New York Mortgage Trust, Inc. (Nasdaq: NYMT) (“NYMT,” the

“Company,” “we,” “our” or “us”) today announced preliminary

estimates of select financial information as of and for the quarter

ended September 30, 2022 in light of sustained market volatility.

Preliminary Estimates of Select

Financial Information for Third Quarter 2022

- Book value per common share. Book

value per common share at September 30, 2022 was estimated to be

between $3.62 and $3.66 compared to $4.06 per common share at June

30, 2022.

- Undepreciated book value per common

share1. Undepreciated book value per common share at September 30,

2022 was estimated to be between $3.86 and $3.90 compared to $4.24

per common share at June 30, 2022.

- Company recourse leverage ratio2

and portfolio recourse leverage ratio3. Company recourse leverage

ratio was estimated to be 0.5x and portfolio recourse leverage

ratio was estimated to be 0.4x as of September 30, 2022.

- Liquidity position. The Company has

maintained a strong liquidity position, with $336 million of

available cash4 and $586 million of unencumbered residential loans,

investment securities (including securities owned in Consolidated

SLST) and mezzanine lending investments as of September 30,

2022.

- Cash dividend. As previously

announced on September 16, 2022, the Company declared a third

quarter 2022 common stock cash dividend of $0.10 per share, payable

on October 26, 2022 to holders of record as of September 26,

2022.

- Stock repurchase program. The

Company repurchased 5.5 million shares of its common stock at an

average repurchase price of $2.62 per share during the quarter

ended September 30, 2022.

The preliminary estimates set forth above are

unaudited and subject to change as the Company’s quarter end

closing process is completed. While the Company believes the

estimates are based on reasonable assumptions, actual results may

vary and such variations may be material. Factors that could cause

actual results to differ from estimates include, but are not

limited to: (i) adjustments in the calculation of, or application

of accounting principles for, the financial results for the quarter

ended September 30, 2022; (ii) the discovery of new information

that impacts the valuation methodologies underlying these results;

(iii) errors in the preliminary assessment of the value of our

assets and liabilities; (iv) accounting changes required by GAAP;

and (v) the risks and uncertainties described under the headings

“Forward-Looking Statements” below and “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2021. The Company undertakes no

obligation to update or revise these estimates, and investors

should not place undue reliance on these estimates because they may

prove to be materially inaccurate. Third quarter actual results

remain subject to the review by the Company’s independent

auditors.

2022 Third Quarter Conference Call Scheduled for

Thursday, November 3, 2022

The Company expects to release its financial

results for the quarter ended September 30, 2022 after the market

close on Wednesday, November 2, 2022. New York Mortgage Trust's

executive management will host a conference call and audio webcast

at 9:00 a.m., Eastern Time, on Thursday, November 3, 2022. To

access the conference call, please pre-register using this link.

Registrants will receive confirmation with dial-in details.

A live audio webcast of the conference call can

be accessed, on a listen-only basis, at the Investor Relations

section of the Company's website at www.nymtrust.com or using this

link. A webcast replay link of the conference call will be

available on the Investor Relations section of the Company’s

website approximately two hours after the call and will be

available for 12 months.

About New York Mortgage

Trust

New York Mortgage Trust, Inc. is a Maryland

corporation that has elected to be taxed as a real estate

investment trust (“REIT”) for federal income tax purposes. NYMT is

an internally managed REIT in the business of acquiring, investing

in, financing and managing primarily mortgage-related single-family

and multi-family residential assets.

Forward-Looking Statements

When used in this press release, in future

filings with the Securities and Exchange Commission (the “SEC”) or

in other written or oral communications, statements which are not

historical in nature, including those containing words such as

“will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,”

“continue,” “intend,” “could,” “would,” “should,” “may” or similar

expressions, are intended to identify “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), and, as such, may involve known and

unknown risks, uncertainties and assumptions.

