Pactiv Evergreen Inc. (“Pactiv Evergreen” or the “Company”) today

reported results for the second quarter of 2022. Michael King,

President and Chief Executive Officer of Pactiv Evergreen, said,

“Building on our positive momentum from the past two quarters, I am

pleased to share that we had a strong second quarter with

significant increases in both net revenues and net income. Net

income from continuing operations was $74 million for the second

quarter of 2022 compared to $8 million in the prior year period.

Adjusted EBITDA1 from continuing operations of $249 million for the

second quarter of 2022 was up 92% compared to $130 million in the

prior year period. Although the second half of the year will likely

present more challenges than the first, we remain confident in our

plans. Accordingly, we are updating and raising our 2022 Adjusted

EBITDA1 guidance from $705 million to a range of $750 million to

$770 million to reflect our strong year-to-date performance.2 We

are encouraged by the progress we have made in our logistics,

cubing and general operations across our plants as well as the

improvement in our labor levels but remain cautious due to the

continued inflationary pressures in the market as well as the

uncertainty around the global energy market and its impact on raw

materials, logistics and other costs. Despite this uncertainty, we

are confident in our ability to manage these higher costs and

execute on our strategy. I want to congratulate all of our team

members on a strong first half of the year and thank them for their

flexibility and dedication. Lastly, during this quarter, I welcomed

Jon Baksht to the organization as our Chief Financial Officer. I am

confident that he will be a tremendous leader for Pactiv Evergreen

as we strive to deliver on our purpose of Packaging a Better Future

while creating long-term value for all our stakeholders.”

Jon Baksht, Chief Financial Officer of Pactiv

Evergreen, said, “I am excited to be here as Pactiv Evergreen’s new

CFO and to share our strong results from the quarter. During the

second quarter, Pactiv Evergreen achieved 21% revenue growth over

the prior year. This was driven by a 23% improvement in price/mix

in the quarter due to contractual cost pass-through price increases

and pricing actions. This was partially offset by a 10% decline in

volumes versus the prior year, primarily due to strong prior year

volumes due to post-COVID re-openings, labor and related impacts

and the previously announced exit from our coated groundwood

business. Excluding the shutdown of the coated groundwood business,

volume was down 8% for the quarter. We also continue to make

progress on improving our mill operations and managing our

inventory levels to better service our customers. While we continue

to make positive internal progress, the current external

environment remains volatile with uncertainty due to the risks from

continued inflationary pressures as well as recession fears.

Although our business should be fairly resilient to these factors,

we believe it is prudent to remain cautious.”

Positioning the Company for Future

Growth

Pactiv Evergreen continues to focus on executing

strategic priorities to better position the Company for future

growth. On January 4, 2022, we entered into a definitive agreement

with SIG Schweizerische Industrie-Gesellschaft GmbH to sell our

carton packaging and filling machinery businesses in China, Korea

and Taiwan. The transaction closed on August 2, 2022, and we

received preliminary proceeds of $336 million, which are subject to

adjustments for cash, indebtedness and working capital as of the

date of completion and exclude taxes. We expect to recognize a gain

on sale in the third quarter of 2022.

____________________1 Adjusted EBITDA is a

non-GAAP measure. Refer to its definition in the discussion on

non-GAAP financial measures and the accompanying reconciliation

below.

2 The Company is unable to provide a

reconciliation of forward-looking Adjusted EBITDA from continuing

operations without unreasonable effort because of the uncertainty

and potential variability in amount and timing of gains or losses

on the sale of businesses and noncurrent assets, non-cash pension

income or expense, unrealized gains or losses on derivatives and

foreign exchange gains or losses on cash, which are reconciling

items between GAAP net income (loss) from continuing operations and

Adjusted EBITDA from continuing operations and could significantly

impact GAAP results.

Second Quarter 2022 Results

Net revenues in the second quarter of 2022 were

$1,640 million compared to $1,352 million in the prior year period.

The increase was primarily due to favorable pricing, due to the

contractual pass-through of higher material costs and pricing

actions across all of our segments. In addition, the Foodservice

segment’s acquisition of Fabri-Kal on October 1, 2021 contributed

$121 million of incremental sales for the three months ended June

30, 2022 as compared to the three months ended June 30, 2021. These

increases were partially offset by lower sales volume, primarily

due to strong prior year period sales volume as businesses and

restaurants re-opened post-COVID-19 lockdowns in our Foodservice

segment, labor and related impacts in our Food Merchandising

segment and our strategic exit from the coated groundwood business

in our Beverage Merchandising segment in December 2021.

