- Second quarter 2024 total revenues of $14.33 million, up

29.8% from second quarter 2023

- Second quarter 2024 net income of $697 thousand, or diluted

earnings per share of $0.01, versus net loss of $104 thousand, or

diluted earnings per share of $(0.00) for second quarter

2023

- Second quarter 2024 Adjusted EBITDA of $2.24 million, up

95.8% from $1.14 million for second quarter 2023, while diluted

Adjusted EBITDA per share was $0.04 versus $0.02 for second quarter

20231

- Total plasma center count increased by eight net new centers

during second quarter 2024, exiting the quarter with 477 centers,

contributing to a 12.6% increase in plasma revenue versus the same

period last year

- Added eight net new patient affordability programs during

second quarter 2024, exiting the quarter with 61 active programs,

leading to a 266.8% increase in pharma patient affordability

revenue over the same period last year

- Exited the quarter with $31.29 million of unrestricted cash

and zero debt; $22.71 million related to payment timing on

pass-through claim reimbursement receivables and related

payables

- Second quarter 2024 gross dollar load volume was up 12.7%

compared to second quarter 2023

- Second quarter 2024 gross spend volume was up 11.2% compared

to second quarter 2023

- Second quarter 2024 average revenue per plasma center per

month of $7,916, up 4.4%, versus $7,581 for second quarter

2023

- Second quarter 2024 patient affordability claim volume

increased 365.5%, versus second quarter 2023

1Adjusted EBITDA and Adjusted EBITDA per share are

non-GAAP metrics used by management to gauge the operating

performance of the business – see reconciliation of net income to

Adjusted EBITDA at the end of the press release.

Paysign, Inc. (NASDAQ: PAYS), a leading provider of prepaid card

programs, comprehensive patient affordability offerings, digital

banking services and integrated payment processing, today announced

financial results for the second quarter 2024.

“We are extremely pleased with Paysign’s second-quarter

financial results, as we continue to grow our business at a rapid

pace,” stated Mark Newcomer, President & CEO of Paysign. “In

the second quarter, revenues grew 29.8%, and adjusted EBITDA grew

95.8%, driven by double-digit revenue growth in our plasma donor

compensation business and an outstanding 266.8% revenue increase in

our patient affordability business. Our gross margin percentage

increased by 207 basis points, and we expect to see continued

margin expansion as patient affordability remains a dominant growth

driver for the company. Looking forward, we anticipate maintaining

our current trajectory across our two major businesses of plasma

donor compensation and pharma patient affordability while seeking

additional high growth opportunities within the payments space. We

remain committed to delivering sustainable growth and maximizing

shareholder value.”

Quarterly Results

The following additional details are provided to aid in

understanding Paysign’s second quarter 2024 results versus the

year-ago period:

- Total revenues increased 29.8%, or $3.29 million. The increase

was attributable to the following factors:

- Plasma revenue increased $1.26 million, or 12.6%, primarily due

to an increase in plasma locations, plasma donations and dollars

loaded to cards with average monthly revenue per center up 4.4% to

$7,916 versus $7,581 in the same period last year. Total plasma

center count increased by eight net new centers, exiting the

quarter with 477 centers.

- Pharma patient affordability revenue increased $1.95 million,

or 266.8%, primarily due to the growth and launch of new pharma

patient affordability programs. We added eight net new patient

affordability programs throughout the second quarter, exiting with

61 active programs.

- Other revenue increased by $86 thousand, or 28.9%, primarily

due to the growth in our payroll business and the growth and launch

of new prepaid disbursement programs.

- Cost of revenues increased 24.3%, or $1.32 million. Cost of

revenues is comprised of transaction processing fees, data

connectivity fees, data center expenses, network fees, bank fees,

card production costs, postage costs, customer service, program

management, application integration setup, fraud charges and sales

and commission expense. The quarter-over-quarter increase in cost

of revenues was primarily due to an increase in cardholder usage

activity and associated network expenses such as interchange and

ATM costs, an increase in network expenses and sales commissions

related to the growth in our pharma patient affordability business,

an increase in fraud charges, an increase in customer service

expenses associated with wage inflation pressures and the overall

growth in our business.

