Filed pursuant to Rule 424(b)(5)

Registration No. 333-274929

PROSPECTUS SUPPLEMENT

(To prospectus dated October 23, 2023)

133,889,525 Ordinary Shares Represented by 486,871

American Depositary Shares

Pre-Funded Warrants to Purchase up to 389,497,350

Ordinary Shares Represented by 1,416,354 American Depositary Shares

Up to 389,497,350 Ordinary Shares Represented

by 1,416,354 American Depositary Shares Underlying the Pre-Funded Warrants

We are offering 133,889,525

ordinary shares represented by 486,871 American Depositary Shares, or ADSs, to certain institutional investors at an offering price of

$1.55 per ADS pursuant to this prospectus supplement and the accompanying prospectus. Each ADS represents two hundred seventy-five (275)

ordinary shares. See “Description of American Depositary Shares” in the accompanying prospectus for more information.

We are also offering pre-funded

warrants to purchase up to 389,497,350 ordinary shares represented by 1,416,354 ADSs to any investor whose purchase of ordinary shares

in this offering would otherwise result in the investor, together with its affiliates and certain related parties, beneficially owning

more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding ordinary shares immediately following the consummation

of this offering, in lieu of ordinary shares that would otherwise result in the investor’s beneficial ownership exceeding 4.99%

(or at the election of the investor, 9.99%) of our outstanding ordinary shares.

Each pre-funded warrant will

be exercisable for one ADS. The pre-funded warrant is being offered at an offering price of $1.5499 per pre-funded warrant. The pre-funded

warrants will have an exercise price of $0.0001 per ADS, will be immediately exercisable and may be exercised at any time until all of

the pre-funded warrants are exercised in full. We are also offering the ordinary shares (or the ADSs) issuable from time to time upon

exercise of the pre-funded warrants being offered by this prospectus supplement and accompanying prospectus.

In a concurrent private placement,

we are selling to such investors unregistered warrants to purchase up to an aggregate of 523,386,875 ordinary shares represented by 1,903,225

ADSs at an exercise price of $1.55 per ADS. The warrants are exercisable at any time upon issuance and will expire five years from the

initial exercise date.

The warrants, the ADSs issuable

upon the exercise of the warrants and the ordinary shares represented by such ADSs are being offered pursuant to the exemption provided

in Section 4(a)(2) under the Securities Act of 1933, as amended, or the Securities Act, and/or Regulation D promulgated thereunder, and

they are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

The ADSs are listed on the

Nasdaq Capital Market under the symbol “MOB.” On January 25, 2024, the last reported sale price of the ADSs on the Nasdaq

Capital Market was $1.83 per ADS. There is no established trading market for the pre-funded warrants and we do not intend to list the

pre-funded warrants on any securities exchange or nationally recognized trading system.

The aggregate market value

of our outstanding voting and non-voting common equity held by non-affiliates as of January 25, 2024, based on the closing price of our

ADSs on Nasdaq Capital Market on December 27, 2023, as calculated in accordance with General Instruction I.B.5. of Form F-3, was approximately

$8.92 million. During the prior 12 calendar month period that ends on, and includes, the date of this prospectus supplement (excluding

this offering), we have not sold any securities pursuant to General Instruction I.B.5 of Form F-3.

Investing in the securities

involves a high degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus supplement and in the documents

incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of information that should

be considered in connection with an investment in the Ordinary Shares.

Neither the Securities

and Exchange Commission, the Australian Securities and Investments Commission nor any state or other foreign securities commission has

approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to

the contrary is a criminal offense.

We have retained Ladenburg Thalmann & Co.

Inc., or Ladenburg Thalmann, to act as our placement agent in connection with the offering. The placement agent has agreed to use its

“reasonable best efforts” to sell the securities offered by this prospectus supplement and the accompanying prospectus. We

have agreed to pay the placement agent fees, in respect of ADSs placed by the placement agent, set forth in the table below, which assumes

that we sell all of the securities we are offering.

| | |

Per ADS | | |

Per Pre-

Funded Warrant | | |

Total | |

| Offering price | |

$ | 1.55 | | |

| 1.5499 | | |

$ | 2,949,857 | |

| Placement agent’s fees (1) | |

$ | 0.116 | | |

| 0.116 | | |

$ | 221,239 | |

| Proceeds, before expenses, to us | |

$ | 1.434 | | |

| 1.4339 | | |

$ | 2,728,618 | |

|

(1) |

We have agreed to pay the placement agent an expense allowance of up to $75,000. See “Plan of Distribution” on page S-13 of this prospectus supplement for more information regarding the placement agent’s compensation. |

|

(2) |

The amount of the offering proceeds to us presented in this table does not give effect to the sale or exercise, if any, of the unregistered common warrants in a concurrent private placement. |

Delivery of the securities is expected to be made

on or about January 30, 2024, subject to customary closing conditions.

Ladenburg Thalmann

The date of this

prospectus supplement is January 25, 2024

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

A registration statement on

Form F-3 (File No. 333-274929) utilizing a shelf registration process relating to the securities described in this prospectus supplement

was declared effective on October 23, 2023. Under that shelf registration statement, of which this prospectus supplement is a part, we

may, from time to time, sell up to an aggregate of up to US $50,000,000 of our ordinary shares, including in the form of American Depositary

Shares, or ADSs, warrants to purchase ordinary shares, including in the form of ADSs, subscription rights and a combination of such securities,

separately or as units, in one or more offerings. As of January 25, 2024, we have not sold any ordinary shares under that shelf registration

statement. Each ADS represents 275 ordinary shares. We refer to the ADSs, ordinary shares, subscription rights, warrants and units, collectively,

as the “securities” in this prospectus.

This document contains two

parts. The first part is this prospectus supplement, which describes the terms of this offering of the Ordinary Shares, and also adds,

updates and changes information contained in the accompanying prospectus and the documents incorporated herein and therein by reference.

The second part is the accompanying prospectus, which gives more general information about us, some of which may not apply to this offering.

You should read both this prospectus supplement and the accompanying prospectus, including the information incorporated by reference herein

and therein. To the extent the information contained in this prospectus supplement differs or varies from the information contained in

the accompanying prospectus or any document filed prior to the date of this prospectus supplement and incorporated herein or therein by

reference, the information in this prospectus supplement will control; provided, that if any statement in one of these documents is inconsistent

with a statement in another document having a later date, the statement in the document having the later date modifies or supersedes the

earlier statement. In addition, this prospectus supplement and the accompanying prospectus do not contain all of the information provided

in the registration statement that we filed with the SEC that contains the accompanying prospectus (including the exhibits to the registration

statement). For further information about us, you should refer to that registration statement, which you can obtain from the SEC as described

elsewhere in this prospectus supplement under “Where You Can Find More Information.” You may obtain a copy of this prospectus

supplement, the accompanying prospectus and any of the documents incorporated by reference without charge by requesting it from us in

writing or by telephone at the following address or telephone number: Mobilicom Limited, 1 Rakefet Street, Shoham, Israel 6083705. Attention:

Liad Gelfer, Director of Finance, telephone number: +972-52-5989900.

