Nkarta Reports Fourth Quarter and Full Year 2023 Financial Results and Corporate Highlights

March 21 2024 - 4:01PM

Nkarta, Inc. (Nasdaq: NKTX), a clinical-stage biopharmaceutical

company developing engineered natural killer (NK) cell therapies,

today reported financial results for the fourth quarter and year

ended December 31, 2023.

“Patients with severe autoimmune diseases deserve novel,

effective treatments,” noted Paul J. Hastings, President and CEO of

Nkarta. “Recent academic studies have shown that CD19-directed cell

therapy has the promise to be truly transformative, and we believe

that NKX019 may replicate these early results with superior safety

and accessibility. Our approach leverages the potential advantages

of NK cells, including fludarabine-free lymphodepletion, deep and

rapid B-cell depletion, and the added utility of on-demand dosing.

Work with investigators, sites and patients is advancing rapidly,

and we remain on track to initiate dosing in our clinical trial of

NKX019 in refractory lupus nephritis in the first half of

2024.”

Hastings continued, “The potential of NKX019 to transform the

treatment landscape in autoimmune disease demands our focus. To

support our early-mover advantage and advance this program, Nkarta

has deprioritized the development of NKX101. This follows a planned

interim evaluation of Phase 1 data from NKX101 that included 14 new

patients with AML. While the safety profile remained encouraging,

the response rate was meaningfully lower than that from the first 6

previously reported patients. We see promise in NKX101, but before

pursuing further development or significant investment, we will

evaluate options for optimizing future study design, dosing

schedule and manufacturing. We are grateful for the support of the

NKX101 investigators as well as their patients for their commitment

and trust.”

NKX019 in autoimmune disease

- In October 2023, Nkarta announced the expansion of its pipeline

to include autoimmune disease following the clearance by FDA of the

IND application for NKX019 in lupus nephritis (LN).

- The multi-center, open label, dose escalation clinical trial

will assess the safety and clinical activity of NKX019 in up to 12

patients with refractory LN. Patients will receive a three-dose

cycle of NKX019 at 1 billion or 1.5 billion cells per dose

following lymphodepletion (LD) with single agent cyclophosphamide

(cy), an agent with an established safety profile in systemic lupus

erythematosus (SLE) and LN.

- Nkarta plans to dose the first patient in the LN study in the

first half of 2024.

- NKX019 is highly active against B cells from patients with

multiple autoimmune diseases, and Nkarta is evaluating additional

indications for potential clinical investigation with NKX019.

NKX019 in non-Hodgkin lymphoma (NHL)

- In October 2023, Nkarta announced a new cohort in its Phase 1

study of NKX019 in relapsed/refractory (r/r) NHL. The cohort (n=6)

introduces a compressed dosing schedule, where patients receive

NKX019 doses on Days 0, 3 and 7 following LD with fludarabine (flu)

and cy. This regimen is designed to intensify exposure of NKX019 by

dosing closer to LD. In addition, patients with ongoing cytopenias

have the potential to receive NKX019 following LD with cy

alone.

- Nkarta expects to announce preliminary data from the NKX019

compressed dosing cohort in mid-2024.

- Nkarta is no longer enrolling patients in the cohorts in which

NKX019 was being administered on Days 0, 7 and 14 following LD.

Future development of NKX019 in the NHL indication will be

contingent on favorable outcomes from the compressed dosing

cohort.

- In June 2023, Nkarta presented preliminary clinical data based

on a November 2022 data cut-off from its Phase 1 clinical trial of

NKX019 in patients with r/r NHL at the annual meeting of the

European Hematology Association and the International Conference on

Malignant Lymphoma. 7 of 10 patients achieved complete response

(70% CR rate) following treatment with NKX019 monotherapy at

highest dose levels.

- In January 2024, Nkarta reported that 4 of 4 patients with r/r

NHL that relapsed after achieving CR following treatment with

NKX019 were again able to achieve CR after re-treatment with

NKX019. These outcomes suggest that relapse, when it occurs, may be

attributable to mechanisms of NKX019 exposure and not resistance to

NKX019.

NKX101 in acute myeloid leukemia (AML)

- Nkarta announced today that it has closed patient enrollment in

its clinical trial of NKX101 and deprioritized the program as part

of a pipeline realignment that directs primary resources to its

lead pipeline program, NKX019, for the treatment of autoimmune

disease. This follows a recent review of preliminary safety and

response data from patients with r/r AML that received NKX101 after

LD comprising fludarabine and cytarabine (flu/Ara-C). The aggregate

CR/CRi rate (5 of 20 patients) was lower than what had been

observed in the first 6 patients in the cohort. The safety profile

of NKX101 was consistent with previously reported data.

