Oxford Square Capital Corp. Announces Net Asset Value and Selected Financial Results for the Quarter Ended December 31, 2020 ...

March 22 2021 - 8:30AM

Oxford Square Capital Corp. (NasdaqGS: OXSQ) (NasdaqGS: OXSQL)

(NasdaqGS: OXSQZ) (the “Company,” “we,” “us” or “our”) announced

today its financial results and related information for the quarter

ended December 31, 2020.

- As of December 31,

2020, net asset value (“NAV”) per share was $4.55, compared with

the NAV per share of $3.85 at the prior quarter end.

- For the quarter

ended December 31, 2020 we recorded GAAP net investment income of

approximately $4.7 million, or $0.10 per share.

- We recorded net

unrealized appreciation of approximately $35.7 million and net

realized losses on investments of approximately $0.7 million for

the quarter ended December 31, 2020, compared to net unrealized

appreciation of approximately $20.9 million and net realized losses

on investments of approximately $4.4 million for the quarter ended

September 30, 2020.

- In total, we had a

net increase in net assets from operations of approximately $39.7

million, or $0.80 per share, for the quarter ended December 31,

2020, compared with a net increase in net assets from operations of

approximately $20.8 million, or $0.42 per share, for the quarter

ended September 30, 2020.

-

Total investment income for the quarter ended December 31, 2020

amounted to approximately $8.6 million, compared with approximately

$8.2 million for the quarter ended September 30, 2020. For the

quarter ended December 31, 2020 the components of investment income

were as follows:

-

$5.2 million from our debt investments,

-

$3.5 million from our CLO equity investments

- Our total

expenses for the quarter ended December 31, 2020 were approximately

$3.9 million, compared with total expenses of approximately $4.0

million for the third quarter of 2020.

- During the

fourth quarter of 2020, we made investments of approximately $46.9

million and recognized proceeds of approximately $25.4 million from

sales of investments, and $51.1 million from repayments and

amortization payments on our debt investments.

- As of December 31, 2020, the

following metrics applied (note that none of these values

represents a total return to shareholders):

- The weighted average yield of our

debt investments was 8.0% at current cost, compared with 8.3% as of

September 30, 2020.

- The weighted average effective

yield of our CLO equity investments at current cost was 8.0%,

compared with 7.7% as of September 30, 2020.

- The weighted average cash

distribution yield of our cash income producing CLO equity

investments at current cost was 19.2%, compared with 11.7% as of

September 30, 2020.

- Our weighted

average credit rating was 2.1 based on total fair value and 2.4

based on total principal amount as of December 31, 2020, compared

to 2.3 based on total fair value and 2.5 based on total principal

value as of September 30, 2020.

- As of

December 31, 2020, we had two debt investments on non-accrual

status, with a combined fair value of $4.2 million. Also, as of

December 31, 2020, our preferred equity investments in one of our

portfolio companies were on non-accrual status, which had zero fair

value.

- On February 23,

2021, our Board of Directors declared the following distributions

on our common stock:

|

Month Ending |

Record Date |

Payment Date |

Amount Per Share |

|

April 30, 2021 |

April 16, 2021 |

April 30, 2021 |

$0.035 |

|

May 31, 2021 |

May 14, 2021 |

May 28, 2021 |

$0.035 |

|

June 30, 2021 |

June 16, 2021 |

June 30, 2021 |

$0.035 |

In light of current economic and market

conditions, including as a result of the global crisis caused by

the spread of the COVID-19 virus, we believe that no reliance

should be placed on these distributions representing the prospect

for any particular level of common stock distributions for any

periods in the future.

We will hold a conference call to discuss fourth quarter 2020

earnings on Wednesday, March 24, 2021 at 9:00 AM Eastern time. The

toll free dial-in number is 1-888-339-0740. There will be a

recording available for 30 days. If you are interested in hearing

the recording, please dial 1-877-344-7529. The replay pass-code

number is 10153501.

