Q4 net revenue of $182.4 million, and operating

margin above the high end of guidance Q4 annual recurring revenue

of almost $35 million, growing 25% year over year Q4 free cash flow

of $19.0 million - sixth consecutive quarter of cash generation Q1

2025 restructuring implemented from position of strength to fund

2025 investment opportunities Added $125 million in cash and

repurchased more than $33 million of stock in 2024

NETGEAR, Inc. (NASDAQ: NTGR), a global leader in intelligent

networking solutions for businesses, homes, and service providers,

today reported financial results for the fourth quarter and full

year ended December 31, 2024.

Q4 2024

- Net revenue of $182.4 million, down 3.3% from Q4 prior

year

- GAAP gross margin of 32.6%, down from 34.8% in Q4 prior year

Non-GAAP gross margin of 32.8%, down from 35.0% in Q4 prior

year

- GAAP operating income of $(15.1) million compared to $(2.9)

million from Q4 prior year Non-GAAP operating income of $(4.2)

million compared to $2.7 million from Q4 prior year

- GAAP EPS of $(0.31) compared to $(0.06) from Q4 prior year

Non-GAAP EPS of $(0.06) compared to $0.09 from Q4 prior year

- Cash and equivalents up $13.0 million from the prior quarter

(repurchased $10.7 million of stock )

2024 Fiscal Year

- Net revenue of $673.8 million, down 9.1% from the prior

year

- GAAP gross margin of 29.1%, down from 33.6% in the prior year

Non-GAAP gross margin of 29.3%, down from 33.9% in the prior

year

- GAAP operating income of $12.2 million compared to $(33.3)

million in the prior year Non-GAAP operating income of $(49.6)

million compared to $(9.9) million in the prior year

- GAAP EPS of $0.42 compared to $(3.57) in the prior year

Non-GAAP EPS $(0.91) compared to $(0.03) in the prior year

- Cash and equivalents ended at $408.7 million, up $125.0 million

from the prior year

The accompanying schedules provide a reconciliation of financial

measures computed on a GAAP basis to financial measures computed on

a non-GAAP basis.

CJ Prober, Chief Executive Officer, commented, “Having recently

passed my one-year anniversary at NETGEAR, I’m thrilled with our

progress as we once again delivered revenue and operating margin

above the high end of guidance while driving dramatic shifts in our

operating model and focus on the customer. These results were

enabled by the proactive steps we took throughout the year to

improve our organization, operating model and strategy in pursuit

of long-term growth and profitability. In the last year, we

aggressively de-stocked our channel, dramatically lowered our

inventory, significantly increased our cash position, continued to

innovate with new product launches and software enhancements, and

added great new people to our world class team. Going forward, the

focus is on improving our software capabilities and driving

recurring revenue where we have a solid starting point at almost

$35 million annual recurring revenue as we exit 2024.”

Bryan Murray, Chief Financial Officer, added, “This marked the

sixth consecutive quarter of free cash flow generation, which came

in at $19.0 million, driven by DSOs reaching their lowest level in

over seven years with the improved linearity in the business

enabling us to match sell-in with sell-through. We exited the

quarter with nearly $409 million in cash, a sequential increase of

$13.0 million. Capital allocation remains a key focus for NETGEAR

and in Q4 we resumed our share repurchase program, repurchasing

approximately $10.7 million of our common stock. Importantly, to

maximize long-term shareholder value, we completed a restructuring

of the business, ultimately saving more than $20 million in annual

operating expenses that we are reinvesting into the business to

capitalize on our highest priority opportunities to expand revenue

and profitability.”

NETGEAR For Business (NFB) Segment Results

- Revenue was $80.8 million, up 14.9% year over year

- Non-GAAP gross margin was 43.9%, down 270 basis points year

over year

- Non-GAAP contribution margin was 19.7%, down 90 basis points

year over year

Mr. Prober continued, “For NFB, our leading ProAV products drove

another record quarter in end user sales while we added almost 50

new manufacturing partners and launched Engage 2.0, substantially

expanding our software capabilities in this product category. The

continuing strong performance of this business provides a great

foundation for our return to profitable growth.”

