false

0000278165

0000278165

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January

18, 2024

OMNIQ

CORP.

(Exact name of registrant as specified in charter)

| Delaware |

|

001-40768 |

|

20-3454263 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

1865 West 2100 South, Salt Lake City, UT 84119

(Address of Principal Executive Offices) (Zip Code)

(714) 899-4800

(Registrant’s Telephone Number, Including Area

Code)

Not Applicable

(Former Name or Former Address, If Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Ticker symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

OMQS |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mart

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 18, 2024, Omniq Corp’s (the “Company’)

wholly owned subsidiary, Quest Marketing, Inc. (“Quest”) with Prestige Capital Finance, LLC (“Prestige”), entered

into a Purchase and Sale Agreement (the “Purchase and Sale Agreement”) in which Quest has sold, transferred and assigned all

of its right, title and interest to specific accounts receivable owed to Quest, as set forth on the assignment forms provided by Prestige

(the “Assignments”) together with all rights of action accrued or to accrue thereon, including without limitation, full power

to collect, sue for, compromise, assign or in any other manner enforce collection thereof in Prestige’s name or otherwise. In exchange

for those specific accounts receivables owed to Quest, Prestige has paid to Quest eighty percent (80%) of the face value of the accounts

therein described (the “Down Payment”). Notwithstanding anything to the contrary contained in this Agreement, the maximum

outstanding balance of Quest to Prestige shall be $7,500,000 (“Maximum Advance”).

In addition, Prestige’s purchase from Quest

shall be at a discount, which such discount shall be based on the number of days an account is outstanding from the date of the down payment.

The discount fee, which shall be based on the number of days an account is outstanding from the date of the down payment, shall be as

follows: If paid within 30 days a discount fee of 1.50% plus an additional .50% for each 10-day period thereafter up to a maximum of 90

days. Notwithstanding the foregoing, if an account is not repaid in accordance with a chargeback of such account (as further provided

in the Purchase and Sale Agreement), then the discount fee shall increase by 1.5% for each 10-day period (the “Default Rate”)

thereafter, until the account is paid in full.

Item 2.03 Creation of a Direct Financial Obligation

Or An Obligation Under An Off-Balance Sheet Arrangement Of A Registrant

The information set forth in Item 1.01 of this Current

Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: January 24, 2024

| OMNIQ Corp. |

|

| |

|

|

| By: |

/s/ Shai S. Lustgarten |

|

| |

Shai S. Lustgarten |

|

| |

President and CEO |

|

Exhibit

10.1

Prestige

Capital Finance, LLC

400

KELBY STREET, 10TH FLOOR, FORT LEE, NEW JERSEY 07024 (201) 944-4455

Purchase

and Sale Agreement (“Agreement”)

1.

ASSIGNMENT. PRESTIGE CAPITAL FINANCE, LLC (“Prestige”) hereby buys and QUEST MARKETING, INC., (“Seller”)

hereby sells, transfers and assigns all of Seller’s right, title and interest in and to those specific accounts receivable

owing to Seller as set forth on the assignment forms provided by Prestige (the “Assignments”) together with all rights of

action accrued or to accrue thereon, including without limitation, full power to collect, sue for, compromise, assign or in any other

manner enforce collection thereof in Prestige’s name or otherwise. All of Seller’s accounts receivable and contract rights

which are presently or at any time hereafter assigned by Seller, and accepted by Prestige, are collectively referred to as (the “Account(s)”).

2.

ADVANCE. Upon Prestige’s receipt and acceptance of each Assignment, Prestige shall pay to Seller EIGHTY percent (80%)

of the face value of the Accounts therein described (the “Down Payment”). Notwithstanding anything to the contrary contained

in this Agreement, the maximum outstanding balance of Seller to Prestige shall be $7,500,000 (“Maximum Advance”).

3.

RESERVE. Prestige will hold in reserve the difference between the Purchase Price (hereinafter defined) and the Down Payment (the

“Reserve”) and provided there are no outstanding chargebacks, disputes or defaults under the Agreement and Seller has not

ceased operations for 30 or more consecutive days, will pay to Seller, the Reserve, less any sums due Prestige hereunder, four (4) business

days from the date on which the Accounts have been collected in good funds and/or charged back. For purposes of this Agreement, the term

“Purchase Price” shall mean the net face value of Accounts, less; Prestige’s discount fee described in paragraph 4

below, returns, credits, allowances and discounts; and less all other sums charged or chargeable to Seller’s Accounts.

