Table of Contents

As filed with the Securities and Exchange Commission

on October 30, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PAYSIGN,

INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

|

95-4550154 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

2615 St. Rose Parkway

Henderson, Nevada 89052

(Address of Principal Executive Offices) (Zip Code)

PAYSIGN, INC. 2023 EQUITY

INCENTIVE PLAN

(Full Title of the Plan)

Mark R. Newcomer

Chief Executive Officer

Paysign, Inc.

2615 St. Rose Parkway

Henderson, Nevada 89052

(Name and Address of Agent for Service)

(702) 453-2221

(Telephone Number, Including Area Code, of Agent

for Service)

Copy to:

Brian H. Blaney, Esq.

Katherine A. Beck, Esq.

Greenberg Traurig, LLP

2375 E. Camelback Road, Suite 800

Phoenix, Arizona 85016

(602) 445-8000

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| Accelerated filer |

☐ |

|

Emerging growth company ☒ |

| |

|

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement registers shares of

our common stock, par value $0.001 per share, consisting of (i) 420,000 shares of common stock that will be issued

upon the vesting of restricted stock awards granted under the Paysign, Inc. 2023 Equity Incentive Plan (the “Plan”), and (ii)

160,000 shares reserved for future issuance pursuant to awards that may be granted under the Plan.

This Registration Statement contains two parts.

The first part contains a “reoffer prospectus” prepared in accordance with Part I of Form S-3 (in accordance with Instruction

C of the General Instructions to Form S-8). The reoffer prospectus permits reoffers and resales on a continuous or delayed basis of those

shares referred to above that constitute “restricted securities” or “control securities,” within the meaning of

Form S-8, by certain of our stockholders, as more fully set forth therein. The second part contains information required to be set forth

in the Registration Statement pursuant to Part II of Form S-8.

REOFFER PROSPECTUS

PAYSIGN, INC.

420,000 Shares of Common Stock

This Reoffer Prospectus (this

“Prospectus”) relates to an aggregate of up to 420,000 shares (the “Shares”) of our common stock, par value

$0.001 per share (the “Common Stock”), which may be offered and sold from time to time by certain of our stockholders

(the “Selling Stockholders”) who have acquired or will acquire such Shares pursuant to the vesting of restricted stock

awards issued under the Paysign, Inc. 2023 Equity Incentive Plan (the “Plan”). See “Selling

Stockholders.” This Prospectus covers the offering for resale of (i) shares acquired by the Selling Stockholders prior to

the filing of a Registration Statement on Form S-8 (“Restricted Shares”) and (ii) shares to be acquired by Selling

Stockholders who may be deemed affiliates of our company after the filing of a Registration Statement on Form S-8 pursuant to

restricted stock awards currently held by those Selling Stockholders (“Control Shares”). Our Common

Stock is listed on The Nasdaq Stock Market under the symbol “PAYS.” On October 29, 2024, the last reported sales price

of the our Common Stock on The Nasdaq Stock Market was $3.71 per share.

We will not receive any of the proceeds from sales

of the Shares by any of the Selling Stockholders. The Shares may be offered from time to time by any or all of the Selling Stockholders

(and their donees and pledgees) through ordinary brokerage transactions, in negotiated transactions or in other transactions, at such

prices as the Selling Stockholder may determine, which may relate to market prices prevailing at the time of sale or be a negotiated price.

See “Plan of Distribution.” We will bear all costs, expenses and fees in connection with the registration of the Shares. Brokerage

commissions and similar selling expenses, if any, attributable to the offer or sale of the Shares will be borne by the Selling Stockholder

(or their donees and pledgees).

We are an “emerging growth company”

as defined under the federal securities laws and are subject to reduced reporting requirements.

Investing in our securities involves a high

degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in

“Risk Factors” beginning on page 2 of this Prospectus.

Each Selling Stockholder and any broker executing

selling orders on behalf of a Selling Stockholder may be deemed to be an “underwriter” as defined in the Securities Act of

1933, as amended (the “Securities Act”). If any broker-dealers are used to effect sales, any commissions paid to broker-dealers

and, if broker-dealers purchase any of the Shares as principals, any profits received by such broker-dealers on the resale of the Shares,

may be deemed to be underwriting discounts or commissions under the Securities Act. In addition, any profits realized by the Selling Stockholders

may be deemed to be underwriting commissions.

