Report of Foreign Issuer (6-k)

August 14 2020 - 4:10PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the period ended August 14, 2020

Commission File Number: 001-12033

|

Nymox Pharmaceutical Corporation

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l): ☐

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_____________

Item 1.01. Entry into Material Definitive Agreement.

On August 12, 2020 the Company entered into a placement agent agreement (the “Agreement”) with A.G.P./Alliance Global Partners (“A.G.P.”) relating to the Company’s registered direct offering of shares of the Company’s common stock (the “Offering”) to select investors (the “Investors”). Pursuant to the Agreement, the Company agreed to pay A.G.P. a cash fee of 7% of the gross proceeds from the Offering raised from Investors and to reimburse the A.G.P. for offering expenses and placement agent fees incurred in connection therewith.

In addition, on August 12, 2020, the Company and the Investors entered into a securities purchase agreement (the “Purchase Agreement”) relating to the issuance and sale of an aggregate of 3,600,000 shares of the Company’s common stock, no par value (the “Common Stock”) in the Offering (the “Shares”). The purchase price per share in the Offering was $2.50 for aggregate gross proceeds to the Company of approximately $9.0 million. The Purchase Agreement restricts the Company from issuing additional shares of Common Stock for a period of 90 days from the closing of the Offering, subject to certain exceptions.

The net proceeds to the Company from the Offering, after deducting placement agent fees and estimated Offering expenses, are expected to be approximately $8.2 million. The Offering closed on August 14, 2020.

The Company’s common stock is registered under the Securities Act of 1933, as amended (the “Securities Act”), on the Company’s Registration Statement on Form F-3 (Registration No. 333-237564), previously filed with the Securities and Exchange Commission and declared effective on May 12, 2020.

The representations, warranties and covenants contained in the Purchase Agreement were made solely for the benefit of the parties to the Purchase Agreement. In addition, such representations, warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Purchase Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by stockholders of, or other investors in, the Company. Accordingly, the Purchase Agreement is included with this filing only to provide investors with information regarding the terms of the transactions. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures.

The foregoing description of the Letter Agreement and the Purchase Agreement are subject to, and qualified in their entirety by, the forms of Letter Agreement and Purchase Agreement attached hereto as Exhibits 10.1 and 10.2, respectively, and incorporated herein by reference. Cutler Law Group P.C., counsel to the Company, delivered an opinion as to legality of the issuance of the shares in the Offering, a copy of which is attached hereto as Exhibit 5.1 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On August 14, 2020, the Company issued a press release with respect to the information set forth above. A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference. The disclosure in this Item 7.01 (including the exhibit) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated by reference in any of the Company’s filings under the Securities Act or the Exchange Act, except to the extent, if any, expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

NYMOX PHARMACEUTICAL CORPORATION

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

/s/ Paul Averback, MD

|

|

|

|

|

Paul Averback, MD

|

|

|

|

|

President and Chief Executive Officer

|

|

Date: August 14, 2020

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Aug 2024 to Sep 2024

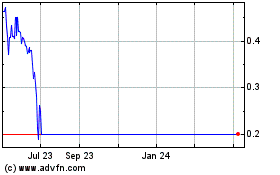

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Sep 2023 to Sep 2024