- This announcement reflects the NKX101 clinical update that

Nkarta had planned to report in the first half of 2024. Nkarta

plans to present these data at a future medical conference.

- In June 2023, Nkarta reported updated clinical data from its

Phase 1 clinical trial evaluating NKX101 in patients with relapsed

or refractory (r/r) AML. In the first 6 patients that received

NKX101 after flu/Ara-C LD, 4 of 6 achieved CR/CRi as of the data

cut-off on June 10, 2023. In a follow-up report on these 6 patients

presented at the annual meeting of the American Society of

Hematology, of those patients who achieved CR/CRi, 3 of 4 remained

in CR/CRi at 4 months as of the data cut off on October 31,

2023.

Fourth Quarter and Full Year 2023 Financial

Highlights

- As of December 31, 2023, Nkarta had cash, cash equivalents, and

investments of $250.9 million, including restricted cash of $2.7

million.

- Research and development (R&D) expenses were $96.8 million

for the full year 2023 and $23.3 million for the fourth quarter of

2023. Non-cash stock-based compensation expense included in R&D

expense was $8.0 million for the full year 2023 and $1.7 million

for the fourth quarter of 2023.

- General and administrative (G&A) expenses were $34.9

million for the full year 2023 and $7.9 million for the fourth

quarter of 2023. Non-cash stock-based compensation expense included

in G&A expense was $9.2 million for the full year 2023 and $1.8

million for the fourth quarter of 2023.

- Net loss was $117.5 million, or $2.40 per basic and diluted

share, for the full year 2023. This net loss includes non-cash

charges of $26.5 million that consisted primarily of share-based

compensation, depreciation, and an impairment charge against

right-of-use assets that Nkarta plans to sublease. Net loss was

$27.8 million, or $0.57 per basic and diluted share, for the fourth

quarter of 2023.

Financial Guidance

- Nkarta expects its current cash and cash equivalents will be

sufficient to fund its current operating plan into 2026.

About NKX019NKX019 is an allogeneic,

cryopreserved, off-the-shelf immunotherapy candidate that uses

natural killer (NK) cells derived from the peripheral blood of

healthy adult donors. It is engineered with a humanized

CD19-directed CAR for enhanced cell targeting and a proprietary,

membrane-bound form of interleukin-15 (IL-15) for greater

persistence and activity without exogenous cytokine support. CD19

is a biomarker for normal B cells as well as those implicated in

autoimmune disease and B cell-derived malignancies.

About NKX101NKX101 is an allogeneic,

cryopreserved, off-the-shelf cancer immunotherapy candidate that

uses natural killer (NK) cells derived from the peripheral blood of

healthy donors. It is engineered with a chimeric antigen receptor

(CAR) targeting NKG2D ligands on tumor cells. NKG2D, a key

activating receptor found on naturally occurring NK cells, induces

a cell-killing immune response through the detection of stress

ligands that are widely expressed on cancer cells. NKX101 is also

engineered with a membrane-bound form of interleukin-15 (IL-15) for

greater persistence and activity without exogenous cytokine

support.

About NkartaNkarta is a clinical-stage

biotechnology company advancing the development of allogeneic,

off-the-shelf natural killer (NK) cell therapies. By combining its

cell expansion and cryopreservation platform with proprietary cell

engineering technologies and CRISPR-based genome engineering

capabilities, Nkarta is building a pipeline of future cell

therapies engineered for deep therapeutic activity and intended for

broad access in the outpatient treatment setting. For more

information, please visit the company’s website at

www.nkartatx.com.

Cautionary Note on Forward-Looking Statements

Statements contained in this press release regarding matters that

are not historical facts are “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended. Words such as “anticipates,” “believes,”

“expects,” “intends,” “plans,” “potential,” “projects,” “would” and

“future” or similar expressions are intended to identify

forward-looking statements. Examples of these forward-looking

statements include, but are not limited to, statements concerning

Nkarta’s expectations regarding any or all of the following:

Nkarta’s position, plans, strategies, and timelines for the

continued and future clinical development and commercial potential

of its product candidates, including NKX019 and NKX101, and for the

outcomes of realignment of Nkarta’s pipeline; the therapeutic

potential, accessibility, tolerability, advantages, and safety

profile of NK cell therapies, including NKX019 for the treatment of

autoimmune diseases, such as LN, and NHL, and NKX101 for the

treatment of AML; plans and timelines for the future availability

and disclosure of NKX019 clinical data or other clinical updates;

and Nkarta’s expected cash runway. Interim clinical data for NKX019

and NKX101 included in this press release are subject to the risk

that one or more of the clinical outcomes may materially change as

patient enrollment continues and more data on existing patients

become available.

