OptimumBank Holdings, Inc. (NASDAQ: OPHC) (“OptimumBank” or the

“Company”) today reported strong financial performance for the

second quarter of 2024. For the three months ended June 30, 2024,

the Company achieved net income of $3.5 million, or $.36 per basic

share and $0.34 per diluted share, compared to net income of $1.3

million, or $0.18 per basic and diluted share, for the same period

in 2023. This reflects significant growth in both earnings and

profitability year-over-year.

Key Financial Highlights:

Comparison of the Three-Month Periods

Ended June 30, 2024, and 2023:

- Net interest

income for the second quarter of 2024 reached $8.7

million, a remarkable increase of 56% from $5.6 million in the

second quarter of 2023, driven by a 54% rise in average

interest-earning assets.

- Net interest

margin improved to 3.79%, up from 3.73% in the same

quarter last year, illustrating enhanced yield on assets despite

rising deposit costs.

- Noninterest income

surged to $1.2 million for the second quarter of 2024, up 56% from

$772,000 for the second quarter of 2023. This growth was primarily

attributed to increased service charges and a notable rise in other

noninterest income.

- Noninterest

expenses increased by 30% to $5 million for the first

quarter of 2024, driven by employee compensation and benefits, data

processing, and other operating costs.

Asset and Deposit Growth:

- Gross loans

expanded to $761.1 million as of June 30, 2024, an 12% increase

from December 31, 2023, reflecting robust business growth. The

allowance for credit losses increased to $8.2 million or 1.08% of

loans outstanding at June 30, 2024, compared to $7.7 million or

1.13% of loans outstanding at December 31, 2023.

- Total deposits

grew by 19% to $762.6 million. This increase was driven by a

combination of higher noninterest-bearing demand deposits and an

increase in time deposits.

Capital Position:

- Tier 1 capital to

total assets ratio was 9.68% as of June 30, 2024, compared to

10.00% at the end of 2023, reflecting a solid capital base

supporting continued growth.

Chairman of the Board

Commentary

Moishe Gubin, Chairman of OptimumBank Holdings,

Inc., stated, “Our strong financial performance in the second

quarter of 2024 underscores the noteworthy progress we have made.

Achieving net income of $3.5 million, or $.34 per diluted share, is

a testament to our strategic focus and operational excellence. Our

net interest income surged by 56% year-over-year, driven by an

increase in average interest-earning assets. This growth reflects

our strategic lending activity and careful management of interest

rates and asset yields.”

“Despite the rising deposit costs, our net

interest margin improved to 3.79%, up from 3.73% in the same period

last year, illustrating our ability to enhance yield on assets.

Noninterest income also saw a significant increase of 56% from the

previous second quarter of 2023, bolstered by higher service

charges and other noninterest income. These gains highlight our

diversified revenue streams and strong operational

performance.”

“We have made appropriate strides in expanding

our loan portfolio, which grew by 11.9% to $761.1 million as of

June 30, 2024. Our deposit growth of 19.2% to $762.6 million,

particularly the notable 90.1% rise in time deposits, underscores

our solid market position and trust among our customers.”

“Our capital position remains strong, with a

Tier 1 capital to total assets ratio of 9.68%, providing a solid

foundation for continued growth. As we move forward, we are

confident in our ability to sustain this momentum and deliver

long-term value to our shareholders. Our strategic initiatives,

coupled with the ongoing support from stakeholders position us well

for future success. Our ATM offering (“at-the market offering”)

will become effective in the next couple of weeks through our

designated agent and will allow the Company to continuously sell

shares in the open market to fund our growth.”

Chairman Gubin’s comments align with the

company’s reported financial performance and strategic

achievements, emphasizing growth, operational efficiency, and a

strong market position.

Net Interest Income and Net Interest

Margin

Comparison of the Three-Month Periods

Ended June 30, 2024, and 2023

| (Dollars in

thousands) |

June 30, 2024 |

June 30, 2023 |

% Change |

| Average interestEarning

assets |

$ |

923,822 |

|

$ |

599,550 |

|

54.1 |

% |

| Net interest income |

$ |

8,742 |

|

$ |

5,592 |

|

56.3 |

% |

| Net interest margin |

|

3.79 |

% |

|

3.73 |

% |

6 bps |

Net interest income for the second quarter of

2024 was $8.7 million, a 56.3% increase from $5.6 million in the

second quarter of 2023. This growth was primarily driven by a rise

in average interest-earning assets, which increased by 54.1% from

the previous year, contributing to higher net interest income. The

increase in net interest income was more than sufficient to offset

the impact of higher interest-bearing deposit costs.

