0001512228

false

A1

0001512228

2023-09-07

2023-09-07

0001512228

NB:CommonSharesWithoutParValueMember

2023-09-07

2023-09-07

0001512228

NB:WarrantsEachExercisableFor1.11829212CommonSharesMember

2023-09-07

2023-09-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): September 7, 2023

NioCorp Developments Ltd.

(Exact name of registrant as specified in its charter)

British Columbia, Canada

(State or other jurisdiction

of incorporation) |

000-55710

(Commission File Number) |

(IRS Employer

Identification No.) |

7000 South Yosemite Street, Suite 115

Centennial, Colorado 80112

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area

code: (720) 639-4647

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares, without par value |

NB |

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for 1.11829212 Common Shares |

NIOBW |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

On September 7, 2023, NioCorp Developments Ltd. (“NioCorp”

or the “Company”) issued a press release (the “Press Release”) announcing that NioCorp has delivered an Advance

Notice pursuant to the Standby Equity Purchase Agreement, dated January 26, 2023 (the “Standby Equity Purchase Agreement”)

requesting the purchase of shares (the “Advance Shares”) of the Company’s common shares, without par value.

A copy of the Press Release is filed as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated herein by reference.

No Offer or Solicitation

This Current Report on Form 8-K, the Press Release and the information

contained herein and therein do not constitute an offer to sell or the solicitation of an offer to buy any securities. The Advance Shares

are being offered and sold in reliance on the exemption from registration set forth in Section 4(a)(2) of the Securities Act of 1933 (the

“Securities Act”). The Advance Shares have not been registered under the Securities Act, or the securities laws of any state

or other jurisdiction, and may not be offered or sold in the United States without registration or an applicable exemption from the registration

requirements of the Securities Act and applicable state securities or blue sky laws and foreign securities laws. In Canada, no offering

of securities shall be made except by means of a prospectus in accordance with the requirements of applicable Canadian securities laws

or an exemption therefrom. Neither this Current Report on Form 8-K nor the Press Release is, and under no circumstances is it to be construed

as, a prospectus, offering memorandum, an advertisement or a public offering in any province or territory of Canada. In Canada, no prospectus

has been filed with any securities commission or similar regulatory authority in respect of any of the securities referred to herein.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NIOCORP DEVELOPMENTS LTD. |

| |

|

|

| DATE: September 7, 2023 |

By: |

/s/ Neal S. Shah |

| |

|

Neal S. Shah

Chief Financial Officer |

Exhibit 99.1

NioCorp Delivers Advance

Notice under the Standby Equity Purchase Agreement

CENTENNIAL, Colo. (September 7, 2023) –

NioCorp Developments Ltd. ("NioCorp" or the "Company") (Nasdaq: NB; I TSX: NB) today announced

that it has delivered a written notice (the “Advance Notice”) pursuant to the previously announced Standby Equity Purchase

Agreement, dated January 26, 2023 (the “Standby Equity Purchase Agreement”), requesting the purchase of 70,000

shares (the “Advance Shares”) of the Company’s common shares, without par value (the “Common

Shares”).

The Company has elected an Option 2 Pricing Period (as defined

in the Standby Equity Purchase Agreement). Subject to the satisfaction of certain conditions contained in the Standby Equity Purchase

Agreement, the Advance Shares will be issued at a purchase price equal to 97% of the daily volume-weighted average price of the Common

Shares on The Nasdaq Stock Market LLC (“Nasdaq”) as reported on Bloomberg Financial Markets during a pricing period

of three consecutive trading days commencing on the date hereof.

The Company expects the issuance and sale of the Advance Shares

will close on or about September 11, 2023.

Investors and securityholders should refer

to the Company’s news release dated January 26, 2023 and its management information and proxy circular dated February 8, 2023 for

additional information regarding the Standby Equity Purchase Agreement, both as filed by NioCorp with the applicable Canadian securities

regulatory authorities through the website maintained by the Canadian Securities Administrators at www.sedar.com.

No Offer or Solicitation

This communication does not constitute an offer to sell

or the solicitation of an offer to buy any securities. The Advance Shares are being offered and sold in reliance on the exemption from

registration set forth in Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”). The issuance and sale

by the Company of the Advance Shares have not been registered under the Securities Act, or the securities laws of any state or other jurisdiction,

and may not be offered or sold in the United States without registration or an applicable exemption from the registration requirements

of the Securities Act and applicable state securities or blue sky laws and foreign securities laws. In Canada, no offering of securities

shall be made except by means of a prospectus in accordance with the requirements of applicable Canadian securities laws or an exemption

therefrom. This communication is not, and under

NioCorp Developments Ltd., 7000 S. Yosemite, Centennial, CO 80112 | (720) 334-7066 | info@niocorp.com

no circumstances is it to be construes as, a prospectus,

offering memorandum, an advertisement or a public offering in any province or territory of Canada. In Canada, no prospectus has been filed

with any securities commission or similar regulatory authority in respect of any of the Advance Shares.

