false

0001642380

0001642380

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): November 12, 2024

Oncocyte

Corporation

(Exact

name of registrant as specified in its charter)

| California |

|

1-37648 |

|

27-1041563 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

15

Cushing

Irvine,

California 92618

(Address

of principal executive offices) (Zip code)

(949)

409-7600

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, no par value |

|

OCX |

|

The

Nasdaq Stock Market LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

November 12, 2024, Oncocyte Corporation (“we,” “us,” “our,” the “Company” or “Oncocyte”)

issued a press release announcing our financial results for the three and nine months ended September 30, 2024. A copy of the press release

is furnished as Exhibit 99.1, which, in its entirety, is incorporated herein by reference.

The

information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished and shall not be

deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section. Such information shall not be deemed incorporated by reference into any filing

of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless

of any general incorporation language in such filing, except as otherwise expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ONCOCYTE

CORPORATION |

| |

|

|

| Date:

November 12, 2024 |

By: |

/s/

Joshua Riggs |

| |

|

Joshua

Riggs |

| |

|

President

and Chief Executive Officer |

Exhibit

99.1

Oncocyte

Reports Commercial Launch Progress; On Track to Sign 20 Transplant Centers by End of 2025

| ● | Transplant

centers representing about 9% of German transplant volumes and about 2% of U.S. transplant

volumes have signed on to use GraftAssure kitted research test in early launch phase |

| ● | FDA

pre-submission process for approval of kitted clinical test is underway |

IRVINE,

Calif., Nov. 12, 2024 (GLOBE NEWSWIRE) — Oncocyte Corporation (Nasdaq: OCX) (“Oncocyte” or the “Company”),

a diagnostics technology company, today published the following letter to shareholders in conjunction with its third quarter results:

Fellow

Shareholders,

We

are pleased to report that we are making considerable progress on two fronts that help de-risk our path to meaningful revenue. First,

we are continuing to sign new research customers at well-respected hospitals and universities. In addition to the two customers mentioned

in our August update, we have now signed agreements with two leading transplant university hospitals in the U.S. and Germany,

as well as major research hospitals in Switzerland, Austria, and the U.K. Given the concentrated nature of the transplant market, we

believe each new customer represents a key step toward capturing an estimated $1 billion global total addressable market for our transplant

rejection testing technology.

Second,

our clinical kitted test product development remains on track, and we have already had productive dialogue with the U.S. Food and Drug

Administration (FDA), which we describe below.

The

international response to GraftAssure™, which is our research-use-only assay that can detect early evidence of graft organ damage,

is exceeding our expectations. We attribute this success to our robust research partnerships in Europe, and to our team’s scientific

leadership in researching the dd-cfDNA biomarker1 for over a decade. Our customers in Germany now represent about 9% of the

country’s annual organ transplant volumes.2

Additionally,

we are making inroads toward capturing share in the much larger U.S. market. In August, we reported that our U.S. sales funnel represents

25% of transplant volumes. Three months later, we are pleased to report that hospitals representing about 2% of overall organ transplant

volumes3 have now signed up to use GraftAssure.

We

also received significant interest and engagement from the transplant lab community at the American Society for Histocompatibility &

Immunogenetics (ASHI) conference in Anaheim in October. This continuous positive reinforcement from the customer base gives us confidence

that we are on the right track.

1Donor-derived

cell-free DNA (dd-cfDNA). The proprietary intellectual property we acquired in 2021 was developed in Germany.

2According

to Deutsche Stiftung Organtransplantation (DSO) data, 2023 German organ transplant volumes were 3,586 and German hospitals using GraftAssure

performed 323 transplants that year, representing about 9% of 2023 German transplant volumes.

3According

to Organ Procurement and Transplantation Network data, 2023 U.S. kidney, liver, heart and lung transplant volumes were 45,562

and U.S. hospitals using GraftAssure performed about 930 transplants that year, representing about 2% of 2023 U.S. transplant volumes.

Executive

summary

Oncocyte

is at a pivotal stage in commercializing our IP in organ transplant, primarily by making a kitted test that quantifies an established

biomarker, donor-derived cell-free DNA (dd-cfDNA), and uses a digital-PCR workflow that we believe offers distinct advantages over assays

run on Next-Generation Sequencing (NGS) technology. Our scientists have played a pivotal role over the past decade in developing the

science that established dd-cfDNA as a trusted biomarker4, and we are now commercializing a product by pursuing a market disruptive

approach. We aim to deliver proven, more affordable, faster tests that can be run at local labs.