A presentation containing further detail regarding our quarterly

results of operations has been posted under the Investor Relations

section of our website at www.oxfordsquarecapital.com.

OXFORD SQUARE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES

|

|

December 31,2020 |

|

December 31, 2019 |

|

ASSETS |

|

|

|

|

|

|

|

|

Non-affiliated/non-control investments (cost: $407,547,351 and

$467,828,907, respectively) |

$ |

294,674,000 |

|

|

$ |

361,985,203 |

|

|

Affiliated investments (cost: $16,836,822 and $16,836,822,

respectively) |

|

— |

|

|

|

2,816,790 |

|

|

Cash equivalents |

|

59,137,284 |

|

|

|

14,410,486 |

|

|

Restricted cash |

|

— |

|

|

|

2,050,452 |

|

|

Interest and distributions receivable |

|

2,299,259 |

|

|

|

3,480,036 |

|

|

Securities sold not settled |

|

950,000 |

|

|

|

— |

|

|

Other assets |

|

597,238 |

|

|

|

523,626 |

|

|

Total assets |

$ |

357,657,781 |

|

|

$ |

385,266,593 |

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

Notes payable – 6.50% Unsecured Notes, net of deferred issuance

costs of $1,055,065 and $1,380,658, respectively |

$ |

63,315,160 |

|

|

$ |

62,989,567 |

|

|

Notes payable – 6.25% Unsecured Notes, net of deferred issuance

costs of $1,243,082 and $1,476,878, respectively |

|

43,547,668 |

|

|

|

43,313,872 |

|

|

Notes payable – Credit Facility, net of deferred issuance costs of

$0 and $10,051, respectively |

|

— |

|

|

|

28,080,550 |

|

|

Securities purchased not settled |

|

23,156,556 |

|

|

|

— |

|

|

Base Fee and Net Investment Income Incentive Fee payable to

affiliate |

|

1,159,703 |

|

|

|

1,480,653 |

|

|

Accrued interest payable |

|

478,191 |

|

|

|

632,235 |

|

|

Accrued expenses |

|

573,977 |

|

|

|

771,174 |

|

|

Total liabilities |

|

132,231,255 |

|

|

|

137,268,051 |

|

| COMMITMENTS AND

CONTINGENCIES (Note 9) |

|

|

|

|

|

|

|

| NET

ASSETS |

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, 100,000,000 shares authorized;

49,589,607 and 48,448,987 shares issued and outstanding,

respectively |

|

495,895 |

|

|

|

484,489 |

|

|

Capital in excess of par value |

|

452,650,210 |

|

|

|

451,839,302 |

|

|

Total distributable earnings/(accumulated losses) |

|

(227,719,579 |

) |

|

|

(204,325,249 |

) |

|

Total net assets |

|

225,426,526 |

|

|

|

247,998,542 |

|

|

Total liabilities and net assets |

$ |

357,657,781 |

|

|

$ |

385,266,593 |

|

| Net asset value per common

share |

$ |

4.55 |

|

|

$ |

5.12 |

|

| |

|

|

|

|

|

|

|

OXFORD SQUARE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF

OPERATIONS

|

|

Year Ended December 31,

2020 |

|

Year Ended December 31,

2019 |

|

Year Ended December 31,

2018 |

|

INVESTMENT INCOME |

|

|

|

|

|

|

|

|

|

|

|

| From

non-affiliated/non-control investments: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income – debt investments |