Compared to the first quarter of 2024, net

interest income was 12.8% higher, reflecting changes in asset

yields and deposit costs. The net interest margin for the second

quarter of 2024 was 3.79%, up from 3.73% in the second quarter of

2023. This improvement was due to the growth in average

interest-earning assets and more favorable yields, despite the

rising costs of interest-bearing deposits.

Noninterest Income

Three Months and Six Months Ended June

30 2024, and 2023

|

(Dollars in thousands) |

Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

Six Months Ended June 30, 2024 |

Six Months Ended June 30, 2023 |

| Service charges and fees |

$ |

864 |

$ |

759 |

$ |

1,832 |

$ |

1,478 |

| Other |

$ |

337 |

$ |

13 |

$ |

608 |

$ |

23 |

|

Total noninterest income |

$ |

1,201 |

$ |

772 |

$ |

2,440 |

$ |

1,501 |

Noninterest income for the second quarter of

2024 was $1.2 million, a 55.6% increase from $772,000 in the first

quarter of 2024. The increase was primarily driven by higher

service charges and fees, which rose to $864,000 from $759,000 in

the previous quarter. Additionally, there was a significant

increase in other noninterest income, which rose to $337,000 from

$13,000 in the first quarter of 2024 from the sale of the

guaranteed portion of U.S. Small Business Administration (“SBA”)

SBA 7A loans.

Noninterest Expense

Three Months and Six Months Ended June

30 2024, and 2023

|

(Dollars in thousands) |

Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

Six Months Ended June 30, 2024 |

Six Months Ended June 30, 2023 |

| Salaries and employee

benefits |

$ |

3,031 |

$ |

2,041 |

$ |

5,879 |

$ |

4,007 |

| Professional fees |

$ |

238 |

$ |

171 |

$ |

433 |

$ |

368 |

| Occupancy and equipment |

$ |

202 |

$ |

188 |

$ |

408 |

$ |

377 |

| Data processing |

$ |

575 |

$ |

385 |

$ |

1,129 |

$ |

751 |

| Regulatory assessment |

$ |

231 |

$ |

224 |

$ |

352 |

$ |

433 |

| Litigation Settlement |

|

— |

$ |

375 |

|

— |

$ |

375 |

|

Other |

$ |

807 |

$ |

518 |

$ |

1,591 |

$ |

1,013 |

|

Total noninterest expenses |

$ |

5,084 |

$ |

3,902 |

$ |

9,792 |

$ |

7,324 |

Noninterest expense for the second quarter of

2024 was $5.1 million, an increase of 30.1% from $3.9 million in

the first quarter of 2024. This change was mainly driven by an

increase in employee compensation and benefits, data processing

costs, and professional fees. There was no litigation settlement

expense during 2024.

Compared to the second quarter of 2023,

noninterest expenses increased by 30% to $5.1 million from $3.9

million. This rise was mainly due to higher data processing costs

and an increase in other operating expenses, including a

significant rise in salaries and employee benefits.

