Second most profitable year in Company history;

operating discipline and diversification strategy deliver more

consistent results in all market cycles

January 2023 acquisition of Metal-Fab

immediately accretive; broadens product offerings, manufacturing

capabilities and geographic reach

Strong balance sheet, record cash flow and

increased access to capital enable Company to continue investing in

higher-return growth opportunities

Quarterly dividend increased from $0.09 to

$0.125 per share

Olympic Steel, Inc. (Nasdaq: ZEUS), a leading national

metals service center, today announced results for the three and 12

months ended December 31, 2022.

Fourth-Quarter Results

Net income for the fourth quarter totaled $4.0 million, or $0.34

per diluted share, compared with net income of $24.9 million, or

$2.16 per diluted share, in the fourth quarter of 2021. The results

include $0.9 million of LIFO pre-tax income in the fourth quarter

of 2022, compared with $9.9 million of LIFO pre-tax expense in the

same period a year ago. Adjusted EBITDA for the fourth quarter of

2022 was $11.9 million, compared with $51.1 million in the fourth

quarter of 2021. Sales for the fourth quarter of 2022 totaled $520

million, compared with $625 million in the fourth quarter of

2021.

Full-Year Results

Net income for 2022 totaled $90.9 million, or $7.87 per diluted

share, compared with net income of $121.1 million, or $10.52 per

diluted share, in 2021. The results include $0.6 million of LIFO

pre-tax expense in 2022, compared with $21.9 million of LIFO

pre-tax expense in 2021. Adjusted EBITDA for 2022 was $152.0

million, compared with $211.1 million in 2021. Sales for 2022

totaled $2.6 billion compared with $2.3 billion in 2021.

“Olympic Steel delivered another year of extraordinary

performance in 2022, capped off by a strong finish in the fourth

quarter. Our team weathered ongoing economic pressures and a

historic decline in metals pricing to record the second most

profitable year in Company history, with our Specialty Metals and

Pipe and Tube segments hitting all-time profitability highs,” said

Richard T. Marabito, Chief Executive Officer. “Our results validate

that our strategy to reduce the impact of market cyclicality on our

business is working. The deliberate steps we have taken to invest

in diversified, higher-return products and services, along with our

relentless focus on operational disciplines have improved our

bottom line and strengthened our business for the long term.”

Marabito continued, “Importantly, we have also improved our

position to invest in and accelerate growth. In 2022, our record

cash flow enabled us to reduce our debt by $162 million, or 49%,

providing increased liquidity for higher-return growth

opportunities, including our January 2023 purchase of Metal-Fab,

Inc., the second-largest acquisition in our history and our sixth

acquisition in the last five years. Metal-Fab is a perfect fit for

Olympic Steel, adding a consistent, recession-resistant track

record of double-digit EBITDA margins and an expanded catalog of

products to our growing portfolio of metal-intensive end-use

products.”

As the Company reported on February 15, 2023, the Board of

Directors approved a regular quarterly cash dividend of $0.125 per

share, which is an increase of $0.035 per share from the Company’s

last quarterly dividend of $0.09 per share. The dividend is payable

on March 15, 2023, to shareholders of record on March 1, 2023. The

Company has paid a regular quarterly dividend since March 2006.

Marabito concluded, “Olympic Steel is a stronger and more

resilient company, and we are off to a fast start in 2023. In

January, we increased our asset-based revolver from $475 million to

$625 million, providing additional capital to further execute our

growth and diversification strategy. We are also pleased to reward

shareholders through an increased quarterly dividend.”

The table that follows provides a reconciliation of non-GAAP

measures to the most directly comparable measures prepared in

accordance with GAAP.

Olympic Steel, Inc.

Reconciliation of Net Income

Per Diluted Share to

Adjusted Net Income Per

Diluted Share

(Figures may not foot due to

rounding.)

The following table reconciles

adjusted net income per diluted share to the most directly

comparable GAAP financial measure:

Three months ended

Twelve months ended

December 31,

December 31,

2022

2021

2022

2021

Net income per diluted share

$

0.34

$

2.16

$

7.87

$

10.52

Excluding the following items LIFO (Income) Expense

(0.07

)

0.63

0.04

1.39

Gain on Sale of Detroit Operation

-

-

-

(0.23

)

Gain on Sale of Milan Warehouse

-

-

(0.13

)

-

Adjusted net income per dilluted share (non-GAAP)

$

0.28

$

2.79

$

7.77

$

11.69

Reconciliation of Net Income

to Adjusted EBITDA

(in thousands)

The following table reconciles

Adjusted EBITDA to the most directly comparable GAAP financial

measure:

Three Months Ended Twelve Months Ended

12/31/2022 12/31/2021 12/31/2022

12/31/2021 Net income (GAAP):

$

3,959

$

24,861

$

90,931

$

121,051

Excluding the following items: Foreign exchange loss included in

net income

7

12

45

36

Interest and other expense on debt

2,804

2,013

10,080

7,631

Income tax provision

904

9,394

32,691

43,748

Depreciation and amortization

5,144

4,995

19,738

20,316

Earnings before interest, taxes, depreciation and

amortization (EBITDA)

12,818

41,275

153,485

192,782

LIFO Expense (Income)

(935

)

9,850

565

21,850

Gain on Sale of Detroit Operation

-

-

-

(3,499

)

Gain on Sale of Milan Warehouse

-

-

(2,083

)

-

Adjusted EBITDA (non-GAAP)

$

11,883

$

51,125

$

151,967

$

211,133

Conference Call and Webcast

A simulcast of Olympic Steel’s 2022 fourth-quarter earnings

conference call can be accessed via the Investor Relations section

of the Company’s website at www.olysteel.com. The live simulcast

will begin at 10 a.m. ET on February 24, 2023, and a replay will be

available for approximately 14 days thereafter.

Forward-Looking Statements

It is the Company’s policy not to endorse any analyst’s sales or

earnings estimates. Forward-looking statements in this release are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are typically identified by words or phrases such as

“may,” “will,” “anticipate,” “should,” “intend,” “expect,”

“believe,” “estimate,” “project,” “plan,” “potential,” and

“continue,” as well as the negative of these terms or similar

expressions. Such forward-looking statements are subject to certain

risks and uncertainties that could cause actual results to differ

materially from those implied by such statements. Readers are

cautioned not to place undue reliance on these forward-looking

statements. Such risks and uncertainties include, but are not

limited to: risks of falling metals prices and inventory

devaluation; supply disruptions and inflationary pressures,

including the availability and rising costs of transportation,

energy, logistical services and labor; risks associated with

shortages of skilled labor, increased labor costs and our ability

to attract and retain qualified personnel; rising interest rates

and their impacts on our variable interest rate debt; risks

associated with supply chain disruption resulting from the

imbalance of metal supply and end-user demands related to the novel

coronavirus, or COVID-19, including additional shutdowns in large

markets, such as China, and other factors; supplier consolidation

or addition of new capacity; risks associated with the invasion of

Ukraine, including economic sanctions, or additional war or

military conflict, could adversely affect global metals supply and

pricing; general and global business, economic, financial and

political conditions, including, but not limited to, recessionary

conditions and legislation passed under the current administration;