- Gross profit increased by $1.97 million, or 35.1%, primarily

due to increased plasma and pharma patient affordability revenue.

Our gross profit margin increased to 52.9% versus 50.9% in the

prior year, an increase of 207 basis points, primarily due to a

greater revenue contribution from our patient affordability

business (18.7% versus 6.6%).

- Selling, general and administrative expenses (SG&A)

increased by $716 thousand, or 13.5%, and consisted primarily of an

increase in (i) compensation and benefits of approximately $1.30

million due to continued hiring to support the company’s growth, a

tight labor market and increased benefit costs; (ii) technologies

and telecom of approximately $372 thousand primarily related to

ongoing platform security investments; and (iii) all other

operating expenses of approximately $12 thousand. This increase was

offset by a decrease in stock compensation of approximately $160

thousand, a decrease in non-IT professional services of

approximately $162 thousand and a $647 thousand increase in the

amount of capitalized platform development costs. We exited the

quarter with 149 employees versus 108 employees at the end of the

same period last year.

- Depreciation and amortization expense increased by $482

thousand, or 50.3%, due mainly to the continued capitalization of

new software development costs and equipment purchases related to

the enhancement to our processing platform and ongoing hiring to

support our growth.

- Other income increased by $212 thousand primarily related to an

increase in interest income resulting from higher average cash

balances and higher interest rates.

- Income tax provision increased as a result of tax benefits

related to our stock-based compensation, changes to the company’s

valuation allowance recorded on its net deferred tax assets and a

pretax loss in the prior period. The effective tax rate was 25.8%

versus (126.3%) compared to the same period last year.

- Net income of $697 thousand, or $0.01 per diluted share,

improved by $801 thousand compared to net loss of $104 thousand, or

$(0.00) per diluted share, during the same period in the prior

year. The overall change in net income relates to the factors

mentioned above.

- “EBITDA,” defined as earnings before interest, taxes,

depreciation and amortization expense, which is a non-GAAP metric,

increased by $1.25 million, or 403.1%, to $1.57 million due to the

factors mentioned above.

- “Adjusted EBITDA,” which excludes stock-based compensation from

EBITDA, and which is a non-GAAP metric used by management to gauge

the operating performance of the business, increased by $1.09

million, or 95.8%, to $2.24 million, or $0.04 per diluted share,

due to the factors mentioned above.

Second Quarter 2024 Milestones

- Exited the quarter with approximately 6.8 million cardholders

and approximately 610 card programs.

- Quarter-over-quarter revenue increased 29.8%.

- Plasma revenue increased 12.6%.

- Pharma patient affordability revenue increased 266.8%.

- Added eight net new plasma donation centers, ending the quarter

with 477 centers.

- Added eight net new pharma patient affordability programs,

ending the quarter with 61 active programs.

- Restricted cash balances increased 10.7% from December 31,

2023, to $102.24 million, primarily due to increased funds on cards

and growth in customer programs.

Balance Sheet at June 30, 2024

The company’s cashflows increased $24.18 million from December

31, 2023, largely related to the launch of new pharma patient

affordability programs and new plasma centers.

Unrestricted cash increased $14.30 million to $31.29 million

from December 31, 2023. The increase resulted primarily from

payment timing on pass-through claim reimbursement receivables and

related payables associated with our patient affordability business

in the amount of $16.02 million. In addition to the impact of net

pass-through claim reimbursements, the positive impact of net

income and non-cash adjustments offset by investment in fixed

assets and net increase in assets and liabilities lead to the

increase in the unrestricted cash balance.

Restricted cash increased $9.88 million to $102.2 million from

December 31, 2023, primarily due to increases in funds on cards of

$3.74 million and customer deposits for our plasma and pharma

customers of $6.15 million. Restricted cash are funds used for

customer card funding and pharmaceutical claim reimbursements with

a corresponding offset under current liabilities.