You should rely only on the

information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. We have not, and

the placement agent has not, authorized anyone to provide you with information that is different. No dealer, salesperson or other person

is authorized to give any information or to represent anything not contained in or incorporated by reference into this prospectus supplement

and the accompanying prospectus, and you must not rely upon any information or representation not contained in or incorporated by reference

into this prospectus supplement or the accompanying prospectus. This prospectus supplement and the accompanying prospectus do not constitute

an offer to sell or solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

We are offering to sell, and seeking offers to buy, our securities offered hereby only in jurisdictions where offers and sales are permitted.

You should not assume that the information we have included in this prospectus supplement or the accompanying prospectus is accurate as

of any date other than the date of this prospectus supplement or the accompanying prospectus, respectively, or that any information we

have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of

the time of delivery of this prospectus supplement and the accompanying prospectus or of any of our securities. Our business, financial

condition, results of operations and prospects may have changed since those dates.

In this prospectus, references

to the terms “Mobilicom,” “the Company,” “we,” “us,” “our” and similar terms,

refer to Mobilicom Limited and its subsidiaries, unless we state or the context implies otherwise. We own or have rights to trademarks,

service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website

names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely

for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and

™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade

names.

All references to “$”

(other than in our audited and unaudited consolidated financial statements) or “US$” in this prospectus refer to U.S. dollars.

All references to “AUD$” or “AUD” in this prospectus mean Australian dollars.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

information contained elsewhere or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary

does not contain all of the information that you should consider before investing in our securities. You should carefully read the entire

prospectus supplement and the accompanying prospectus, including the “Risk Factors” section, starting on page S-4 of this

prospectus supplement and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus,

as well as the financial statements and notes thereto and the other information incorporated by reference herein and therein, before making

an investment decision.

Overview

We are a provider

of hardware products and software and cybersecurity solutions that we design, develop and manufacture and that are embedded into small-sized

drones or small-sized unmanned aerial vehicles, or SUAVs, and into robotic systems, or robotics. We hold both patented technology and

unique know-how. We are aiming to further develop our global customer base by increasing our number of design wins and targeted pilot

projects and ultimately cross-sell our other solutions to those same customers in order to become a leading end-to-end provider to SUAV

and robotics systems original equipment manufacturers, or OEMs, who, in turn, sell their systems into the security and surveillance, process

industry (processing of bulk resources into other products), infrastructure inspection, first responders, homeland security, government

and defense and courier market segments. By “design win” we are referring to the large-scale and adoption of our component

products by our OEM customers on an-ongoing basis. The “pilot projects” refer to initial small-scale sales and implementation.

An “end-to-end” provider is one that provides all of the key components its customers need for their products.

We aim to penetrate

the commercial segment of our markets by leveraging the experience we have gained in the defense segment of our markets. We believe that

our key competitive advantages are our ability to provide a near end-to-end solution to our customers, which enables us to have an insider’s

view of our customers’ needs as well as our holistic cybersecurity approach and highly secured offering, and outstanding performance

in harsh environments. This is evidenced by our recent design wins and pilot projects, and top-tier defense and aerospace manufacturers

from United States, Israel and Europe. We further believe our products have performed well in harsh environmental conditions. Our solutions

have been deployed by our various customers worldwide, including in the United States, Europe, Israel and other Asian countries.

Recent Developments Affecting Our Business

In October 2023, Hamas terrorists

infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets. Hamas

also launched extensive rocket attacks on the Israeli population and industrial centers located along Israel’s border with the Gaza

Strip and in other areas within the State of Israel. These attacks resulted in thousands of deaths and injuries, and Hamas additionally

kidnapped many Israeli civilians and soldiers. Following the attack, Israel’s security cabinet declared war against Hamas and commenced

a military campaign against Hamas and other terrorist organizations in parallel to their continued rocket and terror attacks, which included

call-up reservists for active military duty in the Israel Defense Forces. To date, none of our member of management nor employees is in

active military reserve duty (. Nevertheless, our product, research and development and business development activities remain on track.

See also Risk Factors – “Security, political and economic instability in the Middle East may harm our business”.

Corporate Information

We

were incorporated under the laws of Australia in 2017. We have an office at Level 21, 459 Collins Street, Melbourne, VIC, Australia, 3000.

Our telephone number is +61 3 8630 3321. Our operational headquarters are located at 1 Rakefet Street, Shoham, Israel 6083705. We have

duly designated our subsidiary, Mobilicom Inc. as our authorized agent in the United States in connection with this prospectus. Mobilicom

Inc., incorporated in Delaware, is registered at 1000 N. West Street, Wilmington, Delaware under the registered agent MWE Corporate Services

LLC.

Our

company commercial website address is https://mobilicom.com/ and our investors relations website address is https://ir.mobilicom.com/.

Information contained on or accessible through our website is neither a part of nor incorporated into this prospectus, and the inclusion

of our website address herein is an inactive textual reference only. The SEC also maintains an Internet website that contains reports,

proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our filings with the

SEC will also be available to the public through the SEC’s website at www.sec.gov.

THE OFFERING

| ADSs we are offering |

|

486,871 ADSs representing 133,889,525 Ordinary Shares.

|

| |

|

|

|

Offering price per ADS

|

|

$1.55 per ADS. |

| Pre-funded warrants we are offering |

|

389,497,350 ordinary shares represented by 1,416,354 ADSs to the investor whose purchase of ordinary shares in this offering would otherwise result in the investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or at the election of the investor, 9.99%) of our outstanding ordinary shares immediately following the consummation of this offering, in lieu of ordinary shares that would otherwise result in the investor’s beneficial ownership exceeding 4.99% (or at the election of the investor, 9.99%) of our outstanding ordinary shares. The pre-funded warrant is being offered at an offering price of $1.5499 per pre-funded warrant. The pre-funded warrants will have an exercise price of $0.001 per ADS, will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. This prospectus supplement also relates to the offering of the ordinary shares (or the ADSs) issuable upon exercise of the pre-funded warrants. |

| |

|

|

| Offering price per pre-funded warrant |

|

$1.5499 per pre-funded warrant. |

| |

|

|

| Concurrent Private Placement |

|

In a concurrent private placement, for each ADS

and pre-funded warrant purchased in this offering, the investor will receive an unregistered warrant to purchase one ADS (100% warrant

coverage), or a total of warrants to purchase up to an aggregate of 523,386,875 ordinary shares represented by 1,903,225 ADSs. The warrants

have an exercise price of $1.55 per ADS, are immediately exercisable from the date of issuance and will expire three years following the

effectiveness of an initial resale registration statement registering the ADSs issuable upon the exercise of the warrants. The warrants,

the ADSs issuable upon the exercise of the warrants and the ordinary shares represented by such ADSs are being offered pursuant to the

exemption provided in Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder, and they are not being offered

pursuant to this prospectus supplement and the accompanying prospectus.

