Nathan's Famous, Inc. Reports Second Quarter Results

November 07 2024 - 6:30AM

Nathan's Famous, Inc. (“Nathan’s”, the “Company”, “we”, “us” or

“our”) (NASDAQ:NATH) today reported results for its second fiscal

quarter ended September 29, 2024.

For the thirteen-week period ended September 29,

2024 (“second quarter fiscal 2025”):

- Revenues were $41,109,000 as

compared to $38,744,000 during the thirteen weeks ended September

24, 2023;

- Income from operations was

$9,632,000 as compared to $9,104,000 during the thirteen weeks

ended September 24, 2023;

- Adjusted EBITDA1, a non-GAAP

financial measure, was $10,350,000 as compared to $9,774,000 during

the thirteen weeks ended September 24, 2023;

- Income before provision for income

taxes was $8,099,000 as compared to $7,864,000 during the thirteen

weeks ended September 24, 2023;

- Net income was $6,030,000 as

compared to $5,711,000 during the thirteen weeks ended September

24, 2023; and

- Earnings per diluted share was

$1.47 per share as compared to $1.40 per share during the thirteen

weeks ended September 24, 2023.

For the twenty-six weeks ended September 29,

2024 (“fiscal 2025”):

- Revenues were $85,876,000 as compared to $80,729,000 during the

twenty-six weeks ended September 24, 2023;

- Income from operations was $23,377,000 as compared to

$20,567,000 during the twenty-six weeks ended September 24,

2023;

- Adjusted EBITDA1, a non-GAAP financial measure, was $24,631,000

as compared to $21,810,000 during the twenty-six weeks ended

September 24, 2023;

- Income before provision for income taxes was $20,883,000 as

compared to $17,996,000 during the twenty-six weeks ended September

24, 2023;

- Net income was $15,307,000 as compared to $13,099,000 during

the twenty-six weeks ended September 24, 2023; and

- Earnings per diluted share was $3.74 per share as compared to

$3.20 per share during the twenty-six weeks ended September 24,

2023.

The Company also reported the following:

- License royalties increased to

$22,412,000 during the twenty-six weeks ended September 29, 2024,

(“fiscal 2025 period”) as compared to $19,997,000 during the

twenty-six weeks ended September 24, 2023. During the fiscal 2025

period, royalties earned under the retail agreement, including the

foodservice program, from Smithfield Foods, Inc., increased 13% to

$20,605,000 as compared to $18,303,000 of royalties earned during

the twenty-six weeks ended September 24, 2023.

- In the Branded Product Program,

which features the sale of Nathan’s hot dogs to the foodservice

industry, sales increased by $2,160,000 to $50,682,000 during the

fiscal 2025 period as compared to $48,522,000 during the twenty-six

weeks ended September 24, 2023. The volume of hot dogs sold by the

Company increased by 2%. Our average selling price, which is

partially correlated to the beef markets, increased by

approximately 2.5% compared to the prior year period. Income from

operations decreased by $151,000 to $3,197,000 during the fiscal

2025 period as compared to $3,348,000 for the twenty-six weeks

ended September 24, 2023, due primarily to a 3% increase in the

cost of beef and beef trimmings.

- Sales from Company-owned

restaurants were $9,547,000 during the fiscal 2025 period as

compared to $8,851,000 during the twenty-six weeks ended September

24, 2023. Restaurant sales were impacted by higher sales at our

Coney Island locations due to an increase in our average check,

offset by lower sales at our location in Oceanside, New York.

- Franchise fees and royalties were

$2,247,000 during the fiscal 2025 period as compared to $2,366,000

during the twenty-six weeks ended September 24, 2023. Total

royalties were $2,047,000 during the fiscal 2025 period as compared

to $2,128,000 during the twenty-six weeks ended September 24, 2023.

The decrease in franchise royalties during the fiscal 2025 period

was primarily due to a decline in franchise restaurant sales to

$36,334,000 as compared to $36,433,000 for the twenty-six weeks

ended September 24, 2023.2 Total franchise fee income,

including cancellation fees, was $200,000 during the fiscal 2025

period as compared to $238,000 during the twenty-six weeks ended

September 24, 2023. Twenty-one franchised locations opened during

the fiscal 2025 period.

- During the fiscal 2025 period, we

recorded Advertising Fund revenue and expense of $988,000 as

compared to $993,000 during the twenty-six weeks ended September

24, 2023.

- During the fiscal 2025 period, the

Board of Directors declared and paid two quarterly cash dividends

of $0.50 per share totaling $4,085,000.

- Effective November 7, 2024, the

Board of Directors declared its quarterly cash dividend of $0.50

per share payable on December 6, 2024 to shareholders of record at

the close of business on November 25, 2024.

