Outlook Therapeutics, Inc. (Nasdaq: OTLK), a biopharmaceutical

company working to achieve FDA approval for the first ophthalmic

formulation of bevacizumab for the treatment of retinal diseases,

today announced that it has received written agreement from the FDA

under an SPA for the NORSE EIGHT clinical trial protocol evaluating

ONS-5010 in neovascular age-related macular degeneration (AMD)

subjects. Additionally, Outlook Therapeutics entered into

securities purchase agreements with certain institutional and

accredited investors for up to $172 million in gross proceeds to

fund the advancement of ONS-5010.

“The SPA increases our confidence that ONS-5010,

if approved, will more effectively meet the needs of retina

surgeons, patients and payers in the $9.5 billion ophthalmic

anti-VEGF market in the United States, and the financing represents

a significant commitment by our new and existing stockholders to

advance this important development program,” commented Russell

Trenary, President and Chief Executive Officer. “We believe that

the funds we expect to receive in this financing will position

Outlook Therapeutics to support the ONS-5010 development pathway

through potential FDA approval and launch.”

The FDA has reviewed and agreed upon the NORSE

EIGHT trial protocol pursuant to the SPA. If the NORSE EIGHT trial

is successful, it would satisfy the FDA’s requirement for a second

adequate and well-controlled clinical trial to address fully the

clinical deficiency identified in the Complete Response Letter

(CRL).

NORSE EIGHT will be a randomized, controlled,

parallel-group, masked, non-inferiority study of approximately 400

newly diagnosed, wet AMD subjects randomized in a 1:1 ratio to

receive 1.25 mg ONS-5010 or 0.5 mg ranibizumab intravitreal

injections. Subjects will receive injections at Day 0

(randomization), Week 4, and Week 8 visits. The primary endpoint

will be mean change in BCVA from baseline to week 8. Outlook

Therapeutics expects NORSE EIGHT topline results and resubmission

of the ONS-5010 BLA by the end of calendar year 2024. In addition,

through a Type A meeting and additional interactions, Outlook

Therapeutics has identified the approaches needed to resolve the

chemistry, manufacturing and controls comments in the

CRL. Outlook Therapeutics is working to address the open items

and expects to resolve these comments prior to the expected

completion of NORSE EIGHT.

Private Placements

Additionally, Outlook Therapeutics announced

that it has entered into a definitive securities purchase agreement

with certain institutional and accredited investors to purchase

shares of common stock and accompanying warrants in a private

placement, the closing of which is conditioned upon stockholder

approval of the transaction and certain other corporate actions,

expected in the first quarter of 2024. The private placement is

expected to provide up to $60 million in gross proceeds at closing,

before deducting placement agent fees and offering expenses. In

addition, Outlook Therapeutics will have the potential to receive

additional gross proceeds of up to $99 million upon the full cash

exercise of the warrants being issued in the private placement,

before deducting placement agent fees and offering expenses. The

warrants include a feature that allows Outlook Therapeutics to

require cash exercise if certain stock price and milestone

conditions are met.

At the 2024 annual meeting, Outlook

Therapeutics’ stockholders will be asked to approve, among other

items, (i) an authorized share capital increase and (ii) a reverse

stock split, each of which must be implemented prior to closing of

the private placement, as well as (iii) approval of the private

placement under for Nasdaq Rule 5635(d). GMS Ventures and Syntone

Ventures, Outlook Therapeutics’ largest stockholders, as well as

its directors, have entered into support agreements pursuant to

which they have agreed to vote in favor of these proposals.

The private placement is being led by Great

Point Partners, LLC, with participation from existing investor GMS

Ventures as well as new investors Altium Capital, Armistice

Capital, Caligan Partners LP, Schonfeld Strategic Advisors, Sphera

Healthcare, Velan Capital, Woodline Partners LP, and an undisclosed

life sciences dedicated investor.

BofA Securities and BTIG are acting as

co-placement agents in connection with the financing.

Outlook Therapeutics also entered into a

securities purchase agreement with Syntone Ventures, another

existing stockholder, to purchase $5 million in shares of common

stock and warrants on the same terms as the private placement,

subject to receipt of requisite approvals in addition to the

necessary corporate action items described above.

Outlook Therapeutics intends to use the net

proceeds from the financings to fund its ONS-5010 clinical

development programs, including to initiate and fund the planned

NORSE EIGHT clinical trial, and for working capital and other

general corporate purposes.

Convertible Note Extension

In addition, on January 22, 2024, Outlook

Therapeutics reached an agreement with the holder of its

outstanding convertible promissory note to extend the maturity

until July 1, 2025, subject to certain conditions, including

receipt of at least $25.0 million of proceeds from an equity

offering and reduction of the conversion price on $15.0 million

aggregate principal amount of the note.

The offer and sale of the foregoing securities

are being made by Outlook Therapeutics in a private placement under

Section 4(a)(2) of the Securities Act of 1933, as amended (the

Act), and/or Regulation D promulgated thereunder, and such

securities have not been registered under the Act or applicable

state securities laws. Accordingly, such securities may not be

offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Act and such applicable state

securities laws.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About ONS-5010 / LYTENAVA™

(bevacizumab-vikg)

ONS-5010 is an investigational ophthalmic

formulation of bevacizumab under development as an intravitreal

injection for the treatment of wet AMD and other retinal diseases.

