Nano Dimension Ltd. (Nasdaq: NNDM, “Nano

Dimension” or the “Company”), an industry leader in

Additively

Manufactured

Electronics, additive PCB assembly & printhead

drivers and software (

AME), and a supplier of

Additive

Manufacturing machines

and materials (

AM), today announced financial

results for the second quarter ended June 30th, 2024 and shared a

letter from the Company’s Chief Executive Officer.

Revenue:

- For Q2/2024 was $15.0 million, compared to Q2/2023’s $14.7

million.

- For H1/2024 was $28.4 million, compared to H1/2023’s

$29.7 million.

Gross Margin (“GM”):

- For Q2/2024 was 45.4%, compared to Q2/2023’s 44.1%.

- For H1/2024 was 45.8%, compared to H1/2023’s 44.0%.

Adjusted Gross Margin (“Adjusted

GM”):

- For Q2/2024 was 46.6%, compared to Q2/2023’s 47.5%.

- For H1/2024 was 48.1%, compared to H1/2023’s 47.3%.

Net Income / Loss:

-

For Q2/2024 was a loss of $44.3 million, compared to

Q2/2023’s loss of $9.4 million.

-

For H1/2024 was a loss of $79.2 million, compared to H1/2023’s

income of $12.6 million.

Net Income / Loss excluding changes in

Company’s holdings in Stratasys’ shares:

-

For Q2/2024 was a loss of $12.9 million, compared to Q2/2023’s loss

of $21.3 million.

-

For H1/2024 was a loss of $22.1 million, compared to

H1/2023’s loss of $44.6 million.

Adjusted EBITDA:

- For Q2/2024 was negative $16.1 million, compared to

Q2/2023’s negative $23.5 million.

- For H1/2024 was negative $29.7 million, compared to

H1/2023’s negative $47.2 million.

Company improves Net cash burn1 by

further reduction of expenses :

- For Q2/2024 was negative $11 million, compared to Q2/2023’s

negative $31 million.

- For H1/2024 was negative $18 million, compared to H1/2023’s

negative $58 million.

Details regarding Adjusted GM, Net Income / Loss

excluding changes in Company’s holdings on Stratasys’ shares,

Adjusted EBITDA and Net Cash Burn can be found below in this press

release under “non-IFRS measures.”

____________________1 Change in cash, cash

equivalents and deposits net of treasury shares repurchase.

CEO MESSAGE TO

SHAREHOLDERS:

Dear Shareholders,

Exciting times are ahead, as your company

continues to improve from the top to the bottom line. Additionally,

a transformational M&A definitive agreement is expected to

change our scale, makeup and merits of the business model,

exponentially.

On our business as it is

today

The first point to highlight is this year’s

quarterly revenue of $15.0 million. This is a record, especially in

the context of alleged macroeconomic headwinds and high interest

rates that seemingly all companies in our industry attest to as

being meaningfully challenging. Our exposure to markets indicates

“headwinds” mostly in central Europe, at this point.

But we are not only resting on our laurels. We

see continued improvements in our financial strength as we move

below the top-line and into our cash flow. This has been the focus

of our leadership team since we announced our Reshaping Nano

Initiative in Q3/2023. Our efforts are bearing fruit. In comparing

our H1 figures for 2024 vs. 2023, we see a 183 bps improvement in

gross margin and a $40 million reduction in net cash burn. The

latter is a monumental change and a reflection of the hard work of

our team to realize synergies and organizational efficiencies.

It is also important to call out that our

improved financial strength has not come at the expense of

innovation. In Q2/2024, we saw our industrial AI group, DeepCube,

along with our respective materials and software teams, all work on

new developments that will advance the impact of our products and

services for our customers. Our Additive Electronics team

implemented a new Integrated Inspection System (I2S), which brings

together pick-and-place functionality with inline inspection. The

team at Global Inkjet Systems Ltd. (“GIS”) also announced a new

partnership with Esko-Graphics BV and Fiery, LLC that combines the

partners’ respective workflow automation, prepress, color

management, and job management solutions with GIS’s advanced print

control systems, creating a streamlined process for Industry 4.0

smart printing.

Outlook, moving forward:

There is more to do. While our employees should

be proud of what they have achieved, management should not rest.

The future of Nano Dimension will undoubtedly be shaped by the

eventual closing of our agreement to acquire Desktop Metal, Inc.

(“DM”), which we worked on initially since late 2022, again in late

2023, and announced on July 3rd, 2024. This acquisition will create

a leader in AM.

The combined company will bring together

outstanding teams and one of the most advanced portfolios in AM for

mass production. I also believe this combination is compelling as

the products and services portfolio can be characterized as having

long term high growth potential. Together, we will accelerate our

industry’s transition to integrated digital manufacturing

solutions.

Now that the deal is signed, the team is

committed to preparing for realizing synergies to the greatest

extent possible and as soon as possible. To do this, we are working

on a post-merger integration plan to ensure a seamless transition

from day one after closing of the transaction.

I believe this acquisition was secured at an

exceptionally compelling valuation for our shareholders with the

total consideration being at most $183 million, and, with some

potential adjustments, as low as $135 million. This creates a pro

forma company that, based on the last full year figures from 2023,

had revenue of $246 million with 28% of that generated from

recurring revenue associated with consumables and services.

