false

--12-31

0001372299

0001372299

2024-05-10

2024-05-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 10, 2024

OCUGEN,

INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36751 |

|

04-3522315 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

11

Great Valley Parkway

Malvern,

Pennsylvania 19355

(484)

328-4701

(Addresses, including zip code, and telephone numbers,

including area code, of principal executive offices)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value per share |

|

OCGN |

|

The

Nasdaq Stock Market LLC

(The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.03. Material

Modification to Rights of Security Holders.

The disclosure set forth

in Item 5.03 below is hereby incorporated herein by reference.

Item 5.03. Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Series C Preferred

Stock

The board of directors (the “Board”)

of Ocugen, Inc. (the “Company”) declared a dividend of one one-thousandth (1/1,000th) of a share of

Series C Preferred Stock, par value $0.01 per share (“Series C Preferred Stock”), for each outstanding share

of the Company’s common stock, par value $0.01 per share (“Common Stock”) to stockholders of record at

5:00 p.m. Eastern Time on May 20, 2024 (the “Record Date”).

General;

Transferability. Shares of Series C Preferred Stock will be uncertificated and represented in book-entry form. No shares

of Series C Preferred Stock may be transferred by the holder thereof except in connection with a transfer by such holder of any shares

of Common Stock held by such holder, in which case a number of one one-thousandths (1/1,000ths) of a share of Series C Preferred

Stock equal to the number of shares of Common Stock to be transferred by such holder will be automatically transferred to the transferee

of such shares of Common Stock.

Voting

Rights. Each share of Series C Preferred Stock will entitle the holder thereof to 1,000,000 votes per share (and, for the

avoidance of doubt, each fraction of a share of Series C Preferred Stock will have a ratable number of votes). Thus, each one-thousandth (1/1,000th)

of a share of Series C Preferred Stock would entitle the holder thereof to 1,000 votes. The outstanding shares of Series C Preferred Stock

will vote together with the outstanding shares of Common Stock of the Company as a single class exclusively with respect to (1) any

proposal to adopt an amendment to the Company’s Sixth Amended and Restated Certificate of Incorporation, as amended (the “Certificate

of Incorporation”), to increase the number of authorized shares of Common Stock in accordance with the terms of such amendment

(the “Share Increase Proposal”), (2) any proposal to adopt an amendment to the Certificate of Incorporation

to adjust voting requirements for certain future amendments to the Certificate of Incorporation in accordance with recent amendments to

Section 242(d) of the General Corporation Law of the State of Delaware (the “Voting Standard Proposal”) and

(3) any proposal to adjourn any meeting of stockholders called for the purpose of voting on the Share Increase Proposal or Voting Standard

Proposal (the “Adjournment Proposal”). The Series C Preferred Stock will not be entitled to vote on any other

matter, except to the extent required under the General Corporation Law of the State of Delaware.

Unless otherwise provided on any applicable proxy

or ballot with respect to the voting on the Share Increase Proposal, Voting Standard Proposal or the Adjournment Proposal, the vote of

each share of Series C Preferred Stock (or fraction thereof) entitled to vote on the Share Increase Proposal, Voting Standard Proposal,

Adjournment Proposal or any other matter brought before any meeting of stockholders held to vote on the Share Increase Proposal, Voting

Standard Proposal and the Adjournment Proposal will be cast in the same manner as the vote, if any, of the share of Common Stock (or fraction

thereof) in respect of which such share of Series C Preferred Stock (or fraction thereof) was issued as a dividend is cast on the Share

Increase Proposal, Voting Standard Proposal, Adjournment Proposal or such other matter, as applicable, and the proxy or ballot with respect

to shares of Common Stock held by any holder on whose behalf such proxy or ballot is submitted will be deemed to include all shares of

Series C Preferred Stock (or fraction thereof) held by such holder. Holders of Series C Preferred Stock will not receive a separate ballot

or proxy to cast votes with respect to the Series C Preferred Stock on the Share Increase Proposal, Voting Standard Proposal or Adjournment

Proposal.

Dividend

Rights. The holders of Series C Preferred Stock will not be entitled to receive dividends of any kind.

Liquidation

Preference. The Series C Preferred Stock will rank senior to the Common Stock as to any distribution of assets upon a liquidation,

dissolution or winding up of the Company, whether voluntarily or involuntarily (a “Dissolution”). Upon any Dissolution,

each holder of outstanding shares of Series C Preferred Stock will be entitled to be paid out of the assets of the Company available for

distribution to stockholders, prior and in preference to any distribution to the holders of Common Stock, an amount in cash equal to $0.01

per outstanding share of Series C Preferred Stock.