4.

DISCOUNT. Prestige’s purchase of the Accounts from Seller shall be at a discount fee which is deducted from the face value

of each Account upon collection. The discount fee, which shall be based on the number of days an Account is outstanding from the date

of the Down Payment, shall be as follows: If paid within 30 days a discount fee of 1.50% plus an additional .50% for each 10-day

period thereafter up to a maximum of 90 days. Notwithstanding the foregoing, if an Account is not repaid in accordance with a chargeback

of such Account (as provided in paragraph 7 below), then the discount fee shall increase by 1.5% for each 10-day period (the “Default

Rate”) thereafter, until the Account is paid in full.

| (a) | In

the event, during the initial Term, or any renewal Term, the JPMorgan Chase Prime Rate (“Prime”)

increases to 9% per annum or greater, at such time the aforementioned 30-day fee shall be

increased by .10% and the 10-day incremental periods will be adjusted accordingly (the “Prime

Rate Adjustment”)”. Thereafter, an additional Prime Rate Adjustment shall be

applied for each 50-basis point increase in Prime. Should Prime decrease back to 8.50% or

lower, the 30 day rate shall return to its original 1.50% for all subsequent assignments; |

| | | |

| (b) | Notwithstanding

anything to the contrary, there shall be a facility fee of 1% of the Maximum Advance, due

at closing, payable out of the proceeds of the initial Advance and thereafter, due on the

first day of any renewal Term. Seller shall also pay a 1% facility fee, which shall be due

upon approval, for any increase in the Maximum Advance. |

5.

WARRANTIES, REPRESENTATION AND COVENANTS. As an inducement for Prestige’s entering into this Agreement and with full knowledge

that the truth and accuracy of the warranties, representations and covenants in this Agreement are being relied upon by Prestige, instead

of the delay of a complete credit investigation, Seller warrants, represents and covenants that:

| (a) | Seller

is properly licensed and authorized to operate the business as a reseller of computer vision

image processing-based solutions; |

| | | |

| (b) | Seller

is the sole and absolute owner of the Accounts and has the full legal right to make said

sale, assignment and transfer; |

| | | |

| (c) | The

correct amount of each Account will be set forth on the Assignments; |

| | | |

| (d) | Each

Account is an accurate and undisputed statement of indebtedness from an account debtor for

a sum certain, without offset or counterclaim and which is due and payable in ninety days

or less; |

| | | |

| (e) | Each

Account is an accurate statement of a bona fide sale, delivery and acceptance of merchandise

or performance of service by Seller to an account debtor; |

| | | |

| (f) | Seller

does not own, control or exercise dominion in any way whatsoever, over the business of any

account debtor; |

| | | |

| (g) | All

financial records, statements, books or other documents shown to Prestige by Seller at any

time either before or after the signing of this Agreement are true and accurate; |

| (h) | Seller

will not under any circumstance or in any manner whatsoever, interfere with any of Prestige’s

rights under this Agreement; |

| | | |

| (i) | Seller

has not and will not, at any time, permit any lien, security interest or encumbrance to be

created upon any of its accounts receivable and/or its inventory without the prior written

consent of Prestige. In the event Seller is in breach of this representation, then the

discount fee in paragraph 4 above shall/may be increased by .5% until such breach has been

satisfied in full to the satisfaction of Prestige; |

| | | |

| (j) | Seller

will not enter into any agreement for a “Merchant Cash Advance” or similar product

without the prior written consent of Prestige. In the event Seller is in breach of this

representation, then the discount fee in paragraph 4 above shall be increased by .5% until

such breach has been satisfied in full to the satisfaction of Prestige; |

| | | |

| (k) | There

are no outstanding federal or state tax liens recorded against Seller; |

| | | |

| (l) | Seller

will not change or modify the terms of the Accounts with any account debtor unless Prestige

first consents, in writing; |

| | | |

| (m) | Seller

will notify Prestige, in advance of: any change in Seller’s place of business; Seller

having or acquiring more than one place of business; any change in Seller’s chief executive

office; and/or any change in the office or offices where Seller’s books and records

concerning accounts receivable are kept; |

| | | |

| (n) | Seller

will notify Prestige, in writing, in advance of any planned temporary or permanent closure