Connected Home Products (CHP) Segment Results

- Revenue was $101.6 million, down 14.2% year over year

- Non-GAAP gross margin was 23.9%, down 420 basis points year

over year

- Non-GAAP contribution margin was (1.3)%, down 740 basis points

year over year

Mr. Prober continued, “We’ve had a great reception to our

recently released WiFi 7 Orbi and Nighthawk products and we are

making progress in executing on our ‘good-better-best’ product

strategy, which we expect to help us reclaim market share in 2025.

Importantly, recurring revenue improved by 25% year over year, a

result of the targeted software investments we’ve made across both

businesses, including recent upgrades to our Armor offering.

Although the full benefits of NETGEAR’s revamped strategy will take

time to materialize completely, we’re focused on generating

long-term value for shareholders and remain confident in the

consumer market opportunity ahead of us as we progress through

2025.”

Business Outlook

Mr. Murray continued, “We expect to continue to see more

predictable performance that is aligned with the market for both of

our businesses now that both our destocking and inventory reduction

actions are completed. However, within NFB, although end user

demand for our ProAV line of managed switches remains strong, we

are facing lengthy lead times for supply, which will result in us

under shipping in Q1 and this is reflected in our muted top line

guidance. On the CHP side, we are seeing signs of market stability

and expect to experience normal seasonality in the retail portion

of this business. We expect revenue from the service provider

channel to be approximately $15 million in Q1, down on a sequential

basis. Accordingly, we expect first quarter net revenue to be in

the range of $145 million to $160 million. In the first quarter we

expect to maintain the gross margin performance experienced in the

recent fourth quarter, however with our seasonally lower topline we

expect our first quarter GAAP operating margin to be in the range

of (16.4)% to (13.4)%, and non-GAAP operating margin to be in the

range of (10.0)% to (7.0)%. Our GAAP tax expense is expected to be

in the range of $1.0 million to $2.0 million, and our non-GAAP tax

benefit is expected to be in the range of $0.5 million to $1.5

million for the first quarter of 2025.”

A reconciliation between the Business Outlook on a GAAP and

non-GAAP basis is provided in the following table:

Three months ending

March 30, 2025

(In millions, except for percentage

data)

Operating Margin Rate

Tax Expense (Benefit)

GAAP

(16.4)% - (13.4)%

$1.0 - $2.0

Estimated adjustments for1:

Stock-based compensation expense

4.0%

-

Restructuring and other charges

2.4%

-

Non-GAAP tax adjustments

-

$(2.5)

Non-GAAP

(10.0)% - (7.0)%

$(1.5) - $(0.5)

1 Business outlook does not include

estimates for any currently unknown income and expense items which,

by their nature, could arise late in a quarter, including:

litigation reserves, net; acquisition-related charges; impairment

charges; restructuring and other charges and discrete tax benefits

or detriments that cannot be forecasted (e.g., windfalls or

shortfalls from equity awards or items related to the resolution of

uncertain tax positions). New material income and expense items

such as these could have a significant effect on our guidance and

future GAAP results.

Investor Conference Call / Webcast Details

NETGEAR will review the fourth quarter and full year results and

discuss management's expectations for the first quarter of 2025

today, Wednesday, February 5, 2025 at 5 p.m. ET (2 p.m. PT). The

toll-free dial-in number for the live audio call is (888) 660-6392.

The international dial-in number for the live audio call is (929)

203-0899. The conference ID for the call is 1030183. A live webcast

of the conference call will be available on NETGEAR's Investor

Relations website at http://investor.netgear.com. A replay of the

call will be available via the web at

http://investor.netgear.com.

About NETGEAR, Inc.

Founded in 1996 and headquartered in the USA, NETGEAR® (NASDAQ:

NTGR) is a global leader in innovative networking technologies for

businesses, homes, and service providers. NETGEAR delivers a wide

range of award-winning, intelligent solutions designed to unleash

the full potential of connectivity and power extraordinary

experiences. For businesses, NETGEAR offers reliable, easy-to-use,

high-performance networking solutions, including switches, routers,

access points, software, and AV over IP technologies, tailored to

meet the diverse needs of organizations of all sizes. NETGEAR’s

Connected Home products deliver advanced connectivity, powerful

performance, and enhanced security features right out of the box,

designed to keep families safe online, whether at home or on the

go. More information is available from the NETGEAR Press Room or by

calling (408) 907-8000. Connect with NETGEAR: Facebook, Instagram

and the NETGEAR blog at NETGEAR.com.