Redemption.

All shares of Series C Preferred Stock that are not present in person or by proxy at any meeting of stockholders held to vote on the Share

Increase Proposal, Voting Standard Proposal and the Adjournment Proposal as of immediately prior to the opening of the polls at such meeting

(the “Initial Redemption Time”) will automatically be redeemed in whole, but not in part, by the Company at

the Initial Redemption Time without further action on the part of the Company or the holder of shares of Series C Preferred Stock (the

“Initial Redemption”). Any outstanding shares of Series C Preferred Stock that have not been redeemed pursuant

to an Initial Redemption will be redeemed in whole, but not in part, (i) if such redemption is ordered by the Board in its sole discretion,

automatically and effective on such time and date specified by the Board in its sole discretion or (ii) automatically upon the approval

by the Company’s stockholders of the Share Increase Proposal or Voting Standard Proposal at any meeting of the stockholders held

for the purpose of voting on such proposal.

Each share of Series C Preferred Stock redeemed

in any redemption described above will be redeemed in consideration for the right to receive an amount equal to $0.01 in cash for each

ten whole shares of Series C Preferred Stock that are “beneficially owned” by the “beneficial owner” (as such

terms are defined in the certificate of designation of preferences, rights and limitations with respect to the Series C Preferred Stock

(the “Certificate of Designation”)) thereof as of immediately prior to the applicable redemption time and redeemed

pursuant to such redemption. However, the redemption consideration in respect of the shares of Series C Preferred Stock (or fractions

thereof) redeemed in any redemption described above: (i) will entitle the former beneficial owners of less than ten whole shares

of Series C Preferred Stock redeemed in any redemption to no cash payment in respect thereof and (ii) will, in the case of a former

beneficial owner of a number of shares of Series C Preferred Stock (or fractions thereof) redeemed pursuant to any redemption that is

not equal to a whole number that is a multiple of ten, entitle such beneficial owner to the same cash payment, if any, in respect of such

redemption as would have been payable in such redemption to such beneficial owner if the number of shares (or fractions thereof) beneficially

owned by such beneficial owner and redeemed pursuant to such redemption were rounded down to the nearest whole number that is a multiple

of ten (such, that for example, the former beneficial owner of 25 shares of Series C Preferred Stock redeemed pursuant to any redemption

will be entitled to receive the same cash payment in respect of such redemption as would have been payable to the former beneficial owner

of 20 shares of Series C Preferred Stock redeemed pursuant to such redemption).

The Series C Preferred Stock is not convertible

into, or exchangeable for, shares of any other class or series of stock or other securities of the Company. The Series C Preferred Stock

has no stated maturity and is not subject to any sinking fund.

The Certificate of Designation

was filed with the Secretary of State of the State of Delaware and became effective on May 10, 2024. The foregoing description of the

Series C Preferred Stock does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designation,

which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits

The following exhibits

are being filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Ocugen, Inc. |

| Date: May 10, 2024 |

|

|

| |

By: |

/s/ Shankar

Musunuri |

| |

Name: |

Shankar Musunuri |

| |

Title: |

Chairman, Chief Executive Officer, & Co-Founder |

Exhibit 3.1

OCUGEN, INC.

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES C PREFERRED STOCK

Pursuant to Section 151 of the

General Corporation Law of the State of Delaware

The undersigned, Shankar Musunuri, does hereby certify that:

1. He is the Chief Executive Officer of Ocugen, Inc.,

a Delaware corporation (the “Corporation”).

2. The Corporation is authorized to issue 10,000,000

shares of preferred stock, par value $0.01 per share (the “Preferred Stock”), 30,000 of which are designated as Series A

Convertible Preferred Stock and 54,745 of which are designated as Series B Convertible Preferred Stock.

