SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

Under the Securities

Exchange Act of 1934

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT TO

§240.13d-1(a) AND

AMENDMENTS THERETO

FILED PURSUANT TO §240.13d-2(a)

NUTRIBAND INC.

(Name of Issuer)

Common Stock, par value

$0.001 per share

(Title of Class of

Securities)

67092M208

(CUSIP Number)

Tel: (407) 377-6695

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

December 21, 2023

(Date of Event which

Requires Filing of this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check

the following box. ☐

Note. Schedules filed in paper

format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other

parties to whom copies are to be sent.

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to

all other provisions of the Act (however, see the Notes).

| CUSIP No. 67092M208 | | Schedule 13D | | Page 2 of 6 Pages |

| 1 |

|

NAME OF REPORTING PERSON

T.I.I. - JETSERVICES, LDA |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐ (b): ☒ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

On July 17, 2023, Nutriband Inc. (the “Issuer”) entered

into an amended Credit Line Note (the “Note”) Agreement with the Reporting Person, for an increased $5,000,000 credit

line facility Note (replacing the $2,000,000 credit line facility with the same lender that the Issuer entered into with the Reporting

Person on March 17, 2023). Outstanding advances under the Note bear interest at 7% per annum. The Note is due and payable in full

on March 19, 2026. Interest is payable annually on December 31 of each year during the term of the Note. During the nine months ended

October 31, 2023, the Issuer was advanced $2,000,000 on the Note.

On December 21, 2023, the Issuer issued 1,026,720 shares of common

stock upon conversion of the $2,000,000 principal and $53,440 accrued interest of the Credit Line Note held by the Reporting Person at

a conversion price of $2.00 per share.

|

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Portugal |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,347,524* |

| |

8 |

|

SHARED VOTING POWER

-0- |

| |

9 |

|

SOLE DISPOSITIVE POWER

1,347,524 * |

| |

10 |

|

SHARED DISPOSITIVE POWER

-0- |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,347,524* |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.92%* |

| 14 |

|

TYPE OF REPORTING PERSON

CO (Corporation) |

| * | The

calculation is based on 8,459,870 shares of Common Stock outstanding as of December 21, 2023. |

| CUSIP No. 67092M208 | | Schedule 13D | | Page 3 of 6 Pages |

| Item 1. |

Security and Issuer |

This statement on Schedule 13D relates to shares (the “Shares”)

of the common stock, par value $0.001 per share (the “common stock”) of Nutriband

Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 121

South Orange Ave., Orlando, FL 32801.

| Item 2. |

Identity and Background |

(a) This statement on Schedule 13D is being

filed by TII Jet Services, LDA, a Portugal limited company (the “Reporting Person”). The Reporting Person is

filing this Schedule 13D to report an increase in the number of shares of common stock of the Issuer beneficially owned by the Reporting

Person as a result of conversion of a loan made pursuant to the Note held by the Reporting Person into shares of common stock of the Issuer,

as reported in the Issuer’s Current Report on Form 8-K filed with the SEC on December 29, 2023.

(b) The address of the principal office of

the Reporting Person is Rua das Ladieras 5, Porto Santo, Portugal, 9400-131.

(c) The name, residence or business address,

present principal occupation or employment and citizenship (or state of organization) of each director, executive officer, trustees, general

partner, managing member, control person of the Reporting Persons are listed on Schedule I hereto. The principal business of the Reporting

Person is aviation services.

(d) During the last five years, neither the

Reporting Person nor any of the persons named in Schedule I has been convicted in a criminal proceeding (excluding traffic violations

and similar misdemeanors).