While

we don’t expect meaningful revenue in transplant rejection testing until we have reached the clinical in-vitro diagnostic (IVD5)

stage of our kitted product development, we believe that customers who are signing up for GraftAssure RUO are motivated by the eventual

opportunity to use our IVD kits to measure this biomarker in their own labs, capturing the benefit of a rapid response time and the ability

to generate revenue by running the test.

We

also can run our clinical-use assay, VitaGraft, at our clinical lab in Nashville. We received Medicare reimbursement on that test in

August 2023.

Strategic

progress

We

are on track to meet the commitment that we made to investors in August to have more than 20 transplant centers running GraftAssure tests

through the end of 2025. We estimate that each center represents a potential annual high-margin revenue stream of several hundred thousand

dollars to $2 million of clinical-use tests, depending on the size of the center.

By

staying science-driven and putting customers first, we are building solid relationships. Deploying our GraftAssure assay is a key part

of our land-and-expand strategy to drive commercial adoption of our tests.

We

are especially pleased to report on how quickly we are moving to capture market share. GraftAssure began shipping in June and in less

than five months, we are well into step two of our land-and-expand strategy. In fact, we have one customer in the U.S. and one prominent

university hospital in Europe that are progressing to stage three. A simple breakdown:

4MolDX,

a program that identifies and establishes coverage and U.S. government reimbursement for

molecular diagnostic tests, cited our publications twice when it established the LCD (Local

Coverage Determination) for Medicare and Medicaid reimbursement coverage for cell free DNA

testing. Source: https://www.cms.gov/medicare-coverage-database/view/lcd.aspx?lcdId=38671&ver=4

5The

kitted version of our assay must be cleared by regulatory bodies in the U.S., Europe and elsewhere as an in-vitro diagnostic (IVD) to

be used in clinical decision making.

Land:

Drive market penetration with GraftAssure to build customer install base

| 1. | Convert

sales funnel into signed customers: Either our sales team or Bio-Rad’s, or a combination

of both, helps introduce our assay to potential academic research customers. Then, we work

with institutions to sign agreements to run GraftAssure. |

| 2. | Empower

labs to run our assay in-house: Our team provides comprehensive training on the digital-PCR

workflow used for GraftAssure, which we believe offers distinct advantages over assays run

on Next-Generation Sequencing (NGS) technology.6 |

| 3. | Drive

routine use of GraftAssure & reorders: Customer labs begin to run GraftAssure to

perform research. Once the lab uses up the initial GraftAssure marketing samples, they place

orders for additional kits. Initially, we expect kit orders will reflect nominal (low revenue)

amounts and will increase significantly in the next phase of our strategy. |

Expand:

Democratize testing through FDA-cleared VitaGraft+ kit

| 4. | Obtain

regulatory clearance for clinical use: Oncocyte is pursuing IVD clearance from the FDA

for VitaGraft+, which is based on the same underlying IP and is similar to GraftAssure. In

Europe, we will be pursuing CE Marketing under In Vitro Diagnostic Regulation (IVD-R).7 |

| 5. | Obtain

reimbursement from Medicare and other payors: Shortly after FDA clearance, we expect

MolDx to attach a coverage decision to VitaGraft+, making it a reimbursed test. (Note that

the version of the test that we run at our Nashville lab received reimbursement in August

2023). |

| 6. | Begin

to generate meaningful revenue: Oncocyte expects to sell about $1 million per year in

VitaGraft+ kits to an average hospital lab customer, which would order the test to manage

its patients in house. Our goal is to enable labs to serve patients more quickly, and to

bill payors, thus generating revenue for the hospital and increasing the sustainability of

local care for the community. To put it simply, we expect our kits would enable the lab to

perform the test to generate revenue for the lab. |

To

recap, our strategy is to land major transplant centers and research universities with our research-use-only (RUO) product. Doing

so establishes our technology and increases its potential utility by enabling researchers to explore and expand potential applications

of dd-cfDNA.

Once

we have achieved FDA clearance for our test kits to be used to make clinical decisions – that is, approved as an IVD – we

believe that these institutions will begin using our VitaGraft+ tests to manage their patients, while continuing to use our GraftAssure

test kit to perform research. Of note, our GraftAssure research product may not be used to support clinical treatment decisions.

We

are pleased with our strategic progress and our ability to move quickly to establish a customer base to support future revenue growth.

As a reminder of our journey to date: The first prototypes of GraftAssure were completed in December 2023, and by April 2024, we welcomed

Bio-Rad Laboratories as an investor and strategic partner, supporting GraftAssure’s global launch. Under this partnership, Bio-Rad

and Oncocyte are co-marketing GraftAssure in the U.S. and Germany. Bio-Rad has exclusive distribution and commercial rights of the RUO

product outside the U.S. and Germany, with the exception of several major potential international customers where both companies have

mutually agreed to allow Oncocyte to take commercial lead.

