FALSE0001849820December 3100018498202024-07-182024-07-180001849820us-gaap:CommonStockMember2024-07-182024-07-180001849820us-gaap:WarrantMember2024-07-182024-07-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 18, 2024

NAUTICUS ROBOTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40611 | | 87-1699753 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

17146 Feathercraft Lane, Suite 450, Webster, TX 77598

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (281) 942-9069

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | KITT | | The Nasdaq Stock Market LLC |

| Warrants | | KITTW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year

On July 18, 2024, Nauticus Robotics, Inc. (the "Company") filed a certificate of amendment to its Second Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware (the "Certificate of Amendment") to effect a 1-for-36 reverse stock split of the shares of the Company's common stock, par value $0.0001 per share on July 22, 2024. No fractional shares will be issued in connection with the reverse stock split, but will instead be rounded up to the nearest whole share. The Board of Directors of the Company approved the Certificate of Amendment to meet the share bid price requirements of the NASDAQ Capital Market. The Company’s stockholders approved the Certificate of Amendment at a special meeting held on June 17, 2024.

The Company's common stock is expected to begin trading on a reverse stock split-adjusted basis on the Nasdaq Capital market when the market opens on July 23, 2024. The trading symbol for the Company's common stock will remain "KITT." The Company was assigned a new CUSIP number (63911H 207) in connection with the reverse split.

All options, warrants and other convertible securities of the Company outstanding immediately prior to the effectiveness of the Certificate of Amendment will be adjusted in accordance with the terms of the plans, agreements or arrangements governing such options, warrants and other convertible securities and subject to rounding to the nearest whole share.

Each stockholder’s percentage ownership interest in the Company and proportional voting power will remain virtually unchanged by the Certificate of Amendment, except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and privileges of the holders of shares of the Company’s common stock will be substantially unaffected.

Item 7.01 Regulation FD Disclosure

On July 18, 2024, the Company issued a press release announcing the reverse stock split. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| 3.1 | | |

| 99.1 | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: July 18, 2024 | Nauticus Robotics, Inc. |

| | |

| By: | /s/ Nicholas J. Bigney |

| | Name: | Nicholas J. Bigney |

| | Title: | General Counsel |

CERTIFICATE OF AMENDMENT

TO THE

SECOND AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF NAUTICUS ROBOTICS, INC.

Nauticus Robotics, Inc., (the “Corporation”), a corporation duly organized and validly existing under the General Corporation Law of the State of Delaware (the “DGCL”), hereby files this Certificate of Amendment (this “Certificate of Amendment”) to the Amended and Restated Certificate of Incorporation of the Corporation, as amended, and certifies as follows:

1.The original Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on June 18, 2020, an Amended and Restated Certificate of Incorporation of the Corporation was filed with the Secretary of State of Delaware on July 14, 2021, and a Second Amended and Restated Certificate of Incorporation of the Corporation was filed with the Secretary of State of Delaware on September 9, 2022.

2.The Second Amended and Restated Certificate of Incorporation, as amended, is hereby amended by adding the following to the end of paragraph (A) of Article Fourth thereof:

Upon the filing and effectiveness (the “Effective Time”) pursuant to the DGCL of the Certificate of Amendment to the Amended and Restated Certificate of Incorporation, as amended, each 36 shares of Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and converted into one share of Common Stock (the “Reverse Stock Split”). No fractional shares shall be issued in connection with the Reverse Stock Split. Stockholders who, immediately prior to the Effective Time, own a number of shares of Common Stock which is not evenly divisible by the exchange ratio set forth above shall, with respect to such fractional interest, be entitled to receive the next highest whole number of shares of Common Stock. Each certificate that immediately prior to the Effective Time represented shares of Common Stock or book-entry then outstanding representing shares of Common Stock, shall thereafter represent the number of shares of Common Stock that give effect to the Reverse Stock Split; provided, that each person holding of record a stock certificate or certificates that represented shares of Common Stock shall receive, upon surrender of such certificate or certificates, a new certificate or certificates evidencing and representing the number of shares of Common Stock to which such person is entitled under the foregoing, subject to the rounding up of any fractional interests as described in the foregoing.

3.This Certificate of Amendment was duly adopted in accordance with the provisions of Section 242 of the DGCL.

4.This Certificate of Amendment shall become effective at 4:01 p.m. Eastern Time on July 22, 2024.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed by its duly authorized officer on July 18, 2024.

NAUTICUS ROBOTICS, INC.

By:_/s/ John W. Gibson, Jr._________________

Name: John W. Gibson, Jr.

