NEXGEL, Inc. (“NEXGEL” or the “Company”) (NASDAQ: “NXGL”), a

leading provider of ultra-gentle, high-water-content hydrogel

products for healthcare and consumer applications, today announced

record second quarter 2024 revenue of $1.44 million and is

reiterating revenue guidance for the 2024 third and fourth quarter

of $2.2 million and $2.6 million, respectively.

Adam Levy, NEXGEL’s Chief Executive Officer,

commented, “The second quarter of 2024 was a record revenue quarter

for the Company, totaling $1.44 million, an increase of 23.4%

year-over-year and 13.7% sequentially. Branded consumer product

revenue was a key growth driver during the quarter led by our Silly

George brand, which contributed revenue for approximately half the

quarter. At the time of closing on the acquisition, Silly George

was on a revenue run rate of $2 million. In July alone Silly George

sales were over $380,000 on Shopify only. We continue to be excited

with this acquisition and revenue opportunities from our

partnerships with STADA and Cintas in the back half of this

year.”

Second Quarter 2024 Business and

Operational Highlights

- Acquired Silly George, an

international beauty company with specialty in eye and eyelash

consumer products.

- Announced the first product,

Histasolv®, sold as DAOSIN® in Europe, to be distributed in

partnership with STADA Arzneimittel AG (“STADA”) in North

America.

- Signed agreement with Cintas

Corporation, a leading provider of corporate identity uniforms,

first aid and safety products and services to over 1 million

businesses across North America, to distribute SilverSeal.

Subsequent Events

- Issued revenue guidance for the

third and fourth quarters of 2024 of $2.2 million and $2.6 million,

an increase of 83% and 140% year-over-year, respectively.

- Closed on registered direct

offering led by insiders for gross proceeds of approximately $1.11

million.

- In partnership with Innovative

Optics, a leading supplier of safety products and person protective

equipment for medical, surgical, and aesthetic healthcare

facilities globally, initiated an institutional review board study

on the benefits of hydrogel application during laser hair

removal.

Second Quarter 2024 Financial

Highlights

For the quarter ended June 30, 2024, revenue

totaled $1.44 million, an increase of $273,000, or 23.4%, as

compared to $1.17 million for the quarter ended June 30, 2023. The

increase in revenue was driven by sales growth in branded consumer

products, including approximately 45 days of revenue from Silly

George, partially offset by a decrease in contract manufacturing.

Contract manufacturing revenue was impacted by CGN’s move into its

new facility and will normalize and grow in the third and fourth

quarter of 2024.

Gross profit totaled $410,000 for the three

months ended June 30, 2024, compared to a gross profit of $175,000

for the three months ended June 30, 2023. The increase of $235,000

in gross profit year-over-year was primarily due to the increase in

branded consumer products.

Gross profit margin for the second quarter of

2024 was 28.5% compared to a gross margin for the second quarter of

2023 of 15.0% and a gross profit margin of 21.9% in the first

quarter of 2024.

Cost of revenues increased by $38,000, or 3.8%,

to $1.03 million for the three months ended June 30, 2024, as

compared to $992,000 for the three months ended June 30, 2023. The

increase in cost of revenues is primarily aligned with sales of

branded consumer products, partially offset by a decrease in cost

of revenues from lower contract manufacturing revenue.

Selling, general and administrative expenses

increased by $506,000 or 57.4%, to $1.39 million for the three

months ended June 30, 2024, as compared to $882,000 for the three

months ended June 30, 2023. The increase in selling, general and

administrative expenses is primarily attributable to an increase in

advertising, marketing, and Amazon fees, attributable to promotion

of Kenkoderm and Silly George. The Company expects these costs to

increase in the third quarter with a full quarter of Silly George

revenue and with further growth in branded consumer products.

Research and development expenses increased by

$21,000 to $76,000 for the three months ended June 30, 2024, from

$55,000 for the three months ended June 30, 2023.

Net loss for the three months ended June 30,

2024, was $979,000 as compared to a net loss of $642,000 in the

three months ended June 30, 2023.

As of June 30, 2024, the Company had a cash

balance of approximately $1.1 million. Subsequent to the end of the

quarter, the Company closed on a registered direct offering of

$1.11 million, led by insiders. The use of proceeds for the

financing is for working capital and the immediate requirement for

additional inventory and marketing to meet the higher-than-expected

demand for the Silly George brand products. The Company believes it

has sufficient cash and marketable securities to operate its

business plan into 2025.