© 2025 NETGEAR, Inc. NETGEAR and the NETGEAR logo are trademarks

or registered trademarks of NETGEAR, Inc. and its affiliates in the

United States and/or other countries. Other brand and product names

are trademarks or registered trademarks of their respective

holders. The information contained herein is subject to change

without notice. NETGEAR shall not be liable for technical or

editorial errors or omissions contained herein. All rights

reserved.

Source: NETGEAR-F

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 for NETGEAR, Inc.:

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. The words “anticipate,” “expect,” “believe,” “will,” “may,”

“should,” “estimate,” “project,” “outlook,” “forecast” or other

similar words are used to identify such forward-looking statements.

However, the absence of these words does not mean that the

statements are not forward-looking. The forward-looking statements

represent NETGEAR, Inc.’s expectations or beliefs concerning future

events based on information available at the time such statements

were made and include statements regarding: NETGEAR’s future

operating performance and financial condition, including

expectations regarding growth, revenue, operating margin and gross

margin; creating long-term value for shareholders; positioning

NETGEAR for long term success; long-term potential and profitable

growth; continued end user demand for NETGEAR’s ProAV line of

managed switches; expectations regarding more predictable

performance that is aligned to the market; revenue from the service

provider channel; expectations regarding continuing market demand

for the NETGEAR’s products and services; and expectations regarding

expected tax benefits or tax expenses. These statements are based

on management's current expectations and are subject to certain

risks and uncertainties, including the following: future demand for

NETGEAR’s products and services may be lower than anticipated;

NETGEAR may be unsuccessful, or experience delays, in manufacturing

and distributing its new and existing products and services;

consumers may choose not to adopt NETGEAR’s new product and

services offerings or adopt competing products and services;

NETGEAR may fail to manage costs, including the cost of key

components, the cost of air freight and ocean freight, and the cost

of developing new products and manufacturing and distribution of

its existing offerings; NETGEAR may fail to successfully continue

to effect operating expense savings; changes in the level of

NETGEAR's cash resources and NETGEAR’s planned usage of such

resources; changes in NETGEAR’s stock price and developments in the

business that could increase NETGEAR’s cash needs; fluctuations in

foreign exchange rates; loss of services of key personnel may

affect NETGEAR’s ability to executive on business strategy

effectively; and the actions and financial health of NETGEAR’s

customers, including NETGEAR’s ability to collect receivables as

they become due. Further, certain forward-looking statements are

based on assumptions as to future events that may not prove to be

accurate. Therefore, actual outcomes and results may differ

materially from what is expressed or forecast in such

forward-looking statements. Further information on potential risk

factors that could affect NETGEAR and its business are detailed in

NETGEAR’s periodic filings with the Securities and Exchange

Commission, including, but not limited to, those risks and

uncertainties listed in the section entitled "Part II - Item 1A.

Risk Factors" in NETGEAR’s quarterly report on Form 10-Q for the

fiscal quarter ended September 29, 2024, filed with the Securities

and Exchange Commission on November 1, 2024. Given these

circumstances, you should not place undue reliance on these

forward-looking statements. NETGEAR undertakes no obligation to

release publicly any revisions to any forward-looking statements

contained herein to reflect events or circumstances after the date

hereof or to reflect the occurrence of unanticipated events, except

as required by law.

Non-GAAP Financial Information:

To supplement our unaudited selected financial data presented on

a basis consistent with Generally Accepted Accounting Principles

(“GAAP”), we disclose certain non-GAAP financial measures that

exclude certain charges, including non-GAAP gross profit, non-GAAP

gross margin, non-GAAP research and development, non-GAAP sales and

marketing, non-GAAP general and administrative, non-GAAP total

operating expenses, non-GAAP operating income (loss), non-GAAP

operating margin, non-GAAP other income (expenses), net, non-GAAP

net income (loss) and non-GAAP net income (loss) per diluted share.

These supplemental measures exclude adjustments for amortization of

intangibles, stock-based compensation expense, intangibles

impairment, restructuring and other charges, litigation reserves,

net, gain/loss on investments, net, gain on litigation settlements,

and adjust for effects related to non-GAAP tax adjustments. These

non-GAAP measures are not in accordance with or an alternative for

GAAP, and may be different from non-GAAP measures used by other

companies. We believe that these non-GAAP measures have limitations

in that they do not reflect all of the amounts associated with our

results of operations as determined in accordance with GAAP and

that these measures should only be used to evaluate our results of

operations in conjunction with the corresponding GAAP measures. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for the most directly

comparable GAAP measures. We compensate for the limitations of

non-GAAP financial measures by relying upon GAAP results to gain a

complete picture of our performance.