Certain Non-GAAP Financial

Information:

In addition to disclosing results that are

determined in accordance with Generally Accepted Accounting

Principles in the United States of America ("US GAAP"), the Company

is disclosing EBITDA, a non-GAAP financial measure which is defined

as net income, excluding (i) interest expense; (ii) provision for

income taxes and (iii) depreciation and amortization expense. The

Company is also disclosing Adjusted EBITDA, a non-GAAP financial

measure which is defined as EBITDA, excluding (i) the loss on debt

extinguishment and (ii) share-based compensation that the Company

believes will impact the comparability of its results of

operations.

The Company believes that EBITDA and Adjusted

EBITDA are useful to investors to assist in assessing and

understanding the Company's operating performance and underlying

trends in the Company's business because EBITDA and Adjusted EBITDA

are (i) among the measures used by management in evaluating

performance and (ii) are frequently used by securities analysts,

investors and other interested parties as a common performance

measure.

EBITDA and Adjusted EBITDA are not recognized

terms under US GAAP and should not be viewed as alternatives to net

income or other measures of financial performance or liquidity in

conformity with US GAAP. Additionally, our definitions of EBITDA

and Adjusted EBITDA may differ from other companies. Analysis of

results and outlook on a non-US GAAP basis should be used as a

complement to, and in conjunction with, data presented in

accordance with US GAAP. Please see the table at the end of this

press release for a reconciliation of EBITDA and Adjusted EBITDA to

net income.

About Nathan’s Famous

Nathan’s is a Russell 2000 Company that

currently distributes its products in 50 states, the District of

Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, and nineteen

foreign countries through its restaurant system, foodservice sales

programs and product licensing activities. For additional

information about Nathan’s please visit our website at

www.nathansfamous.com.

__________________________

1 EBITDA and Adjusted EBITDA are non-GAAP financial measures.

Please see the definitions of EBITDA and Adjusted EBITDA on page 3

of this release and the reconciliation of EBITDA and Adjusted

EBITDA to net income in the table at the end of this release.

2 Franchise restaurant sales are not revenues of

the Company and are not included in the Company’s Consolidated

Financial Statements.

Except for historical information contained in

this news release, the matters discussed are forward looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, that involve risks and uncertainties. Words

such as “anticipate”, “believe”, “estimate”, “expect”, “intend”,

and similar expressions identify forward-looking statements, which

are based on the current belief of the Company’s management, as

well as assumptions made by and information currently available to

the Company’s management. Among the factors that could cause actual

results to differ materially include but are not limited to: the

impact of disease epidemics such as the COVID-19 pandemic;

increases in the cost of food and paper products; the impact of

price increases on customer visits; the status of our licensing and

supply agreements, including our licensing revenue and overall

profitability being substantially dependent on our agreement with

Smithfield Foods, Inc.; the impact of our debt service and

repayment obligations under our Credit Agreement, including the

effect on our ability to fund working capital, operations and make

new investments; economic (including inflationary pressures like

those currently being experienced); weather (including the impact

on sales at our restaurants particularly during the summer months),

and changes in the price of beef and beef trimmings; our ability to

pass on the cost of any price increases in beef and beef trimmings;

legislative and business conditions; the collectability of

receivables; changes in consumer tastes; the continued viability of

Coney Island as a destination location for visitors; the ability to

attract franchisees; the impact of the minimum wage legislation on

labor costs in New York State or other changes in labor laws,

including regulations which could render a franchisor as a “joint

employer” or the impact of our union contracts; our ability to

attract competent restaurant and managerial personnel; the

enforceability of international franchising agreements; the future

effects of any food borne illness, such as bovine spongiform

encephalopathy, BSE and e coli; and the risk factors reported from

time to time in the Company’s SEC reports. The Company does not

undertake any obligation to update such forward-looking

statements.

COMPANY Robert

Steinberg, Vice President - Finance and CFO

CONTACT: (516)

