OLB Group Continues Record Revenue Growth for 2022

August 15 2022 - 9:00AM

Business Wire

First Six Months Year Over Year Revenue Increased 3X from

$5.1 Million to $17.2 Million

The OLB Group, Inc. (NASDAQ:OLB), a diversified Fintech

eCommerce merchant services provider and cryptocurrency mining

enterprise, announced record revenue in 2022. Highlights for the

period include the following:

- Adjusted EBITDA $745,169 vs. Negative EBITDA (-$1,180,698) as

of June 30, 2022 and 2021, respectively.

- Total Corporate Assets $43,000,000 at June 30, 2022

- Cash Balance at June 30, 2022 approximately $3,600,000

- Zero Debt other than an equipment lease to finance the purchase

of 100 Miners for approximately $750,000

For the Six Months

Ended 6/30/2022

For the Six Months

Ended 6/30/2021

Total revenue

$17,158,894

$5,059,976

Total operating expense

$20,445,623

$6,709,257

Loss from operations

($3,286,729)

($1,649,281)

Total other income & expense

$393,179

($116,712)

Net Loss

($2,893,550)

($1,765,993)

Amortization expense

$1,901,943

$431,807

Depreciation expense

$1,594,250

$0

Interest expense

$0

$0

EBITDA

$602,643

($1,334,186)

Stock based compensation expenses

$141,386

$153,488

Adjusted EBITDA

$745,169

($1,180,698)

Link to the fillings: https://www.sec.gov/ix?doc=/Archives/edgar/data/1314196/000121390022047522/f10q0622_olbgroup.htm

Link to today earnings call https://us06web.zoom.us/meeting/register/tZYld-CtrDIqGtEsK1DYEYDzXa_n2__SBnC6

OUTLOOK FOR 2022

OTHER BUSINESS UPDATES AS OF June 30, 2022:

- No corporate debt other than equipment financing lease for

approximately $700,000.

- $3.6 million cash on hand

- Insider Share Ownership Approximately 32%

- Diversified revenue sources (eCommerce merchant services and

Bitcoin mining)

- 98% of revenue earned from profitable eCommerce operations

- Annualized revenue run rate at $36 Million vs. 2021 revenue of

$9.6 Million

- As of August 12, 2022, company market capitalization was $24.7

Million and Price to Sales Ratio of 1.44

- Increase in revenues projected from organic growth,

acquisitions, new initiatives in crypto payments and Bitcoin

mining

- eCommerce and Bitcoin mining annualized revenue run rate

projected to be between $36 million and $38 million by the end of

2022

Future OLB Press Releases and Updates

Interested investors or shareholders can be notified of future

Press releases and Industry Updates email to: ir@olb.com

About The OLB Group, Inc.

The OLB Group, Inc. is a diversified Fintech eCommerce merchant

services provider and Bitcoin crypto mining enterprise. The

Company's eCommerce platform delivers cloud-based merchant services

for a comprehensive digital commerce solution to over 10,500

merchants in all 50 states. DMint, a wholly owned subsidiary of OLB

Group, is engaged in the mining of Bitcoin utilizing sustainable

natural gas with an initial deployment of efficient 1,000

ASIC-based S19j Pro 96T mining computers.

For more information about The OLB Group, please visit

https://www.olb.com and http://investors.olb.com

Safe Harbor Statement

All statements from The OLB Group, Inc. in this news release

that are not based on historical fact are "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995 and the provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements include, but are not limited to, statements concerning

the impact of COVID-19 on our operations and financial condition,

our ability to implement our proprietary merchant boarding and CRM

system and to roll out our Omni Commerce and SecurePay

applications, including payment methods, to our current merchants

and the integration of our secure payment gateway with our

crowdfunding platform, our ability to successfully launch a

cryptocurrency mining operation and our ability to earn revenue

from the new operations. While the Company’s management has based

any forward-looking statements contained herein on its current

expectations, the information on which such expectations were based

may change. These forward-looking statements rely on a number of

assumptions concerning future events and are subject to a number of

risks, uncertainties, and other factors, many of which are outside

of our control, that could cause actual results to materially

differ from such statements. Such risks, uncertainties, and other

factors include statements regarding the expected revenue and

income for operations to be generated by The OLB Group, Inc. For

other factors that may cause our actual results to differ from

those that are expected, see the information under the caption

"Risk Factors" in the Company’s most recent Form 10-K and 10-Q

filings, and amendments thereto, as well as other public filings

with the SEC since such date. The Company operates in a rapidly

changing and competitive environment, and new risks may arise.

Accordingly, investors should not place any reliance on

forward-looking statements as a prediction of actual results. The

Company disclaims any intention to, and undertakes no obligation

to, update or revise any forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220815005222/en/

OLB Group Investor Relations Rick Lutz IR@OLB.com (212) 278-0900

Ext. 333

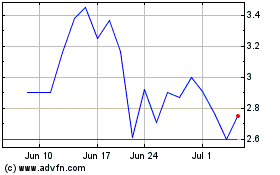

OLB (NASDAQ:OLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

OLB (NASDAQ:OLB)

Historical Stock Chart

From Jul 2023 to Jul 2024