Having said that, we intend, if needed, to forgo

inflating the top line, for the benefit, if possible, of improved

EBITDA and reduction of negative cash flow while driving toward

cash generation and positive profits.

In closing, with our recent and continued

financial advancements along with a definitive agreement to acquire

DM, our team is “laser focused” on generating returns and expanding

value for our shareholders. We will continue to pursue operational

excellence and a M&A strategy that complements our offerings,

supporting our journey to becoming leaders in digital

manufacturing.

Thank you,

Yoav SternChief Executive Officer and a member

of the Board of Directors Nano Dimension

FINANCIAL RESULTS:

Financial results for the second quarter

ended June 30, 2024

- Total revenues for the second quarter of 2024 were $14,986,000,

compared to $14,737,000 in the second quarter of 2023. The increase

is attributed to increased sales of the Company’s product

lines.

- Total cost of revenues for the second quarter of 2024 was

$8,178,000, compared to $8,242,000 in the second quarter of

2023.

- As a result of the reorganizational plan executed by the

Company in the fourth quarter of 2023 and other cost reduction

efforts taken in 2024, the Company’s operating expenses across all

departments have decreased in the second quarter of 2024 compared

to the second quarter of 2023.

- Research and development (“R&D”) expenses for the second

quarter of 2024 were $9,121,000, compared to $16,386,000 in the

second quarter of 2023. The decrease is mainly attributed to a

decrease in payroll and related expenses, as well as in share-based

compensation expenses, materials for R&D use, subcontractors

and professional services, largely associated with organizational

synergies.

- Sales and marketing expenses for the second quarter of 2024

were $7,221,000, compared to $8,217,000 in the second quarter of

2023. The decrease is mainly attributed to a decrease in payroll

and related expenses, largely associated with organizational

synergies.

- General and administrative expenses for the second quarter of

2024 were $8,581,000, compared to $12,322,000 in the second quarter

of 2023. The decrease is mainly attributed to a decrease in

professional services, largely associated with organizational

synergies.

- Other expenses, net for the second quarter of 2024 were

$2,721,000. The forementioned expenses were related to DM

transaction costs.

- Net loss attributable to owners of the Company for the second

quarter of 2024 was $43,971,000, or $0.20 loss per share, compared

to net loss attributable to owners of the Company of $9,119,000, or

$0.04 per share, in the second quarter of 2023. The increase is

mainly attributed to the re-valuation of the Company’s investment

in securities.

Financial results for the six months

ended June 30, 2024

- Total revenues for the six months period ended June 30,

2024, were $28,350,000, compared to $29,702,000 in the six months

period ended June 30, 2023. The decrease is attributed to

decreased sales of the Company’s product lines in the first quarter

of 2024.

- Total cost of revenues for the six months period ended

June 30, 2024, was $15,364,000, compared to $16,641,000 in the

six months period ended June 30, 2023. The decrease is

attributed mostly to decreased sales of the Company’s product

lines.

- As a result of the reorganization plan executed by the Company

in the fourth quarter of 2023 and other cost reduction efforts

taken in 2024, the Company’s operating expenses across all

departments have decreased in the first half of 2024 compared to

the first half of 2023.

- R&D expenses for the six months period ended June 30,

2024, were $18,254,000, compared to $35,636,000 in the six months

period ended June 30, 2023. The decrease is attributed mostly

to a decrease in payroll and related expenses, as well as in

share-based compensation expenses, materials for R&D use,

subcontractors and professional services, largely associated with

organizational synergies.

- Sales and marketing expenses for the six months period ended

June 30, 2024, were $13,738,000, compared to $15,703,000 in

the six months period ended June 30, 2023. The decrease is

mainly attributed to a decrease in payroll and related expenses, as

well as in share-based compensation expenses, largely associated

with organizational synergies.

- General and administrative expenses for the six months period

ended June 30, 2024, were $18,183,000, compared to $23,355,000

in the six months period ended June 30, 2023. The decrease is

mainly attributed to a decrease in professional services expenses,

largely associated with organizational synergies.

- Other expenses for the six months period ended June 30,

2024, were $2,612,000. The forementioned expenses mainly related to

DM transaction costs.

- Net loss attributable to owners of the Company for the for the

six months period ended June 30, 2024, was $78,743,000, or

$0.35 loss per share, compared to net income attributable to owners

of the Company of $13,103,000, or $0.05 per share, in the six

months period ended June 30, 2023, with gains mainly

attributed to the re-valuation of the Company’s investment in

securities.

Conference call information The

Company will host a conference call to discuss these financial

results today, August 20th, 2024, at 9:00 a.m. EDT (4:00 p.m. IDT),

which can be accessed per the details below. For webcast link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=YLm29wAAFor

phone:U.S. Dial-in Number (Toll Free): 1-844-695-5517International

Dial-in Number: 1-412-902-6751Israel Dial-in Number (Toll Free):

1-80-9212373

Please request the “Nano Dimension NNDM call”

when prompted by the conference call operator. For those unable to

participate in the conference call, there will be a replay

available from a link on Nano Dimension’s website at

http://investors.nano-di.com/events-and-presentations.