THESE SECURITIES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION

OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The date

of this Prospectus is October 30, 2024.

_______________________________________

TABLE OF CONTENTS

You should

rely only on the information contained in this Prospectus or in any accompanying prospectus supplement by us or on our behalf. No person

is authorized to give any information or represent anything not contained or incorporated by reference in this Prospectus or any prospectus

supplement. This Prospectus and any prospectus supplement do not constitute an offer to sell or a solicitation of any offer to buy any

securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. The information

contained in this Prospectus or any prospectus supplement, as well as information incorporated by reference, is current only as of the

date of that information. Our business, financial condition and results of operations may have changed since that date.

Unless the

context otherwise requires, all references in this Prospectus to “we,” “us,” “our” or “our company”

refer to Paysign, Inc. and its consolidated subsidiaries.

THE COMPANY

We are a vertically integrated provider of prepaid

card products and processing services for corporate, consumer and government applications. Our payment solutions are utilized by our corporate

customers as a means to increase customer loyalty, increase patient adherence rates, reduce administration costs and streamline operations.

Public sector organizations can utilize our payment solutions to disburse public benefits or for internal payments. We market our prepaid

card solutions under our Paysign® brand. As we are a payment processor and prepaid card program manager, we derive our revenue from

all stages of the prepaid card lifecycle.

We operate on a powerful, high-availability payments

platform with cutting-edge fintech capabilities that can be seamlessly integrated with our clients’ systems. This distinctive positioning

allows us to provide end-to-end technologies that securely manage transaction processing, cardholder enrollment, value loading, account

management, data and analytics, and customer service. Our architecture is known for its cross-platform compatibility, flexibility, and

scalability – allowing our clients and partners to leverage these advantages for cost savings and revenue opportunities.

Our suite of product offerings includes solutions

for corporate rewards, prepaid gift cards, general purpose reloadable debit cards, employee incentives, consumer rebates, donor compensation,

clinical trials, healthcare reimbursement payments and pharmaceutical payment assistance, and demand deposit accounts accessible with

a debit card. In the future, we expect to further expand our product into other prepaid card offerings such as travel cards and expense

reimbursement cards. Our cards are sponsored by our issuing bank partners.

Our revenues include fees generated from cardholder

fees, interchange, card program management fees, transaction claims processing fees, breakage and settlement income. Revenue from cardholder

fees, interchange, card program management fees and transaction claims processing fees is recorded when the performance obligation is

fulfilled. Breakage is recorded ratably over the estimated card life based on historical redemption patterns, market-specific trends,

escheatment rules and existing economic conditions and relates solely to our open-loop gift card business, which began at the end of 2022.

Settlement income is recorded at the expiration of the card program and relates solely to our pharma prepaid business which ended in 2022.

We were incorporated in Nevada on August 24, 1995.

Our principle executive offices are located at 2615 St. Rose Parkway, Henderson, Nevada 89052, and our telephone number is (702) 453-2221.

Our website address is www.paysign.com. Information contained on, or that can be accessed through, our website is not incorporated

by reference into this Prospectus, and you should not consider information on our website to be part of this Prospectus. We qualify as

an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, and are subject to reduced reporting

requirements that are otherwise applicable to public companies.

RISK FACTORS

Investing in our Common Stock involves a high

degree of risk. Before investing in our Common Stock, you should carefully consider the risks set forth under the caption “Risk

Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “Commission”) on March

27, 2024, which are incorporated by reference herein, and subsequent reports filed with the Commission, together with the financial and

other information contained or incorporated by reference in this Prospectus. If any of the risks actually occur, our business, results

of operations, financial condition and prospects could be harmed. In that event, the trading price of our Common Stock could decline,

and you could lose part or all of your investment. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial also may impair our business operations.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Prospectus may be considered

forward-looking under federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created

thereby. All statements, besides statements of fact included in this Prospectus are forward-looking. Such forward-looking statements include,

among others:

| · | our belief that our payment solutions are utilized by our corporate customers as a means to increase customer

loyalty, increase patient adherence rates, reduce administration costs and streamline operations; |

| | | |

| · | our belief that public sector organizations can utilize our payment solutions to disburse public benefits

or for internal payments; |

| | | |

| · | our belief that we operate on a powerful, high-availability payments platform with cutting-edge fintech

capabilities that can be seamlessly integrated with our clients’ systems; |

| | | |

| · | our belief that our architecture is known for its cross-platform compatibility, flexibility, and scalability