338-8500 ext. 229

|

Nathan's Famous, Inc. and Subsidiaries |

|

|

|

(unaudited) |

|

|

|

|

Thirteen weeks ended |

|

Twenty-six weeks ended |

|

|

Sept. 29, 2024 |

|

Sept. 24, 2023 |

|

Sept. 29, 2024 |

|

Sept. 24, 2023 |

|

Financial Highlights |

|

|

|

|

|

|

|

|

|

|

Total revenues |

$ |

41,109,000 |

|

$ |

38,744,000 |

|

$ |

85,876,000 |

|

$ |

80,729,000 |

|

|

|

|

|

|

|

|

|

|

Income from operations (a) |

$ |

9,632,000 |

|

$ |

9,104,000 |

|

$ |

23,377,000 |

|

$ |

20,567,000 |

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

6,030,000 |

|

$ |

5,711,000 |

|

$ |

15,307,000 |

|

$ |

13,099,000 |

|

|

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.48 |

|

$ |

1.40 |

|

$ |

3.75 |

|

$ |

3.21 |

|

Diluted |

$ |

1.47 |

|

$ |

1.40 |

|

$ |

3.74 |

|

$ |

3.20 |

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used in |

|

|

|

|

|

|

|

|

Computing net income per share: |

|

|

|

|

|

|

|

|

Basic |

|

4,085,000 |

|

|

4,080,000 |

|

|

4,085,000 |

|

|

4,080,000 |

|

Diluted |

|

4,095,000 |

|

|

4,092,000 |

|

|

4,092,000 |

|

|

4,090,000 |

|

|

|

|

|

|

|

|

|

|

Select Segment Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

Branded product program |

$ |

24,536,000 |

|

$ |

23,352,000 |

|

$ |

50,682,000 |

|

$ |

48,522,000 |

|

Product licensing |

|

9,491,000 |

|

|

8,339,000 |

|

|

22,412,000 |

|

|

19,997,000 |

|

Restaurant operations |

|

6,522,000 |

|

|

6,484,000 |

|

|

11,794,000 |

|

|

11,217,000 |

|

Corporate (b) |

|

560,000 |

|

|

569,000 |

|

|

988,000 |

|

|

993,000 |

|

Total Revenues |

$ |

41,109,000 |

|

$ |

38,744,000 |

|

$ |

85,876,000 |

|

$ |

80,729,000 |

|

|

|

|

|

|

|

|

|

|

Income from operations (c) |

|

|

|

|

|

|

|

|

Branded product program |

$ |

697,000 |

|

$ |

1,387,000 |

|

$ |

3,197,000 |

|

$ |

3,348,000 |

|

Product licensing |

|

9,446,000 |

|

|

8,293,000 |

|

|

22,321,000 |

|

|

19,906,000 |

|

Restaurant operations |

|

1,781,000 |

|

|

1,639,000 |

|

|

2,827,000 |

|

|

2,308,000 |

|

Corporate (d) |

|

(2,292,000) |

|

|

(2,215,000) |

|

|

(4,968,000) |

|

|

(4,995,000) |

|

Income from operations (c) |

$ |

9,632,000 |

|

$ |

9,104,000 |

|

$ |

23,377,000 |

|

$ |

20,567,000 |

|

|

- Excludes loss on debt extinguishment, interest expense,

interest and dividend income, and other income, net.

- Represents Advertising Fund revenue.

- Excludes loss on debt extinguishment, interest expense,

interest and dividend income and other income, net which are

managed centrally at the corporate level, and, accordingly, such

items are not presented by segment since they are excluded from the

measure of profitability reviewed by the Chief Operating Decision

Maker.

- Consists principally of administrative expenses not allocated

to the operating segments such as executive management, finance,

information technology, legal, insurance, corporate office costs,

incentive compensation, compliance costs and the operating results

of the Advertising Fund.

|

Nathan's Famous, Inc. and Subsidiaries |

|

|

|

Reconciliation of Net Income to EBITDA and Adjusted

EBITDA |

|

(unaudited) |

|

|

|

|

Thirteen weeks ended |

|

Twenty-six weeks ended |

|

|

Sept. 29, 2024 |

|

Sept. 24, 2023 |

|

Sept. 29, 2024 |

|

Sept. 24, 2023 |

|

|

|

|

EBITDA |

|

|

|

|

|

|

|

|

Net Income |

$ |

6,030,000 |

|

$ |

5,711,000 |

|

$ |

15,307,000 |

|

$ |

13,099,000 |

|

|

|

|

|

|

|

|

|

|

Interest Expense |

1,441,000 |

|

1,413,000 |

|

2,501,000 |

|

2,827,000 |

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

2,069,000 |

|

2,153,000 |

|

5,576,000 |

|

4,897,000 |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

247,000 |

|

315,000 |

|

496,000 |

|

628,000 |

|

|

|

|

|

|

|

|

|

|

EBITDA |

$ |

9,787,000 |

|

$ |

9,592,000 |

|

$ |

23,880,000 |

|

$ |

21,451,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

EBITDA |

$ |

9,787,000 |

|

$ |

9,592,000 |

|

$ |

23,880,000 |

|

$ |

21,451,000 |

|

|

|

|

|

|

|

|

|

|

Loss on debt extinguishment |

334,000 |

|

- |

|

334,000 |

|

- |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

229,000 |

|

182,000 |

|

417,000 |

|

359,000 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

10,350,000 |

|

$ |

9,774,000 |

|

$ |

24,631,000 |

|

$ |

21,810,000 |

|

|

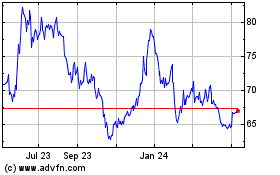

Nathans Famous (NASDAQ:NATH)

Historical Stock Chart

From Feb 2025 to Mar 2025

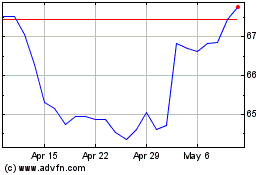

Nathans Famous (NASDAQ:NATH)

Historical Stock Chart

From Mar 2024 to Mar 2025