About Nano Dimension

Nano Dimension’s (Nasdaq: NNDM) vision is to transform existing

electronics and mechanical manufacturing into Industry 4.0

environmentally friendly & economically efficient precision

additive electronics and manufacturing – by delivering solutions

that convert digital designs to electronic or mechanical devices -

on demand, anytime, anywhere.

Nano Dimension’s strategy is driven by the application of deep

learning based AI to drive improvements in manufacturing

capabilities by using self-learning & self-improving systems,

along with the management of a distributed manufacturing network

via the cloud.

Nano Dimension has served over 2,000 customers across vertical

target markets such as aerospace and defense, advanced automotive,

high-tech industrial, specialty medical technology, R&D and

academia. The Company designs and makes Additive Electronics and

Additive Manufacturing 3D printing machines and consumable

materials. Additive Electronics are manufacturing machines that

enable the design and development of

High-Performance-Electronic-Devices (Hi-PED®s). Additive

Manufacturing includes manufacturing solutions for production of

metal, ceramic, and specialty polymers-based applications - from

millimeters to several centimeters in size with micron

precision.

Through the integration of its portfolio of products, Nano

Dimension is offering the advantages of rapid prototyping,

high-mix-low-volume production, IP security, minimal environmental

footprint, and design-for-manufacturing capabilities, which is all

unleashed with the limitless possibilities of additive

manufacturing.

For more information, please visit www.nano-di.com.

Forward-Looking Statements and Other

Disclaimers

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995 and other

Federal securities laws. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates,” and similar

expressions or variations of such words are intended to identify

forward-looking statements. Specifically this press release

includes statements regarding: (i) transformational M&A

definitive agreement that is expected to change Nano Dimension’s

scale, makeup and merits of business, exponentially, (ii) this

acquisition will create a leader in AM, (iii) the combined company

will bring together outstanding teams and one of the most advanced

portfolios in AM for mass production, (iv) Nano Dimension’s belief

that this combination is so compelling as it combines a company

with one of the broadest portfolios of products and services in DM

with another company with products and services with the highest

growth potential, (v) together, the companies will accelerate their

industry’s transition to digital manufacturing solutions at a

substantial growth rate, (vi) the final merger consideration, which

is subject to certain adjustments and the expectations regarding

those adjustments, and the timing of closing, (vii) that,

post-closing, Nano Dimension intends to forgo for a few quarters,

if needed, inflating the top line, for the benefit, if possible, of

improved EBITDA and reduction of negative cash flow while driving

toward cash generation and positive profits, (viii) advancing the

impact of Nano Dimension’s products and services, (ix) Nano

Dimension’s M&A strategy, and (x) that Nano Dimension will

continue to pursue operational excellence and an M&A strategy

that complements its offerings, supporting its journey to becoming

leaders in digital manufacturing. Because such statements deal with

future events and are based on Nano Dimension’s and DM’s current

expectations, they are subject to various risks and uncertainties.

The acquisition is subject to closing conditions, some of which are

beyond the control of Nano Dimension or DM. Actual results,

performance, or achievements of Nano Dimension or DM could differ

materially from those described in or implied by the statements in

this press release. The forward-looking statements contained or

implied in this press release are subject to other risks and

uncertainties, including (i) the ultimate outcome of the proposed

transaction between Nano and DM, including the possibility that

DM’s stockholders will reject the proposed transaction, (ii) the

effect of the announcement of the proposed transaction on the

ability of Nano Dimension and DM to operate their businesses and

retain and hire key personnel and to maintain favorable business

relationships (iii) the timing of the proposed transaction, (iv)

the occurrence of any event, change or other circumstance that

could give rise to the termination of the proposed transaction; (v)

the ability to satisfy closing conditions to the completion of the

proposed transaction (including any necessary shareholder

approvals), (vi) the Company’s transaction expenses are greater

than expected; (vii) the Company draws on the loan facility

provided by Nano Dimension, (vii) other risks related to the

completion of the proposed transaction and actions related thereto,

and (viii) the risks and uncertainties discussed under the heading

“Risk Factors” in Nano Dimension’s annual report on Form 20-F filed

with the SEC on March 21, 2024, and in any subsequent filings with

the SEC, and under the heading “Risk Factors” in DM’s annual report

on Form 10-K filed with the SEC on March 15, 2024, and in any

subsequent filings with the SEC. The combined company financial

information included in this press release has not been audited or

reviewed by Nano Dimension’s auditors and such information is

provided for illustrative purposes only. You should note that such

combined company information has not been prepared in accordance

with and does not purport to comply with Article 11 of Regulation

S-X under the U.S. Securities Act of 1933, as amended (the

“Securities Act’). Except as otherwise required by law, Nano

Dimension undertakes no obligation to publicly release any

revisions to these forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. References and links to websites have been

provided as a convenience, and the information contained on such

websites is not incorporated by reference into this press release.

Nano Dimension is not responsible for the contents of third-party

websites.

No Offer or Solicitation

This press release is not intended to and shall

not constitute an offer to buy or sell or the solicitation of an

offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made, except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Additional Information about the Transaction and Where

to Find It

In connection with the proposed transaction, DM

filed a definitive proxy statement with the SEC on August 15, 2024.