$ |

20,252,055 |

|

|

$ |

28,000,283 |

|

|

$ |

25,183,547 |

|

|

Income from securitization vehicles and investments |

|

15,014,000 |

|

|

|

25,244,866 |

|

|

|

27,837,032 |

|

|

Other income |

|

676,450 |

|

|

|

1,694,434 |

|

|

|

2,984,773 |

|

|

Total investment income from non-affiliated/non-control

investments |

|

35,942,505 |

|

|

|

54,939,583 |

|

|

|

56,005,352 |

|

| From affiliated

investments: |

|

|

|

|

|

|

|

|

|

|

|

|

Dividend income – non-cash |

|

— |

|

|

|

7,710,805 |

|

|

|

— |

|

|

Interest income – debt investments |

|

— |

|

|

|

— |

|

|

|

271,916 |

|

|

Total investment income from affiliated investments |

|

— |

|

|

|

7,710,805 |

|

|

|

271,916 |

|

|

Total investment income |

|

35,942,505 |

|

|

|

62,650,388 |

|

|

|

56,277,268 |

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

7,878,906 |

|

|

|

9,901,426 |

|

|

|

7,181,009 |

|

|

Base Fee |

|

4,525,034 |

|

|

|

6,704,467 |

|

|

|

7,309,435 |

|

|

Professional fees |

|

1,545,279 |

|

|

|

1,454,942 |

|

|

|

1,227,296 |

|

|

Compensation expense |

|

708,350 |

|

|

|

832,256 |

|

|

|

907,995 |

|

|

Director’s fees |

|

441,500 |

|

|

|

417,500 |

|

|

|

441,501 |

|

|

Insurance |

|

330,746 |

|

|

|

281,146 |

|

|

|

247,178 |

|

|

Transfer agent and custodian fees |

|

206,686 |

|

|

|

239,323 |

|

|

|

227,381 |

|

|

General and administrative |

|

591,512 |

|

|

|

829,476 |

|

|

|

644,104 |

|

|

Total expenses before incentive fees |

|

16,228,013 |

|

|

|

20,660,536 |

|

|

|

18,185,899 |

|

|

Net investment income incentive fees |

|

— |

|

|

|

3,511,493 |

|

|

|

4,585,151 |

|

|

Capital gains incentive fees |

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total incentive fees |

|

— |

|

|

|

3,511,493 |

|

|

|

4,585,151 |

|

|

Total expenses |

|

16,228,013 |

|

|

|

24,172,029 |

|

|

|

22,771,050 |

|

|

Net investment income |

|

19,714,492 |

|

|

|

38,478,359 |

|

|

|

33,506,218 |

|

|

Net change in unrealized appreciation/depreciation on

investments |

|

|

|

|

|

|

|

|

|

|

|

|

Non-Affiliate/non-control investments |

|

(7,029,647 |

) |

|

|

(50,107,582 |

) |

|

|

(36,969,481 |

) |

|

Affiliated investments |

|

(2,816,790 |

) |

|

|

(19,386,212 |

) |

|

|

(2,323,867 |

) |

|

Total net change in unrealized appreciation/depreciation on

investments |

|

(9,846,437 |

) |

|

|

(69,493,794 |

) |

|

|

(39,293,348 |

) |

|

Net realized losses |

|

|

|

|

|

|

|

|

|

|

|

|

Non-Affiliated/non-control investments |

|

(8,151,553 |

) |

|

|

(1,709,816 |

) |

|

|

(3,370,732 |

) |

|

Affiliated investments |

|

— |

|

|

|

— |

|

|

|

5,241 |

|

|

Extinguishment of debt |

|

(5,211 |

) |

|

|

(72,666 |

) |

|

|

(60,752 |

) |

|

Total net realized losses |

|

(8,156,764 |

) |

|

|

(1,782,482 |

) |

|

|

(3,426,243 |

) |

|

Net increase/(decrease) in net assets resulting from

operations |

|

1,711,291 |

|

|

|

(32,797,917 |

) |

|

|

(9,213,373 |

) |

| Net increase in net assets

resulting from net investment income per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