|

| |

|

|

| Use of Proceeds |

|

We estimate the net proceeds from this offering

will be approximately $2.56 million, based upon an offering price of $1.55 per ADS and $1.5499 per pre-funded warrant, after deducting

placement agent fees and estimated offering expenses payable by us, and assuming full exercise of the pre-funded warrants. We currently

intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds”

on page S-8 of this prospectus supplement. |

|

Ordinary shares to be outstanding

after this offering |

|

1,850,063,568 ordinary shares, assuming the

full exercise of the pre-funded warrants sold hereunder.

|

| |

|

|

| Risk factors |

|

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus supplement and on page 2 of the accompanying

prospectus, for a discussion of certain factors you should consider before investing in our securities. |

| |

|

|

|

Listing

|

|

Our ADSs are listed on the Nasdaq Capital Market under the symbol “MOB.”

We do not intend to list the pre-funded warrants on any securities exchange or nationally recognized trading system.

|

| |

|

|

| Depositary |

|

The Bank of New York Mellon. |

Unless otherwise

indicated, the number of ordinary shares outstanding prior to and after this offering is based on 1,326,676,693 ordinary shares

outstanding as of January 25, 2024. The number of ordinary shares referred to be outstanding after this offering and, unless

otherwise indicated, the other information in this prospectus, excludes as of such date:

| |

● |

761,842,950 ordinary shares (reflecting 2,770,338 ADS) issuable upon the exercise of tradable warrants issued to investors under August 2022 listing and IPO on Nasdaq, at an exercise price of $5.00; |

| |

● |

44,279,675 ordinary shares (reflecting 161,017 ADS) issuable upon the exercise of warrants issued as compensation to the underwriter in connection with August 2022 listing and IPO on Nasdaq, at an exercise price of $5.16; |

| ● | an aggregate of

278,920,379 ordinary shares issuable upon the exercise of options under our incentive option plan granted to employees, directors

and consultants, at a weighted average exercise price of AUD$0.02 (approximately $0.01), of which 21,278,713 ordinary shares were

vested at a weighted average exercise price of AUD$0.08 (approximately $0.06); |

| ● | 54,150,000 shares

reserved for issuance under our incentive option plan; |

| ● | 523,386,875

ordinary shares represented by 1,903,225 ADSs issuable upon exercise of unregistered warrants to be issued to the investor in a private

placement concurrently with this offering, at an exercise price of $1.55 per ADS; and |

| ● | 26,169,275

ordinary shares represented by 95,161 ADSs issuable upon the exercise of warrants to be issued as compensation to the placement agent

in connection with this offering, at an exercise price of $1.55 per ADS. |

RISK FACTORS

Investing in our securities

involves significant risks. Before making an investment decision, you should carefully consider the risks described below and in the documents

incorporated by reference into this prospectus supplement and the accompanying prospectus, together with all of the other information

appearing in this prospectus supplement or the accompanying prospectus or incorporated by reference herein or therein, including in light

of your particular investment objectives and financial circumstances. The risks so described are not the only risks we face. Additional

risks not presently known to us or that we currently deem immaterial may also impair our business operations and become material. Our

business, financial condition and results of operations could be materially adversely affected by any of these risks. The trading price

of our securities could decline due to any of these risks, and you may lose all or part of your investment. The discussion of risks includes

or refers to forward-looking statements; you should read the explanation of the qualifications and limitations on such forward-looking

statements discussed elsewhere in this prospectus supplement under the caption “Cautionary Statement Regarding Forward-Looking Statements”

below.

Risks Related to this Offering

Since we have broad discretion in how we use the proceeds from

this offering, we may use the proceeds in ways with which you disagree.

We intend to use the net proceeds of this offering

for operations expansion under our main target markets in the United States, Israel and Europe, working capital and general corporate

purposes, which include financing our operations, capital expenditures and business development. Accordingly, our management will have

significant flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard

to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used in ways with which you would agree. It is possible that the net proceeds will be invested in a way that does not yield

us a favorable, or any, return. The failure of our management to use the net proceeds effectively could have a material adverse effect

on our business, financial condition, operating results and cash flow.

A substantial number

of ADSs may be sold in this offering, which could cause the price of our ADSs or ordinary shares to decline.

In this offering we will sell

133,889,525 ordinary shares represented by 486,871 ADSs, and 389,497,350 ordinary shares represented by 1,416,354 ADSs underlying a pre-funded

warrant, which, in the aggregate, represent approximately 28.3% of our outstanding ordinary shares as of January 25, 2024 after giving

effect to the sale of the ordinary shares represented by ADSs and assuming the full exercise of the pre-funded warrants in this offering.

In addition, for each ADS purchased in this offering, the investor will receive an unregistered warrant to purchase one ADS (a total of

warrants to purchase an aggregate of 523,386,875 ordinary shares represented by 1,903,225 ADSs). This sale and any future sales of a substantial

number of ADSs or ordinary shares in the public market, or the perception that such sales may occur, could adversely affect the price

of the ADSs on the Nasdaq Capital Market. We cannot predict the effect, if any, that market sales of those ADSs or ordinary shares or

the availability of those ADSs or ordinary shares for sale will have on the market price of the ADSs or our ordinary shares.

We may need additional financing in the future. We may be unable

to obtain additional financing or if we obtain financing it may not be on terms favorable to us. You may lose your entire investment.

Based on our current plans, we believe our existing

cash and cash equivalents, along with cash generated from this offering, will be sufficient to fund our operating expense and capital

requirements for at least 10 months from the date of this prospectus supplement, although there is no assurance of this and we may need

additional funds in the future. If our capital resources are insufficient to meet future capital requirements, we will have to raise additional

funds. We may be unable to obtain additional funds through financing activities, and if we obtain financing it may not be on terms favorable

to us. If we are unable to obtain additional funds on terms favorable to us, we may be required to cease or reduce our operating activities.

If we must cease or reduce our operating activities, you may lose your entire investment.

The price of the ADSs may be volatile.

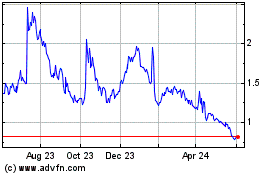

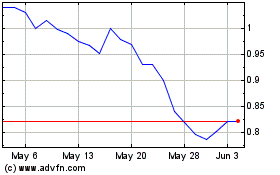

The market price of the ADSs has fluctuated in

the past. Consequently, the current market price of the ADSs may not be indicative of future market prices, and we may be unable to sustain

or increase the value of your investment in the ADSs.

We do not anticipate paying any dividends.

No dividends have been paid on our Ordinary Shares.

