expand, restrict, further tax, prevent or negatively impact

operations in or adjacent to the jurisdictions in which we do or

seek to do business (such as a smoking ban at any of our properties

or the award of additional gaming licenses proximate to our

properties, as recently occurred with Illinois and Pennsylvania

legislation); (s) the effects of local and national economic,

credit, capital market, housing, and energy conditions on the

economy in general and on the gaming and lodging industries in

particular; (t) the activities of our competitors (commercial and

tribal) and the rapid emergence of new competitors (traditional,

internet, social, sweepstakes based and VGTs in bars and truck

stops); (u) increases in the effective rate of taxation for any of

our operations or at the corporate level; (v) our ability to

identify attractive acquisition and development opportunities

(especially in new business lines) and to agree to terms with, and

maintain good relationships with partners/municipalities for such

transactions; (w) the costs and risks involved in the pursuit of

such opportunities and our ability to complete the acquisition or

development of, and achieve the expected returns from, such

opportunities; (x) our expectations for the continued availability

and cost of capital; (y) the impact of weather, including flooding,

hurricanes and tornadoes; (z) changes in accounting standards; (aa)

the risk of failing to maintain the integrity of our information

technology infrastructure and safeguard our business, employee and

customer data (particularly as our iGaming division grows); (bb)

with respect to our iGaming and sports betting endeavors, the

impact of significant competition from other companies for online

sports betting, iGaming and sportsbooks, our ability to achieve the

expected financial returns related to our investment in Barstool

Sports, our ability to obtain timely regulatory approvals required

to own, develop and/or operate sportsbooks may be delayed and there

may be impediments and increased costs to launching the online

betting, iGaming and sportsbooks, including delays, and increased

costs, intellectual property and legal and regulatory challenges,

as well as our ability to successfully develop innovative products

that attract and retain a significant number of players in order to

grow our revenues and earnings, our ability to establish key

partnerships, our ability to generate meaningful returns and the

risks inherent in any new business; (cc) with respect to our

proposed Pennsylvania Category 4 casinos in York and Berks

counties, risks relating to construction, and our ability to

achieve our expected budgets, timelines and investment returns,

including the ultimate location of other gaming properties in the

Commonwealth of Pennsylvania; and (dd) other factors included in

“Risk Factors” of the Company’s Annual Report on Form 10-K for the

year ended December 31, 2019, the Company’s Quarterly Report on

Form 10-Q for the quarter ended March 31, 2020, subsequent

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K,

each as filed with the U.S. Securities and Exchange Commission. The

Company does not intend to update publicly any forward-looking

statements except as required by law. In light of these risks,

uncertainties and assumptions, the forward-looking events discussed

in this press release may not occur.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200511005457/en/

General Media Inquiries: Eric Schippers, Sr. Vice

President, Public Affairs Penn National Gaming 610/373-2400

Financial Media and Analyst Inquiries: Justin Sebastiano,

Sr. Vice President of Finance and Treasurer Penn National Gaming

610/373-2400

Joseph N. Jaffoni, Richard Land JCIR 212/835-8500 or

penn@jcir.com

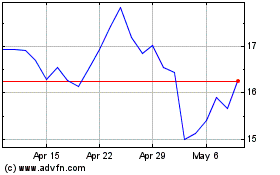

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Oct 2024 to Nov 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Nov 2023 to Nov 2024