false

0001769759

0001769759

2024-05-14

2024-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

May 14, 2024

Monogram Orthopaedics Inc.

(Exact name of registrant as

specified in its charter)

| Delaware |

|

001-41707 |

|

81-3777260 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

3919 Todd Lane, Austin,

TX 78744

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area

code: (512) 399-2656

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.001 per share |

|

MGRM |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and

Financial Condition.

On May 14, 2024, Monogram Orthopaedics Inc., a Delaware corporation

(the “Company”) issued a press release announcing, among other things, its financial results for the three months ended March

31, 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information

in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section,

and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as

amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

On May 14, 2024, the

Company issued a press release, providing certain operational highlights of the Company that occurred the three months ended March 31,

2024.

The Company plans to hold a conference call to

discuss the matters set forth in the press release, followed by a question-and-answer period, on Wednesday, May 22, 2024 at 4:30 pm Eastern

Time. Interested parties may participate by registering at https://streamyard.com/watch/wvMTc4vvHEgn, after which they will receive

instructions on how to join participate in the meeting.

The press release is furnished as Exhibit 99.1 to this Current Report

on Form 8-K.

The information in this

Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such a filing.

By providing the information

in Item 7.01 of this Current Report, including Exhibit 99.1 hereto, the Company is not making an admission as to the materiality of any

information herein. The information contained in this Current Report is intended to be considered in the context of more complete information

included in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”) and other public announcements

that the Company has made and may make from time to time by press release or otherwise. The Company undertakes no duty or obligation to

update or revise the information contained in this Current Report, except as may be required by law, although it may do so from time to

time as its management believes is appropriate. Any such updating may be made through the filing of other reports or documents with the

SEC, through press releases or through other public disclosures.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K, including the

press release, contains forward-looking statements. Forward-looking statements reflect management's current knowledge, assumptions, judgment,

and expectations regarding future performance or events. Although management believes that the expectations reflected in such statements

are reasonable, they give no assurance that such expectations will prove to be correct, and you should be aware that actual events or

results may differ materially from those contained in the forward- looking statements. Words such as "will," "expect,"

"intend," "plan," "potential," "possible," "goals," "accelerate," "continue,"

and similar expressions identify forward-looking statements.

Forward-looking statements are subject to a number

of risks and uncertainties including, but not limited to, the risks inherent in the Company’s lack of profitability and need for

additional capital to grow its business; the Company’s dependence on partners to further the development of its product candidates;

the uncertainties inherent in the development, attainment of the requisite regulatory authorizations and approvals and launch of any new

product; the outcome of pending or future litigation; and the various risks and uncertainties described in the "Risk Factors"

sections of the Company’s latest annual and quarterly reports and other filings with the SEC.

All forward-looking statements are expressly

qualified in their entirety by this cautionary notice. You should not rely upon any forward-looking statements as predictions of

future events. The Company undertakes no obligation to revise or update any forward-looking statements made in this Current Report

on Form 8-K to reflect events or circumstances after the date hereof, to reflect new information or the occurrence of unanticipated

events, to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements,

in each case, except as required by law.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits

The following exhibit index lists the exhibits that are either filed

or furnished with the Current Report on Form 8-K.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MONOGRAM ORTHOPAEDICS INC. |

| |

|

| |

By: |

/s/Benjamin Sexson |

| |

Name: Benjamin Sexson |

| |

Title: Chief Executive Officer |

Dated: May 14, 2024

Exhibit 99.1

Monogram Orthopaedics Reports First Quarter

2024 Financial Results

Verification and Validation Testing Expected

to be Largely Complete in Q2 2024; 510(k) Submission with FDA Accelerated for Second Half of 2024

Engaged Contract Research Organization to Oversee

mBôs Robot Clinical Trial Activities Outside the U.S.