6Our

assay runs on a digital PCR (polymerase chain reaction) instrument, which allows us to create

a simple workflow for the lab technician, delivering a result in four to eight hours, compared

with ≥30 hours in estimated time using NGS technology. Further, testing a single sample

is an affordable option, given that the batch size – in contrast to NGS – does

not alter the cost per result.

7CE

Marketing refers to Conformité Européenne (French for "European Conformity"), under the European Union’s

IVD-R.

The

transplant market is highly concentrated with fewer than 100 academic and research centers in the U.S. that account for approximately

80% of transplant volumes8. Markets outside the U.S. are similarly concentrated within high-end academic institutions. Bio-Rad’s

global infrastructure puts those centers well within reach, allowing for high-touch sales and service in those regions.

Regulatory

update

We

are pleased to report that our FDA pre-submission remains on track. Since our last quarterly update, we have cleared the first stage

gate in our clinical product development process and submitted a Q-Sub to the FDA.

Specifically,

Oncocyte has submitted its plan for an IVD version of the dd-cfDNA kitted test to the FDA, beginning the Q-submission process. We already

have begun to engage in productive dialogue with the FDA, and a meeting is scheduled for early December in connection with the submission.

The Q-sub is a formal pathway for companies to get written feedback on their development plan and is a critical step in gaining confidence

in the validation process that we expect to begin in early 2025.

As

a reminder, the IVD development process occurs in three phases, culminating in FDA submission. Since our August update, we have completed

Phase 1: Planning and Inputs. We are currently in Phase 2: Design and Outputs and will proceed with Phase 3: Verification and Validation

thereafter.

Meanwhile,

we also are thrilled to report that several hospitals have expressed interest in supporting the FDA submission process. Six hospitals

or clinics, all of which are in major cities (given the highly concentrated nature of the transplant market) have expressed interest

in participating in our clinical observational study. In addition, four institutions have expressed interest in participating in the

reproducibility study. We believe these sites represent potential future VitaGraft+ customers.

The

clinical director of one transplant center, who expressed interest in supporting our FDA submission, told us that his transplant center

would benefit from having access to a kitted product. Because Oncocyte’s kitted test is run on a digital PCR instrument9,

our FDA-cleared tests will be designed to provide actionable information when the time to treat is critical. “In a for-cause setting,

send out testing doesn’t do me any good,” the clinical director said. “I cannot wait for two days.”

8Company

estimates based on UNOS data (https://unos.org/about/national-organ-transplant-system/

9Digital

PCR provides ultrasensitive nucleic acid detection and absolute quantification.

Scientific

update

We

continue to advance the science of dd-cfDNA and demonstrate its clinical value.

On

August 11, Transplant International published a review that concluded that dd-cfDNA is a valuable, non-invasive biomarker that

enhances graft surveillance and personalized therapy for patients with antibody-mediated rejection (AMR), potentially improving outcomes

and reducing premature graft loss.

Also

in August, we announced a case series that represented the second study showing VitaGraft Kidney as a measure of response to the

benefit of therapy on AMR, which is a leading cause of allograft failure. The case series study, involving two patients, underscored

the significant potential of using repeated VitaGraft Kidney measurements to monitor the efficacy of a targeted therapy drug, in this

case, daratumumab.

The

daratumumab study represented the second publication this year that showed Oncocyte’s ability to monitor therapeutic efficacy.

In the phase 2 randomized controlled trial published in The New England Journal of Medicine in May 2024, VitaGraft Kidney

was also used to measure the response to the drug felzartamab for patients with AMR after kidney transplantation.

These

papers’ authors included Oncocyte’s Chief Science Officer, Ekke Schuetz, and Senior R&D Director, Julia Beck.

We

believe that the growing body of literature around the dd-cfDNA biomarker should support claims expansion, which we expect to translate

to an increase in our total addressable market. Within the coming years, we expect to see claims expansion regarding using dd-cfDNA to

monitor DSA+ patients, in the application of anti-CD38 drugs, as described above with daratumumab and felzartamab, and claims expansion

to monitoring for minimal residual disease (MRD) in transplant rejection. Notably, in October, felzartamab received Breakthrough Therapy

Designation (BTD) from FDA for the treatment of late AMR in kidney transplant patients.

Finally,

our engagement in oncology also continues to make progress, even with limited additional investment, as we primarily focus on commercializing

our transplant products. In October, we announced the peer-reviewed publication of positive data related to our proprietary gene

expression test, DetermaIO™.