For More Information

Contact Jim Sims, Corporate

Communications Officer, NioCorp Developments Ltd., (720) 334-7066, jim.sims@niocorp.com

About NioCorp

NioCorp is developing a critical minerals project in Southeast Nebraska

that is expected to produce niobium, scandium, and titanium, subject to the receipt of sufficient project financing. The Company also

is evaluating the potential to produce several rare earths from the Elk Creek Project. Niobium

is used to produce specialty alloys as well as High Strength, Low Alloy steel, which is a lighter, stronger steel used in automotive,

structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased

strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used

in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications,

armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making

of Neodymium-Iron-Boron magnets, which are used across a wide variety of defense and civilian applications.

Cautionary Note Regarding Forward-Looking Statements

This communication contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable

Canadian securities laws (collectively, “forward-looking statements”). Forward-looking statements may include, but

are not limited to, statements regarding the offering, issuance and sale of the Advance Shares, including the number of Advance Shares

that may ultimately be sold, the price at which the Advance Shares may be sold and the expected timing for the closing of the issuance

and sale of the Advance Shares, and the expected and potential production of the Elk Creek Project.

The forward-looking statements are based on the current expectations

of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and

speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated.

Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions

relating to: results of the Company’s demonstration-scale processing plant; the future price of metals; the stability of the financial

and capital markets; other current estimates and assumptions regarding NioCorp’s business combination (the “Business Combination”)

with GX Acquisition Corp. II and the Standby Equity Purchase Agreement (together with the Business Combination, the “Transactions”),

and their expected benefits, including the ability to access the full amount of the expected net proceeds of the Standby Equity Purchase

Agreement over the next three years; NioCorp’s ability to receive a final commitment of financing from the Export-Import Bank of

the United States (“EXIM”); anticipated benefits of the listing of the Common Shares on Nasdaq; the financial and business

performance of NioCorp; NioCorp’s anticipated results and developments in the operations of NioCorp in future periods; NioCorp’s

planned exploration activities; the adequacy of NioCorp’s financial resources; NioCorp’s ability to secure sufficient project

financing to complete construction and commence operation of the Elk Creek Project; NioCorp’s expectation and ability to produce

niobium,

NioCorp Developments Ltd., 7000 S. Yosemite, Centennial, CO 80112 | (720) 334-7066 | info@niocorp.com

scandium, and titanium at the Elk Creek Project; the outcome of current

recovery process improvement testing, and NioCorp’s expectation that such process improvements could lead to greater efficiencies

and cost savings in the Elk Creek Project; the Elk Creek Project’s ability to produce multiple critical metals; the Elk Creek Project’s

projected ore production and mining operations over its expected mine life; the completion of the demonstration plant and technical and

economic analyses on the potential addition of magnetic rare earth oxides to NioCorp’s planned product suite; the exercise of options

to purchase additional land parcels; the execution of contracts with engineering, procurement and construction companies; NioCorp’s

ongoing evaluation of the impact of inflation, supply chain issues and geopolitical unrest on the Elk Creek Project’s economic model;

the impact of health epidemics, including the COVID-19 pandemic, on NioCorp’s business and the actions NioCorp may take in response

thereto; and the creation of full time and contract construction jobs over the construction period of the Elk Creek Project.

Forward-looking statements are frequently, but not always, identified

by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,”

“potential,” “possible,” and similar expressions, or statements that events, conditions, or results “will,”

“may,” “could,” or “should” (or the negative and grammatical variations of any of these terms) occur

or be achieved. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, or future events or performance (often, but not always, using words or phrases such as “expects”

or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,”

“estimates,” or “intends,” or stating that certain actions, events, or results “may,” “could,”

“would,” “might,” or “will” be taken, occur or be achieved) are not statements of historical fact

and may be forward-looking statements. Such forward-looking statements reflect the Company’s current views with respect to future

events and are subject to certain known and unknown risks, uncertainties, and assumptions. Many factors could cause actual results, performance,

or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such

forward-looking statements, including, among others, risks related to the following: NioCorp’s ability to recognize the anticipated

benefits of the Transactions, including NioCorp’s ability to access the full amount of the expected net proceeds under the Standby