or cessation of Seller’s business. |

| | | |

| (o) | Seller

will immediately notify Prestige of any proposed or actual change of the Seller’s and/or

any account debtor’s identity, legal entity or corporate structure; |

| | | |

| (p) | A

notification letter from Seller and/or all invoices will state on their face that the Accounts

represented thereby have been assigned to Prestige and are to be paid directly to Prestige;

and |

| | | |

| (q) | No

Account shall be on a bill-and-hold, guaranteed sale, sale-and-return, sale on approval,

consignment or any other repurchase or return basis; |

The

warranties, representations and covenants contained in this paragraph 5 shall be continuous and be deemed to be renewed each time Seller

assigns Accounts to Prestige. Notwithstanding the provisions contained in paragraph 6 of this Agreement, Prestige shall have recourse

against the Seller in the event that any of the warranties, representations and covenants set forth in this paragraph 5 are breached.

Secondly, the Seller’s CEO, is certifying these statements in this Section 5 as a validity guarantor.but not an absolute guarantor

of payment.

6.

FULL RECOURSE. Prestige shall have full recourse against Seller for Advances made by Prestige if payments are not received or if

after receipt has to be disgorged for any reason. All credit risk on Accounts shall be borne by the Seller and not by Prestige.

7.

CHARGE-BACK. In the event that any Account is not paid within 90 days of invoice date or for any other reason, including, without

limitation, any alleged defense, counterclaim, offset, dispute or other claim (real or merely asserted) whether arising from or relating

to the sale of goods or rendition of services or arising from or relating to any other transaction or occurrence, then in any such event

Prestige shall have the right to chargeback such Account to Seller. Seller acknowledges that all amounts chargeable to Seller’s

account under this Agreement shall be payable by Seller on demand. Upon satisfaction of a chargeback of an Account and provided there

are no other outstanding chargebacks or defaults at such time, Prestige shall include the collections of chargeback invoices, if any,

in the Reserve. Notwithstanding the foregoing, if a chargeback is not cured within 5 business days, Prestige may charge the Default Rate

above until satisfied.

8.

NOTICE OF DISPUTE. Seller must immediately notify Prestige of any disputes between any account debtor and Seller.

9.

SETTLEMENT OF DISPUTE. Upon 10 days’ notice to Seller, Prestige may, at its option, settle any dispute with any account debtor.

Such settlement does not relieve Seller of any of its obligations under this Agreement.

10.

SOLE PROPERTY. Once Prestige has purchased the Accounts, the payment from account debtors relative to the Accounts is the sole property

of Prestige. Any interference by Seller with this payment may result in civil and/or criminal liability.

11.

SECURITY INTEREST. As a further inducement for Prestige to enter into this Agreement, and as security for the prompt performance,

observance and payment of all obligations owing by Seller to Prestige, Seller hereby grants to Prestige a continuing security interest

in and lien upon the following (herein collectively referred to as the “Collateral”): all accounts, inventory, machinery

and equipment, instruments, documents, chattel paper and general intangibles (as such terms are defined in the Uniform Commercial Code),

whether now owned or hereafter created or acquired by Seller, wherever located, and all replacements and substitutions therefore, accessions

thereto, and products and proceeds thereof, and all property of Seller at any time in Prestige’s possession.

12.

FINANCING STATEMENTS. Seller will, at its expense perform all acts and execute all documents requested by Prestige at any time to

evidence, perfect, maintain and enforce Prestige’s security interest and other rights in the Collateral and the priority thereof.

13.

HOLD IN TRUST. Seller will hold in trust and safekeeping, as the property of Prestige and immediately turnover to Prestige, the original

check or other form of payment received by Seller if payment on the Accounts comes into Seller’s possession. Should Seller come

into possession of a check comprising payments owing to both Seller and Prestige, Seller shall turnover said check to Prestige. In the

event Seller receives a payment, in the form of a check, for an Account and it is improperly deposited into Seller’s bank account

or in the event Seller fails to turnover to Prestige a wire transfer or ACH payment it receives from an Account within two business days

of receipt, then Prestige reserves the right to impose liquidated damages upon Seller of up to 20% of the amount of any payment so improperly

retained. Notwithstanding the foregoing, with respect to the improperly deposited checks, Prestige agrees to waive the aforementioned

charge on the first two (2) occasions provided that on such occasions Seller remits, in full, the improperly deposited funds to Prestige

within two (2) business days of receipt.