In calculating non-GAAP financial measures, we exclude certain

items to facilitate a review of the comparability of our operating

performance on a period-to-period basis because such items are not,

in our view, related to our ongoing operational performance. We use

non-GAAP measures to evaluate the operating performance of our

business, for comparison with forecasts and strategic plans, and

for benchmarking performance externally against competitors. In

addition, management’s incentive compensation is determined using

certain non-GAAP measures. Since we find these measures to be

useful, we believe that investors benefit from seeing results

“through the eyes” of management in addition to seeing GAAP

results. We believe that these non-GAAP measures, when read in

conjunction with our GAAP financials, provide useful information to

investors by offering:

- the ability to make more meaningful period-to-period

comparisons of our on-going operating results;

- the ability to better identify trends in our underlying

business and perform related trend analyses;

- a better understanding of how management plans and measures our

underlying business; and

- an easier way to compare our operating results against analyst

financial models and operating results of competitors that

supplement their GAAP results with non-GAAP financial

measures.

The following are explanations of the adjustments that we

incorporate into non-GAAP measures, as well as the reasons for

excluding them in the reconciliations of these non-GAAP financial

measures:

Amortization of intangibles consists primarily of non-cash

charges that can be impacted by, among other things, the timing and

magnitude of acquisitions. We consider our operating results

without these charges when evaluating our ongoing performance and

forecasting our earnings trends, and therefore exclude such charges

when presenting non-GAAP financial measures. We believe that the

assessment of our operations excluding these costs is relevant to

our assessment of internal operations and comparisons to the

performance of our competitors.

Stock-based compensation expense consists of non-cash charges

for the estimated fair value of stock options, restricted stock

units, performance shares and shares under the employee stock

purchase plan granted to employees. We believe that the exclusion

of these charges provides for more accurate comparisons of our

operating results to peer companies due to the varying available

valuation methodologies, subjective assumptions and the variety of

award types. In addition, we believe it is useful to investors to

understand the specific impact stock-based compensation expense has

on our operating results.

Other items consist of certain items that are the result of

either unique or unplanned events, including, when applicable:

restructuring and other charges, litigation reserves, net, and

gain/loss on investments, net. It is difficult to predict the

occurrence or estimate the amount or timing of these items in

advance. Although these events are reflected in our GAAP financial

statements, these unique transactions may limit the comparability

of our on-going operations with prior and future periods. The

amounts result from events that often arise from unforeseen

circumstances, which often occur outside of the ordinary course of

continuing operations. Therefore, the amounts do not accurately

reflect the underlying performance of our continuing business

operations for the period in which they are incurred.

Non-GAAP tax adjustments consist of adjustments that we

incorporate into non-GAAP measures in order to provide a more

meaningful measure on non-GAAP net income (loss). We believe

providing financial information with and without the income tax

effects relating to our non-GAAP financial measures, as well as

adjustments for valuation allowances on deferred tax assets,

provides our management and users of the financial statements with

better clarity regarding both current period performance and the

on-going performance of our business. Non-GAAP income tax expense

(benefit) is computed on a current and deferred basis with non-GAAP

income (loss) consistent with use of non-GAAP income (loss) as a

performance measure. The Non-GAAP tax provision (benefit) is

calculated by adjusting the GAAP tax provision (benefit) for the

impact of the non-GAAP adjustments, with specific tax provisions

such as state income tax and Base-erosion and Anti-Abuse Tax

recomputed on a non-GAAP basis, as well as adjustments for

valuation allowances on deferred tax assets. The tax valuation

allowance is a non-cash adjustment primarily reflecting our

expectations of, and assumptions as to, future operating results

and applicable tax laws, that are not directly attributable to the

current quarter’s operating performance. For interim periods, the

non-GAAP income tax provision (benefit) is calculated based on the

forecasted annual non-GAAP tax rate before discrete items and

adjusted for interim discrete items. Included in the non-GAAP tax

adjustments for the three and twelve months ended December 31, 2024

and December 31, 2023 are adjustments to tax expense (benefit)

related to differences between our prior forecasts and actual

results for the twelve months ended.