3. The following resolutions were duly adopted

by the board of directors of the Corporation (the “Board of Directors”):

WHEREAS, the Sixth Amended and Restated Certificate

of Incorporation of the Corporation (as amended, the “Certificate of Incorporation”) provides for a class of its authorized

stock known as Preferred Stock, consisting of 10,000,000 shares, $0.01 par value per share, issuable from time to time in one or more

series;

WHEREAS, the Board of Directors is authorized,

without further stockholder approval, to establish from time to time the number of shares to be included in each such series, and to fix

the designation, powers, preferences, and rights of the shares of each such series and any qualifications, limitations or restrictions

thereof; and

WHEREAS, it is the desire of the Board of Directors,

pursuant to such authority, to fix the rights, preferences, restrictions and other matters relating to a series of the preferred stock,

which shall consist of up to 260,000 shares of the preferred stock which the Corporation has the authority to issue, as follows:

NOW, THEREFORE, BE IT RESOLVED, that the Board

of Directors does hereby provide for the issuance of a series of preferred stock for cash or exchange of other securities, rights or property

and does hereby fix and determine the rights, preferences, restrictions and other matters relating to such series of preferred stock as

follows:

TERMS OF PREFERRED STOCK

| 1. | Designation, Amount and Par Value. The series of Preferred Stock created hereby shall be designated as the Series C Preferred

Stock (the “Series C Preferred Stock”), and the number of shares so designated shall be 260,000. Each share of

Series C Preferred Stock shall have a par value of $0.01 per share. |

| 2. | Dividends. The holders of Series C Preferred Stock, as such, shall not be entitled to receive dividends of any kind. |

| 3. | Voting Rights. Except as otherwise provided by the Certificate of Incorporation or required by law, the holders of shares of

Series C Preferred Stock shall have the following voting rights. |

| 3.1. | Except as otherwise provided herein, each outstanding share of Series C Preferred Stock shall have 1,000,000 votes per share

(and, for the avoidance of doubt, each fraction of a share of Series C Preferred Stock shall have a ratable number of votes). The

outstanding shares of Series C Preferred Stock shall vote together with the outstanding shares of common stock, par value $0.01 per

share (the “Common Stock”), of the Corporation as a single class exclusively with respect to the Share Increase Proposal,

Voting Standard Proposal and the Adjournment Proposal (as such terms are defined below) and shall not be entitled to vote on any other

matter except to the extent required under the General Corporation Law of the State of Delaware (the “DGCL”). Notwithstanding

the foregoing, and for the avoidance of doubt, each share of Series C Preferred Stock (or fraction thereof) redeemed pursuant to

the Initial Redemption (as defined below) shall have no voting power with respect to, and the holder of each share of Series C Preferred

Stock (or fraction thereof) redeemed pursuant to the Initial Redemption shall have no voting power with respect to any such share of Series C

Preferred Stock (or fraction thereof) on, the Share Increase Proposal, Voting Standard Proposal, the Adjournment Proposal or any other

matter brought before any meeting of stockholders held to vote on the Share Increase Proposal or Voting Standard Proposal. As used herein,

(1) the term “Share Increase Proposal” means any proposal to adopt an amendment to the Certificate of Incorporation

to increase the number of authorized shares of Common Stock in accordance with the terms of such amendment, (2) the term “Voting

Standard Proposal” means any proposal to adopt an amendment to the Certificate of Incorporation to adjust voting requirements

for certain future amendments to the Certificate of Incorporation in accordance with recent amendments to Section 242(d) of

the General Corporation Law of the State of Delaware, and (3) the term “Adjournment Proposal” means any proposal

to adjourn any meeting of stockholders called for the purpose of voting on the Share Increase Proposal or Voting Standard Proposal. |

| 3.2. | Unless otherwise provided on any applicable proxy or ballot with respect to the voting on the Share Increase Proposal, Voting Standard

Proposal or the Adjournment Proposal, the vote of each share of Series C Preferred Stock (or fraction thereof) entitled to vote on

the Share Increase Proposal, Voting Standard Proposal, the Adjournment Proposal or any other matter brought before any meeting of stockholders

held to vote on the Share Increase Proposal, Voting Standard Proposal and the Adjournment Proposal shall be cast in the same manner as

the vote, if any, of the share of Common Stock (or fraction thereof) in respect of which such share of Series C Preferred Stock (or

fraction thereof) was issued as a dividend is cast on the Share Increase Proposal, Voting Standard Proposal, the Adjournment Proposal

or such other matter, as applicable, and the proxy or ballot with respect to shares of Common Stock held by any holder on whose behalf

such proxy or ballot is submitted will be deemed to include all shares of Series C Preferred Stock (or fraction thereof) held by

such holder. Holders of Series C Preferred Stock will not receive a separate ballot or proxy to cast votes with respect to the Series C