– allowing our clients and partners to leverage these advantages for cost savings and revenue opportunities; and |

| | | |

| · | our expectation that in the future we will further expand our product into other prepaid card offerings

such as travel cards and expense reimbursement cards. |

We caution that these statements are qualified

by important risks, uncertainties and other factors that could cause actual results to differ materially from those reflected by such

forward-looking statements. Such factors include, among others:

| · | the inability to continue our current growth rate in future periods; |

| | | |

| · | that a downturn in the economy, including as a result of COVID-19 and variants, as well as further government

stimulus measures, could reduce our customer base and demand for our products and services, which could have an adverse effect on our

business, financial condition, profitability and cash flows; |

| | | |

| · | operating in a highly regulated environment; |

| | | |

| · | failure by us or business partners to comply with applicable laws and regulations; |

| | | |

| · | changes in the laws, regulations, credit card association rules or other industry standards affecting

our business; |

| | | |

| · | that a data security breach could expose us to liability and protracted and costly litigation; and |

| | | |

| · | other risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2023. |

Except to the extent required by federal securities

laws, we undertake no obligation to publicly update or revise any statements in this Prospectus, whether as a result of new information,

future events or otherwise.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of the Shares by the Selling Stockholders. All proceeds from the sale of the Shares will be for the account of the Selling Stockholders,

as described below. See the sections titled “Selling Stockholders” and “Plan of Distribution.”

SELLING STOCKHOLDERS

This Prospectus relates to Shares that are being

registered for reoffers and resales by Selling Stockholders who have acquired or will acquire such Shares pursuant to the vesting of restricted

stock awards issued under the Plan.

Beneficial ownership is determined in accordance

with the rules of the Commission, is based upon 53,968,374 shares outstanding as of the date of this Prospectus (including the 420,000

Shares issuable upon the vesting of restricted stock awards being registered for resale pursuant to the Registration Statement of which

this Prospectus forms a part), and generally includes voting or investment power with respect to securities. Options to purchase shares

of common stock that are currently exercisable or exercisable within 60 days of the date of this Prospectus are deemed to be outstanding

and to be beneficially owned by the person holding such options for the purpose of computing the percentage ownership of such person but

are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Shares of restricted stock,

whether vested or unvested, are deemed to be outstanding and to be beneficially owned by the person holding such restricted stock for

the purpose of computing the percentage ownership of such person and are treated as outstanding for the purpose of computing the percentage

ownership of each other person.

The inclusion in the table of the individuals

named therein shall not be deemed to be an admission that any such individuals are “affiliates” of our company.

Unless otherwise indicated below, the address

of each Selling Stockholder listed below is c/o Paysign, Inc., 2615 St. Rose Parkway, Henderson, Nevada 89052. Unless otherwise indicated

below, to our knowledge, the Selling Stockholders listed below have sole voting and dispositive power with respect to all such shares

that they beneficially own, subject to community property laws where applicable.

| | |

Shares Beneficially Owned

Prior

to the Offering | | |

Shares

Being Offered(1) | | |

Shares Beneficially Owned

After the Offering(2) | |

| Selling Stockholder | |

Shares | | |

Percentage | | |

Shares | | |

Shares | | |

Percentage | |

| Named Selling Stockholders(3) | |

| 447,476(4) | | |

| * | | |

| 420,000 | | |

| 27,476 | | |

| * | |

___________

* Less

than 1%.