2024 Outlook

“We delivered another solid quarter with year-over-year

quarterly revenues increasing 29.8% to $14.3 million and adjusted

EBITDA increasing 95.8% to $2.2 million as our pharma patient

affordability business continued its growth momentum. We exited the

quarter with 477 plasma centers and 61 pharma patient affordability

programs, an increase of 13 and 18, respectively, since the end of

2023,” said Jeff Baker, Paysign CFO.

“Due to the outperformance of our business during the first two

quarters of the year relative to our initial expectations, we are

raising our full year guidance as follows: total revenues are

estimated to be in the range of $56.5 million to $58.5 million

versus our initial guidance of $54.5 million to $56.7 million,

reflecting year-over-year growth of 20% to 24%. Plasma revenues are

estimated to account for approximately 78% of total revenue while

pharma revenue is estimated to account for approximately 20% of

total revenue. Full-year gross profit margins are expected to be

between 54.0% and 55.0% versus our initial guidance of 52.0% to

54.0% reflecting increased revenue contribution from our pharma

patient affordability business. Operating expenses are expected to

be between $30.0 million and $32.0 million versus our initial

guidance of $29.0 and $31.0 million as we continue to make

investments in people and technology to support the growth of our

business. Of this amount, depreciation and amortization are

expected to remain unchanged between $6.0 million and $6.5 million,

while stock-based compensation is expected to remain unchanged

between $2.7 million and $3.0 million. Given the continued

increases in our average daily balances of unrestricted and

restricted cash and the current interest rate environment, we

expect to generate interest income of $3.0 million to $3.2 million.

We expect our tax rate to be between 28.0% and 29.0% and our fully

diluted share count outstanding to be 55.8 million to 56.0 million.

Taking all of the factors above into consideration, we expect net

income to be in the range of $2.0 million to $3.0 million, or $0.04

to $0.06 per diluted share, and adjusted EBITDA to be in the range

of $9.0 million to $10.0 million (15.0% to 17.0% of total

revenues), or $0.16 to $0.18 per diluted share,” Baker

concluded.

Second Quarter 2024 Financial Results Conference Call

Details

The company will hold a conference call at 5:00 p.m. Eastern

time on Wednesday, July 31, 2024, to discuss its second quarter

2024 financial results. The conference call may include

forward-looking statements. The dial-in information for this call

is 877.407.2988 (within the U.S.) and +1.201.389.0923 (outside the

U.S.). A call replay will be available until October 29, 2024, and

can be accessed by dialing 877.660.6853 (within the U.S.) and

+1.201.612.7415 (outside the U.S.), using passcode 13747519.

Forward-Looking Statements

Certain statements in this press release may be considered

forward-looking under federal securities laws, and we intend that

such forward-looking statements be subject to the safe harbor

created thereby. All statements, besides statements of fact

included in this release are forward-looking. Such forward-looking

statements include, among others, our optimism that our business

will continue to grow at a rapid pace; our expectation that we will

see continued margin expansion as patient affordability remains a

dominant growth driver for the company; our anticipation of

maintaining our current trajectory across our two major businesses

of plasma donor compensation and pharma patient affordability while

seeking additional high growth opportunities with the payments

space; our belief that our commitment remains firm on delivering

sustainable growth and maximizing shareholder value; our

expectations for total revenue, plasma revenue as a percentage of

total revenue, pharma revenue as a percentage of total revenue,

full-year gross profit margins, operating expenses, depreciation

and amortization, stock-based compensation, interest income, tax

rate, fully diluted share count, net income, and adjusted EBITDA

for the full-year 2024. We caution that these statements are

qualified by important risks, uncertainties and other factors that

could cause actual results to differ materially from those

reflected by such forward-looking statements. Such factors include,

among others, the inability to continue our current growth rate in

future periods; that a downturn in the economy, including as a

result of COVID-19 and variants, as well as further government

stimulus measures, could reduce our customer base and demand for

our products and services, which could have an adverse effect on

our business, financial condition, profitability and cash flows;

operating in a highly regulated environment; failure by us or

business partners to comply with applicable laws and regulations;

changes in the laws, regulations, credit card association rules or

other industry standards affecting our business; that a data

security breach could expose us to liability and protracted and

costly litigation; and other risk factors set forth in our Form

10-K for the year ended December 31, 2023. Except to the extent

required by federal securities laws, the company undertakes no

obligation to publicly update or revise any statements in this

release, whether as a result of new information, future events or

otherwise.