Because no FDA-approved ophthalmic formulations of bevacizumab are

available currently, clinicians wishing to treat retinal patients

with bevacizumab have had to use unapproved repackaged IV

bevacizumab provided by compounding pharmacies—products that have

known risks of contamination and inconsistent potency and

availability. If approved, ONS-5010 would provide an FDA-approved

option for physicians that currently prescribe unapproved

repackaged oncologic IV bevacizumab from compounding pharmacies for

the treatment of wet AMD.

Bevacizumab-vikg is a recombinant humanized

monoclonal antibody (mAb) that selectively binds with high affinity

to all isoforms of human vascular endothelial growth factor (VEGF)

and neutralizes VEGF’s biologic activity through a steric blocking

of the binding of VEGF to its receptors Flt-1 (VEGFR-1) and KDR

(VEGFR-2) on the surface of endothelial cells. Following

intravitreal injection, the binding of bevacizumab-vikg to VEGF

prevents the interaction of VEGF with its receptors on the surface

of endothelial cells, reducing endothelial cell proliferation,

vascular leakage, and new blood vessel formation in the retina.

About Outlook Therapeutics,

Inc.Outlook Therapeutics is a biopharmaceutical company

working to achieve FDA approval for the launch of ONS-5010/

LYTENAVA™ (bevacizumab-vikg) as the first FDA-approved ophthalmic

formulation of bevacizumab for use in retinal indications,

including wet AMD, DME and BRVO. The FDA accepted Outlook

Therapeutics’ BLA submission for ONS-5010 to treat wet AMD with an

initial PDUFA goal date of August 29, 2023; the FDA did not approve

the BLA during this review cycle and Outlook Therapeutics is

working with the FDA to address the issues that have been raised so

that the BLA may be re-submitted. If ONS-5010 ophthalmic

bevacizumab is approved, Outlook Therapeutics expects to

commercialize it as the first and only FDA-approved ophthalmic

formulation of bevacizumab for use in treating retinal diseases in

the United States, United Kingdom, Europe, Japan, and other

markets. As part of the Outlook Therapeutics' multi-year commercial

planning process, Outlook Therapeutics and Cencora entered into a

strategic commercialization agreement to expand the Outlook

Therapeutics’ reach for connecting to retina specialists and their

patients. Cencora will provide third-party logistics (3PL) services

and distribution, as well as pharmacovigilance services and other

services in the United States. For more information, please visit

www.outlooktherapeutics.com.Forward-Looking

Statements This press release contains forward-looking

statements. All statements other than statements of historical

facts are “forward-looking statements,” including those relating to

future events. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,” “believe,”

“continue,” “estimate,” “expect,” “intend,” “may,” “optimistic,”

“plan,” “potential,” “target,” “will,” or “would” the negative of

terms like these or other comparable terminology, and other words

or terms of similar meaning. These include, among others,

statements about ONS-5010’s potential as the first FDA-approved

ophthalmic formulation of bevacizumab-vikg, expectations concerning

Outlook Therapeutics’ ability to remediate or otherwise resolve

deficiencies identified in the CRL issued by the FDA, including

with respect to an additional clinical trial and CMC issues,

expectations concerning the NORSE EIGHT trial design, the timing

for initiation and completion of NORSE EIGHT and resubmission of

the BLA for ONS-5010, the private placement, including expected

proceeds from the issuance of the shares of common stock and

exercise of the warrants, satisfaction of closing conditions,

including receipt of necessary stockholder approvals, and uses of

proceeds, the sufficiency of Outlook Therapeutics’ resources,

including funds from the financing, to fund its operations through

various milestones, expectations concerning decisions of regulatory

bodies, including the FDA and EMA, and the timing thereof, plans

for potential commercial launch of ONS-5010, expectations

concerning the relationship with Cencora and the benefits and

potential expansion thereof, and other statements that are not

historical fact. Although Outlook Therapeutics believes that it has

a reasonable basis for the forward-looking statements contained

herein, they are based on current expectations about future events

affecting Outlook Therapeutics and are subject to risks,

uncertainties and factors relating to its operations and business

environment, all of which are difficult to predict and many of

which are beyond its control. These risk factors include those

risks associated with developing pharmaceutical product candidates,

risks of conducting clinical trials and risks in obtaining

necessary regulatory approvals, the content and timing of decisions

by the FDA, as well as those risks detailed in Outlook

Therapeutics’ filings with the Securities and Exchange Commission

(the SEC), including the Annual Report on Form 10-K for the fiscal

year ended September 30, 2023, filed with the SEC on December 22,

2023, and future quarterly reports Outlook Therapeutics files with

the SEC, which include uncertainty of market conditions and future

impacts related to macroeconomic factors, including as a result of

the ongoing overseas conflict, high interest rates, inflation and

potential future bank failures on the global business environment.

These risks may cause actual results to differ materially from

those expressed or implied by forward-looking statements in this

press release. All forward-looking statements included in this

press release are expressly qualified in their entirety by the

foregoing cautionary statements. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof. Outlook Therapeutics does not undertake

any obligation to update, amend or clarify these forward-looking

statements whether as a result of new information, future events or

otherwise, except as may be required under applicable securities

law.

Investor

Inquiries: Jenene

ThomasChief Executive OfficerJTC Team, LLCT:

833.475.8247 OTLK@jtcir.com

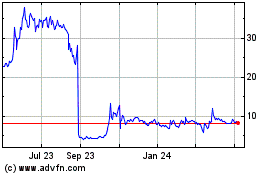

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Oct 2024 to Nov 2024

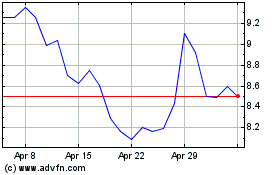

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Nov 2023 to Nov 2024