Our

DetermaIO immuno-oncology assay predicted response to the drug atezolizumab in a phase 2 clinical trial, the results of which were published

in the peer-reviewed journal, Clinical Cancer Research10. In the study, only DetermaIO was both statistically significant

and predictive of a pathologic complete response (pCR) among the various biomarkers assessed. This study validated DetermaIO’s

utility in identifying which breast cancer patients are most likely to benefit from neoadjuvant atezolizumab therapy and furthered our

progress into the multi-billion-dollar addressable market in oncology diagnostics.

10The

NeoTRIP Phase 2 clinical trial (NCT002620280) randomized patients with triple-negative breast cancer (TNBC) to receive neoadjuvant carboplatin

and nab-paclitaxel (chemotherapies to shrink tumors), with or without the immunotherapy, atezolizumab. Oncocyte’s DetermaIO test

was among several established biomarkers and gene signatures assessed for its ability to predict which patients with early stage TNBC

are most likely to benefit from the immunotherapy. The study was performed in collaboration with the Michelangelo Foundation for

Cancer Research, a well-regarded independent scientific organization based in Milan.

With

this publication, DetermaIO continues to solidify its added value over standard-of care biomarkers and assays. The aforementioned study

has been included in our CMS submission as we continue our efforts to secure reimbursement coverage to increase access to this valuable

test.

While

we don’t expect to realize meaningful revenue related to our oncology IP within the near term, these studies support partnering

discussions with larger companies, support our CMS submission, and validate our research and development pipeline, which is designed

to drive sustained rapid growth over the next decade.

Financing

update

We

continue to prudently manage the inherent tradeoffs between investing for rapid growth and controlling expenses to limit dilutive capital

raises ahead of a material potential valuation increase.

On

October 2, we announced that we entered into a securities purchase agreement for a private placement that generated gross proceeds of

$10.2 million, before deducting banking and legal fees and other capital raising expenses. We sold 3.46 million11 shares of

our common stock in the private placement, which priced at the market at $2.948 per share.

We

were pleased to welcome support from new and existing investors, including Bio-Rad Laboratories, and to be able to finance the company’s

continued operations by selling common stock priced at the market, meaning without any discount to the closing price.

We

feel confident in our ability to continue to execute on critical milestones and access capital to fund operations and growth.

Q3

2024 Financial Overview

| ● | Relative

to our strategic objective of commercializing our transplant tests, we consider ourselves

to be “pre-revenue.” Our reported revenue of $115,000 in the third quarter was

derived from pharma services performed at our clinical laboratory in Nashville. |

| ● | A

gross profit of $50,000 reflected the relatively fixed costs of operating our Nashville laboratory.

These costs include labor as well as infrastructure expenses such as the depreciation of

laboratory equipment, allocated rent costs, leasehold improvements, and allocated information

technology costs. |

| ● | Operating

expenses of $13.6 million included $448,000 in non-cash stock-based compensation expenses,

$318,000 in non-cash depreciation and amortization expenses and a $7.1 million non-cash expense

from the change in fair value of contingent consideration. Excluding these non-cash items

in the current and prior periods, our Q3 operating expenses increased approximately 13% sequentially

and decreased 8% year over year. |

11For

accuracy, this share amount includes insider purchases of 37,037 shares at $2.97 per share, a higher amount paid than non-insiders due

to specific exchange rules regarding insider transactions.

| ○ | Research

and development expenses of $2.8 million reflected the incremental investments we are making

in our IVD product launch. Specifically, we increased investment in IVD software development

and regulatory consulting expenses in the third quarter compared with the second quarter. |

| ○ | Sales

and marketing expenses of $1.0 million reflected added costs as we commercialize our transplant

tests. Specifically, we recorded growth in commissions, lease expenses associated with the

cost of digital PCR instruments at our customer pilot sites, and incremental travel to newly

signed European customers and potential customers. |

| ○ | General

and administrative expenses of $2.6 million were roughly flat, reflecting cost discipline

as we focus on investing in research and development on IVD product development, and sales

and marketing of GraftAssure. |

| ○ | The

$7.1 million non-cash expense associated with the increase in the fair value of the contingent

consideration liability was tied primarily to a decrease in the discount rate percentage

used in valuing our transplant intellectual property, due to both macro and micro factors,

including the lowered interest rate targets from the Federal Reserve and Oncocyte’s

progress toward achieving revenue. |

| ● | Loss

from continuing operations was $13.5 million, or $0.98 share. |

| ● | Non-GAAP

loss from operations was $5.6 million and excludes certain non-cash items. Please refer to

the table below, “Reconciliation of Non-GAAP Financial Measure,” for additional

information. |

| ● | Our

Q3 2024 per share results reflect 13.7 million weighted average shares outstanding. Including

the shares issued as part of our October private placement, we currently have 16.8 million

shares outstanding. |

| ● | Oncocyte’s

cash, cash equivalents, and restricted cash balance at the end of the third quarter was approximately