NETGEAR, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

December 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

286,444

$

176,717

Short-term investments

122,246

106,931

Accounts receivable, net

156,210

185,059

Inventories

162,539

248,851

Prepaid expenses and other current

assets

30,590

30,421

Total current assets

758,029

747,979

Property and equipment, net

11,288

8,273

Operating lease right-of-use assets

28,047

37,285

Goodwill

36,279

36,279

Other non-current assets

16,587

17,326

Total assets

$

850,230

$

847,142

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

58,481

$

46,850

Accrued employee compensation

23,290

21,286

Other accrued liabilities

148,078

168,084

Deferred revenue

30,261

27,091

Income taxes payable

9,973

1,037

Total current liabilities

270,083

264,348

Non-current income taxes payable

7,583

12,695

Non-current operating lease

liabilities

19,796

29,698

Other non-current liabilities

11,702

4,906

Total liabilities

309,164

311,647

Stockholders’ equity:

Common stock

29

30

Additional paid-in capital

997,912

967,651

Accumulated other comprehensive income

241

136

Accumulated deficit

(457,116

)

(432,322

)

Total stockholders’ equity

541,066

535,495

Total liabilities and stockholders’

equity

$

850,230

$

847,142

NETGEAR, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share and percentage data)

(Unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net revenue

$

182,419

$

182,854

$

188,674

$

673,759

$

740,840

Cost of revenue

123,035

126,371

123,038

477,832

491,588

Gross profit

59,384

56,483

65,636

195,927

249,252

Gross margin

32.6

%

30.9

%

34.8

%

29.1

%

33.6

%

Operating expenses:

Research and development

20,099

20,905

19,592

81,082

83,295

Sales and marketing

32,212

31,196

30,552

123,694

127,778

General and administrative

17,858

8,357

17,107

63,468

66,243

Litigation reserves, net

3,613

(100,855

)

—

(89,012

)

178

Restructuring and other charges

687

1,072

1,259

4,479

3,962

Intangibles impairment

—

—

—

—

1,071

Total operating expenses

74,469

(39,325

)

68,510

183,711

282,527

Income (loss) from operations

(15,085

)

95,808

(2,874

)

12,216

(33,275

)

Operating margin

(8.3

)%

52.4

%

(1.5

)%

1.8

%

(4.5

)%

Other income, net

3,624

3,485

2,454

12,672

14,139

(Loss) income before income taxes

(11,461

)

99,293

(420

)

24,888

(19,136

)

(Benefit from) provision for income

taxes

(2,575

)

14,219

1,249

12,525

85,631

Net (loss) income

$

(8,886

)

$

85,074

$

(1,669

)

$

12,363

$

(104,767

)

Net (loss) income per share:

Basic

$

(0.31

)

$

2.96

$

(0.06

)

$

0.43

$

(3.57

)

Diluted

$

(0.31

)

$

2.90

$

(0.06

)

$

0.42

$

(3.57

)

Weighted average shares used to compute

net (loss) income per share:

Basic

28,648

28,705

29,623

28,905

29,355

Diluted

28,648

29,364

29,623

29,683

29,355

NETGEAR, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Twelve Months Ended

December 31, 2024

December 31, 2023

Cash flows from operating

activities:

Net income (loss)

$

12,363

$

(104,767

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

6,514

7,161

Stock-based compensation

22,678

17,938

Gain on investments, net

(3,552

)

(3,226

)

Intangibles impairment

—

1,071

Deferred income taxes

1,001

82,319

Provision for excess and obsolete

inventory

6,064

3,168

Changes in assets and liabilities:

Accounts receivable, net

28,849

92,425

Inventories

80,248

47,595

Prepaid expenses and other assets

5,101

(3,189

)

Accounts payable

11,486

(38,947

)

Accrued employee compensation

2,004

(2,846

)

Other accrued liabilities

(15,152

)

(45,893

)

Deferred revenue

3,368

6,969

Income taxes payable

3,825

(2,925

)

Net cash provided by operating

activities

164,797

56,853

Cash flows from investing

activities:

Purchases of short-term investments

(137,228

)

(135,920

)

Proceeds from maturities of short-term

investments

120,290

115,006

Purchases of property and equipment

(8,994

)