$ |

0.40 |

|

$ |

0.81 |

|

|

$ |

0.67 |

|

|

| Net increase/(decrease) in net

assets resulting from operations per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.03 |

|

$ |

(0.69 |

) |

|

$ |

(0.19 |

) |

|

|

Diluted |

$ |

0.03 |

|

$ |

(0.69 |

) |

|

$ |

(0.19 |

) |

|

| Weighted average shares of

common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

49,477,215 |

|

|

47,756,596 |

|

|

|

49,662,157 |

|

|

|

Diluted |

|

49,477,215 |

|

|

47,756,596 |

|

|

|

49,662,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL HIGHLIGHTS

|

|

|

Year Ended December 31,

2020 |

|

Year Ended December 31,

2019 |

|

Year Ended December 31,

2018 |

|

Year Ended December 31,

2017 |

|

Year Ended December 31,

2016 |

|

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value at beginning

of year |

|

$ |

5.12 |

|

|

$ |

6.60 |

|

|

$ |

7.55 |

|

|

$ |

7.50 |

|

|

$ |

6.40 |

|

| Net investment income(1) |

|

|

0.40 |

|

|

|

0.81 |

|

|

|

0.67 |

|

|

|

0.60 |

|

|

|

0.52 |

|

| Net realized and unrealized

gains (losses)(2) |

|

|

(0.36 |

) |

|

|

(1.49 |

) |

|

|

(0.91 |

) |

|

|

0.25 |

|

|

|

1.62 |

|

| Net change in net asset value

from operations |

|

|

0.04 |

|

|

|

(0.68 |

) |

|

|

(0.24 |

) |

|

|

0.85 |

|

|

|

2.14 |

|

| Distributions per share from

net investment income |

|

|

(0.61 |

) |

|

|

(0.80 |

) |

|

|

(0.73 |

) |

|

|

(0.66 |

) |

|

|

(1.06 |

) |

| Distributions based on

weighted average share impact |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