14.

FINANCIAL RECORDS. Seller will furnish to Prestige bank statements, accounts receivable aging and accounts payable aging monthly.

Seller shall also provide other such information as is, from time to time, requested by Prestige.

15.

BOOK ENTRY. Seller will immediately, upon the sale of the Accounts, make the proper entry on its books and records disclosing the

absolute sale of the Accounts to Prestige.

16.

POWER OF ATTORNEY. In order to implement this Agreement, Seller irrevocably appoints Prestige its special attorney in fact or agent

with power to:

| (a) | Strike

out Seller’s address on any correspondence to any account debtor and put on Prestige’s

address; |

| | | |

| (b) | Receive

and open all mail addressed to Seller via Prestige’s address; |

| | | |

| (c

) | Endorse

the name of Seller or Seller’s trade name on any checks or other evidences of payment

that may come into the possession of Prestige in connection with the Accounts; |

| | | |

| (d) | In

Seller’s name, or otherwise, demand, sue for, collect any and all monies due in connection

with the Accounts; and |

| | | |

| (e) | Compromise,

prosecute or defend any action, claim or proceeding relative to the Accounts; |

The

authority granted to Prestige shall remain in full force and effect until the Accounts are paid in full and the entire indebtedness of

Seller to Prestige is discharged.

17.

ADDITIONAL NOTIFICATION; VERIFICATION OF ACCOUNTS

| (a) | Without

in any way limiting the terms and provisions of paragraph 5 (p) hereinabove, Prestige may,

upon default by Seller and in its sole discretion, notify any account debtor to make payment

on any of Seller’s open invoices to Prestige; and |

| | | |

| (b) | Prestige,

or any of its agents, may at any time verify the Accounts by any means deemed appropriate

by Prestige. |

18.

NO ASSUMPTION. Nothing contained in this Agreement shall be deemed to impose any duty or obligation upon Prestige in favor

of

any account debtor and/or any other party in connection with the Accounts.

19.

FUTURE ASSIGNMENTS. Seller may from time to time, at Seller’s option, sell, transfer and assign different Accounts to Prestige.

The future sale of any Accounts shall be subject to and governed by this Agreement and such Accounts shall be identified by separate

and subsequent Assignments.

20.

DISCRETION. Nothing contained in this Agreement shall be construed to impose any obligation upon Prestige to purchase Accounts from

Seller. Prestige shall at its sole discretion determine which Accounts it shall purchase. Further, Prestige shall have the absolute right

at any time to cease accepting any further Assignments from Seller.

21.

LEGAL FEES; EXPENSES. Seller will pay on demand any and all collection expenses and reasonable outside legal counsel’s fees

that Prestige incurs in the event it should become necessary for Prestige to enforce its rights under this Agreement. In addition, once

the Agreement becomes effective, Seller will pay on demand all costs and expenses incurred by Prestige in any way relating to the transactions

contemplated by this Agreement, including, without limitation, all reasonable attorneys’ fees, Federal Express costs (or similar

expenses), wire transfer costs, certified mail costs, lien search costs and dedicated lockbox fees.

22.

BINDING ON FUTURE PARTIES. This Agreement shall inure to the benefit of and is binding upon the heirs, executors, administrators,

successors and assigns of the parties hereto, except that Seller may not assign or transfer any or all of its rights and obligations

under this Agreement to any party without the prior written consent of Prestige.

23.

WAIVER; ENTIRE AGREEMENT. No failure or delay on Prestige’s part in exercising any right, power or remedy granted to Prestige

herein, will constitute or operate as a waiver thereof, nor shall any single or partial exercise of any such right, power or remedy preclude

any other or further exercise thereof or the exercise of any other right set forth herein. This Agreement contains the entire agreement

and understanding of the parties hereto and no amendment, modification or waiver of, or consent with respect to, any provision of this

Agreement, will in any event be effective unless the same is in writing and signed and delivered by Prestige.

24.

NEW JERSEY LAW. This Agreement shall be deemed executed in the State of New Jersey and, in all respects shall be governed and construed

in accordance with the laws of the State of New Jersey. Each of the parties to this Agreement hereby submits to the non-exclusive jurisdiction

of the US District Court of New Jersey and in any New Jersey State Court sitting in Bergen County, New Jersey.