Deposits

Deposits Summary

Condensed Consolidated Balance

Sheets

|

(Dollars in thousands) |

June 30, 2024 |

December 31, 2023 |

% Change June 30, 2024, vs. December 31, 2023 |

|

Total Deposits |

$ |

762,646 |

$ |

639,581 |

19.2 |

% |

| Noninterest-bearing demand

deposits |

$ |

230,947 |

$ |

194,892 |

18.5 |

% |

| Savings, NOW, and money-market

deposits |

$ |

300,378 |

$ |

322,932 |

-7.0 |

% |

| Time

deposits |

$ |

231,321 |

$ |

121,757 |

90.1 |

% |

Six Months Ended June 30 2024, and

2023

| (Dollars in

thousands) |

|

2024 |

|

2023 |

% Change |

| Net Increase in

Deposits |

$ |

123,065 |

$ |

43,732 |

181.2 |

% |

Interest Rates on Deposits

|

(Dollars in thousands) |

Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

| Interest-bearing

Deposits: |

|

|

| Savings, NOW, and money-market

deposits averages |

$ |

325,734 |

$ |

129,890 |

| Interest Expense on Savings,

NOW, and money-market deposits |

$ |

2,550 |

$ |

395 |

| Time Deposits averages |

$ |

258,325 |

$ |

229,376 |

|

Interest Expense on Time Deposits |

$ |

3,369 |

$ |

2,161 |

|

Total Interest-bearing Deposits averages |

$ |

634,535 |

$ |

369,596 |

|

Total Interest Expense on Deposits |

$ |

5,919 |

$ |

2,556 |

Deposit Composition

| (Percentage of Total

Deposits) |

June 30,

2024 |

December 31,

2023 |

| Uninsured Deposits to

Total Deposits |

27.4 |

% |

44.1 |

% |

| Noninterest Deposits to

Total Deposits |

30.3 |

% |

30.5 |

% |

Total deposits were $762.6 million on June 30,

2024, up from $639.6 million on December 31, 2023, representing a

19.2% increase. This growth was driven by an 18.5% increase in

noninterest-bearing demand deposits, which rose to $230.9 million

from $194.9 million. Savings, NOW, and money-market deposits

decreased by 7.0% to $300.4 million from $322.9 million. Time

deposits saw a significant rise of 90.1%, reaching $231.3 million

from $121.8 million. The net increase in deposits for the first

half of 2024 was $123.1 million, up 181.2% compared to the $43.7

million increase in the same period in 2023. Interest-bearing

deposits, comprising savings, NOW, money-market deposits, and time

deposits, totaled $639.5 million, with an interest expense of $5.9

million for the three months ended June 30, 2024. Uninsured

deposits made up 27.4% of total deposits on June 30, 2024, compared

to 44.1% on December 31, 2023. Noninterest deposits accounted for

30.3% of total deposits, down from 30.5% at the end of 2023.

Capital

Capital Requirements to be Well Capitalized

| Date |

Tier 1 Capital to Total Assets |

% |

| June 30,

2024 |

$ |

92,135 |

9.68 |

% |

| December 31,

2023 |

$ |

74,999 |

10.00 |

% |

As of June 30, 2024, the Tier 1 capital to total

assets ratio was 9.68%, representing a Tier 1 capital amount of

$92,135. This is a slight decrease from December 31, 2023, when the

ratio was 10.00% with Tier 1 capital of $74,999.

About OptimumBank Holdings,

Inc.

OptimumBank Holdings, Inc. operates as the bank

holding company for OptimumBank that provides a range of consumer

and commercial banking services to individuals and businesses.

The company accepts demand interest-bearing and

noninterest-bearing savings, money market, NOW and time deposit

accounts, as well as certificates of deposit; and offers

residential and commercial real estate, commercial, and consumer

loans, as well as lending lines for working capital needs. It also

provides debit and ATM cards; investment, cash management, and

notary and night depository services; and direct deposits, money

orders, cashier’s checks, domestic collections, drive-in tellers,

and banking by mail, as well as Internet banking services. In

addition, the company engages in holding, managing, and disposal of

foreclosed real estate. It operates through banking offices located

in Broward County, Florida. OptimumBank Holdings, Inc. was founded

in 2000 and is based in Fort Lauderdale, Florida.

Safe Harbor Statement:

This press release contains forward-looking

statements that can be identified by terminology such as

“believes,” “expects,” “potential,” “plans,” “suggests,” “may,”

“should,” “could,” “intends,” or similar expressions. Many

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results or implied by such

statements. These factors include, but are not limited to, our

limited operating history, managing our expected growth, risks

associated with integration of acquired websites, possible

inadvertent infringement of third-party intellectual property

rights, our ability to effectively compete, our acquisition

strategy, and a limited public market for our common stock, among

other risks. OptimumBank Holdings, Inc.’s future results may also

be impacted by other risk factors listed from time-to-time in its

SEC filings. Many factors are difficult to predict accurately and

are generally beyond the company’s control. Forward looking

statements speak only as to the date they are made and OptimumBank

Holdings, Inc. does not undertake to update forward-looking

statements to reflect circumstances or events that occur after the

date the forward-looking statements are made.