Preferred Stock on the Share Increase Proposal, Voting Standard Proposal, the Adjournment Proposal or any other matter brought before

any meeting of stockholders held to vote on the Share Increase Proposal or the Voting Standard Proposal. |

| 4.1. | The Series C Preferred Stock shall rank senior to the Common Stock as to any distribution of assets upon a liquidation, dissolution

or winding up of the Corporation, whether voluntarily or involuntarily (a “Dissolution”). For the avoidance of any

doubt, but without limiting the foregoing, neither the merger or consolidation of the Corporation with or into any other entity, nor the

sale, lease, exchange or other disposition of all or substantially all of the Corporation’s assets shall, in and of itself, be deemed

to constitute a Dissolution. |

| 4.2. | Upon any Dissolution, each holder of outstanding shares of Series C Preferred Stock shall be entitled to be paid out of the assets

of the Corporation available for distribution to stockholders, prior and in preference to any distribution to the holders of Common Stock,

an amount in cash equal to $0.01 per outstanding share of Series C Preferred Stock. |

| 5.1. | All shares of Series C Preferred Stock that are not present in person or by proxy at any meeting of stockholders held to vote

on the Share Increase Proposal, Voting Standard Proposal and the Adjournment Proposal as of immediately prior to the opening of the polls

at such meeting (the “Initial Redemption Time”) shall automatically be redeemed by the Corporation at the Initial Redemption

Time without further action on the part of the Corporation or the holder thereof (the “Initial Redemption”). |

| 5.2. | Any outstanding shares of Series C Preferred Stock that have not been redeemed pursuant to an Initial Redemption shall be redeemed

in whole, but not in part, (i) if such redemption is ordered by the Board of Directors in its sole discretion, automatically and

effective on such time and date specified by the Board of Directors in its sole discretion or (ii) automatically upon the approval

by the Corporation’s stockholders of the Share Increase Proposal and Voting Standard Proposal at any meeting of stockholders held

for the purpose of voting on such proposals (any such redemption pursuant to this Section 5.2, the “Subsequent Redemption”

and, together with the Initial Redemption, the “Redemptions”). As used herein, the “Subsequent Redemption

Time” shall mean the effective time of the Subsequent Redemption, and the “Redemption Time” shall mean (i) with

respect to the Initial Redemption, the Initial Redemption Time and (ii) with respect to the Subsequent Redemption, the Subsequent

Redemption Time. |

| 5.3. | Each share of Series C Preferred Stock redeemed in any Redemption pursuant to this Section 5 shall be redeemed in consideration

for the right to receive an amount equal to $0.01 in cash for each ten whole shares of Series C Preferred Stock that are “beneficially

owned” by the “beneficial owner” (as such terms are defined below) thereof as of immediately prior to the applicable

Redemption Time and redeemed pursuant to such Redemption, payable upon the applicable Redemption Time; provided, however, that for the

avoidance of doubt, the redemption consideration in respect of the shares of Series C Preferred Stock (or fractions thereof) redeemed

in any Redemption pursuant to this Section 5: (x) shall entitle the former beneficial owners of less than ten whole shares of

Series C Preferred Stock redeemed in any Redemption to no cash payment in respect thereof and (y) shall, in the case of a former

beneficial owner of a number of shares of Series C Preferred Stock (or fractions thereof) redeemed pursuant to any Redemption that

is not equal to a whole number that is a multiple of ten, entitle such beneficial owner to the same cash payment, if any, in respect of

such Redemption as would have been payable in such Redemption to such beneficial owner if the number of shares (or fractions thereof)

beneficially owned by such beneficial owner and redeemed pursuant to such Redemption were rounded down to the nearest whole number that

is a multiple of ten (such, that for example, the former beneficial owner of 25 shares of Series C Preferred Stock redeemed pursuant

to any Redemption shall be entitled to receive the same cash payment in respect of such Redemption as would have been payable to the former

beneficial owner of 20 shares of Series C Preferred Stock redeemed pursuant to such Redemption). As used herein, “Person”

shall mean any individual, firm, corporation, partnership, limited liability company, trust or other entity, and shall include any successor