risks associated with the COVID-19 pandemic, including, but not

limited to customer closures, reduced sales and profit levels,

slower payment of accounts receivable and potential increases in

uncollectible accounts receivable, falling metals prices that could

lead to lower of cost or net realizable value inventory adjustments

and the impairment of intangible and long-lived assets, negative

impacts on our liquidity position, inability to access our

traditional financing sources on the same or reasonably similar

terms as were available before the COVID-19 pandemic and increased

costs associated with and less ability to access funds under our

asset-based credit facility, or ABL Credit Facility, and the

capital markets; the levels of imported steel in the United States

and the tariffs initiated by the U.S. government in 2018 under

Section 232 of the Trade Expansion Act of 1962 and imposed tariffs

and duties on exported steel or other products, U.S. trade policy

and its impact on the U.S. manufacturing industry; the inflation or

deflation existing within the metals industry, as well as product

mix and inventory levels on hand, which can impact our cost of

materials sold as a result of the fluctuations in the last-in,

first-out, or LIFO, inventory valuation; increased customer demand

without corresponding increase in metal supply could lead to an

inability to meet customer demand and result in lower sales and

profits; competitive factors such as the availability, and global

pricing of metals and production levels, industry shipping and

inventory levels and rapid fluctuations in customer demand and

metals pricing; customer, supplier and competitor consolidation,

bankruptcy or insolvency; the timing and outcomes of inventory

lower of cost or net realizable value adjustments and last-in,

first-out, or LIFO, income or expense; reduced production

schedules, layoffs or work stoppages by our own, our suppliers’ or

customers’ personnel; cyclicality and volatility within the metals

industry; reduced availability and productivity of our employees,

increased operational risks as a result of remote work

arrangements, including the potential effects on internal controls,

as well as cybersecurity risks and increased vulnerability to

security breaches, information technology disruptions and other

similar events; fluctuations in the value of the U.S. dollar and

the related impact on foreign steel pricing, U.S. exports, and

foreign imports to the United States; the successes of our efforts

and initiatives to improve working capital turnover and cash flows,

and achieve cost savings; our ability to generate free cash flow

through operations and repay debt; our ability to successfully

integrate recent acquisitions into our business and risks inherent

with the acquisitions in the achievement of expected results,

including whether the acquisition will be accretive and within the

expected timeframe; the adequacy of our existing information

technology and business system software, including duplication and

security processes; the amounts, successes and our ability to

continue our capital investments and strategic growth initiatives,

including acquisitions and our business information system

implementations; events or circumstances that could adversely

impact the successful operation of our processing equipment and

operations; the impacts of union organizing activities and the

success of union contract renewals; changes in laws or regulations

or the manner of their interpretation or enforcement could impact

our financial performance and restrict our ability to operate our

business or execute our strategies; events or circumstances that

could impair or adversely impact the carrying value of any of our

assets; risks and uncertainties associated with intangible assets,

including impairment charges related to indefinite lived intangible

assets; our ability to pay regular quarterly cash dividends and the

amounts and timing of any future dividends; our ability to

repurchase shares of our common stock and the amounts and timing of

repurchases, if any; our ability to sell shares of our common stock

under the at-the-market equity program; and unanticipated

developments that could occur with respect to contingencies such as

litigation, arbitration and environmental matters, including any

developments that would require any increase in our costs for such

contingencies.

In addition to financial information prepared in accordance with

GAAP, this document also contains adjusted earnings per diluted

share and adjusted EBITDA, which are non-GAAP financial measures.

Management’s view of the Company’s performance includes adjusted

earnings per share and adjusted EBITDA, and management uses these

non-GAAP financial measures internally for planning and forecasting

purposes and to measure the performance of the Company. We believe

these non-GAAP financial measures provide useful and meaningful

information to us and investors because they enhance investors’

understanding of the continuing operating performance of our

business and facilitate the comparison of performance between past

and future periods. These non-GAAP financial measures should be

considered in addition to, but not as a substitute for, the

information prepared in accordance with GAAP. Additionally, the

presentation of these measures may be different from non-GAAP

financial measures used by other companies. A reconciliation of

these non-GAAP measures to the most directly comparable GAAP

financial measures is provided above.

About Olympic Steel

Founded in 1954, Olympic Steel is a leading U.S. metals service

center focused on the direct sale of processed carbon, coated and

stainless flat-rolled sheet, coil and plate steel, aluminum, tin

plate, and metal-intensive branded products. The Company's CTI

subsidiary is a leading distributor of steel tubing, bar, pipe,

valves and fittings, and fabricator of value-added parts and

components. Headquartered in Cleveland, Ohio, Olympic Steel

operates from 44 facilities in North America, inclusive of the two

new locations added as part of the Metal-Fab acquisition on January

3, 2023.

For additional information, please visit the Company’s website

at www.olysteel.com.

Olympic Steel, Inc.

Consolidated Statements of Net

Income

(in thousands, except per-share

data)

Three months ended Twelve months ended

December 31, December 31,

2022

2021

2022

2021

Net sales

$

520,044

$

624,586

$

2,559,990

$

2,312,253

Costs and expenses Cost of materials sold (excludes items

shown separately below)

430,811

497,818

2,073,930

1,802,052

Warehouse and processing

25,599

26,864

104,668

103,017

Administrative and general

25,484

30,289

114,004

104,617

Distribution

13,916

13,318

60,529

55,404

Selling

8,269

11,473

40,174

41,881

Occupancy

3,147

3,549

13,200

12,500

Depreciation

4,519

4,395

17,285

17,952

Amortization

625

600

2,453

2,364

Total costs and expenses

512,370

588,306

2,426,243

2,139,787

Operating income

7,674

36,280

133,747

172,466

Other loss, net

7

12

45

36

Income before interest and income taxes

7,667

36,268

133,702

172,430

Interest and other expense on debt

2,804

2,013

10,080

7,631

Income before income taxes

4,863

34,255

123,622

164,799

Income tax provision

904

9,394

32,691

43,748

Net income

$

3,959

$

24,861

$

90,931

$

121,051

Earnings per share: Net income per share -

basic

$

0.34

$

2.16

$

7.87

$

10.53

Weighted average shares outstanding - basic

11,554

11,492

11,551

11,492

Net income per share - diluted

$

0.34

$

2.16

$

7.87

$

10.52

Weighted average shares outstanding - diluted

11,567

11,510

11,559

11,503

Olympic Steel, Inc.

