false

0001754226

0001754226

2024-06-20

2024-06-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13

OR 15(D) OF

THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): June 20, 2024

Orange

County Bancorp, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-40711 |

26-1135778 |

| (State

or Other Jurisdiction) |

(Commission

File No.) |

(I.R.S.

Employer |

| of

Incorporation) |

|

Identification

No.) |

| 212

Dolson Avenue, Middletown,

New York |

10940 |

| (Address

of Principal Executive Offices) |

(Zip

Code) |

Registrant's

telephone number, including area code: (845)

341-5000

Not Applicable

(Former name or

former address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.50 |

|

OBT |

|

The

Nasdaq Stock Market, LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 | Regulation FD Disclosure |

On June 20, 2024, Orange County Bancorp, Inc.

(the “Company”), parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, made available

and distributed to analysts and prospective investors a slide presentation. The slide presentation will be reviewed with certain analysts

and certain institutional investors at the Stephens Inc. Summer Bank Bash on June 20, 2024. The presentation materials include information

regarding the Company’s operating and growth strategies and financial performance. The slide presentation is furnished in this Current

Report on Form 8-K, pursuant to this Item 7.01, as Exhibit 99.1, and is incorporated herein by reference.

This Current Report and the information included below and furnished as exhibits hereto shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated

by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such a filing. The furnishing of the information in this Current Report is not intended to, and does not, constitute a determination

or admission by the Company that the information in this report is material or complete, or that investors should consider this information

before making an investment decision with respect to any security of the Company or any of its affiliates.

| Item 9.01 | Financial Statements and Exhibits |

| |

(a) |

Financial statements of businesses acquired. None. |

| |

|

|

| |

(b) |

Pro forma financial information. None. |

| |

|

|

| |

(c) |

Shell company transactions: None. |

| |

|

|

| |

(d) |

Exhibits. |

| |

|

99.1 |

Presentation Materials of Orange County Bancorp, Inc. |

| |

|

104 |

Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| | ORANGE COUNTY BANCORP, INC. |

| | |

| DATE: June 20, 2024 | By: |

/s/ Michael Lesler |

| | |

Michael Lesler |

| | |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

INVESTOR Presentation June 2024

Safe Harbor Statement and Disclaimer . Forward - Looking Statements This presentation contains, and future oral and written statements by us and our management may contain, forward - looking stateme nts within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward - looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of our beliefs concerning future events, business plans, objectives, expected operati ng results, and the assumptions upon which those statements are based. Forward - looking statements include without limitation, any statement that may predict, forecast, indicate or imply fu ture results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expe ct, ” “aim,” “intend,” “plan,” or words or phases of similar meaning. We caution that the forward - looking statements are based largely on our expectations and are subject to a number of kno wn and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond our control. Such forward - looking statements are based o n various assumptions (some of which may be beyond our control) and are subject to risks and uncertainties, which change overtime, and other factors which could cause ac tua l results to differ materially from those currently anticipated. New risks and uncertainties may emerge from time to time, and it is not possible for us to predict their occurre nce or how they will affect us. If one or more of the factors affecting our forward - looking information and statements proves incorrect, then our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward - looking information and statements contained in this presentation. Therefore, we caution you not to place un due reliance on our forward - looking information and statements. We disclaim any duty to revise or update the forward - looking statements, whether written or oral, to reflect actual results or changes in the factors affecting the forward - looking statements, except as specifically required bylaw. Industry Information This presentation includes statistical and other industry and market data that we obtained from government reports and other thi rd - party sources. Our internal data, estimates, and forecasts are based on information obtained from government reports, trade and business organizations and other contacts in t he markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and thir d p arty research, surveys, and studies) is accurate and reliable, we have not independently verified such information. In addition, estimates, forecasts and assumptions are necessarily subjec t t o a high degree of uncertainty and risk due to a variety of factors. Finally, forward - looking information obtained from these sources is subject to the same qualifications and the addit ional uncertainties regarding the other forward - looking statements in this presentation. 2