Net income from continuing operations was $74

million in the second quarter of 2022 compared to $8 million in the

second quarter of 2021. The increase was primarily due to $158

million of higher gross profit, largely driven by favorable

pricing, net of higher material and manufacturing costs, as well as

the contribution from the acquisition of Fabri-Kal. The increase

due to higher gross profit was partially offset by a $40 million

increase in tax expense, primarily attributable to improved

profitability, a $33 million increase in selling, general and

administrative expenses, primarily driven by higher

employee-related costs and higher costs related to the acquisition

of Fabri-Kal, and a $27 million change in non-operating

expense/income, primarily due to lower gross pension plan assets

and liabilities.

Adjusted EBITDA1 was $249 million in the second

quarter of 2022 compared to $130 million in the second quarter of

2021. The increase reflects favorable pricing, net of raw material

costs passed through, and the impact from the acquisition of

Fabri-Kal, partially offset by higher manufacturing and

employee-rated costs and lower sales volume.

Segment Results (compared to the second

quarter of 2021)

Foodservice

|

|

For the Three Months Ended June 30, |

|

|

Components of Change in Net Revenues |

|

| |

2022 |

|

|

2021 |

|

|

Change |

|

% Change |

|

|

Price/Mix |

|

|

Volume |

|

|

Acquisitions |

|

|

Total segment net revenues |

$ |

791 |

|

|

$ |

571 |

|

|

$ |

220 |

|

39 |

% |

|

27 |

% |

|

(9 |

)% |

|

21 |

% |

| Segment Adjusted EBITDA |

$ |

165 |

|

|

$ |

62 |

|

|

$ |

103 |

|

166 |

% |

|

|

|

|

|

|

|

|

|

| Segment Adjusted EBITDA

margin |

|

21 |

% |

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The increase in net revenues was primarily due

to favorable pricing, due to the contractual pass-through of higher

material costs and pricing actions taken to offset higher input

costs. In addition, the acquisition of Fabri-Kal on October 1, 2021

contributed $121 million of incremental sales for the three months

ended June 30, 2022 as compared to the three months ended June 30,

2021. These increases were partially offset by lower sales volume

as the prior year period had strong sales volume as businesses and

restaurants re-opened post-COVID-19 lockdowns.

The increase in Adjusted EBITDA was primarily

due to favorable pricing, net of material costs passed through, and

the impact from the acquisition of Fabri-Kal, partially offset by

higher manufacturing costs, lower sales volume and higher

employee-related costs.

Food Merchandising

|

|

For the Three Months Ended June 30, |

|

|

Components of Change in Net Revenues |

|

| |

2022 |

|

|

2021 |

|

|

Change |

|

% Change |

|

|

Price/Mix |

|

|

Volume |

|

|

Total segment net revenues |

$ |

444 |

|

|

$ |

388 |

|

|

$ |

56 |

|

14 |

% |

|

20 |

% |

|

(6 |

)% |

| Segment Adjusted EBITDA |

$ |

78 |

|

|

$ |

59 |

|

|

$ |

19 |

|

32 |

% |

|

|

|

|

|

|

| Segment Adjusted EBITDA

margin |

|

18 |

% |

|

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The increase in net revenues was primarily due

to favorable pricing, due to pricing actions taken to offset higher

input costs and the contractual pass-through of higher material

costs, partially offset by lower sales volume, primarily due to

labor and related impacts.

The increase in Adjusted EBITDA was primarily

due to favorable pricing, net of material costs passed through,

partially offset by higher manufacturing costs and lower sales

volume.

Beverage Merchandising

|

|

For the Three Months Ended June 30, |

|

|

Components of Change in Net Revenues |

|

| |

2022 |

|

|

2021 |

|

|

Change |

|

% Change |

|

|

Price/Mix |

|

|

Volume |

|

|

FX |

|

|

Total segment net revenues |

$ |

420 |

|

|

$ |

387 |

|

|

$ |

33 |

|

9 |

% |

|

19 |

% |

|

(9 |

)% |

|

(1 |

)% |

| Segment Adjusted EBITDA |

$ |

29 |

|

|

$ |

15 |

|

|

$ |

14 |

|

93 |

% |

|

|

|

|

|

|

|

|

|

| Segment Adjusted EBITDA

margin |

|

7 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The increase in net revenues was primarily due

to favorable pricing, due to pricing actions taken to offset higher

input costs and the contractual pass-through of higher material

costs, and favorable product mix. These increases were partially

offset by lower sales volume, primarily due to our strategic exit

from the coated groundwood business in December 2021.