About Paysign, Inc.

Paysign, Inc. (NASDAQ: PAYS) is a leading financial services

provider uniquely positioned to provide technology solutions

tailored to the healthcare industry. As an early innovator in

prepaid card programs, patient affordability, digital banking

services and integrated payment processing, Paysign enables

countless exchanges of value for businesses, consumers and

government agencies across all industry types.

Incorporated in southern Nevada in 1995, Paysign operates on a

powerful, high-availability payments platform with cutting-edge

fintech capabilities that can be seamlessly integrated with our

clients’ systems. This distinctive positioning allows Paysign to

provide end-to-end technologies that securely manage transaction

processing, cardholder enrollment, value loading, account

management, data and analytics and customer service. Paysign’s

architecture is known for its cross-platform compatibility,

flexibility and scalability – allowing our clients and partners to

leverage these advantages for cost savings and revenue

opportunities.

Through Paysign’s direct connections for processing and program

management, the company navigates all aspects of the prepaid card

lifecycle completely in house – from concept and card design to

inventory, fulfillment and launch. The company’s 24/7/365 in-house,

bilingual customer service is facilitated through live agents,

interactive voice response (IVR) and two-way SMS alerts, reflecting

the company’s commitment to world-class consumer support.

For more than two decades, Paysign has been a trusted partner

for major pharmaceutical and healthcare companies, as well as

multinational corporations, delivering fully managed programs built

to meet their individual business goals. The company’s suite of

offerings include solutions for corporate rewards, prepaid gift

cards, general purpose reloadable (GPR) debit cards, employee

incentives, consumer rebates, donor compensation, clinical trials,

healthcare reimbursement payments and copay assistance. For more

information, visit paysign.com.

Paysign, Inc.

Condensed Consolidated Statements of

Operation (Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenues

Plasma industry

$

11,273,262

$

10,014,461

$

21,641,296

$

19,374,528

Pharma industry

2,674,901

729,236

5,063,545

1,318,798

Other

383,436

297,354

816,832

491,015

Total revenues

14,331,599

11,041,051

27,521,673

21,184,341

Cost of revenues

6,745,836

5,425,311

12,996,659

10,520,932

Gross profit

7,585,763

5,615,740

14,525,014

10,663,409

Operating expenses

Selling, general and administrative

6,020,464

5,304,625

11,931,662

10,250,075

Depreciation and amortization

1,439,622

958,001

2,726,027

1,803,017

Total operating expenses

7,460,086

6,262,626

14,657,689

12,053,092

Income (loss) from operations

125,677

(646,886

)

(132,675

)

(1,389,683

)

Other income

Interest income, net

813,357

600,867

1,544,701

1,185,064

Income (loss) before income tax

provision

939,034

(46,019

)

1,412,026

(204,619

)

Income tax provision

241,932

58,137

405,828

59,667

Net income (loss)

$

697,102

$

(104,156

)

$

1,006,198

$

(264,286

)

Net income (loss) per share

Basic

$

0.01

$

(0.00

)

$

0.02

$

(0.01

)

Diluted

$

0.01

$

(0.00

)

$

0.02

$

(0.01

)

Weighted average common shares

Basic

53,008,286

52,259,002

52,926,462

52,330,829

Diluted

55,861,786

52,259,002

55,374,336

52,330,829

Paysign, Inc.