(e) During the last five years, neither the

Reporting Person nor any of the persons named in Schedule I was a party to a civil proceeding of a judicial or administrative body of

competent jurisdiction and as a result of such proceeding has been or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, U.S. federal or state securities laws or finding any violations with

respect to such laws.

| Item 3. |

Source and Amount of Funds or Other Consideration |

The Reporting Person purchased the 1,026,720 shares of common stock

of the Issuer through conversion at the rate of $2.00 per share of the outstanding principal of $2,000,000 and accrued interest of $53,440

at December 21, 2023 on the Note held by the Reporting Person in the ordinary course of its business as a holder of debt of the Issuer

(the “Conversion”). The purchase price paid by the Reporting Person for the issued conversion shares was $2.00 per share.

| Item 4. |

Purpose of Transaction |

The Reporting Person expects to review from

time to time its investment in the Issuer and may, depending on the market and other conditions: (i) convert future principal amounts added

to the Note, (ii) purchase additional shares of common stock or equity security of the Issuer, and (iii) sell all or a portion

of the shares of common stock of the Issuer now beneficially owned or related derivatives hereafter acquired by it. Except as set forth

in this Item 4, the Reporting Person has no present plans or proposals which relate to or would result in any of the matters set forth

in paragraphs (a) through (j) of Item 4 of Schedule 13D.

| CUSIP No. 67092M208 | | Schedule 13D | | Page 4 of 6 Pages |

| Item 5. |

Interest in Securities of the Issuer |

The percentage of the Issuer’s Common Stock reported owned by

the Reporting Person is based on 8,459,720 shares of Common Stock of the Issuer outstanding as of December 21, 2023, and upon 1,026,720

shares issued upon conversion of $2,000,000 of principal and $53,440 of accrued interest on the Note at December 21, 2023 (the “Conversion”),

and 320,814 shares of common stock held by Reporting Person at that date. In addition to the shares of common stock acquired in the Conversion

described in this Schedule, in October 2021, the Reporting Person converted a note of the Issuer into 17,182 shares of common stock, and

over time has purchased 303,632 shares in the open market.

The information contained in rows 7, 8, 9,

10, 11 and 13 on the cover page of this statement on Schedule 13D is hereby incorporated by reference.

No person other than the Reporting Person

is known to have the power to direct the receipt of dividends from, or proceeds from the sale of, the Shares.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

None.

| Item 7. |

Material to Be Filed as Exhibits |

| CUSIP No. 67092M208 | | Schedule 13D | | Page 5 of 6 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement on Schedule 13D is true, complete and correct.

Dated: January 23, 2024

| |

TII Jet Services, LDA |

| |

|

| |

/s/ Viorica Carlig |

| CUSIP No. 67092M208 | | Schedule 13D | | Page 6 of 6 Pages |

SCHEDULE I

The name, principal occupation or employment,

business address, citizenship (or state of organization) and shares of Common Stock of the Issuer beneficially owned by each manager,

executive officer, director or control person of the Reporting Person are set forth below.

| Name | |

Present Principal Occupation or Employment | |

Business

Address | |

Citizenship | |

Beneficial

Ownership

of

Shares | |

| Vitalie Botgros | |

Mr. Botgros is the ultimate beneficial owner of shares of common stock

of Issuer owned by the Reporting Person. Mr. Botgros is able to exercise control of the Reporting Person through ownership of 100% of

the outstanding shares of Nociata Holding Limited, a Cyprus Limited company, that in turn owns all of the outstanding shares of the Reporting

Person. | |

(1) | |

Romania | |

| 1,347,524 | (3) |

| | |

| |

| |

| |

| | |

| Viorica Carlig | |

President of Reporting Person and President of Nociata Holding Limited. (2) | |

(1) | |

Portugal | |

| 0 | |

| (1) | The

business address of these persons is Rua das Ladieras 5, Porto Santo, Portugal 9400-131. |

| (2) | Ms.

Carlig disclaims beneficial ownership of these shares of the Issuer’s common stock held by the Reporting Person. |

| (3) | Mr.

Botgros is the beneficial owner of 100% of the shares of common stock of the Issuer held by the Reporting Person. |

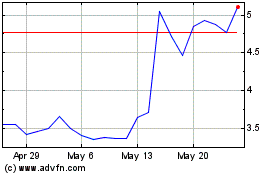

Nutriband (NASDAQ:NTRB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nutriband (NASDAQ:NTRB)

Historical Stock Chart

From Nov 2023 to Nov 2024