(5,799

)

Purchases of long-term investments

(225

)

(720

)

Net cash used in investing activities

(26,157

)

(27,433

)

Cash flows from financing

activities:

Repurchases of common stock

(33,088

)

—

Restricted stock unit withholdings

(3,409

)

(2,793

)

Proceeds from exercise of stock

options

4,019

—

Proceeds from issuance of common stock

under employee stock purchase plan

3,565

3,590

Net cash (used in) provided by financing

activities

(28,913

)

797

Net increase in cash and cash

equivalents

109,727

30,217

Cash and cash equivalents, at beginning of

period

176,717

146,500

Cash and cash equivalents, at end of

period

$

286,444

$

176,717

NETGEAR, INC.

RECONCILIATIONS OF GAAP

MEASURES TO NON-GAAP MEASURES

(In thousands, except

percentage data)

(Unaudited)

STATEMENT OF OPERATIONS DATA:

Three Months Ended

Twelve Months Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

GAAP gross profit

$

59,384

$

56,483

$

65,636

$

195,927

$

249,252

GAAP gross margin

32.6

%

30.9

%

34.8

%

29.1

%

33.6

%

Amortization of intangibles

—

—

—

—

257

Stock-based compensation expense

391

444

358

1,613

1,405

Non-GAAP gross profit

$

59,775

$

56,927

$

65,994

$

197,540

$

250,914

Non-GAAP gross margin

32.8

%

31.1

%

35.0

%

29.3

%

33.9

%

GAAP research and development

$

20,099

$

20,905

$

19,592

$

81,082

$

83,295

Stock-based compensation expense

(887

)

(868

)

(885

)

(3,297

)

(3,935

)

Non-GAAP research and development

$

19,212

$

20,037

$

18,707

$

77,785

$

79,360

GAAP sales and marketing

$

32,212

$

31,196

$

30,552

$

123,694

$

127,778

Stock-based compensation expense

(2,190

)

(1,520

)

(1,237

)

(6,182

)

(5,336

)

Non-GAAP sales and marketing

$

30,022

$

29,676

$

29,315

$

117,512

$

122,442

GAAP general and administrative

$

17,858

$

8,357

$

17,107

$

63,468

$

66,243

Stock-based compensation expense

(3,158

)

(2,788

)

(1,821

)

(11,586

)

(7,262

)

Non-GAAP general and administrative

$

14,700

$

5,569

$

15,286

$

51,882

$

58,981

GAAP total operating expenses

$

74,469

$

(39,325

)

$

68,510

$

183,711

$

282,527

Stock-based compensation expense

(6,235

)

(5,176

)

(3,943

)

(21,065

)

(16,533

)

Intangibles impairment

—

—

—

—

(1,071

)

Restructuring and other charges

(687

)

(1,072

)

(1,259

)

(4,479

)

(3,962

)

Litigation reserves, net

(3,613

)

100,855

—

89,012

(178

)

Non-GAAP total operating expenses

$

63,934

$

55,282

$

63,308

$

247,179

$

260,783

GAAP operating (loss) income

$

(15,085

)

$

95,808

$

(2,874

)

$

12,216

$

(33,275

)

GAAP operating margin

(8.3

)%

52.4

%

(1.5

)%

1.8

%

(4.5

)%

Amortization of intangibles

—

—

—

—

257

Stock-based compensation expense

6,626

5,620

4,301

22,678

17,938

Intangibles impairment

—

—

—

—

1,071

Restructuring and other charges

687

1,072

1,259

4,479

3,962

Litigation reserves, net

3,613

(100,855

)

—

(89,012

)

178

Non-GAAP operating (loss) income

$

(4,159

)

$

1,645

$

2,686

$

(49,639

)

$

(9,869

)

Non-GAAP operating margin

(2.3

)%

0.9

%

1.4

%

(7.4

)%

(1.3

)%

GAAP other income, net

$

3,624

$

3,485

$

2,454

$

12,672

$

14,139

Gain/loss on investments, net

110

(49

)

(8

)

93

8

Gain on litigation settlements

—

—

—

—

(6,000

)

Non-GAAP other income, net

$

3,734

$

3,436

$

2,446

$

12,765

$

8,147

NETGEAR, INC.

