Q2 2022 Revenue Growth of 34% Year-over-Year

and Continued Positive Adjusted EBITDA Raises Full Year 2022

Revenue and Adjusted EBITDA Guidance

Payoneer Global Inc. (“Payoneer”) (NASDAQ: PAYO), the commerce

technology company powering payments and growth for the new global

economy, today reported financial results for its second quarter

ended June 30, 2022.

Second Quarter

2022 Financial Highlights

($ in mm)

2Q

2021

3Q

2021

4Q

2021

1Q

2022

2Q

2022

YoY Change

Revenue

$

110.9

$

122.7

$

139.2

$

137.0

$

148.2

34

%

Transaction costs as a % of revenue

25.7

%

20.1

%

20.2

%

18.7

%

17.7

%

(800 bps) Revenue less transaction costs

$

82.4

$

98.0

$

111.1

$

111.4

$

122.0

48

%

Net income (loss)

(12.4

)

0.8

(18.9

)

20.2

4.4

N.M. Adjusted EBITDA

0.7

6.1

13.5

10.4

14.7

2,087

%

Operational Metrics Volume

($bn)

$

13.6

$

13.6

$

16.2

$

14.6

$

14.6

8

%

Revenue as a % of volume ("Take Rate") 82 bps 90 bps 86 bps 94 bps

101 bps 19 bps

“Payoneer delivered strong revenue growth and profitability,”

said Scott Galit, Co-Chief Executive Officer of Payoneer. “Results

highlight our multi-year investments to build a diverse and global

business model across industries, products, and geographies, which

together continues to increase our overall effective take rate. We

are growing the number of customers using our services, benefitting

from our strategic expansion into higher value services, as well as

seeing better-than-expected results from Ukraine and rising

interest rate tailwinds.”

“We plan to continue to deliver positive adjusted EBITDA going

forward,” said John Caplan, Co-Chief Executive Officer of Payoneer.

“We are optimistic about our long-term growth opportunity and are

committed to creating enduring value for all our stakeholders. We

intend to expand our suite of solutions for our customers, provide

a dynamic, inclusive workplace for our employees, and deliver

strong, consistent financial returns for our shareholders.”

Second Quarter 2022 Business

Highlights

The Company had several achievements in the quarter, reinforcing

its conviction for its long-term investment strategy and ability to

drive growth across its diversified business model.

- 50% year-over-year revenue growth in its portfolio of emerging

markets, which includes Latin America, Southeast Asia, South Asia,

Middle East, North Africa and more

- B2B AP/AR volumes grew over 65% year-over-year and represented

12% of total volume in the second quarter

- The Payoneer ecosystem continues to expand with a significant

increase in integration activity with banks and SMB platforms,

including new partnerships with EC21, Linnworks, PrivatBank, and

Shoplazza

- Customer funds exceeded $5 billion for the first time as of

June 30, 2022

Updated 2022 Guidance

“We are pleased with our second quarter and first half results,

which highlighted the global breadth of our business and diversity

of our revenue drivers,” said Michael Levine, Chief Financial

Officer of Payoneer. “We have good momentum heading into the second

half of 2022, and we see traction in our strategic

investments.”

“Therefore, we are raising our revenue guidance for the full

year. This reflects our latest views on the evolving broader

macro-economic and geopolitical environment, the diversity of

geographies and industries that we serve, and the strength of our

operations. It also includes our improving outlook on our business

in Ukraine given the resilience of its people despite the ongoing

war, along with the contribution from interest income in a rising

rate environment.”

“We anticipate positive adjusted EBITDA for 2022 while we invest

in our long-term growth. We remain confident that our continued

execution, customer adoption of our higher value services, and

successful penetration into high-growth regions all support our

increased guidance for the full year 2022, even with uncertainty

ahead around inflation, economic growth, and interest rate

levels.”

Updated 2022 guidance is as follows:

Revenue

$580 million - $590 million

Transaction costs

~19.5% of revenue

Adjusted EBITDA (1)

$30 million to $35 million

(1)

Please refer to “Financial Information;

Non-GAAP Financial Measures” below

Webcast

Payoneer will host a live webcast of its earnings on a

conference call with the investment community beginning at 4:30

p.m. ET today, August 11, 2022. To access the webcast, go to the

investor relations section of the Company’s website at

https://investor.payoneer.com. A replay will be available on the

investor relations website following the call.