| Tax return of capital

distributions |

|

|

— |

|

|

|

— |

|

|

|

(0.07 |

) |

|

|

(0.14 |

) |

|

|

(0.10 |

) |

| Total distributions(3) |

|

|

(0.61 |

) |

|

|

(0.80 |

) |

|

|

(0.79 |

) |

|

|

(0.80 |

) |

|

|

(1.15 |

) |

| Effect of shares

issued/repurchased, gross |

|

|

— |

|

|

|

— |

|

|

|

0.08 |

|

|

|

— |

|

|

|

0.11 |

|

| Net asset value at end of

year |

|

$ |

4.55 |

|

|

$ |

5.12 |

|

|

$ |

6.60 |

|

|

$ |

7.55 |

|

|

$ |

7.50 |

|

| Per share market value at

beginning of year |

|

$ |

5.44 |

|

|

$ |

6.47 |

|

|

$ |

5.74 |

|

|

$ |

6.61 |

|

|

$ |

6.08 |

|

| Per share market value at end

of year |

|

$ |

3.05 |

|

|

$ |

5.44 |

|

|

$ |

6.47 |

|

|

$ |

5.74 |

|

|

$ |

6.61 |

|

| Total return based on Market

Value(4) |

|

|

(31.75 |

)% |

|

|

(4.14 |

)% |

|

|

26.95 |

% |

|

|

(2.01 |

)% |

|

|

33.29 |

% |

| Total return based on Net

Asset Value(5) |

|

|

0.82 |

% |

|

|

(10.26 |

)% |

|

|

(1.99 |

)% |

|

|

11.33 |

% |

|

|

35.31 |

% |

| Shares outstanding at end of

year |

|

|

49,589,607 |

|

|

|

48,448,987 |

|

|

|

47,650,959 |

|

|

|

51,479,409 |

|

|

|

51,479,409 |

|

|

Ratios/Supplemental

Data(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets at end of period

(000’s) |

|

225,427 |

|

|

247,999 |

|

|

314,724 |

|

|

388,419 |

|

|

385,992 |

|

| Average net assets

(000’s) |

|

191,137 |

|

|

289,373 |

|

|

369,258 |

|

|

385,947 |

|

|

343,328 |

|

| Ratio of expenses to average

net assets |

|

8.45 |

% |

|

8.35 |

% |

|

6.17 |

% |

|

7.95 |

% |

|

12.38 |

% |

| Ratio of net investment income

to average net assets |

|

10.26 |

% |

|

13.30 |

% |

|

9.07 |

% |

|

7.96 |

% |

|

7.80 |

% |

| Portfolio turnover

rate(6) |

|

23.72 |

% |

|

12.75 |

% |

|

35.18 |

% |

|

43.02 |

% |

|

25.73 |

% |

____________

(1) Represents per share net

investment income for the period, based upon weighted average

shares outstanding.(2) Net

realized and unrealized gains include rounding adjustments to

reconcile change in net asset value per

share.(3) Management monitors

available taxable earnings, including net investment income and

realized capital gains, to determine if a tax return of capital may

occur for the year. To the extent the Company’s taxable earnings

fall below the total amount of the Company’s distributions for that

fiscal year, a portion of those distributions may be deemed a tax

return of capital to the Company’s stockholders. The ultimate tax

character of the Company’s earnings cannot be determined until tax

returns are prepared after the end of the fiscal

year.(4) Total return based on

market value equals the increase or decrease of ending market value

over beginning market value, plus distributions, assuming

distribution reinvestment prices obtained under the Company’s

distribution reinvestment plan, excluding any discounts divided by

the beginning market value per

share.(5) Total return based on

net asset value equals the increase or decrease of ending net asset

value over beginning net asset value, plus distributions, divided

by the beginning net asset

value.(6) Portfolio turnover

rate is calculated using the lesser of the annual cash investment

sales and debt repayments or annual cash investment purchases over

the average of the total investments at fair

value.(7) The following table

provides supplemental performance ratios measured for the years

ended December 31, 2020, 2019, 2018, 2017 and 2016:

|

|

|

Year Ended December 31,

2020 |

|

Year Ended December 31,

2019 |

|

Year Ended December 31,

2018 |

|

Year Ended December 31,

2017 |

|

Year Ended December 31,

2016 |

|

Ratio of expenses to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses before incentive

fees |

|

8.45 |

% |

|

7.14 |

% |

|

4.92 |

% |

|

6.95 |

% |

|

11.57 |

% |

| Net Investment Income

Incentive Fees |

|

— |

% |

|

1.21 |

% |

|

1.24 |

% |

|

1.00 |

% |

|

0.81 |

% |

| Capital Gains Incentive

Fees |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

| Ratio of expenses, excluding

interest expense, to average net assets |

|

4.35 |

% |

|

4.93 |

% |

|

4.21 |

% |

|

4.61 |

% |

|

7.37 |

% |

About Oxford Square Capital Corp.Oxford Square

Capital Corp. is a publicly-traded business development company

principally investing in syndicated bank loans and debt and equity

tranches of collateralized loan obligation (“CLO”) vehicles. CLO

investments may also include warehouse facilities, which are

financing structures intended to aggregate loans that may be used

to form the basis of a CLO vehicle.

Forward-Looking Statements This press release

contains forward-looking statements subject to the inherent

uncertainties in predicting future results and conditions. Any

statements that are not statements of historical fact (including

statements containing the words “believes,” “plans,” “anticipates,”

“expects,” “estimates” and similar expressions) should also be

considered to be forward-looking statements. These statements are

not guarantees of future performance, conditions or results and

involve a number of risks and uncertainties, including the impact

of COVID-19 and related changes in base interest rates

and significant market volatility on our business, our portfolio

companies, our industry and the global economy. Certain

factors could cause actual results and conditions to differ

materially from those projected in these forward-looking

statements. These factors are identified from time to time in our

filings with the Securities and Exchange Commission. We undertake

no obligation to update such statements to reflect subsequent

events, except as may be required by law.

Contact:Bruce Rubin203-983-5280

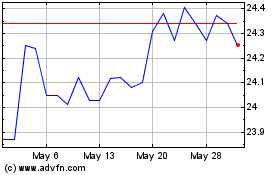

Oxford Square Capital (NASDAQ:OXSQZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Oxford Square Capital (NASDAQ:OXSQZ)

Historical Stock Chart

From Mar 2024 to Mar 2025