The increase in Adjusted EBITDA was primarily

due to favorable pricing, net of material costs passed through,

partially offset by higher manufacturing costs, including $11

million due to a scheduled annual pulp mill outage, higher

employee-related costs and lower sales volume.

Year to Date Financial Results (Six

Months Ended June 30, 2022):

- Net Revenues of

$3,135 million for the six months ended June 30, 2022 compared to

$2,516 million in the prior year period.

- Net Income from

continuing operations of $117 million for the six months ended June

30, 2022 compared to a net loss of $3 million in the prior year

period.

- Adjusted EBITDA1

from continuing operations of $431 million for the six months ended

June 30, 2022 compared to $207 million in the prior year

period.

Net revenues for the six months ended June 30,

2022 were $3,135 million compared to $2,516 million in the six

months ended June 30, 2021. The increase was primarily due to

favorable pricing, due to the contractual pass-through of higher

material costs and pricing actions across all of our segments. In

addition, the Foodservice segment’s acquisition of Fabri-Kal on

October 1, 2021 contributed $223 million of incremental sales for

the six months ended June 30, 2022 as compared to the six months

ended June 30, 2021. These increases were partially offset by lower

sales volume, primarily due to strong sales volume in the prior

year period as businesses and restaurants re-opened post-COVID-19

lockdowns in our Foodservice segment, labor and related impacts in

our Food Merchandising segment and our strategic exit from the

coated groundwood business in our Beverage Merchandising segment in

December 2021.

Net income from continuing operations for the

six months ended June 30, 2022 was $117 million compared to a net

loss of $3 million in the six months ended June 30, 2021. The

change was primarily driven by $282 million of higher gross profit,

primarily driven by favorable pricing, partially offset by higher

material and manufacturing costs, lower sales volume and higher

logistics costs. Higher gross profit was also driven by the

contribution from the Fabri-Kal acquisition, plus the benefit

related to prior year period costs of $50 million from Winter Storm

Uri. The increase due to higher gross profit was partially offset

by a $94 million increase in tax expense, primarily attributable to

improved profitability, a $49 million increase in selling, general

and administrative expenses, primarily driven by higher

employee-related costs and higher costs related to the acquisition

of Fabri-Kal, and a $40 million decrease in non-operating income,

primarily due to lower gross pension plan assets and

liabilities.

Adjusted EBITDA1 for the six months ended June

30, 2022 was $431 million compared to $207 million in the six

months ended June 30, 2021. The increase reflects favorable

pricing, net of material costs passed through, and the impact from

the acquisition of Fabri-Kal, partially offset by higher

manufacturing costs, lower sales volume and higher employee-related

and logistics costs. The increase in Adjusted EBITDA also includes

the benefit related to prior year period costs of $50 million from

Winter Storm Uri.

Balance Sheet and Cash Flow

Highlights

- Cash and cash equivalents were $246 million as of June 30,

2022, with a further $9 million of cash and cash equivalents

classified within current assets held for sale.

- Total outstanding debt was $4,264 million at June 30,

2022.

- For the quarter ended June 30, 2022, capital expenditures

totaled $64 million.

- The Company paid dividends to shareholders of $0.20 per share

during the six months ended June 30, 2022. The Company’s Board of

Directors declared a second quarter 2022 dividend on August 1, 2022

of $0.10 per share of common stock, payable on September 15, 2022

to shareholders of record as of August 31, 2022.

Outlook

We are updating and raising our 2022 Adjusted

EBITDA1 guidance from $705 million to a range of $750 million to

$770 million to reflect our strong year-to-date performance2. We

are encouraged by the progress we have made in our mill operations

as well as the improvement in our labor levels but remain cautious

due to the continued inflationary pressures in the market as well

as the uncertainty around the global energy market and its impact

on raw materials, logistics and other costs. Despite this

uncertainty, we are confident in our ability to manage these higher

costs and execute on our strategy.