Because such statements are subject to risks and uncertainties,

actual results may differ materially from those expressed or

implied by such forward-looking statements. These risks and

uncertainties include, among others: Nkarta’s limited operating

history and historical losses; Nkarta’s lack of any products

approved for sale and its ability to achieve profitability; the

risk that the results of preclinical studies and early-stage

clinical trials may not be predictive of future results; Nkarta’s

ability to raise additional funding to complete the development and

any commercialization of its product candidates; Nkarta’s

dependence on the clinical success of NKX019; that Nkarta may be

delayed in initiating, enrolling or completing its clinical trials;

competition from third parties that are developing products for

similar uses; Nkarta’s ability to obtain, maintain and protect its

intellectual property; Nkarta’s dependence on third parties in

connection with manufacturing, clinical trials and pre-clinical

studies; and the complexity of the manufacturing process for CAR NK

cell therapies.

These and other risks and uncertainties are described more fully

in Nkarta’s filings with the Securities and Exchange Commission

(“SEC”), including the “Risk Factors” section of Nkarta’s Quarterly

Report on Form 10-Q for the quarter ended September 30, 2023, filed

with the SEC on November 9, 2023, and Nkarta’s other documents

subsequently filed with or furnished to the SEC. All

forward-looking statements contained in this press release speak

only as of the date on which they were made. Except to the extent

required by law, Nkarta undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made.

|

|

|

Nkarta, Inc.Condensed Statements of

Operations(in thousands, except share and per

share data)(Unaudited) |

|

|

|

|

|

Three Months

EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

23,322 |

|

|

|

26,845 |

|

|

|

96,773 |

|

|

|

90,897 |

|

|

General and administrative |

|

|

7,863 |

|

|

|

8,138 |

|

|

|

34,877 |

|

|

|

28,058 |

|

| Total operating expenses |

|

|

31,185 |

|

|

|

34,983 |

|

|

|

131,650 |

|

|

|

118,955 |

|

| Loss from operations |

|

|

(31,185 |

) |

|

|

(34,983 |

) |

|

|

(131,650 |

) |

|

|

(118,955 |

) |

| Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

3,456 |

|

|

|

2,890 |

|

|

|

14,107 |

|

|

|

5,588 |

|

|

Other income (expense), net |

|

|

(25 |

) |

|

|

(489 |

) |

|

|

42 |

|

|

|

(470 |

) |

| Total other income, net |

|

|

3,431 |

|

|

|

2,401 |

|

|

|

14,149 |

|

|

|

5,118 |

|

| Net loss |

|

$ |

(27,754 |

) |

|

$ |

(32,582 |

) |

|

$ |

(117,501 |

) |

|

$ |

(113,837 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and

diluted |

|

$ |

(0.57 |

) |

|

$ |

(0.67 |

) |

|

$ |

(2.40 |

) |

|

$ |

(2.61 |

) |

| Weighted average shares used

to compute net loss per share, basic and diluted |

|

|

49,100,140 |

|

|

|

48,833,577 |

|

|

|

49,014,300 |

|

|

|

43,631,722 |

|

|

|

|

Nkarta, Inc.Condensed Balance

Sheets(in

thousands)(Unaudited) |

|

|

|

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

Cash, cash equivalents, restricted cash and short-term

investments |

|

$ |

250,932 |

|

|

$ |

354,886 |

|

| Property and equipment, net |

|

|

79,326 |

|

|

|

61,908 |

|

| Operating lease right-of-use

assets |

|

|

39,949 |

|

|

|

45,749 |

|

| Other assets |

|

|

8,678 |

|

|

|

10,395 |

|

|

Total assets |

|

$ |

378,885 |

|

|

$ |

472,938 |

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

|

| Accounts payable, accrued and

other liabilities |

|

$ |

17,261 |

|

|

$ |

17,797 |

|

| Operating lease liabilities |

|

|

88,339 |

|

|

|

82,934 |

|

|

Total liabilities |

|

|

105,600 |

|

|

|

100,731 |

|

| Stockholders’ equity |

|

|

273,285 |

|

|

|

372,207 |

|

|

Total liabilities and stockholders' equity |

|

$ |

378,885 |

|

|

$ |

472,938 |

|

|

|

Nkarta Media/Investor Contact:Greg MannNkarta,

Inc.gmann@nkartatx.com

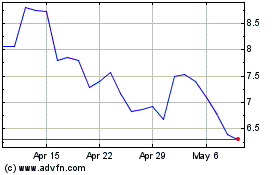

Nkarta (NASDAQ:NKTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nkarta (NASDAQ:NKTX)

Historical Stock Chart

From Dec 2023 to Dec 2024