Franchise Overview 3 1) There are 3 branches located in Middletown. Background ▪ Successfully completed IPO and NASDAQ listing in August 2021 ▪ Bank was established in 1892 and has operated successfully for 132 years ▪ Headquartered in Middletown, NY ▪ Premier business bank in the Hudson Valley region, operating in diverse and stable markets ▪ Highly attractive core deposit franchise ▪ Full service commercial bank with focus on small to medium sized businesses ▪ Diverse, high - margin private banking and trust/wealth management service offerings Strong Banking Institution with Established Presence in Stable Markets Geographic Presence $2.5B TOTAL ASSETS $1.7B TOTAL NET LOANS $2.1B TOTAL DEPOSITS $1.7B AUM Company Background Q1 2024 Snapshot - + + + + + + + - 2015: Opened White Plains branch (Westchester) 2016: Opened Mamaroneck & Hawthorne branches (Westchester) 2017: Opened New City branch (Rockland) 2017: Opened Mount Vernon branch (Westchester) 2017: Closure of Vails Gate branch (Orange) 2018: Sale of Fishkill branch (Dutchess) 2018: Opened Cortlandt Manor branch (Westchester) 2019: Opened LPO in Bronx, NY market 2021: Opened Bronx branch and Nanuet branch (Rockland) 2024: Opened Yonkers branch (Westchester) 2024: Identified a second Bronx branch location Branches & LPOs (16) (1) Market Footprint Expansion of Franchise Footprint HVIA + +

Structure & Scope Balanced, Client - Driven Business Model 4 Business Banking Private Banking Orange Wealth Management • 16 branches; new Bronx branch will be 17 • Focus on small to medium size businesses in the communities served • Seasoned lenders with significant regional and industry expertise • Comprehensive product offering • Full treasury management suite Key Metrics $1.7 billion net loans $2.1 billion deposits • Launched in mid 2017 • Division of Orange Bank & Trust • Client - driven service linking our four primary product areas 1) Cash Management / Treasury 2) Loans (Commercial and/or Residential) 3) Trust, Estate and Custody Services 4) Investment Advisory Services (through HVIA) Approximately 680 Clients • Subsidiary of Orange County Bancorp, Inc. • Acquired in late 2012 from Sterling Bancorp • SEC registered Investment Advisor $1.7 billion AUM • Founding division of the Bank • Traditional trust & administration services to local clients • Niche focus on Special Needs Trust and Guardianship services Note: Key financial metrics are as of March 31, 2024 (unaudited). Client - Driven Service Unifies Three Unique Product Areas

9HFWD ,QF 5KLQHEHFN %DQFRUS 0+& )LUVW )HGHUDO 6DYLQJV )LUVW *UHHQZLFK )LQDQFLDO 7%% ,QYHVWPHQWV :RUNHUV 8QLWHG :DOONLOO 9DOOH 3RQFH )LQDQFLDO *URXS 7UXVW&R %DQN &RUS &RQQHFW2QH 7RPSNLQV )LQDQFLDO 5LGJHZRRG :DOGHQ 1RUWKHDVW &RPPXQLW 2UDQJH &RXQW %DQFRUS Franchise Scarcity Value in Highly Attractive Markets 5 Attractive Demographics in a Large, Growing Addressable Market Median Household Income** ($000s) * Lower Hudson Valley comprised of Orange, Westchester, and Rockland counties; community banks defined as banks with les s t han $10 billion in total assets. ** Represents the weighted average household income by deposits to all company markets. Note: Deposit data as of June 30, 2023; Demographic data from Claritas is based primarily on most recently available census data. Source: S&P Capital IQ Pro, FDIC, Claritas . 2UDQJH 1< :HVWFKHVWHU 1< 5RFNODQG 1< 6WDWH RI 1< 8 6 2YHUDOO OBT Growth Markets Orange County Westchester & Rockland Counties Bronx County • Attractive and stable market • 60 miles from New York City • 132 - year - operating history in the region • Strong foundation for growth and low - cost deposit funding • Continued remote workplace migration • Primary OBT growth markets • Large, economically diverse and affluent markets • Unbalanced Market: large regional/national banks, few small community banks • Reputation as leading local bank for small business • Significant long - term growth opportunity relative to current market share • Densely populated area with approximately 1.5 million residents • Diversified economy typical of urban population centers • Persistent need for housing in the region generates growth through demand for construction lending and refinancing activity Community Bank Deposit Market Share in the Lower Hudson Valley* Deposits ($M) Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 $2,142