Conference Call and Webcast

Presentation

The Company will host a conference call and

webcast presentation to discuss these results on August 4, 2022 at

8:00 a.m. U.S. Eastern Time. Investors interested in participating

in the live call may dial (877) 300-9306 from the U.S. or (412)

542-4176 internationally and use access code 10169042. Participants

may also access the live webcast and supplemental presentation on

the Pactiv Evergreen Investor Relations website at

https://investors.pactivevergreen.com/financial-information/sec-filings

under “News & Events.” The Company may from time to time use

this Investor Relations website as a means of disclosing material

non-public information and for complying with our disclosure

obligations under Regulation FD.

About Pactiv Evergreen Inc.

Pactiv Evergreen Inc. (NASDAQ: PTVE) is a leading manufacturer and

distributor of fresh foodservice and food merchandising products

and fresh beverage cartons in North America. With a team of

approximately 16,500 employees, the Company produces a broad range

of on-trend and feature-rich products that protect, package and

display food and beverages for today’s consumers. Its products,

many of which are made with recycled, recyclable or renewable

materials, are sold to a diversified mix of customers, including

restaurants, foodservice distributors, retailers, food and beverage

producers, packers and processors. Learn more at

www.pactivevergreen.com.

Note to Investors Regarding

Forward-Looking Statements

This press release contains forward-looking

statements. All statements contained in this press release other

than statements of historical fact are forward-looking statements,

including statements regarding our guidance as to our future

financial results and our expectations regarding the duration and

severity of ongoing macroeconomic challenges. In some cases, you

can identify these statements by forward-looking words such as

“may,” “might,” “will,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,”

“likely” or “continue,” the negative of these terms and other

comparable terminology. These statements are only predictions based

on our expectations and projections about future events as of the

date of this press release and are subject to a number of risks,

uncertainties and assumptions that may prove incorrect, any of

which could cause actual results to differ materially from those

expressed or implied by such statements, including, among others,

those described under the heading “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2021 filed with

the Securities and Exchange Commission, or SEC, and our Quarterly

Reports on Form 10-Q for the quarter ended March 31, 2022 filed

with the SEC and the quarter ended June 30, 2022 to be filed with

the SEC. New risks emerge from time to time, and it is not possible

for our management to predict all risks, nor can management assess

the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statement the Company makes. Investors are cautioned not to place

undue reliance on any such forward-looking statements, which speak

only as of the date they are made. Except as otherwise required by

law, the Company undertakes no obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Use of Non-GAAP Financial

Measures

The Company uses the non-GAAP financial measure

“Adjusted EBITDA” in evaluating our past results and future

prospects. The Company defines Adjusted EBITDA as net income (loss)

from continuing operations calculated in accordance with GAAP plus

the sum of income tax expense (benefit), net interest expense,

depreciation and amortization and further adjusted to exclude

certain items, including but not limited to restructuring, asset

impairment and other related charges, gains on the sale of

businesses and noncurrent assets, non-cash pension income or

expense, operational process engineering-related consultancy costs,

business acquisition and integration costs and purchase accounting

adjustments, unrealized gains or losses on derivatives, foreign

exchange losses on cash, executive transition charges and gains or

losses on certain legal settlements. The Company has provided below

a reconciliation of Adjusted EBITDA from continuing operations to

net income (loss) from continuing operations, the most directly

comparable GAAP financial measure.

The Company presents Adjusted EBITDA because it

is a key measure used by our management team to evaluate its

operating performance, generate future operating plans, make

strategic decisions and incentivize and reward its employees. In

addition, our chief operating decision maker uses the Adjusted

EBITDA of each reportable segment to evaluate its respective

operating performance. Accordingly, the Company believes that

presenting this metric provides useful information to investors and

others in understanding and evaluating our operating results in the

same manner as our management team and Board of Directors. The

Company also believes that Adjusted EBITDA and similar measures are

widely used by investors, securities analysts, rating agencies and

other parties in evaluating companies as measures of financial

performance and debt service capabilities.