DM may also file other relevant documents with the SEC regarding

the proposed transaction. This document is not a substitute for the

proxy statement or any other document that DM may file with the

SEC. The definitive proxy statement has been mailed to shareholders

of DM. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY

STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH

THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME

AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security

holders can obtain free copies of the proxy statement and other

documents containing important information about DM and the

proposed transaction at the website maintained by the SEC

at http://www.sec.gov. Copies of the documents filed with the

SEC by the Company are available free of charge on DM’s website

at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in the Solicitation

Nano Dimension, DM and certain of their

respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from DM shareholders in

respect of the proposed transaction. Information about the

directors and executive officers of Nano Dimension, including a

description of their direct or indirect interests, by security

holdings or otherwise, is set forth in Nano’s Annual Report on Form

20-F for the fiscal year ended December 31, 2023, which was filed

with the SEC on March 21, 2024. Information about the directors and

executive officers of DM, including a description of their direct

or indirect interests, by security holdings or otherwise, is set

forth in DM’s proxy statement for its 2024 Annual Meeting of

Stockholders, which was filed with the SEC on April 23, 2024 and

DM’s Annual Report on Form 10-K for the fiscal year ended December

31, 2023, which was filed with the SEC on March 15, 2024. Other

information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by

security holdings or otherwise, is contained in the proxy statement

and other relevant materials filed with the SEC regarding the

proposed transaction. Investors should read the proxy statement

carefully before making any voting or investment decisions. You may

obtain free copies of these documents from Nano Dimension or DM

using the sources indicated above.

NANO DIMENSION INVESTOR RELATIONS

CONTACT

Tomer Pinchas, CFO & COO |

ir@nano-di.com

| |

|

Unaudited Consolidated Statements of Financial Position as

at |

| |

| |

June 30, |

December 31, |

| |

2023 |

2024 |

20232 |

| (In thousands of USD) |

(Unaudited) |

(Unaudited) |

|

| Assets |

|

|

|

|

Cash and cash equivalents |

454,555 |

|

231,777 |

|

309,571 |

|

|

Bank deposits |

499,841 |

|

532,042 |

|

541,967 |

|

|

Restricted deposits |

60 |

|

60 |

|

60 |

|

|

Trade receivables |

12,523 |

|

12,150 |

|

12,710 |

|

|

Other receivables |

5,360 |

|

5,134 |

|

11,290 |

|

|

Inventory |

19,546 |

|

19,289 |

|

18,390 |

|

| Total current

assets |

991,885 |

|

800,452 |

|

893,988 |

|

| |

|

|

|

|

Restricted deposits |

858 |

|

875 |

|

881 |

|

|

Investment in securities |

172,185 |

|

81,342 |

|

138,446 |

|

|

Deferred tax |

249 |

|

— |

|

— |

|

|

Other receivables |

826 |

|

— |

|

— |

|

|

Property plant and equipment, net |

14,014 |

|

15,969 |

|

16,716 |

|

|

Right-of-use assets |

14,135 |

|

10,104 |

|

12,072 |

|

|

Intangible assets |

— |

|

2,235 |

|

2,235 |

|

| Total non-current

assets |

202,267 |

|

110,525 |

|

170,350 |

|

| Total

assets |

1,194,152 |

|

910,977 |

|

1,064,338 |

|

| |

|

|

|

|

Liabilities |

|

|

|

|

Trade payables |

3,216 |

|

2,935 |

|

4,696 |

|

|

Other payables |

21,173 |

|

20,374 |

|

25,265 |

|

|

Current portion of lease liability |

4,611 |

|

3,558 |

|

4,473 |

|

|

Current portion of bank loan |

274 |

|

139 |

|

38 |

|

| Total current

liabilities |

29,274 |

|

27,006 |

|

34,472 |

|

| |

|

|

|

|

Liability in respect of government grants |

1,882 |

|

2,019 |

|

1,895 |

|

|

Employee benefits |

2,485 |

|

3,698 |

|

2,773 |

|

|

Liability in respect of warrants |

140 |

|

— |

|

— |

|

|

Long term lease liability |

10,168 |

|

7,652 |

|

8,742 |

|

|

Deferred tax liabilities |

— |

|

— |

|

75 |

|

|

Bank loan |

647 |

|

347 |

|

595 |

|

| Total non-current

liabilities |

15,322 |

|

13,716 |

|

14,080 |

|

| Total

liabilities |

44,596 |

|

40,722 |

|

48,552 |

|

| |

|

|

|

|

Equity |

|

|

|

|

Non-controlling interests |

892 |

|

618 |

|

1,011 |

|

|

Share capital |

396,238 |

|

405,690 |

|

400,700 |

|

|

Share premium and capital reserves |

1,298,124 |

|

1,301,022 |

|

1,299,542 |

|

|

Treasury shares |

(24,768 |

) |

(167,651 |

) |

(97,896 |

) |

|

Foreign currency translation reserve |

1,176 |

|

1,252 |

|

2,929 |

|

|

Remeasurement of net defined benefit liability (IAS 19) |

1,448 |

|

(726 |

) |

707 |

|

|

Accumulated loss |

(523,554 |

) |

(669,950 |

) |

(591,207 |

) |

| Equity attributable to

owners of the Company |

1,148,664 |

|

869,637 |

|

1,014,775 |

|

| Total

equity |

1,149,556 |

|

870,255 |

|

1,015,786 |

|

| Total liabilities and

equity |

1,194,152 |

|

910,977 |

|

1,064,338 |

|

____________________2 The December 31, 2023

balances were derived from the Company’s audited annual financial

statements.