As of August 14, 2024, NEXGEL had 6,324,266

shares of common stock outstanding, which number does not include

the 444,000 shares of common stock we anticipate issuing in

connection with our recent offering.

Second Quarter 2024 Financial Results

Conference Call

Date: August 14,

2024Time: 4:30 P.M. ETLive Call:

+ 1-800-579-2543 (U.S. Toll Free) or + 1-785-424-1789

(International)Webcast: Events and

Presentations

For interested individuals unable to join the

conference call, a replay will be available through August 28,

2024, by dialing + 1-844-512-2921 (U.S. Toll Free) or +

1-412-317-6671 (International). Participants must use the following

code to access the replay of the call: 11156720. An archived

version of the webcast will also be available for 90 days.

About NEXGEL, INC.

NEXGEL is a leading provider of healthcare,

beauty, and over-the-counter (OTC) products including ultra-gentle,

high-water-content hydrogels. Based in Langhorne, Pa., the Company

has developed and manufactured electron-beam, cross-linked

hydrogels for over two decades. NEXGEL brands include Silverseal®,

Hexagels®, Turfguard®, Kenkoderm® and Silly George®. Additionally,

NEXGEL has strategic contract manufacturing relationships with

leading consumer healthcare companies.

Forward-Looking Statement

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”) (which Sections were

adopted as part of the Private Securities Litigation Reform Act of

1995). Statements preceded by, followed by or that otherwise

include the words “believe,” “anticipate,” “estimate,” “expect,”

“intend,” “plan,” “project,” “prospects,” “outlook,” and similar

words or expressions, or future or conditional verbs, such as

“will,” “should,” “would,” “may,” and “could,” are generally

forward-looking in nature and not historical facts, including,

without limitation, our revenue guidance for the third and fourth

quarter of 2025. These forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

Company's actual results, performance, or achievements to be

materially different from any anticipated results, performance, or

achievements for many reasons. The Company disclaims any intention

to, and undertakes no obligation to, revise any forward-looking

statements, whether as a result of new information, a future event,

or otherwise. For additional risks and uncertainties that could

impact the Company's forward-looking statements, please see the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, including but not limited to the discussion under “Risk

Factors” therein, which the Company filed with the SEC and which

may be viewed at http://www.sec.gov/.

Investor Contacts:Valter Pinto,

Managing DirectorKCSA Strategic

Communications212.896.1254Nexgel@kcsa.com

NEXGEL, INCCONDENSED

CONSOLIDATED BALANCE SHEETS AS OF JUNE 30, 2024

AND DECEMBER 31, 2023 (Unaudited)(in

thousands, except share and per share data)

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| ASSETS: |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

1,069 |

|

|

$ |

2,700 |

|

|

Accounts receivable, net |

|

|

605 |

|

|

|

633 |

|

|

Inventory |

|

|

1,446 |

|

|

|

1,319 |

|

|

Prepaid expenses and other current assets |

|

|

467 |

|

|

|

400 |

|

|

Total current assets |

|

|

3,587 |

|

|

|

5,052 |

|

| Goodwill |

|

|

1,128 |

|

|

|

1,128 |

|

| Intangibles, net |

|

|

855 |

|

|

|

326 |

|

| Property and equipment,

net |

|

|

2,368 |

|

|

|

1,499 |

|

| Operating lease - right of use

asset |

|

|

1,742 |

|

|

|

1,855 |

|

| Other assets |

|

|

95 |

|

|

|

95 |

|

|

Total assets |

|

$ |

9,775 |

|

|

$ |

9,955 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,245 |

|

|

$ |

1,233 |

|

|

Accrued expenses and other current liabilities |

|

|

284 |

|

|

|

398 |

|

|

Deferred revenue |

|

|

179 |

|

|

|

20 |

|

|

Current portion of note payable |

|

|

87 |

|

|

|

80 |

|

|

Warrant liability |

|

|

176 |

|

|

|

146 |

|

|

Contingent consideration liability |

|

|

370 |

|

|

|

439 |

|

|

Financing lease liability, current portion |

|

|

55 |

|

|

|

- |

|

|

Operating lease liabilities, current portion |

|

|

237 |

|

|

|

233 |

|

|

Total current liabilities |

|

|

2,633 |

|

|

|

2,549 |

|

|

Operating lease liabilities, net of current portion |

|

|

1,632 |

|

|

|

1,727 |

|

|

Financing lease liability, net of current portion |

|

|

339 |

|

|

|

- |

|

|

Notes payable, net of current portion |

|

|

645 |

|

|

|

513 |

|

|

Total liabilities |

|

|

5,249 |

|

|

|

4,789 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and Contingencies

(Note 15) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Preferred stock, par value