RECONCILIATIONS OF GAAP

MEASURES TO NON-GAAP MEASURES (CONTINUED)

(In thousands, except per

share data)

(Unaudited)

STATEMENT OF OPERATIONS DATA

(CONTINUED):

Three Months Ended

Twelve Months Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

GAAP net (loss) income

$

(8,886

)

$

85,074

$

(1,669

)

$

12,363

$

(104,767

)

Amortization of intangibles

—

—

—

—

257

Stock-based compensation expense

6,626

5,620

4,301

22,678

17,938

Intangibles impairment

—

—

—

—

1,071

Restructuring and other charges

687

1,072

1,259

4,479

3,962

Litigation reserves, net

3,613

(100,855

)

—

(89,012

)

178

Gain/loss on investments, net

110

(49

)

(8

)

93

8

Gain on litigation settlements

—

—

—

—

(6,000

)

Non-GAAP tax adjustments

(3,761

)

14,203

(1,138

)

23,055

86,586

Non-GAAP net income (loss)

$

(1,611

)

$

5,065

$

2,745

$

(26,344

)

$

(767

)

NET INCOME (LOSS) PER DILUTED

SHARE:

GAAP net (loss) income per diluted

share

$

(0.31

)

$

2.90

$

(0.06

)

$

0.42

$

(3.57

)

Amortization of intangibles

—

—

—

—

0.01

Stock-based compensation expense

0.23

0.19

0.14

0.78

0.61

Intangibles impairment

—

—

—

—

0.04

Restructuring and other charges

0.02

0.04

0.04

0.15

0.13

Litigation reserves, net

0.13

(3.43

)

—

(3.08

)

0.01

Gain/loss on investments, net

—

—

—

—

—

Gain on litigation settlements

—

—

—

—

(0.20

)

Non-GAAP tax adjustments

(0.13

)

0.47

(0.03

)

0.82

2.94

Non-GAAP net income (loss) per diluted

share 1

$

(0.06

)

$

0.17

$

0.09

$

(0.91

)

$

(0.03

)

Shares used in computing GAAP net (loss)

income per diluted share

28,648

29,364

29,623

29,683

29,355

Shares used in computing non-GAAP net

income (loss) per diluted share

28,648

29,364

29,683

28,905

29,355

1 The per share reconciliation of GAAP to

non-GAAP may not aggregate due to both calculations utilizing a

different share basis. The net loss per diluted share calculation

uses a lower share count as it excludes potentially dilutive shares

included in the net income per diluted share calculation.

NETGEAR, INC.

SUPPLEMENTAL FINANCIAL

INFORMATION

(In thousands, except per

share data, DSO, inventory turns, weeks of channel inventory,

headcount and percentage data)

(Unaudited)

Three Months Ended

December 31, 2024

September 29, 2024

June 30, 2024

March 31, 2024

December 31, 2023

Cash, cash equivalents and short-term

investments

$

408,690

$

395,732

$

294,339

$

289,421

$

283,648

Cash, cash equivalents and short-term

investments per diluted share

$

14.27

$

13.48

$

10.19

$

9.85

$

9.56

Accounts receivable, net

$

156,210

$

177,326

$

147,069

$

172,771

$

185,059

Days sales outstanding (DSO)

80

88

93

96

89

Inventories

$

162,539

$

161,976

$

188,936

$

211,270

$

248,851

Ending inventory turns

3.0

3.1

2.4

2.2

2.0

Weeks of channel inventory:

U.S. retail channel

9.7

9.5

9.5

11.2

10.8

U.S. distribution channel

3.3

2.4

2.8

4.0

7.9

EMEA distribution channel

4.8

5.3

5.2

5.9

6.4

APAC distribution channel

10.0

9.5

8.3

8.0

10.0

Deferred revenue (current and

non-current)

$

35,362

$

35,068

$

34,216

$

33,714

$

31,994

Headcount

655

638

622

628

635

Non-GAAP diluted shares

28,648

29,364

28,883

29,395

29,683

NET REVENUE BY GEOGRAPHY

Three Months Ended

Twelve Months Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Americas

$122,857

67%

$127,752

70%

$124,798

66%

$456,040

68%

$504,349

68%

EMEA

35,920

20%

32,798

18%

37,899

20%

127,260

19%

148,922

20%

APAC

23,642

13%

22,304

12%

25,977

14%

90,459

13%

87,569

12%

Total

$182,419

100%

$182,854

100%

$188,674

100%

$673,759

100%

$740,840

100%

NETGEAR, INC.