About Payoneer

Payoneer (NASDAQ: PAYO) is the world’s go-to partner for digital

commerce, everywhere. From borderless payments to boundless growth,

Payoneer promises any business, in any market, the technology,

connections and confidence to participate and flourish in the new

global economy.

Since 2005, Payoneer has been imagining and engineering a truly

global ecosystem so the entire world can realize its potential.

Powering growth for customers ranging from aspiring entrepreneurs

in emerging markets to the world’s leading digital brands like

Airbnb, Amazon, Google, Upwork and Walmart, Payoneer offers a

universe of opportunities, open to you.

Forward-Looking Statements

This press release includes, and oral statements made from time

to time by representatives of Payoneer, may be considered

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

relate to future events or Payoneer’s future financial or operating

performance. For example, projections of future volume, revenue,

transaction cost and adjusted EBITDA are forward-looking

statements. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “expect,”

“intend,” “plan,” “will,” “estimate,” “anticipate,” “believe,”

“predict,” “potential” or “continue,” or the negatives of these

terms or variations of them or similar terminology. Such

forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially

from those expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Payoneer and its

management, as the case may be, are inherently uncertain. Factors

that may cause actual results to differ materially from current

expectations include, but are not limited to: (1) the outcome of

any legal proceedings; (2) changes in applicable laws or

regulations; (3) the possibility that Payoneer may be adversely

affected by geopolitical and other economic, business and/or

competitive factors; (4) Payoneer’s estimates of its financial

performance; and (5) other risks and uncertainties set forth in

Payoneer’s Annual Report on Form 10-K for the period ended December

31, 2021 and future reports that Payoneer may file with the SEC

from time to time. Nothing in this press release should be regarded

as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. Payoneer

does not undertake any duty to update these forward-looking

statements.

Financial Information; Non-GAAP Financial Measures

Some of the financial information and data contained in this

press release, such as adjusted EBITDA, have not been prepared in

accordance with United States generally accepted accounting

principles (“GAAP”). Payoneer uses these non-GAAP measures to

compare Payoneer’s performance to that of prior periods for

budgeting and planning purposes. Payoneer believes these non-GAAP

measures of financial results provide useful information to

management and investors regarding certain financial and business

trends relating to Payoneer’s results of operations. Payoneer's

method of determining these non-GAAP measures may be different from

other companies' methods and, therefore, may not be comparable to

those used by other companies and Payoneer does not recommend the

sole use of these non-GAAP measures to assess its financial

performance. Payoneer management does not consider these non-GAAP

measures in isolation or as an alternative to financial measures

determined in accordance with GAAP. The principal limitation of

these non-GAAP financial measures is that they exclude significant

expenses and income that are required by GAAP to be recorded in

Payoneer’s financial statements. In addition, they are subject to

inherent limitations as they reflect the exercise of judgments by

management about which expense and income are excluded or included

in determining these non-GAAP financial measures. In order to

compensate for these limitations, management presents non-GAAP

financial measures in connection with GAAP results. You should

review Payoneer’s financial statements, which are included in

Payoneer’s Annual Report on Form 10-K for the year ended December

31, 2021 and its Quarterly Report on Form 10-Q for the quarterly

period ended June 30, 2022, and not rely on any single financial

measure to evaluate Payoneer’s business.

Non-GAAP measures include the following item:

Adjusted EBITDA: We provide

adjusted EBITDA, a non-GAAP financial measure that represents our

net income (loss) adjusted to exclude: M&A related income,

stock-based compensation expenses, reorganization related expenses,

share in losses (gain) of associated company, gain from change in

fair value of warrants, other financial expense (income), net,

taxes on income, and depreciation and amortization.

Other companies may calculate the above measure differently, and

therefore Payoneer’s measures may not be directly comparable to

similarly titled measures of other companies.