| |

|

Unaudited Consolidated Statements of Profit or Loss and

Other Comprehensive Income |

| |

| |

Six Months EndedJune 30, |

Three Months EndedJune 30, |

Year EndedDecember

31,2023 |

| |

| |

2023 |

2024 |

2023 |

2024 |

| |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

| |

USD |

USD |

USD |

USD |

USD |

|

Revenues |

29,702 |

|

28,350 |

|

14,737 |

|

14,986 |

|

56,314 |

|

| Cost of revenues |

16,447 |

|

15,299 |

|

8,180 |

|

8,157 |

|

30,759 |

|

| Cost of revenues - write-down

of inventories |

194 |

|

65 |

|

62 |

|

21 |

|

97 |

|

| Total cost of revenues |

16,641 |

|

15,364 |

|

8,242 |

|

8,178 |

|

30,856 |

|

| Gross

profit |

13,061 |

|

12,986 |

|

6,495 |

|

6,808 |

|

25,458 |

|

| Research and development

expenses |

35,636 |

|

18,254 |

|

16,386 |

|

9,121 |

|

62,004 |

|

| Sales and marketing

expenses |

15,703 |

|

13,738 |

|

8,217 |

|

7,221 |

|

31,707 |

|

| General and administrative

expenses |

23,355 |

|

18,183 |

|

12,322 |

|

8,581 |

|

58,254 |

|

| Other expense (income),

net |

— |

|

2,612 |

|

— |

|

2,721 |

|

(1,627 |

) |

| Operating

loss |

(61,633 |

) |

(39,801 |

) |

(30,430 |

) |

(20,836 |

) |

(124,880 |

) |

| Finance income |

80,780 |

|

21,846 |

|

23,954 |

|

10,535 |

|

70,934 |

|

| Finance expenses |

6,442 |

|

61,143 |

|

2,852 |

|

33,819 |

|

1,652 |

|

| Income (Loss) before

taxes on income |

12,705 |

|

(79,098 |

) |

(9,328 |

) |

(44,120 |

) |

(55,598 |

) |

| Taxes benefit (expenses) |

(152 |

) |

(125 |

) |

(78 |

) |

(141 |

) |

(62 |

) |

| Income (Loss) for the

period |

12,553 |

|

(79,223 |

) |

(9,406 |

) |

(44,261 |

) |

(55,660 |

) |

| Loss attributable to

non-controlling interests |

(550 |

) |

(480 |

) |

(287 |

) |

(290 |

) |

(1,110 |

) |

| Income (Loss) attributable to

owners |

13,103 |

|

(78,743 |

) |

(9,119 |

) |

(43,971 |

) |

(54,550 |

) |

| |

|

|

|

|

|

| Income (Loss) per

share |

|

|

|

|

|

| Basic gain (loss) per

share |

0.05 |

|

(0.35 |

) |

(0.04 |

) |

(0.20 |

) |

(0.22 |

) |

| |

|

|

|

|

|

| Other comprehensive

income items that after initial recognition

in comprehensive income were or will be transferred to

profit or loss |

|

|

|

|

|

| Foreign currency translation

differences for foreign operations |

597 |

|

(1,708 |

) |

194 |

|

(4 |

) |

2,368 |

|

| Other comprehensive

income items that will not be transferred to profit or

loss |

|

|

|

|

|

| Remeasurement of net defined

benefit liability (IAS 19), net of tax |

(1,060 |

) |

(1,433 |

) |

(1,060 |

) |

— |

|

(1,801 |

) |

| Total other

comprehensive income (loss) for the period |

(463 |

) |

(3,141 |

) |

(866 |

) |

(4 |

) |

567 |

|

| Total comprehensive

income (loss) for the period |

12,090 |

|

(82,364 |

) |

(10,272 |

) |

(44,265 |

) |

(55,093 |

) |

| Comprehensive loss

attributable to non-controlling interests |

(546 |

) |

(511 |

) |

(296 |

) |

(297 |

) |

(1,088 |

) |

| Comprehensive income (loss)