Non-GAAP information should be considered as

supplemental in nature and is not meant to be considered in

isolation or as a substitute for the related financial information

prepared in accordance with GAAP. In addition, our Adjusted EBITDA

metric may not be the same as or comparable to similar non-GAAP

financial measures presented by other companies. Because of these

and other limitations, you should consider Adjusted EBITDA

alongside other financial performance measures, including our net

income (loss) and other GAAP results. In addition, in evaluating

Adjusted EBITDA, you should be aware that in the future the Company

will incur expenses such as those that are the subject of

adjustments in deriving Adjusted EBITDA and you should not infer

from our presentation of Adjusted EBITDA that our future results

will not be affected by these expenses or any unusual or

non-recurring items.

Contact:Dhaval

Patel732.501.9657dhaval.patel@pactivevergreen.com

Pactiv Evergreen

Inc.Condensed Consolidated Statements of Income

(Loss)(in millions, except per share

amounts)(unaudited)

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Net revenues |

$ |

1,640 |

|

|

$ |

1,352 |

|

|

$ |

3,135 |

|

|

$ |

2,516 |

|

| Cost of sales |

|

(1,332 |

) |

|

|

(1,202 |

) |

|

|

(2,595 |

) |

|

|

(2,258 |

) |

| Gross

profit |

|

308 |

|

|

|

150 |

|

|

|

540 |

|

|

|

258 |

|

| Selling, general and

administrative expenses |

|

(148 |

) |

|

|

(115 |

) |

|

|

(290 |

) |

|

|

(241 |

) |

| Restructuring, asset impairment

and other related charges |

|

(1 |

) |

|

|

(10 |

) |

|

|

(1 |

) |

|

|

(8 |

) |

| Other income, net |

|

12 |

|

|

|

5 |

|

|

|

40 |

|

|

|

11 |

|

| Operating income from

continuing operations |

|

171 |

|

|

|

30 |

|

|

|

289 |

|

|

|

20 |

|

| Non-operating (expense) income,

net |

|

(2 |

) |

|

|

25 |

|

|

|

8 |

|

|

|

48 |

|

| Interest expense, net |

|

(50 |

) |

|

|

(42 |

) |

|

|

(99 |

) |

|

|

(84 |

) |

| Income (loss) from

continuing operations before tax |

|

119 |

|

|

|

13 |

|

|

|

198 |

|

|

|

(16 |

) |

| Income tax (expense) benefit |

|

(45 |

) |

|

|

(5 |

) |

|

|

(81 |

) |

|

|

13 |

|

| Income (loss) from

continuing operations |

|

74 |

|

|

|

8 |

|

|

|

117 |

|

|

|

(3 |

) |

| Loss from discontinued

operations, net of income taxes |

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

(4 |

) |

| Net income

(loss) |

|

74 |

|

|

|

7 |

|

|

|

117 |

|

|

|

(7 |

) |

| Income attributable to

non-controlling interests |

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

| Net income (loss)

attributable to Pactiv Evergreen Inc. common

shareholders |

$ |

73 |

|

|

$ |

7 |

|

|

$ |

116 |

|

|

$ |

(8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share

attributable to Pactiv Evergreen Inc. common

shareholders |

|

|

|

|

|

|

|

|

|

|

|

| From continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.41 |

|

|

$ |

0.05 |

|

|

$ |

0.65 |

|

|

$ |

(0.02 |

) |

|

Diluted |

$ |

0.40 |

|

|

$ |

0.05 |

|

|

$ |

0.65 |

|

|

$ |

(0.02 |

) |

| From discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

— |

|

|

$ |

(0.01 |

) |

|

$ |

— |

|

|

$ |

(0.02 |

) |

|

Diluted |

$ |

— |

|

|

$ |

(0.01 |

) |

|

$ |

— |

|

|

$ |

(0.02 |

) |

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.41 |

|

|

$ |

0.04 |

|

|

$ |

0.65 |

|

|

$ |

(0.04 |

) |

|

Diluted |

$ |

0.40 |

|

|

$ |

0.04 |

|

|

$ |

0.65 |

|

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares

outstanding - basic |

|

177.7 |

|

|

|

177.4 |

|

|

|

177.7 |

|

|

|

177.3 |

|

| Weighted-average shares

outstanding - diluted |

|

178.3 |

|

|

|

177.7 |

|

|

|

178.2 |

|

|

|

177.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pactiv Evergreen

Inc.Condensed Consolidated Balance

Sheets(in

millions)(unaudited)