Management to Host Business Update Conference

Call on Wednesday, May 22 at 4:30 p.m. Eastern Time

AUSTIN, TX –

May 14, 2024 - Monogram Orthopaedics Inc. (NASDAQ:MGRM) ("Monogram" or the "Company"), an AI-driven robotics

company focused on improving human health with an initial focus on orthopedic surgery, has reported its financial and operational results

for the first quarter ended March 31, 2024.

First Quarter 2024 and Subsequent Operational

Highlights

| · | Received feedback from the U.S. Food and Drug

Administration (the “FDA”) for the Company’s verification test protocols and proposed clinical trial protocol on an

outside the U.S. (OUS) target population. |

| · | The Company anticipates that Verification and

Validation testing will be largely complete in Q2 of 2024 and anticipates a 510(k) submission to follow in the second half of 2024. |

| · | Introduced mVision technology, a novel approach

to registration and tracking that the company is now working on as a standalone product or for integration into the mBôs surgical

robotic system in the future. |

| · | Presented a product discussion featuring Monogram's

mBôs and mVision technologies with a surgeon panel. |

| · | Presented at the Canaccord Genuity 2024 Musculoskeletal

Conference |

Management Commentary

“In the first quarter, we took the initiative

to accelerate our commercial timeline by making key modifications to our strategy,” said Ben Sexson, Chief Executive Officer of

Monogram. “Our team has worked tirelessly to advance Monogram toward the critical milestone of a 510(k) submission. The inherent

value of our mBôs surgical robot, our mVision technology, and our underlying IP is gaining increasing recognition within both the

orthopedic and robotics industries.

“Our communications with the FDA related

to our mBôs™ TKA System verification test plan and OUS clinical trial protocol have been productive. Based on the FDA’s

feedback, we believe our proposed testing plan is sufficient for evaluating the safety and effectiveness of our robotic system, supporting

a strong 510(k) submission with the goal of ultimately obtaining FDA clearance. Our team has been active with the rigorous internal and

external testing that encompasses the Verification and Validation phase, which we expect to be largely complete by the end of Q2 2024. We look forward to providing updates in the months to come as we continue to execute our commercialization strategy,” concluded

Sexson.

Upcoming 2024 Milestones

| · | Largely complete mBôs system verification and validation – H1

2024 |

| · | Submit 510(k) application to FDA – H2 2024 |

| · | Progress towards OUS live-patient surgery trials |

| · | Expanded international relationships |

First Quarter 2024 Financial Results

Research and development expenses for the first

quarter ended March 31, 2024, were $2.4 million, compared to $1.9 million the prior-year quarter. The R&D increase was primarily due

to the Company moving into the verification and validation phase of its robot prototype, which is expected to be largely complete the

first half of 2024, as well as the introduction of mVision technology in the first quarter.

General & administrative expenses for the

first quarter ended March 31, 2024, were $1.1 million compared to $0.8 million in the prior-year quarter. The increase was primarily

due to increases in consulting fees, insurance and regulatory compliance and professional fees.

Net loss was $3.5 million for the first quarter

ended March 31, 2024, an improvement compared to a net loss of $3.9 million for the prior-year quarter.

Cash and cash equivalents totaled $10.1 million as of March 31, 2024,

compared to $13.6 million as of December 31, 2023.

First Quarter 2024 Business Update Conference Call

Monogram Chief Executive Officer Ben Sexson and

Chief Financial Officer Noel Knape will host the conference call, followed by a question-and-answer period.

To access the call, please use the following

information:

| Date:

|

Wednesday,

May 22, 2024 |

| Time: |

4:30

p.m. Eastern time (1:30 p.m. Pacific time) |

| Registration

Link: |

https://streamyard.com/watch/wvMTc4vvHEgn |

About Monogram Orthopaedics

Monogram Orthopaedics (NASDAQ: MGRM) is working

to develop a product solution architecture with the long-term goal of enabling patient-optimized orthopedic implants at scale by linking

3D printing and robotics with advanced pre-operative imaging. The Company has a robotic system that can autonomously execute optimized

paths for high-precision insertion of implants in synthetic bone specimens. Monogram intends to produce and market robotic surgical equipment

and related software, orthopedic implants, tissue ablation tools, navigation consumables, and other miscellaneous instrumentation necessary

for reconstructive joint replacement procedures. The Company has not yet made 510(k) premarket notification submissions or obtained 510(k)

clearances for its robotic products. FDA approval is required to market these products, and the Company has not obtained FDA approval

for any of its robotic products, and it cannot estimate the timing or assure the ability, to obtain such clearances.