SUPPLEMENTAL FINANCIAL

INFORMATION (CONTINUED)

(In thousands)

(Unaudited)

NET REVENUE BY SEGMENT

Three Months Ended

Twelve Months Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

NETGEAR for Business

$

80,792

$

78,530

$

70,296

$

287,812

$

293,975

Connected Home

101,627

104,324

118,378

385,947

446,865

Total net revenue

$

182,419

$

182,854

$

188,674

$

673,759

$

740,840

SERVICE PROVIDER NET REVENUE

Three Months Ended

Twelve Months Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

NETGEAR for Business

$

264

$

268

$

152

$

977

$

579

Connected Home

19,801

22,949

27,313

90,035

98,659

Total service provider net revenue

$

20,065

$

23,217

$

27,465

$

91,012

$

99,238

NETGEAR, INC.

SUPPLEMENTAL FINANCIAL

INFORMATION (CONTINUED)

(In thousands)

(Unaudited)

SEGMENT DATA:

Three Months Ended

Twelve Months Ended

December 31, 2024

September 29, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(In thousands, except percentage

data)

NETGEAR for Business

Connected Home

Total

NETGEAR for Business

Connected Home

Total

NETGEAR for Business

Connected Home

Total

NETGEAR for Business

Connected Home

Total

NETGEAR for Business

Connected Home

Total

Net revenue

$

80,792

$

101,627

$

182,419

$

78,530

$

104,324

$

182,854

$

70,296

$

118,378

$

188,674

$

287,812

$

385,947

$

673,759

$

293,975

$

446,865

$

740,840

Cost of revenue

45,354

77,290

122,644

43,436

82,491

125,927

37,519

85,162

122,681

168,399

307,820

476,219

163,083

326,843

489,926

Gross profit

35,438

24,337

59,775

35,094

21,833

56,927

32,777

33,216

65,993

119,413

78,127

197,540

130,892

120,022

250,914

Gross margin

43.9

%

23.9

%

32.8

%

44.7

%

20.9

%

31.1

%

46.6

%

28.1

%

35.0

%

41.5

%

20.2

%

29.3

%

44.5

%

26.9

%

33.9

%

Contribution income (loss)

15,907

(1,297

)

14,610

16,133

(4,780

)

11,353

14,511

*

7,209

*

21,720

*

44,005

(26,011

)

17,994

56,765

*

9,545

*

66,310

*

Contribution margin

19.7

%

(1.3

)%

8.0

%

20.5

%

(4.6

)%

6.2

%

20.6

%

*

6.1

%

*

11.5

%

*

15.3

%

(6.7

)%

2.7

%

19.3

%

*

2.1

%

*

9.0

%

*

Corporate and unallocated costs

(18,769

)

(9,708

)

(19,034

)

*

(67,633

)

(76,179

)

*

Amortization of intangibles

—

—

—

—

(257

)

Stock-based compensation expense

(6,626

)

(5,620

)

(4,301

)

(22,678

)

(17,938

)

Intangibles impairment

—

—

—

—

(1,071

)

Restructuring and other charges

(687

)

(1,072

)

(1,259

)

(4,479

)

(3,962

)

Litigation reserves, net

(3,613

)

100,855

—

89,012

(178

)

Other income, net

3,624

3,485

2,454

12,672

14,139

Loss before income taxes

$

(11,461

)

$

99,293

$

(420

)

$

24,888

$

(19,136

)

_______________________

* Financial information for each

reportable segment in the prior year periods were recast to conform

to the current reportable segment structure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205238534/en/

NETGEAR Investor Relations Erik Bylin investors@netgear.com

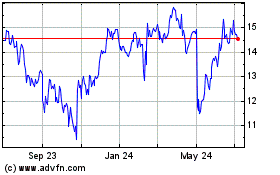

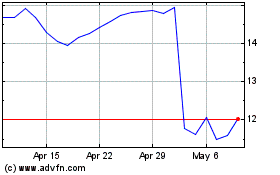

NETGEAR (NASDAQ:NTGR)

Historical Stock Chart

From Jan 2025 to Feb 2025

NETGEAR (NASDAQ:NTGR)

Historical Stock Chart

From Feb 2024 to Feb 2025