| (1) |

Reflects shares of our Common Stock offered under this Prospectus. |

| (2) |

Assumes that all of the Shares held by each Selling Stockholder and being offered under this Prospectus are sold, and that no Selling Stockholder will acquire additional shares of Common Stock before the completion of this offering. |

| (3) |

Includes the following four named non-affiliate employees, each of whom holds at least 1,000 Shares: Rodney A. Brooks, Cosimo Cambi, Ramandeep Singh, and Hariharan Venkatachalam. Each of these persons beneficially owns less than 1% of our Common Stock. |

| (4) |

Consists

of (i) 13,476 shares of Common Stock and (ii) 434,000 shares of Common Stock issuable upon the vesting of restricted stock awards, including

the 420,000 Shares issuable upon the vesting of restricted stock awards being registered for resale pursuant to the Registration Statement

of which this Prospectus forms a part. |

PLAN OF DISTRIBUTION

The purpose of this Prospectus is to permit the

Selling Stockholders, if they desire, to offer for sale and sell the Shares they acquired or will acquire pursuant to the vesting of restricted

stock awards issued under the Plan at such times and at such places as the Selling Stockholders choose.

The decision to sell any Shares is within the

discretion of the holders thereof, subject generally to our policies affecting the timing and manner of sale of Common Stock by certain

individuals. There can be no assurance that any Shares will be sold by the Selling Stockholders.

Sales of Shares by the Selling Stockholders may

be effected from time to time in one or more types of transactions (which may include block transactions) on The Nasdaq Stock Market,

in the over-the-counter market, in negotiated transactions, through the writing of options on the Shares, through settlement of short

sales of Shares, or a combination of such methods of sale, at market prices prevailing at the time of sale, at fixed prices (which may

be changed) or at negotiated prices. Such transactions may or may not involve brokers or dealers. The Selling Stockholders have advised

us that they have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the

sale of their Shares, nor is there an underwriter or coordinating broker acting in connection with the proposed sale of the Shares by

the Selling Stockholders.

The Selling Stockholders may effect such transactions

by selling Shares directly to purchasers or to or through broker-dealers, which may act as agents or principals. Such broker-dealers may

receive compensation in the form of discounts, concessions, or commissions from the Selling Stockholders and/or the purchasers of Shares

for whom such broker-dealers may act as agents or to whom they sell as principal, or both (which compensation as to a particular broker-dealer

might be in excess of customary commissions).

The Selling Stockholders and any broker-dealers

that act in connection with the sale of Shares might be deemed to be “underwriters” within the meaning of Section 2(11) of

the Securities Act, and any commissions received by such broker-dealers and any profit on the resale of the Shares sold by them while

acting as principals might be deemed to be underwriting discounts or commissions under the Securities Act. The Selling Stockholders may

agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the Shares against certain

liabilities, including liabilities arising under the Securities Act.

Because the Selling Stockholders may be deemed

to be “underwriters” within the meaning of Section 2(11) of the Securities Act, the Selling Stockholders will be subject to

the prospectus delivery requirements of the Securities Act, which may include delivery through the facilities of The Nasdaq Stock Market

pursuant to Rule 153 under the Securities Act.

The Selling Stockholders and any other person

participating in the sale of the Shares will be subject to the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares

by the Selling Stockholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution

of the Shares to engage in market-making activities with respect to the particular Shares being distributed. This may affect the marketability

of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The Selling Stockholders also may resell all or

a portion of the Shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided they meet the criteria

and conform to the requirements of such Rule.

LEGAL MATTERS

The validity of the Shares being offered hereby

has been passed upon by Greenberg Traurig, LLP, Phoenix, Arizona.

EXPERTS

Our consolidated financial statements as of December 31, 2023 and 2022, and for the years then ended, incorporated in this Prospectus by reference from our Annual Report on

Form 10-K for the year ended December 31, 2023, have been audited by Moss Adams LLP, an independent registered public accounting

firm, as stated in their report. Such consolidated financial statements are incorporated by reference in reliance upon the report of such

firm given their authority as experts in accounting and auditing.