Title: President & CEO

Nauticus Robotics Announces Transformative 1-for-36 Reverse Stock Split

HOUSTON – July 18, 2024. Nauticus Robotics, Inc. (“Nauticus” or the “Company”) (NASDAQ: KITT) today announced that it will proceed with a 1-for-36 reverse stock split ("Reverse Split") of its outstanding shares of common stock (the "Common Stock") following approval by its Board of Directors. This ratio is within the range approved by stockholders at the annual meeting of the Company’s shareholders held on June 17, 2024.

Key Information About the Reverse Split

What is a Reverse Split?

A reverse stock split is a corporate action that reduces the number of outstanding shares and proportionately increases the share price. In this case, Nauticus is implementing a 1-for-36 reverse stock split, meaning that every 36 shares of our common stock will be consolidated into one share.

Why is Nauticus enacting the Reverse Split?

By reducing the number of shares, the per-share stock price of Nauticus’ common stock should increase proportionally. The primary objective of the Reverse Split is to increase the share price to comply with the minimum bid price required by The Nasdaq Capital Market. A higher share price can also make the stock more attractive to a broader range of investors, including institutional investors who may have minimum price thresholds for investments.

How will the Reverse Split affect current investors?

Every 36 shares of Nauticus common stock held by shareholders will be automatically combined into one share. Fractional shares will be rounded up to the nearest share. This adjustment will not change the ownership of the company or change the overall value of Nauticus, and the share price should be adjusted accordingly. Current shareholders will retain the same percentage ownership in the Company as before the reverse split.

When will the Reverse Split be effective?

The Reverse Split is expected to become effective at 4:01 p.m., Eastern Time, on July 22, 2024. After-market trading of shares in Nauticus’ Common Stock may be suspended temporarily at that time. Nauticus expects the Common Stock will begin trading on a post-split basis at the market open on July 23, 2024 under the symbol "KITT" with the new CUSIP number 63911H 207.

Do shareholders need to take any action in connection with the Reverse Split?

Shareholders holding their shares electronically in book-entry form are not required to take any action to receive the post-split shares. Shareholders who hold certificated shares will receive instructions from Continental Stock Transfer and Trust, our transfer agent who is acting as the exchange agent for the Reverse Split.

Where can I find additional information?

Additional information about the Reverse Stock Split can be found in Nauticus' definitive proxy statement (Form DEF 14A) filed with the U.S. Securities and Exchange Commission on April 26, 2024.

About Nauticus Robotics

Nauticus Robotics, Inc. develops autonomous robots for the ocean industries. Autonomy requires the extensive use of sensors, artificial intelligence, and effective algorithms for perception and decision allowing the robot to adapt to changing environments. The company’s business model includes using robotic systems for service, selling vehicles and components, and licensing of related software to both the commercial and defense business sectors. Nauticus has designed and is currently testing and certifying a new generation of vehicles to reduce operational cost and gather data to maintain and operate a wide variety of subsea infrastructure. Besides a standalone service offering and forward-facing products, Nauticus’ approach to ocean robotics has also resulted in the development of a range of technology products for retrofit/upgrading traditional ROV operations and other third-party vehicle platforms. Nauticus’ services provide customers with the necessary data collection, analytics, and subsea manipulation capabilities to support and maintain assets while reducing their operational footprint, operating cost, and greenhouse gas emissions, to improve offshore health, safety, and environmental exposure.

Cautionary Language Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Act”), and are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the Act as well as protections afforded by other federal securities laws. Such forward-looking statements include but are not limited to: the expected timing of product commercialization or new product releases; customer interest in Nauticus’ products; estimated operating results and use of cash; and Nauticus’ use of and needs for capital. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends,” or “continue” or similar expressions. Forward-looking statements inherently involve risks and uncertainties that may cause actual events, results, or performance to differ materially from those indicated by such statements. These forward-looking statements are based on Nauticus’ management’s current expectations and beliefs, as well as a number of assumptions concerning future events. There can be no assurance that the events, results, or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and Nauticus is not under any obligation and expressly disclaims any obligation, to update, alter, or otherwise revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports which Nauticus

has filed or will file from time to time with the Securities and Exchange Commission (the “SEC”) for a more complete discussion of the risks and uncertainties facing the Company and that could cause actual outcomes to be materially different from those indicated in the forward-looking statements made by the Company, in particular the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in documents filed from time to time with the SEC, including Nauticus’ most recent Annual Report on Form 10-K. Should one or more of these risks, uncertainties, or other factors materialize, or should assumptions underlying the forward-looking information or statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated, or expected. The documents filed by Nauticus with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

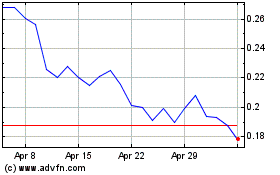

Nauticus Robotics (NASDAQ:KITT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nauticus Robotics (NASDAQ:KITT)

Historical Stock Chart

From Jul 2023 to Jul 2024