Business Strategy 6 Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. Leverage Relationships to Drive Organic Growth Derive Loan Growth Through Relationship - Based Model Continue to Grow Core Deposit Franchise Continue to Build Fee - Based Business Strategic Expansion / Opportunistic M&A • The Bank’s historical success has been closely tied to that of its clients and the communities it serves • Seek trusted advisor role with clients as they build their businesses with the Bank’s resources and support • Majority of loan growth comes from existing clients and referrals • Direct access to senior management offers customers quicker response time on loan applications and other transactions • Differentiated level of service provides a pricing advantage, often resulting in higher loan rates • Core deposits (which includes all deposits except certificates of deposit) comprise 88.7% of total funding, attributed to the bank’s long - standing relationships with clients • Cash management has helped the Bank expand depth and efficiency of deposit product offerings • By continuing to broaden its suite of business services, deposits and loans grew 6.1% and 4.2% respectively year over year as of Q1 2024 • Strategic Expansion: Ongoing investments in Rockland, Westchester and Bronx Counties continue to be significant drivers of growth & profitability • Capitalize on Market Disruption: Consolidation from the sales/mergers of Signature Bank, The Westchester Bank, Sterling National Bank, Hudson Valley Bank, Hometown Bank, Greater Hudson Bank and PCSB Bank presents opportunities to hire seasoned bankers and capture market share • Opportunistic M&A: Could include fee - based business, whole bank or branch acquisitions that would improve market position in geographies with attractive demographics • Having recently reached $1.7 billion in combined AUM in Q1 2024, the Company’s trust and advisory services businesses provide a strong foundation of fee - based revenue • Company intends to expand HVIA’s services into Westchester and Rockland counties • Private Banking service enables approximately 680 clients to leverage the resources of the platform

)< )< )< 4 )< )< )< 4 )< )< )< 4 Consistent History of Growth 7 Note: Financial data as of March 31, 2024 is unaudited. Source: Company filings. Current Success is Attributed to Disciplined Organic Growth Gross Loans ($M) Total Assets ($M) Consolidated Equity Ex. AOCI ($M) Total Deposits ($M) Impact of AOCI Losses $238 $229 $206 $186 2021 FY 2022 FY 2023 FY Q1 2024 $1,291 $1,569 $1,747 $1,733

)< )< )< 4 1HW ,QWHUHVW ,QFRPH 1RQLQWHUHVW ,QFRPH )< )< )< 4 ò 52$$ 52$( )< )< )< 4 Strong and Consistent Historical Profitability 8 Net Interest Margin (%) Net Income ($M) Pre - Provision Revenue ($M) ROAA and ROAE (%) Success Maintaining Strong Profitabilit y Metrics $72 .6 $9 0.1 $ 101.7 $25.3 1) Local peers include NASDAQ, NYSE and NYSEAM traded U.S. banks and thrifts in the NYC MSA with total assets under $50 billion as of Q1 2024, excluding merger targets and mutuals; excludes PFS due to recently closed merger with LBAI; peer data sourced from S&P Capital IQ Pro. 2) Reflects annualized metric. Note: Financial data as of March 31, 2024 is unaudited. Source: Company filings. )< )< )< 4 ò 2%7 /RFDO 3HHUV ñ

&5( & , &5( &RQVWUXFWLRQ 5HVLGHQWLDO 5( +RPH (TXLW &RQVXPHU Loan Composition 9 1) CRE and C&D loans as a % of Total Risk - Based Capital; Bank level Call Report data. Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. Total Loans: $1.7 Billion Commercial - Focused Portfolio with Conservative Concentrations ▪ Advantageous, relationship - based lending model through existing clients and referrals ▪ Syndicated loans represent less than 2.5% of total loans ▪ Majority of lending occurs within market; ~88.3% of loans are in market as of March 31, 2024 ▪ $301.4 million (17.4% of loans) are repricing or maturing within one year or less ▪ $1.3 billion (72.5% of loans) are repricing or maturing within five years Geographic Composition of RE Secured Loans Loan Portfolio Commentary 5.89% Yield on Loans 405% CRE Concentration¹ (% of Risked - Based Capital) 39% C&D Concentration¹ (% of Risked - Based Capital) :HVWFKHVWHU 2UDQJH %URQ[ 2WKHU 1< &RXQWLHV &7 2WKHU 1HZ -HUVH 5RFNODQG 0DQKDWWDQ