Investor Relations & Corporate

RelationsContact: Seth DenisonTelephone: (305) 401-4140 /

SDenison@OptimumBank.com

Select Financial Data

Condensed Consolidated Balance

Sheets

(Dollars in thousands, except share

amounts)

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

(Unaudited) |

|

|

|

(audited) |

|

| Assets: |

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

11,923 |

|

|

$ |

14,009 |

|

| Interest-bearing deposits with

banks |

|

|

92,133 |

|

|

|

62,654 |

|

| Total cash and cash

equivalents |

|

|

104,056 |

|

|

|

76,663 |

|

| Debt securities available for

sale |

|

|

23,540 |

|

|

|

24,355 |

|

| Debt securities

held-to-maturity (fair value of $280 and $326) |

|

|

315 |

|

|

|

360 |

|

| Loans, net of allowance for

credit losses of $8,208 and $7,683 |

|

|

751,903 |

|

|

|

671,094 |

|

| Federal Home Loan Bank

stock |

|

|

2,691 |

|

|

|

3,354 |

|

| Premises and equipment,

net |

|

|

1,877 |

|

|

|

1,375 |

|

| Right-of-use lease assets |

|

|

2,021 |

|

|

|

2,161 |

|

| Accrued interest

receivable |

|

|

2,994 |

|

|

|

2,474 |

|

| Deferred tax asset |

|

|

3,024 |

|

|

|

2,903 |

|

| Other assets |

|

|

7,357 |

|

|

|

6,515 |

|

| |

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

899,778 |

|

|

$ |

791,254 |

|

| Liabilities and Stockholders’

Equity: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

| Noninterest-bearing demand

deposits |

|

$ |

230,947 |

|

|

$ |

194,892 |

|

| Savings, NOW and money-market

deposits |

|

|

300,378 |

|

|

|

322,932 |

|

| Time deposits |

|

|

231,321 |

|

|

|

121,757 |

|

| |

|

|

|

|

|

|

|

|

| Total deposits |

|

|

762,646 |

|

|

|

639,581 |

|

| |

|

|

|

|

|

|

|

|

| Federal Home Loan Bank

advances |

|

|

45,000 |

|

|

|

62,000 |

|

| Federal Reserve Bank

advances |

|

|

— |

|

|

|

13,600 |

|

| Operating lease

liabilities |

|

|

2,122 |

|

|

|

2,248 |

|

| Other liabilities |

|

|

3,039 |

|

|

|

3,818 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

812,807 |

|

|

|

721,247 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and contingencies

(Notes 8 and 11) |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock, no par value

6,000,000 shares authorized: |

|

|

— |

|

|

|

— |

|

| Series A Preferred, no par

value, no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

| Series B Convertible

Preferred, no par value, 1,520 shares authorized, 1,360 shares

issued and outstanding |

|

|

— |

|

|

|

— |

|

| Series C Convertible

Preferred, no par value, 4,000,000 and 0 shares authorized, 525,641

and 0 shares issued and outstanding |

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Common stock, $.01 par value;

30,000,000 shares authorized, 9,677,431 and 7,250,218 shares issued

and outstanding |

|

|

96 |

|

|

|

72 |

|

| Additional paid-in

capital |

|

|

102,424 |

|

|

|

91,221 |

|

| Accumulated deficit |

|

|

(10,098 |

) |

|

|

(15,971 |

) |

| Accumulated other

comprehensive loss |

|

|

(5,451 |

) |

|

|

(5,315 |

) |

| |

|

|

|

|

|

|

|

|

| Total stockholders’

equity |

|

|

86,971 |

|

|

|

70,007 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

899,778 |

|

|

$ |

791,254 |

|

Condensed Consolidated Statements of Earnings

(Unaudited)(in thousands, except per share

amounts)