|

|

|

|

|

|

|

As of June 30, 2022 |

|

As of March 31, 2022 |

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

246 |

|

$ |

283 |

|

Accounts receivable, net |

|

527 |

|

|

502 |

|

Related party receivables |

|

50 |

|

|

41 |

|

Inventories |

|

1,103 |

|

|

968 |

|

Other current assets |

|

137 |

|

|

113 |

|

Assets held for sale |

|

131 |

|

|

134 |

| Total current

assets |

|

2,194 |

|

|

2,041 |

|

Property, plant and equipment, net |

|

1,759 |

|

|

1,771 |

|

Operating lease right-of-use assets, net |

|

271 |

|

|

272 |

|

Goodwill |

|

1,814 |

|

|

1,812 |

|

Intangible assets, net |

|

1,096 |

|

|

1,112 |

|

Deferred income taxes |

|

7 |

|

|

7 |

|

Other noncurrent assets |

|

144 |

|

|

147 |

| Total

assets |

$ |

7,285 |

|

$ |

7,162 |

| Liabilities |

|

|

|

|

Accounts payable |

$ |

493 |

|

$ |

433 |

|

Related party payables |

|

9 |

|

|

11 |

|

Current portion of long-term debt |

|

30 |

|

|

30 |

|

Current portion of operating lease liabilities |

|

63 |

|

|

62 |

|

Income taxes payable |

|

6 |

|

|

5 |

|

Accrued and other current liabilities |

|

372 |

|

|

373 |

|

Liabilities held for sale |

|

24 |

|

|

27 |

| Total current

liabilities |

|

997 |

|

|

941 |

|

Long-term debt |

|

4,207 |

|

|

4,213 |

|

Long-term operating lease liabilities |

|

219 |

|

|

222 |

|

Deferred income taxes |

|

257 |

|

|

231 |

|

Long-term employee benefit obligations |

|

196 |

|

|

194 |

|

Other noncurrent liabilities |

|

140 |

|

|

144 |

| Total

liabilities |

$ |

6,016 |

|

$ |

5,945 |

| Total equity attributable

to Pactiv Evergreen Inc. common shareholders |

|

1,264 |

|

|

1,213 |

|

Non-controlling interests |

|

5 |

|

|

4 |

| Total

equity |

$ |

1,269 |

|

$ |

1,217 |

| Total liabilities and

equity |

$ |

7,285 |

|

$ |

7,162 |

| |

|

|

|

|

|

| |

|

|

|

|

|

Pactiv Evergreen

Inc.Condensed Consolidated Statements of Cash

Flows(in

millions)(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Three Months Ended March 31, |

|

|

For the Three Months Ended June 30, |

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

| Cash provided by

operating activities |

|

|

|

|

|

|

|

|

|

Net income |

$ |

74 |

|

|

$ |

43 |

|

|

$ |

7 |

|

| Adjustments to reconcile net

income to operating cash flows: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