INCORPORATION OF DOCUMENTS BY REFERENCE

The following documents, which we have filed with

the Commission, are incorporated by reference in this Prospectus:

| (a) | Annual Report on Form 10-K for the

year ended December 31, 2023, as filed with the Commission on March 27, 2024; |

| (b) | Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as filed

with the Commission on May 8, 2024; |

| (c) | Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, as filed with the Commission on August

1, 2024; |

| (d) | Definitive Proxy Statement on Schedule 14A, as filed with the Commission on March 29, 2024; |

| (e) | Current Reports on Form 8-K as filed with the Commission on January 29, 2024, March 15, 2024, April 19, 2024, and May 7, 2024, but only to the extent that the items therein are specifically stated to be “filed” rather than “furnished”

for the purposes of Section 18 of the Exchange Act; and |

| (f) | The description of our Common Stock contained in Exhibit 4.2 to the Annual Report on Form 10-K for the

year ended December 31, 2019, as filed with the Commission on April 3, 2020, including any amendment or report filed for the purpose of

updating such description. |

In addition, all documents subsequently filed

with the Commission by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective

amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall

be deemed to be incorporated by reference in this Prospectus and to be a part hereof from the date of filing of such documents; except

as to any portion of any future annual or quarterly report to stockholders or document or current report furnished under Item 2.02 or

7.01 of Form 8-K that is not deemed “filed” under such provisions. Any statement contained in a document incorporated or deemed

to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Prospectus to the extent that

a statement contained herein or in any other subsequently filed document which also is deemed to be incorporated by reference herein modifies

or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to

constitute a part of this Prospectus. Under no circumstances will any information furnished under Item 2.02 or 7.01 of Form 8-K be deemed

incorporated herein by reference unless such Form 8-K expressly provides to the contrary.

You should rely only on the information provided

or incorporated by reference in this Prospectus or any related prospectus. We have not authorized anyone to provide you with different

information. You should not assume that the information in this Prospectus or any related prospectus is accurate as of any date other

than the date on the front of the document.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports, proxy

statements and other information with the Commission. Our filings are available to the public over the Internet at the Commission’s

website at www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including

any amendments to those reports, and other information that we file with or furnish to the Commission pursuant to Section 13(a) or 15(d)

of the Exchange Act can also be accessed free of charge by linking directly from our website at www.paysign.com. These filings

will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Commission.

Information contained on our website is not part of this Prospectus.

We hereby undertake to provide without charge

to each person, including any beneficial owner, to whom a copy of this Prospectus is delivered, upon written or oral request of any such

person, a copy of any and all of the information that has been incorporated by reference in this Prospectus but not delivered with the

Prospectus other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference into the information

that this Prospectus incorporates. Requests for documents should be directed to our Corporate Secretary, Robert Strobo, Esq., at 2615

St. Rose Parkway, Henderson, Nevada 89052.

PART I

INFORMATION REQUIRED IN THE

SECTION 10(a) PROSPECTUS

Items 1 and 2, and the documents incorporated

by reference in this Registration Statement pursuant to Item 3 of Part II of this prospectus, taken together, constitute a prospectus

that meets the requirements of Section 10(a) of the Securities Act of 1933, as amended (the “Securities Act”).

Item 1. Plan Information.

The documents containing the information specified

in this Item 1 will be sent or given to participants of the Paysign, Inc. 2023 Equity Incentive Plan (the “Plan”) as specified

by Rule 428(b)(1) under the Securities Act. In accordance with the rules and regulations of the Securities and Exchange Commission (the

“Commission”) and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this

Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

The documents containing the information specified

in this Item 2 and incorporated by reference in Item 3 of Part II of this Registration Statement will be sent or given to participants

of the Plan, without charge, upon written or oral request, as specified by Rule 428(b)(1) under the Securities Act. The request shall

be directed to our Corporate Secretary, Robert Strobo, Esq., at 2615 St. Rose Parkway, Henderson, Nevada 89052 or by telephone at (702)

453-2221. In accordance with the rules and regulations of the Commission and the instructions to Form S-8, such documents are not being

filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule

424 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE

REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which we have filed with

the Commission, are incorporated by reference in this Registration Statement:

| (a) | Annual Report on Form 10-K for the

year ended December 31, 2023, as filed with the Commission on March 27, 2024; |

| (b) | Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as filed

with the Commission on May 8, 2024; |

| (c) | Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, as filed with the Commission on August