Monogram Orthopaedics is working to advance the

way orthopedic surgery is done. Our system is being developed to combine personalized knee implants with precision robotic surgical systems

to give patients a better-fitting knee replacement with minimally invasive surgery. One hundred thousand knee replacements failing each

year in a $19.4B market represents an enormous opportunity for us.

To learn more, visit www.monogramorthopedics.com.

Forward-Looking Statements

This press release may include "forward-looking

statements.'' To the extent that the information presented in this presentation discusses financial projections, information, or expectations

about the Company’s business plans, results of operations, products or markets, or otherwise makes statements about future events,

such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as ''should,'' ''may,''

''intends,'' ''anticipates,'' ''believes,'' ''estimates,'' ''projects,'' ''forecasts,'' ''expects,'' ''plans,'' and ''proposes.'' Although

the Company believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are

a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. You are

urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading

"Risk Factors" and elsewhere in the offering statement filed with the SEC. Forward-looking statements speak only as of the

date of the document in which they are contained, and the Company does not undertake any duty to update any forward-looking statements

except as may be required by law.

Investor Relations

Chris Tyson

Executive Vice President

MZ North America

Direct: 949-491-8235

MGRM@mzgroup.us

MONOGRAM ORTHOPAEDICS INC.

CONDENSED BALANCE SHEETS

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 10,077,573 | | |

$ | 13,589,028 | |

| Account receivable | |

| – | | |

| 364,999 | |

| Prepaid expenses and other current assets | |

| 629,751 | | |

| 664,262 | |

| Total current assets | |

| 10,707,324 | | |

| 14,618,289 | |

| Equipment, net of accumulated depreciation | |

| 903,011 | | |

| 945,020 | |

| Intangible assets, net | |

| 496,250 | | |

| 548,750 | |

| Operating lease right-of-use assets | |

| 435,116 | | |

| 466,949 | |

| Total assets | |

$ | 12,541,701 | | |

$ | 16,579,008 | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,321,313 | | |

$ | 2,462,268 | |

| Accrued liabilities | |

| 531,239 | | |

| 227,684 | |

| Operating lease liabilities, current | |

| 131,081 | | |

| 128,266 | |

| Total current liabilities | |

| 1,983,633 | | |

| 2,818,218 | |

| Operating lease liabilities, non-current | |

| 330,561 | | |

| 363,724 | |

| Total liabilities | |

| 2,314,194 | | |

| 3,181,942 | |

| Commitments and contingencies | |

| — | | |

| — | |

| Stockholders' equity: | |

| | | |

| | |

| Common stock, $.001 par value; 90,000,000 shares authorized, 31,633,995 and 31,338,391 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | |

| 31,634 | | |

| 31,338 | |

| Additional paid-in capital | |

| 65,211,241 | | |

| 64,874,392 | |

| Accumulated deficit | |

| (55,015,368 | ) | |

| (51,508,664 | ) |

| Total stockholders' equity | |

| 10,227,507 | | |

| 13,397,066 | |

| Total liabilities and stockholders' equity | |

$ | 12,541,701 | | |

$ | 16,579,008 | |

MONOGRAM ORTHOPAEDICS INC.