$5.1 million, down $5.9 million sequentially. As mentioned, on October 2, 2024, we entered

into a securities purchase agreement for a private placement. After deducting banking and

legal fees and other transaction-related expenses, net proceeds were approximately $9.4 million

from the private placement. |

We

are pleased that our third quarter outgoing cash flow from operations (net cash used in operating activities) of $5.55 million came in

favorable to our budget of $6 million, which was partially a result of operational efficiency and partly a result of inventory manufacturing

timing.

Webcast

and Conference Call Information

Conference

Call and Webcast on Tuesday, November 12, 2024, at 2:00 p.m. PT / 5:00 p.m. ET

Interested

parties may access the live call via telephone by dialing toll free 800-715-9871 for domestic callers. Once dialed in, ask to be joined

to the Oncocyte Corporation call.

The

live webcast of the call may be accessed by visiting the “Events & Presentations” section of the Company’s website

at https://investors.oncocyte.com/. A replay of the webcast will be available on the Company’s website shortly after the

conclusion of the call.

CONFERENCE

CALL DETAILS:

Participant

Toll-Free Dial-In Number: (800) 715-9871

Participant

Toll Dial-In Number: +1 (646) 307-1963

Conference

ID: 4153469

WEBCAST

DETAILS: https://events.q4inc.com/attendee/686764682

About

Oncocyte

Oncocyte

is a diagnostics technology company. The Company’s tests are designed to help provide clarity and confidence to physicians and

their patients. VitaGraft™ is a clinical blood-based solid organ transplantation monitoring test. GraftAssure™ is a research

use only (RUO) blood-based solid organ transplantation monitoring test. DetermaIO™ is a gene expression test that assesses the

tumor microenvironment to predict response to immunotherapies. DetermaCNI™ is a blood-based monitoring tool for monitoring therapeutic

efficacy in cancer patients. For more information about Oncocyte, please visit https://oncocyte.com/. For more information about

our products, please visit the following web pages:

VitaGraft

Kidney™ - https://oncocyte.com/vitagraft-kidney/

VitaGraft

Liver™ - https://oncocyte.com/vitagraft-liver/

GraftAssure™

- https://oncocyte.com/graftassure/

DetermaIO™

- https://oncocyte.com/determa-io/

DetermaCNI™

- https://oncocyte.com/determa-cni/

VitaGraft™,

GraftAssure™, DetermaIO™, and DetermaCNI™ are trademarks of Oncocyte Corporation.

CONTACT:

Jeff

Ramson

PCG

Advisory

(646)

863-6893

jramson@pcgadvisory.com

Forward-Looking

Statements

Any

statements that are not historical fact (including, but not limited to statements that contain words such as “will,” “believes,”

“plans,” “anticipates,” “expects,” “estimates,” “may,” and similar expressions)

are forward-looking statements. These statements include those pertaining to, among other things, future expansion and growth, the Company’s

land-and-expand strategy to drive commercial adoption of its tests and capture market share, plans to have transplant centers running

GraftAssure tests through the end of 2025, projected revenue path, IVD strategy, assumptions regarding regulatory approvals and clearances,

timing and planned regulatory submissions, the ongoing global launch of GraftAssure with the support of Bio-Rad Laboratories, our ability

to continue to access capital, and other statements about the future expectations, beliefs, goals, plans, or prospects expressed by management.

Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization

of diagnostic tests or products, uncertainty in the results of clinical trials or regulatory approvals, the capacity of Oncocyte’s

third-party supplied blood sample analytic system to provide consistent and precise analytic results on a commercial scale, potential

interruptions to supply chains, the need and ability to obtain future capital, maintenance of intellectual property rights in all applicable

jurisdictions, obligations to third parties with respect to licensed or acquired technology and products, the need to obtain third party

reimbursement for patients’ use of any diagnostic tests Oncocyte or its subsidiaries commercialize in applicable jurisdictions,

and risks inherent in strategic transactions such as the potential failure to realize anticipated benefits, legal, regulatory or political

changes in the applicable jurisdictions, accounting and quality controls, potential greater than estimated allocations of resources to

develop and commercialize technologies, or potential failure to maintain any laboratory accreditation or certification. Actual results

may differ materially from the results anticipated in these forward-looking statements and accordingly such statements should be evaluated

together with the many uncertainties that affect the business of Oncocyte, particularly those mentioned in the “Risk Factors”

and other cautionary statements found in Oncocyte’s Securities and Exchange Commission (SEC) filings, which are available from

the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date

on which they were made. Oncocyte undertakes no obligation to update such statements to reflect events that occur or circumstances that

exist after the date on which they were made, except as required by law.