Forward-looking statements are based on

estimates, projections, beliefs and assumptions of management of

the Company at the time of such statements and are not guarantees

of future performance. Forward-looking statements involve risks and

uncertainties in predicting future results and conditions. Actual

results and outcomes could differ materially from those projected

in these forward-looking statements due to a variety of factors,

including, without limitation: changes in the Company’s business

and investment strategy; changes in interest rates and the fair

market value of the Company’s assets, including negative changes

resulting in margin calls relating to the financing of the

Company’s assets; changes in credit spreads; changes in the

long-term credit ratings of the U.S., Fannie Mae, Freddie Mac, and

Ginnie Mae; general volatility of the markets in which the Company

invests; changes in prepayment rates on the loans the Company owns

or that underlie the Company’s investment securities; increased

rates of default or delinquency and/or decreased recovery rates on

the Company’s assets; the Company’s ability to identify and acquire

targeted assets, including assets in its investment pipeline;

changes in relationships with the Company’s financing

counterparties and the Company’s ability to borrow to finance its

assets and the terms thereof; changes in the Company’s

relationships with and/or the performance of its operating

partners; the Company’s ability to predict and control costs;

changes in laws, regulations or policies affecting the Company’s

business, including actions that may be taken to contain or address

the impact of the COVID-19 pandemic; the Company’s ability to make

distributions to its stockholders in the future; the Company’s

ability to maintain its qualification as a REIT for federal tax

purposes; the Company’s ability to maintain its exemption from

registration under the Investment Company Act of 1940, as amended;

risks associated with investing in real estate assets, including

changes in business conditions and the general economy, the

availability of investment opportunities and the conditions in the

market for Agency RMBS, non-Agency RMBS, ABS and CMBS securities,

residential loans, structured multi-family investments and other

mortgage-, residential housing- and credit-related assets,

including changes resulting from the ongoing spread and economic

effects of COVID-19; and the impact of COVID-19 on the Company, its

operations and its personnel.

These and other risks, uncertainties and

factors, including the risk factors described in the Company’s

reports filed with the SEC pursuant to the Exchange Act, could

cause the Company’s actual results to differ materially from those

projected in any forward-looking statements the Company makes. All

forward-looking statements speak only as of the date on which they

are made. New risks and uncertainties arise over time and it is not

possible to predict those events or how they may affect the

Company. Except as required by law, the Company is not obligated

to, and does not intend to, update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Non-GAAP Financial Measures

In addition to the results presented in

accordance with GAAP, this press release includes a non-GAAP

financial measure, undepreciated book value per common share.

Undepreciated book value per common share of $3.86-$3.90 is a

supplemental non-GAAP financial measure calculated as GAAP book

value per common share of $3.62-$3.66 adjusted for the Company's

share of cumulative depreciation and lease intangible amortization

expenses related to operating real estate, net held at the end of

the period, representing adjustments of $0.08 and $0.16 per common

share, respectively. By excluding these non-cash adjustments,

undepreciated book value reflects the value of the Company’s rental

property portfolio at its undepreciated basis. The Company's rental

property portfolio includes single-family rental homes directly

owned by the Company and consolidated multi-family apartment

communities. The Company believes that the presentation of

undepreciated book value per common share is useful to investors

and the Company as it allows management to consider the overall

portfolio exclusive of non-cash adjustments to operating real

estate, net and facilitates the comparison of our financial

performance to that of our peers.

The Company’s presentation of undepreciated book

value per common share may not be comparable to similarly-titled

measures of other companies, who may use different calculations.

Because undepreciated book value per common share is not calculated

in accordance with GAAP, it should not be considered a substitute

for, or superior to, the financial measures calculated in

accordance with GAAP and should be carefully evaluated.

For Further Information

AT THE COMPANYInvestor Relations Phone: 212-792-0107Email:

InvestorRelations@nymtrust.com

1 Represents a non-GAAP financial measure. A reconciliation of

undepreciated book value per common share to GAAP book value per

common share is included below in "Non-GAAP Financial Measures."2

Represents the Company's total outstanding recourse repurchase

agreement financing, subordinated debentures and senior unsecured

notes divided by the Company's total stockholders' equity.3

Represents the Company's outstanding recourse repurchase agreement

financing divided by the Company’s total stockholders’ equity.4

Available cash is calculated as unrestricted cash of $370

million less $34 million of cash held by the Company’s consolidated

multi-family apartment communities.

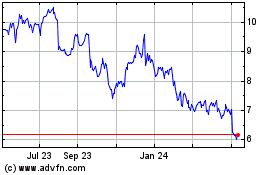

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Jan 2025 to Feb 2025

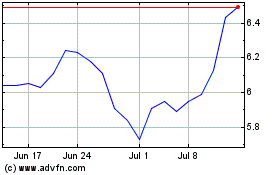

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Feb 2024 to Feb 2025