0001719406

false

0001719406

2023-07-07

2023-07-07

0001719406

us-gaap:CommonStockMember

2023-07-07

2023-07-07

0001719406

us-gaap:WarrantMember

2023-07-07

2023-07-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported) July 7, 2023

NRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38302 |

|

82-2844431 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

1201 Orange Street,

Suite 600

Wilmington, Delaware |

|

19801 |

| (Address of principal executive offices) |

|

(Zip Code) |

(484) 254-6134

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

|

NRXP |

|

The Nasdaq Stock Market LLC |

| Warrants to purchase one share of Common Stock |

|

NRXPW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On July 7, 2023, NRX Pharmaceuticals, Inc.

(the “Company”) entered into Amendment #2 to Convertible Promissory Note (the “Second Amendment”), with

Streeterville Capital, LLC (the “Streeterville”). Pursuant to the Second Amendment, the Company and Streeterville agreed

to further amend the terms of that certain convertible promissory note dated November 4, 2022 in the original principal amount of

$11,020,000 (the “Original Note”), as amended by Amendment to Convertible Promissory Note dated March 30, 2023 (as

amended, the “Note”). In accordance with the Second Amendment, the Company and Streeterville agreed to amend the

redemption provisions of the Note. In particular, the Company agreed to pay Streeterville an amount in cash equal to $1,800,000 on

or before July 10, 2023, which amount was paid on July 10, 2023. In addition, beginning on or before July 31, 2023, on or before the

last day of each month until December 31, 2023 (the “Minimum Payment Period”), the Company shall pay Streeterville an

amount equal to $400,000 in cash (a “Minimum Payment”), less any amount satisfied by the delivery of Redemption

Conversion Shares (as defined and discussed below). Notwithstanding the foregoing, Streeterville may also submit a request for

redemption of up to an aggregate of $1,000,000 per month (the “Maximum Monthly Redemption Amount” and, together with the

Minimum Payment Amount, the “Redemption Amounts”) in accordance with the terms of the Note. However, the portion of each

Minimum Payment that is not satisfied by the delivery of Redemption Conversion Shares is the maximum amount of cash the Company will

be required to pay in accordance with the Second Amendment during the Minimum Payment Period. The redemption of the Maximum Monthly

Redemption Amount in excess of the Minimum Amount may be satisfied by the delivery of additional Redemption Conversion Shares.

During the Minimum Payment Period, the Company

is permitted to pay the Redemption Amounts in the form of shares of common stock of the Company (the “Redemption Conversion Shares”)

calculated on the basis of the Redemption Conversion Price (as defined in the Note) without regard to the existence of an Equity Conditions

Failure. Moreover, the Redemption Premium (as defined in the Note) will continue to apply to the Redemption Amounts.

The foregoing description of the Second Amendment

does not purport to be complete and is qualified in its entirety by the full text of the Second Amendment attached hereto as Exhibit

10.1.

Item 3.01. Notice of Delisting or Failure to

Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 20, 2023, the Company

received a written notification (the “Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”) indicating that the

Company was not in compliance with Nasdaq Listing Rule 5450(b)(2)(A) – Market Value of Listed Securities (“MVLS”) because

the Company has not maintained a minimum MVLS of $50,000,000 for the last thirty-three (33) consecutive business days.

Nasdaq’s Notice has

no immediate effect on the listing of the common stock on The Nasdaq Global Market and, at this time, the common stock will continue to

trade on The Nasdaq Global Market under the symbol “NRXP”.

Pursuant to Nasdaq Listing

Rule 5810(c)(3)(C), the Company has been provided an initial compliance period of 180 calendar days, or until January 22, 2024, to regain

compliance with the MVLS requirement. To regain compliance, the Company’s MVLS must meet or exceed $50,000,000 for a minimum period

of ten consecutive business days prior to January 22, 2024.

If the Company does not regain

compliance within the allotted compliance period Nasdaq will provide notice that the Company’s shares of common stock will be subject

to delisting and may potentially be traded on the Over-the-Counter market thereafter.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

NRX Pharmaceuticals, Inc. |

| |

|

| Date: July 28, 2023 |

/s/ Stephen Willard |

| |

Stephen Willard |

| |

Acting General Counsel |

Exhibit 10.1

AMENDMENT #2 TO CONVERTIBLE PROMISSORY NOTE

This Amendment #2 to Convertible

Promissory Note (this “Amendment”) is entered into as of July 7, 2023, by and between Streeterville

Capital, LLC, a Utah limited liability company (“Lender”), and NRX Pharmaceuticals, Inc.,

a Delaware corporation (“Borrower”). Capitalized terms used in this Amendment without definition shall have the meanings

given to them in the Note (as defined below) and Amendment #1 (as defined below).