In addition, guidance for fiscal year, where adjusted, is

provided on a non-GAAP basis, which Payoneer will continue to

identify as it reports its future financial results. The Company

cannot reconcile its expected adjusted EBITDA to expected net

income under “2022 Guidance” without unreasonable effort because

certain items that impact net income and other reconciling metrics

are out of the Company's control and/or cannot be reasonably

predicted at this time, which unavailable information could have a

significant impact on the Company’s GAAP financial results.

In this earnings release, we reference volume, which is an

operational metric. Volume refers to the total dollar value of

transactions successfully completed or enabled by our platform, not

including orchestration transactions. For a customer that both

receives and later sends payments, we count the volume only once,

with certain limited exceptions where both received and sent

payment are counted.

TABLE - 1 PAYONEER GLOBAL INC. CONSOLIDATED

STATEMENTS OF INCOME (LOSS) (UNAUDITED) (U.S. dollars in

thousands, except share and per share data)

Three months ended

Six months ended

June 30,

June 30,

2022

2021

2022

2021

Revenues $

148,190

$

110,927

$

285,148

$

211,533

Transaction costs ($338 and $658 interest expense and fees

associated with relatedparty transaction during the three and six

months ended June 30, 2022,respectively)

26,212

28,521

51,787

48,676

Other operating expenses

35,392

32,010

70,151

58,624

Research and development expenses

26,607

18,541

52,522

35,194

Sales and marketing expenses

36,820

27,702

71,289

50,841

General and administrative expenses

20,192

18,163

38,320

28,680

Depreciation and amortization

5,171

4,351

9,626

9,028

Total operating expenses

150,394

129,288

293,695

231,043

Operating loss

(2,204

)

(18,361

)

(8,547

)

(19,510

)

Financial income (expense): Gain from change in fair value

of Warrants

12,831

12,076

44,027

12,076

Other financial expense, net

(4,824

)

(2,937

)

(7,519

)

(3,559

)

Financial income (expense), net

8,007

9,139

36,508

8,517

Income (loss) before taxes on income and share of gain

(loss) of associatedcompany

5,803

(9,222

)

27,961

(10,993

)

Taxes on income

1,374

3,197

3,341

4,928

Share in gain (loss) of associated company

(7

)

5

13

(1

)

Net income (loss) $

4,422

$

(12,414

)

$

24,633

$

(15,922

)

Per share data

Net income (loss) per share attributable to common stockholders

— Basic earnings (loss) per share

$

0.01

$

(0.63

)

$

0.07

$

(0.84

)

— Diluted earnings (loss) per share $

0.01

$

(0.63

)

$

0.07

$

(0.84

)

Weighted average common shares outstanding — Basic

345,522,076

66,744,348

345,831,177

58,702,320

Weighted average common shares outstanding — Diluted

366,013,696

66,744,348

369,047,627

58,702,320

TABLE - 2

PAYONEER GLOBAL INC. RECONCILIATION OF NET INCOME (LOSS)

TO ADJUSTED EBITDA (UNAUDITED) (U.S. dollars in thousands)

Three months ended June

30,

Six months ended June

30,

2022

2021

2022

2021

(in thousands)

Net income (loss) $

4,422

$

(12,414

)

$

24,633

$

(15,922

)

Depreciation & amortization

5,171

4,351

9,626

9,028

Taxes on income

1,374

3,197

3,341

4,928

Other financial expenses (income), net

4,824

2,937

7,519

3,559

EBITDA

15,791

(1,929

)

45,119

1,593

Stock based compensation expenses(1)

11,890

10,671

24,798

14,968

Reorganization related expenses(2)

—

5,087

—

5,087

Share in losses (gain) of associated company

7

(5

)

(13

)

1

M&A related income(3)

(116

)

(1,074

)

(735

)

(1,074

)

Gain from change in fair value of Warrants(4)

(12,831

)

(12,076

)

(44,027

)

(12,076

)

Adjusted EBITDA $

14,741

$

674

$

25,142

$

8,499

(1) Represents non-cash charges associated with stock-based

compensation expense, which has been, and will continue to be for

the foreseeable future, a significant recurring expense in our

business and an important part of our compensation strategy. (2)

Represents the non-recurring reorganizational costs that were not

recorded as a reduction of additional paid in capital. The amounts

relate to legal and professional services associated with the

Reorganization. (3) Represents non-recurring fair value adjustment

of a liability related to our 2020 acquisition of optile. (4)

Changes in the estimated fair value of the warrants are recognized

as gain or loss on the statements of operations. The impact is

removed from EBITDA as it represents market conditions that are not

in control of the Company.