attributable to owners of the Company |

12,636 |

|

(81,853 |

) |

(9,976 |

) |

(43,968 |

) |

(54,005 |

) |

| |

|

Consolidated Statements of Changes in Equity

(Unaudited)(In thousands of USD) |

| |

| |

Share capital |

Share premium and capital reserves |

Remeasurement of IAS 19 |

Treasury shares |

Foreign currency translation reserve |

Accumulated loss |

Total |

Non-controlling interests |

Total equity |

| |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

| |

USD |

USD |

USD |

USD |

USD |

USD |

USD |

USD |

USD |

| For the six months

ended June 30, 2024: |

|

|

|

|

|

|

|

|

|

|

Balance as December 31, 2023 |

400,700 |

1,299,542 |

|

707 |

|

(97,896 |

) |

2,929 |

|

(591,207 |

) |

1,014,775 |

|

1,011 |

|

1,015,786 |

|

| Investment of

non-controlling party in subsidiary |

— |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

118 |

|

118 |

|

| Loss for the

period |

— |

— |

|

— |

|

— |

|

— |

|

(78,743 |

) |

(78,743 |

) |

(480 |

) |

(79,223 |

) |

| Other comprehensive

loss for the period |

— |

— |

|

(1,433 |

) |

— |

|

(1,677 |

) |

— |

|

(3,110 |

) |

(31 |

) |

(3,141 |

) |

| Exercise of warrants,

options andvesting of RSUs |

4,990 |

(4,990 |

) |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

| Repurchase

of treasury shares |

— |

— |

|

— |

|

(69,755 |

) |

— |

|

— |

|

(69,755 |

) |

— |

|

(69,755 |

) |

| Share-based payment

acquired |

— |

(363 |

) |

— |

|

— |

|

— |

|

— |

|

(363 |

) |

— |

|

(363 |

) |

| Share-based

payments |

— |

6,833 |

|

— |

|

— |

|

— |

|

— |

|

6,833 |

|

— |

|

6,833 |

|

| Balance as of June 30,

2024 |

405,690 |

1,301,022 |

|

(726 |

) |

(167,651 |

) |

1,252 |

|

(669,950 |

) |

869,637 |

|

618 |

|

870,255 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Share capital |

Share

premium and capital reserves |

Remeasurement of IAS 19 |

Treasury

shares |

Presentation / Foreign currency translation

reserve |

Accumulated

loss |

Total |

Non-controlling interests |

Total

equity |

| |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

Thousands |

| |

USD |

USD |

USD |

USD |

USD |

USD |

USD |

USD |

USD |

| For the three months

ended June 30, 2024: |

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2024 |

404,366 |

1,298,973 |

|

(726 |

) |

(149,461 |

) |

1,249 |

(625,979 |

) |

928,422 |

|

857 |

|

929,279 |

|

| Investment of

non-controlling party in subsidiary |

— |

— |

|

— |

|

— |

|

— |

— |

|

— |

|

58 |

|

58 |

|

| Loss for the

period |

— |

— |

|

— |

|

— |

|

— |

(43,971 |

) |

(43,971 |

) |

(290 |

) |

(44,261 |

) |

| Other comprehensive

gain (loss) for the period |

— |

— |

|

— |

|

— |

|

3 |

— |

|

3 |

|

(7 |

) |

(4 |

) |

| Exercise of warrants,

options and vesting of RSUs |

1,324 |

(1,324 |

) |

— |

|

— |

|

— |

— |

|

— |

|

— |

|

— |

|

| Repurchase

of treasury shares |

— |

— |

|

— |

|

(18,190 |

) |

— |

— |

|

(18,190 |

) |

— |

|

(18,190 |

) |

| Share-based

payments |

— |

3,373 |

|

— |

|

— |

|

— |

— |

|

3,373 |

|

— |

|

3,373 |

|

| Balance as of June 30,

2024 |

405,690 |

1,301,022 |

|

(726 |

) |

(167,651 |

) |

1,252 |

(669,950 |

) |

869,637 |

|

618 |

|

870,255 |

|

| |

|

Consolidated Statements of Cash Flows

(Unaudited)(In thousands of USD) |

| |

| |

Six Months Ended June 30, |

Three Months EndedJune 30, |

Year Ended

December 31, 2023 |

| |

2023 |

2024 |

2023 |

2024 |

| Cash flow from

operating activities: |

|

|

|

|

|

|

Net income (loss) |

12,553 |

|

(79,223 |

) |

(9,406 |

) |

(44,261 |

) |

(55,660 |

) |

| Adjustments: |

|

|

|

|

|

| Depreciation and

amortization |

2,963 |

|

3,431 |

|

1,540 |

|

1,365 |

|

6,544 |

|

| Financing income net |

(17,622 |

) |

(17,840 |

) |

(9,470 |

) |

(8,042 |

) |

(46,281 |

) |

| Revaluation of financial

liabilities accounted at fair value |

485 |

|

33 |

|

294 |

|

11 |

|

461 |

|

| Revaluation of financial

assets accounted at fair value |

(57,201 |

) |

57,104 |

|

(11,925 |

) |

31,315 |

|

(23,462 |

) |

| Loss from disposal of property