| |

|

Three Months Ended |

| |

|

June 30, |

| |

|

2024 |

|

|

2023 |

| Interest income: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Loans |

|

$ |

12,948 |

|

|

$ |

7,252 |

| Debt securities |

|

|

165 |

|

|

|

172 |

| Other |

|

|

2,075 |

|

|

|

755 |

| |

|

|

|

|

|

|

|

| Total interest income |

|

|

15,188 |

|

|

|

8,179 |

| |

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

| Deposits |

|

|

5,919 |

|

|

|

2,556 |

| Borrowings |

|

|

527 |

|

|

|

31 |

| |

|

|

|

|

|

|

|

| Total interest expense |

|

|

6,446 |

|

|

|

2,587 |

| |

|

|

|

|

|

|

|

| Net interest income |

|

|

8,742 |

|

|

|

5,592 |

| |

|

|

|

|

|

|

|

| Credit loss expense |

|

|

195 |

|

|

|

704 |

| |

|

|

|

|

|

|

|

| Net interest income after

credit loss expense |

|

|

8,547 |

|

|

|

4,888 |

| |

|

|

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

|

|

| Service charges and fees |

|

|

864 |

|

|

|

759 |

| Other |

|

|

337 |

|

|

|

13 |

| |

|

|

|

|

|

|

|

| Total noninterest income |

|

|

1,201 |

|

|

|

772 |

| |

|

|

|

|

|

|

|

| Noninterest expenses: |

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

|

3,031 |

|

|

|

2,041 |

| Professional fees |

|

|

238 |

|

|

|

171 |

| Occupancy and equipment |

|

|

202 |

|

|

|

188 |

| Data processing |

|

|

575 |

|

|

|

385 |

| Regulatory assessment |

|

|

231 |

|

|

|

224 |

| Litigation Settlement |

|

|

— |

|

|

|

375 |

| Other |

|

|

807 |

|

|

|

518 |

| |

|

|

|

|

|

|

|

| Total noninterest

expenses |

|

|

5,084 |

|

|

|

3,902 |

| |

|

|

|

|

|

|

|

| Net earnings before income

taxes |

|

|

4,664 |

|

|

|

1,758 |

| |

|

|

|

|

|

|

|

| Income taxes |

|

|

1,168 |

|

|

|

446 |

| |

|

|

|

|

|

|

|

| Net earnings |

|

$ |

3,496 |

|

|

$ |

1,312 |

| |

|

|

|

|

|

|

|

| Net earnings per share -

Basic |

|

$ |

0.36 |

|

|

$ |

0.18 |

| Net earnings per share -

Diluted |

|

|

0.34 |

|

|

$ |

0.18 |

Condensed Consolidated Statements of Comprehensive

Income (Unaudited)(In thousands)

| |

|

Three Months Ended |

| |

|

June 30, |

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

| Net earnings |

|

$ |

3,496 |

|

|

$ |

1,312 |

|

| |

|

|

|

|

|

|

|

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

| Change in unrealized loss on

debt securities: |

|

|

|

|

|

|

|

| Unrealized gain (loss) arising

during the period |

|

|

312 |

|

|

|

(380 |

) |

| |

|

|

|

|

|

|

|

| Amortization of unrealized

loss on debt securities transferred to held-to-maturity |

|

|

1 |

|

|

|

1 |

|

| |

|

|

|

|

|

|

|

| Other comprehensive income

(loss) before income taxes |

|

|

313 |

|

|

|

(379 |

) |

| |

|

|

|

|

|

|

|

| Deferred income tax

(provision) benefit |

|

|

(67 |

) |

|

|

91 |

|

| |

|

|

|

|

|

|

|

| Total other comprehensive

income (loss) |

|

|

246 |

|

|

|

(288 |

) |

| |

|

|

|

|

|

|

|

| Comprehensive income |

|

$ |

3,742 |

|

|

$ |

1,024 |

|

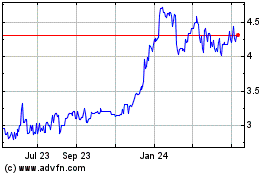

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Feb 2025 to Mar 2025

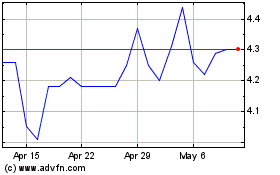

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Mar 2024 to Mar 2025