Three months ended,

June 30, 2021

Sept. 30, 2021

Dec. 31, 2021

Mar. 31, 2022

June 30, 2022

(in thousands)

Net income (loss) $

(12,414

)

$

837

$

(18,902

)

$

20,211

$

4,422

Depreciation & amortization

4,351

4,435

4,534

4,455

5,171

Taxes on income

3,197

662

3,121

1,967

1,374

Other financial expenses (income), net

2,937

3,306

(11

)

2,695

4,824

EBITDA

(1,929

)

9,240

(11,258

)

29,328

15,791

Stock based compensation expenses(1)

10,671

8,590

13,455

12,908

11,890

Reorganization related expenses(2)

5,087

—

—

—

—

Share in losses (gain) of associated company

(5

)

10

26

(20

)

7

M&A related income(3)

(1,074

)

(390

)

(257

)

(619

)

(116

)

Gain from change in fair value of Warrants(4)

(12,076

)

(11,321

)

11,573

(31,196

)

(12,831

)

Adjusted EBITDA $

674

$

6,129

$

13,539

$

10,401

$

14,741

(1) Represents non-cash charges associated with stock-based

compensation expense, which has been, and will continue to be for

the foreseeable future, a significant recurring expense in our

business and an important part of our compensation strategy. (2)

Represents the non-recurring reorganizational costs that were not

recorded as a reduction of additional paid in capital. The amounts

relate to legal and professional services associated with the

Reorganization. (3) Represents non-recurring fair value adjustment

of a liability related to our 2020 acquisition of optile. (4)

Changes in the estimated fair value of the warrants are recognized

as gain or loss on the statements of operations. The impact is

removed from EBITDA as it represents market conditions that are not

in control of the Company.

TABLE - 3 PAYONEER GLOBAL

INC. EARNINGS (LOSS) PER SHARE (UNAUDITED) (U.S. dollars

in thousands, except share and per share data)

Three Months Ended

Six months ended

June 30,

June 30,

2022

2021

2022

2021

Numerator: Net income (loss) $

4,422

$

(12,414

)

$

24,633

$

(15,922

)

Less dividends and revaluation attributable to redeemable and

redeemable convertible preferred stock

—

29,611

—

33,632

Net income (loss) attributable to common stockholders $

4,422

$

(42,025

)

$

24,633

$

(49,554

)

Denominator: Weighted average common shares outstanding — Basic

345,522,076

66,744,348

345,831,177

58,702,320

Add: Dilutive impact of options to purchase common stock

19,844,013

—

22,541,797

—

Dilutive impact of private warrants

647,607

—

674,653

—

Weighted average common shares – diluted

366,013,696

66,744,348

369,047,627

58,702,320

Net income (loss) per share attributable To common stockholders —

Basic earnings (loss) per share $

0.01

$

(0.63

)

$

0.07

$

(0.84

)

Diluted earnings (loss) per share $

0.01

$

(0.63

)

$

0.07

$

(0.84

)

TABLE - 4 PAYONEER GLOBAL INC. CONSOLIDATED

BALANCE SHEETS (UNAUDITED) (U.S. dollars in thousands,

except share and per share data)