CONDENSED STATEMENTS OF OPERATIONS (UNAUDITED)

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Product revenue | |

$ | — | | |

$ | — | |

| Cost of goods sold | |

| — | | |

| — | |

| Gross profit | |

| — | | |

| — | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 2,406,754 | | |

| 1,939,551 | |

| Marketing and advertising | |

| 119,694 | | |

| 1,132,625 | |

| General and administrative | |

| 1,083,711 | | |

| 822,889 | |

| Total operating expenses | |

| 3,610,159 | | |

| 3,895,065 | |

| Loss from operations | |

| (3,610,159 | ) | |

| (3,895,065 | ) |

| Other income: | |

| | | |

| | |

| Change in fair value of warrant liability | |

| — | | |

| 2,523 | |

| Interest income and other, net | |

| 103,455 | | |

| 34,820 | |

| Total other income | |

| 103,455 | | |

| 37,343 | |

| Net loss before taxes | |

| (3,506,704 | ) | |

| (3,857,722 | ) |

| Income taxes | |

| — | | |

| — | |

| Net loss | |

$ | (3,506,704 | ) | |

$ | (3,857,722 | ) |

| Basic and diluted loss per common share | |

$ | (0.11 | ) | |

$ | (0.40 | ) |

| Weighted-average number of basic and diluted shares outstanding | |

| 31,535,795 | | |

| 9,673,870 | |

MONOGRAM ORTHOPAEDICS INC.

CONDENSED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Operating activities: | |

| | | |

| | |

| Net loss | |

$ | (3,506,704 | ) | |

$ | (3,857,722 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 294,899 | | |

| 368,140 | |

| Other expenses settled with stock issuances | |

| 37,500 | | |

| — | |

| Loss from change in fair value of common stock make-whole obligation | |

| 45,252 | | |

| — | |

| Depreciation and amortization | |

| 105,898 | | |

| 102,503 | |

| Change in fair value of warrant liability | |

| — | | |

| (2,523 | ) |

| Changes in non-cash working capital balances: | |

| | | |

| | |

| Account receivable | |

| 364,999 | | |

| — | |

| Other current assets | |

| (111,445 | ) | |

| 231,518 | |

| Accounts payable | |

| (1,140,955 | ) | |

| 516,762 | |

| Accrued liabilities | |

| 258,303 | | |

| (243,501 | ) |

| Operating lease assets and liabilities, net | |

| 1,485 | | |

| 2,446 | |

| Cash used in operating activities | |

| (3,650,768 | ) | |

| (2,882,377 | ) |

| Investing activities: | |

| | | |

| | |

| Purchases of equipment | |

| (11,389 | ) | |

| (14,792 | ) |

| Cash used in investing activities | |

| (11,389 | ) | |

| (14,792 | ) |

| Financing activities: | |

| | | |

| | |

| Proceeds from issuances of Common Stock, net of cash costs | |

| 150,702 | | |

| — | |

| Proceeds from issuances of Series C Preferred Stock, net | |

| — | | |

| 147,042 | |

| Cash provided by financing activities | |

| 150,702 | | |

| 147,042 | |

| Decrease in cash and cash equivalents during the period | |

| (3,511,455 | ) | |

| (2,750,127 | ) |

| Cash and cash equivalents, beginning of the period | |

| 13,589,028 | | |

| 10,468,645 | |

| Cash and cash equivalents, end of the period | |

$ | 10,077,573 | | |

$ | 7,718,518 | |

| | |

| | | |

| | |

| Cash paid for interest | |

$ | — | | |

$ | — | |

| Cash paid for income taxes | |

$ | — | | |

$ | — | |

| Noncash investing and financing activities: | |

| | | |

| | |

| Amortization of deferred issuance costs of Common Stock Purchase Agreement | |

$ | 145,956 | | |

$ | — | |

| Cashless exercise of warrant | |

$ | 246 | | |

$ | — | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

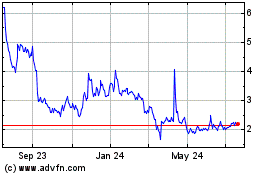

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Oct 2024 to Nov 2024

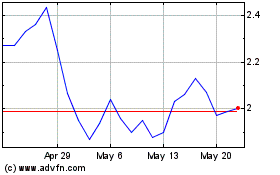

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Nov 2023 to Nov 2024