We do not intend to pay cash dividends on our Ordinary Shares in the foreseeable future, and anticipate that profits, if any, received

from operations will be reinvested in our business. Any decision to pay dividends will depend upon our profitability at the time, cash

available and other relevant factors including, without limitation, the conditions set forth in the Israeli Companies Law, or the Companies

Law.

You may not have the same voting rights

as the holders of our Ordinary Shares and may not receive voting materials in time to be able to exercise the right to vote.

Holders of the ADSs are

not be able to exercise voting rights attaching to the Ordinary Shares underlying the ADSs on an individual basis. Instead, holders of

the ADSs may only exercise the voting rights attaching to the Ordinary Shares in accordance with the Deposit Agreement. Purchasers of

ADSs in this offering may not receive voting materials in time to instruct the depositary to vote, and it is possible that they, or persons

who hold their ADSs through brokers, dealers or other third parties, will not have the opportunity to exercise a right to vote. Furthermore,

the depositary will not be liable for any failure to carry out any instructions to vote, for the manner in which any vote is cast or for

the effect of any such vote. As a result, you may not be able to exercise voting rights and may lack recourse if your ADSs are not voted

as requested.

You may not receive the same distributions

or dividends as those we make to the holders of our Ordinary Shares, and, in some limited circumstances, you may not receive dividends

or other distributions on our Ordinary Shares and you may not receive any value for them, if it is illegal or impractical to make them

available to you.

The depositary for the

ADSs has agreed to pay to you any cash dividends or other distributions it or the custodian receives on our Ordinary Shares or other deposited

securities underlying the ADSs, after deducting its fees and expenses. Although, as stated above, we do not currently anticipate paying

any dividends, if we do, you will receive these distributions in proportion to the number of Ordinary Shares your ADSs represent. However,

the depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any holders of

ADSs. For example, it would be unlawful to make a distribution to a holder of ADSs if it consists of securities that require registration

under the U.S. Securities Act of 1933, as amended, or the Securities Act, but that are not properly registered or distributed under an

applicable exemption from registration. In addition, conversion into U.S. dollars from foreign currency that was part of a dividend or

distribution made in respect of deposited Ordinary Shares may require the approval or license of, or a filing with, a government or an

agency thereof, which may be unobtainable. In these cases, the depositary may determine not to distribute such property and hold it as

“deposited securities” or may seek to effect a substitute dividend or distribution, including net cash proceeds from the sale

of the dividends or distributions. We have no obligation to register under U.S. securities laws any ADSs, Ordinary Shares, rights or other

securities received through such distributions. We also have no obligation to take any other action to permit the distribution of ADSs,

Ordinary Shares, rights or anything else to holders of ADSs. In addition, the depositary may withhold from such dividends or distributions

its fees and an amount on account of taxes or other governmental charges to the extent the depositary believes it is required to make

such withholding. This means that you may not receive the same distributions or dividends as those we make to the holders of our Ordinary

Shares, and, in some limited circumstances, you may not receive any value for such distributions or dividends if it is illegal or impractical

for us to make them available to you. These restrictions may cause a material decline in the value of the ADSs.

You may be subject to limitations on

transfer of your ADSs.

ADSs are transferable

on the books of the depositary. However, the depositary may close its transfer books at any time or from time to time when it deems expedient

in connection with the performance of its duties. In addition, the depositary may refuse to deliver, transfer or register transfers of

ADSs generally when our books or the books of the depositary are closed, or at any time if we or the depositary deems it advisable to

do so because of any requirement of law or of any government or governmental body, or under any provision of the deposit agreement, or

for any other reason in accordance with the terms of the deposit agreement.

ADSs holders may not be entitled to

a jury trial with respect to claims arising under the deposit agreement, which could augur less favorable results to the plaintiff(s)

in any such action.

The deposit agreement

governing the ADSs representing our Ordinary Shares provides that holders and beneficial owners of ADSs irrevocably waive the right to

a trial by jury in any legal proceeding arising out of or relating to the deposit agreement or the ADSs, including claims under federal

securities laws, against us or the depositary to the fullest extent permitted by applicable law. If this jury trial waiver provision is

prohibited by applicable law, an action could nevertheless proceed under the terms of the deposit agreement with a jury trial. To our

knowledge, the enforceability of a jury trial waiver under the federal securities laws has not been finally adjudicated by a federal court.

However, we believe that a jury trial waiver provision is generally enforceable under the laws of the State of New York, which govern

the deposit agreement, by a court of the State of New York or a federal court, which have non-exclusive jurisdiction over matters arising

under the deposit agreement, applying such law. In determining whether to enforce a jury trial waiver provision, New York courts and federal

courts will consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that

a party has knowingly waived any right to trial by jury. We believe that this is the case with respect to the deposit agreement and the

ADSs. In addition, New York courts will not enforce a jury trial waiver provision in order to bar a viable setoff or counterclaim sounding

in fraud or one which is based upon a creditor’s negligence in failing to liquidate collateral upon a guarantor’s demand,

or in the case of an intentional tort claim (as opposed to a contract dispute), none of which we believe are applicable in the case of

the deposit agreement or the ADSs. No condition, stipulation or provision of the deposit agreement or ADSs serves as a waiver by any holder

or beneficial owner of ADSs or by us or the depositary of compliance with any provision of the federal securities laws. If you or any

other holder or beneficial owner of ADSs brings a claim against us or the depositary in connection with matters arising under the deposit

agreement or the ADSs, you or such other holder or beneficial owner may not be entitled to a jury trial with respect to such claims, which

may have the effect of limiting and discouraging lawsuits against us and / or the depositary. If a lawsuit is brought against us and /

or the depositary under the deposit agreement, it may be heard only by a judge or justice of the applicable trial court, which would be

conducted according to different civil procedures and may augur different results than a trial by jury would have had, including results

that could be less favorable to the plaintiff(s) in any such action, depending on, among other things, the nature of the claims, the judge

or justice hearing such claims, and the venue of the hearing.

Risks Related to Israeli Law and our

Operations in Israel

Security, political and economic instability in the Middle East

may harm our business.

Our principal research and

development facilities and sole manufacturing facility are located in Israel. In addition, certain of our key employees, officers and

directors are residents of Israel. Accordingly, political, economic and military conditions in the Middle East may affect our business

directly. Since the establishment of the State of Israel in 1948, a number of armed conflicts have occurred between Israel and its neighboring

countries and terrorist organizations active in the region, including Hamas (an Islamist militia and political group in the Gaza Strip)

and Hezbollah (an Islamist militia and political group in Lebanon).

In particular, in October

2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and

military targets. Hamas also launched extensive rocket attacks on the Israeli population and industrial centers located along Israel’s

border with the Gaza Strip and in other areas within the State of Israel. These attacks resulted in thousands of deaths and injuries,

and Hamas additionally kidnapped many Israeli civilians and soldiers. Following the attack, Israel’s security cabinet declared war

against Hamas and commenced a military campaign against Hamas and these terrorist organizations in parallel continued rocket and terror

attacks. As a result of the events of October 7, 2023, the Israeli government declared that the country was at war and the Israeli military

began to call-up reservists for active duty. To date, none of our member of management nor employees is in active military reserve duty

.. Military service call ups that result in absences of personnel from us for an extended period of time may materially and adversely affect

our business, prospects, financial condition and results of operations.