Equity Purchase Agreement over the next three years; unexpected costs related to the Transactions; the outcome of any legal proceedings

that may be instituted against NioCorp following closing of the Transactions; NioCorp’s ability to receive a final commitment of

financing from EXIM on the anticipated timeline, on acceptable terms, or at all; NioCorp’s ability to continue to meet Nasdaq listing

standards; NioCorp’s ability to operate as a going concern; risks relating to the Common Shares, including price volatility, lack

of dividend payments and dilution or the perception of the likelihood any of the foregoing; NioCorp’s requirement of significant

additional capital; the extent to which NioCorp’s level of indebtedness and/or the terms contained in agreements governing NioCorp’s

indebtedness or the Standby Equity Purchase Agreement may impair NioCorp’s ability to obtain additional financing; covenants contained

in agreements with NioCorp’s secured creditors that may affect its assets; NioCorp’s limited operating history; NioCorp’s

history of losses; the restatement of NioCorp’s consolidated financial statements as of and for the fiscal years ended June 30,

2022 and 2021 and the interim periods ended September 30, 2021, December 31, 2021, March 31, 2022, September 30, 2022 and December 31,

2022 and the impact of such restatement on NioCorp’s future financial statements and other financial measures; the material weaknesses

in NioCorp’s internal control over financial reporting, NioCorp’s efforts to remediate such material weaknesses and the timing

of remediation; the possibility that NioCorp may qualify as a “passive foreign investment company” under the U.S. Internal

Revenue Code of 1986, as amended (the “Code”); the potential that the Transactions could result in NioCorp becoming

subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections

of the Code; cost increases for NioCorp’s exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp’s

information technology systems, including those related to cybersecurity; equipment and supply shortages; variations in the market demand

for, and prices of, niobium, scandium, titanium and rare earth products; current and future offtake agreements, joint ventures, and partnerships;

NioCorp’s ability to

NioCorp Developments Ltd., 7000 S. Yosemite, Centennial, CO 80112 | (720) 334-7066 | info@niocorp.com

attract qualified management; the effects of the COVID-19 pandemic

or other global health crises on NioCorp’s business plans, financial condition and liquidity; estimates of mineral resources and

reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; changes in demand

for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions

in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly

affect the mining industry; the impacts of climate change, as well as actions taken or required by governments related to strengthening

resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other

regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ

from projections/expectations or may not realize the perceived potential of NioCorp’s projects; risks of accidents, equipment breakdowns,

and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in

development programs; operating or technical difficulties in connection with exploration, mining, or development activities; the management

of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature

of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the

title to NioCorp’s properties; potential future litigation; and NioCorp’s lack of insurance covering all of NioCorp’s

operations.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive

of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about

the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially

from those reflected in the forward-looking statements due to a variety of risks, uncertainties, and other factors, including without

limitation those discussed under Part I, Item 1A. “Risk Factors” contained in the Company’s most recent Annual Report

on Form 10-K, and Part II, Item 1A. “Risk Factors” contained in the Company’s subsequent Quarterly Reports on Form 10-Q,

as well as any amendments thereto.

The Company’s forward-looking statements contained in this

communication are based on the beliefs, expectations, and opinions of management as of the date of this communication. The Company does

not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations, or opinions

should change, except as required by law. For the reasons set forth above, investors should not attribute undue certainty to, or place

undue reliance on, forward-looking statements.

NioCorp Developments Ltd., 7000 S. Yosemite, Centennial, CO 80112 | (720) 334-7066 | info@niocorp.com

Cover

|

Sep. 07, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 07, 2023

|

| Entity File Number |

000-55710

|

| Entity Registrant Name |

NioCorp Developments Ltd.

|

| Entity Central Index Key |

0001512228

|

| Entity Tax Identification Number |

98-1262185

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

7000 South Yosemite Street

|

| Entity Address, Address Line Two |

Suite 115

|

| Entity Address, City or Town |

Centennial

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80112

|

| City Area Code |

(720)

|

| Local Phone Number |

639-4647

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Shares, without par value |

|

| Title of 12(b) Security |

Common Shares, without par value

|

| Trading Symbol |

NB

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for 1.11829212 Common Shares |

|

| Title of 12(b) Security |

Warrants, each exercisable for 1.11829212 Common Shares

|

| Trading Symbol |

NIOBW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NB_CommonSharesWithoutParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NB_WarrantsEachExercisableFor1.11829212CommonSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

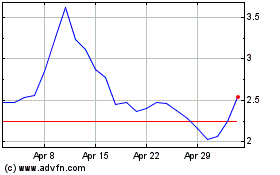

NioCorp Developments (NASDAQ:NB)

Historical Stock Chart

From Nov 2024 to Dec 2024

NioCorp Developments (NASDAQ:NB)

Historical Stock Chart

From Dec 2023 to Dec 2024