(by merger or otherwise) to such entity. As used herein, a Person shall be deemed the “beneficial owner” of, and shall

be deemed to “beneficially own,” any securities which such Person is deemed to beneficially own, directly or indirectly,

within the meaning of Rule l3d-3 of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended. |

| 5.4. | From and after the time at which any shares of Series C Preferred Stock are called for redemption (whether automatically or otherwise)

in accordance with Section 5.1 or Section 5.2, such shares of Series C Preferred Stock shall cease to be outstanding, and

the only right of the former holders of such shares of Series C Preferred Stock, as such, will be to receive the applicable redemption

price, if any. The shares of Series C Preferred Stock redeemed by the Corporation pursuant to this Certificate of Designation shall,

upon such redemption, be automatically retired and restored to the status of authorized but unissued shares of Preferred Stock. Notwithstanding

anything to the contrary herein or otherwise, and for the avoidance of doubt, any shares of Series C Preferred Stock (or fraction

thereof) that have been redeemed pursuant to an Initial Redemption shall not be deemed to be outstanding for the purpose of voting or

determining the number of votes entitled to vote on any matter submitted to stockholders (including the Share Increase Proposal, Voting

Standard Proposal, the Adjournment Proposal or any other matter brought before any meeting of stockholders held to vote on the Share Increase

Proposal or the Voting Standard Proposal) from and after the time of the Initial Redemption. Notice of any meeting of stockholders for

the submission to stockholders of any proposal to approve the Share Increase Proposal or the Voting Standard Proposal shall constitute

notice of a redemption of shares of Series C Preferred Stock pursuant to an Initial Redemption and result in the automatic redemption

of the applicable shares of Series C Preferred Stock (and/or fractions thereof) pursuant to the Initial Redemption at the Initial

Redemption Time pursuant to Section 5.1 hereof. Notice by the Corporation of the stockholders’ approval of the Share Increase

Proposal or the Voting Standard Proposal, whether by press release or by the filing of a Current Report on Form 8-K with the Securities

and Exchange Commission, shall constitute a notice of a redemption of shares of Series C Preferred Stock pursuant to a Subsequent

Redemption and result in the automatic redemption of the applicable shares of Series C Preferred Stock (and/or fractions thereof)

pursuant to the Subsequent Redemption at the Subsequent Redemption Time pursuant to Section 5.2 hereof. In connection with the filing

of this Certificate of Designation, the Corporation has set apart funds for payment for the redemption of all shares of Series C

Preferred Stock pursuant to the Redemptions and shall continue to keep such funds apart for such payment through the payment of the purchase

price for the redemption of all such shares. |

| 6. | Transfer. Shares of Series C Preferred Stock will be uncertificated and represented in book-entry form. No shares of Series C

Preferred Stock may be transferred by the holder thereof except in connection with a transfer by such holder of any shares of Common Stock

held thereby, in which case a number of one one-thousandths (1/1,000ths) of a share of Series C Preferred Stock equal to the number

of shares of Common Stock to be transferred by such holder shall be automatically transferred to the transferee of such shares of Common

Stock. Notice of the foregoing restrictions on transfer shall be given in accordance with Section 151 of the DGCL. |

| 7. | Fractional Shares. The Series C Preferred Stock may be issued in whole shares or in any fraction of a share that is one

one-thousandth (1/1,000th) of a share or any integral multiple of such fraction, which fractions shall entitle the holder, in proportion

to such holder’s fractional shares, to exercise voting rights, participate in distributions upon a Dissolution and have the benefit

of any other rights of holders of Series C Preferred Stock. |

| 8. | Severability. Whenever possible, each provision hereof shall be interpreted in a manner as to be effective and valid under

applicable law, but if any provision hereof is held to be prohibited by or invalid under applicable law, then such provision shall be

ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining

provisions hereof. |

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF, Ocugen, Inc.

has caused this Certificate of Designation of Series C Preferred Stock to be duly executed by the undersigned duly authorized officer

as of this 10th day of May, 2024.

| |

OCUGEN, INC. |

| |

|

|

| |

By: |

/s/ Shankar Musunuri |

| |

Name: |

Shankar Musunuri |

| |

Title: |

Chairman, Chief Executive Officer, & Co-Founder |

[Signature Page to the Certificate of

Designation of Series C Preferred Stock]

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

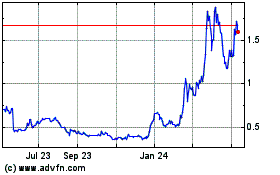

Ocugen (NASDAQ:OCGN)

Historical Stock Chart

From Oct 2024 to Nov 2024

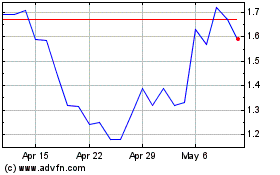

Ocugen (NASDAQ:OCGN)

Historical Stock Chart

From Nov 2023 to Nov 2024