86 |

|

|

|

84 |

|

|

|

77 |

|

|

Deferred income taxes |

|

27 |

|

|

|

18 |

|

|

|

(3 |

) |

|

Unrealized (gain) loss on derivatives |

|

(1 |

) |

|

|

(5 |

) |

|

|

3 |

|

|

Other asset impairment charges |

|

— |

|

|

|

— |

|

|

|

2 |

|

|

Gain on sale of businesses and noncurrent assets |

|

— |

|

|

|

(27 |

) |

|

|

— |

|

|

Non-cash portion of employee benefit obligations |

|

3 |

|

|

|

(10 |

) |

|

|

(24 |

) |

|

Non-cash portion of operating lease expense |

|

22 |

|

|

|

19 |

|

|

|

19 |

|

|

Amortization of OID and DIC |

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

Equity based compensation |

|

6 |

|

|

|

4 |

|

|

|

2 |

|

|

Other non-cash items, net |

|

9 |

|

|

|

2 |

|

|

|

5 |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

(43 |

) |

|

|

(11 |

) |

|

|

(33 |

) |

|

Inventories |

|

(154 |

) |

|

|

(115 |

) |

|

|

7 |

|

|

Other current assets |

|

(21 |

) |

|

|

9 |

|

|

|

2 |

|

|

Accounts payable |

|

61 |

|

|

|

66 |

|

|

|

44 |

|

|

Operating lease payments |

|

(21 |

) |

|

|

(19 |

) |

|

|

(20 |

) |

|

Income taxes payable/receivable |

|

1 |

|

|

|

(1 |

) |

|

|

23 |

|

|

Accrued and other current liabilities |

|

(1 |

) |

|

|

59 |

|

|

|

1 |

|

|

Employee benefit obligation contributions |

|

(2 |

) |

|

|

(1 |

) |

|

|

(2 |

) |

|

Other assets and liabilities |

|

(1 |

) |

|

|

4 |

|

|

|

1 |

|

| Net cash provided by

operating activities |

|

46 |

|

|

|

120 |

|

|

|

113 |

|

| Cash used in investing

activities |

|

|

|

|

|

|

|

|

|

Acquisition of property, plant and equipment |

|

(64 |

) |

|

|

(50 |

) |

|

|

(71 |

) |

|

Acquisition of business, net of cash acquired |

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

Disposal of businesses and joint venture equity interests, net of

cash disposed |

|

— |

|

|

|

47 |

|

|

|

— |

|

| Net cash used in

investing activities |

|

(64 |

) |

|

|

(5 |

) |

|

|

(71 |

) |

| Cash used in financing

activities |

|

|

|

|

|

|

|

|

|

Long-term debt repayments |

|

(5 |

) |

|

|

(6 |

) |

|

|

(3 |

) |

|

Dividends paid to common shareholders |

|

(18 |

) |

|

|

(18 |

) |

|

|

(17 |

) |

|

Other financing activities |

|

(3 |

) |

|

|

(3 |

) |

|

|

(1 |

) |

| Net cash used in

financing activities |

|

(26 |

) |

|

|

(27 |

) |

|

|

(21 |

) |

| Effect of exchange rate changes

on cash and cash equivalents |

|

(3 |

) |

|

|

— |

|

|

|

1 |

|

|

(Decrease) increase in cash and cash equivalents |

|

(47 |

) |

|

|

88 |

|

|

|

22 |

|

|

Cash and cash equivalents, including amounts classified as held for

sale, as of beginning of the period(1) |

|

302 |

|

|

|

214 |

|

|

|

328 |

|

| Cash and cash equivalents

as of end of the period(1) |

$ |

255 |

|

|

$ |

302 |

|

|

$ |

350 |

|

(1) Includes $9 million, $19 million and $17

million of cash and cash equivalents classified as current assets

held for sale as of June 30, 2022, March 31, 2022 and December 31,

2021, respectively.

Pactiv Evergreen

Inc.Reconciliation of Reportable Segment Net

Revenues to Total Net Revenues(in

millions)(unaudited)

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Reportable segment net

revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Foodservice |

$ |

791 |

|

|

$ |

571 |

|

|

$ |

1,488 |

|

|

$ |

1,025 |

|

|

Food Merchandising |

|

444 |

|

|

|

388 |

|

|

|

848 |

|

|

|

730 |

|

|

Beverage Merchandising |

|

420 |

|

|

|

387 |

|

|

|

823 |

|

|

|

744 |

|

| Other |

|

27 |

|

|

|

24 |

|

|

|

49 |

|

|

|

53 |

|

| Intersegment revenues |

|

(42 |

) |

|

|

(18 |

) |

|

|

(73 |

) |

|

|

(36 |

) |

| Total net

revenues |

$ |

1,640 |

|

|

$ |

1,352 |

|

|

$ |

3,135 |

|

|

$ |

2,516 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pactiv Evergreen

Inc.Reconciliation of Reportable Segment Adjusted

EBITDA to Adjusted EBITDA from Continuing

Operations(in

millions)(unaudited)

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Reportable segment

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

Foodservice |

$ |

165 |

|

|

$ |

62 |

|

|

$ |

281 |

|

|

$ |

123 |

|

|

Food Merchandising |

|

78 |

|

|

|

59 |

|

|

|

138 |

|

|

|

114 |

|

|

Beverage Merchandising |

|

29 |

|

|

|

15 |

|

|

|

53 |

|

|

|

(17 |

) |

| Other |

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

|

3 |

|

| Unallocated |

|

(25 |

) |

|

|

(8 |

) |

|

|

(43 |

) |

|

|

(16 |

) |

| Adjusted EBITDA from

continuing operations (Non-GAAP) |

$ |

249 |

|

|

$ |

130 |

|

|

$ |

431 |

|

|

$ |

207 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pactiv Evergreen

Inc.Reconciliation of Net Income (Loss) from

Continuing Operations to Adjusted EBITDA from Continuing

Operations(in

millions)(unaudited)