A. Borrower

previously issued to Lender that certain Convertible Promissory Note dated November 4, 2022 in the principal amount of $11,020,000.00

(the “Note”).

B. Pursuant

to that certain Amendment to Convertible Promissory Note dated March 30, 2023 (“Amendment #1,” and together with

this Amendment, the “Amendments”), Borrower and Lender amended the Note to address ownership limitation issues.

C. Lender

and Borrower have agreed, subject to the terms, conditions and understandings expressed in this Amendment, to amend the Note and Amendment

#1.

NOW, THEREFORE, for good and

valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1. Recitals.

Each of the parties hereto acknowledges and agrees that the recitals set forth above in this Amendment are true and accurate and are hereby

incorporated into and made a part of this Amendment.

2. Cash

Payment. Notwithstanding the terms and conditions of the Note and Amendment #1, Borrower covenants and agrees to pay to Lender an

amount in cash equal to $1,800,000.00 on or before July 10, 2023. Borrower shall make such payment to Lender via wire to an account

designated in writing by Lender.

3. Equity

Conditions. Notwithstanding the terms and conditions of the Note and Amendment #1, Lender agrees that from the date hereof until December 31,

2023, Borrower may pay any Redemption Amount via a Redemption Conversion, even if an Equity Conditions Failure exists.

4. Minimum

Debt Service Payment; Maximum Monthly Redemption Amount; Waiver. Notwithstanding the terms and conditions of the Note and Amendment

#1, Borrower shall, beginning on or before July 31, 2023, and on or before the last day of each month thereafter until December 31,

2023 (the “Minimum Payment Period”), pay to Lender an amount equal to $400,000.00 in cash, less any Redemption Amount

satisfied in Redemption Conversion Shares for such month (each, a “Minimum Payment”). For any portion of a Redemption

Amount to be deemed satisfied in Redemption Conversion Shares, such shares must have been deposited and cleared for resale in Lender’s

brokerage account. For the avoidance of doubt, (i) Borrower shall make six (6) separate Minimum Payments to Lender in the amount

of $400,000.00 under this Section 4 during the Minimum Payment Period, (ii) that portion of each Minimum Payment that is not

satisfied in Redemption Conversion Shares is the maximum amount of cash Borrower shall be required to pay in fulfillment of its obligations

under this Section 4, and (iii) Lender may still submit Redemption Notices during the Minimum Payment Period for any Redemption

Amount, up to the Maximum Monthly Redemption Amount, in excess of the Minimum Payment, which amount Borrower may satisfy in Redemption

Conversion Shares. Moreover, Lender hereby waives the application of the Trigger Effect and any of the other remedies set forth in Section 4

of the Note, including without limitation any Default Interest or other fees and expenses applicable to Trigger Events or Events of Default

that may have heretofore occurred (the “Waiver”). Notwithstanding the foregoing, the Waiver shall not apply to any

Trigger Events or Events of Default occurring after the date of this Amendment.

5. Redemption

Premium. For the avoidance of doubt, all Minimum Payments and any other payment of any Redemption Amount in cash, including the required

cash payment set forth in Section 2 hereof, shall be subject to the Redemption Premium.

6. Representations

and Warranties. In order to induce Lender to enter into this Amendment, Borrower, for itself, and for its affiliates, successors and

assigns, hereby acknowledges, represents, warrants and agrees as follows:

(a) Borrower

has full power and authority to enter into this Amendment and to incur and perform all obligations and covenants contained herein, all

of which have been duly authorized by all proper and necessary action. No consent, approval, filing or registration with or notice to

any governmental authority is required as a condition to the validity of this Amendment or the performance of any of the obligations of

Borrower hereunder.

(b) There

is no fact known to Borrower or which should be known to Borrower which Borrower has not disclosed to Lender on or prior to the date of

this Amendment which would or could reasonably be expected to materially and adversely affect the understanding of Lender expressed in

this Amendment or any representation, warranty, or recital contained in this Amendment.

(c) Except

as expressly set forth in this Amendment, Borrower acknowledges and agrees that neither the execution and delivery of this Amendment nor

any of the terms, provisions, covenants, or agreements contained in this Amendment shall in any manner release, impair, lessen, modify,

waive, or otherwise affect the liability and obligations of Borrower under the Note or any other transaction documents entered into in

connection with the Note (the “Transaction Documents”).