25.

INDEMNITY. Seller shall hold Prestige harmless from and against any action or other proceeding brought by any account debtor against

Prestige arising from Prestige’s collecting or attempting to collect any of the Accounts, unless such action or proceeding is due

to the gross negligence, recklessness or intentionally tortious acts of Prestige.

26.

CURRENCY. All dollar amounts referred to in this Agreement are stated in the lawful currency of the United States of America (the

“Original Currency”). Seller and all account debtors will make payment relative to all amounts owing under this Agreement

in the Original Currency. If a payment is made to Prestige in a currency (the “Other Currency”) other than the Original Currency,

such payment will constitute a discharge of the liability of the payor only to the extent of the amount of the Original Currency it receives

on the date of receipt. If the amount of the Original Currency which Prestige is able to purchase is less than the amount of such currency

originally due to it, Seller will indemnify and save Prestige harmless from and against any loss or damage arising as a result of such

deficiency.

27.

TERM. This Agreement will remain in effect for one year from the date that this Agreement becomes effective (the “Term”).

Thereafter, the Term will be automatically renewed for successive periods of one (1) year each unless either party provides the other

with a written notice of termination of at least sixty (60) days prior to the expiration of the initial Term or any renewal Term; provided,

however, Prestige may terminate this Agreement at any time upon sixty (60) days’ notice to Seller. In the event of a material

breach by Seller of any term or provision of this Agreement or upon Seller’s insolvency or the insolvency of any guarantor of Seller’s

obligations herein, Prestige shall have the right to terminate this Agreement without notice to Seller, and all of Seller’s obligations

to Prestige herein shall be immediately due and payable. In the event of termination, the provisions of this Agreement shall remain in

full force and effect until all of the Accounts and all of Seller’s obligations to Prestige have been paid in full.

28.

EARLY TERMINATION. In the event that Seller wishes to terminate the Agreement prior to the expiration of the Term, or in the event

Prestige terminates this Agreement due to a material breach by Seller of any term or provision of this Agreement, then in addition to

paying Prestige all other obligations due under this Agreement, Seller shall also pay Prestige an early termination fee equal to $15,000

per month for each month remaining under the Term. Seller shall provide Prestige with written notice fifteen days prior to an early

termination.

29.

INVALID PROVISIONS. If any provision of this Agreement shall be declared illegal or contrary to law, it is agreed that such provision

shall be disregarded and this Agreement shall continue in force as though said provision had not been incorporated herein.

30.

EFFECTIVE. This Agreement shall become effective when it is accepted and executed by an authorized officer of Prestige. Facsimile

machine or PDF copies of an original signature by either party on this Agreement shall be binding as if said copies were original signatures.

31.

JURY WAIVER. The parties hereto hereby mutually waive trial by jury in the event of any litigation with respect to any matter connected

with this Agreement.

| |

|

|

Accepted: |

| |

|

|

|

|

| QUEST MARKETING, INC, |

|

|

PRESTIGE

CAPITAL FINANCE, LLC |

| |

|

|

|

|

| By:

|

/s/ Shai Lustgarten |

|

By:

|

/s/ Alan R. Eliasof |

| |

SHAI

S. LUSTGARTEN, CEO |

|

|

ALAN

R. ELIASOF, CEO |

| |

|

|

|

|

| This

____18th ___ day of January 2024 |

|

This

_______ day of ___________________________, 202_ |

In

consideration of the foregoing Agreement, each of the undersigned hereby personally agrees to be jointly and severally liable for any

damages suffered by Prestige Capital Finance, LLC by virtue of the breach of any warranty, representation or covenant made by Seller

in paragraph 5 above.

| Date:

|

January

18, 2024 |

|

By:

|

/s/

Shai Lustgarten |

| |

|

|

|

SHAI

S. LUSTGARTEN, Individually |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

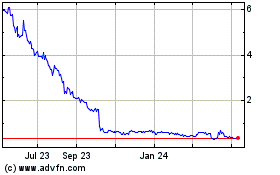

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

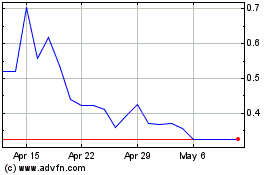

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Feb 2024 to Feb 2025