$0.001 per share, 5,000,000 shares authorized, no shares issued and

outstanding |

|

|

- |

|

|

|

- |

|

| Common stock, par value $0.001

per share, 25,000,000 shares authorized; 6,324,266 and 5,741,838

shares issued and outstanding as of June 30, 2024 and December 31,

2023, respectively |

|

|

6 |

|

|

|

6 |

|

| Additional paid-in

capital |

|

|

20,614 |

|

|

|

19,406 |

|

| Accumulated deficit |

|

|

(16,454 |

) |

|

|

(14,715 |

) |

| Total NexGel stockholders’

equity |

|

|

4,166 |

|

|

|

4,697 |

|

| Non-controlling interest in

joint venture |

|

|

360 |

|

|

|

469 |

|

| Total stockholders’

equity |

|

|

4,526 |

|

|

|

5,166 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

9,775 |

|

|

$ |

9,955 |

|

NEXGEL, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE

THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)(in thousands, except share and per

share data)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

|

| |

|

June 30, |

|

|

June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| Revenues, net |

|

$ |

1,440 |

|

|

$ |

1,167 |

|

|

$ |

2,706 |

|

|

$ |

1,786 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

|

1,030 |

|

|

|

992 |

|

|

|

2,019 |

|

|

|

1,669 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

410 |

|

|

|

175 |

|

|

|

687 |

|

|

|

117 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and

development |

|

|

76 |

|

|

|

55 |

|

|

|

78 |

|

|

|

84 |

|

|

| Selling, general

and administrative |

|

|

1,388 |

|

|

|

882 |

|

|

|

2,534 |

|

|

|

1,679 |

|

|

| Total operating

expenses |

|

|

1,464 |

|

|

|

937 |

|

|

|

2,612 |

|

|

|

1,763 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(1,054 |

) |

|

|

(762 |

) |

|

|

(1,925 |

) |

|

|

(1,646 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

(30 |

) |

|

|

(9 |

) |

|

|

(46 |

) |

|

|

(10 |

) |

|

| Interest

income |

|

|

1 |

|

|

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

| Loss on sale of

assets |

|

|

(4 |

) |

|

|

- |

|

|

|

(4 |

) |

|

|

- |

|

|

| Other income |

|

|

6 |

|

|

|

- |

|

|

|

6 |

|

|

|

4 |

|

|

| Gain on

investments |

|

|

23 |

|

|

|

116 |

|

|

|

57 |

|

|

|

124 |

|

|

| Changes in fair

value of warrant liability |

|

|

79 |

|

|

|

11 |

|

|

|

26 |

|

|

|

77 |

|

|

| Total other income

(expense), net |

|

|

75 |

|

|

|

120 |

|

|

|

41 |

|

|

|

197 |

|

|

| Loss before income

taxes |

|

|

(979 |

) |

|

|

(642 |

) |

|

|

(1,884 |

) |

|

|

(1,449 |

) |

|

| Income tax

expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Net loss |

|

$ |

(979 |

) |

|

$ |

(642 |

) |

|

|

(1,884 |

) |

|

|

(1,449 |

) |

|

| Less: Income

attributable to non-controlling interest in joint venture |

|

|

94 |

|

|

|

(53 |

) |

|

|

146 |

|

|

|

(60 |

) |

|

| Net loss

attributable to NexGel stockholders |

|

|

(885 |

) |

|

|

(695 |

) |

|

|

(1,738 |

) |

|

|

(1,509 |

) |

|

| Net loss per

common share - basic |

|

$ |

(0.14 |

) |

|

$ |

(0.12 |

) |

|

|

(0.28 |

) |

|

|

(0.27 |

) |

|

| Net loss per

common share - diluted |

|

$ |

(0.14 |

) |

|

$ |

(0.12 |

) |

|

|

(0.28 |

) |

|

|

(0.27 |

) |

|

| Weighted average

shares used in computing net loss per common share - basic |

|

|

6,254,659 |

|

|

|

5,662,338 |

|

|

|

6,118,212 |

|

|

|

5,624,275 |

|

|

| Weighted average

shares used in computing net loss per common share – diluted |

|

|

6,254,659 |

|

|

|

5,662,338 |

|

|

|

6,118,212 |

|

|

|

5,624,275 |

|

|

NEXGEL, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX

MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)(in thousands)

| |

|

Six Months EndedJune 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Operating

Activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,738 |

) |

|

$ |

(1,509 |

) |

| Adjustments to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Income (loss) attributable to non-controlling interest in joint

venture |

|

|

(146 |

) |

|

|

60 |

|

|

Depreciation and amortization |

|

|

144 |

|

|

|

68 |

|

|

Changes in ROU asset and operating lease liability |

|

|

21 |

|

|

|

21 |

|

|

Share-based compensation and restricted stock vesting |

|

|

118 |

|

|

|

53 |

|

|

Gain on investment in marketable securities |

|

|

(57 |

) |

|

|

124 |

|

|

Changes in fair value of warrant liability |

|

|

(26 |

) |

|

|

(77 |

) |

| |

|

|

|

|

|

|

|

|

| Changes in

operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

28 |

|

|

|

(728 |

) |

|

Inventory |

|

|

(127 |

) |

|

|

(577 |

) |

|

Prepaid expenses and other assets |

|

|

(67 |

) |

|

|

(226 |

) |

|

Accounts payable |

|

|

13 |

|

|

|

793 |

|

|

Accrued expenses and other current liabilities |

|

|

(114 |

) |

|

|

— |

|

|

Deferred revenue |

|

|

159 |

|

|

|

72 |

|

| Net Cash

Used in Operating Activities |

|

|

(1,792 |

) |

|

|

(1,926 |

) |

| |

|

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

|

|

Proceeds from sales of marketable securities |

|

|

57 |

|

|

|

4,772 |

|

|

Capital expenditures |

|

|

(361 |

) |

|

|

(253 |

) |

|

Net cash paid for asset acquisition |

|

|

(400 |

) |

|

|

- |

|

| Net Cash

Provided by (Used in) Investing Activities |

|

|

(704 |

) |

|

|

4,519 |

|

| |

|

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

|

|

Proceeds from equity offering, net of expenses |

|

|

946 |

|

|

|

— |

|

|

Investment by joint venture partner |

|

|

37 |

|

|

|

— |

|

|

Principal payment on financing lease liability |

|

|

(22 |

) |

|

|

— |

|

|

Change in contingent consideration liability |

|

|

(69 |

) |

|

|

— |

|

|

Principal payments of notes payable |

|

|

(27 |

) |

|

|

(3 |

) |

| Net Cash

Provided by (Used in) Financing Activities |

|

|

865 |

|

|

|

(3 |

) |

| Net

Decrease in Cash |

|

|

(1,631 |

) |

|

|

2,590 |

|

| Cash – Beginning

of period |

|

|

2,700 |

|

|

|

1,101 |

|

|

Cash – End of period |

|

$ |

1,069 |

|

|

$ |

3,691 |

|

|

Supplemental Disclosure of Cash Flows

Information |

|

|

|

|

|

|

|

|

| Cash paid during

the year for: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

27 |

|

|

$ |

— |

|

|

Taxes |

|

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

Non-cash Investing and Financing activities |

|

|

|

|

|

|

|

|

|

Shares issued in conjunction with asset acquisition |

|

$ |

200 |

|

|

$ |

— |

|

|

Property and equipment financed under notes payable |

|

$ |

165 |

|

|

$ |

— |

|

|

Property and equipment financed under financing leases |

|

$ |

416 |

|

|

$ |

— |

|

|

Property and equipment contributed as capital investment to JV |

|

$ |

— |

|

|

$ |

500 |

|

|

ROU asset and operating lease liabilities recognized upon

consolidation of JV |

|

$ |

— |

|

|

$ |

334 |

|

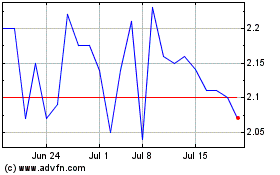

NexGel (NASDAQ:NXGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

NexGel (NASDAQ:NXGL)

Historical Stock Chart

From Dec 2023 to Dec 2024