(d) Borrower

has no defenses, affirmative or otherwise, rights of setoff, rights of recoupment, claims, counterclaims, actions or causes of action

of any kind or nature whatsoever against Lender, directly or indirectly, arising out of, based upon, or in any manner connected with,

the transactions contemplated hereby, whether known or unknown, which occurred, existed, was taken, permitted, or begun prior to the execution

of this Amendment and occurred, existed, was taken, permitted or begun in accordance with, pursuant to, or by virtue of any of the terms

or conditions of the Transaction Documents. To the extent any such defenses, affirmative or otherwise, rights of setoff, rights of recoupment,

claims, counterclaims, actions or causes of action exist or existed, such defenses, rights, claims, counterclaims, actions and causes

of action are hereby waived, discharged and released. Borrower hereby acknowledges and agrees that the execution of this Amendment by

Lender shall not constitute an acknowledgment of or admission by Lender of the existence of any claims or of liability for any matter

or precedent upon which any claim or liability may be asserted.

(e) Each

of Borrower and Lender represents and warrants that as of the date hereof no Events of Default or other material breaches exist under

the Transaction Documents or Amendment #1 or have occurred prior to the date hereof.

7. Certain

Acknowledgments. Each of the parties acknowledges and agrees that no property or cash consideration of any kind whatsoever has been

or shall be given by Lender to Borrower in connection with this Amendment.

8. Other

Terms Unchanged. The Note and Amendment #1, as amended by this Amendment, remain and continue in full force and effect, constitute

legal, valid, and binding obligations of each of the parties, and are in all respects agreed to, ratified, and confirmed. Any reference

to the Note after the date of this Amendment is deemed to be a reference to the Note and Amendment #1 as amended by this Amendment. If

there is a conflict between the terms of this Amendment and the Note or Amendment #1, the terms of this Amendment shall control. Except

as otherwise set forth herein, no forbearance or waiver may be implied by this Amendment. Except as expressly set forth herein, the execution,

delivery, and performance of this Amendment shall not operate as a waiver of, or as an amendment to, any right, power, or remedy of Lender

under the Note or Amendment #1, as in effect prior to the date hereof. For the avoidance of doubt, this Amendment shall be subject to

the governing law, venue, and Arbitration Provisions, as set forth in the Note.

9. No

Reliance. Borrower acknowledges and agrees that neither Lender nor any of its officers, directors, members, managers, equity holders,

representatives or agents has made any representations or warranties to Borrower or any of its agents, representatives, officers, directors,

or employees except as expressly set forth in this Amendment and the Transaction Documents and, in making its decision to enter into the

transactions contemplated by this Amendment, Borrower is not relying on any representation, warranty, covenant or promise of Lender or

its officers, directors, members, managers, equity holders, agents or representatives other than as set forth in this Amendment.

10. Counterparts.

This Amendment may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall

constitute one instrument. The parties hereto confirm that any electronic copy of another party’s executed counterpart of this Amendment

(or such party’s signature page thereof) will be deemed to be an executed original thereof.

11. Further

Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall execute

and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to

carry out the intent and accomplish the purposes of this Amendment and the consummation of the transactions contemplated hereby.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned have executed

this Amendment as of the date set forth above.

| |

LENDER: |

| |

|

| |

Streeterville Capital,

LLC |

| |

|

| |

By: |

|

| |

|

John M. Fife, President |

| |

|

| |

BORROWER: |

| |

|

| |

NRX Pharmaceuticals, Inc. |

| |

|

| |

By: |

|

| |

|

Stephen Willard, CEO |

[Signature Page to Amendment

#2 to Convertible Promissory Note]

v3.23.2

Cover

|

Jul. 07, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 07, 2023

|

| Entity File Number |

001-38302

|

| Entity Registrant Name |

NRX PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001719406

|

| Entity Tax Identification Number |

82-2844431

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1201 Orange Street

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Wilmington

|

| Entity Address, State or Province |

DE

|

| Entity Address, Postal Zip Code |

19801

|

| City Area Code |

484

|

| Local Phone Number |

254-6134

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

NRXP

|

| Security Exchange Name |

NASDAQ

|

| Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of Common Stock

|

| Trading Symbol |

NRXPW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

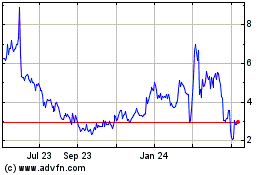

NRX Pharmaceuticals (NASDAQ:NRXP)

Historical Stock Chart

From Jun 2024 to Jul 2024

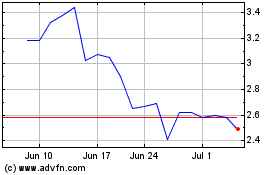

NRX Pharmaceuticals (NASDAQ:NRXP)

Historical Stock Chart

From Jul 2023 to Jul 2024