1, 2024; |

| (d) | Definitive Proxy Statement on Schedule 14A, as filed with the Commission on March 29, 2024; |

| (e) | Current Reports on Form 8-K as filed with the Commission on January 29, 2024, March 15, 2024, April 19, 2024, and May 7, 2024, but only to the extent that the items therein are specifically stated to be “filed” rather than “furnished”

for the purposes of Section 18 of the Exchange Act; and |

| (f) | The description of our Common Stock contained in Exhibit 4.2 to the Annual Report on Form 10-K for the

year ended December 31, 2019, as filed with the Commission on April 3, 2020, including any amendment or report filed for the purpose of

updating such description. |

In addition, all documents subsequently filed

with the Commission by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective

amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall

be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents;

except as to any portion of any future annual or quarterly report to stockholders or document or current report furnished under Item 2.02

or 7.01 of Form 8-K that is not deemed “filed” under such provisions. Any statement contained in a document incorporated or

deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein or in any other subsequently filed document which also is deemed to be incorporated by

reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so

modified or superseded, to constitute a part of this Registration Statement. Under no circumstances will any information furnished under

Item 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference unless such Form 8-K expressly provides to the contrary.

You should rely only on the information provided

or incorporated by reference in this Registration Statement or any related prospectus. We have not authorized anyone to provide you with

different information. You should not assume that the information in this Registration Statement or any related prospectus is accurate

as of any date other than the date on the front of the document.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

We are a Nevada corporation. Section 78.7502 of

Chapter 78 of the Nevada Revised Statutes (“NRS”) empowers a corporation to indemnify any person who was or is a party or

is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative, except an action by or in the right of the corporation, by reason of the fact that the person is or was a director,

officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise or as a manager of a limited-liability company,

against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by

the person in connection with the action, suit or proceeding if the person (a) is not liable pursuant to NRS Section 78.138; or (b) acted

in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with

respect to any criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful. Under NRS Section 78.138, a

director or officer is not individually liable to the corporation unless such person breached their fiduciary duty and such breach involved

intentional misconduct, fraud or a knowing violation of law. If the action or suit is by or in the right of the corporation, indemnification

may not be made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after

exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and

only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application

that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the

court deems proper.

Under Article V.B of our Amended and Restated

Articles of Incorporation, we are required to indemnify, to the fullest extent permitted by Nevada law, its officers and directors. Furthermore,

Article V.C of our Amended and Restated Articles of Incorporation, we are required to pay (or through insurance purchased and maintained

by us or through other financial arrangements) any expenses of an officer or director as they are incurred and in advance of the final

disposition of a civil or criminal action, suit or proceeding, upon receipt of an undertaking by or on behalf of the director or officer

to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is not entitled to be indemnified

by the corporation.

Under Article VII of our Amended and Restated

Bylaws, we are required to indemnify and hold harmless, to the fullest extent permitted by Nevada law, each director or officer who was

or is a party to, or is threatened to be made a party to, or is otherwise involved in, any threatened, pending, or completed action, suit

or proceeding, by reason of the fact that he or she is or was a director or officer or member, manager, or managing member of a predecessor

limited liability company or affiliate of such limited liability company, or is or was serving in any capacity at our request as a director,

officer, employee, agent, partner, member, manager, or fiduciary of, or in any other capacity for, another corporation or any partnership,

joint venture, limited liability company, trust, or other enterprise or affiliate. Indemnification may not be made to or on behalf of

an indemnitee if a final adjudication establishes that his or her acts or omissions involved intentional misconduct, fraud, or a knowing

violation of law and was material to the cause of action. Furthermore, we are required to advance expenses to an indemnitee in advance

of a final disposition of the proceeding.

The indemnification provided by our Amended and

Restated Articles of Incorporation and Amended and Restated Bylaws is not exclusive of any rights to which those indemnified may be entitled

under any agreement, vote of stockholders or disinterested directors or otherwise, both as to action in his official capacity and as to

action in another capacity while holding such office, and shall continue as to a person who has ceased to be a director, officer, employee,

or agent and shall inure to the benefit of the heirs, executors, and administrators of such a person.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers and controlling persons of our company pursuant to the Nevada law, our

Amended and Restated Articles of Incorporation, our Amended and Restated Bylaws or any of our indemnification agreements with our directors

and officers, we have been informed that in the opinion of the Commission such indemnification is against public policy as expressed in

the Securities Act and is therefore unenforceable.

