Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 21 2024 - 4:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-41426

Nano Labs Ltd

(Exact name of registrant as specified in its charter)

China Yuangu Hanggang Technology Building

509 Qianjiang Road, Shangcheng District,

Hangzhou, Zhejiang, 310000

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Interim Condensed Balance Sheet as of September

30, 2024

Nano Labs Ltd (the “Company”) sets

forth the preliminary unaudited condensed balance sheet as of September 30, 2024, which have been prepared by, and are the responsibility

of, the Company’s management. The preliminary financial data are based on the information currently available to us as of the date

of this report.

Nano Labs Ltd

Consolidated

Balance Sheets

(Unaudited)

| | |

As of

Sept 30, | | |

As of

Sept 30, | |

| | |

2024 | | |

2024 | |

| | |

RMB | | |

US$* | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

| 50,322,415 | | |

| 7,181,325 | |

| Restricted cash | |

| 418,201 | | |

| 59,680 | |

| Accounts receivable, net | |

| 2,178,747 | | |

| 310,921 | |

| Inventories, net | |

| 10,191,230 | | |

| 1,454,353 | |

| Prepayments | |

| 24,155,244 | | |

| 3,447,105 | |

| Other current assets | |

| 52,524,971 | | |

| 7,495,643 | |

| Total current assets | |

| 139,790,808 | | |

| 19,949,026 | |

| Non-current assets: | |

| | | |

| | |

| Property, plant and equipment, net | |

| 197,476,913 | | |

| 28,181,196 | |

| Intangible asset, net | |

| 46,991,905 | | |

| 6,706,040 | |

| Operating lease right-of-use assets | |

| 7,028,136 | | |

| 1,002,959 | |

| Total non-current assets | |

| 251,496,954 | | |

| 35,890,195 | |

| TOTAL ASSETS | |

| 391,287,762 | | |

| 55,839,222 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term debts | |

| 20,000,000 | | |

| 2,854,126 | |

| Current portion of long-term debts | |

| 4,580,000 | | |

| 653,595 | |

| Accounts payable | |

| 12,481,588 | | |

| 1,781,201 | |

| Advance from customers | |

| 83,505,919 | | |

| 11,916,819 | |

| Operating lease liabilities, current | |

| 2,877,067 | | |

| 410,576 | |

| Other current liabilities | |

| 70,839,217 | | |

| 10,109,201 | |

| Total current liabilities | |

| 194,283,792 | | |

| 27,725,518 | |

| Non-current liabilities: | |

| | | |

| | |

| Long-term debts | |

| 169,833,636 | | |

| 24,236,327 | |

| Operating lease liabilities, non-current | |

| 3,938,711 | | |

| 562,079 | |

| Total non-current liabilities | |

| 173,772,347 | | |

| 24,798,406 | |

| Total liabilities | |

| 368,056,139 | | |

| 52,523,923 | |

| Shareholders' equity : | |

| | | |

| | |

| Class A ordinary shares | |

| 100,584 | | |

| 14,354 | |

| Class B ordinary shares | |

| 36,894 | | |

| 5,265 | |

| Additional paid-in capital | |

| 531,220,288 | | |

| 75,808,472 | |

| Accumulated deficit | |

| (519,783,722 | ) | |

| (74,176,402 | ) |

| Statutory reserves | |

| 6,647,109 | | |

| 948,584 | |

| Accumulated other comprehensive income | |

| 5,010,470 | | |

| 715,026 | |

| Total Nano Labs Ltd shareholders' equity | |

| 18,516,603 | | |

| 2,642,436 | |

| Noncontrolling interests | |

| 4,715,020 | | |

| 672,863 | |

| Total shareholders' equity | |

| 23,231,623 | | |

| 3,315,299 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | |

| 391,287,762 | | |

| 55,839,222 | |

| * | Convenient translation rate is US$1 = RMB7.0074 |

In accordance with Nasdaq Listing Rule 5550(b)(1),

the Company is required to maintain a minimum of $2.5 million in stockholders’ equity for continued listing on The Nasdaq Capital

Market. Based on the financial statements for the six months ended/as of June 30, 2024, as disclosed by the Company on September 18, 2024,

the Company had fallen below this requirement.

During the three months ended September 30, 2024,

the Company entered into agreements with Mr. Jianping Kong, its chairman and chief executive officer, and Mr. Qifeng Sun, its vice chairman,

along with their respective affiliates (the “Lenders”) on September 20, 2024, to convert the interest-free loans from the

Lenders in an aggregated amount of US$8.5 million into certain amount of Class A ordinary shares (the “Conversion”) in lieu

of repayment of the Loans. The Conversion has been closed on September 23, 2024. This transaction has strengthened the Company’s

financial position and increased its stockholders’ equity. As of the date the Company furnished this report, the Company reasonably

believes it is compliant with Nasdaq Capital Market’s minimum stockholders' equity requirement of $2.5 million as a result of the

aforementioned transaction.

The Company acknowledges that Nasdaq will continue

to monitor its ongoing compliance with the stockholders’ equity requirement. If at the time of its next periodic report the Company

does not evidence compliance with this requirement, it may be subject to delisting from The Nasdaq Capital Market.

This report on Form 6-K is hereby incorporated

by reference into the Company’s Registration Statement on Form F-3, as amended, initially filed with the U.S. Securities and Exchange

Commission (the “SEC”) on August 14, 2023 (Registration No. 333-273968) and a prospectus supplement dated April 11, 2024 thereunder,

and shall be a part thereof from the date on which this current report is furnished, to the extent not superseded by documents or reports

subsequently filed or furnished.

Forward-Looking Statements

This report contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, without limitation, the Company’s compliance with the relevant Nasdaq

continued listing standards, which can be identified by terminology such as “may,” “will,” “expect,”

“anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,”

“potential,” “continue,” “is/are likely to” or other similar expressions. Such statements are based

upon management’s current expectations and current market and operating conditions, and relate to events that involve known or unknown

risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control,

which may cause the Company’s compliance status, actual results, performance or achievements to differ materially from those in

the forward-looking statements. Further information regarding these and other risks, uncertainties or factors is included in the Company’s

filings with the SEC. The Company does not undertake any obligation to

update any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Nano Labs Ltd |

| |

|

|

| Date: November 21, 2024 |

By: |

/s/ Jianping Kong |

| |

Name: |

Jianping Kong |

| |

Title: |

Chairman and Chief Executive Officer |

3

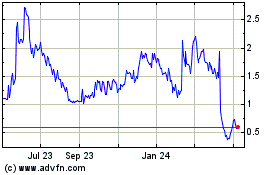

Nano Labs (NASDAQ:NA)

Historical Stock Chart

From Nov 2024 to Dec 2024

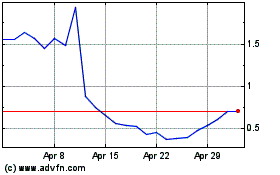

Nano Labs (NASDAQ:NA)

Historical Stock Chart

From Dec 2023 to Dec 2024