June 30,

December 31,

2022

2021

Assets: Current assets: Cash and cash equivalents $

492,002

$

465,926

Restricted cash

3,102

3,000

Customer funds

5,140,642

4,401,254

Accounts receivable, net

14,334

13,844

CA receivables, net

38,602

53,675

Other current assets

31,206

25,024

Total current assets

5,719,888

4,962,723

Non-current assets: Property, equipment and software,

net

13,414

12,140

Goodwill

19,480

21,127

Intangible assets, net

39,806

37,529

Restricted cash

5,349

5,113

Deferred taxes

3,834

4,900

Investment in associated company

6,635

7,013

Severance pay fund

1,242

1,723

Operating lease right of use assets

19,075

12,943

Other assets

13,564

13,541

Total assets $

5,842,287

$

5,078,752

Liabilities and shareholders’ equity: Current

liabilities: Trade payables $

26,738

$

17,200

Outstanding operating balances

5,140,642

4,401,254

Other payables

73,479

79,374

Total current liabilities

5,240,859

4,497,828

Non-current liabilities: Long-term debt from related

party

14,769

13,665

Warrant liability

15,850

59,877

Other long-term liabilities

27,879

20,309

Total liabilities

5,299,357

4,591,679

Shareholders’ equity: Preferred stock, $0.01 par

value, 380,000,000 shares authorized; no shares were issued and

outstanding at June 30, 2022 andDecember 31, 2021.

—

—

Common stock, $0.01 par value, 3,800,000,000 and 3,800,000,000

shares authorized; 346,439,294 and 340,384,157 sharesissued and

outstanding at June 30, 2022 and December 31, 2021, respectively.

3,464

3,404

Additional paid-in capital

611,997

575,470

Accumulated other comprehensive income (loss)

(605

)

2,253

Accumulated deficit

(71,926

)

(94,054

)

Total shareholders’ equity

542,930

487,073

Total liabilities and shareholders’ equity $

5,842,287

$

5,078,752

TABLE - 5 PAYONEER GLOBAL INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED) (U.S. dollars in

thousands)

Six months ended

June 30,

2022

2021

Cash Flows from Operating Activities Net income (loss) $

24,633

$

(15,922

)

Adjustment to reconcile net income (loss) to net cash provided by

(used in) operating activities: Depreciation and amortization

9,626

9,028

Deferred taxes

1,066

344

Stock-based compensation expenses

25,275

15,128

Share in loss (gain) of associated company

(13

)

1

Gain from change in fair value of Warrants

(44,027

)

(12,076

)

Transaction costs allocated to Warrants

—

5,087

Foreign currency re-measurement loss

2,491

861

Changes in operating assets and liabilities: Other current assets

(6,650

)

(8,311

)

Trade payables

9,538

(468

)

Deferred revenue

24

1,862

Accounts receivables

(490

)

5,560

CA extended to customers

(109,422

)

(189,927

)

CA collected from customers

121,990

206,796

Other payables

(6,318

)

1,407

Other long-term liabilities

(3,695

)

(3,582

)

Operating lease right-of-use assets

5,134

4,676

Other assets

(288

)

(3,768

)

Net cash provided by operating activities

28,874

16,696

Cash Flows from Investing Activities Purchase of

property, equipment and software

(5,093

)

(2,044

)

Capitalization of internal use software

(7,772

)

(6,646

)

Severance pay fund (contributions) distributions, net

481

(423

)

Customer funds in transit, net

(22,139

)

9,396

Net cash provided by (used in) investing activities

(34,523

)

283

Cash Flows from Financing Activities Exercise of

options

11,312

16,346

Outstanding operating balances, net

739,388

287,486

Proceeds from Reverse Recapitalization, net

—

108,643

Proceeds from PIPE financing, net

—

280,185

Proceeds from related party facility, net

1,103

-

Repayment of long-term debt

—

(40,025

)

Net cash provided by financing activities

751,803

652,635

Effect of exchange rate changes on cash and cash equivalents

(2,491

)

(871

)

Net change in cash, cash equivalents, restricted cash and

customer funds

743,663

668,743

Cash, cash equivalents, restricted cash and customer funds at

beginning of the period

4,838,433

3,413,289

Cash, cash equivalents, restricted cash and customer funds at

end of the period $

5,582,096

$

4,082,032

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220811005217/en/

Investor: Michelle Wang investor@payoneer.com

Media: Irina Marciano PR@payoneer.com

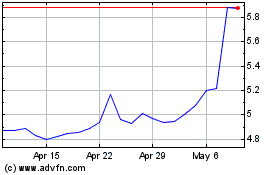

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Jan 2024 to Jan 2025