We maintain a Directors’ and Officers’

Liability Insurance Policy designed to reimburse us for any covered payments made by us pursuant to the foregoing indemnification.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

_______________

* Filed herewith.

| (1) | Incorporated by reference to Exhibit 10.1 to our Current Report on Form 8-K filed on May 9, 2023 (File

Number 001-38623). |

Item 9. Undertakings.

A. The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus

any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered

would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be

reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and

price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement

or any material change to such information in this Registration Statement;

provided, however, that paragraphs (A)(1)(i)

and (A)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Exchange Act

that are incorporated by reference in this Registration Statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at

the termination of the offering.

B.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefits plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in

this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of

the Commission, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In

the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or

paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Henderson, State of Nevada, on October 30, 2024.

| |

PAYSIGN, INC. |

| |

|

|

| |

By: |

/s/ Mark R. Newcomer |

| |

|

Mark R. Newcomer |

| |

|

Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each

person whose signature appears below constitutes and appoints Mark R. Newcomer and Robert Strobo, and each of them, as

his or her true and lawful attorney-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his

or her name, place, and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this

Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities

and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform

each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or

she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their

or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates

indicated.

|

Signature |

Title |

Date |

| |

|

|

|

/s/ Mark R.

Newcomer |

Chief Executive Officer, Director and Chairman

(Principal Executive Officer) |

October 30, 2024 |

| Mark R. Newcomer |

| |

|

|

|

/s/ Jeff Baker |

Chief Financial Officer and Treasurer

(Principal Financial Officer and Principal Accounting Officer) |

October 30, 2024 |

| Jeff Baker |

| |

|

|

|

/s/ Matthew

Lanford |

President, Chief Operating Officer and Director |

October 30, 2024 |

| Matthew Lanford |

| |

|

|

|

/s/ Joan M.

Herman |

Executive Vice President and Director |

October 30, 2024 |

| Joan M. Herman |

| |

|

|

|

/s/ Dan R.

Henry |

Director |

October 30, 2024 |

| Dan R. Henry |

| |

|

|

|

/s/ Bruce

Mina |

Director |

October 30, 2024 |

| Bruce Mina |

| |

|

|

|

/s/ Jeffrey

B. Newman |

Director |

October 30, 2024 |

| Jeffrey B. Newman |

| |

|

|

|

/s/ Dennis

Triplett |

Director |

October 30, 2024 |

| Dennis Triplett |

Exhibit 5.1

October 30, 2024

Paysign, Inc.

2615 St. Rose Parkway

Henderson, Nevada 89052

| Re: | Registration Statement on Form S-8

Paysign, Inc. |

Ladies and Gentlemen:

As legal counsel to Paysign,

Inc., a Nevada corporation (the “Company”), we have assisted in the preparation of the Company’s Registration

Statement on Form S-8 (the “Registration Statement”), to be filed with the Securities and Exchange Commission on or

about October 30, 2024, in connection with the registration under the Securities Act of 1933, as amended, of (i) 420,000 shares of the

Company’s common stock, par value $0.001 per share (“Common Stock”), that will be issued upon the vesting of

restricted stock awards granted under the Company’s 2023 Equity Incentive Plan (the “Plan”), and (ii) 160,000

shares of Common Stock reserved for future issuance pursuant to awards that may be granted under the Plan (collectively, the “Shares”).

The facts, as we understand them, are set forth in the Registration Statement.

With respect to the opinion

set forth below, we have examined originals, certified copies, or copies otherwise identified to our satisfaction as being true copies,

only of the following:

| A. | The Amended and Restated Articles of Incorporation of the Company; |

| | | |

| B. | The Amended and Restated Bylaws of the Company; |

| | | |

| C. | Various resolutions of the Board of Directors and the Compensation Committee of the Company adopting the

Plan and authorizing the issuance of the Shares; |

| | | |

| D. | The Plan; |

| | | |

| E. | Various restricted stock agreements; and |

| | | |

| F. | The Registration Statement. |

Subject to the assumptions

that (i) the documents and signatures examined by us are genuine and authentic, and (ii) the persons executing the documents examined

by us have the legal capacity to execute such documents, and subject to the further limitations and qualifications set forth below, based

solely upon our review of items A through F above, it is our opinion that the Shares will be validly issued, fully paid, and nonassessable

when issued and sold in accordance with the terms of the Plan and the Registration Statement.