-

Tables Follow -

ONCOCYTE CORPORATION

CONDENSED

CONSOLIDATED BALANCE SHEETS

(In

thousands, except per share data)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash

equivalents | |

$ | 3,363 | | |

$ | 9,432 | |

| Accounts receivable, net

of allowance for credit losses of $2 and $5, respectively | |

| 209 | | |

| 484 | |

| Inventories | |

| 232 | | |

| — | |

| Deferred financing costs | |

| 330 | | |

| — | |

| Prepaid expenses and other

current assets | |

| 627 | | |

| 643 | |

| Assets

held for sale | |

| 32 | | |

| 139 | |

| Total current assets | |

| 4,793 | | |

| 10,698 | |

| NONCURRENT ASSETS | |

| | | |

| | |

| Right-of-use and financing

lease assets, net | |

| 3,001 | | |

| 1,637 | |

| Machinery and equipment,

net, and construction in progress | |

| 3,494 | | |

| 3,799 | |

| Intangible assets, net | |

| 56,529 | | |

| 56,595 | |

| Restricted cash | |

| 1,700 | | |

| 1,700 | |

| Other

noncurrent assets | |

| 699 | | |

| 463 | |

| TOTAL ASSETS | |

$ | 70,216 | | |

$ | 74,892 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’

EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 872 | | |

$ | 953 | |

| Accrued compensation | |

| 1,906 | | |

| 1,649 | |

| Accrued royalties | |

| 1,116 | | |

| 1,116 | |

| Accrued expenses and other

current liabilities | |

| 985 | | |

| 452 | |

| Accrued severance from

acquisition | |

| 2,314 | | |

| 2,314 | |

| Right-of-use and financing

lease liabilities, current | |

| 1,283 | | |

| 665 | |

| Current liabilities of

discontinued operations | |

| — | | |

| 45 | |

| Contingent

consideration liabilities, current | |

| 614 | | |

| 393 | |

| Total current liabilities | |

| 9,090 | | |

| 7,587 | |

| NONCURRENT LIABILITIES | |

| | | |

| | |

| Right-of-use and financing

lease liabilities, noncurrent | |

| 2,708 | | |

| 2,204 | |

| Contingent

consideration liabilities, noncurrent | |

| 48,707 | | |

| 39,507 | |

| TOTAL LIABILITIES | |

| 60,505 | | |

| 49,298 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Series A Redeemable Convertible

Preferred Stock, no par value; stated value $1,000 per share; 5 shares issued and outstanding at December 31, 2023; aggregate

liquidation preference of $5,296 as of December 31, 2023 | |

| — | | |

| 5,126 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred stock, no par

value, 5,000 shares authorized; no shares issued and outstanding | |

| — | | |

| — | |

| Common stock, no par value,

230,000 shares authorized; 13,374 and 8,261 shares issued and outstanding at September 30, 2024 and December 31, 2023,

respectively | |

| 326,682 | | |

| 310,295 | |

| Accumulated other comprehensive

income | |

| 57 | | |

| 49 | |

| Accumulated

deficit | |

| (317,028 | ) | |

| (289,876 | ) |

| Total shareholders’

equity | |

| 9,711 | | |

| 20,468 | |

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY | |

$ | 70,216 | | |

$ | 74,892 | |

ONCOCYTE

CORPORATION

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In

thousands, except per share data)