Since the war broke out on

October 7, 2023, our operations have not been adversely affected by this situation, and we have not experienced disruptions to our

business operations. As such, our product research and development and business development activities remain on track. However, the intensity

and duration of Israel’s current war against Hamas is difficult to predict at this stage, as are such war’s economic implications

on our business and operations and on Israel’s economy in general. If the war extends for a long period of time or expands to other

fronts, such as Lebanon, Syria and the West Bank, our operations may be adversely affected.

Additionally, political uprisings,

social unrest and violence in various countries in the Middle East, including Israel’s neighbor Syria, have affected the political

stability of those countries. This instability may lead to deterioration of the political relationships that exist between Israel and

certain countries and have raised concerns regarding security in the region and the potential for armed conflict. In addition, Iran has

threatened to attack Israel. Iran is also believed to have a strong influence among the Syrian government, Hamas and Hezbollah. These

situations may potentially escalate in the future into more violent events which may affect Israel and us. These situations, including

conflicts which involved missile strikes against civilian targets in various parts of Israel have in the past negatively affected business

conditions in Israel.

Any hostilities involving

Israel or the interruption or curtailment of trade between Israel and its present trading partners could have a material adverse effect

on our business. The political and security situation in Israel may result in parties with whom we have contracts claiming that they are

not obligated to perform their commitments under those agreements pursuant to force majeure provisions. These or other Israeli political

or economic factors could harm our operations and product development. Any hostilities involving Israel or the interruption or curtailment

of trade between Israel and its present trading partners could adversely affect our operations and could make it more difficult for us

to raise capital. We could experience disruptions if acts associated with such conflicts result in any serious damage to our facilities.

Furthermore, several countries, as well as certain companies and organizations, continue to restrict business with Israel and Israeli

companies, which could have an adverse effect on our business and financial condition. Our business interruption insurance may not adequately

compensate us for losses, if at all, that may occur as a result of an event associated with a security situation in the Middle East, and

any losses or damages incurred by us could have a material adverse effect on our business.

FORWARD-LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus and certain information incorporated by reference in this prospectus supplement and the accompanying prospectus

contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are often characterized by the use of forward-looking terminology such as “may,”

“will,” “expect,” “anticipate,” “estimate,” “continue,” “believe,”

“should,” “intend,” “project” or other similar words, but are not the only way these statements are

identified.

These forward-looking statements

may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections

of results of operations or of financial condition, statements relating to the research, development and use of our products, and all

statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project,

believe or anticipate will or may occur in the future.

Forward-looking statements

are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on

assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions,

expected future developments and other factors they believe to be appropriate.

Important factors that could

cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements

include, among other things:

| |

● |

our ability to implement our growth strategies; |

| |

|

|

| |

● |

our competitive advantages; |

| |

|

|

| |

● |

the development of new products and services; |

| |

|

|

| |

● |

our ability to obtain and maintain financing on acceptable terms; |

| |

|

|

| |

● |

the impact of competition; |

| |

|

|

| |

● |

changes in laws, rules and regulations; |

| |

|

|

| |

● |

our ability to maintain our software licenses and product certifications; |

| |

|

|

| |

● |

general market, political, and economic conditions in the countries in which we operate; |

| |

● |

security, political and economic instability in the Middle East that could harm our business, including due to the current war between Israel and Hamas; |

| |

|

|

| |

● |

our ability to maintain good business relationships with our customers, suppliers and other strategic partners; |

| |

|

|

| |

● |

our ability to protect intellectual property; |

| |

● |

our ability to retain key personnel; |

| |

|

|

| |

● |

the absence of material adverse changes in the industry or global economy ;and |

| |

|

|

| |

● |

those factors referred to in our most recent Annual Report on Form 20-F in “Item 3. Key Information - D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well as in our Annual Report on Form 20-F generally, which is incorporated by reference into this prospectus. |

Readers are urged to carefully

review and consider the various disclosures made throughout this prospectus and any prospectus supplement, which are designed to advise

interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking

statements. Any forward-looking statements are made as of the date hereof, and we undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

USE OF PROCEEDS

We estimate the net proceeds

from this offering will be approximately $2.95 million, based upon an offering price of $1.55 per ADS and $1.5499 per pre-funded warrant,

after deducting placement agent fees and estimated offering expenses payable by us, and assuming full exercise of the pre-funded warrants.

We intend to use the net proceeds

from the sale of securities under this prospectus for operations expansion under our main target markets in the United States, Israel

and Europe and general corporate purposes (which for the avoidance of doubt may include acquisitions, in the Company’s discretion),

including working capital. The timing and amount of our actual expenditures will be based on many factors, and we cannot specify with

certainty all of the particular uses of the net proceeds from this offering. Accordingly, our management will have significant discretion

and flexibility in applying the net proceeds of this offering. We have no current commitments or binding agreements with respect to any

material acquisition of or investment in any technologies, products or companies.

Pending our use of the net

proceeds from this offering, we may invest the net proceeds of this offering in a variety of capital preservation investments, including

but not limited to short-term, investment grade, interest bearing instruments and U.S. government securities.

DIVIDEND POLICY

We have not declared or paid

any dividends on our ordinary shares, and we do not anticipate paying any dividends in the foreseeable future. Our board of directors

presently intends to reinvest all earnings in the continued development and operation of our business.

Payment of dividends in the

future, if any, will be at the discretion of our board of directors. If our board of directors elects to pay dividends, the form, frequency

and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial conditions, contractual

restrictions and other factors that our board of directors may deem relevant.