plant and equipment and right-of-use assets |

345 |

|

6 |

|

221 |

|

— |

|

326 |

|

| Increase in deferred tax |

(95 |

) |

— |

|

(92 |

) |

— |

|

(11 |

) |

| Share-based payments |

11,542 |

|

6,833 |

|

5,418 |

|

3,373 |

|

20,101 |

|

| Other |

68 |

|

74 |

|

23 |

|

37 |

|

164 |

|

| |

(59,515 |

) |

49,641 |

|

(13,991 |

) |

28,059 |

|

(42,158 |

) |

| Changes in assets and

liabilities: |

|

|

|

|

|

| (Increase) decrease in

inventory |

(1,212 |

) |

(1,899 |

) |

(667 |

) |

388 |

|

(340 |

) |

| (Increase) decrease in other

receivables |

669 |

|

5,845 |

|

1,520 |

|

1,256 |

|

(5,775 |

) |

| (Increase) decrease in trade

receivables |

(6,039 |

) |

3 |

|

(2,331 |

) |

(310 |

) |

(5,603 |

) |

| Increase (decrease) in other

payables |

(1,345 |

) |

(3,779 |

) |

(817 |

) |

(1,862 |

) |

4,856 |

|

| Increase (decrease) in

employee benefits |

(399 |

) |

132 |

|

162 |

|

81 |

|

(1,478 |

) |

| Increase (decrease) in trade

payables |

(828 |

) |

(1,410 |

) |

(2,633 |

) |

(1,065 |

) |

1,089 |

|

| |

|

|

|

|

|

| |

(9,154 |

) |

(1,108 |

) |

(4,766 |

) |

(1,512 |

) |

(7,251 |

) |

| Net cash used in

operating activities |

(56,116 |

) |

(30,690 |

) |

(28,163 |

) |

(17,714 |

) |

(105,069 |

) |

| |

|

|

|

|

|

| Cash flow from

investing activities: |

|

|

|

|

|

| Change in bank deposits |

(151,391 |

) |

5,412 |

|

77,106 |

|

12,006 |

|

(189,060 |

) |

| Interest received |

17,998 |

|

22,715 |

|

6,706 |

|

5,561 |

|

41,529 |

|

| Change in restricted bank

deposits |

(34 |

) |

(25 |

) |

237 |

|

(14 |

) |

(27 |

) |

| Acquisition of property plant

and equipment |

(7,121 |

) |

(1,169 |

) |

(3,177 |

) |

(393 |

) |

(9,098 |

) |

| Acquisition of intangible

asset |

— |

|

(711 |

) |

— |

|

— |

|

(1,524 |

) |

| Payment of a liability for

contingent consideration in a business combination |

(9,255 |

) |

— |

|

(5,295 |

) |

— |

|

(9,255 |

) |

| Other |

— |

|

— |

|

— |

|

— |

|

835 |

|

| Net cash from (used

in) investing activities |

(149,803 |

) |

26,222 |

|

75,577 |

|

17,160 |

|

(166,600 |

) |

| Cash flow from

financing activities: |

|

|

|

|

|

| Lease payments |

(2,471 |

) |

(2,306 |

) |

(1,251 |

) |

(1,166 |

) |

(4,823 |

) |

| Repayment long-term bank

debt |

(96 |

) |

(107 |

) |

(39 |

) |

(34 |

) |

(536 |

) |

| Proceeds from non-controlling

interests |

550 |

|

— |

|

550 |

|

— |

|

1,089 |

|

| Amounts recognized in respect

of government grants liability |

(172 |

) |

(101 |

) |

(87 |

) |

(65 |

) |

(298 |

) |

| Payments of share price

protection recognized in business combination |

(1,780 |

) |

(363 |

) |

(1,780 |

) |

— |

|

(4,459 |

) |

| Repurchase of treasury

shares |

(19,741 |

) |

(69,755 |

) |

(1,349 |

) |

(18,190 |

) |

(96,387 |

) |

| Net cash used in

financing activities |

(23,710 |

) |

(72,632 |

) |

(3,956 |

) |

(19,455 |

) |

(105,414 |

) |

| Increase (decrease) in

cash and cash equivalents |

(229,629 |

) |

(77,100 |

) |

43,458 |

|

(20,009 |

) |

(377,083 |

) |

| Cash and cash

equivalents at beginning of the period |

685,362 |

|

309,571 |

|

412,172 |

|

251,858 |

|

685,362 |

|

| Effect of exchange rate

fluctuations on cash |

(1,178 |

) |

(694 |

) |

(1,075 |

) |

(72 |

) |

1,292 |

|

| Cash and cash

equivalents at end of the period |

454,555 |

|

231,777 |

|

454,555 |

|

231,777 |

|

309,571 |

|

| |

|

|

|

|

|

| Non-cash transactions: |

|

|

|

|

|

| Intangible asset acquired on

credit |

— |

|

— |

|

— |

|

— |

|

711 |

|

| Property plant and equipment

acquired on credit |

328 |

|

176 |

|

(148 |

) |

176 |

|

214 |

|

| Repurchase of treasury shares

on credit |

3,518 |

|

— |

|

3,518 |

|

— |

|

— |

|

| Recognition of a right-of-use

asset |

199 |

|

223 |

|

72 |

|

65 |

|

929 |

|

The following are reconciliations of income before taxes, as

calculated in accordance with International Financial Reporting

Standards (“IFRS”), to EBITDA and Adjusted EBITDA, as well as of

gross profit, as calculated in accordance with IFRS, to Adjusted

Gross Profit:

| |

For the Six Months Ended June 30, |

For the Three Months Ended June 30, |

| |

2023 |

2024 |

2023 |

2024 |

| |

In thousands of USD |

In thousands of USD |

|

Net income (loss) |

12,553 |

|

(79,223 |

) |

(9,406 |

) |

(44,261 |

) |

| Tax expenses |

152 |

|

125 |

|

78 |

|

141 |

|

| Depreciation |

2,963 |

|

3,431 |

|

1,540 |

|

1,365 |

|

| Interest income |

(23,567 |

) |

(21,846 |

) |

(12,047 |

) |

(10,535 |

) |

| EBITDA (loss) |

(7,899 |

) |

(97,513 |

) |

(19,835 |

) |

(53,290 |

) |

| Finance expense from

revaluation of assets and liabilities |

(56,299 |

) |

57,496 |

|

(11,522 |

) |

31,524 |

|

| Exchange rate differences |

5,475 |

|

3,608 |

|

2,430 |

|

2,275 |

|

| Share-based compensation

expenses |

11,542 |

|

6,833 |

|

5,418 |

|

3,373 |

|

| Other income |

- |

|

(115 |

) |

- |

|

- |

|

| Adjusted EBITDA (loss) |

(47,181 |

) |

(29,691 |

) |

(23,509 |

) |

(16,118 |

) |

| |

|

|

|

|

|

|

|

|

| Gross profit |

13,061 |

|

12,986 |

|

6,495 |

|

6,808 |

|

| Depreciation |

186 |

|

184 |

|

120 |

|

43 |

|

| Share-based payments |

812 |

|

462 |

|

390 |

|

127 |

|

| Adjusted gross profit |

14,059 |

|

13,632 |

|

7,005 |

|

6,978 |

|

| |

|

|

|

|

|

|

|

|

EBITDA is a non-IFRS measure and is defined as

income before taxes, excluding depreciation and amortization

expenses and interest income. We believe that EBITDA, as described

above, should be considered in evaluating the Company’s operations.

EBITDA facilitates the Company’s performance comparisons from

period to period and company to company by backing out potential

differences caused by variations in capital structures, and the age

and depreciation charges and amortization of fixed and intangible

assets, respectively (affecting relative depreciation and

amortization expense, respectively), and EBITDA is useful to an

investor in evaluating our operating performance because it is

widely used by investors, securities analysts and other interested

parties to measure a company’s operating performance without regard

to the items mentioned above.

Adjusted EBITDA is a non-IFRS measure and is

defined as earnings before other financial income, income tax,

depreciation and amortization, share-based payments and other

extraordinary income, net, which consists of additional

compensation for damaged fixed assets. Other financial expenses

(income), net includes exchange rate differences as well as finance

income or revaluation of assets and liabilities. We believe that

Adjusted EBITDA, as described above, should also be considered in

evaluating the company’s operations. Like EBITDA, Adjusted EBITDA

facilitates operating performance comparisons from period to period

and company to company by backing out potential differences caused

by variations in capital structures (affecting other financial

expenses (income), net), and the age and depreciation charges and

amortization of fixed and intangible assets, respectively

(affecting relative depreciation and amortization expense,

respectively), as well as from share-based payment expenses, and

Adjusted EBITDA is useful to an investor in evaluating our

operating performance because it is widely used by investors,

securities analysts and other interested parties to measure a

company’s operating performance without regard to non-cash items,

such as expenses related to share-based payments.

Adjusted gross profit, excluding depreciation

and amortization and share-based compensation expenses, is a

non-IFRS measure and is defined as gross profit excluding

amortization expenses. We believe that adjusted gross profit, as

described above, should also be considered in evaluating the

Company’s operations. Adjusted gross profit facilitates gross

profit and gross margin comparisons from period to period and

company to company by backing out potential differences caused by

variations in amortization of inventory and intangible assets.

Adjusted gross profit is useful to an investor in evaluating our

performance because it enables investors, securities analysts and

other interested parties to measure a company’s performance without

regard to non-cash items, such as amortization expenses. Adjusted

gross margin is calculated by dividing the adjusted gross profit by

the revenues.

EBITDA, Adjusted EBITDA, and Adjusted gross

profit do not represent cash generated by operating activities in

accordance with IFRS and should not be considered alternatives to

net income (loss) as indicators of our operating performance or as

measures of our liquidity. These measures should be considered in

conjunction with net income (loss) as presented in our consolidated

statements of profit or loss and other comprehensive income. Other

companies may calculate these measures differently than we do.

Net Income / Loss excluding changes in Company’s

holdings in Stratasys’ shares. We believe that by excluding the

value of the Company’s holdings in Stratasys’ shares we neutralize

the volatility of these shares and provide investors an additional

measurement to evaluate the operating performance of the Company

and its liquidity. This measurement should not be considered as an

alternative to net income (loss) as an indicator of our operating

performance or as a measure of our liquidity. This measurement

should be considered in conjunction with net income (loss) as

presented in our consolidated statements of profit or loss and

other comprehensive income.

Net cash burn is a non-IFRS measure and defined

as the change in cash, cash equivalents and deposits net of

treasury shares repurchase and Stratasys shares. We believe that

net cash burn, as described above, should be considered in

evaluating the Company’s financial strength. Net cash burn gives a

sense of how our use of cash and cash flow has changed

overtime.

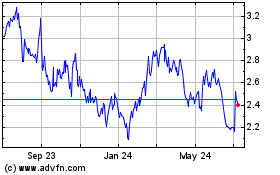

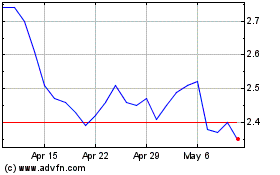

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Oct 2024 to Oct 2024

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Oct 2023 to Oct 2024