| | |

Three

Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net

revenue | |

$ | 115 | | |

$ | 429 | | |

$ | 395 | | |

$ | 1,189 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost

of revenues | |

| 43 | | |

| 159 | | |

| 184 | | |

| 593 | |

| Cost

of revenues – amortization of acquired intangibles | |

| 22 | | |

| 22 | | |

| 66 | | |

| 66 | |

| Gross

profit | |

| 50 | | |

| 248 | | |

| 145 | | |

| 530 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

expenses: | |

| | | |

| | | |

| | | |

| | |

| Research

and development | |

| 2,817 | | |

| 2,185 | | |

| 7,582 | | |

| 6,747 | |

| Sales

and marketing | |

| 1,043 | | |

| 713 | | |

| 2,742 | | |

| 2,213 | |

| General

and administrative | |

| 2,565 | | |

| 2,487 | | |

| 7,645 | | |

| 9,430 | |

| Change

in fair value of contingent consideration | |

| 7,140 | | |

| (435 | ) | |

| 9,421 | | |

| (16,947 | ) |

| Impairment

losses | |

| — | | |

| 1,811 | | |

| — | | |

| 6,761 | |

| Impairment

loss on held for sale assets | |

| — | | |

| — | | |

| 169 | | |

| 1,283 | |

| Total

operating expenses | |

| 13,565 | | |

| 6,761 | | |

| 27,559 | | |

| 9,487 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

from operations | |

| (13,515 | ) | |

| (6,513 | ) | |

| (27,414 | ) | |

| (8,957 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other

(expenses) income: | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| (31 | ) | |

| (14 | ) | |

| (54 | ) | |

| (39 | ) |

| Unrealized

(loss) gain on marketable equity securities | |

| — | | |

| (89 | ) | |

| — | | |

| 8 | |

| Other

income, net | |

| 53 | | |

| 127 | | |

| 316 | | |

| 125 | |

| Total

other income, net | |

| 22 | | |

| 24 | | |

| 262 | | |

| 94 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

from continuing operations | |

| (13,493 | ) | |

| (6,489 | ) | |

| (27,152 | ) | |

| (8,863 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

from discontinued operations | |

| — | | |

| — | | |

| — | | |

| (2,926 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

$ | (13,493 | ) | |

$ | (6,489 | ) | |

$ | (27,152 | ) | |

$ | (11,789 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss per share: | |

| | | |

| | | |

| | | |

| | |

| Net

loss from continuing operations - basic and diluted | |

$ | (13,493 | ) | |

$ | (6,687 | ) | |

$ | (27,415 | ) | |

$ | (9,602 | ) |

| Net

loss from discontinued operations - basic and diluted | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | (2,926 | ) |

| Net

loss attributable to common stockholders - basic and diluted | |

$ | (13,493 | ) | |

$ | (6,687 | ) | |

$ | (27,415 | ) | |

$ | (12,528 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss from continuing operations per share - basic and diluted | |

$ | (0.98 | ) | |

$ | (0.81 | ) | |

$ | (2.36 | ) | |

$ | (1.29 | ) |

| Net

loss from discontinued operations per share - basic and diluted | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | (0.39 | ) |

| Net

loss attributable to common stockholders per share - basic and diluted | |

$ | (0.98 | ) | |

$ | (0.81 | ) | |

$ | (2.36 | ) | |

$ | (1.68 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

average shares outstanding - basic and diluted | |

| 13,714 | | |

| 8,256 | | |

| 11,624 | | |

| 7,446 | |

ONCOCYTE

CORPORATION

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In

thousands)