We express no opinion as to

the applicability or effect of any laws, orders, or judgments of any state or other jurisdiction other than federal securities laws and

the substantive laws of the state of Nevada, including judicial interpretations of such laws. Further, our opinion is based solely upon

existing laws, rules, and regulations, and we undertake no obligation to advise you of any changes that may be brought to our attention

after the date hereof.

We hereby expressly consent

to any reference to our firm in the Registration Statement, inclusion of this Opinion as an exhibit to the Registration Statement, and

to the filing of this Opinion with any other appropriate governmental agency.

| |

Very truly yours, |

| |

|

| |

/s/ Greenberg Traurig, LLP |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in this Registration Statement

on Form S-8 of Paysign, Inc. of our report dated March 27, 2024, relating to the consolidated financial statements, appearing in

the Annual Report on Form 10-K of Paysign, Inc. for the year ended December 31, 2023, filed with the Securities and Exchange

Commission. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/ Moss Adams LLP

Dallas, Texas

October 30, 2024

Exhibit 107

Calculation

of Filing Fee Tables

Form S-8

(Form

Type)

Paysign,

Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Security

Type |

Security

Class Title |

Fee

Calculation Rule |

Amount

Registered (1) |

Proposed

Maximum Offering Price Per Unit |

Maximum

Aggregate Offering Price |

Fee

Rate |

Amount

of Registration Fee |

| Equity |

Common

Stock, par value $0.001 per share |

457(c)

and 457(h) |

420,000

(2) |

$3.72

(3) |

$1,562,400

(3) |

0.00015310 |

$239.20 |

| Equity |

Common

Stock, par value $0.001 per share |

457(c)

and 457(h) |

160,000

(4) |

$3.72

(3) |

$595,200

(3) |

0.00015310 |

$91.13 |

| Total

Offering Amounts |

|

|

$2,157,600 |

|

$330.33 |

| Total

Fee Offsets |

|

|

|

|

— |

| Net

Fee Due |

|

|

|

|

$330.33 |

| |

|

|

|

|

|

|

|

|

| (1) | Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities

Act”), this Registration Statement shall also cover any additional shares of Paysign, Inc. (the “Registrant”) common

stock, par value $0.001 per share (“Common Stock”), that may become issuable by reason of any stock dividend, stock split,

recapitalization, or any other similar transaction that results in an increase in the number of outstanding shares of Common Stock of

the Registrant. |

| (2) | Represents shares of Common Stock issued or issuable pursuant to the vesting of restricted stock awards

issued under the Paysign, Inc. 2023 Equity Incentive Plan (the “Plan”). |

| (3) | Pursuant to Rule 457(c) and 457(h) under the Securities Act, the proposed maximum offering price per share

and the proposed maximum aggregate offering price for the shares have been calculated solely for the purpose of computing the registration

fee on the basis of the average high and low prices of the Registrant’s Common Stock as reported by the Nasdaq Stock Market LLC

on October 23, 2024. |

| (4) | Represents shares of Common Stock authorized for issuance under the Plan. This Registration Statement

does not include 4,420,000 shares of Common Stock authorized for issuance under the Plan that were previously registered by the Registrant. |

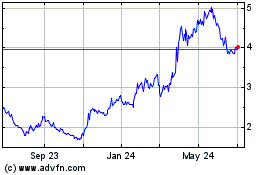

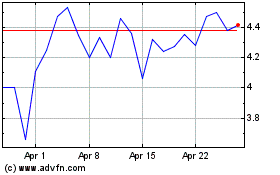

Paysign (NASDAQ:PAYS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Paysign (NASDAQ:PAYS)

Historical Stock Chart

From Jan 2024 to Jan 2025