5HWDLO 2IILFH &RPPHUFLDO 2WKHU ,QGXVWULDO 0XOWLIDPLO 0L[HG 8VH &RPPHUFLDO 0L[HG 8VH +RVSLWDOLW 0XOWLIDPLO LQF &R2S %XLOGLQJ :DUHKRXVH $VVLVWHG /LYLQJ /DQG +HDOWK &DUH 0HG 5HVWDXUDQW 2WKHU Overview of Commercial Real Estate Portfolio (Excluding Multifamily and Construction) 10 Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. CRE Portfolio Geographic Composition ($M) CRE Portfolio by Property Type :HVWFKHVWHU 2UDQJH %URQ[ 5RFNODQG 0DQKDWWDQ 2WKHU 1< &RXQWLHV 1HZ -HUVH 2WKHU 6WDWHV Total CRE: $991 Million Total CRE: $991 Million Limited exposure to core NYC metro area with only 3% of the CRE portfolio in Manhattan Well diversified CRE portfolio across property types Non - owner - occupied represents ~ 46% of the portfolio

Overview of Multifamily Portfolio 11 Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. Multifamily Portfolio Detail Multifamily Portfolio Geographic Composition Weighted Average LTV 57.1% Average Loan Size $2.18 Million Portfolio Characteristic % of Total Multifamily Portfolio % of Portfolio Rent Stabilized 23.7% % of Portfolio Rent Controlled 3.1% % Maturing in 2024 0.6% % Maturing in 2025 6.6% % Maturing in 2026 7.5% % Maturing in 2027 or later 85.4% %URQ[ :HVWFKHVWHU 2UDQJH 0DQKDWWDQ 5RFNODQG 2WKHU 6WDWHV 2WKHU 1< &RXQWLHV 1HZ -HUVH Total Multi: $272 Million

CRE Office Portfolio Overview 12 Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. Office Portfolio Overview Office Portfolio Geographic Composition PSC Update Portfolio Characteristic % of Total Office Portfolio % of Portfolio in Bronx and Queens 3.6% % of Portfolio in Manhattan None % Maturing in 2024 2.9% % Maturing in 2025 7.4% % Maturing in 2026 9.5% % Maturing in 2027 or later 80.3% 2UDQJH 0LGGOHVH[ %HUJHQ :HVWFKHVWHU 5RFNODQG 1DVVDX 2WKHU 1< &RXQWLHV 2WKHU 6WDWHV 2WKHU 1- &RXQWLHV Total Office: $161 Million Weighted Average LTV 56.3% Average Loan Size $1.66 Million

Credit Quality 13 1) Local peers include NASDAQ, NYSE and NYSEAM traded U.S. banks and thrifts in the NYC MSA with total assets under $50 billion as of Q1 2024, excluding merger targets and mutuals; excludes PFS due to recently closed merger with LBAI; peer data sourced from S&P Capital IQ Pro. Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. Asset Quality Has B een Historically Sound, Managed Well Through Cycles • Strong and proven credit culture throughout cycles • OBT recorded a $362 thousand provision for loan losses in the first quarter of 2024 and charge - offs of $97 thousand • At 1.47% of gross loans, the Company’s reserve level is above local peers¹ and well - positioned for any potential downturn in credit cycles Credit Quality Commentary 4 4 NPAs / Assets (%) Net Charge - off (NCOs) / Average Loans (%) 4 Loan Loss Reserve / Gross Loans (%) 4 2%7 /RFDO 3HHUV ñ $5.8 million Non - Performing Assets (0.24% of Total Assets) $25.5 million Loan Loss Reserve (440.86% of NPLs)

Liquidity Overview 14 Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. Strong Recent Deposit Growth and Significant Borrowing Capacity • Borrowings consist of both short - term and long - term borrowings and provide the Company with one of its sources of funding • Maintaining available borrowing capacity provides the Company with a contingent source of liquidity • Total borrowings from the Federal Home Loan Bank of New York were $38.0 million at March 31, 2024 as compared to $234.5 million at December 31, 2023 • This decrease represents a focus by management to reduce borrowings by using lower - cost deposits, which experienced growth during the first quarter • The Company has the capacity to borrow an additional $476.4 million from the Federal Home Loan Bank of New York as of March 31, 2024 • During the first quarter of 2024, the Company also utilized $50.0 million of funding through the Bank Term Funding Program from the Federal Reserve under a one - year facility expiring in March 2025 • The Company’s uninsured and uncollateralized deposits at March 31, 2024 totaled $795.3 million, or 37% of deposits