| | |

Three

Months Ended

September

30, | | |

Nine

Months Ended

September

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| CASH

FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

$ | (13,493 | ) | |

$ | (6,489 | ) | |

$ | (27,152 | ) | |

$ | (11,789 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation

and amortization expense | |

| 318 | | |

| 404 | | |

| 935 | | |

| 1,289 | |

| Amortization

of intangible assets | |

| 22 | | |

| 22 | | |

| 66 | | |

| 66 | |

| Stock-based

compensation | |

| 450 | | |

| 608 | | |

| 1,254 | | |

| 2,276 | |

| Equity

compensation for bonus awards and consulting services | |

| 14 | | |

| 108 | | |

| 110 | | |

| 108 | |

| Unrealized

gain on marketable equity securities | |

| — | | |

| 89 | | |

| — | | |

| (8 | ) |

| Change

in fair value of contingent consideration | |

| 7,140 | | |

| (435 | ) | |

| 9,421 | | |

| (16,947 | ) |

| Impairment

losses | |

| — | | |

| 1,811 | | |

| — | | |

| 6,761 | |

| Loss

on disposal of discontinued operations | |

| — | | |

| — | | |

| — | | |

| 1,521 | |

| Impairment

loss on held for sale assets | |

| — | | |

| — | | |

| 169 | | |

| 1,283 | |

| Changes

in operating assets and liabilities: | |

| | | |

| | | |

| | | |

| | |

| Accounts

receivable | |

| (124 | ) | |

| (166 | ) | |

| 275 | | |

| 130 | |

| Inventories | |

| (232 | ) | |

| — | | |

| (232 | ) | |

| — | |

| Prepaid

expenses and other assets | |

| (295 | ) | |

| 78 | | |

| (345 | ) | |

| 645 | |

| Accounts

payable and accrued liabilities | |

| 649 | | |

| 126 | | |

| 263 | | |

| (4,193 | ) |

| Lease

assets and liabilities | |

| — | | |

| 75 | | |

| (123 | ) | |

| (43 | ) |

| Net

cash used in operating activities | |

| (5,551 | ) | |

| (3,769 | ) | |

| (15,359 | ) | |

| (18,901 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| CASH

FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | | |

| | | |

| | |

| Proceeds

from sale of equipment | |

| — | | |

| 231 | | |

| — | | |

| 354 | |

| Construction

in progress and purchases of furniture and equipment | |

| (87 | ) | |

| (17 | ) | |

| (302 | ) | |

| (17 | ) |

| Cash

sold in discontinued operations | |

| — | | |

| — | | |

| — | | |

| (1,372 | ) |

| Net

cash used in investing activities | |

| (87 | ) | |

| 214 | | |

| (302 | ) | |

| (1,035 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| CASH

FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | | |

| | | |

| | |

| Proceeds

from sale of common shares | |

| — | | |

| — | | |

| 15,807 | | |

| 13,848 | |

| Financing

costs to issue common shares | |

| — | | |

| — | | |

| (538 | ) | |

| (427 | ) |

| Proceeds

from sale of common shares under at-the-market transactions | |

| 18 | | |

| — | | |

| 18 | | |

| — | |

| Financing

costs for at-the-market sales | |

| (187 | ) | |

| — | | |

| (187 | ) | |

| — | |

| Redemption

of Series A redeemable convertible preferred shares | |

| — | | |

| — | | |

| (5,389 | ) | |

| (1,118 | ) |

| Repayment

of financing lease obligations | |

| (86 | ) | |

| (30 | ) | |

| (119 | ) | |

| (87 | ) |

| Net

provided by financing activities | |

| (255 | ) | |

| (30 | ) | |

| 9,592 | | |

| 12,216 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET

CHANGE IN CASH, CASH EQUIVALENTS (INCLUDES DISCONTINUED OPERATIONS) AND RESTRICTED CASH | |

| (5,893 | ) | |

| (3,585 | ) | |

| (6,069 | ) | |

| (7,720 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| CASH,

CASH EQUIVALENTS (INCLUDES DISCONTINUED OPERATIONS) AND RESTRICTED CASH, BEGINNING | |

| 10,956 | | |

| 19,068 | | |

| 11,132 | | |

| 23,203 | |

| CASH,

CASH EQUIVALENTS AND RESTRICTED CASH, ENDING | |

$ | 5,063 | | |

$ | 15,483 | | |

$ | 5,063 | | |

$ | 15,483 | |

Oncocyte

Corporation

Reconciliation

of Non-GAAP Financial Measure

Consolidated

Adjusted Loss from Operations

Note:

In addition to financial results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), this

press release also includes a non-GAAP financial measure (as defined under SEC Regulation G). We believe that disclosing the adjusted

amounts is helpful in assessing our ongoing performance, providing insight into the Company’s core operating performance by excluding

certain non-recurring, non-cash, and / or intangible items that may obscure the underlying trends in the business. The following is a

reconciliation of the non-GAAP measure to the most directly comparable GAAP measure:

| | |

Three

Months Ended | |

| | |

September

30, | | |

June 30, | | |

September

30, | |

| | |

2024 | | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(unaudited) | | |

(unaudited) | |

| | |

(In thousands) | |

| Consolidated

GAAP loss from operations | |

$ | (13,515 | ) | |

$ | (4,632 | ) | |

$ | (6,513 | ) |

| Stock-based compensation | |

| 450 | | |

| 386 | | |

| 608 | |

| Depreciation and amortization expenses | |

| 340 | | |

| 326 | | |

| 426 | |

| Change in fair value of contingent consideration | |

| 7,140 | | |

| (1,031 | ) | |

| (435 | ) |

| Impairment losses | |

| — | | |

| — | | |

| 1,811 | |

| Consolidated

Non-GAAP loss from operations, as adjusted | |

$ | (5,585 | ) | |

$ | (4,951 | ) | |

$ | (4,103 | ) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

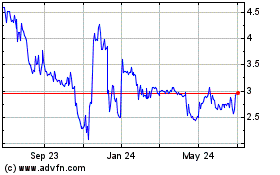

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Dec 2024 to Jan 2025

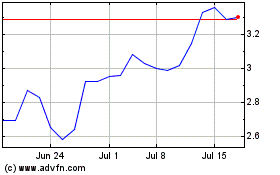

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Jan 2024 to Jan 2025