CAPITALIZATION

The following table presents

our capitalization:

| - | as of June 30, 2023 on an actual basis. |

| - | on an as adjusted basis, giving additional effect to completion of this offering based on an aggregate

of (i) 133,889,525 ordinary shares represented by 486,871 ADSs at the offering price of $1.55 per ADS, and (ii) 389,497,350 ordinary shares

represented by 1,416,354 ADSs underlying a pre-funded warrant, at the offering price of $1.5499 per pre-funded warrant, assuming full

exercise of the pre-funded warrants sold in this offering, after deducting the placement agent fees and estimated offering expenses payable

by us, resulting in aggregate net proceeds of approximately $2.56 million. |

This table should be read

in conjunction with our financial statements and the notes thereto incorporated by reference herein and the accompanying prospectus.

| | |

June 30, 2023 (Unaudited) | |

| | |

Actual | | |

As Adjusted | |

| | |

AUD$ | | |

USD | | |

AUD$ | | |

USD | |

| Cash and cash equivalents | |

| 15,922,705 | | |

| 10,551,826 | | |

| 19,791,204 | | |

| 13,115,444 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | | |

| | |

| Issued capital | |

| 41,651,795 | | |

| 27,602,250 | | |

| 45,520,295 | | |

| 30,165,868 | |

| Reserves | |

| (581,695 | ) | |

| (385,484 | ) | |

| (581,695 | ) | |

| (385,484 | ) |

| Accumulated losses | |

| (26,198,381 | ) | |

| (17,361,418 | ) | |

| (26,198,381 | ) | |

| (17,361,418 | ) |

| Total shareholders’ equity | |

| 14,871,719 | | |

| 9,855,348 | | |

| 18,740,219 | | |

| 12,418,966 | |

| Total capitalization | |

| 30,794,424 | | |

| 20,407,174 | | |

| 38,531,423 | | |

| 25,534,410 | |

Unless otherwise indicated,

the number of ordinary shares outstanding prior to and after this offering is based on 1,326,676,693 ordinary shares outstanding as of

June 30, 2023. The number of ordinary shares referred to above to be outstanding after this offering and, unless otherwise indicated,

the other information in this prospectus, excludes as of such date:

| |

● |

761,842,950 ordinary shares (reflecting 2,770,338 ADS) issuable upon the exercise of tradable warrants issued to investors under August 2022 listing and IPO on Nasdaq, at an exercise price of $5.00; |

| |

● |

44,279,675 ordinary shares (reflecting 161,017

ADS) issuable upon the exercise of warrants issued as compensation to the underwriter in connection with August 2022 listing and IPO on

Nasdaq, at an exercise price of $5.16;

|

| |

● |

an

aggregate of 278,920,379 ordinary shares issuable upon the exercise of options under our incentive option plan granted to employees,

directors and consultants, at a weighted average exercise price of AUD$0.02 (approximately $0.01), of which 21,278,713 ordinary

shares were vested at a weighted average exercise price of AUD$0.08 (approximately $0.06); and |

| |

● |

54,150,000 shares reserved for issuance under our incentive option plan. |

DESCRIPTION OF SECURITIES WE ARE OFFERING

Ordinary Shares

The material terms and provisions

of our ordinary shares are described under the heading “Description of Share Capital” in the accompanying prospectus.

Pre-Funded Warrants

The following is a summary

of the material terms and provisions of the pre-funded warrants that are being offered hereby. This summary is subject to and qualified

in its entirety by the form of pre-funded warrants, which has been provided to the investor in this offering and which will be filed with

the SEC as an exhibit to Current Report on Form 6-K in connection with this offering and incorporated by reference into the registration

statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions of the form of

warrant for a complete description of the terms and conditions of the pre-funded warrants.

Duration and Exercise Price

The pre-funded warrants

offered hereby will have an exercise price of $0.0001 per ADS (unless such price is voluntarily reduced by the Company pursuant to

the terms of the pre-funded warrants). The pre-funded warrants will be exercisable and may be exercised at any time after their

initial exercise date, as described in the pre-funded warrants, until such pre-funded warrants are exercised in full. The exercise

prices and numbers of ordinary shares issuable upon exercise are subject to appropriate adjustment in the event of share dividends,

share splits, reorganizations or similar events affecting our ordinary shares. Pre-funded warrants will be issued in certificated

form only.

Exercisability

The pre-funded warrants will

be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by

payment in full for the number of ordinary shares purchased upon such exercise (except in the case of a cashless exercise as discussed

below). A holder (together with its affiliates) may not exercise any portion of such holder’s warrants to the extent that the holder

would own more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding ordinary shares immediately after exercise,

except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding

ordinary shares after exercising the holder’s pre-funded warrants up to 9.99% of the number of ordinary shares outstanding immediately

after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the pre-funded warrants.

The investor in this offering may also elect prior to the issuance of pre-funded warrants to have the initial exercise limitation set

at 9.99% of our outstanding ordinary shares.

Cashless Exercise

The holder may elect to receive

upon such exercise (either in whole or in part) the net number of ordinary shares determined according to a formula set forth in the warrant.

Fundamental Transactions

In the event of any

fundamental transaction, as described in the pre-funded warrants and generally including any merger with or into another entity,

sale of all or substantially all of our assets, tender offer or exchange offer, reclassification of our ordinary shares, or a

business combination, then upon any subsequent exercise of a pre-funded warrant, the holder will have the right to receive as

alternative consideration, for each ordinary share that would have been issuable upon such exercise immediately prior to the

occurrence of such fundamental transaction, the number of common shares of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by

a holder of the number of ordinary shares for which the pre-funded warrant is exercisable immediately prior to such event.

Transferability

In accordance with its terms

and subject to applicable laws, a pre-funded warrant may be transferred at the option of the holder upon surrender of the pre-funded warrant

to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Fractional Shares

No fractional ordinary shares

will be issued upon the exercise of the pre-funded warrants. Rather, the number of ordinary shares to be issued will, at our election,

either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal

to such fraction multiplied by the exercise price.

Trading Market

There is no established trading

market for any of the pre-funded warrants, and we do not expect a market to develop. We do not intend to apply for a listing for any of

the warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity

of the pre-funded warrants will be limited.

Rights as a Shareholder

Except as otherwise provided

in the pre-funded warrants or by virtue of the holders’ ownership of ordinary shares, the holders of pre-funded warrants do not

have the rights or privileges of holders of our ordinary shares, including any voting rights, until such pre-funded warrant holders exercise

their warrants.

PRIVATE PLACEMENT OF

WARRANTS

Concurrently

with the sale of ADSs and pre-funded warrants in this offering, we will issue and sell to the investor in this offering a warrant to purchase

up to an aggregate of 523,386,875 ordinary shares represented by 1,903,225 ADSs at an initial exercise price equal to $1.55 per ADS.

The exercise price is subject to certain adjustments in the event of (1) payment of a share dividend or other distribution on any class

of capital stock that is payable in ADSs or ordinary shares; (2) subdivisions of outstanding ADSs or ordinary shares into a larger number

of shares; or (3) combinations of outstanding ADSs or ordinary share into a smaller number of shares; provided that no such adjustment of the exercise price will

occur where there is a sale or grant of shares or share equivalents and an effective price per share less than the exercise price then

in effect.

Each

warrant shall be exercisable on the issuance date and shall be exercisable until three years following the initial exercise date. Subject to limited exceptions, a holder

of warrants will not have the right to exercise any portion of its warrants if the holder, together with its affiliates, would beneficially

own in excess of 4.99% or 9.99%, or the Beneficial Ownership Limitation, of the number of our ordinary shares outstanding immediately

after giving effect to such exercise. If at the time after the issue date of the warrants, a registration statement or current prospectus

covering the resale of the ADSs or ordinary shares issuable upon exercise of the warrants is not available, the holder may exercise the

warrants in whole or in part on a cashless basis.