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Net income (loss) from continuing operations

(GAAP) |

$ |

74 |

|

|

$ |

8 |

|

|

$ |

117 |

|

|

$ |

(3 |

) |

| Income tax expense (benefit) |

|

45 |

|

|

|

5 |

|

|

|

81 |

|

|

|

(13 |

) |

| Interest expense, net |

|

50 |

|

|

|

42 |

|

|

|

99 |

|

|

|

84 |

|

| Depreciation and

amortization |

|

86 |

|

|

|

77 |

|

|

|

170 |

|

|

|

150 |

|

| Restructuring, asset impairment

and other related charges(1) |

|

1 |

|

|

|

10 |

|

|

|

1 |

|

|

|

8 |

|

| Gain on sale of businesses and

noncurrent assets(2) |

|

— |

|

|

|

— |

|

|

|

(27 |

) |

|

|

— |

|

| Non-cash pension expense

(income)(3) |

|

2 |

|

|

|

(25 |

) |

|

|

(8 |

) |

|

|

(48 |

) |

| Operational process

engineering-related consultancy costs(4) |

|

1 |

|

|

|

7 |

|

|

|

4 |

|

|

|

10 |

|

| Business acquisition and

integration costs and purchase accounting adjustments(5) |

|

2 |

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

| Unrealized (gains) losses on

derivatives(6) |

|

(1 |

) |

|

|

3 |

|

|

|

(6 |

) |

|

|

4 |

|

| Foreign exchange losses on

cash(7) |

|

— |

|

|

|

1 |

|

|

|

2 |

|

|

|

1 |

|

| Executive transition

charges(8) |

|

2 |

|

|

|

— |

|

|

|

2 |

|

|

|

10 |

|

| Gain on legal settlement(9) |

|

(15 |

) |

|

|

— |

|

|

|

(15 |

) |

|

|

— |

|

| Costs associated with legacy sold

facility(10) |

|

3 |

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

| Other |

|

(1 |

) |

|

|

2 |

|

|

|

(1 |

) |

|

|

4 |

|

| Adjusted EBITDA from

continuing operations (Non-GAAP) |

$ |

249 |

|

|

$ |

130 |

|

|

$ |

431 |

|

|

$ |

207 |

|

|

(1) |

Reflects restructuring, asset impairment and other related charges

(net of reversals) primarily associated with our closure of

Beverage Merchandising’s coated groundwood operations. |

| (2) |

Reflects the gain from the sale

of businesses and noncurrent assets, primarily related to the sale

of our equity interests in Naturepak Beverage Packaging Co.

Ltd. |

| (3) |

Reflects the non-cash pension

expense (income) related to our employee benefit plans, including

the pension settlement gain of $10 million recognized during the

six months ended June 30, 2022. |

| (4) |

Reflects the costs incurred to

evaluate and improve the efficiencies of our manufacturing and

distribution operations. |

| (5) |

Reflects integration costs

related to the acquisition of Fabri-Kal. |

| (6) |

Reflects the mark-to-market

movements in our commodity derivatives. |

| (7) |

Reflects foreign exchange losses

on cash, primarily on U.S. dollar amounts held in non-U.S. dollar

functional currency entities. |

| (8) |

Reflects charges relating to key

executive retirement and separation agreements in the first half of

2021 and in the second quarter of 2022. |

| (9) |

Reflects the gain, net of costs,

arising from the settlement of a historical legal action. |

| (10) |

Reflects costs related to a

closed facility, sold prior to our acquisition of the entity. |

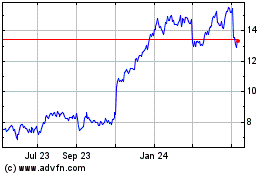

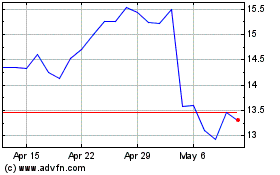

Pactiv Evergreen (NASDAQ:PTVE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pactiv Evergreen (NASDAQ:PTVE)

Historical Stock Chart

From Jul 2023 to Jul 2024