Condensed Consolidated Balance

Sheets

June 30, 2024

(Unaudited)

December 31, 2023

(Audited)

ASSETS

Current assets

Cash

$

31,290,865

$

16,994,705

Restricted cash

102,240,796

92,356,308

Accounts receivable, net

25,750,319

16,222,341

Other receivables

1,650,201

1,585,983

Prepaid expenses and other current

assets

2,474,716

2,020,781

Total current assets

163,406,897

129,180,118

Fixed assets, net

1,107,852

1,089,649

Intangible assets, net

10,710,142

8,814,327

Operating lease right-of-use asset

3,006,844

3,215,025

Deferred tax asset, net

4,077,175

4,299,730

Total assets

$

182,308,910

$

146,598,849

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

Accounts payable and accrued

liabilities

$

50,254,617

$

26,517,567

Operating lease liability, current

portion

401,075

383,699

Customer card funding

102,079,826

92,282,124

Total current liabilities

152,735,518

119,183,390

Operating lease liability, long-term

portion

2,721,724

2,928,078

Total liabilities

155,457,242

122,111,468

Stockholders’ equity

Common stock; $0.001 par value;

150,000,000 shares authorized, 53,782,382 and 53,452,382 issued at

June 30, 2024, and December 31, 2023, respectively

53,782

53,452

Additional paid-in capital

23,357,481

21,999,722

Treasury stock at cost, 698,008 shares

(1,277,884

)

(1,277,884

)

Retained earnings

4,718,289

3,712,091

Total stockholders’ equity

26,851,668

24,487,381

Total liabilities and stockholders’

equity

$

182,308,910

$

146,598,849

Paysign, Inc. Non-GAAP Measures

To supplement Paysign’s financial results presented on a GAAP

basis, we use non-GAAP measures that exclude from net income the

following cash and non-cash items: interest, taxes, depreciation

and amortization and stock-based compensation. We believe these

non-GAAP measures used by management to gauge the operating

performance of the business help investors better evaluate our past

financial performance and potential future results. Non-GAAP

measures should not be considered in isolation or as a substitute

for comparable GAAP accounting, and investors should read them in

conjunction with the company’s financial statements prepared in

accordance with GAAP. The non-GAAP measures we use may be different

from, and not directly comparable to, similarly titled measures

used by other companies.

“EBITDA” is defined as earnings before interest, taxes,

depreciation and amortization expense. “Adjusted EBITDA” reflects

the adjustment to EBITDA to exclude stock-based compensation

charges.

EBITDA and Adjusted EBITDA are not intended to represent cash

flows from operations, operating income (loss) or net income (loss)

as defined by U.S. GAAP as indicators of operating performances.

Management cautions that amounts presented in accordance with

Paysign’s definition of Adjusted EBITDA may not be comparable to

similar measures disclosed by other companies because not all

companies calculate Adjusted EBITDA in the same manner.

Paysign, Inc.

Adjusted EBITDA (Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Reconciliation of EBITDA and Adjusted

EBITDA to net income (loss):

Net income (loss)

$

697,102

$

(104,156

)

$

1,006,198

$

(264,286

)

Income tax provision

241,932

58,137

405,828

59,667

Interest income, net

(813,357

)

(600,867

)

(1,544,701

)

(1,185,064

)

Depreciation and amortization

1,439,622

958,001

2,726,027

1,803,017

EBITDA

1,565,299

311,115

2,593,352

413,334

Stock-based compensation

670,138

830,426

1,334,089

1,448,670

Adjusted EBITDA

$

2,235,437

$

1,141,541

$

3,927,441

$

1,862,004

Adjusted EBITDA per share

Basic

$

0.04

$

0.02

$

0.07

$

0.04

Diluted

$

0.04

$

0.02

$

0.07

$

0.03

Weighted average common shares

Basic

53,008,286

52,259,002

52,926,462

52,330,829

Diluted

55,861,786

54,475,747

55,374,336

54,630,341

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731077597/en/

Paysign Investor Relations: 888.522.4810 ir@paysign.com

paysign.com/investors

Paysign Media Relations: Alicia Ches 888.522.4850

pr@paysign.com

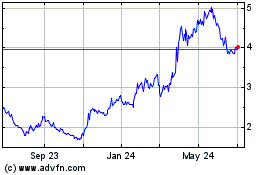

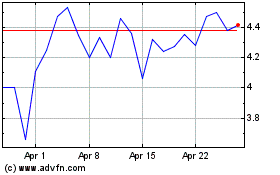

Paysign (NASDAQ:PAYS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Paysign (NASDAQ:PAYS)

Historical Stock Chart

From Jan 2024 to Jan 2025