If,

at any time while the warrants are outstanding, (1) we consolidate or merge with or into another entity in which the Company is not the

surviving entity; (2) we sell, lease, assign, convey or otherwise transfer all or substantially all of our assets; (3) any tender offer

or exchange offer (whether completed by us or a third party) is completed pursuant to which holders of a majority of our outstanding ordinary

shares (including any ordinary shares underlying the ADSs) tender or exchange their shares for securities, cash or other property; (4)

we effect any reclassification of our ordinary shares or compulsory share exchange pursuant to which outstanding ordinary share is effectively

converted or exchange for other securities, cash or property or (5) any transaction is consummated whereby any person or entity acquires

more than 50% of the Company’s outstanding ordinary shares (including any ordinary shares underlying the ADSs), each, a Fundamental

Transaction, then upon any subsequent exercise of a warrant, the holder thereof will have the right to receive the same amount and kind

of securities, cash or other property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if

it had been, immediately prior to such Fundamental Transaction, the holder of the number of ordinary shares then underlying the ADSs issuable

upon exercise of the warrant.

If,

at any time while the warrants are outstanding, we declare or make any dividend or other distribution of our assets (or rights to acquire

our assets) to holders of our ordinary shares, by way of return of capital or otherwise, then each holder of a warrant shall be entitled

to participate in such distribution to the same extent that the holder would have participated therein if the holder had held the number

of ADSs or ordinary shares acquirable upon complete exercise of the warrant immediately prior to the record date for such distribution.

If

at any time while the warrants are outstanding we grant, issue or sell any ordinary share equivalents or rights to purchase stock,

warrants, securities or other property pro rata to the record holders of our ordinary shares, or the Purchase Rights (as such term is defined in the warrants), then each

holder of a warrant will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights

which such holder could have acquired if such holder had held the number of ADSs or ordinary shares acquirable upon complete

exercise of the warrant immediately prior to the date on which a record is taken for the grant, issuance or sale of such Purchase

Rights, or, if no such record is taken, the date as of which the record holders of ordinary shares are to be determined for the

grant, issue or sale of such Purchase Rights.

Additionally,

we have agreed to issue to the placement agent, or its designees, warrants to purchase up to an aggregate of 26,169,275 ordinary shares

represented by 95,161 ADSs at an initial exercise price equal to $1.55 per ADS. The material terms of the placement agent warrants

are substantially the same as those issuable to the investor, as described above, with the exception of the following terms: (a)

the Beneficial Ownership Limitation is 4.99%, (b) holders of placement agent warrants are not entitled to receive cash dividends or distribution

or return of capital in the form of cash made to holders of ordinary shares or ADSs and (c) the placement agent warrants are exercisable

immediately until the earlier of (i) three years following the effectiveness of an initial resale registration statement registering the

ADSs issuable upon the exercise of the placement agent warrants and (ii) the five-year anniversary of the commencement of sales pursuant

to the offering. See “Plan of Distribution”.

The

warrants, the placement agent warrants and the ADSs and ordinary shares issuable upon exercise of the warrants and placement agent warrants

will be issued and sold without registration under the Securities Act, or state securities laws, in reliance on the exemptions provided

by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder and in reliance on similar exemptions under applicable

state laws. Accordingly, the investors and the placement agent, or its designees, may exercise the warrants and the placement agent warrants,

respectively, and sell the underlying ADSs and ordinary shares only pursuant to an effective registration statement under the Securities

Act covering the resale of those securities or pursuant to an applicable exemption from registration under the Securities Act.

PLAN OF DISTRIBUTION

We have entered into a

placement agent agreement, dated as of January 25, 2024, with Ladenburg Thalmann Subject to the terms and conditions contained in

the placement agent agreement, the placement agent has agreed to act as placement agent in connection with the sale of the Ordinary

Shares and Warrants.

The placement agent may

engage or retain other brokers or selected dealers to assist in the placement of the securities and/or act as sub-agents on the

placement agent’s behalf in connection with the offering. The placement agent is not purchasing or selling any of the

securities offered by us under this prospectus supplement and the accompanying prospectus, nor is it required to arrange the

purchase or sale of any specific number or dollar amount of securities. The placement agent has agreed to use reasonable best

efforts to arrange for the sale of the securities. There is no required minimum number of securities that must be sold as a

condition to completion of this offering. The purchase price for the securities has been determined based upon arm’s-length

negotiations between the investors and us.

The placement agent

agreement provides that the obligations of the placement agent and the investors of the securities are subject to certain conditions

precedent, including, among other things, the absence of any material adverse effect or development involving a prospective material

adverse change in the condition or the business activities, financial or otherwise, of the Company, and the receipt of customary

legal opinions, letters and certificates. The placement agent agreement also provides that we will indemnify the placement agent

against specified liabilities, including liabilities under the Securities Act.

We have entered into a

securities purchase agreement directly with each investor in connection with this offering, and we will only sell to investors who

have entered into the securities purchase agreement. Under the securities purchase agreement, we have agreed not to enter

into any agreement to issue or announce the issuance or proposed issuance of any securities or securities equivalents until ninety

(90) days after the closing date of this offering, or file any registration statement or any amendment or supplement thereto or its

then equivalent relating to equity securities issuable in connection with the Company’s share option or other employee benefit

plans, subject to certain customary exceptions. We currently anticipate that the closing of the sale of the securities offered

hereby will be completed on or about January 30, 2024, subject to customary closing conditions.

The placement agent may be

deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by the placement

agent and any profit realized on the resale of the Ordinary Shares sold by the placement agent while acting as principal might be deemed

to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply

with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities

Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of

Ordinary Shares by the placement agent acting as principal. Under these rules

and regulations, the placement agent:

| |

● |

may

not engage in any stabilization activity in connection with our securities; and |

| |

● |

may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution. |

Commissions

and Expenses

Upon the closing of this

offering, we will pay the placement agent a cash transaction fee equal to $221,239 representing 6.5% of the gross proceeds to us

from the sale of the securities in the offering from investors introduced to the Company by the placement agent and a non-accountable expense allowance equal to 1.0% of the gross proceeds received by the Company from the

sale of the securities at closing of the offering. We have also

agreed to reimburse the placement agent for certain fees and disbursements incurred by them in connection with this offering in an

amount of up to an aggregate of $75,000, inclusive of the $42,500 advance payment previously paid by the Company

to the Placement Agent.

We estimate the total offering

expenses of this offering that will be payable by us, excluding the placement agent fees, will be approximately $90,000, which includes

legal and printing costs, various other fees and the reimbursement of the placement agent expenses.

Lock-up Agreements

The Company’s directors,

executive officers, employees and shareholders holding at least ten percent (10%) of the outstanding ordinary shares agreed to enter into

customary “lock-up” agreements in favor of the placement agent for a period of ninety (90) days from the effectiveness date

of the resale registration statement registering the securities issued in the concurrent private placements to this offering subject to

exceptions listed in the lock-up agreements.