$YJ )HG )XQGV 5DWH 2%7 /RFDO 3HHUV ó 2UDQJH :HVWFKHVWHU 5RFNODQG %URQ[ Leading Core Deposit Franchise Areas of Focus Keys to Success x Dedicated deposit relationship managers x Investment into customer experience/cash management product suite x Obtain deposit relationships at loan origination Escrow x Attractable DDA capture Municipal Deposits x Comprise 15% of total deposits x Competitive products and niche focus x Focused on local opportunities and long - term relationships 15 Low Cost of Total Deposits² Stable and Low - Cost Core Funding Base 1RQ ,QWHUHVW %HDULQJ 'HPDQG ,QWHUHVW %HDULQJ 'HPDQG $FFRXQWV 0RQH 0DUNHW 6DYLQJV &HUWLILFDWHV RI 'HSRVLW Total Deposits: $2.1 Billion Composition by Geography 29.6% Noninterest - Bearing 88.7% Core Deposits¹ 134 bps Cost of Deposits 1) Core deposits defined as total deposits minus certificates of deposit. 2) Cost of total deposits calculated using total annualized deposit interest expense and average total deposits in the given period. 3) Local peers include NASDAQ, NYSE and NYSEAM traded U.S. banks and thrifts in the NYC MSA with total assets under $50 billion as of Q1 2024, excluding merger targets and mutuals; excludes PFS due to recently closed merger with LBAI; peer data sourced from S&P Capital IQ Pro. Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. Source: S&P Capital IQ Pro.

8 6 *RYHUQPHQW $JHQFLHV 0RUWJDJH EDFNHG 6HFXULWLHV &RUSRUDWH 6HFXULWLHV 0XQLFLSDO 6HFXULWLHV Conservatively Managed Securities Portfolio 16 Note: Financial data as of March 31, 2024 (unaudited) unless otherwise noted. ▪ $476.1 million in securities, primarily concentrated in mortgage - backed securities, municipal securities and agency ▪ 69% pledged as collateral to secure public deposits ▪ Historically served as use for excess liquidity – this is no longer the case ▪ 7.31 year weighted average life Securities Portfolio Commentary Securities Portfolio Composition $476.1 Million Total Portfolio Fair Value of Investment Securities ▪ Recent decline in fair value was primarily attributable to changes in interest rates, and not credit quality ▪ No intent to sell securities before their anticipated recovery Available for Sale Securities Amortized Cost Estimated Fair Value Ptx. Unrealized Gain / (Loss) U.S. Government Agencies $95,665 $85,191 $(10,474) Mortgage - backed Securities 330,841 279,201 (51,640) Corporate Securities 23,524 19,175 (4,349) Municipal Securities 103,697 92,510 (11,187) Total $553,727 $476,077 $(77,650) 100% Securities Classified as Available for Sale

Ability to Take Advantage of M&A Driven Market Disintermediation Successful and Ongoing Expansion of Market Footprint Highly Attractive Market Geography and Scarcity Value of Franchise Stable, Low - Cost Deposit Base: 47% Transaction Accounts, 134 bps Total Cost 1 Demonstrated Loan Growth Driven by Relationship - Based Model Complementary Offerings in Private Banking and Trust & Wealth Businesses Consistent and Very Strong Financial Metrics Strong and Experienced Management Team Company Highlights 17 1) For the quarter ended March 31, 2024 (unaudited).

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

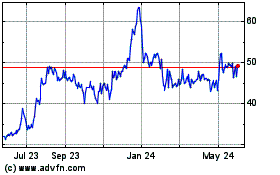

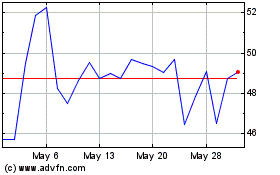

Orange County Bancorp (NASDAQ:OBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Orange County Bancorp (NASDAQ:OBT)

Historical Stock Chart

From Nov 2023 to Nov 2024