Balance Sheets

(in thousands)

As ofDecember 31,2022 As ofDecember 31,2021

Assets Cash and cash equivalents

$

12,189

$

9,812

Accounts receivable, net

219,789

284,570

Inventories, net (includes LIFO reserves of $20,301 and $19,736 as

of December 31, 2022 and December 31, 2021 respectively)

416,931

485,029

Prepaid expenses and other

9,197

9,989

Total current assets

658,106

789,400

Property and equipment, at cost

429,810

413,396

Accumulated depreciation

(281,478

)

(266,340

)

Net property and equipment

148,332

147,056

Goodwill

10,496

10,496

Intangible assets, net

32,035

33,653

Other long-term assets

14,434

15,241

Right of use asset, net

28,224

27,726

Total assets

$

891,627

$

1,023,572

Liabilities Accounts payable

$

101,446

$

148,649

Accrued payroll

40,334

44,352

Other accrued liabilities

16,824

25,395

Current portion of lease liabilities

6,098

5,940

Total current liabilities

164,702

224,336

Credit facility revolver

165,658

327,764

Other long-term liabilities

12,619

15,006

Deferred income taxes

10,025

9,890

Lease liabilities

22,655

22,137

Total liabilities

375,659

599,133

Shareholders' Equity Preferred stock

-

-

Common stock

134,724

133,427

Accumulated other comprehensive loss

1,311

(1,996

)

Retained earnings

379,933

293,008

Total shareholders' equity

515,968

424,439

Total liabilities and shareholders' equity

$

891,627

$

1,023,572

Olympic Steel, Inc.

Segment Financial

Information

(In thousands, except tonnage and

per-ton data. Figures may not foot to consolidated totals due to

Corporate expenses.)

Three months ended December

31,

Carbon Flat Products

Specialty Metals Flat

Products

Tubular and Pipe

Products

2022

2021

2022

2021

2022

2021

Tons sold

187,110

192,545

31,073

34,529

N/A

N/A

Net sales

$

270,132

$

367,670

$

161,278

$

157,218

$

88,634

$

99,698

Average selling price per ton

1,444

1,910

5,190

4,553

N/A

N/A

Cost of materials sold

232,615

304,509

133,495

110,477

64,701

82,832

Gross profit

37,517

63,161

27,783

46,741

23,933

16,866

Operating expenses

39,727

41,884

19,750

22,584

18,054

21,226

Operating income (loss)

(2,210

)

21,277

8,033

24,157

5,879

(4,360

)

Depreciation and amortization

2,810

2,716

1,023

1,030

1,293

1,232

LIFO expense / (income)

-

-

-

-

(935

)

9,850

Twelve months ended December 31, Carbon Flat

Products Specialty Metals FlatProducts Tubular and

PipeProducts

2022

2021

2022

2021

2022

2021

Tons sold

806,919

921,295

142,092

157,807

N/A

N/A

Net sales

$

1,356,605

$

1,344,150

$

776,022

$

585,751

$

427,363

$

382,352

Average selling price per ton

1,681

1,459

5,461

3,712

N/A

N/A

Cost of materials sold

1,164,459

1,059,620

589,472

441,825

319,999

300,607

Gross profit

192,146

284,530

186,550

143,926

107,364

81,745

Operating expenses

167,131

174,456

92,888

73,382

72,508

74,392

Operating income

25,015

110,074

93,662

70,544

34,856

7,353

Depreciation and amortization

10,695

11,286

4,060

3,692

4,913

5,267

LIFO expense

-

-

-

-

565

21,850

As ofDecember 31,2022 As ofDecember 31,2021

Assets Flat-products

$

631,607

$

777,074

Tubular and pipe products

258,412

245,962

Corporate

1,608

536

Total assets

$

891,627

$

1,023,572

Other Information

(in thousands, except per-share

and ratio data)

(in thousands except per share data)

As ofDecember

31,2022 As ofDecember 31,2021 Shareholders' equity per

share

$

46.36

$

38.31

Debt to equity ratio 0.32 to 1 0.77 to 1

Twelve Months EndedDecember 31,

2022

2021

Net cash from (used for) operating activities

$

185,853

$

(146,374

)

Cash dividends per share

$

0.36

$

0.08

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230222006003/en/

Richard A. Manson Chief Financial Officer (216) 672-0522

ir@olysteel.com

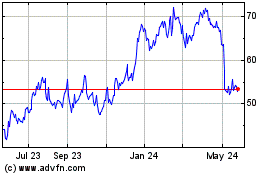

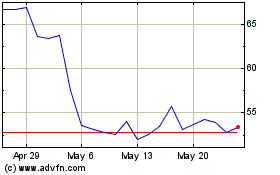

Olympic Steel (NASDAQ:ZEUS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Olympic Steel (NASDAQ:ZEUS)

Historical Stock Chart

From Dec 2023 to Dec 2024