Listing

Our ADSs are listed on the Nasdaq Capital Market

under the symbol “MOB.”

Foreign Regulatory Restrictions on Purchase of Securities Offered

Hereby Generally

No action has been or will

be taken in any jurisdiction (except in the United States) that would permit a public offering of the securities offered by this prospectus

supplement and accompanying prospectus, or the possession, circulation or distribution of this prospectus supplement and accompanying

prospectus or any other material relating to us or the securities offered hereby in any jurisdiction where action for that purpose is

required. Accordingly, the securities offered hereby may not be offered or sold, directly or indirectly, and neither of this prospectus

supplement and accompanying prospectus nor any other offering material or advertisements in connection with the securities offered hereby

may be distributed or published, in or from any country or jurisdiction except in compliance with any applicable rules and regulations

of any such country or jurisdiction.

Other

The placement agency agreement

and the securities purchase agreement are included as exhibits to a Report of Foreign Private Issuer on Form 6-K that we filed with the

SEC and that is incorporated by reference into the registration statement of which this prospectus supplement forms a part.

EXPERTS

The consolidated financial

statements as of December 31, 2022 and 2021 and for each of the three years in the period ended December 31, 2022 incorporated by reference

in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the report of Ziv

Haft (BDO Member Firm), an independent registered public accounting firm, incorporated herein by reference, given on the authority of

said firm as experts in auditing and accounting.

LEGAL MATTERS

The validity of our securities

and other legal matters concerning this offering relating to Australian law will be passed upon for us by QR Lawyers, Melbourne, Australia.

The validity of our securities being offered by this prospectus and certain legal matters in connection with this offering relating to

U.S. federal law will be passed upon for us by Greenberg Traurig, P.A., Tel Aviv, Israel. Additional legal matters may be passed upon

for us or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement on Form F-3, including amendments and relevant exhibits and schedules, under the Securities Act covering

the ordinary shares to be sold in this offering. This prospectus supplement and accompanying prospectus, which constitute a part of the

registration statement, summarize material provisions of contracts and other documents that we refer to in this prospectus supplement.

Since this prospectus supplement does not contain all of the information contained in the registration statement, you should read the

registration statement and its exhibits and schedules for further information with respect to us and our ordinary shares (and ADSs representing

our ordinary shares). Our SEC filings, including the registration statement, are also available to you on the SEC’s Web site at http://www.sec.gov.

We are subject to the information

reporting requirements of the Exchange Act that are applicable to foreign private issuers, and under those requirements we file reports

with the SEC. Those other reports or other information may be inspected without charge at the locations described above. As a foreign

private issuer, we are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements, and our

officers, directors and principal shareholder are exempt from the reporting and short-swing profit recovery provisions contained in Section 16

of the Exchange Act. In addition, we are not required under the Exchange Act to file annual, quarterly and current reports and financial

statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act.

However, we file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC, an

annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate

by reference our publicly filed reports into this prospectus, which means that information included in those reports is considered part

of this prospectus. Information that we file with the SEC after the date of this prospectus will automatically update and supersede the

information contained in this prospectus.

This

prospectus incorporates by reference the documents listed below, which have been previously filed with the SEC:

| |

● |

our

Annual Report on Form 20-F for the year ended December 31, 2022, filed with the SEC on March 30, 2023; |

| |

● |

our

Reports on Form 6-K filed with the SEC on April 7, 2023, April 27, 2023 (solely with respect to the first, third,

fourth and fifth paragraphs and the section titled Forward Looking Statement of the press release attached as Exhibit 99.1); April 27, 2023, May 1, 2023 (solely with respect to the Notice of Annual General Meeting Attached as Exhibit 99.1), May 9, 2023 (solely with respect to the first three paragraphs and the section titled Forward Looking Statement of the press release

attached as Exhibit 99.1), May 22, 2023 (solely with respect to the first three paragraphs and the section titled

Forward Looking Statement of the press release attached as Exhibit 99.1), May 31, 2023, June 28, 2023, June 29, 2023 (solely with respect to the first five paragraphs and the section titled Forward Looking Statement of the press release

attached as Exhibit 99.1), July 10, 2023 (solely with respect to the first three and the fifth paragraphs and the

section titled Forward Looking Statement of the press release attached as Exhibit 99.1), July 27, 2023 (solely with

respect to the first two paragraphs and the section titled Forward Looking Statement of the press release attached as Exhibit 99.1), August 31, 2023 (solely with respect to (i) the Interim Condensed Financial Statements as of June 30, 2023, attached

as Exhibit 99.1; and (ii) the Management’s Discussion and Analysis of Financial Condition and Results of Operations for

the six months ended June 30, 2023, attached as Exhibit 99.2), September 5, 2023 (solely with respect to the first,

third, fourth and fifth paragraphs and the section titled Forward Looking Statement of the press release attached as Exhibit 99.1), September 12, 2023 (solely with respect to the first two paragraphs and the section titled Forward Looking Statement

of the press release attached as Exhibit 99.1), September 19, 2023 (solely with respect to the first two paragraphs

and the section titled Forward Looking Statement of the press release attached as Exhibit 99.1), September 28, 2023 (solely

with respect to the first two paragraphs and the section titled Forward Looking Statement of the press release attached as Exhibit 99.1), October 10, 2023, October 12, 2023, October 19, 2023 (solely with respect to the first paragraph and the section titled

Forward Looking Statement of the press release attached as Exhibit 99.1 and Exhibit 99.2), November 24, 2023, November 27, 2023

(solely with respect to the first three paragraphs and the section titled Forward Looking Statement of the press release attached

as Exhibit 99.1), December 12, 2023 (solely with respect to the first, second, third and fifth paragraphs and the section titled

Forward Looking Statement of the press release attached as Exhibit 99.1), December 14, 2023 (solely with respect to the first, second

and fourth paragraphs and the section titled Forward Looking Statement of the press release attached as Exhibit 99.1), January 9, 2024 (solely with respect to the first three paragraphs and the section titled Forward Looking Statement of the press release attached

as Exhibit 99.1), January 24, 2024 (solely with respect to the first two paragraphs and the section titled Forward Looking Statement

of the press release attached as Exhibit 99.1) and January 30, 2024; and |

| |

● |

The

description of our ordinary shares contained in Exhibit 2.1 to our Annual Report on Form 20-F for the year ended December 31,

2022, filed with the SEC on March 30, 2023, including any amendment or report filed with the SEC for the purpose of updating such

description. |

All subsequent annual reports

filed by us pursuant to the Exchange Act on Form 20-F prior to the termination of the offering shall be deemed to be incorporated by reference

to this prospectus and to be a part hereof from the date of filing of such documents. We may also incorporate part or all of any Form

6-K subsequently submitted by us to the SEC prior to the termination of the offering by identifying in such Forms 6-K that they, or certain